-

-

- Bitcoin is up 64% since January, capturing global attention and driving up crypto-related stocks1

- Cathie Wood predicts Bitcoin could reach $1.48 million by 2030,2 while Bernstein anticipates $200,000 by 2025.3

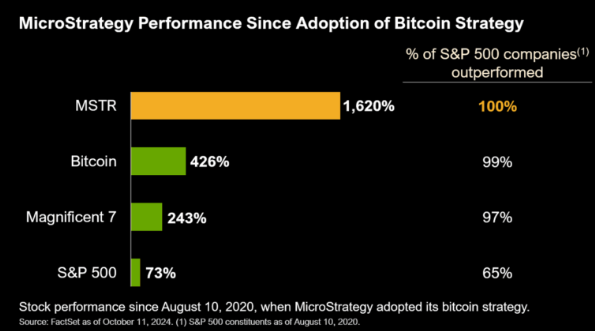

- MicroStrategy has gained over 260% this year, outperforming even Bitcoin with its bold Bitcoin-centric strategy4

- MicroStrategy posted a 1,347.5% return over the last four years, surpassing NVIDIA’s 951.7% gains.5

-

Bitcoin is roaring up 64% this year, sending shockwaves through global markets and lighting up crypto stocks.

As demand continues to surge, experts are increasingly bullish on Bitcoin’s future.

Ark Invest CEO Cathie Wood projects Bitcoin reaching an eye-popping US$1.48 million by 2030, while Standard Chartered anticipates a surge to $125,0006 should favorable political conditions come to pass.

Similarly, analysts at Bernstein see Bitcoin hitting $200,000 by 2025, calling it a “conservative” estimate given the current trajectory of adoption and institutional interest.

With price predictions soaring, it’s no wonder that companies like MicroStrategy are riding this wave to new heights.

MicroStrategy has surged over 260% year-to-date, driven by a bold “all-in” Bitcoin strategy that’s outpaced even Bitcoin’s own gains.

This extraordinary rise has cemented MicroStrategy’s place as the market’s top Bitcoin play, outperforming the S&P 500 and even tech giants like Tesla, Apple, and Microsoft.7

Over the past four years, MicroStrategy’s aggressive approach has paid off, delivering a remarkable 1,347.5% return and eclipsing even investor favorite NVIDIA, which saw gains of 951.7% in the same period.8

Source: CNN9

Michael Saylor, the visionary behind MicroStrategy, isn’t stopping.

His goal? To turn MicroStrategy into a Bitcoin investment powerhouse with $150 billion in holdings, paving the way to a trillion-dollar valuation.10

Institutional heavyweights like BlackRock are betting big too, recently boosting their stake to 5.2%, signaling confidence in Saylor’s game plan and the broader crypto rally.11

Crypto Prices Soar as Institutional Demand and Market Confidence Grow

Bitcoin isn’t the only one making waves.

The digital currency market as a whole is on an explosive trajectory, driven by rising institutional interest and projections of robust long-term growth.

Assets like Solana and Ethereum have experienced substantial increases, boosted by new trends like AI-driven memecoins, which have added unexpected value to platforms like Solana.

At the same time, institutional backing has taken Bitcoin ETFs to new heights, with US investors pouring $13 billion into Bitcoin ETF shares so far this year.

These moves reflect growing mainstream acceptance and confidence in the market’s staying power.

Neptune Digital Assets: Canada’s Diversified Answer to MicroStrategy

In this highly favorable landscape, Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) has emerged as one of Canada’s most promising digital asset companies.

Dubbed “Canada’s MicroStrategy,” Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) combines a bold Bitcoin strategy with a more diversified approach, giving it the potential to capture market gains while mitigating some of Bitcoin’s inherent volatility.

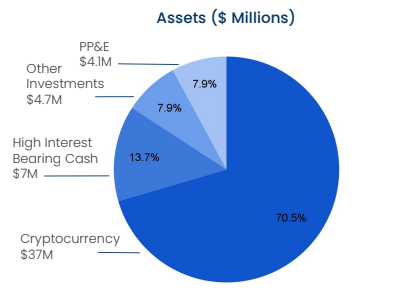

Neptune’s portfolio is notably diverse, extending beyond Bitcoin to include assets like Solana, Ethereum, and Cosmos, as well as a stake in SpaceX.

This balanced approach distinguishes Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) from single-asset companies and offers investors a unique opportunity to gain exposure to the broader digital asset space.

It also allowed the company to secure TSXV Top 50 status twice, a testament to its steady growth and strategic foresight.12

As demand for crypto assets grows, Neptune’s positioning as a diversified crypto company may allow it to capitalize on market gains with greater resilience.

A High-Yield Staking Model Built for Stability

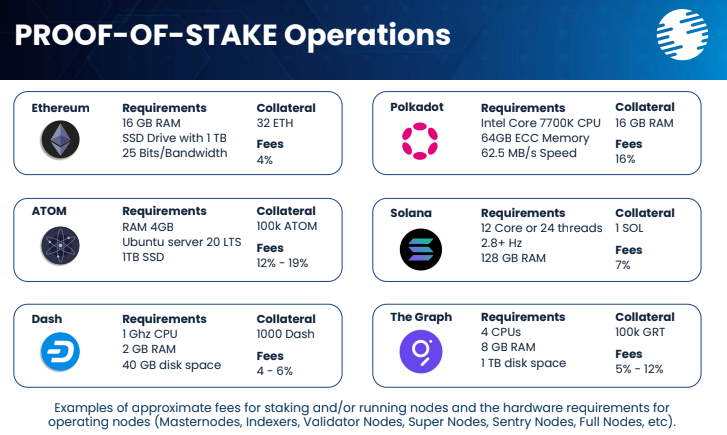

One of Neptune’s most compelling strategies is its emphasis on staking, a more efficient, environmentally friendly alternative to traditional Bitcoin mining.

Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) generates consistent returns by operating validators, or software nodes, across several high-potential proof-of-stake networks.

This model, which requires no energy-intensive mining hardware, yields between 4-19% annually, providing a steady revenue stream that Neptune reinvests into Bitcoin to fuel treasury growth.

Neptune’s strategic holdings include:13

-

-

- 350 Bitcoin securely held in cold storage

- 32,000 Solana tokens, 27K of which were acquired at a 67% discount and staked to generate returns14

- 200,000 ATOM tokens in the Cosmos ecosystem

- Additional positions in Ethereum (ETH), Polkadot (DOT), Fantom (FTM), DASH, Graph (GRT), OCEAN, and other tokens, including AI-linked assets like Graph and OCEAN, giving Neptune valuable exposure to the growing AI market.15

-

Beyond crypto, Neptune’s portfolio includes select real estate and a notable US$3 million stake in SpaceX, providing access to one of the most innovative private companies in the world.16

A Strong Balance Sheet and Aligned Shareholders

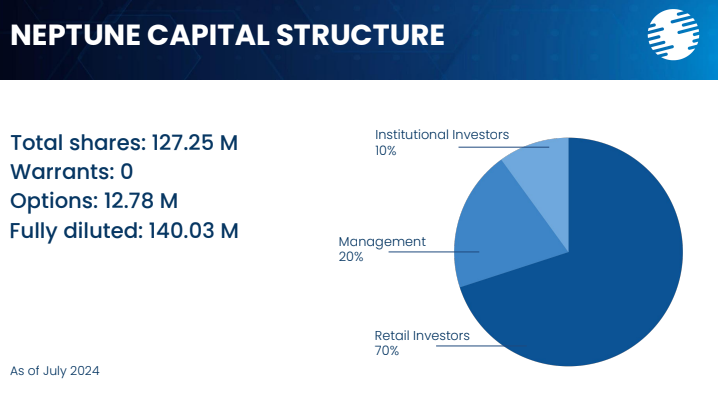

Neptune’s financial structure is designed with long-term resilience in mind. The company holds no debt, boasts a $5 million cash balance capable of sustaining operations for up to 5 years, and maintains 20% insider ownership. This alignment between management and shareholders strengthens Neptune’s commitment to its growth strategy.

In a move that underscores management’s confidence, Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) recently launched a share buyback program, aiming to reduce the public float by 10%.

Share buybacks are a clear sign that Neptune’s leadership believes the company is undervalued and positioned for growth, making this an attractive opportunity for investors.

Adding to its robust financial position, Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) is exploring a credit facility of up to US$25 million, allowing it to act swiftly on new opportunities in the digital asset space without diluting shareholders.

This flexibility could prove advantageous as the market expands, giving Neptune the resources needed to scale up its asset base of Bitcoin and other crypto holdings.

8 Reasons

Neptune Digital Assets Could Be the Next Big Crypto Stock

1

Crypto Market Momentum: Positioned to benefit as the digital currency market continues its rally.

2

Canada’s MicroStrategy: A diversified approach to Bitcoin and digital assets, with greater resilience against volatility.

3

Diversified Portfolio: Exposure to top digital assets, including Bitcoin, Solana, Ethereum, and an exclusive stake in SpaceX.

4

Strong Financials: Debt-free, with $5 million in cash and record net income in recent quarters.

5

Reliable Revenue Streams: A self-sustaining staking model that generates 4-19% annual yields.

6

Strategic Solana Acquisition: Purchased at a 67% discount, providing both yield and growth.

7

Share Buyback Program: Reducing outstanding shares to maximize shareholder value.

8

Proven Leadership: Guided by an experienced team with expertise in blockchain, crypto, and finance.

As the global digital currency market continues to expand, Neptune Digital Assets is well-positioned to capture value through its diversified, income-generating approach.

With significant room for growth and a strong balance sheet, Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF) is emerging as a key player in Canada’s crypto space.

Those seeking exposure to a balanced crypto stock with upside potential should watch Neptune as the company prepares for future growth.

Click here to dive deeper into Neptune Digital Assets Corp. (TSXV:NDA) (OTCQB:NPPTF).