A New Category Is Taking Shape, And Early Footprints Matter

Most investors still think the next retail breakthrough will look like a better website.

A faster checkout.

A slicker ordering app.

But retail is being rebuilt in a very different direction, toward storefronts that stay open all day, all night, without needing a single employee behind the counter.

That is the shift VenHub Global, Inc. (NASDAQ:VHUB) is betting on a smart store that behaves less like a convenience shop, and more like a deployable piece of infrastructure.1

The reason this matters is simple.

When a store does not need staffing schedules, it can live in places traditional retail struggles to serve.

Transit hubs.

Campuses.

Hospitals.

Venues.

The in between corridors where demand is real, but labor and security make the math ugly.

That is exactly why VenHub Global, Inc. (NASDAQ:VHUB) has been pushing into transportation first, including a 24 hour smart store at the Metro Transit Center at LAX.2

This is not a concept render.

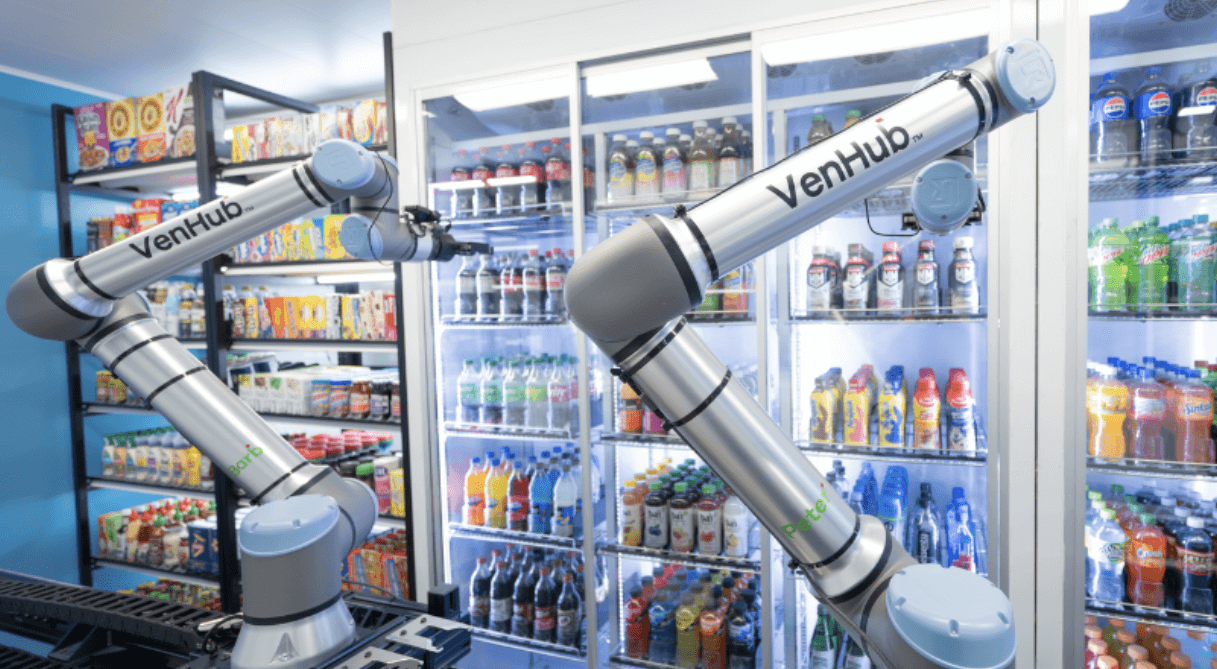

The store is built around AI driven machine vision, robotics, and connected sensors, designed to manage the shopping flow automatically, from product identification to robotic fulfillment, and operate 24-7 without staff.3

That difference, concept versus deployed, is where categories are born.

It is also why VenHub Global, Inc. (NASDAQ:VHUB) is leaning into public validation moments, including a live, fully operational smart store experience at CES 2026, open for real use on the show floor.4

The company also showcased a fully operational VenHub Smart Store at NRF 2026: Retail’s Big Show at the Javits Convention Center in New York City, giving attendees a live look at its autonomous, staff‑free retail system and reinforcing its position as an early leader in real, deployable smart store technology.5

In the early days of a new format, the story always sounds smaller than it is.

One unit here.

One unit there.

Then the pattern becomes obvious, because the format is repeatable.

That is the point investors should focus on with VenHub Global, Inc. (NASDAQ:VHUB), not that robots can hand over snacks, but that a standardized smart store can be installed, stocked, and run like a network.

And when a business becomes a network, the upside is rarely linear.

It tends to compound.

Here is what this new storefront format is designed to unlock, in plain language:

-

-

- A convenience store that can stay open 24 7 without on site staff6

- A customer flow that is mobile based, browse, pay, then watch automated fulfillment happen7

- A deployment approach the company says can install in under seven days8

- A retail experience designed for high traffic transportation hubs, where traditional retail is hardest to staff and secure9

-

The key word in all of this is repeatable.

One store proves the machine works.

A handful proves the machine can survive real world traffic.

A network is when the market starts paying attention.

That is why VenHub Global, Inc. (NASDAQ:VHUB) highlighting multiple transportation locations matters, including its expansion into Los Angeles Union Station, another major hub where the value of 24 hour access is obvious.10

The public recognition has started showing up too.

The company announced it was named Startup of the Year at the 2025 RTIH Awards, with additional finalist recognition in other categories.11

That kind of signal does not guarantee outcomes.

But it does support the framing that autonomous retail is moving from curiosity to category.

And VenHub Global, Inc. (NASDAQ:VHUB) is setting the standard early, in a category that hasn’t even crowned a leader yet.

Retail has two brutal problems that do not show up in glossy investor decks.

Hours and overhead.

If a store cannot stay open late, sales cap out.

If a store needs staffing to stay open late, costs surge.

The promise of an autonomous store is that it attacks both constraints at once, then turns “location” into a growth lever again.

That is the larger bet behind VenHub Global, Inc. (NASDAQ:VHUB), a storefront that can be dropped into places people already move through every day, then run like software.

Breaking News

Retail’s Two Invisible Taxes Are Forcing A New Store Format

Most investors judge retail by what they can see, storefronts, shelves, traffic, brand.

But the real economics are set by two costs that rarely show up in the glossy version of the story.

Hours, and overhead.

A store that closes early leaves money on the table, but a store that stays open late has to pay for it, often with the most expensive kind of labor coverage, and the hardest shifts to staff.

That is why the pressure is building behind formats like VenHub Global, Inc. (NASDAQ:VHUB), not because autonomy is trendy, but because the math is getting tighter in the traditional model.

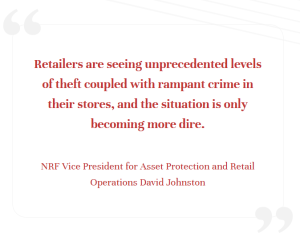

The second tax is loss.

Retailers have a word for it, shrink.

And it has become big enough to change strategy at the highest level.

The National Retail Federation reported that shrink represented about $112.1 billion in industry losses in 2022, with an average shrink rate of 1.6% in FY 2022.12That number matters because it does not hit like a one time expense.

It hits every day, across every aisle, across every location, in ways that force retailers to make defensive choices.

Cut hours. Pull product. Add security.

Spend more to protect the same sales base.

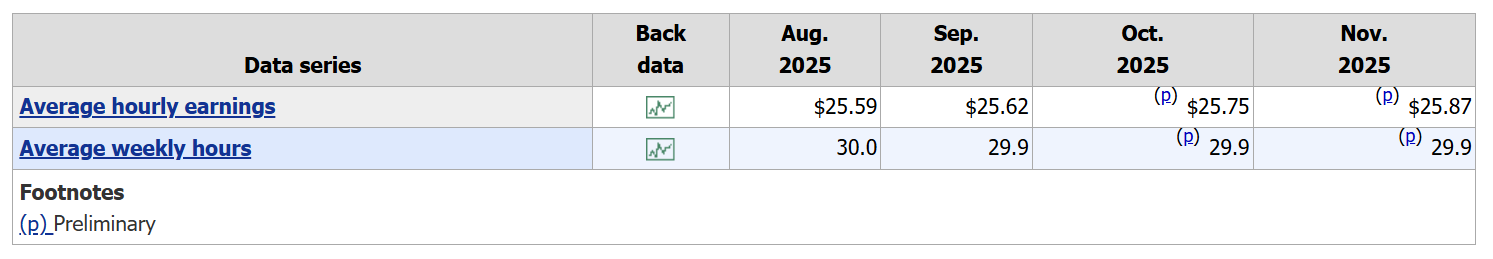

Now bring labor back into the picture.

Retail is not paying tech wages, but it is still a wage driven business, and those costs rise whether sales rise or not.

BLS data for retail trade shows average hourly earnings around $25.87 as of November 2025, with weekly hours under 30 on average, a reminder that retailers are constantly juggling coverage, not just paying a fixed salary base.13

This is the part that quietly breaks the old playbook.

Longer hours are supposed to mean more revenue.

But longer hours also mean more staffing friction, more exposure to loss, and more operational drag.

So the industry starts looking for a third option.

Not a better website.

Not a slightly faster checkout.

A different kind of store format that changes the cost structure entirely.

That is where VenHub Global, Inc. (NASDAQ:VHUB) fits in the story.

The core idea is not that robots are fun.

It is that a store designed to operate without on-site staff can push hours back up, without pushing payroll up in the same way.

In other words, VenHub Global, Inc. (NASDAQ:VHUB) is aiming at the root cause, not the symptom.

When a retailer can keep a location open late without begging for coverage, the location becomes viable again.

When a retailer can run a tighter, more monitored flow, the security spend can shift from reactive to structural.

That is why autonomous retail is moving from curiosity to necessity, and why VenHub Global, Inc. (NASDAQ:VHUB) belongs in the “category being forced into existence” bucket, not the “cool gadget” bucket.

Because the real driver is not hype.

It is pressure.

And pressure is what creates new categories.

Why This Is Not A Vending Machine, It Is A Store That Behaves Like A System

It is tempting to look at VenHub Global, Inc. (NASDAQ:VHUB) and file it away as “vending, but nicer.”

That misses the point.

A vending machine sells what is inside the box.

This format is designed to behave like a full convenience store, with a shopping flow, a product catalog, and a fulfillment engine that can be repeated across locations.14

Start with how the customer actually uses it.

The company describes a smartphone driven experience where customers browse products, place an order, pay securely, then watch the automated fulfillment process deliver the items through pickup windows.15

That is a different psychological experience than “push a button and hope the chips do not get stuck.”

It feels closer to ordering from a digital shelf, then watching the back room do the work.

And it is designed to be fast.

The company says transactions can be completed in as little as 90 seconds.16

Now look behind the glass.

VenHub Global, Inc. (NASDAQ:VHUB) positions the store as a robotics driven system, using robotics, machine vision, and connected sensors to run the shopping flow without on site staff.17

The store has been described as being operated by two robotic arms, affectionately named Barb and Peter, that pick items and hand them over to customers, with inventory that can vary by location.18

That matters because it signals something investors should care about.

This is not “automation for one task.”

It is AI automation for the entire loop, merchandising, ordering, picking, and dispensing, with software coordinating the steps.

-

-

- Computer vision for robotic picking and placement, including image segmentation and point cloud generation to locate items for the robotic arms.19

- Machine vision plus connected sensors and IoT to run a staff free store flow, with the company describing the units as “AI powered” and autonomous in press release coverage.20

- Inventory management and optimization claims, with VenHub describing AI used to monitor and manage inventory, and some third party coverage also describing AI driven inventory and product identification.21

-

In plain language, it is closer to a micro fulfillment system than a kiosk.22

The company also talks about the store adapting inventory based on location patterns, customer behavior, and time of day, which is how a network learns, not how a standalone box operates.23

This is where the “deployable infrastructure” idea starts to click.

If the unit can be installed quickly, then locations that used to be impossible can become realistic.

The Smart Store can be installed in under seven days and operate 24 7 without on site staff.24

That is why VenHub Global, Inc. (NASDAQ:VHUB) keeps showing transportation and high traffic corridors first.

Those are places where demand exists all day, but staffing and security make traditional formats painful.

A system that is designed for unattended operation changes the equation, because it can extend hours without extending headcount.

And it can tighten control of the shopping environment because the flow is built around monitored access and automated fulfillment, not open aisles and blind corners.25

One more detail most people miss.

The store is also meant to be managed remotely.

That does not sound exciting at first, until you realize what it does to scalability.

If operations can be centralized, then every additional unit becomes less about hiring, and more about rollout, replenishment, and uptime.

That is the difference between a one off concept and a repeatable platform.

So when VenHub Global, Inc. (NASDAQ:VHUB) says it is building a fully autonomous smart store that can run continuously, the real investor question is not “are robots cool.”

The real question is whether this format is standardized enough to repeat, because repeatable is where categories are born.26

Why Transportation Hubs Are The First Beachhead For Autonomous Retail

The easiest way to understand VenHub Global, Inc. (NASDAQ:VHUB) is to stop thinking about “retail,” and start thinking about “flow.”

Airports and transit centers are rivers of people, early mornings, late nights, delays, missed connections, staff who are looking for a snack after-hours

Those are also the exact hours when traditional retail breaks down, because staffing gets expensive and security gets harder, so the simplest option becomes closing the doors.

That is why transportation is a logical first wedge for VenHub Global, Inc. (NASDAQ:VHUB), because 24 hour access is not a marketing line in these locations, it is the product.

The LAX location shows the logic.

In 2024, LAX handled more than 76 million passengers, roughly 208,000 per day, and the LAX, Metro Transit Center Station opened for passenger service on June 6, 2025, creating a new rail and bus connection point in the airport ecosystem.27

That kind of site creates a clean test.

Heavy traffic, long operating hours, and real world unpredictability.

If an autonomous store can stay open, stay stocked, and keep the experience smooth in that environment, it has a much stronger case for repeatability.

This is also where the CEO spells out the positioning in plain language.

“Retail should work for people, not the other way around,” said Shahan Ohanessian, Founder and CEO, framing the LAX deployment as access and convenience built around safety and simplicity.28

Then comes the second validation point, Union Station.

VenHub announced a 24 7 Smart Store at Los Angeles Union Station, positioning it as fully autonomous retail inside one of the nation’s busiest transportation hubs.29

The company and third party coverage point to the same reason this matters, scale meets traffic.

Union Station sees more than 60,000 people passing through daily, and the location is described as carrying 400 plus essential products, a real convenience assortment, not a novelty rack.30

For investors watching VenHub Global, Inc. (NASDAQ:VHUB), the point is not that these are two interesting locations.

The point is that they are two repeatable use cases.

Transportation hubs concentrate demand without the company needing to create it.

They create urgency, people need something now.

And they reward uptime, because every closed hour is lost sales.

That is why this beachhead matters for VenHub Global, Inc. (NASDAQ:VHUB).

Prove the unit where retail is hardest to run, then take the same playbook into the rest of the market.

The Network Play: How One Smart Store Turns Into A Scalable Revenue Engine

The real bet behind VenHub Global, Inc. (NASDAQ:VHUB) is not that a single unit can sell snacks without staff.

It is that the unit is built to be repeatable, then managed like a network.

That distinction matters because a one off retail location is a job.

A network of standardized units starts to behave like a platform.

And VenHub has been explicit about the difference, describing Smart Stores that can be installed in under seven days, operate 24 7 without on site staff, and complete transactions in as little as 90 seconds.31

That kind of speed is not just a customer feature.

It is a deployment feature.

If installs are measured in days, not quarters, VenHub Global, Inc. (NASDAQ:VHUB) can chase “available real estate windows” that traditional retail cannot touch, transit partnerships, venue activations, campus corridors, and high foot traffic sites that want a turnkey footprint without buildout drama.32

Now look at how the company presents monetization.

On its investor materials, VenHub Global, Inc. (NASDAQ:VHUB) outlines three revenue streams:

-

-

- Hardware sales, revenue from selling the autonomous Smart Store units.

- Recurring software subscriptions, monthly fees for access to the platform software and services.

- Monthly maintenance fees, ongoing support for the robotics, sensors, and operating systems.33

-

That model is important for investors because it does not rely on just one lever.

Hardware can fund growth.

Software can create recurring revenue.

Maintenance can tie the installed base to ongoing service economics.

And that installed base is the key phrase.

Once there are enough units deployed, the “per store” story becomes less important than the network story, uptime, replenishment cadence, and whether units can run consistently in high traffic environments.

VenHub has pointed to that pattern already, describing strong customer demand and frequent restocking cycles at its first LA Metro location, then expanding into Union Station as a second collaboration.34

Investors should treat any pre order figure as a claim that still needs to be tracked through filings and execution.

But as a narrative signal, it explains why VenHub Global, Inc. (NASDAQ:VHUB) keeps leaning into public proof moments like CES 2026, where the company says it will run a fully functioning Smart Store on the show floor, not a demo, and let visitors buy from hundreds of products on their phones while automated fulfillment runs live.36

That is not a marketing stunt.

It is a stress test in front of the market.

And if the unit performs the same way it performs in live deployments, it reinforces the only question that matters at this stage for VenHub Global, Inc. (NASDAQ:VHUB).

Is this a one time novelty, or a store format that can be rolled out like infrastructure, then scaled like software.

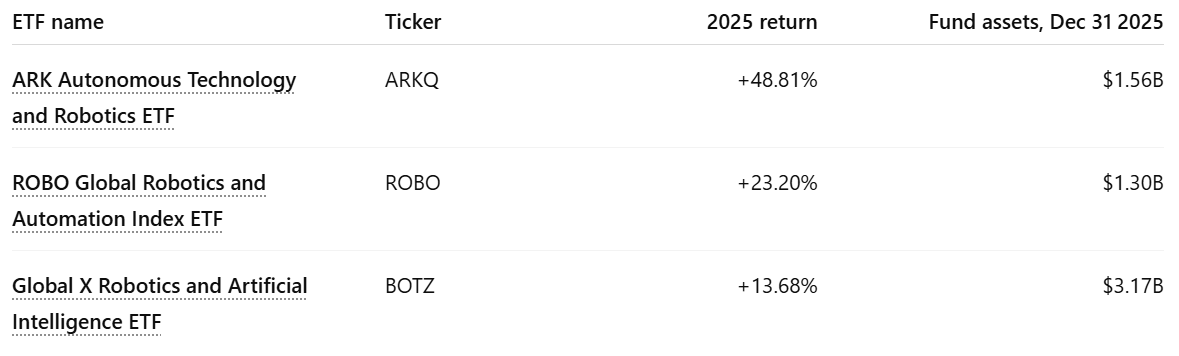

Wall Street Chased Robotics in 2025, VenHub Is Building a Retail Version of That Trade

If 2025 proved anything, it is that investors stopped treating robotics as a nice to have, and started treating it as an operating advantage.

Not a lab project.

Not a sci-fi demo.

A real lever that can widen margins, reduce labor exposure, and scale faster than human staffed operations.

That backdrop matters for VenHub Global, Inc. (NASDAQ:VHUB), because this is not a traditional retail story.

It is an automation story that happens to sell convenience goods.

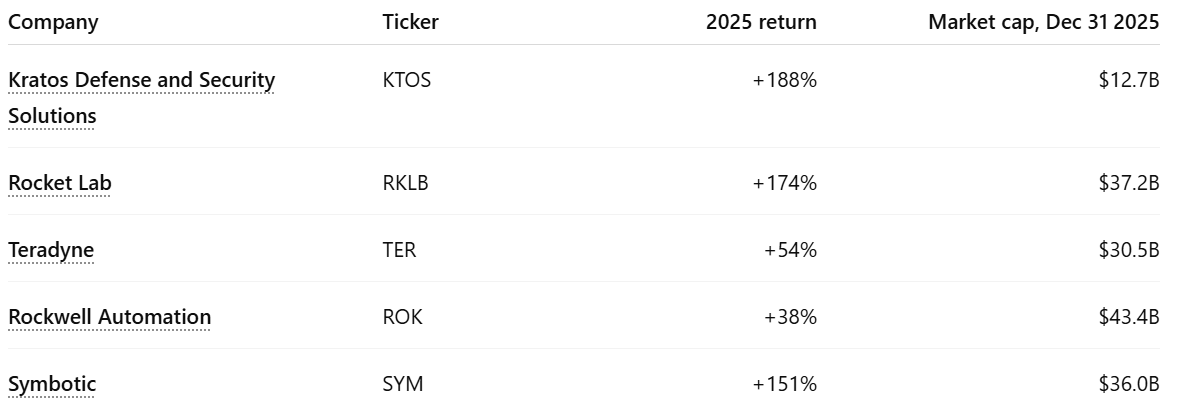

In 2025, money flowed toward the theme through public market baskets and pure plays.

Here is a quick snapshot of how “robotics and automation” exposure performed in 2025, using widely followed ETFs.

2025 Robotics and Automation Market Signal, ETF comps:

Those are not penny stock numbers.

Those are theme level moves.

Now layer in what happened with individual automation names that actually shipped product into the real world.

2025 Automation Winners:

That matters because VenHub Global, Inc. (NASDAQ:VHUB) is trying to do something similar, just in a different part of the physical economy.

Symbotic is the back of house, pallets, warehouses, distribution.

VenHub is the front of the house, the point where a human used to stand behind a counter, take payment, and hand over the product.

Same concept.

Let machines do the repeatable work, so the unit can run longer hours, with lower labor drag, in locations that were previously too expensive or too difficult to staff.

That is why the better comparison is not a traditional convenience chain.

It is any business that turns physical operations into a repeatable unit that can be deployed like infrastructure.

And the broader market tailwind is real.

Industry forecasters expect robotics to keep expanding over the coming years, pushed by labor constraints and efficiency demands across the economy.37

So when investors ask whether VenHub Global, Inc. (NASDAQ:VHUB) belongs in the robotics conversation, the answer is yes, if the product is truly doing what the company says it does.

Robotics.

Machine vision.

Sensors.

Automated fulfillment.

A store the company says can operate 24 hours a day without staff.

VenHub has tied that pitch to real world deployments in high traffic transportation locations, including LAX, and it has positioned CES 2026 as a live working proof point on the show floor.38

The opportunity for investors is not that one smart store exists.

It is that the format can be repeated, and networked, in the same way early automation winners scaled from one facility to hundreds.

That is the lane VenHub Global, Inc. (NASDAQ:VHUB) is trying to enter, while the category is still young enough that leadership is not locked in.

Inside The Smart Store, Why This Is Robotics Wearing A Retail Costume

The easiest way to understand VenHub Global, Inc. (NASDAQ:VHUB) is to stop thinking about it like a convenience store.

Think of it like a robotic system that just happens to dispense snacks, drinks, and everyday essentials.

A customer does not walk aisles, wait at a counter, then pay.

In many US stores, even basic items are now locked behind cases due to shrink, adding friction and delays in understaffed locations.

The flow is closer to a mobile order, browse on a phone, pay, then watch automated fulfillment deliver the items to a pickup window.39

That matters, because once the “store” becomes a machine, the business starts behaving like infrastructure.

The company says its Smart Stores can be installed in under seven days and operate 24-7 without on site staff, using robotics, machine vision, and connected sensors.40

And it is designed to move fast.

In its LAX Metro Transit Center launch release, VenHub described transactions that can be completed in as little as 90 seconds.41

That speed is not just a customer perk.

It is part of the economic argument.

If a unit can serve demand spikes in transit corridors, campuses, and venues, without payroll scheduling or late night staffing risk, it changes what “good location” means.

That is why VenHub Global, Inc. (NASDAQ:VHUB) has been leaning into transportation hubs as proof points, including LAX and Los Angeles Union Station.42

Under the hood, the company positions the system as a blend of smart shelving, inventory sensing, and robotic picking, with vision systems verifying product selection and delivery.43

One of the more revealing details is that VenHub does not frame this as “one company runs all stores.”

It also sells its Smart Stores to entrepreneurs and brands, with coverage citing a base cost of about $275,000 per unit and a software services fee of $2,500 per month.44

That is a different strategy than building a single retail chain.

It is closer to building a platform, then scaling distribution through owners, partners, and branded deployments.

And VenHub Global, Inc. (NASDAQ:VHUB) has been explicit about wanting public validation moments that prove the system is real, not a demo.

At CES 2026, VenHub positioned itself as a fully functioning Smart Store on the show floor, operating the same way it does in live deployments.45

The Business Model, Hardware Sales Plus Recurring Software, And A Path To Network Scale

The most important question is not whether one smart store can work.

It is whether VenHub Global, Inc. (NASDAQ:VHUB) can turn a working unit into a repeatable rollout.

Because the winners in automation are rarely the companies with the flashiest demo.

They are the ones that can manufacture, deploy, support, and expand, without breaking the economics.

VenHub’s model is built around two layers.

First, the physical unit itself, a Smart Store that the company markets to locations and operators who want 24 hour retail access without on site staff.47

Second, the ongoing platform layer, the software and services that keep the store running, monitoring inventory, managing the transaction flow, and supporting operations across different locations.48

That is why VenHub Global, Inc. (NASDAQ:VHUB) keeps emphasizing deployment speed and operational consistency.

Those claims are aimed at the bottlenecks that kill most retail expansions, hiring, training, shrink control, and the cost of keeping doors open late.

Pricing also gives investors a clear anchor point.

If the unit price holds anywhere near that level, scale stops being a vague story and starts looking like a measurable pipeline problem, production capacity, installations, and repeat orders.

The company has also pointed to demand indicators.

A prior Nasdaq listing announcement described a pre-order book of over $300 million in potential revenue from customer pre orders.49

A later SEC filed Form CA described securing more than 1,000 Smart Store pre orders, with the note that these were generated primarily with no material advertising or marketing expenditures.50

This is where the framing for VenHub Global, Inc. (NASDAQ:VHUB) gets sharper.

The early units, like the transportation hub deployments and the planned live store at CES 2026, are not just about sales.

They are proof points that the machine works under real traffic, in public, with real transactions.51

If that proof compounds, the narrative shifts.

From a single store story.

To a standardized infrastructure rollout, where each new deployment makes the next one easier to sell, easier to finance, and easier to replicate.

Press Releases

- VenHub to Ring Nasdaq Opening Bell on February 4th in Celebration of Market Debut

- VenHub Appoints Former Amazon Executive, Ian Rasmussen, to Spearhead Nationwide Smart Store Expansion with Focus on Strategic Partnerships and Enterprise Integrations

- VenHub Begins Trading on Nasdaq Under Ticker Symbol “VHUB”

- VenHub to Launch Fully Operational 24/7 Smart Store at NRF 2026, Showcasing the Future of Autonomous Retail Live in New York City

- VenHub to Showcase Live 24/7 Autonomous Smart Store Experience at CES 2026

The People Behind The Smart Store Rollout

A smart store can look impressive in a video.

But this story only becomes real when the same unit can be built, delivered, installed, and kept running, over and over, in the kinds of locations where retail usually breaks down, late hours, staffing friction, security concerns, and nonstop foot traffic.

That is why the leadership bench matters for VenHub Global, Inc. (NASDAQ:VHUB), because the difference between a cool prototype and a scalable network is execution.

Top 8 Reasons

Investors Are Paying Attention Right Now

1

Live deployments in real transit hubs, including a 24 hour Smart Store at the LAX Metro Transit Center, show VenHub Global, Inc. (NASDAQ:VHUB) is beyond a concept.

2

The company says the unit can run 24 7 without staff, using robotics, machine vision, and sensors, which is the core disruptive claim.

3

VenHub says Smart Stores can be installed in under seven days, which is a key constraint breaker for scaling physical infrastructure.

4

The company described transactions as fast as 90 seconds, which matters because throughput is what makes autonomous retail economics work.

5

CES 2026 was a live public proof moment, with the company describing a fully operational Smart Store on the show floor for real use and taking home two key awards at the show. VenHub was also featured in Bloomberg’s CES coverage alongside global robotics and automation brands, reinforcing its positioning within the broader next-generation retail and robotics conversation.52

6

Transportation is becoming the wedge, with expansion into Los Angeles Union Station adding another high traffic validation point.

7

Management has highlighted large early demand, including a stated figure of over $300 million in Smart Store pre-orders across the US.

8

Third party recognition has started showing up, including VenHub being named Startup of the Year at the 2025 RTIH Awards.

The Moment Before A Category Gets Priced In

Most investors only notice a new category after the rollout is obvious.

After the headlines.

After the first winners have already re-rated.

But the way these stories usually work is simpler.

One working deployment proves the machine.

A handful proves it can survive real traffic.

A network is when the market starts valuing the format, not the prototype.

That is the setup VenHub Global, Inc. (NASDAQ:VHUB) is trying to build right now, with live transportation deployments, a public proof moment at CES 2026, and an automation model aimed at keeping stores open 24 hours without staffing drag.

The next step is not guessing the finish line.

It is tracking the milestones, new deployments, new partners, and whether the pattern repeats.

To get the full corporate presentation and stay on top of every press release and update, enter your email to subscribe and download the deck for VenHub Global, Inc. (NASDAQ:VHUB).