-

-

-

- Gold prices have recently reached an all-time high of $2,431.55 per ounce in April 20241

- Gold demand is surging due to factors like high inflation, central bank buying, and geopolitical conflicts

- Major banks are predicting gold will go as high as $3,000 per ounce in the next six to 18 months2

-

-

The gold bull market is on fire this year…

But it’s about to get even hotter.

Gold prices have soared to a record high of $2,431.55 per ounce in April 2024, driven by a mix of short-term and long-term catalysts.

But Goldman Sachs and Bank of America both see it going as high as $3,000 per ounce in the next six to 18 months.3,4

Why?

Inflation rates are high, central banks are buying up gold, and geopolitical conflicts are creating economic uncertainty.

These factors are pushing investors towards gold as a safe haven, driving demand through the roof.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

China’s Gold Buying Trends Show Strong Investment Demand

Another factor driving the gold bull run is a significant boost from record gold buying in China.

Both the central bank and consumers are adding to their gold reserves at unprecedented rates.

Gwen Preston, VP of Investor Relations at West Red Lake Gold Ltd. (TSXV:WRLG) (OTCQB:WRLGF), highlighted this trend at the May Metals Investors Forum.5

She explained that Chinese consumers and retail investors are rethinking their financial strategies as the avenues that have worked so well to protect and grow wealth in recent years like real estate, the stock market, and interest rates falter amidst the worst deflation in 15 years.

In April, China saw strong wholesale gold demand driven by a surge in investment, despite weaknesses in the jewelry sector. Chinese gold ETFs also had their best month on record.6

On top of that, China’s central bank continued its 18-month streak of consecutive purchases, adding 60,000 troy ounces to its reserves in April despite high prices.

China’s influence on the gold market reflects the shifting dynamics in global economic power and the growing impact of emerging markets on commodity trends.

What is the Criteria for a Standout Gold Company?

In the current market landscape, savvy investors are keenly aware of the burgeoning opportunities in the gold sector.

With gold prices hitting record highs and indications of a major bull run on the horizon, the allure of gold mining companies are stronger than ever.

Here’s what we look for in our analysis:

-

-

- World-Class Location: Operating in a high-grade gold district with substantial historical production.

- Top-Tier Assets: Ownership of fully permitted mines with significant past production.

- High-Grade Resource: Indicated resources with high-grade gold content.

- Advanced Infrastructure in Place: Equipped with infrastructure and efficient production facilities such as a mill.

- Near-Term Path to Production: A company with a targeted production start in the near future.

- Upcoming Catalysts: Strategic plans and milestones that will generate significant news flow.

- Backed by Prominent Investors: Strong support from well-known financial institutions and investors.

- Robust Financial Foundation: Recent substantial private placements or financings to support operations.

- Experienced Leadership: Management team with proven track records in the gold mining industry.

- Fully Permitted: All required permits secured, allowing for a quick return to production activities.

-

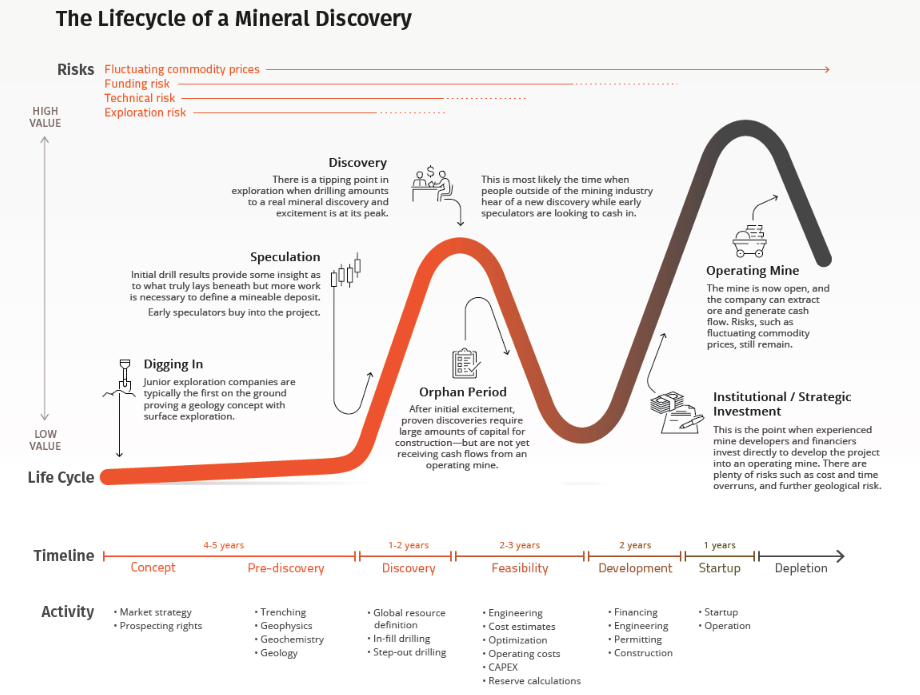

How the Lassonde Curve Can Help Pinpoint Golden Opportunities

When evaluating gold mining companies, it’s crucial to assess the project’s stage. Is it in the pre-discovery phase, has a major discovery been made, or is the mine under construction?

To determine the right pick at the right time, one helpful tool is the Lassonde Curve.

Source: Visual Capitalist7

According to the Lassonde Curve, bringing a mine into production typically requires ten to fifteen years of consultation, exploration, permitting, planning, and financing, often costing tens of millions of dollars.

One surprising aspect of this curve is the significant drop in value that often occurs after a major discovery.

This drop occurs because investors, unless committed for the long haul, are reluctant to wait through the lengthy feasibility and development stages.

On top of that, fewer than 1 in 10,000 projects ever reach production.8

That’s what makes companies like West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) stand out among the masses.

This company isn’t starting a project from scratch.

West Red Lake Gold Mines has confirmed the Mineral Resource Estimate for the Madsen Mine through an independent report from SRK Consulting, which includes:

-

-

- 65 million ounces of gold at 7.4 g/t in 6.9 million tonnes (Indicated)9

- 37 million ounces of gold at 6.3 g/t in 1.8 million tonnes (Inferred)10

-

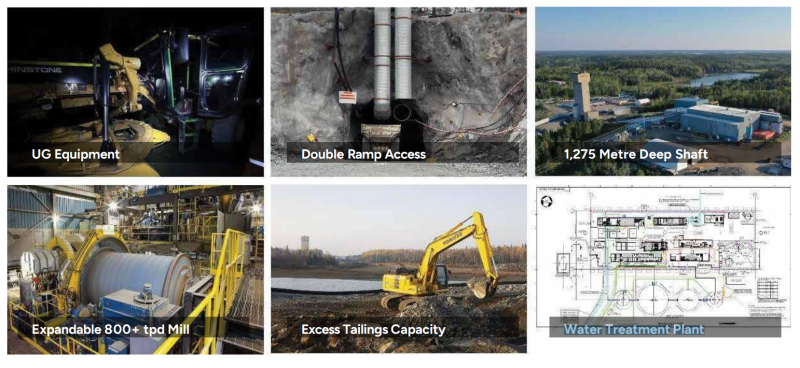

What makes this mine even more promising is that it already has most of the necessary infrastructure, including a new and expandable 800 tonne per day (tpd) processing mill, a double ramp access underground, a 1,275-meter (4,183-foot) deep shaft, and a water treatment plant.

In short, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) has bypassed many of the lengthy steps needed to put a mine into production.

The focus now is on completing a few remaining infrastructure projects at the Madsen Mine, which are already well underway.

The company expects to complete these key milestones over the next six to twelve months, setting a clear path toward its goal of restarting production in early 2025.

Gearing Up for Major Growth as the Market Heats Up

You don’t have to look far to find success stories about mining companies that have seen substantial share price increases as they progressed from exploration to development and into production.

One prime example is Artemis Gold, which saw its share price rise significantly with the advancement of its Blackwater Gold Project in Canada. Acquired in 2020, the project progressed through feasibility studies and permitting.

After some lengthy delays with permitting, the project went into full-scale construction in 2023.11 Since then, the stock has increased more than 105% and could go higher still as Artemis nears the first phase of development and pours its first gold bar, expected in the second half of 2024.12

G Mining Ventures is another company that experienced notable valuation increases with the Tocantinzinho Gold Project in Brazil. The project moved towards production with the commencement of construction in late 2022, drawing significant investor interest.13G Mining has also seen stock price appreciation during this time, going up 221% since September 2022.

Press Releases

- West Red Lake Gold Releases Maden Mine Commercial Production Video

- West Red Lake Gold Declares Commercial Production at Madsen Gold Mine

- West Red Lake Gold Reports Mid-Q4 Madsen Mine Update

- West Red Lake Gold Confirms Additional High-Grade Gold in Lower Austin with 26.16 g/t Au over 11.2m, 37.87 g/t Au over 3.55m and 10.55 g/t Au over 8m

- West Red Lake Gold Commences 5,000 Metre Drill Program at Rowan

Perseus Mining also saw stock price appreciation leading up to its first gold pour at its Yaouré Gold Mine in Côte d’Ivoire in December 2020 and continued to grow through 2021 and 2022 as it ramped up production. Since the company began construction at Yaouré in May 2019, the stock has increased by over 380%, revealing the market’s positive response to advancing towards production.14

These examples highlight the potential for significant growth during this phase, signaling that West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) could follow a similar trajectory as it moves rapidly towards its targeted restart.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

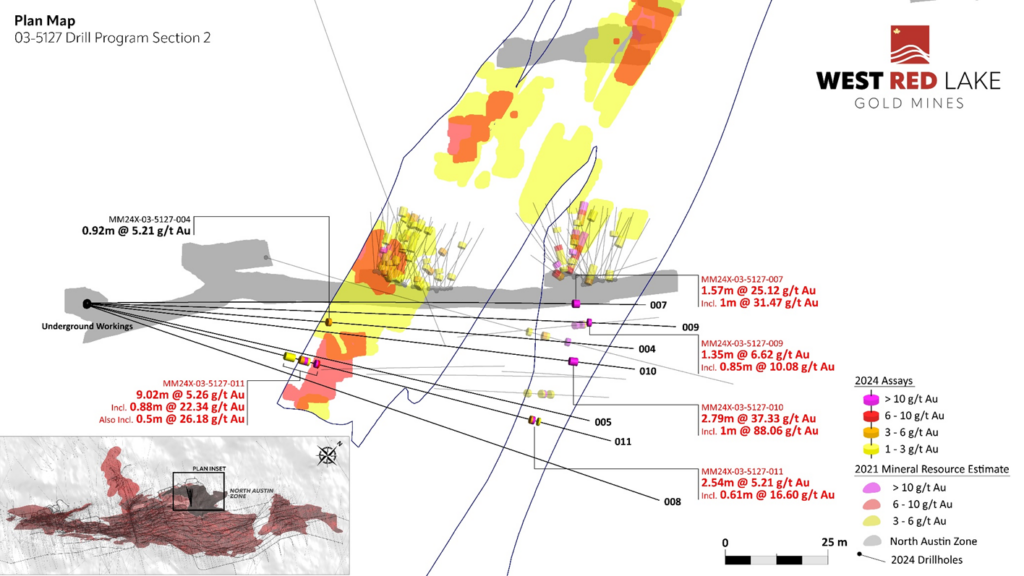

To further de-risk the asset, West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) has conducted additional in-fill drilling focused on near-term, high-grade zones.

The company recently announced significant drill results from its 100%-owned Madsen Mine, including:

-

-

- 16.69 g/t gold over 8.0 meters and 7.48 g/t gold over 12.0 meters at the South Austin Zone, which has an indicated resource of 474,600 ounces at 8.7 g/t gold and an inferred resource of 31,800 ounces at the same grade.15

- 37.33 g/t gold over 2.79 meters and 5.26 g/t gold over 9.0 meters at the North Austin Zone, indicating a new high-grade area extending the resource northeast. The team is focusing on expanding this zone further down-plunge, with promising continuity observed in initial results.16

-

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is on an accelerated path to target gold production in 2025,17 generating significant catalysts and milestones along the way. The mine restart plan includes:18

-

-

- Pre-Feasibility Study (PFS) by Q4 2024

- 38,000-meter (124,672-foot) underground drill program by Q4 2024

- 3,200 meters (10,498 feet) of underground development by Q4 2024

- Targeting a Madsen Mine restart by 2025

- Optimizing the project to focus on sustainable, cash-flowing operations

-

First Gold Pour at the Madsen Mine

As West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) moves forward with a targeted restart at Madsen, the company has also been conducting a mill cleanup and gold recovery program, yielding impressive results.

In May, the company reported significant progress in its cleanup and gold recovery operations, discovering substantial amounts of previously unaccounted-for gold.

This initiative has already yielded 415 ounces of gold worth approximately $750,000 from the initial recovery phase.19

Encouraged by these results, West Red Lake Gold Mines began a more thorough cleanup in early 2024, aiming to recover a substantial amount of gold that was locked up in the milling circuit by the end of May.20

In June, West Red Lake Gold Mines poured its first gold bar from the gold recovered during the mill cleanup and recovery program.21

The ongoing gold bull run is providing significant support for West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) as the company works towards a targeted restart of the Madsen Mine in 2025. With record gold prices and key milestones approaching, the company is likely to garner market attention.

For those interested in gold mining opportunities, keeping an eye on West Red Lake Gold Mines could be worthwhile as it progresses towards its production goals.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers