Intel stock was trading at $27.26 in pre-Market: 09:05 AM EDT

After the market closes on Thursday, Intel (NASDAQ:INTC) is scheduled to release its fiscal third-quarter results. For the largest semiconductor manufacturer in the world, the report comes at a favorable time.

For the quarter that ended in September, Wall Street analysts predict that Intel (NASDAQ:INTC) will make 33 cents a share on $15.3 billion in revenue. Intel (NASDAQ:INTC), which reported $19.2 billion in revenue, earned $1.71 per share during the same period last year.

According to reports, Chief Executive Pat Gelsinger informed Intel (NASDAQ:INTC) staff members last week that layoffs are imminent. This week earlier, HSBC analyst Edward Lee stated that Intel (NASDAQ:INTC) is “the tech powerhouse who lost its way in recent years” and began his coverage of the business with a very diplomatic-sounding decrease rating.

Then there is Mobileye (NASDAQ:MBLY), a self-driving technology company owned by Intel (NASDAQ:INTC), which went public on Wednesday with an IPO valued at roughly $17 billion. As Mobileye (MBLY) went public, its stock shot up more than 30%, despite Gelsinger’s claim that the IPO wasn’t done to raise money but rather to “maximize the company’s potential.”

Intel stock price forecast

The price of Intel (NASDAQ:INTC) stock is also just a little bit above the October 13 low of $24.59 a share, which is a 52-week low. Investors are eagerly awaiting Intel’s results, which are scheduled to be released after regular trade on Thursday. Intel is struggling on numerous fronts, from declining PC demand to a weakening economy and fiercer competition.

Intel has already recovered from a difficult time. The business released financial figures for the June quarter in July that were drastically below Wall Street forecasts. At the time, it also gave a dismal sales prognosis for the following quarter and drastically cut its revenue projection for the entire year.

On Wednesday, Intel stock lost 47% of its value so far this year. The iShares Semiconductor ETF (NASDAQ:SOXX), which tracks the performance of the ICE Semiconductor Index, has decreased 40% over the same time period, therefore, it has performed worse than chip producers as a whole. Intel Stock Rises Alongside Other Semiconductors Rivals Hoping To Close The Week Higher On Q3 Earnings Release

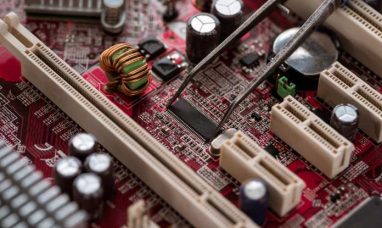

Featured Image – Megapixl © Wolterk