Something fundamental has shifted in the gold market.

This isn’t just another bull run driven by inflation fears or central bank stimulus.

This is a structural reallocation of global capital happening right now, in real time, driven by the world’s most sophisticated institutional players.

The kind of players who don’t chase momentum. They create it.

And the numbers don’t lie…

Gold just shot above $4,475 per ounce and major banks are now racing to lift forecasts.

JPMorgan is calling for $5,055 gold by Q4 2026.1 Goldman Sachs sees $4,900.2 Bank of America targets $5,000.

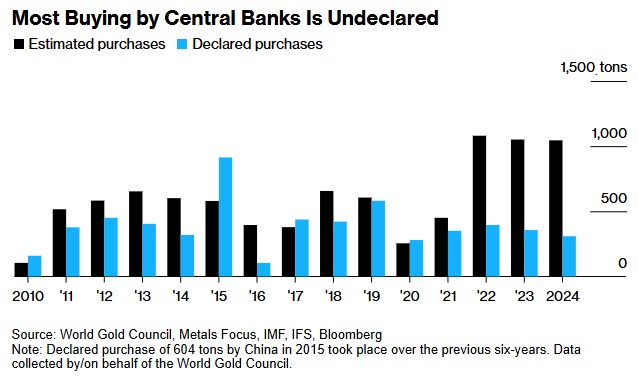

Central banks have more than doubled their historical average3 and 76% of them plan to increase their gold reserves over the next five years,4 marking a clear shift away from dollar-denominated assets.

But the institutional shift extends beyond central banks. Tether, the digital currency giant behind USDT, has quietly accumulated 116 tonnes of gold, making it one of the world’s top 50 sovereign holders.5

Meanwhile, Morgan Stanley sees another 10% decline in the US dollar by the end of 2026.6

The result?

Central banks, crypto institutions, and Western investors are now competing for the same limited supply at a time when global mine output is barely growing.7

This is the perfect storm for sustained gold prices above $5,000.

But the real upside isn’t in bullion, it’s in the producers.

Especially the rare few moving into production right now with growth lined up behind.

That’s where the market’s valuation disconnect becomes extreme.

When gold moves from $2,000 to $5,000, producers don’t just see a 2.5X revenue bump. With operating leverage, cash flow can climb 5X, 10X, or more.

This is why sophisticated capital doesn’t just buy bullion in a gold bull market. It seeks leverage through the right producers.

And this brings us to one of the most compelling setups in the entire sector, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF).

A new producer with high-grade resources in a Tier-One jurisdiction, led by a team that has already built billion-dollar gold companies, with a clear path to doubling output in just a few years……

Yet still priced like an early-stage developer.

The window to recognize this disconnect is narrowing fast.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) ramped up its new high-grade gold mine through H2 2025 and started 2026 by declaring its mine up and running And at Madsen, consistent production isn’t the end of the story: it’s the start of the expansion story phase.

With multiple growth targets already defined, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is positioned to move rapidly from brand new mine into a multi-year production buildout.

Here’s why this story deserves serious attention.

The Perfect Storm: Three Forces Driving Gold Towards $5,000

Three powerful forces are colliding right now to create what may be the most compelling gold bull market in decades.

And they’re setting up an unprecedented opportunity for West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF), one of the only new gold producers in 2026 and one of even fewer with significant growth potential.

Force #1: Institutional Buyers Are Rebalancing Into Gold at Historic Scale

Central banks have purchased over 1,000 tonnes of gold annually since 2022, with a whopping 76% planning to increase reserves over the next five years.8

China has led this charge with quietly escalating purchases despite record prices.

But here’s the craziest part: the reported figures barely scratch the surface.

Goldman Sachs believes central banks are quietly adding roughly 80 tonnes of gold a month worth nearly $8.5 billion, with several undisclosed buyers routing purchases through Switzerland to keep their activity hidden.9,10

But the institutional shift extends beyond central banks.

Tether quietly became one of the world’s largest gold holders, accumulating 116 tonnes by Q3 2025.

That represents 2% of global quarterly demand from a single entity that is a new addition to the gold market.

Tether’s gold-backed stablecoin (XAUt) is pulling an entirely new class of digital-first investors into the market—investors who would never touch traditional gold products.

Unlike Western investors who tend to take profits when gold gets “too expensive,” today’s main gold buyers are deliberately piling in for strategic diversification and high-growth tokenized products.

This creates sustained, price-insensitive demand that provides a floor under gold prices and amplifies potential leverage for near‑term producers like West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF).

Force #2: The Dollar’s Structural Decline Provides Tailwinds

Morgan Stanley forecasts another 10% decline in the US dollar by the end of 2026. This isn’t about tariffs or short-term policy. This is about structural fiscal deficits and a gradual shift away from dollar hegemony that’s been accelerating since 2022.

The result? Gold surged over 50% in 2025, surpassing $4,000 per ounce for the first time.

Force #3: New Gold Production Is Scarce Just When Demand Is Exploding

Here’s the critical supply constraint: global mine production rose just 1% in 2024 to 3,661 tonnes, the slowest expansion in over a decade.11

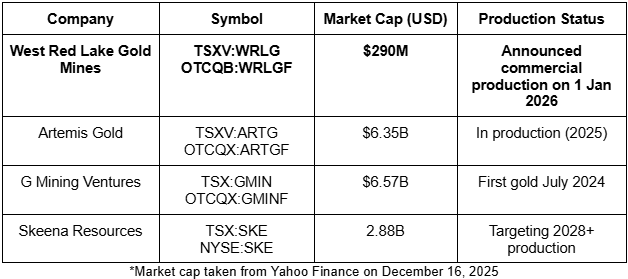

According to BMO Capital Markets, only four single-asset gold producers were set to come online in 2025.

One (Artemis’ Blackwater Mine) launched early in the year and re-rated aggressively.

That meant just three new producers came online during the rest of the year while gold ascended, and only one in a Tier One jurisdiction: West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF).

The opportunity is clear: unprecedented institutional demand, supportive macro conditions, and severely constrained new supply create the perfect environment for producers.

Especially near-term producers with growth potential.

The Market Still Isn’t Giving West Red Lake Gold Mines Credit for What They’ve Achieved

Most investors are still treating West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) like a pre-production developer.

That couldn’t be further from the truth.

They Saved a Mine From the Rubble Through Technical Expertise and Discipline

The previous operator at Madsen rushed to production and that mistake cost them severely. After just over a year, the company went bankrupt due to high costs and inconsistent production, and the skepticism stuck to the asset.12

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) took the opposite approach: methodical, disciplined, technically rigorous.

This wasn’t a team of promoters making promises.

This was a team of operators who had built and run producing mines at billion-dollar companies, and they brought that expertise to every single decision.

They didn’t just acquire a failed project and hope for the best.

They completely re-evaluated the geology, re-designed the mine plan, conducted extensive bulk sampling to prove the resource, and rebuilt the operation from the ground up with the kind of technical rigor that major producers demand.

And now West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is proving it works:

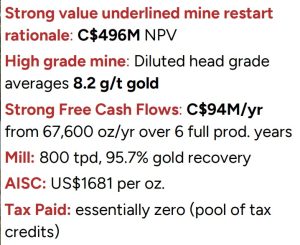

January 2025 Pre-Feasibility Study confirmed a post-tax NPV of $496 million, a high-grade 8.2 g/t mine plan, and strong annual free cash flow using a gold price of US$2,640 per oz.13

Today, with gold trading near $4,300 per ounce, the same operation sits in a completely different economic reality. Margins expand, cash flow potential increases, and the leverage to gold is far larger than the market is currently recognizing.

That is the macro backdrop.

What makes this story compelling is that West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is not waiting on future promises to unlock that value. It spent last year unlocking it and declared the Madsen Mine up and running on January 1, a rare new gold mine in this rising gold market., .

The execution that got them here is visible in all the milestones West Red Lake Gold Mines achieved in 2025::

- Bulk sample completed in Q1: roughly 15,000 tonnes processed from six zones with very strong reconciliation between model and reality on tonnes, grade, and ounces.

- Mine ramped up

- Mill restarted and operational

- Underground connection drift completed (1.4 km) to enable efficient ore movement

- 250+ employees hired, trained, and operational

- Reliable mine plan being executed

This isn’t a story about what might happen. In 2025 West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) executed a production restart in real-time. Now, in 2026, the market will have to decide what value to give to a gold producer that just brought its first mine into production smoothly and methodically.

The bulk sample at the Madsen Mine was the first big moment of truth, and West Red Lake Gold Mines delivered. The grades held up. The tonnes were there. The technical model worked.

After that the company restarted the mine and ramped up operations. In December the operation hit its stride and on January 1st the company declared Madsen in commercial production. Yet despite this execution, the market still hasn’t fully priced in what WRLG has already achieved, or what comes next.

Here’s why this disconnect won’t last:

7 Reasons

West Red Lake Gold Mines Could Be One of the Highest-Leverage Gold Opportunities of 2026

Press Releases

- West Red Lake Gold Confirms High-Grade Continuity at Rowan with First Round of Infill Drilling Results

- West Red Lake Gold Releases Maden Mine Commercial Production Video

- West Red Lake Gold Declares Commercial Production at Madsen Gold Mine

- West Red Lake Gold Reports Mid-Q4 Madsen Mine Update

- West Red Lake Gold Confirms Additional High-Grade Gold in Lower Austin with 26.16 g/t Au over 11.2m, 37.87 g/t Au over 3.55m and 10.55 g/t Au over 8m

Production in Q1 2026, Then the Real Story Begins

Here’s where it gets even more compelling.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) just started the year by hitting its stride of full production.14

Not years away: it just happened .

In Q4 of 2025, the Madsen Mine continued to advance steadily toward full-scale operations. In October alone, mined ore production increased by 24% over the prior month, underscoring the strong upward trajectory.

Then in December the mine hit its stride, producing 3,215 ounces of gold by sending 689 tonnes of ore through the mill each day. That’s 86% of the mill’s permitted capacity, which meant the mine checked the requirement to declare commercial production.

But here’s what makes this company truly rare: while most companies struggle just to achieve initial production, West Red Lake Gold Mines already has a clear path to double it.

Unlike most junior miners that finally achieve production and then spend years trying to figure out how to expand, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) has already developed multiple pathways to significant production increases:

Fork Zone Expansion at Madsen

In November 2025, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) commenced a fully-funded 3,000-metre drill program at the Fork Deposit, located just 250 metres from the Madsen Mine.16

Once considered an intermediate-grade satellite resource, Fork has been re-envisioned as a high-grade near-mine expansion target.

The shallow nature of the deposit allows for efficient definition drilling from surface and, with its proximity to existing underground development, this core zone could become part of the production pipeline within months of successful infill drilling.

The Fork deposit currently contains:

- 20,900 oz grading 5.3 g/t Au Indicated

- 49,500 oz grading 5.2 g/t Au Inferred

Historic drilling highlights include intercepts of 13.05m @ 13.97 g/t Au and 9.3m @ 8.14 g/t Au.

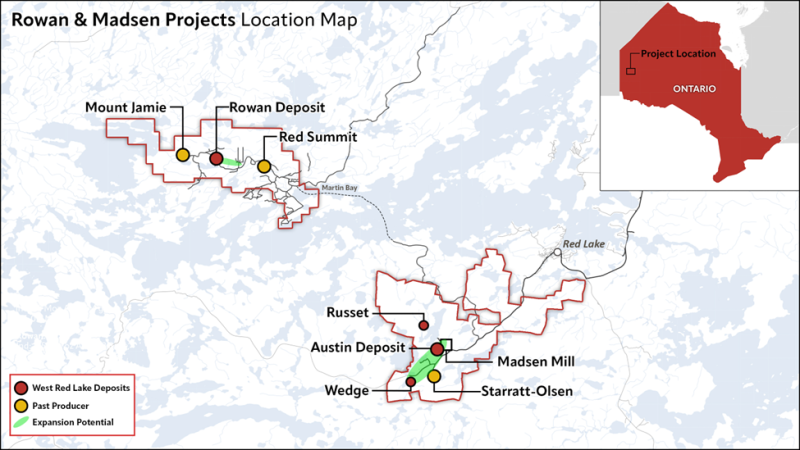

Rowan Property: A Potential 35,000 Ounce Per Year Operation

In October 2025, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) commenced a 5,000-metre drill program at its Rowan Project.17

That effort follows a July 2025 Preliminary Economic Assessment (PEA) that demonstrated robust economics for an underground mine at Rowan, producing an average of 35,230 ounces per year over a 5-year mine life at an average grade of 8.0 g/t gold.18

A combined Pre-Feasibility Study for Madsen and Rowan, expected by Q3 2026, will evaluate the potential for developing the two projects using shared infrastructure and integrated mine planning.

The 5,000-metre (“m”) HQ diameter diamond drill program at Rowan is designed to meaningfully advance the project’s resource and support mine planning.

Infill drilling on Veins 001 and 004 is targeted to support the potential upgrade of Inferred resources to the Indicated category, while conversion-focused drilling on Veins 006b and 013 aims to pull these historic parts of the resource into mine design consideration ahead of the planned combined Pre-Feasibility Study (“PFS”) for the Madsen Mine and Rowan projects.19

According to CEO Shane Williams, success in advancing Rowan through permitting and development, alongside Madsen, could position WRLG to target a combined production rate approaching 100,000 ounces per year of gold in Red Lake later this decade.20

High-Grade Discovery Potential at Madsen

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) continues to intersect exceptional high-grade gold in the Austin Zone. Recent November 2025 drilling delivered:22

- 26.16 g/t Au over 11.2m (including 2m @ 131.70 g/t Au with visible gold)

- 37.87 g/t Au over 3.55m (including 1.5m @ 85.73 g/t Au)

- 10.55 g/t Au over 8m (including 2m @ 34.27 g/t Au)

These results, combined with October drilling that hit a stunning 139.45 g/t Au over 7.8m and 74.70 g/t Au over 8.7m, show potential for up to 600 meters of continuity within a high-grade panel that remains open for expansion.23

The Austin Zone currently contains an Indicated resource of 914,200 oz grading 6.9 g/t Au, with an additional Inferred resource of 104,900 oz grading 6.5 g/t Au.

Management is making it clear: they have a path to doubling production, and they’re prioritizing projects that make that happen quickly.

With Fork drilling underway, Rowan advancing toward a combined PFS, and continued high-grade discoveries at depth, the growth pipeline is robust and fully funded.

Once the market absorbs the fact that West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) started 2026 with a bang by declaring achieving full production, the next part of the story becomes obvious:

This isn’t just a new mine, it’s a scalable platform aiming toward a 100,000-ounce-per-year profile.

This is the rare moment where you’re investing not just in rare new gold production, but in a company that’s already solving the next problem before most investors even realize the first one is solved.

Think About What This Means in the Current Market

Investors are giving billion-dollar valuations to companies whose first gold is still years away.

Skeena Resources is valued around $4B while targeting 2028+ production. Vizsla Silver & Gold trades at almost $3 billion despite a production timeline that stretches to 2028 at the earliest.

These companies have charted a path to production, but it’s entirely forward-looking.

Now compare that to West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF):

- Just declared success putting its first mine into production, an achievement the market is just starting to notice

- Already demonstrated technical execution through successful bulk sample and mine ramp up

- Clear path to double production after initial restart

- Trading at a fraction of peer valuations despite being significantly further along

This is the disconnect.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is already there.

The production timeline isn’t a distant projection; it’s happening. The growth path isn’t theoretical; it’s being actively developed and drilled.

And yet the market is still valuing West Red Lake Gold Mines like a speculative development story while paying premium multiples for companies that won’t produce for years.

Why Near-Term Producers Outperform

The Lassonde Curve shows that the most significant stock price appreciation happens during the transition from development to production, the “golden runway” phase where institutional money floods in.

History proves it:

- Artemis Gold: Up 660% since June 2023 as Blackwater approached production.24

- SilverCrest Metals: Rapidly surged 89% after Las Chispas went into production, resulting in a $1.7 billion buyout.25

- G Mining Ventures: Up 1,000% since construction began at Tocantinzinho, which is now in production.26

The pattern is clear: as companies prove they can produce, deliver on guidance, and generate cash flow, the market re-rates them aggressively.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) is entering this exact phase but still trading at a fraction of peer valuations.

The disconnect is obvious.

Companies with production years away command billion-dollar valuations. Companies already in production trade at multiples far higher.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF), newly in full-scale operations with a clear path to growing and ultimately doubling output, trades at a fraction of these multiples.

There are very few production stories with significant growth potential in this market. West Red Lake Gold Mines is one of them. And it should be attracting significant institutional attention.

The question is whether you recognize it before the broader market does.

World-Class Assets in a Top-Tier Jurisdiction

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) controls the fully permitted Madsen Gold Mine in Ontario’s Red Lake Gold District, one of the highest-grade gold regions in Canada with over 30 Moz of historical production.

The Assets:

- 1.65 Moz gold (Indicated) at 7.4 g/t Au

- 366 Koz gold (Inferred) at 6.3 g/t Au

- 2.5 million ounces of historic production from the mine

- 800 tonne-per-day mill already built and operational

- 80 km² land package with significant exploration upside

Mining.com called it “one of the world’s highest-grade, undeveloped gold projects.”

The infrastructure is built. The permits are in place. The technical team at West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) has proven they can execute.

And execute they did, declaring their first mine up and running on January 1st.

Leadership That’s Built Billion-Dollar Producers

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) isn’t led by promoters making promises. It’s led by operators who’ve built and run producing mines.

This isn’t a team hoping to figure it out. They’ve done this before at billion-dollar companies.

They know how to give guidance and meet that guidance. They know how to build mines that perform. And they’re bringing that expertise to every decision at West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF).

The Re-Rating Catalyst Is Simple

The market rewards proof.

When companies demonstrate they can:

- Hit their production targets

- Deliver on promised grades

- Execute disciplined mine plans

- Generate cash flow

That’s when institutional money flows in. That’s when valuations re-rate.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) demonstrated technical prowess in 2025 with a bulk sample and mine ramp up that worked: The grades held up. The mill operates. The plan executes.

And on January 1st the next catalyst arrived the mine achieved commercial production, making it a rare new gold mine in a rising gold market.

And unlike other companies where production is the end of the story, for West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) it’s just the beginning because the path to doubling production is already being developed.

Once investors see that West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) delivered, the narrative shifts entirely.

This isn’t a question of “can they do it?” anymore. It becomes “how fast can they grow it?”

That’s when the re-rating happens.

Why This Setup Is So Rare

Think about what West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) offers:

✓ New gold producer in a bull market likely heading toward $5,000 gold

✓ Proven technical execution through successful bulk sample and ramp up

✓ Built infrastructure (mill, camp, underground development)

✓ High-grade resource 1.65 Moz gold (Indicated) at 7.4 g/t Au

✓ Clear growth path to double production

✓ Experienced leadership from billion-dollar producers

✓ Tier-One jurisdiction (Ontario, Canada)

✓ Fully funded for future exploration with a cash position of C$46M

✓ Still trading like a developer despite being in production and almost at full scale

This combination (new production PLUS growth potential PLUS proven execution) is extremely rare in the junior mining space.

Most juniors with production timelines this short have already been re-rated or acquired. Most with billion-dollar market caps won’t produce for years.

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) sits in the sweet spot: newly in production so the riskiest parts of new mining are largely complete, but still undervalued enough that the upside is significant.

This is the rare moment in the gold market where there are very few stories like this available.

The Gold Market Has Fundamentally Changed And the Window Won’t Stay Open

Gold is no longer a short-term trade.

Central banks and major institutions are buying aggressively as the US dollar weakens, creating steady, price-insensitive demand just as global mine supply stalls.

In a market like this, new producers with real growth ahead become the highest-leverage potential opportunities. That’s exactly where West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) sits.

Yet the market still values WRLG like a developer.

But with full-scale operations now underway, the story just shifted: West Red Lake Gold Mines is a producer in the middle of a historic gold bull market with a clear path to expand and ultimately double output.

That’s when re-ratings can happen.

The mine is running. The bulk sample and successful ramp up proved the grades and approach. The team has already executed. The only question is which investors recognize the setup before the broader market does.

With gold breaking records, institutional demand accelerating, and new production scarce, there are very few opportunities with this kind of potential leverage.

For investors seeking high-leverage exposure to the gold cycle, West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) deserves serious attention.

To stay ahead of ramp-up milestones, drill results, and expansion updates, download the latest investor presentation and follow WRLG’s progress in real time.

*Figures are in Canadian dollars unless otherwise stated

Shane WilliamsB. Eng. M. Sc – CEO, President & Director

Shane WilliamsB. Eng. M. Sc – CEO, President & Director  Frank GiustraAdvisor

Frank GiustraAdvisor  Anthony MakuchB.Sc, P.Eng – Director

Anthony MakuchB.Sc, P.Eng – Director  Duncan MiddlemissDirector

Duncan MiddlemissDirector