Deere & Company (NYSE:DE), also known as John Deere, just reported earnings. Let’s take a look. The company reported earnings per share of $6.16 versus the $6.69 estimate on revenue of $14.1 billion versus $12.78 billion.

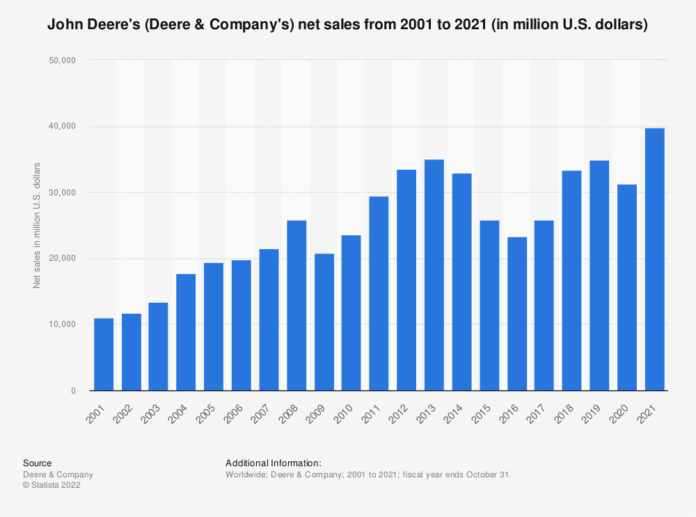

So looking at revenue, it has been growing pretty nicely over the past year or two years here because recently they’ve raised their prices, so naturally revenues are going to increase when there’s a lot of inflation and companies are raising prices across their products, right?

Deere & Company Cuts Full-Year Outlook

And another thing worth mentioning, which is why Deere & Company (NYSE:DE) stock’s probably fallen, is they cut the full-year industry outlook for both the US and Canada when it comes to agriculture and turf, and they also cut their net income guidance. It was $7 billion to $7.4 billion. Now it’s that $7 billion to $7.2 billion.

And as you guys can see on the stock here, it dropped down over 5% after these earnings came out, and it makes sense to me.

Let me know your thoughts.