The digital currency market is experiencing explosive growth, with trading volumes expected to surpass $108 trillion in 2024—a 90% increase in two years. This surge is driven by technological innovation, shifting regulations, and increasing global adoption. A key development is Ripple’s recent legal victory against the SEC, which has provided much-needed regulatory clarity and boosted market confidence. Another key indicator is the successful launch of nine US Ether ETFs, further signaling mainstream acceptance of digital currencies.

As digital currencies gain traction, companies involved in the ecosystem—such as trading platforms, mining operations, and blockchain technology providers—are emerging as major players. These digital currency stocks offer exposure to the growing market without the inherent risk that comes along with directly buying digital currencies.

With that in mind, here is our top 5 digital currency stocks to watch in 2024:

- WonderFi Technologies Inc. (TSX:WNDR) (OTCQB:WONDF)

- Coinbase Global Inc. (NASDAQ:COIN)

- Riot Platforms, Inc. (NASDAQ:RIOT)

- PayPal Holdings Inc. (NASDAQ:PYPL)

- Block Inc. (NYSE:SQ)

1. WonderFi Technologies Inc. (TSX:WNDR) (OTCQB:WONDF)

WonderFi Technologies Inc. (TSX:WNDR) (OTCQB:WONDF) stands as the owner of Canada’s largest regulated digital currency trading platform and a global leader in both centralized and decentralized financial services. With over $1.35 billion in assets under custody, WonderFi is equipped to support participants worldwide, offering a suite of services that includes trading, payments, and decentralized products such as purpose-built blockchains and non-custodial wallet applications.

The company is designed to offer investors diversified exposure to the global digital asset ecosystem and has a strong track record of launching new products and securing necessary registrations. WonderFi also owns leading brands like Bitbuy, Coinsquare, and SmartPay.

WonderFi Technologies Inc. (TSX:WNDR) (OTCQB:WONDF) just reported a 303% year-over-year increase in revenue, reaching C$12.0 million for Q2 2024. This surge in revenue is a testament to the company’s expanding market presence and its successful integration of acquisitions, such as Bitbuy, Coinsquare, and SmartPay.

WonderFi’s digital currency trading volumes also saw a significant 358% rise, highlighting the increasing adoption of its platforms. With $46.7 million in cash and digital assets, the company continues to strengthen its financial position, underpinned by a focus on innovation and the development of new decentralized products through WonderFi Labs.

WonderFi also recently introduced a new innovation and development arm, WonderFi Labs. WonderFi Labs develops and invests in centralized and EVM-compatible decentralized products, including the WonderFi Layer 2 blockchain and Non-Custodial Wallet. Focused on advancing decentralized technologies, it aims to broaden WonderFi’s offerings and strengthen its role in digital finance.

As the global economy increasingly shifts toward blockchain technology, WonderFi is strategically positioned to expand its market and wallet share by continuing to innovate within the digital asset space.

Sponsored

This Industry is Taking Off in 2024!

Big names in finance and tech are betting big on this red-hot sector.

They know something big is on the horizon.

The digital currency market is surging and our top choice is managing over $1.5b in assets.

Find out which player is poised to make a splash in 2025—don’t get left behind.

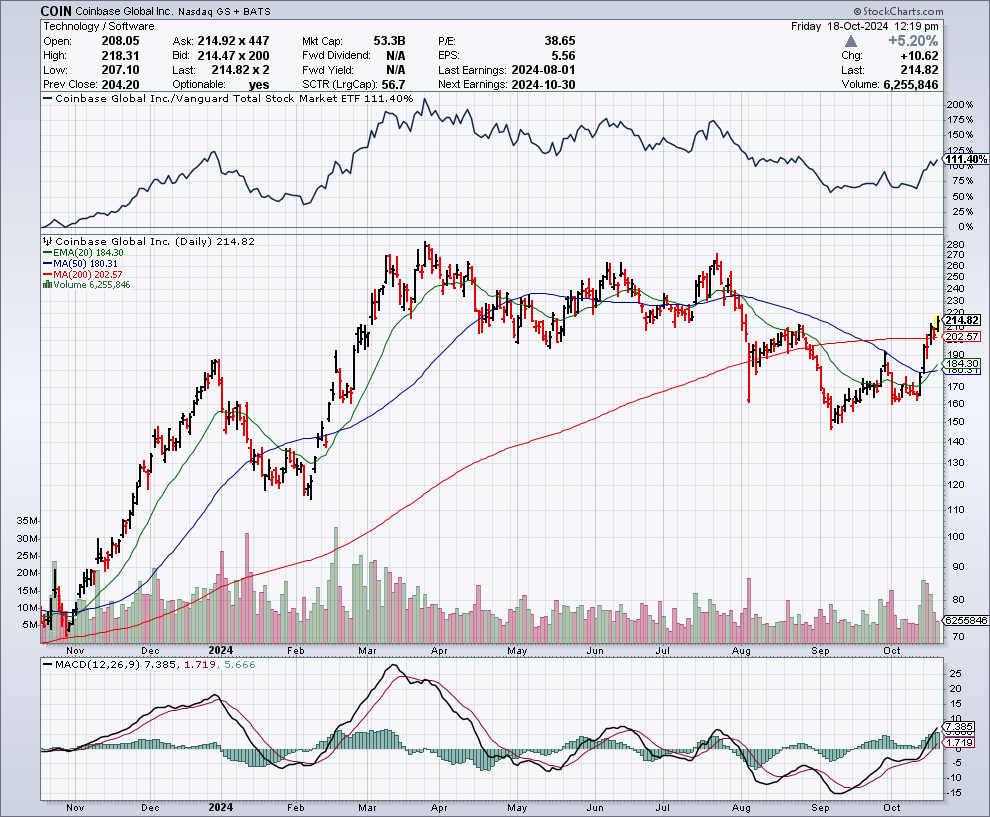

2. Coinbase Global Inc. (NASDAQ:COIN)

Coinbase Global Inc. (NASDAQ:COIN), a top digital currency exchange, went public in April 2021. It offers users the ability to trade over 240 digital assets, including BTC, Ethereum, and Cardano (ADA). Coinbase’s growth is closely linked to rising digital currency prices, attracting millions of new users. The company earns revenue through transaction fees but aims to expand beyond trading by offering a debit card for spending from digital wallets and a cloud platform for businesses handling digital currencies.

Notably, Coinbase has introduced innovative services like asset loans, allowing users to borrow against their digital currency holdings without selling them, and blockchain analytics, which help monitor transactions and track illicit activities. This makes Coinbase a key player in the evolving market. As digital currency trading and adoption grow, Coinbase and its shareholders are well-positioned to benefit from the expanding digital currency landscape.

3. Riot Platforms, Inc. (NASDAQ:RIOT)

Riot Platforms, Inc. (NASDAQ:RIOT) is a leading BTC mining company based in the United States, focused on supporting the BTC network through industrial-scale mining operations. The company operates one of the largest digital currency mining facilities in North America, leveraging cutting-edge technology and a vertically integrated strategy to maximize efficiency and output. Riot’s primary facility, located in Rockdale, Texas, is equipped with thousands of miners, providing the company with a significant share of the global BTC hash rate.

Riot Platforms is committed to expanding its operations and increasing its BTC production capacity while maintaining a focus on sustainability and cost-effectiveness. The company also engages in strategic partnerships and acquisitions to enhance its mining capabilities and infrastructure. As the demand for BTC and blockchain technology continues to grow, Riot Platforms aims to remain at the forefront of the industry, delivering value to its shareholders through continuous innovation and operational excellence.

4. PayPal Holdings Inc. (NASDAQ:PYPL)

PayPal Holdings Inc. (NASDAQ:PYPL) is a global leader in digital payments, providing a platform that enables individuals and businesses to transact online securely and efficiently. Since its inception, PayPal has revolutionized the way people make payments by offering a reliable alternative to traditional banking methods. The company operates across multiple segments, including online payment processing, mobile payments, and peer-to-peer transactions through its popular Venmo app. PayPal’s expansive network of over 400 million active users and its presence in more than 200 markets worldwide underscore its significant influence in the fintech space.

Additionally, PayPal has been at the forefront of adopting emerging financial technologies, including digital currency transactions, further diversifying its services. The company’s strategic acquisitions, such as Honey for e-commerce solutions and iZettle for in-store payments, have strengthened its ecosystem, making PayPal a comprehensive platform for digital commerce. With its strong brand reputation and continuous innovation, PayPal remains a dominant force in the evolving digital payments landscape.

5. Block Inc. (NYSE:SQ)

Block Inc. (NYSE:SQ), formerly known as Square, is a prominent fintech company that has revolutionized the way businesses and individuals manage payments and financial services. Founded by Jack Dorsey, Block began as a simple mobile payment solution for small businesses and has since evolved into a comprehensive ecosystem that includes point-of-sale hardware, software, and a suite of financial services. Block’s Cash App, a mobile payment service, has become a significant growth driver, allowing users to send money, invest in stocks, and even buy and sell BTC.

The company’s expansion into decentralized finance (DeFi) and its focus on blockchain technology further underscore its commitment to innovation in the financial sector. Additionally, Block’s acquisition of Afterpay has strengthened its position in the buy-now-pay-later market, enhancing its appeal to both consumers and merchants. With its diverse product offerings and strategic focus on emerging technologies, Block is poised for continued growth in the rapidly evolving fintech landscape.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers