When most investors were chasing Tesla, a different electric vehicle company was quietly building the largest EV footprint on the planet.

BYD, backed by Warren Buffett’s Berkshire Hathaway, didn’t launch with fanfare or flash.

It focused on one thing: electrifying overlooked vehicle categories—buses, delivery vans, sedans for the Chinese middle class.

And while Tesla captured headlines, BYD captured market share.

In 2023, it became the world’s top-selling EV manufacturer, surpassing Tesla in total sales.1

Its stock didn’t explode overnight. It built over time—delivering for investors who recognized the power of real revenue, real production, and real government alignment.

Now, that same model is coming to aviation.

And just like BYD, one company is quietly building the infrastructure, locking in OEM partnerships, expanding global routes, and electrifying one of the most overlooked transportation categories in the world: regional air travel.

The next frontier isn’t roads.

Its runways—specifically, thousands of short-haul routes connecting America’s overlooked regional airports. A market projected to top $115 billion globally by 2035 according to McKinsey & Company.2

And there’s a company that’s already laying the foundation today with a network of combustion aircraft, developing the necessary technology for the future, and locking in major OEM deals.

They’re not doing it alone either.

They’ve formed a deep alliance with Palantir Technologies (NASDAQ:PLTR)—the same $40 billion AI powerhouse that helped the US military track terrorists and supported the CDC during the CV-19 crisis.3

Palantir doesn’t just write code—they build mission-critical systems.

And now, they’re embedding that firepower into a new aviation platform that could disrupt how people fly in the same way Uber changed how we get around town.

This isn’t about waiting for futuristic flying cars.

This is about a real, operational business—one that flew over 350,000 passengers last year and generated ~$119 million in 2024 revenue.

It’s backed by the team at Palantir. And it’s building the future of regional air travel right now.

The name?

Surf Air Mobility Inc. (NYSE:SRFM).

The Airline Most People Have Never Heard of — But Could Soon Be Flying With

Surf Air Mobility Inc. (NYSE:SRFM) isn’t some speculative moonshot.

It’s already one of the largest commuter airlines in the US by scheduled departures and the largest passenger operator of Cessna Grand Caravan aircraft in the US.

And in Q4 2024, Surf Air (NYSE:SRFM) delivered what few in this space have: Results.

Revenue came in at $28.05 million — up 5% year-over-year.4

And they did it while beginning to roll out one of the most ambitious AI-enabled software platforms in aviation.

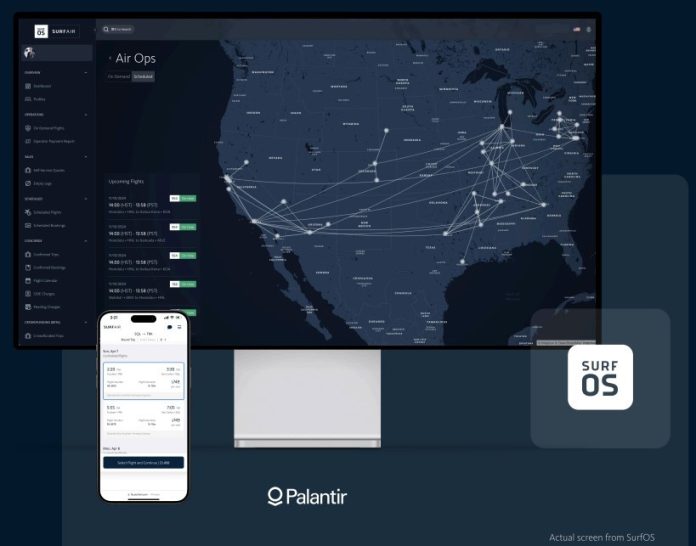

It’s called SurfOS.5

And it’s being developed with Palantir Technologies (NASDAQ:PLTR) — the same $207 billion AI powerhouse that built battlefield intelligence systems for the Pentagon and helped track global disease outbreaks for the CDC.

And they didn’t just partner — they’re the largest investor.

Palantir now owns approximately 19% of Surf Air Mobility (NYSE:SRFM) .6,7,8

Why? Because SurfOS isn’t just some bolt-on feature.

It’s aiming to be the brain of the next-gen regional airline.

And while most “air mobility” stocks are still pre-revenue science projects…

Surf Air (NYSE:SRFM) is flying over 350,000 passengers a year.9

With electrification agreements in place, a re-fleeting strategy underway, and a transformation plan firing on all cylinders…

This isn’t a sketch on a whiteboard.

It’s a real business, with real momentum, and a very real chance to lead a $100B+ aviation revolution.

Here are the 8 biggest reasons Surf Air Mobility (NYSE:SRFM) deserves a spot on your radar — before Wall Street figures it out.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

8 Reasons

Surf Air Mobility Inc. (NYSE:SRFM) Could Be the Next Aviation Tech Stock to Get Noticed

1

They’re Already Flying: Most “air mobility” stocks are still pre-revenue. Surf Air Mobility (NYSE:SRFM) flew over 350,000 passengers in 2024 across tens of thousands of flights on a fleet of over 50 Cessna Grand aircraft, making it one of the largest commuter airlines in the US by scheduled departures.

2

They’re Hitting a Financial Inflection Point: In Q4 2024, Surf Air (NYSE:SRFM) reported $28.05 million in revenue, up 5% year-over-year and above guidance. They also reduced their adjusted EBITDA loss by 63%, signaling a clear shift toward a focus on profitability of their airline operations.

3

Backed by Palantir’s AI Firepower: Palantir Technologies (NASDAQ:PLTR)—the $207 billion AI company behind US military and intelligence systems—owns ~19% of Surf Air Mobility (NYSE:SRFM). Palantir is powering Surf Air Mobility’s SurfOS software, an AI-powered aviation platform set to redefine short-haul air travel.

4

Electrification: Instead of designing futuristic planes, Surf Air Mobility (NYSE:SRFM) is retrofitting proven aircraft. With an exclusive agreement with Textron Aviation, they’re developing and certifying electrified powertrains for the Cessna Grand Caravan—targeting cutting emissions and potentially slashing operating costs by up to 50%.10

5

SurfOS Is Already Gaining Traction: SurfOS isn’t vaporware—they already have agreements with six beta users. SurfOS is aiming to become the operating system for regional air mobility.11

6

Major Institutions Are on Board: Beyond Palantir, heavyweight investors like BlackRock, Vanguard, and The Colony Group have taken positions in Surf Air (NYSE:SRFM).

7

A Transformation Plan That’s Underway: Surf Air is executing a four-phase transformation strategy: Transformation, Optimization, Expansion and Acceleration. They’re currently in Phase 2 and on track.

8

A $100+ Billion Market Hiding in Plain Sight: The global market for regional air mobility is projected to hit $75–115 billion by 2035. With real operations, software, and electrification plans already in motion, Surf Air Mobility (NYSE:SRFM) is positioning itself to lead the entire category.

BYD Quietly Dominated EVs. Could Surf Air Mobility (NYSE:SRFM) Do the Same in Aviation?

While Wall Street was distracted by Tesla’s headlines, one company was quietly electrifying the world’s largest car market.

That company was BYD.

It didn’t need viral tweets or hype cycles. It simply focused on execution—building electric buses, trucks, and affordable EVs for the masses.

Backed by Warren Buffett’s Berkshire Hathaway, BYD scaled quietly… until one day, it passed Tesla as the world’s top-selling EV maker.

Now, that same quiet disruption could be unfolding in the sky.

Could Surf Air Mobility (NYSE:SRFM) do for regional air travel what BYD did for road-based transport?

- Retrofitting existing platforms with electric powertrains once the technology is certified instead of starting from scratch

- Scaled routes and operations long before its competitors

- And embedding its infrastructure with powerful software—this time, with Palantir’s data and AI platforms running the system

While others are still building prototypes and chasing certification, Surf Air (NYSE:SRFM) flew over 350,000 passengers12 last year and pulled in $119.4 million in revenue.13

That’s not a pitch. That’s proof.

And like BYD, it’s playing the long game—focusing on electrifying a category most have overlooked: short-haul, regional air travel.

It’s early. It’s under the radar. And it’s backed by institutional capital and a strategic partner in Palantir Technologies (NASDAQ:PLTR).

If BYD taught us anything, it’s that quiet execution can lead to global dominance.

Surf Air Mobility (NYSE:SRFM) might just be next.

Press Releases

- Surf Air Mobility Appoints Shawn Pelsinger to Board of Directors

- Surf Air Mobility to Present at the H.C. Wainwright 27th Annual Global Investment Conference

- Electra and Surf Air Mobility Complete First Commercial Demonstrations of Ultra Short Aircraft at Virginia Tech

- Surf Air Mobility Reports Second Quarter 2025 Financial Results, Exceeding Revenue and Adjusted EBITDA Guidance

- Surf Air Mobility Reports Key Achievements in Optimization Phase of Transformation Plan

The EV Air Race Is Crowded — But Only One Company Is Actually Flying

Billions have poured into flashy air taxi startups.

From Joby to Archer to Lilium, these companies are building futuristic aircraft with the promise of transforming how we fly.

But there’s one big problem: none of them are generating meaningful revenue.

They haven’t been certified. They’re not carrying passengers. And in most cases, they’re still burning hundreds of millions just to stay airborne on paper.

Now take a look at Surf Air Mobility (NYSE:SRFM).

This company is already flying over 350,000 passengers per year with its fleet of Cessna Caravan aircraft, has $119 million in revenue,14 a planned path to profitability—and it’s trading at a fraction of the value of its rivals.

Let’s break down how Surf Air Mobility (NYSE:SRFM) stacks up against the rest of the sector:

Why Surf Air Mobility (NYSE:SRFM) Looks Like the Smart Play

While the market is infatuated with eVTOL prototypes, Surf Air Mobility (NYSE:SRFM) is quietly doing what these other companies are still dreaming about: generating real revenue, flying real passengers, and building real technology infrastructure.

Let’s break this down:

- Revenue Reality Check: Joby, Archer, Lilium, and Vertical Aerospace are all pre-revenue. Some have made test flights. None have passengers. Meanwhile, Surf Air Mobility generated $119.4 million in 2024, flew over 350,000 passengers.19

- Valuation: Despite delivering operational success, Surf Air’s market cap is just ~$45 million—a fraction of its revenue. Compare that to Joby or Archer, trading at 70x–100x revenue multiples.

- Electrification Platform: While others are trying to certify new aircraft from scratch (a multi-billion dollar gamble), Surf Air (NYSE:SRFM) plans to retrofit existing, FAA-certified aircraft—which has the potential to drastically reduce time, cost, and risk to market.

- Software-as-a-Service Upside: SurfOS, their AI-powered regional air mobility operating system built with Palantir Technologies has already rolled out to beta users.

- Palantir’s Backing: Let’s not forget—Palantir holds a ~19% stake in SRFM.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The Setup Is There. Now Let’s Look at Who’s Already In

If investors had paid closer attention to BYD before it overtook Tesla…

They might’ve realized that the quietest plays often become the biggest winners.

Surf Air Mobility (NYSE:SRFM) could be one of those plays.

With real revenue, AI software, and planes in the sky—might just be the most overlooked opportunity in the entire aviation tech sector.

But here’s the part the market hasn’t caught up to yet:

Some of the smartest money in tech already knows.

Start with Palantir Technologies (NYSE:PLTR)—arguably one of the most powerful AI firms on the planet.

Palantir now holds a ~19% stake in the company.20

But Palantir isn’t alone.

Institutional investors hold approximately 17.68% of Surf Air Mobility‘s (NYSE:SRFM) stock. Notable institutional shareholders as of April 10 include:21

- Palantir Technologies Inc.: Holding a significant position valued at approximately $3.29 million.

- Focus Partners Wealth: With holdings around $1.86 million.

- Rathbones Group PLC: Invested approximately $1.85 million in the company.

And here’s where it gets even more interesting…

Recent short interest data shows a sharp drop in bearish bets—down over 15% month-over-month. Short sellers are starting to back off. That’s usually a sign the winds are shifting.22

Meanwhile, analysts are starting to wake up.

- Canaccord Genuity just upgraded SRFM from “Hold” to a “Buy.”23

- HC Wainwright & Co.: Initiated coverage with a “Buy” recommendation on March 7, 2025.24

- The average 12-month price target? $6.26—a projected gain of 175% from here.25

This can be what it looks like just before Wall Street catches up.

Low float. Institutional backing. Analyst upgrades. A clear operational plan.

All the pieces seem to be falling into place.

The Roadmap to Lift-Off — And What’s Coming Next

Executional momentum is building for Surf Air Mobility (NYSE:SRFM).

The company isn’t just fine-tuning operations. It’s actively executing on a four-phase transformation plan designed to optimize its airline business, expand routes, and bring electrified aviation to life.

Phase 1? Done. They secured a $50 million term loan,26 overhauled their capital structure, exited unprofitable routes, and slashed liabilities by more than $42 million.

Now Surf Air Mobility (NYSE:SRFM) is in Phase 2: Optimization. And here’s where things get really interesting.

They’ve already:

- Relocated their Air Operations Center to Addison, Texas, a suburb of Dallas—placing them in the heart of one of America’s top aviation hubs.

- Hired elite leadership from Southwest Airlines, Flexjet, and Bombardier to run operations with military-level efficiency.

- Delivered four brand-new Cessna Grand Caravan EX aircraft from Textron Aviation to refresh their fleet and prep for future electric upgrades.

And they’re not stopping there.

In 2025, Surf Air (NYSE:SRFM) plans to:

- Achieve profitability in airline operations (defined by positive adjusted EBITDA)

- Roll out SurfOS to more third-party users, with the potential to open a new high-margin software revenue stream

- Secure FAA certification milestones tied to their electrified powertrain—targeting a 2027 Supplemental Type Certificate (STC) for the Cessna Grand Caravan27

On top of that, they’re working to create a new venture called Surf Air Technologies—a dedicated venture focused on commercializing SurfOS. The company has even stated it’s considering bringing in outside investors to fund this separately.

Internationally, MOUs are already in place to electrify commuter fleets in Brazil and Kenya once the technology is certified—opening up first-mover advantages in emerging markets where regional air travel is essential.

And with new FAA subsidies approved in 2024, providing potential tailwinds to Surf Air’s subsidized essential air routes.28

This is key—because while rivals are still trying to certify futuristic prototypes…

Surf Air (NYSE:SRFM) is already embedding itself into the backbone of regional air infrastructure.

This isn’t a long-term science experiment.

This is a near-term commercial story with real milestones.

Meet the Team Powering the Future of Regional Air Travel

Behind every breakout company is a team that’s been there before.

Surf Air Mobility (NYSE:SRFM) isn’t being run by dreamers or theorists. It’s being led by aviation heavyweights, seasoned operators, and Silicon Valley veterans who know how to scale complex businesses.

Here’s who’s driving the next evolution in flight:

With this kind of leadership—people who’ve built, scaled, and sold billion-dollar aviation platforms before—Surf Air Mobility (NYSE:SRFM) is in good hands.

The Sky Isn’t the Limit. It’s Just the Beginning.

We’ve seen this setup before.

A bold team. A real product. Flowing revenue. Strategic backing from billion-dollar partners. And a massive market hiding in plain sight.

Surf Air Mobility (NYSE:SRFM) isn’t some distant moonshot. This is a real, operational business—with planes in the air, contracts on the books, and a roadmap that’s already in motion.

They’re working on electrification and AI software.

While the rest of the market is distracted by hype and prototypes, Surf Air (NYSE:SRFM) is building for the next aviation revolution—and it’s already happening.

But here’s the thing…

The biggest moves in stocks like this often happen before the headlines.

That’s why we recommend taking a closer look.

Want to go deeper into Surf Air Mobility’s latest announcements, partnerships, and financials?

Subscribe to our newsletter and be the first to get their press releases, investor presentations, and critical updates—before they hit the wire.

Start your research now. Stay in the loop. And don’t miss what could be one of the most exciting aviation tech stories that has come across your desk.

Subscribe here to get first access to breaking news and updates on Surf Air Mobility . Get investment opportunities before the rest of the market in real-time. Get this company's corporate presentation now. Subscribe to download! Over 120,000 subscribers

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Deanna WhiteInterim CEO and COO

Deanna WhiteInterim CEO and COO Oliver ReevesChief Financial Officer

Oliver ReevesChief Financial Officer Sudhin ShahaniCo-Founder

Sudhin ShahaniCo-Founder Carl AlbertChairman

Carl AlbertChairman