TSM stock was trading at $73.56 as of 11:40 AM ED

Morgan Stanley, a financial advisory firm, called Taiwan Semiconductor (NYSE:TSM) a “top pick” on Wednesday, causing shares of the semiconductor foundry to increase.

In the second half of 2023, a semiconductor recovery is predicted, and Taiwan Semiconductor (TSM), which is “the facilitator of future technology,” is likely to profit, according to a group of Morgan Stanley analysts.

Apple Stock Up As Company Preps To Deploy TSMC’s Most Recent Chip Technology In IPhones And Macs

During premarket trading, shares of Taiwan Semiconductor (NYSE:TSM) increased slightly to $73.02. The analysts also stated that Asian semiconductor businesses will likely rebound more quickly than their American counterparts because several are selling at bargain prices and technologies like 5G, artificial intelligence, and electric cars are still experiencing rapid growth.

A Korean news outlet Economic Daily recently reported, Apple (NYSE:AAPL) accepted price increases from Taiwan Semiconductor (TSM) after purportedly declining them earlier this month.

On Wednesday Digitimes reported that Taiwan Semiconductor (TSM) had started contract negotiations with equipment and material suppliers for 2023, asking for 10% price reductions.

TSM Stock is Morgan Stanley’s Number One Tech Pick

The industry’s demand could start to pick up again early next year, Morgan Stanley analysts noted, and TSMC should benefit as the most sophisticated logic chipmaker. An “attractive” rating was also given to Chinese chip manufacturing and Korean technologies by Morgan Stanley. Since the peak of global semiconductor shipment units around September of last year, we are “far advanced in the present cyclical decline,” the analysts noted. We acknowledge that an inflection (bottom) is approaching but do not advocate the start of a new cycle.

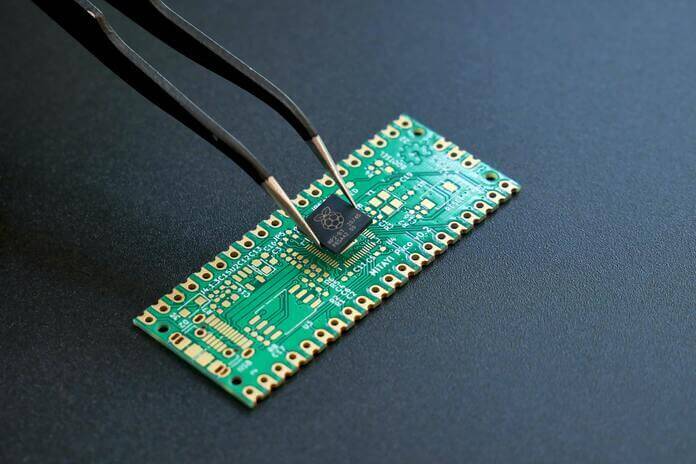

Featured Image- Megapixl @ vishnumaiea