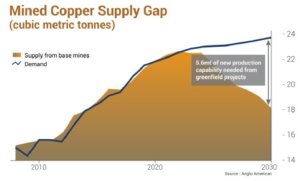

Copper demand is expected to double by 2030. This often overlooked metal has seen its profile soar for two primary reasons:

- Electric Vehicles

- Renewable Energy

You see, the batteries that run all those electric cars that are being built today require copper in order to function. At the same time, renewable energy systems, like solar panels and wind generators, also require lots of copper.

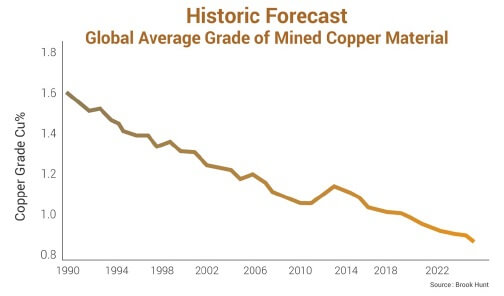

This has put copper in growing demand … at the exact same time that copper production grades are in the midst of a decades-long, steep decline.

That rising demand and lower quality production could potentially result in a 2X price increase for copper, according to Goldman Sachs.

That rising demand and lower quality production could potentially result in a 2X price increase for copper, according to Goldman Sachs.

In fact, Goldman Sachs recently advised investors that forecasts of copper hitting $15,000 per tonne may be conservative.1 The current price of copper is under $7,000 a tonne for the first time since November 2020.2

Another analyst, JP Morgan, said they expect copper prices to surge to around $10,000 a tonne before this year ends.3 That would be a 37% jump over current prices!

All of this bodes well for the copper mining industry … and those investors who make the right choices now before the market really takes off.

Especially when it comes to exploration companies with the potential to deliver new, major high-grade copper discoveries, which is why Torq Resources Inc. (TSXV:TORQ) (OTCQX:TRBMF) caught our eye.

Torq is a Canadian-based copper and gold exploration company with a rare level of quality.

But, before we tell you all about what makes this company so exciting, let’s take a closer look at what is going on with the copper crunch…

Electric Cars + Renewable Energy =

Growing Copper Demand

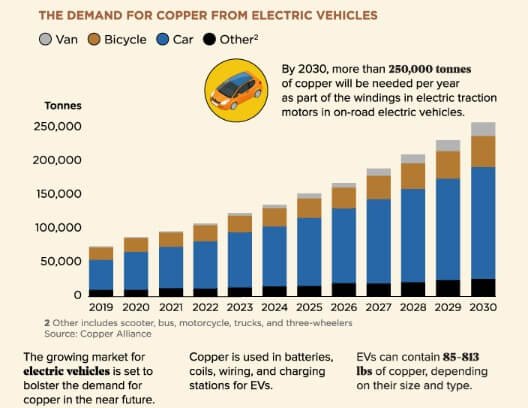

As more countries seek to meet emissions standards, production of electric vehicles (EVs) and other ground-breaking emission-reducing energy technologies is increasing.

For example, the number of EVs sold in 2021 totaled 6.6 million – triple the market share from just two years prior.4

Another way to look at the growth of this market is that in 2012 there were around 130,000 electric cars sold worldwide. Now, ten years later, that many sell in a week.5

The massive scaling of EV production is putting materials needed for their batteries – like copper – in short supply.

The truth is copper plays an integral role in a lot of new energy technology – everything from electric vehicle batteries to charging stations to solar panels to wind generators and much more.

That’s why S&P Global says that demand for copper in the advanced technology marketplace is expected to nearly triple by 2035.6

Source: VisualCapitalist.com; Copper Alliance

At the same time, copper is also still being used in more traditional ways – for example in jewelry, construction, and healthcare. And guess what? Demand for copper in the traditional marketplace is also rising.7

So there is all this growing demand for copper … and while that demand is increasing, copper production grades have been mired in a decades-long, steep downward trend, as evidenced by the graph below.

In fact, BHP recently estimated that declining copper grades will decrease the global copper mine supply by around 2 million tonnes by 2030. 8

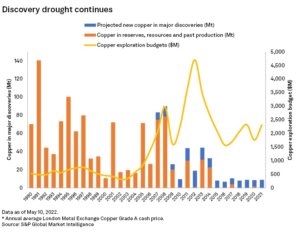

To make matters worse, the rate and size of major copper discoveries have declined over the past decade.9

To make matters worse, the rate and size of major copper discoveries have declined over the past decade.9

So that’s rising demand and declining production … and an obvious opportunity for exploration companies with the resources and assets to step in and help close the widening gap between the two … like Torq Resources (TSXV:TORQ) (OTCQX:TRBMF).

Could This Under-the-Radar Exploration Company Be Unlocking Chile’s Next Great Copper Discovery?

Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) has three premium holdings in prominent mining belts in Chile, which is the world’s top copper-producing country.10

Chile currently boasts six of the world’s largest copper deposits11 and 22% of global copper reserves.12 It is also the world’s top copper producer with 28% of global production13 and 8 of the largest copper miners operating in the country.14

This is a country that is mining friendly – with an investor-friendly concession model, well-established mining laws, fast permitting process, well-trained workforce, and well-developed mining infrastructure.

This is a country that is mining friendly – with an investor-friendly concession model, well-established mining laws, fast permitting process, well-trained workforce, and well-developed mining infrastructure.

Plus, the country’s mining investment forecast over the next 7 years is for over US$60 billion.15 In other words, Chile is the ideal location for a company like Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) to advance its portfolio of copper projects.

In fact, there are many factors working in this company’s favor that make it very attractive.

Press Releases

- Torq Identifies New Targets to Expand on the Discovery at the Margarita Iron-Oxide-Copper-Gold Project

- The Power Play by The Market Herald Releases New Interview with Torq Resources

- Torq Initiates Follow-up Drill Program to Discovery at Margarita Iron-Oxide-Copper-Gold Project

- Torq Amends C$3 Million Credit Facility

- Torq Obtains C$3 Million Credit Facility

7 Reasons

To Add Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) to Your Watchlist Today!

1

Forget the gold rush, we are in the midst of a certified copper rush with both copper prices and demand expected to surge.16 Goldman Sachs says forecasts of a 2x price spike may be conservative!17

2

Torq Resources just struck copper – a significant drill intercept of high-grade copper at its Margarita project in Chile.

3

Torq’s Santa Cecilia project is underexplored and right next door to Newmont & Barrick’s Norte Abierto project, which is believed to hold approximately 23.3 million ounces of gold and 5.8 billion pounds of copper.18

4

Torq has a strong management team with a proven track record of monetizing exploration successes & raising capital. That team includes CEO Shawn Wallace, who has 30 years industry experience, and former Newmont global structural geologist Michael Henrichsen.

5

Torq’s technical team is led by Waldo Cuadra, a seasoned Chilean mining professional with over 40 years of in-country experience and an extensive network of local connections.

6

The company could be following a similar path to Filo Mining, which saw its value shoot up 15X after a major copper-gold discovery at depth.

7

When you considerTorq Resources’ (TSXV:TORQ) (OTCQX:TRBMF) assets and leadership it certainly looks like an undervalued gem that the market hasn’t caught on to yet.

Of course, as with any exploration company, breakout success depends, first and foremost, on the quality of its projects. The good news is Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) has some truly exciting ones in its pipeline. Let’s examine them more closely.

Project 1 – Margarita Project

New Discovery Makes Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) a Company to Watch

As pointed out above, Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) has a lot going for it, including a strong management team and a funded “war chest.”

As pointed out above, Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) has a lot going for it, including a strong management team and a funded “war chest.”

But it was a recent announcement by the company that really started to grab attention within the marketplace.

Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) struck high-quality copper – and lots of it – at its Margarita project in Chile during its maiden 13-hole, 4,075-meter drill program in May.

One drill hole in particular (Falla 13 discovery drill hole 22MAR-013R) revealed just how promising the Margarita project could be.

The drill hole intersected 90 meters (m) of 0.94% copper and 0.84 grams per ton (g/t) gold at a depth of 50 m – 140 m.19

This drill hole alone demonstrates the significant potential for Margarita to host a substantial mineralized body, which is BIG news in light of the world’s need for new, high-grade copper deposits.

The findings also validated Torq Resources’ (TSXV:TORQ) (OTCQX:TRBMF) exploration thesis and represents the potential for a significant new IOCG discovery.

“The Margarita project has the potential to be Chile’s next major IOCG (Iron Oxide Copper-Gold) discovery,” said Waldo Cuadra, General Manager of Chile.20

And Torqdidn’t stop there.

After the discovery, Torq Resources (TSXV:TORQ) (OTCQX:TRBMF)

increased its land position at Margarita, acquiring another 200 hectares (494 acres) and quickly initiated a follow-up 4,000-meter exploration program at the site.21

Less than two weeks later, the company revealed that it has identified new high-priority targets at Margarita.22

What makes the Remolino and Cototuda targets so exciting is that they have similar geological, geochemical, and geophysical characteristics as the Falla 13 discovery drill hole mentioned above – meaning they have high potential to host new bodies of copper-gold mineralization.

Now That Alone Would Be Enough to Put Torq Resources

in the Spotlight, But the Company Has More

Going for it … Much More!

Project 2 – Santa Cecilia Project

Asset Labeled “Extremely Rare”

by Well-Respected Geologist

That brings us to the Torq Resources’ (TSXV:TORQ) (OTCQX:TRBMF) Santa Cecilia project.

That brings us to the Torq Resources’ (TSXV:TORQ) (OTCQX:TRBMF) Santa Cecilia project.

The project is located in the world-class Maricunga belt where it is surrounded by multi-million-ounce gold and gold-copper deposits (including, Salares Norte, La Coipa, Cerro Maricunga, Marte, Lobo, La Pepa, El Volcan, Caspiche and Cerro Casale).

Torq’s Santa Cecilia Project is immediately adjacent to Barrick/Newmont’s Norte Abierto project, one of the largest undeveloped gold and copper deposits in the world.23

That proximity to Norte Abierto means there’s proven/probable reserves of 23.2 million ounces of gold and 5.8 billion pounds of copper located less than 2 km away from Torq’s property.24

And this is a property where very limited exploration has been performed to date. But the little that has been performed at Santa Cecilia has been favorable.

For example, 30 years ago a major international mining company drilled 47 holes (approximately 14,000 meters) and made two discoveries on the property.

The company drilled a clearly defined epithermal gold system as well as a high-grade gold and silver system. They hit grades that undoubtedly would have been pursued if they were drilled in this decade.

But, with the average price of gold back in 1990 being a meager $383.73 per ounce25 – about 4.5x lower than today – the company stopped exploring.

Years later, in 2012, the private owner of the property tested his luck for a copper porphyry deposit, drilling two deep holes directly below the epithermal gold system, and discovered significant gold-copper porphyry mineralization at depth, including 925 meters of 0.45% copper equivalent.

When you combine the epithermal gold drilling near the surface with the 925 meter hole directly below it, that’s over 1.5 km of vertical mineralization that has never been followed up on.

The property was held by a private owner for over 30 years … until Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) became the first junior exploration company to option it in October 2021.26

“In my years in the junior market, I have never come across something as significant as this before. It’s very rare for a junior exploration company to be in a position to acquire something of this magnitude.”

– Michael Henrichsen, Torq’s Chief Geological Officer27

Now Torq’s technical team plans to aggressively explore multiple undrilled opportunities to potentially define large-scale mineralized bodies at the site.

It’s Projects Like This That Spawn Comparisons Between Torq Resources & Filo Mining

At Filo’s Filo Del Sol Project, which is located in San Juan, Argentina and Chile, Filo was drilling silver near-surface for an extended period before it discovered a large 114 Moz silver horizontal zone. When the company decided to go deeper in 2021, it hit copper/gold at depth.

Since then the stock has increased in value by 15X, producing the kinds of gains investors love to see:

With Santa Cecilia located in such a favorable location and with such limited exploration done there so far, Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) is truly excited about the results that could be produced as it expands its drilling program.

Project 3 – Andrea Project

Highly Underexplored Property in a

Highly Prolific Mining Area

As we mentioned earlier, Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) has not one, not two, but three potential world-class copper projects.

The Margarita project is the newest discovery but the company’s other two projects also have unique qualities that make them standout.

The Margarita project is the newest discovery but the company’s other two projects also have unique qualities that make them standout.

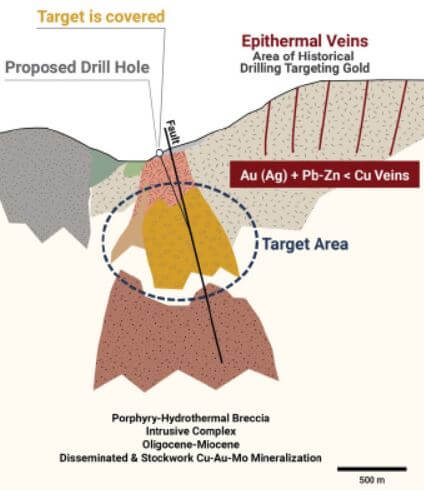

The Andrea project covers 1,200 hectares (2,965 acres)and Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) has an option to own a 100% interest.

The key thing about this project is that it is located in the prolific El Indio belt, which is also home to Barrick Gold’s world-class El Indio and Pascua Lama epithermal gold and silver deposits.

The belt is highly underexplored for copper porphyry systems and Torq Resources has a shallow, untested chargeability anomaly that indicates a proposed drill target area for an upcoming exploration program.

Increasing the Chances for Success Even More Are the Management & Technical Teams Torq Has Assembled

Torq Resources’ (TSXV:TORQ) (OTCQX:TRBMF) proven management team has monetized exploration successes before and knows how to raise capital, even in difficult markets.

They also know how to leverage in-country expertise and deal-flow connections through their Chile-based technical team.

This group of in-country mining veterans has had their eyes on the projects Torqnow holds for over 15 years. And they’re not the only ones.

According to an analyst report by Beacon Securities, both Exeter Resources and Barrick Gold made large cash offerings for the Santa Cecilia project, which were rejected by the owner.28 The project is now the crown jewel in Torq’s portfolio.

Torq’s Chilean team, led by Waldo Cuadra, has a first-rate reputation in the country, having contributed to multiple globally significant discoveries throughout their careers … far beyond what’s expected in a junior miner.

Torq’s Chilean team, led by Waldo Cuadra, has a first-rate reputation in the country, having contributed to multiple globally significant discoveries throughout their careers … far beyond what’s expected in a junior miner.

Adding to the quality of Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) is its loyal investor base that’s been providing stability over the last four years as the company has established its world-class portfolio.

That base includes key investments from industry-leading mining professionals and a good percentage of skin in the game (25%) from management and directors.

With C$4.7 million in their treasury as of March,29 and a recent committed credit facility of C$3 million, the company is ready to advance its Chile projects in 2022.

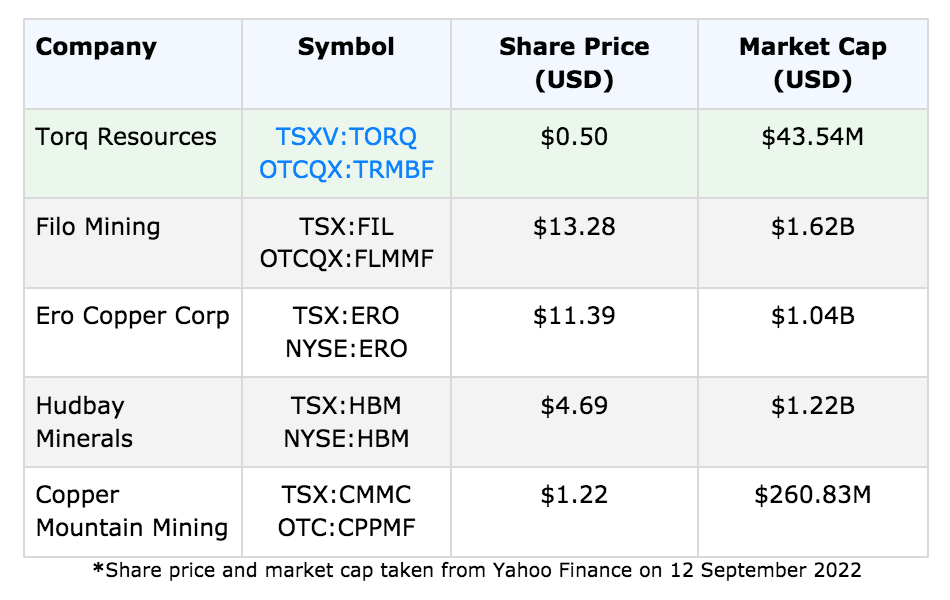

To get a better idea of the growth potential of Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) let’s look at how some mining companies are performing right now and how Torq compares.

When it comes to comparing assets, Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) more than holds its own.

When you consider Torq Resources’ trio of potentially world-class projects, the company’s epic team, its serious track record, and its treasury, it comes at a discount price compared to its peers. That is, until the market catches on to its blue sky potential.

Investors should keep a close watch on Torq Resources (TSXV:TORQ) (OTCQX:TRBMF).

Here Are the Members of Torq’s Management Team

From the top down this is a company well-positioned to grow as copper demand increases.

With one drill program already underway and more exploration unfolding, Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) could soon be announcing results that seriously impact the market and its stock value.

That’s why now is the time to start performing your due diligence on this company. To help you get started here is a recap of the many advantages that are helping Torq Resources stand out in a crowded marketplace:

Recap: 7 Reasons

Torq Resources (TSXV:TORQ) (OTCQX:TRBMF) Has the Potential to be This Year’s Breakout Junior Copper-Gold Miner Stock

1

Both copper price & demand are set to surge. JP Morgan expects a 37% price jump this year!30

2

Torq Resources just made a high-grade copper-gold discovery at the 1,245 hectare Margarita project – 90 meters of 0.94% copper and 0.84 g/t gold.31

3

Former Newmont global structural geologist Michael Henrichsen (who now serves as Torq’s Chief Geological Officer) has called the Margarita asset “extremely rare.”

4

Torq’s flagship Santa Cecilia project is an underexplored property adjacent to Newmont/Barrick’s Norte Abierto project, which is believed to hold approximately 23.3 million ounces gold & 5.8 billion pounds copper.32

5

Torq’s management team includes 30-year mining industry expert Shawn Wallace and former Newmont global structural geologist Michael Henrichsen, whose contributions significantly increased Newmont’s reserves and resources base.

6

The company has amassed a Chile-based technical team whose quality you’d normally only see at a major mining company. The team is led by Waldo Cuadra, who has extensive mining experience in Chile.

7

Torq’s aggressive 2022 exploration program is well underway. The program includes second-phase follow-up drilling to the discovery at Torq’s Margarita project.

Shawn WallaceChief Executive Officer & Director

Shawn WallaceChief Executive Officer & Director Michael HenrichsenChief Geological Officer

Michael HenrichsenChief Geological Officer Waldo CuadraGeneral Manager, Chile

Waldo CuadraGeneral Manager, Chile