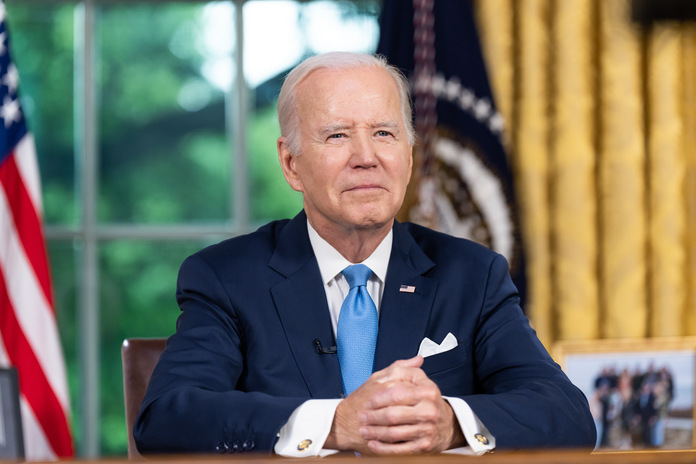

Shares of Novo Nordisk A/S (NYSE:NVO) and Eli Lilly & Co. (NYSE:LLY) fell on Tuesday following President Joe Biden’s call for price reductions on their popular weight loss and diabetes medications. Biden, in collaboration with Vermont Senator Bernie Sanders, criticized the companies for charging “unconscionably high prices” compared to those in other countries, as stated in an editorial published in USA Today.

“If pharmaceutical companies refuse to substantially lower prescription drug prices in our country and end their greed, we will do everything within our power to end it for them,” Biden and Sanders wrote.

Market Reaction and Industry Impact

Novo Nordisk’s shares dropped as much as 3.7% in Copenhagen, while Eli Lilly’s shares fell by 3.9% at the New York market open. Both companies have not yet responded to the comments.

The market for these injectable medicines, particularly in combating obesity, is projected to reach $130 billion annually by the end of the decade. Companies like Pfizer Inc. (NYSE:PFE), AstraZeneca Plc (NASDAQ:AZN), Amgen Inc. (NASDAQ:AMGN), and various smaller biotech firms are actively developing competing products.

Analysts’ Perspectives

Mizuho analyst Jared Holz suggested that Biden’s comments may be an attempt to appeal to certain voters. He noted that given the benefits of these drugs in treating diabetes, heart disease, and other conditions, the current price of around $1,000 per month “actually seems very inexpensive.”

Novo Nordisk has attributed the high list prices of its drugs Ozempic and Wegovy in the US to systemic issues, expressing willingness to collaborate with lawmakers to address these concerns. In May, the company indicated its preparedness to work with legislators in a letter to Sanders. CEO Lars Fruergaard Jorgensen is scheduled to testify before a Senate committee chaired by Sanders in September to discuss the drugs’ pricing.

Future Outlook for Drug Pricing

Novo Nordisk anticipates increasing discounts on both drugs, especially as more insurers cover Wegovy. While Lilly has faced less scrutiny compared to Novo, it remains under the spotlight as the market for obesity and diabetes treatments continues to expand.

Optimism about soaring sales of Novo Nordisk’s Wegovy for obesity and Ozempic for diabetes has driven its market capitalization beyond $600 billion this year, cementing its status as Europe’s most valuable listed company. The stock has risen more than 80% over the past year and has quintupled since the start of 2020.

Featured Image: Wikipedia