The digital currency marketplace continues to be filled with turmoil. Most recently, Voyager Digital declared bankruptcy and was suspended from trading on the Toronto Stock Exchange (TSX).¹

Also recently, Celsius Network LLC, which has also gone bankrupt, announced that it was suing a former investment manager who it says either lost or stole tens of millions of dollars in assets from the company.²

And again, that’s just recent news from this tumultuous marketplace. Earlier this year, digital currency lender BlockFi was ordered to pay $100 million to settle allegations from the SEC and state regulators that it illegally offered a product that pays high interest rates to customers who lend out digital tokens.

In the wake of these developments and others (see below), there is increasing pressure for digital currency exchanges to register with the SEC.

This movement is putting the focus on which exchanges are “doing it the right way” and which ones aren’t – which is also creating a unique investment opportunity for in-the-know investors.

That’s because many of the top companies may have difficulty receiving SEC approval and this is going to open the door to currently little known companies that could then see rapid growth.

Look at what has happened already as the regulation movement picks up steam:

- Binance was forced to announce that it would no longer offer digital versions of stocks like Tesla, Apple and Coinbase due to pressure from regulators.3

- 11 class action lawsuits were filed against digital currency companies like Binance, BitMEX, Tron Foundation and many others. The suits allege the companies sold unregistered securities.4

- Digital currency exchange Poloniex agreed to pay $10.4 million to settle US SEC charges.5

- XRP digital currency saw its value decrease by over 63% when the SEC announced a suit against parent company Ripple.6

An Ugly Truth is Being Revealed …

You see, as the digital currency markets grew rapidly, companies were eager to jump in and get their fair share of the profits being generated … a little too eager it turns out in many cases.

These companies “didn’t jump through the proper hoops” and are now paying the price. But while this is happening it is also creating a powerful opportunity for companies who did things the right way and are built on a solid foundation …

Companies like Kevin O’Leary backed WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF), which is creating a leading global platform that unifies access to digital assets in a regulated manner.

Strengthening its case even more is the fact that WonderFi recently announced two major acquisitions.

On July 4, it announced the acquisition of Coinberry, one of Canada’s leading digital currency asset trading platforms registered with the Canadian Securities Administrators (CSA) and Canada’s first pure-play licensed digital currency broker.7

The acquisition goes hand in hand with WonderFi acquisition of First Ledger Corp., the parent company of Bitbuy Technologies, a leading digital currency platform and Canada’s first digital currency trading platform to become regulated as a digital asset marketplace with a restricted dealer license.8

These acquisitions have helped establish WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) as a leading end-to-end consumer platform for people seeking access to digital currency and decentralized finance!

The company also further strengthened its stature and position in the marketplace by listing on the Toronto Stock Exchange on June 22nd9 and by submitting its application to list on NASDAQ on Aug. 16. 10

Bitbuy and Coinberry Acquisitions Bode Well

for WonderFi’s Future

With its most recent acquisition, WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) becomes the first company in Canada, and one of the first globally, to own and operate multiple licensed, digital currency asset trading platforms regulated by applicable securities commissions.

Not only that, the Coinberry and Bitbuy acquisitions make WonderFi one of the largest digital currency exchange businesses in Canada by number of registered users.

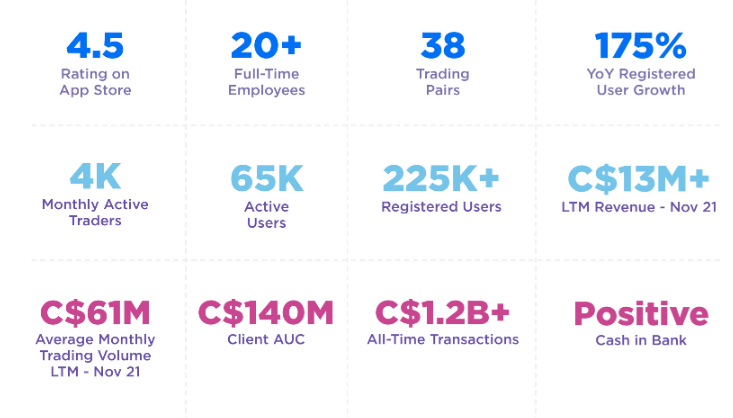

The acquisition of Coinberry brings WonderFi a ton of value, including custody of approximately 225,000 users and $99.5 million of client assets as of the date of the acquisition.

And that’s not all. Check out these numbers:

And Coinberry has had a strong track record of growth since 2020, with its revenue, assets under custody, userbase and transaction volumes all growing significantly.

It’s no wonder, WonderFi CEO Ben Samaroo said, “This acquisition further solidifies WonderFi as a leader amongst digital currency companies…”

And WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) recent purchase of Bitbuy made the company Canada’s leading end-to-end consumer platform for customers to access digital currency and decentralized finance at a whole new level.

Bitbuy has over 400,000 registered users, and more than $5 billion has been transacted through the platform to date.

Bitbuy also had $455 million of assets under custody as of December 31, 2021, with revenues of over $31 million for the year ended September 30, 2021.

Looking back even further, Bitbuy had 3,379% revenue growth from 2017 to 2020, and now WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) can tap that growth for the future of the company.

To put it another way, these acquisitions mark the beginning of what could become an institutional-grade digital currency platform. Picture investment banks, hedge funds, and family offices trading digital currency through the platform in the coming decades.

And then picture all of the revenue that will accompany that. That’s why many are getting excited about WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF).

These acquisitions are an adrenaline injection into the arm of WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) that could see the company blastoff to the next level.

Plus, WonderFi just announced in July a partnership with Meta Venture Capital Partnerships team. Meta, the parent company of Facebook an Instagram, will provide strategic advice to WonderFi on growth marketing, performance and scaling.

8 Reasons

Why WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) is Canada’s Leading Digital Currency Marketplace

1

Large, Disruptive & Rapidly Growing Market: The total addressable market for Web 3 (CeFi, DeFi, GameFi and NFTs) is now over $500 billion12

2

Acquisitions of Coinberry and Bitbuy: With Coinberry, WonderFi (TSX:WNDR) (OTCQB:WONDF) has acquired one of Canada’s leading digital currency asset trading platforms. With Bitbuy, it has the leading digital currency platform and Canada’s first digital currency trading platform to become regulated as a digital asset marketplace with a restricted dealer license

3

First Approved Digital Currency Marketplace in Canada: Last December, Bitbuy registered with the Ontario Securities Commission and Canadian Securities Administrators13

4

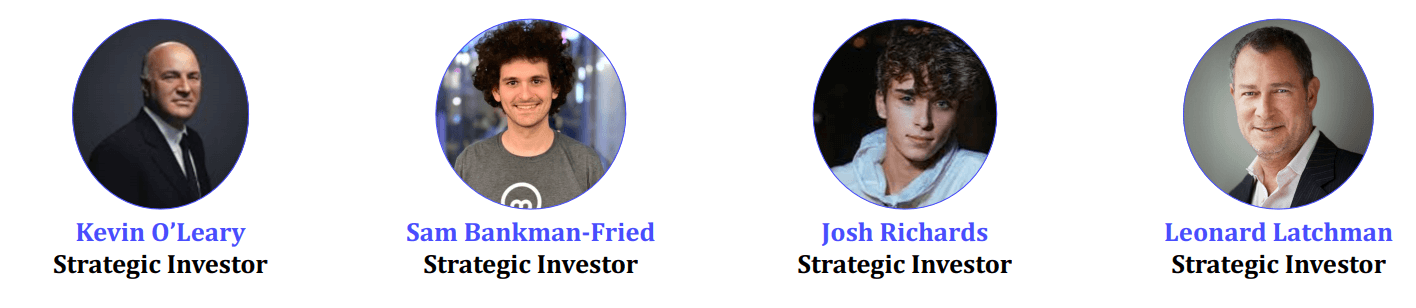

Big Backers: Kevin O’Leary and billionaire Sam Bankman-Fried are both major investors in WonderFi (TSX:WNDR) (OTCQB:WONDF). They have both shown a special knack for identifying breakout companies.

5

Assets on the Balance Sheet: Company assets allow WonderFi (TSX:WNDR) (OTCQB:WONDF) to generate revenue while also giving investors exposure to various digital currency assets

6

Well Funded: $356 million in total assets as of June 30, which includes $15 million in cash and $5.6 million in digital currency assets and inventory, including $187 million of Assets Under Custody for customers14

7

Lower Customer Acquisition Costs: Kevin O’Leary and Josh Richards have audiences in the tens-of-millions that can bring DeFi to the intergenerational masses for less, driving down WonderFi’s (TSX:WNDR) (OTCQB:WONDF) customer acquisition costs

8

Board Stacked with Public Company & digital currency Heavyweights: Company leadership formerly included Sean Clark, co-founder & former CEO of Hut 8, the biggest BTC miner in North America, and currently Bill Koutsouras, the Lead Independent Director of Galaxy Digital

With Big Names Already Betting Big on DeFi … It’s Likely Only a Matter of Time Before WonderFi

Appears on More Big Investor Radars!

That’s why now could be the best time for investors to act.

With experts saying DeFi is “booming”15 and “at the forefront of blockchain and digital currency innovation”, it’s no surprise there’s major investment buzz around the DeFi space.

In fact, O’Leary is now WonderFi Technologies Inc’s (TSX:WNDR) (OTC:WONDF) BIGGEST name shareholder.16

“Imagine if I could have over these years had a five percent yield on my gold, that would have been incredible. Well, I can on my digital currency so that’s really what I’m doing in DeFi and I think I’ve got the best team in North America.”

– Kevin O’Leary.17

The man who has built a reputation on Shark Tank for spotting great investment opportunities says he is convinced that DeFi’s “potential is huge.”18 He adds that new companies entering the space will hold an early adopter advantage19 and that’s why he gathered a team of experts to uncover the sector’s best opportunities.

That search led him to WonderFi (TSX:WNDR) (OTC:WONDF), which he renamed after his “Mr. Wonderful” persona.

But O’Leary isn’t the only noteworthy businessman betting on WonderFi.

Another big-time investor interested in WonderFi is Sam Bankman-Fried, a 29-year-old digital currency billionaire.

Bankman-Fried is worth an estimated $8.7 billion and manages $2.5 billion through Alameda Research, a quantitative digital currency trading firm he founded in 2017.

He is also the founder and CEO of FTX, an expanding digital currency empire that was most recently valued at $32 billion after a $400 million financing round. The raise drew in several notable firms, including Temasek, Softbank Vision Fund 2, Ontario Teachers’ Pension Plan, and Tiger Global.20

Most recently, Bankman-Fried has taken it upon himself to by the digital currency industry’s saviour and has pledged $1 billion to help bail out the industry following the sharp downturn in 2022.21

Bankman-Fried has thrown considerable weight behind WonderFi (TSX:WNDR) (OTCQB:WONDF) – further cementing his partnership with Kevin O’Leary, who is a long-term investor and spokesperson for FTX.

Already, WonderFi has gone through a C$17.7 million financing round,22 an upsized bought deal offering of C$26.36 million,23 and a $45 million bought deal offering24 so that it is well-funded to accomplish its goals.

With celebrity backing and plenty of money in the bank, It’s no surprise that Canaccord Genuity Group has decided to continue covering WonderFi.25

Press Releases

- WonderFi Announces Agreement to Acquire Blockchain Foundry

- WonderFi Announces Listing on OTCQB in the United States

- WonderFi Announces Q3 2022 Financial Results

- WonderFi Announces International Expansion Strategy and Strategic Alignment of Resources

- Meta, Parent Company of Facebook and Instagram, Partners with WonderFi to Provide Strategic Advice on Growth Marketing

The Key to Success is to

Find the Right Opportunity …

The digital currency space is also seeing lots of big-name investors. Celebrities like Justin Bieber, Gweneth Paltrow, Snoop Dogg and Ashton Kutcher recently invested in digital currency start-up MoonPay, which at their peak was worth $3.4B.26

These examples are more evidence of society increasingly placing value on digital assets.

It’s no wonder more major institutions are wading into the DeFi waters every day.

So, what sets WonderFi apart from other companies in the digital currency space?

Well, despite being Canada’s leading digital currency marketplace and having the best prices, deepest liquidity and most products, WonderFi also can scale globally without significant cost.

So With All the Different Investment Opportunities

Available in This Market, Why WonderFi?

One of the biggest reasons WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) stands out in this marketplace is the stability it offers. It is now widely regarded as a solid investment for those seeking exposure to compliant digital currency.

One of the biggest reasons WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) stands out in this marketplace is the stability it offers. It is now widely regarded as a solid investment for those seeking exposure to compliant digital currency.

As Business Insider put it, WonderFi “is working to find a commercial solution to DeFi investing, enabling anyone who has a wallet to wrap their assets and utilize DeFi’s benefits automatically and in a compliant way.”27

To accomplish its mission, the company has created an extremely easy-to-use platform. That platform is another factor driving interest in WonderFi – even more so than the company’s big name investors. For example:

“With the help of Mr. Wonderful, the potential for WonderFi’s proprietary dashboard is huge.” – Midas Letter Live28

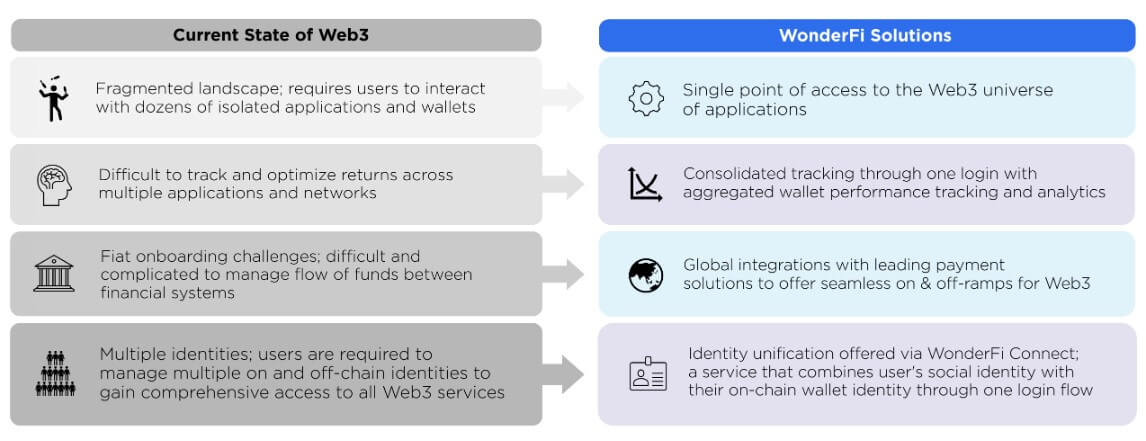

You see, the big issue in the DeFi marketplace is that all the existing DeFi applications are built for digital currency traders and experts.

That inaccessibility has prevented a MUCH bigger market from adopting DeFi.

But with WonderFi Technologies Inc. (TSX:WNDR) (OTC:WONDF) breakthrough WonderFi app released on January 25th, 2022, everything is about to change.

Because anyone can easily reap the full potential of Web3 without being an expert.

Thanks to this easy-to-use platform, now ordinary people can lend, borrow, earn interest, track performance, and trade assets through smart contracts that can be more efficient than traditional financial products.29

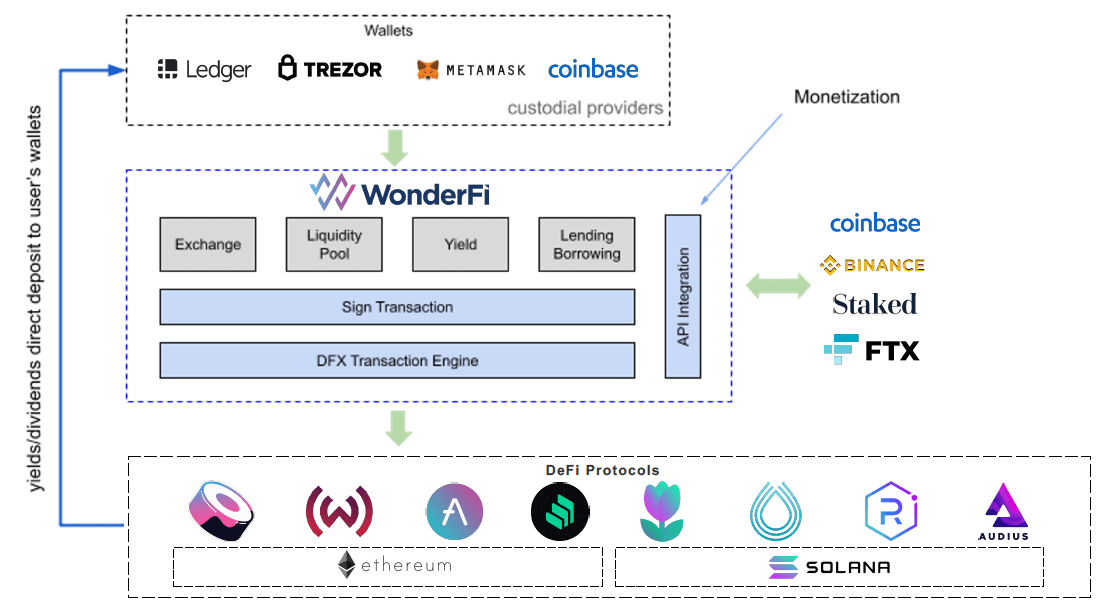

Plus, there is another great thing about WonderFi’s (TSX:WNDR) (OTC:WONDF) platform – it is “non-custodial”.

That means the platform never takes ownership or full control over users’ assets.

Instead, the users have control because only they have the private keys needed to access their assets.30 This could be crucial for getting more people involved in DeFi.

Also, once users have assets in the WonderFi platform, they’ll find educational resources to help them understand the DeFi options they can leverage.

For example, unlike ETFs, WonderFi (TSX:WNDR) (OTC:WONDF) has the ability to generate yield using a variety of strategies available within the DeFi ecosystem, including smart contracts on platforms like ETH and SOL.

This is a Company That Stands Out

from the Competition …

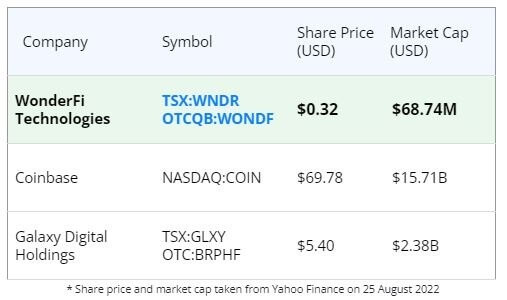

WonderFi’s competitors are companies like Galaxy Digital and Voyager Digital, which just filed for bankruptcy.

Galaxy Digital is a financial services and investment management company that has a varied portfolio of assets. What it doesn’t have is a non-custodial platform like WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF).

Simply put, most digital currency enthusiasts in this space value decentralization, meaning WonderFi (TSX:WNDR) (OTCQB:WONDF) has the huge competitive advantage of having a non-custodial platform (i.e., the WonderFi platform does NOT take ownership or full control of the user’s assets).

As for other competitors, public DeFi companies are largely holding companies that simply hold digital currency assets without tapping into all that DeFi offers.

In contrast, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF) and their user-friendly WonderFi platform not only offer users access to the full power of DeFi, but also solve problems that are currently slowing consumers’ adoption of DeFi.

By making the full DeFi user experience easier and holding digital currency and DeFi assets on its balance sheet, which allow them to generate yield, WonderFi (TSX:WNDR) (OTCQB:WONDF) is on track to fulfilling their mission of bringing DeFi to the masses, which could translate into gaining significant market share.

In fact, on Aug. 15, in its Q3 earnings report, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF) reported $356 million in total assets as of June 30, 2022, including $15 million in cash and $5.6 million in digital currency assets and inventory, as well as $187 million of assets under custody for customers.31

As Interest & Excitement Build, Funding is

Flooding into WonderFi!

Ever since the market got a whiff of WonderFi Technologies (TSX:WNDR) (OTC:WONDF), the money (and noteworthy investors) has continued to pour in.

The initial funding rounds were led by Kevin O’Leary and including strategic investors such as:

- Leonard Latchman, co-founder of psychedelics startup MindMed (Market Cap: $1.22B)

- Argo Blockchain, large-scale digital currency miner (Market Cap: $710.4M)

- BIGG Digital Assets, leading blockchain company (Market Cap: $294.3M)

- Sam Bankman-Fried, millennial billionaire, founder & CEO of digital currency exchange FTX, manages $2.5B of assets through Alameda Research32

- Josh Richards, top social influencer, entrepreneur & co-founder of Animal Capital investment fund

Those are some big-time investors but the great thing about WonderFi being a new, under-the-radar company is that there is still an opportunity for other investors to get involved.

Of course, as word spreads that opportunity will likely get pricier and pricier.

In the News

- Kevin O’Leary-Backed WonderFi Buys Blockchain Foundry, Bolsters Web3 Capabilities – Benzinga

- Kevin O’Leary-backed WonderFi to acquire Coinberry for $38.5 million in next phase of consolidation strategy – Financial Post

- How Much Bitcoin Does Mr. Wonderful Hold? – Zacks

- WonderFi Acquires Sun Machine Entertainment, Lays Foundation For Foray Into Gaming And NFTs – Benzinga

- Kevin O’Leary-Backed DeFi Platform WonderFi to Purchase Bitbuy for $162M in Cash, Shares – CoinBase

Another Factor Working in WonderFi’s Advantage: Its Talented Leadership Team!

The company’s engineers have built world-class, game-changing products like Shopify, Hootsuite and blockchain products dating back many years.

Their business builders, meanwhile, have proven themselves capable of maximizing the potential of tech startups.

The company’s leadership team includes:

Recap: 8 Reasons

to Consider WonderFi Technologies (TSX:WNDR) (OTC:WONDF) Now!

1

Massive and Growing Market: Large, disruptive & rapidly growing

2

Bitbuy & Coinberry Acquisitions: These moves have created one of the largest combined compliant and licensed digital currency companies in Canada

3

Platform: Easy-to-use, solves DeFi’s biggest problems: fragmentation and complexity

4

App Poised to Bring DeFi to Mainstream Audience

5

Valuable Exposure: Assets on the balance sheet enable WonderFi (TSX:WNDR) (OTC:WONDF) to generate revenue while also giving investors exposure to various DeFi assets

6

Billionaire-Backing: WonderFi’s investors include Kevin O’Leary from the Shark Tank TV show, Sam Bankman-Fried, the digital currency billionaire, and many more!

7

Well Funded: In its Q3 earnings report on Aug. 15, the company reported $356 million in total assets, including $15 million in cash33

8

Lower Costs: Kevin O’Leary’s & Josh Richards’ large audiences can drive down customer acquisition costs

Clearly, WonderFi Technologies (TSX:WNDR) (OTCQB:WONDF) has a lot going for it and it is likely under a matter of time before the market catches on. That means now is the time to study this company and consider investing.