It started with a vision—just like Tesla’s early days—transforming an entire industry. Now, a new revolution is taking flight: air taxis.

Right now, there’s a lot of buzz about the Federal Aviation Administration’s (FAA) recent moves to finalize pilot certifications1 and its Innovate 2028 plan,2 laying the groundwork for eVTOL (electric vertical takeoff and landing) aircraft to take to the skies.

Analysts are calling this a pivotal moment, projecting approval by 2026 and forecasting multi-billion-dollar revenue streams for companies by the end of the decade.

And now, Wall Street is starting to catch on.

Wall Street analysts are zeroing in on Joby Aviation (NYSE:JOBY) and Archer Aviation (NYSE:ACHR), two frontrunners in the competitive eVTOL market.

Analysts from Needham & Co. are forecasting these companies could rake in over $4 billion in annual revenue by the decade’s end.3

And the market is buying the hype—literally.

Joby’s stock just surged 12% to almost $7 following the forecast, while Archer soared almost 15% to $5.13, pushing their valuations into the stratosphere.

Here’s the key: these are forward-looking opportunities, built on visionary potential—much like Tesla in its early days. Back then, Tesla’s future seemed uncertain, but those who recognized its promise watched the stock soar to unprecedented heights. Could Air Taxi companies follow a similar trajectory?

Neither of these two companies are generating meaningful revenue yet, and they’re still deep in the development phase, much like Tesla in the mid 2000’s.

While Joby and Archer are still building their roadmaps, Surf Air Mobility Inc. (NYSE:SRFM) has quietly positioned itself ahead of the pack in the regional air mobility market.

This company is at the center of $75+ billion dollar global market opportunity.4

Unlike others in the space, Surf Air Mobility isn’t just a concept—it’s a fully operational business generating real revenue and focused on leading the charge in transforming regional air mobility.

Here’s why Surf Air Mobility stands out:

-

-

- ~$110 million in revenue in 20235 and recently closed a $50 million financing.6

- Exclusive agreements with multi-billion dollar market cap companies Textron Aviation (NYSE: TXT), one of the world’s largest general aviation manufacturers and a strategic partnership with Palantir Technologies, leveraging cutting-edge AI and data analytics.

-

Did we mention that Surf Air Mobility Inc. (NYSE:SRFM) owns the largest commuter airline in the US by scheduled departures?

And when it comes to electrified air travel, Surf Air is creating a platform to enable new technologies to come to market while also developing proprietary electrified powertrains of its own to disrupt regional travel.

Why?

Instead of developing electric planes from scratch (which could take decades), Surf Air Mobility Inc. (NYSE:SRFM) has an agreement with one of the world’s largest general aviation manufacturers Textron Aviation (NYSE:TXT) and aviation technology engineering leader AeroTEC to support its plans of swapping out the engines of popular and widely used existing aircraft with hybrid or fully electric

powertrains, specifically for the Cessna Grand Caravan, once the technology is certified.

With over 400,000 passengers having flown in 2023, a path to electrification certification and powerhouse strategic relationships, Surf Air Mobility Inc. (NYSE:SRFM) is positioned to benefit from the coming evolution of electrified aircraft.

But there’s more…

Surf Air is also revolutionizing how regional air travel is managed, thanks to a game-changing agreement with Palantir Technologies, a $140-billion powerhouse known for its groundbreaking work in AI and data analytics.

It’s a game-changing alliance.

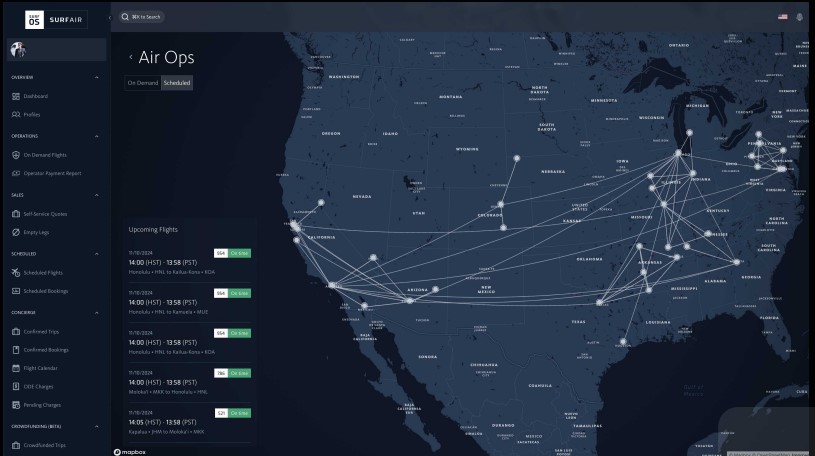

Surf Air Mobility Inc. (NYSE:SRFM) has teamed up with Palantir Technologies to revolutionize regional air mobility with a cutting-edge AI-powered platform, “SurfOS.”7

To drive this transformation, Surf Air plans to launch a new venture entity, Surf Air Technologies LLC, to develop software enabled with Palantir’s unmatched expertise in artificial intelligence, data analytics, and business intelligence.

The collaboration, which began in 2021, was inspired by Surf Air’s vision to address the fragmented and outdated tools available in the regional air mobility market today.

SurfOS utilizes Palantir’s unmatched expertise in artificial intelligence, enterprise data analytics, and business intelligence with Surf Air’s proprietary software, intellectual property, and operational data, the companies are creating a powerful solution that it’s using on its own operations today and that will one day plans to sell to third-party regional air operators, charter brokers, and aircraft manufacturers.

The platform is designed to modernize operations, starting with Part 135 regional air operators, by replacing inadequate legacy tools with a comprehensive, AI-driven system that aims to make managing operations more efficient, while bringing costs down and revenue up.

SurfOS Platform

SurfOS Platform

With Surf Air Mobility’s Southern Airways airline subsidiary, the largest operator by scheduled departures in the US, already leveraging SurfOS, these new tools aim to set a new industry standard for aviation software, making Surf Air’s own airline and charter operations the first to benefit from this groundbreaking technology.

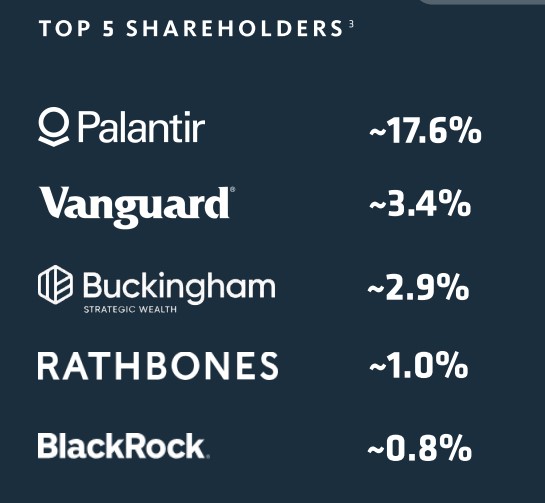

On top of that, Palantir has a ~17.6% stake in the company as of November 2024.

Of course, Palantir isn’t the only notable shareholder supporting Surf Air Mobility Inc. (NYSE:SRFM).8

Vanguard, Buckingham Strategic Wealth, Rathbones, and BlackRock have also taken positions in the company, highlighting institutional interest.

It’s no surprise, considering what Surf Air Mobility Inc. (NYSE:SRFM) has been up to… Some other recent wins include:

-

-

- Restructuring its capital structure with GEM9

- Growing its global presence by inking electrified powertrain MOU agreements in East Africa10 and Brazil11

- Added more subsidized commuter routes in May 202412

-

But before we jump into all of the details, take a look at some of the top reasons Surf Air Mobility Inc. (NYSE:SRFM) is well positioned within the industry.

6 Reasons

Surf Air Mobility Inc. (NYSE:SRFM) is Leading the Electric Revolution of Regional Air Travel

1

A Massive Growth Market: By 2035, the total addressable market (TAM) for small regional flights globally could reach $75 billion to $115 billion by 203513

2

The Largest Commuter Airline in the US: Surf Air Mobility Inc. (NYSE:SRFM) leads the nation with the most scheduled departures, carrying over 404,000 passengers on ~71,000 flights in 2023.14

3

Impressive Revenue Performance: The company generated ~$110M in revenue in 2023,15 underscoring its strong financial position and operational success

4

Powerful Commercial Relationships: Strategic alliances with industry leaders like Palantir Technologies and Textron Aviation bolster Surf Air’s competitive edge across the value chain.

5

Seasoned Leadership Team: A management team with extensive experience, including past leadership roles at Bombardier Flexjet, United, Wisk, and Virgin America, is driving the company forward.

6

Multi-Phased Transformation Plan: Backed by its $50 million financing, Surf Air Mobility Inc. (NYSE:SRFM) is executing a four-phase transformation plan designed to optimize its airline operations and put them on a path to profitability, broadly offer its SurfOS software, expand routes, and create a platform for new electrification technology in the future.

Surf Air Mobility’s Multi-Billion Dollar Transformation Plan

Surf Air Mobility Inc. (NYSE:SRFM), a regional air mobility leader, isn’t just part of the conversation—it’s leading it.

On November 14, Surf Air announced the closing of a $50 million term loan from Comvest Partners, a multi-billion-dollar investment firm.16

This financing has strengthened Surf Air’s balance sheet, reduced liabilities, and positioned the company for the next phase of its four-phase transformation plan:

-

-

- Phase 1: Transformation (Completed)

This phase involved foundational improvements, including restructuring the capital structure, strengthening the balance sheet, appointing a new management team, and realizing operational synergies from the Southern Airways merger. - Phase 2: Optimization (2025-2026)

The focus is on optimizing airline operations, recalibrating the On -Demand business, and driving efficiencies through SurfOS, the proprietary software platform in development with Palantir Technologies. - Phase 3: Expansion (2026-2027)

This phase aims for rapid expansion of Tier 1 routes by leveraging improved business infrastructure and advanced technologies. - Phase 4: Acceleration (2027 and beyond)

The goal is to grow revenue and expand margins by implementing electrification technologies and expanding the technology platform to support the future of regional air mobility.

- Phase 1: Transformation (Completed)

-

Expansion of Surf Air’s Commuter Flight Network

As Surf Air Mobility Inc. (NYSE:SRFM) charges ahead in empowering the electrification of regional air travel, it’s also relentlessly expanding its commuter flight network to enhance convenience for travelers across America.

Let’s dive into Surf Air Mobility’s (NYSE:SRFM) multi-pronged strategy to transform the skies:

-

-

- Acquisition of Southern Airlines jumpstarted operations, deploying a fleet of ~50 aircraft on a nationwide network of flights.

- Agreement with Textron Aviation for over 100 Cessna Grand Caravan EX models signals a commitment to electrification.17

- Strategic alliance with AeroTEC accelerates development and certification of commercial electric aircraft technology.

-

Surf Air Mobility Inc. (NYSE:SRFM) has begun making waves in East Africa and Brazil, sealing strategic MOU agreements with air operators to electrify their fleets once the technology is certified.

In a groundbreaking move, Surf Air Mobility recently announced MOU agreements with some of Kenya’s premier safari air services, Safarilink,Yellow Wings Air, and Z.Boskovic to electrify their fleets.

By upgrading existing Cessna Grand Caravan aircraft fleets with Surf Air Mobility’s (NYSE:SRFM) cutting-edge electrified powertrain technology, they could revolutionize air travel in Kenya and beyond.

This initiative builds upon Surf Air Mobility’s earlier collaboration with Azul, Brazil’s largest airline, to electrify up to 27 of its Cessna Caravans.

With targets of reducing direct operating costs by up to 50% and eliminating 100% of direct carbon emissions on fully electric versions of the powertrain, Surf Air Mobility Inc. (NYSE:SRFM) plans to propel the industry towards a greener, more efficient future in regional air travel.

How Does Surf Air Distance Themselves From Its Competitors?

As the electric aviation space heats up, Surf Air Mobility Inc. (NYSE:SRFM) could emerge as a standout player, offering distinct advantages that resonate with both consumers and investors alike.

Unlike Joby Aviation, BETA Technologies, Archer Aviation, and Lilium N.V.—all of which are pre-revenue from passenger operations—Surf Air Mobility stands out with a solid revenue stream including revenue of $28 million in Q3 202418 and a recently closed $50 million financing.19

Surf Air’s (NYSE:SRFM) market value is hovering just over $33 million.

The best part? These companies may seem like rivals on the surface, but they could ultimately become valuable partners for Surf Air Mobility (NYSE:SRFM), similar to how Air Canada partners with United on select flights.

It’s also like how Uber focuses on delivering a seamless transportation experience regardless of the vehicle, Surf Air Mobility’s tech-enabled operating software and planned leasing services could complement the company’s efforts.

What’s not to like about this company?

Surf Air Mobility Aims to Enable the New Regional Mass Transit Air Travel Solution

It’s 2024 – shouldn’t air travel be as simple and convenient as tapping a button on your smartphone?

Just like how Uber made hailing a ride seamless, Surf Air Mobility Inc. (NYSE:SRFM) aims to make catching a short flight just as easy and convenient.

Imagine skipping the long lines and busy hubs and flying directly between smaller local airports closer to your home and desired destination.

It’s what the industry calls Regional Air Mobility (RAM).

“Regional Air Mobility (RAM) will fundamentally change how we travel, bringing the convenience, speed, and safety of air travel to all Americans, irrespective of their distance from a major hub.” – NASA24

McKinsey & Company predicted that “Innovative propulsion… could introduce a new era of frequent, convenient passenger flights on smaller regional aircraft.”25

The financial horizon is even brighter. By 2035, the global market for these regional flights could be valued between $75 billion and $115 billion, translating to a passenger flow of 300 to 700 million people annually.26

But, what truly makes Surf Air (NYSE:SRFM) the ‘Uber of Commercial Air Travel’ is its approach to streamlining and enhancing the user experience.

The Surf Air App reimagines how we access air travel, making existing aircraft and pilots more accessible to the everyday traveler.

Soaring High With Star-Studded Partnerships

In the fast-paced world of regional air mobility, Surf Air Mobility Inc. (NYSE:SRFM) has assembled a powerhouse team of industry titans, positioning itself for unparalleled success.

-

-

- Textron Aviation – Aircraft Manufacturing

- Exclusive relationship supports Surf Air Mobility’s (NYSE:SRFM) development of electrified Cessna Grand Caravan EX aircraft.

- Palantir Technologies – Software Development

- Enhances operational efficiency with Big Data analytics solutions

- AeroTEC – Engineering & Certification

- Certifies Surf Air’s electrified powertrain technology, ensuring reliability

- Jetstream Aviation – Capital Financing

- Provides flexible aircraft leasing capital

- SkyWest Airlines – Pilot Recruitment

- Ensures a competitive advantage in pilot recruitment

- Textron Aviation – Aircraft Manufacturing

-

Surf Air Mobility’s Multifaceted Revenue Streams

Surf Air Mobility Inc. (NYSE:SRFM) is revamping travel. They’re not just changing the game; they’re rewriting the playbook with a diverse revenue mix.

Scheduled flights linked over 40 US cities27 and over 70,000 flights and 400,000 passengers in 2023, making travel a breeze. Whether it’s a single seat or a private charter, Surf Air is the go-to for fast, convenient journeys.

Their role in essential air services (EAS) adds consistent, subsidized revenue.

A groundbreaking partnership with Purdue University: subsidized flights between Purdue and Chicago O’Hare. Launched in early Q2 2024, these new flights are transforming travel for Purdue’s community.28

In May 2024, Surf Air Mobility Inc. (NYSE:SRFM) launched another subsidized route connecting Williamsport with Washington Dulles, injecting new life into regional travel with frequent weekly flights.29

Stellar Leadership Team

Surf Air Mobility’s (NYSE:SRFM) leadership brings a wealth of experience from aviation, media, and technology, showcasing a track record of success.

RECAP: 6 Key Reasons

You Don’t Want to Sleep On Surf Air Mobility Inc. (NYSE:SRFM)

1

Massive Market Potential: TAM for regional air mobility could reach $75-$115 billion by 2035.

2

US Commuter Airline Leader: Surf Air flew 404,000 passengers in 2023 on ~71,000 flights30

3

Strong Revenue Growth: Generated ~$110 million in revenue in 2023.

4

Key Industry Partnerships: Collaborations with Palantir and Textron Aviation, strengthen its edge.

5

Experienced Leadership: Proven team with experience at United, Bombardier Flexjet, Kitty Hawk, and Virgin America.

6

Bold Transformation Plan: Backed by $50 million, Surf Air Mobility is executing a four-phase transformation plan to optimize operations, broadly offer its SurfOS software, expand routes, and create a platform for new electrification technology in the future.

Demand for short haul flights is set to soar. And who’s ready to meet this surge?

Surf Air Mobility Inc. (NYSE:SRFM).

They’re not just in the business of flying; they’re in the business of revolutionizing regional air mobility.

Start your due diligence and make sure Surf Air Mobility Inc. (NYSE:SRFM) is on your watchlist today.

Opportunities like this don’t come often.

Deanna WhiteInterim CEO and COO

Deanna WhiteInterim CEO and COO Oliver ReevesChief Financial Officer

Oliver ReevesChief Financial Officer Sudhin ShahaniCo-Founder

Sudhin ShahaniCo-Founder Carl AlbertChairman

Carl AlbertChairman