$50 Million Term Loan Secured to Fund Transformation Plan and Path to Profitability

Revenue of $28.4 Million as Compared with Revenue of $28.9 Million on a Pro Forma Basis in the Prior Year, Exceeding Expectations of $25 – $28 Million

Adjusted EBITDA Loss of $8.9 Million, Flat as Compared to Prior Year on a Pro Forma Basis, Exceeding Expectations of a Loss of $10 – $13 Million

LOS ANGELES–Surf Air Mobility Inc. (NYSE:SRFM) (the “Company”), a leading regional air mobility platform, today reported financial results for the third quarter ended September 30, 2024.

“The financial results for the third quarter demonstrate our continued progress on our transformation plan. We are rightsizing our air mobility operations, implementing new processes, driving improved efficiency and repositioning our air mobility operations for sustained profitability,” said Deanna White, Interim CEO and Chief Operating Officer of Surf Air Mobility.

Capital Structure Update:

On November 14, 2024, the Company closed on a new $50 million term loan. The new funding, coupled with significant progress in reducing liabilities during the fourth quarter, unlocks the Company’s ability to complete the rationalization of routes, resolve deferred maintenance, and further improve flight completion rates.

Third Quarter Financial Highlights:

Surf Air Mobility is providing unaudited results for the quarter ended September 30, 2024, as well as unaudited pro forma results for the quarter ended September 30, 2023, which assumes the Company’s acquisition of Southern Airways closed as of the beginning of fiscal year 2023.

Revenue

- Revenue of $28.4 million for the third quarter 2024 as compared to $28.9 million for the same period of the prior year on a pro-forma basis, exceeding the Company’s expectation of $25.0 million – $28.0 million.

Net Loss

- GAAP Net Loss improved to $12.2 million as compared with $74.6 million in the prior year period, which includes investment in R&D for electrification and software technology, stock-based compensation, transaction costs and other non-recurring items.

- Net Loss of $12.2 million for the third quarter of 2024, compared to pro-forma Net Loss of $45.4 million for the same period of the prior year, which includes investment in R&D for electrification and software technology, stock-based compensation, transaction costs and other non-recurring items.

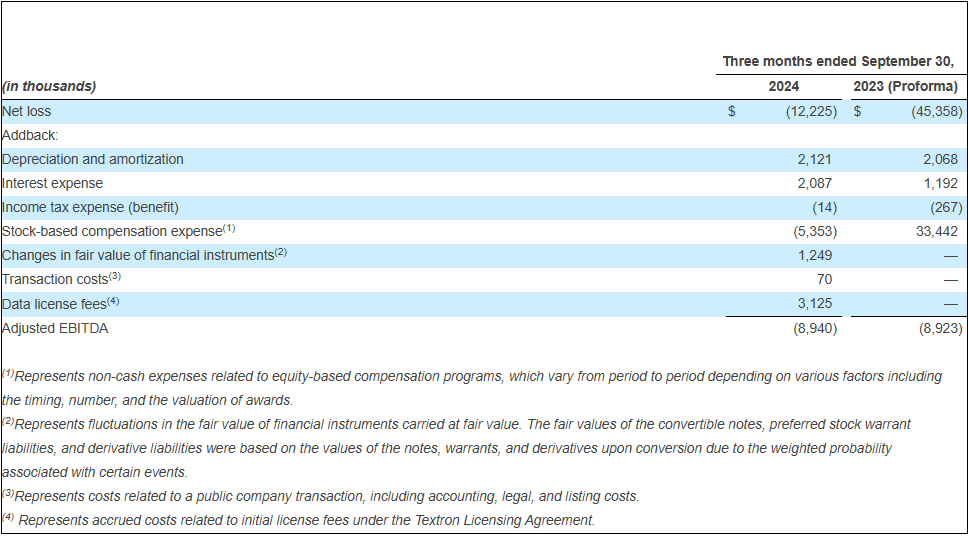

Adjusted EBITDA

- Adjusted EBITDA loss of $8.9 million for the third quarter 2024, was unchanged compared with a loss of $8.9 million for the same period of the prior year on a pro-forma basis, outperforming company expectations of a loss of $10 million to $13 million.

- This outperformance was driven by improved On-Demand operations, realized M&A synergies, lower compensation costs, and lower professional expenses across the quarter. Adjusted EBITDA includes investment in R&D for electrification and software technology.

- See the Adjusted EBITDA table for the reconciliation from Net Loss to Adjusted EBITDA.

Developments on Key Initiatives:

Mobility

- Revenue for the third quarter was relatively unchanged versus the prior year period on a pro-forma basis.

- Scheduled service revenue increased by 2% primarily driven by the addition of subsidized route revenue for Williamsport, Purdue and Lanai, partially offset by a lower completion factor. As discussed in the second quarter earnings call, third quarter completion factor was negatively impacted by unplanned maintenance.

- On Demand service revenue decreased by 13% over the comparable period, which represents the impact of management’s focus on profitability rather than near-term market penetration.

- As of September 30, 2024, Surf Air Mobility supported 20 communities under the EAS program.

- The Company has taken delivery of two new aircraft from Textron Aviation in November 2024.

Software

- The Company continued development of SurfOS software aimed at improving operational efficiency, growing revenue, and reducing costs across the Company’s airline brands (Southern, Mokulele, and Surf Air) and its On Demand charter service.

- The Company announced a plan to form a new venture, Surf Air Technologies LLC, and entered into an agreement with Palantir Technologies Inc. to power its operating system for the Advanced Air Mobility industry.

Electrification

- Aircraft electrification program remains on track to complete its Cessna Caravan STC in 2027.

- The Company has an exclusive relationship with Textron Aviation to be their supplier of electrified powertrains for the Cessna Caravan.

- The Company is actively pursuing the creation of one or more joint ventures or partnerships with key vendors to reduce cost and separately capitalize the Company’s electrification efforts.

- The Company plans to leverage its platform to enable the launch of third-party electrified aircraft. The Company will support these launches with direct consumer distribution via Surf Air’s flight network and operations software tools via SurfOS.

Financial Outlook

- Fourth Quarter 2024 revenue, in the range of $25 million to $28 million.

- Adjusted EBITDA loss, in the range of $5 million to $8 million, which excludes the expected impact of stock-based compensation, changes in fair value of financial instruments, and other non-recurring items.

Investor Presentation – November 2024

The Company’s new investor presentation can be found here or by visiting the Company’s investor website at investors.surfair.com.

Conference Call

Surf Air Mobility will host a conference call today at 5:00 pm ET. Interested parties can register in advance to listen to the webcast here or can find a link on the ‘Events & Presentations’ section of our investor relations website.

Alternatively, listeners may dial into the call as follows:

North America – Toll-Free (800) 715-9871

International (Toll) – (646) 307-1963

Conference ID: 4775356

About Surf Air Mobility

Surf Air Mobility is a Los Angeles-based regional air mobility platform and the largest commuter airline in the U.S. by scheduled departures as well as the largest passenger operator of Cessna Caravans in the U.S. In addition to its airline operations, Surf Air is currently developing an AI powered airline software operating system and is working toward certification of electric powertrain technology. We plan to offer our technology solutions to the entire regional air mobility industry to improve safety, efficiency, profitability and reduce emissions.

Forward-Looking Statements

This Press Release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, including statements regarding the anticipated benefits of the credit facility; Surf Air Mobility’s implementation of its transformation strategy; travel trends; developments on key strategic initiatives; Surf Air Mobility’s profitability and future financial results; and Surf Air Mobility’s balance sheet and liquidity. Readers of this release should be aware of the speculative nature of forward-looking statements. These statements are based on the beliefs of Surf Air Mobility’s management as well as assumptions made by and information currently available to Surf Air Mobility and reflect Surf Air Mobility’s current views concerning future events. As such, they are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, among many others: Surf Air Mobility’s future ability to pay contractual obligations and liquidity will depend on operating performance, cash flow and ability to secure adequate financing; Surf Air Mobility’s limited operating history and that Surf Air Mobility has not yet manufactured any hybrid-electric or fully-electric aircraft; the powertrain technology Surf Air Mobility plans to develop does not yet exist; any accidents or incidents involving hybrid-electric or fully-electric aircraft; the inability to accurately forecast demand for products and manage product inventory in an effective and efficient manner; the dependence on third-party partners and suppliers for the components and collaboration in Surf Air Mobility’s development of hybrid-electric and fully-electric powertrains and its advanced air mobility software platform, and any interruptions, disagreements or delays with those partners and suppliers; the inability to execute business objectives and growth strategies successfully or sustain Surf Air Mobility’s growth; the inability of Surf Air Mobility’s customers to pay for Surf Air Mobility’s services; the inability of Surf Air Mobility to obtain additional financing or access the capital markets to fund its ongoing operations on acceptable terms and conditions; the outcome of any legal proceedings that might be instituted against Surf Air, Southern or Surf Air Mobility, the risks associated with Surf Air Mobility’s obligations to comply with applicable laws, government regulations and rules and standards of the New York Stock Exchange; and general economic conditions. These and other risks are discussed in detail in the periodic reports that Surf Air Mobility files with the SEC, and investors are urged to review those periodic reports and Surf Air Mobility’s other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov, before making an investment decision. Surf Air Mobility assumes no obligation to update its forward-looking statements except as required by law.

Footnotes

Use of Non-GAAP Financial Measures: Surf Air Mobility uses Adjusted EBITDA to identify and target operational results which is beneficial to management and investors in evaluating operational effectiveness. Pro Forma Adjusted EBITDA is a supplemental measure of Surf Air Mobility’s performance that is not required by, or presented in accordance with, U.S. GAAP. Pro Forma Adjusted EBITDA is not a measurement of Surf Air Mobility’s financial performance under U.S. GAAP and should not be considered as an alternative to net income (loss) or any other performance measure derived in accordance with U.S. GAAP. Surf Air Mobility’s calculation of this non-GAAP financial measure may differ from similarly titled non-GAAP measures, if any, reported by other companies. This non-GAAP financial measure should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP.

Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, non-GAAP financial measures may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies.

Surf Air Mobility presents Pro Forma Adjusted EBITDA because it considers this measure to be an important supplemental measure of its performance and believes it is frequently used by securities analysts, investors, and other interested parties in the evaluation of companies in its industry. Management believes that investors’ understanding of Surf Air Mobility’s performance is enhanced by including this non-GAAP financial measure as a reasonable basis for comparing its ongoing results of operations. Unaudited pro forma financial information for the third quarter and year to date period ended September 30, 2024, assumes the acquisition of Southern Airways closed as of the beginning of 2023.

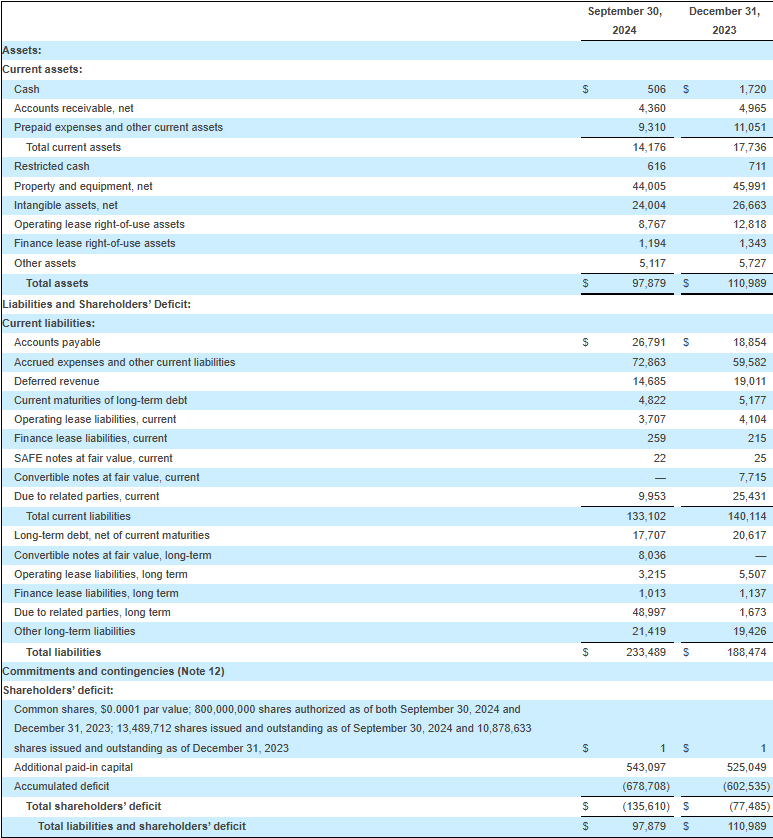

Unaudited Condensed Consolidated Balance Sheets as of September 30, 2024, and December 31, 2023:

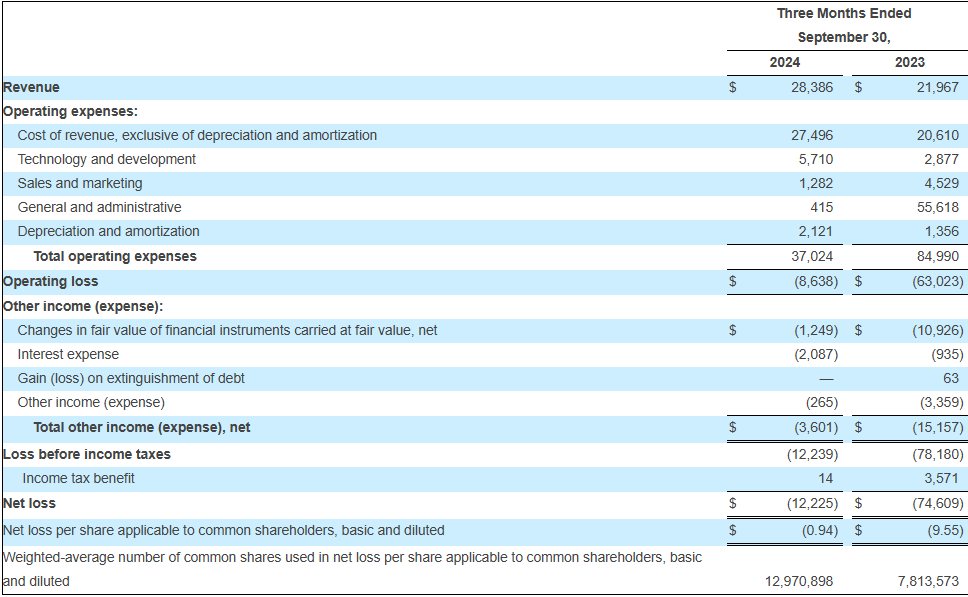

Unaudited Condensed Consolidated Statements of Operations for the Three Months Ended September 30, 2024 and 2023: (in thousands, except share and per share data):

Unaudited Pro Forma Financial Measures; Reconciliation of Net Loss to Adjusted EBITDA for the Three Months Ended September 30, 2024 and Pro forma Net Loss to Pro forma Adjusted EBITDA for the Three Months and Nine Months Ended September 30, 2023 (in thousands):

Visit here for a free report on Surf Air Mobility Inc. (NYSE:SRFM)

Get investment opportunities before the rest of the market in real-time. Get this company's corporate presentation now. Subscribe to download! Over 120,000 subscribersSUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.