On Wednesday, Wall Street analysts who follow Airbnb stock (NASDAQ:ABNB) were cautious due to an unclear outlook for demand going forward. Even though there were problems with the economy as a whole in Q3, Wall Street in general liked how the company did. They also recognized that travel demand has stayed strong. However, a hint of “choppy” earnings in the future was enough to cause some worry.

Airbnb Stock Analysis

For example, Bank of America warned clients that the name may see a drop in demand after the pandemic, even though Airbnb (NASDAQ:ABNB) has one of the best marketplace models because of its growth rate and brand recognition. It was decided that a Neutral rating was the most acceptable given the possibility of a recession.

Oppenheimer focused on the same problems and said that volume problems would get worse by 2023. According to the business, shares at their current levels “appears fully valued” given a valuation premium over peers in its sector, with an opportunity for multiple compression in the coming year. As a result, a Hold-equivalent rating was maintained.

Even though it still thinks the company will do well, Evercore ISI is worried about what has been happening. Equity analyst Mark Mahaney highlighted that “ABNB advised that ADRs will suffer pressure from FX and business mix (geo, urban, and listing type), beginning in Q4; this forced us to revise our ’23 ADR outlook from down 2% to down 7%.” This warning seems to be a departure from what ABNB and BKNG said during our tech conference in September.

The stock was consequently taken off of its “Tactical, Action & Positioning” Outperform List. He nevertheless kept the name with a Buy-equivalent rating. Nevertheless, not all experts exercised caution. In fact, Needham raised its estimates and gave what was probably the most positive response to the results.

Bernie McTernan, an equity analyst, told clients, “We are taking a conservative approach to the flow through, but we are keeping our adjusted EBITDA projections the same in 23E because stronger margins will make up for fewer bookings.” Analysts will keep an eye on the data from the third quarter for signs of a drop in demand after peak travel. This is because demand growth is still strong for both new and old use cases, which makes ADRs higher than expected. He also said that supply dynamics look good, which was meant to counteract some negative ways that the results could be interpreted.

We appreciate ABNB’s positioning because, in our opinion, the company is prepared to profit from the recovery of the economy and pent-up demand for travel. ABNB has been gaining market share in the travel sector, helped by the epidemic, which is, in our opinion, encouraging more individuals to test the service. Because the market is so good, ABNB benefits from a network effect in which clients become both repeat customers and hosts.

He retained a “Buy” rating and set a $150 price objective for the stock, deviating from his more conservative peers’ recommendations. At the opening of the market on Wednesday, shares of the San Francisco-based accommodation platform went down 5.89%.

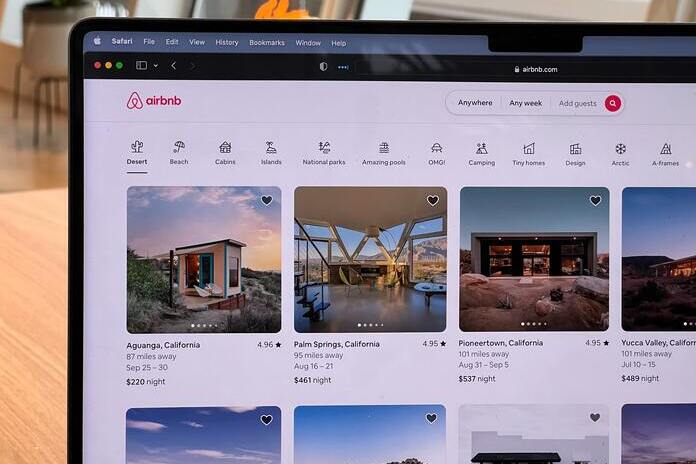

Featured Image- Unsplash @ veryinformed