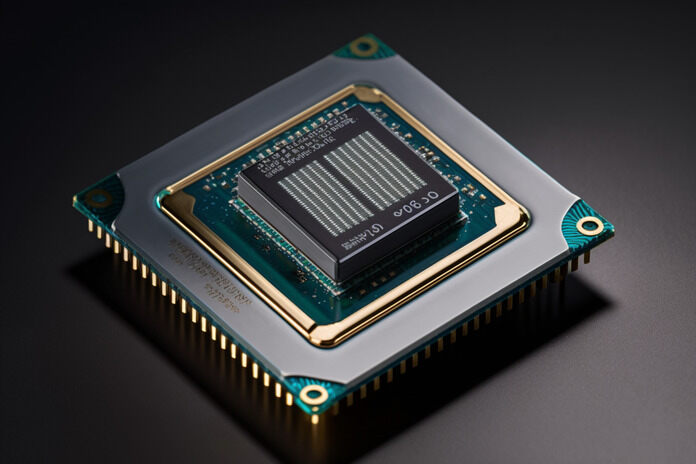

Advanced Micro Devices (NASDAQ:AMD) is gearing up for a strong finish to the year, with plans to launch its much-anticipated artificial intelligence chips that are poised to compete with Nvidia’s (NASDAQ:NVDA) semiconductors head-on. Following the announcement, AMD’s shares surged by approximately 3% during after-hours trading.

Advanced Micro Devices Chief Executive Officer, Lisa Su, disclosed that the company is ready to scale up the production of its flagship MI300 artificial intelligence chips in the fourth quarter. These accelerator chips, which are currently facing a shortage in supply, are designed to challenge Nvidia’s highly advanced H100 chips that are already dominating the market.

During the third quarter, Advanced Micro Devices (NASDAQ:AMD) witnessed significant interest from customers in the MI300 series chips, as the company expanded its collaborations with top-tier cloud providers, major enterprises, and leading AI companies. Investors are now optimistic that the upcoming release of MI300 chips will place AMD in a formidable position to compete against Nvidia in the rapidly expanding market for advanced AI chips.

However, it’s worth noting that AMD’s MI300 chips currently exceed the performance limits allowed for sale to China under export controls issued in October. Unlike its competitors, Nvidia and Intel (NASDAQ:INTC), Advanced Micro Devices (NASDAQ:AMD) has yet to create specialized chips tailored for the highly profitable Chinese market. Nvidia has already remodeled its H100 chips to go along with the U.S. Commerce Department’s restrictions on advanced AI semiconductor sales to China.

Addressing the issue, Lisa Su mentioned that Advanced Micro Devices (NASDAQ:AMD) is considering a similar strategy for its MI300 and older MI250 chips to ensure compliance with U.S. export controls. Nevertheless, AMD sees an opportunity to develop AI solutions for its customer base in China, and the company is committed to working in that direction.

Although Advanced Micro Devices has not provided a detailed full-year forecast, the company expressed confidence that its 2023 sales in the data center business, which includes MI300 chips, will surpass the $6.04 billion achieved in 2022.

Jenny Hardy, a portfolio manager at GP Bullhound, which holds Nvidia and AMD stocks, pointed out that Nvidia still faces supply constraints, which has the potential of opening a window of opportunity for AMD’s chips. If AMD successfully ramps up production and releases the MI300 chips as planned in the fourth quarter, the demand is likely to surge, especially due to the ongoing scarcity of Nvidia chips.

AMD assured investors that it has an adequate supply of components for the MI300 chips to facilitate an aggressive launch in the fourth quarter, with ample supply anticipated for 2024.

The company’s older MI250 chip also continues to attract significant interest as a viable option for less complex AI tasks.

Looking ahead, analysts predict that large cloud players such as Microsoft and Google will increase spending on data centers in the second half of the year, particularly focusing on AI chips and infrastructure. Additionally, the decline in PC shipments seems to have stabilized, and demand is showing signs of improvement.

In light of these factors, AMD’s finance chief Jean Hu expects a double-digit percentage growth in revenue for the Data Center and Client segments during the third quarter, driven by increasing demand for the EPYC and Ryzen processors. However, this growth may be partially offset by declines in the Gaming and Embedded segments.

For the current quarter, AMD forecasts revenue of approximately $5.7 billion, with analysts expecting revenue of around $5.82 billion, according to Refinitiv’s poll.

Featured Image: Freepik