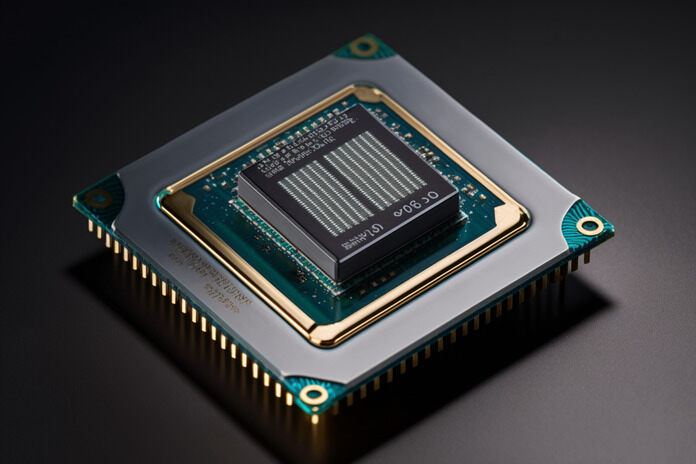

AMD Stock (NASDAQ:AMD)

In a day when semiconductor stocks were mostly flat, AMD (NASDAQ:AMD) maintained its outperformance from last week in the wake of its first-quarter results and artificial intelligence-related headlines. As a result, AMD stock surged.

After news broke last week that Microsoft (NASDAQ:MSFT) was collaborating with AMD (NASDAQ:AMD) on AI chips, AMD stock jumped more than 5%, trading at $95 at midday. Microsoft was initially said to be backing AMD.

Competitor Nvidia (NASDAQ:NVDA) increased by 0.8%, while Intel (NASDAQ:INTC) decreased by 1.3%.

On Monday, Intel acknowledged to Oregon Live that it was undertaking another wave of layoffs.

Recent earnings from AMD, Qualcomm (NASDAQ:QCOM), NXP Semiconductors, and others reflect two themes, according to KeyBanc Capital Markets analyst John Vinh in a note to clients: “limited” signs of a recovery in China, and Apple (NASDAQ:AAPL) linked suppliers lowering their outlooks due to the tech giant’s pull-ins and over-ordering of components between the fourth and first quarters.

Qualcomm stock fell by 0.3%, while NXP Semiconductors gained the same amount.

Qorvo, another smartphone supplier, increased by 0.1%, while Skyworks Solutions (NASDAQ:SWKS), expected to report later this week, increased by 0.9%.

Citi reaffirmed its buy recommendations on the three top memory chip manufacturers – Samsung (OTCPK:SSNLF), SK Hynix, and Micron – despite continued indicators the memory market may rebound later this year, sending shares of Micron Technology (NASDAQ:MU) down by around 0.5%.

Peter Lee, an industry analyst, said that the recent cutbacks in memory production would “gradually” assist in decreasing global stocks, which would, in turn, lead to a rebound in the average selling price of dynamic random access memory (DRAM) after the third quarter and of NAND after the fourth quarter.

For example, Lee predicted in a letter to investors that “major global memory producers” would “profit from constrained memory supply growth on industry-wide memory production decrease and DDR5 demand upside in [the second half of 2023].

Texas Instruments, Analog Devices, and ON Semiconductor were among the other semiconductor companies to show no discernible movement on Monday.

Featured Image: Freepik @ alisaa