AMAT Stock price up on Thursday, trading at $78.78 as of 01:08 PM EDT

Even though the industry is still dealing with the effects of the Biden Administration’s export limits, Applied Materials (AMAT Stock) (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), and KLA Corp. (NASDAQ:KLAC) turned around on Thursday.

Even after stating on Wednesday that the new laws will have a negative impact on its fourth-quarter revenue of between $250 million and $650 million, AMAT Stock (NASDAQ:AMAT) increased more than 4.5%, reversing earlier losses.

As a result, it anticipates revenues to be between $6.15 billion and $6.65 billion, which is less than its previous projection of $6.25 billion to $7.05 billion and the $6.67 billion consensus estimate. As opposed to projections of $2.01 per share, adjusted earnings per share are anticipated to range between $1.54 and $1.78.

AMAT Stock and Semiconductor Outlook

The Gary Dickerson-led Applied Materials (NASDAQ:AMAT) also stated that the updated profits projection took into account an impact of around 23 cents per share from inventory and manufacturing costs associated with the new export laws. Competitors KLA Corp. and Lam Research increased by 3% and 1%, respectively, while ASML Holding, a manufacturer of chip equipment, increased marginally.

Not all semiconductor companies are being equally impacted by the new export limitations. Even though Synopsys restated its fiscal fourth-quarter guidance and stated that the new export limitations would not materially affect its operations, the stock rose by almost 2.5%.

AMAT Stock (NYSE:TSM) increased more than 7% as the multinational foundry giant announced third-quarter results that were above forecasts but lowered its capital expenditure outlook for 2022 due to waning chip demand and export restrictions.

Taiwan Semiconductor (NYSE:TSM) exceeded projections by generating $20.23 billion in revenue and $1.79 in earnings per share during the period, respectively. Taiwan Semiconductor attributed the good quarterly performance, which increased by 25% over the previous quarter and accounted for 41% of its total sales, in part to the robust success in smartphones. Taiwan Semiconductor also said that 72% of its quarterly sales came from customers in North America, up from 64% in the previous quarter.

The Biden Administration granted one-year reprieves to Taiwan Semiconductor (TSM), Samsung (OTCPK:SSNLF), and the South Korean memory chip manufacturer, allowing them to continue receiving machinery for chip manufacturing in China.

However, Taiwan Semiconductor also reduced its projected spending for 2022 from $40–$44 billion to $36 billion. In response to the announcement, rival GlobalFoundries (NASDAQ:GFS) lost about 0.5% of its value in midday trading.

As Qualcomm (NASDAQ:QCOM), Nvidia (NASDAQ:NVDA), and Advanced Micro Devices (NASDAQ:AMD) all increased by more than 1.5% in early trade on Thursday, several other significant semiconductor companies also experienced buying pressure. Broadcom (AVGO) and Micron Technology (MU) both had gains of 1% and 3.8%, while Intel (INTC) saw a gain of about 3.5%. Lam Research (NASDAQ:LRCX) was identified as one of the businesses that the new export limitations will have the greatest impact on by Bank of America earlier this month.

The Unstoppable Rise Of Nvidia And Other Semiconductor Stocks

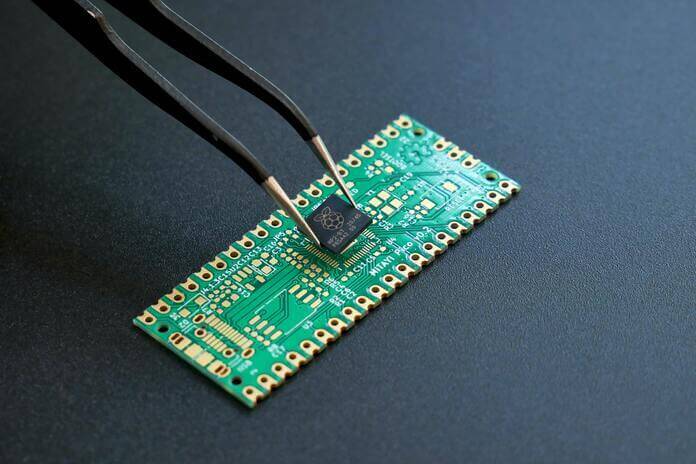

Featured Image- Megapixl @ vishnumaiea