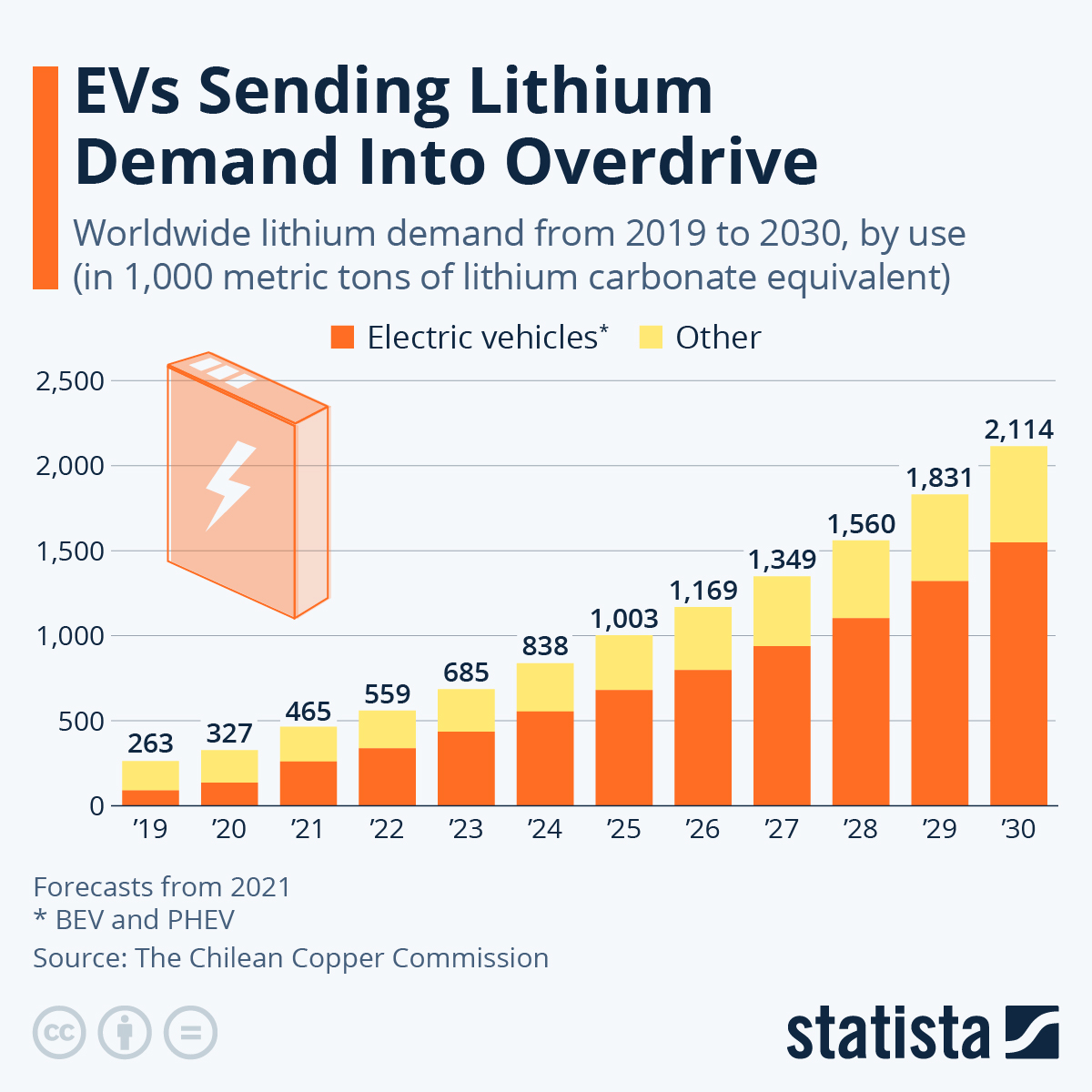

There has been a rapid increase in the need for lithium as the global movement towards renewable energy sources gains steam.

According to the International Energy Agency (IEA), global demand could increase over 40 times by 2040 if countries stick to their Paris agreement targets to reduce planet-heating emissions1 – an initiative that will most likely spark several new mining operations across the US and Canada.

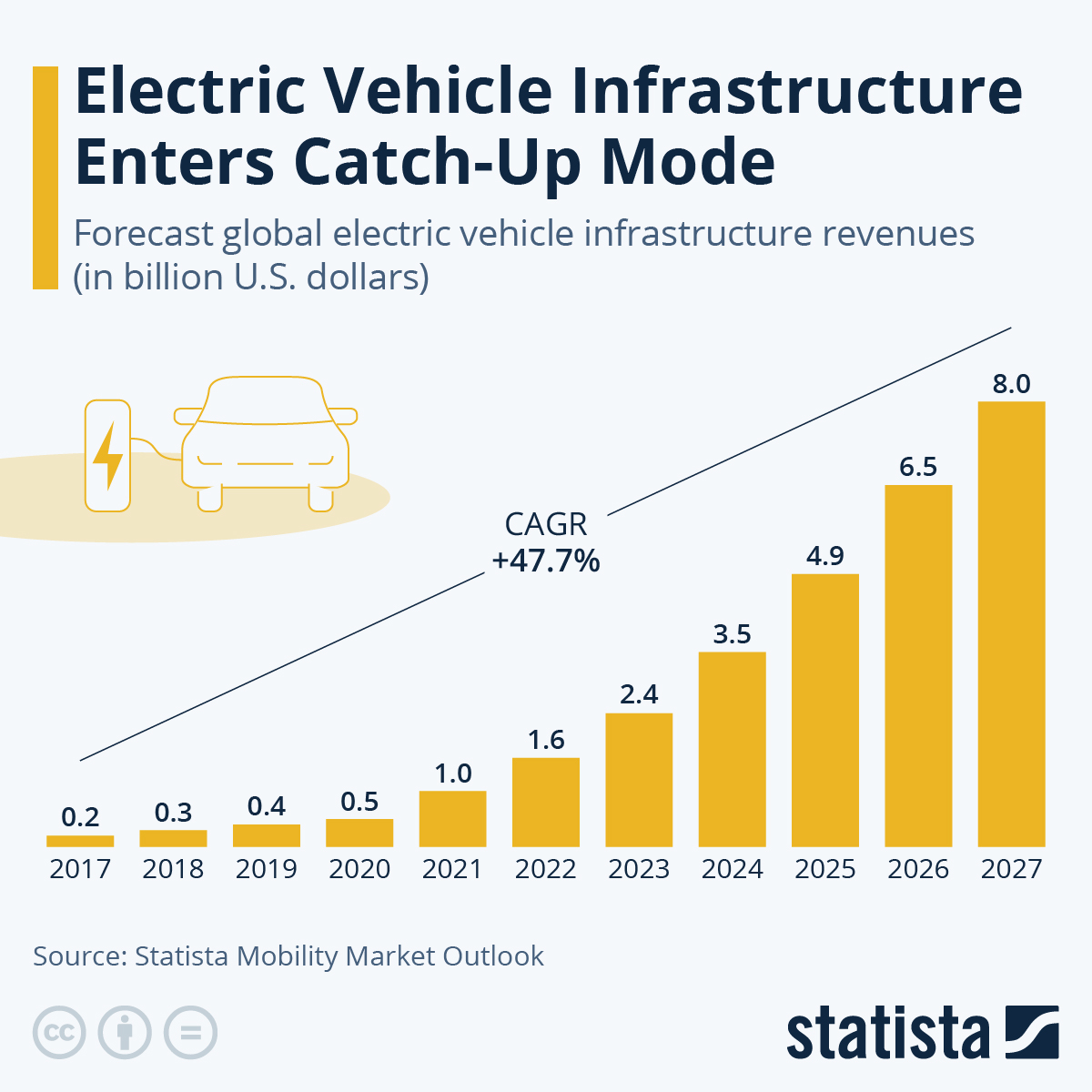

The US Department of Energy announced that it is investing $2.8 billion in grants to expand domestic manufacturing of batteries for EVs and the electrical grid, while the Canadian government’s 2022 federal budget included $3.8 billion in funding for critical minerals development over 8 years.2

Ford, Tesla, and General Motors will need about 900,000 tonnes of lithium from the United States and Canada to meet domestic production demands if demand for electric cars (EVs) takes off as projected. North American output is expected to plateau at 600,000 metric tonnes by 2030.3

All three carmakers have already begun locking down lithium supply. Most recently, GM announced a $650 million investment into Lithium Americas Corp. to accelerate the development of the Thacker Pass project in Nevada, which has the potential to be North America’s largest lithium source. 4

On March 2, LAC began construction at Thacker Pass and is targeting first production in H2 2026.5

Currently, the US produces just 1% of the global lithium supply, most of which comes from Albemarle’s Silver Peak mine, but a unique opportunity exists for miners in the region thanks to several initiatives by the government.

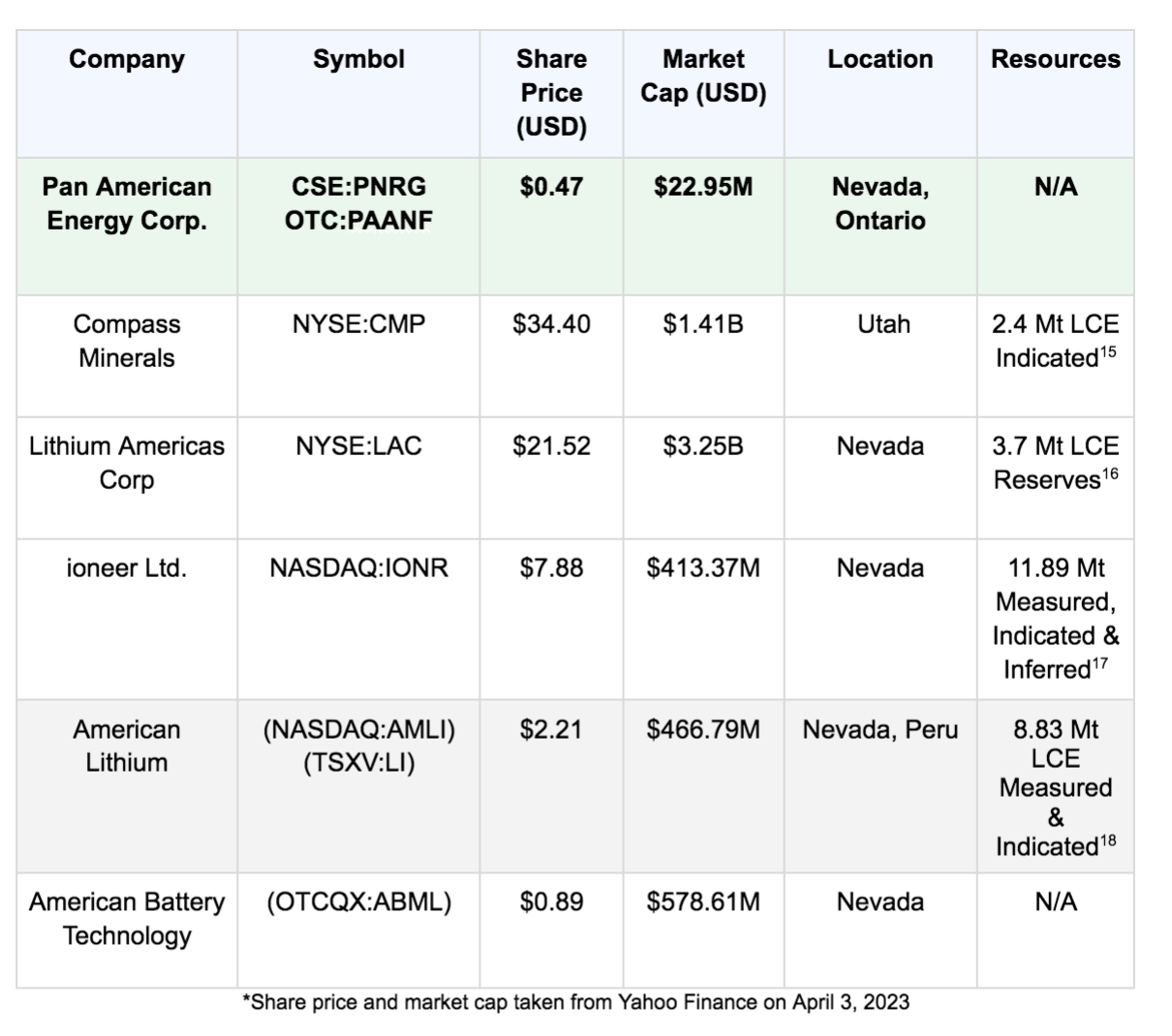

This opportunity bodes well for companies like Pan American Energy Corp. (CSE:PNRG) (OTC:PAANF) who have a diversified asset base in Canada and the US making it perfectly positioned to reap the benefits of the global transition to green energy.

Pan American has promising assets in top mining jurisdictions (Nevada and Ontario) that are located in very close proximity to some of the most exciting lithium discoveries in recent years, including American Battery Technology’s Tonopah Flats project – one of the largest known lithium deposits in the US with an estimated 15.8 million tons of LCE.6

According to Pan American’s (CSE:PNRG) (OTC:PAANF) recent corporate milestones, there is strong evidence to suggest that it has the potential to become a key player in the lithium supply chain.

In October, the company raised about C$8 million to fund drilling and exploration activities across its three lithium projects.

Pan American has multiple catalysts that make it quite attractive for lithium investors and here are some of the reasons why the company has the potential to become one of North America’s most significant lithium producers.

8 Reasons

Why Pan American Energy Corp. (CSE:PNRG) (OTC:PAANF) Lithium Projects Stand Out In North America

1

Diversified asset base: brine, hard rock (LCT-Pegmatite), and claystone

2

Projects are adjacent to industry peers with verified preliminary resources: Its Nevada project borders American Battery Technology’s Tonopah Flats project, which is one of the largest known lithium deposits in the US with an estimated 15.8 million tons of LCE8

3

Domestic sources of battery metals are a national priority (Defense Production Act, Mineral Security Partnership, Inflation Reduction Act, Critical Minerals Strategy ,etc)

4

Discoveries by leading lithium geologists such as Foster Willson one of the most well-known names in project generation and oversight in claystone lithium applications

5

Phase 1 22-hole exploration drill program currently underway at the Horizon Lithium Project, which is already delivering potentially promising results Pan American’s expectations9

6

Excellent infrastructure in place with access to services like power and rail network. Most notably, the Horizon Lithium project is close to Tesla’s gigafactory

7

Historical project samples have yielded economically recoverable resources: For instance, Emerald Field Resources drilling program on the Big Mack project revealed the potential for 325,000 tons of petalite with an opportunity to triple with additional exploration drilling

8

World-class management team with over 50 years combined experience in resource extraction and capital raising. CEO Jason Latkowcer has more than a decade of experience in chemical and technology business development in North and South America

Perfect Opportunity For North American Miners As Lithium Triangle Faces Multiple Challenges

For the first in time in history, global lithium production surpassed 100,000 tonnes in 2021, essentially quadrupling from 2010.10

That exponential increase in production was mainly driven by rising EV sales and multiple government incentives to hasten the shift towards green energy sources. EV manufacturers saw sales jump from 3.2 million in 2020 to over 10 million in 2022,11 illustrating the rising consumer awareness of the benefits of going electric.

In spite of the robust growth in lithium production, suppliers have found it hard to keep up with demand. As a matter of fact, the Lithium Industry Association (LIA) forecasts that the global demand for lithium will grow from 292,000 metric tons in 2020 to 2.5 million metric tons by 2030 as usage of lithium-based batteries in electronics and vehicles ramps up.12 However, there will still be a 650,000-tonne deficit which bodes well for Pan American Energy Corp. (CSE:PNRG) (OTC:PAANF).

While South America’s ‘Lithium Triangle’ (Argentina, Bolivia, and Chile) is currently the top lithium supplier, several challenges in these countries provide North American producers the chance to grab substantial market share.

That is because the US is home to the world’s largest lithium deposits after those in the so-called Lithium Triangle region.

The states of Nevada where one of Pan American’s (CSE:PNRG) (OTC:PAANF) major projects is located, North Carolina, and California together host an estimated 4% of the world’s lithium reserves.

Nevada can be to lithium “what Wall Street is to finance, or what Silicon Valley is to technology” – Steve Sisolak.

Diversified Asset Base In Top Mining Jurisdictions

Pan American Energy (CSE:PNRG) (OTC:PAANF) sets itself apart from the competition thanks to its diversified asset base in top mining jurisdictions based on the Investment Attractiveness Index.13

A quick peer comparison further highlights why Pan American is a company to keep a close eye on. It has the most diversified resource type and footprint and is also one of the most undervalued.

Considering that its properties are adjacent to projects like Anson Resources’ 1,037,900 tonnes LCE Paradox project and Avalon Advanced Materials’ Big Whopper project, which has 8,405,000 tonnes at 1.408% lithium oxide, there’s no reason why Pan American’s valuation can’t potentially catch up to theirs.

Pan American’s Nevada project also borders American Battery Technology’s Tonopah Flats project, which was just named one of the largest known lithium deposits in the US with an estimated 15.8 million tons of LCE.14

After announcing the discovery, American Battery Technology’s value rose by $450M and its share price jumped from $0.63 on February 27 up to a high of $1.45 on March 7, marking a 130% increase in just over a week.

Pan American has a tight ownership structure with insiders and strategic founders owning 3% and 11% respectively.

A deep dive into Pan American Energy’s (CSE:PNRG) (OTC:PAANF) projects, highlights why it has the potential to become a key player in the North American lithium supply chain.

A deep dive into Pan American Energy’s (CSE:PNRG) (OTC:PAANF) projects, highlights why it has the potential to become a key player in the North American lithium supply chain.

The Nevada Advantage – Horizon Lithium Project

In early 2021, Trump approved plans for a $1 billion open-pit mine at Nevada’s Thacker Pass, in a swath of government-owned land that covers 9 square miles above the country’s largest lithium deposit. The Biden administration has since defended that decision, reaffirming the importance of Nevada in North America’s future lithium supply chain.19

Pan American Energy’s (CSE:PNRG) (OTC:PAANF) Horizon project consists of 839 claims spanning 7,015 hectares and is located just 7.5 km from Tonopah, Nevada.

The project is prospective for near-surface claystone lithium based on regional peer analysis which indicates lithium is weakly bound to the clays, unlocking conventional mining methods including open pit.

Considering that Pan American Energy’s (CSE:PNRG) (OTC:PAANF) Horizon project is located closeby to several other lithium projects with promising lithium resources, there’s a good probability that the claim can potentially yield equally encouraging results.

The project benefits from incredible access to infrastructure without being impeded by it – unlike adjacent peers, there are no major highways or powerlines that intersect the property that would need to be moved.

For better context, the property adjoins American Battery Technology’s (ABTC) Tonopah Flats Project, which has just been named one of the largest known lithium deposits in the US with an estimated 15.8 million tons of LCE.20 ABTC is also a recipient of the Department Of Energy’s (DOE) $115 million Bipartisan Infrastructure Law grant, and south of American Lithium’s TLC project, which hosts 4.2 million tons LCE measured resources, 4.63 million tons LCE indicated resources and 1.86 million tons LCE inferred resources.21

Nevada Bureau of Mines and Geology mapping shows ABTC, American Lithium, Enertopia Corp, and Blackrock Silver Corp have Li grades at depths that indicate the Seibert Formation to be the primary host for mineralization.

Press Releases

- Pan American Energy To Collaborate With Integrity Mining And Industrial To Pilot Sustainable Chemistry For Lithium Extraction In North America

- Pan American Energy Corp. Announces Marketing Campaign And Grant Of Rsus

- Pan American Energy Provides A Midway Update On The Horizon Lithium Phase One Drill Program

- Pan American Energy Retains Clarus Securities For Capital Markets Services

- Pan American Energy Completes Magnetic Survey Campaign Fieldwork At The Big Mack Lithium Project

All of these adjacent claims have reported highly encouraging drill sample results which bode well for Pan American Energy (CSE:PNRG) (OTC:PAANF).

ABTC drill results are especially significant because of mineralization beginning near the surface and extending to the bottom at a depth of 710ft with drill holes terminating in lithium mineralization of 1,940 (parts per million) ppm.

The US has continued to show its commitment to bolstering lithium production in Nevada, ioneer Ltd. was just offered a loan of up to $700 million from the DOE for Rhyolite Ridge, a world-class lithium and boron project that’s expected to become a globally significant lithium source.22

Energy Secretary Jennifer Granholm also pledged to support efforts to streamline permitting of mines back in May last year. Pan American Energy was quick to take advantage of this opportunity and decided to submit a Notice of Amendment to the BLM, to increase the number of its exploratory drill holes from 19 which was recently approved.

As part of the company’s operational execution, Pan American Energy partnered with RESPEC Consulting Inc., a leader in geoscience engineering, data, and integrated technology solutions for industry to prepare drilling programming, permitting, and project management. RESPEC is the same firm that worked with American Battery Technology’s SK-1300 technical report.23

The company is now fully permitted to drill 22 lithium prospecting core holes up to 1,000 ft depth/hole.24

On February 13 Pan American Energy Corp. (CSE:PNRG) (OTC:PAANF) began core drilling at the Phase 1 exploration drill program after commissioning KB Drilling, which has a long history of claystone lithium exploration work in the region.25

Since the start of drilling, Pan American has been encountering continuous lithium-bearing clay intercepts.26

On March 22, the company provided a midway update on Phase 1 drilling at Horizon, announcing that six of the eleven fully-funded drill holes have been completed and intercepted over 86% of total drill footage within the Siebert Formation.27

With each drill hole, Pan American is seeing increasing thicknesses of potential lithium-bearing claystone as drilling approaches the anticipated center of the basin.

Not to mention, the base of the Siebert Formation hasn’t been encountered yet meaning tremendous opportunity for program expansion in future exploration.

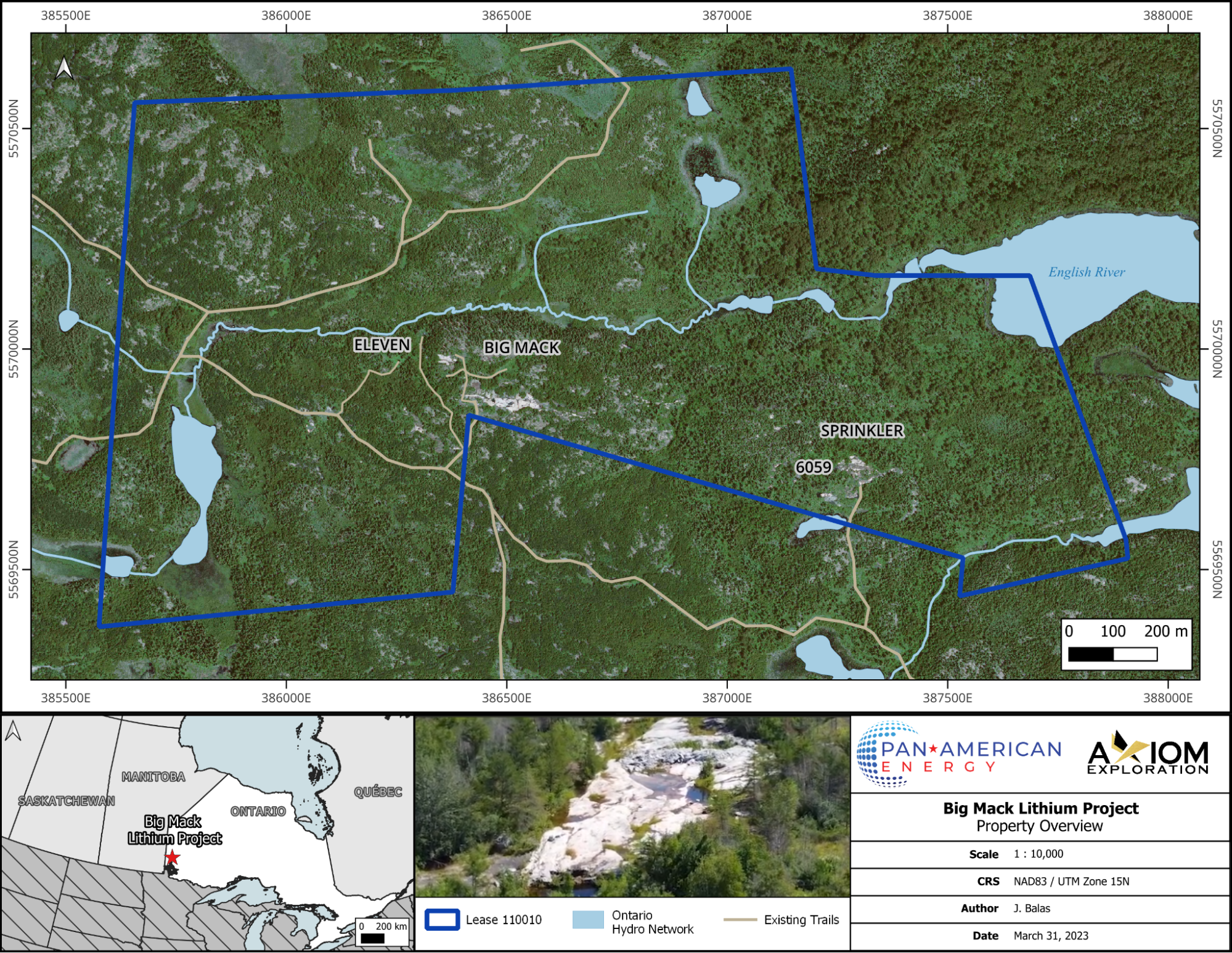

PanAm’s Rare Earth Opportunity – Big Mack Project

Pan American’s (CSE:PNRG) (OTC:PAANF) Big Mack project is located in Ontario, Canada and provides Pan American with the opportunity to not only produce ‘green lithium’ but also other rare earth metals.

The project is close to important infrastructure, accessible by all-weather highway and logging roads, and 50 km by road to the Canadian National Railway. It’s also in an ideal location to ship material to the proposed lithium processing facility in Thunder Bay.

Big Mack is next to Avalon Advanced Materials’ Separation Rapids property which hosts one of the world’s largest “complex-type” rare metal pegmatite deposits known as the “Big Whopper Pegmatite.” Pegmatite is a type of rock composed entirely of crystals and pegmatite lithium deposits, also known as hard-rock lithium deposits, can contain a number of elements, including lithium, tin, tantalum and niobium.

The Big Whopper has pegmatite reserves of 8.4 million tons grading 1.408% Li2O and is only the fourth example in the world of a rare metal pegmatite with the size required to be profitably mined and only the second to be enriched with petalite – another important lithium ore that can be converted to spodumene and processed via conventional means.

Based on Emerald Field Resources’ 15-hole historical diamond drilling program in 1998 and 2001 on the property, an assessment of the results proposed the likelihood of 325,000 tonnes of petalite, which is significant considering a 5-tonne sample has been commercially approved by Corning for glass and acrylic applications.

Interestingly, Pan American’s (CSE:PNRG) (OTC:PAANF) project hosts over 20+ pegmatites identified across the property which contain rare-metal mineralization similar to world-class TANCO (Manitoba) and Bikita pegmatites (Zimbabwe).

The highest historical drill-core sample results at the lithium-bearing zone on the property showed:

- Lithium – 2.74% – Li2O

- Cesium – 0.088% – Cs2O

- Rubidium – 0.814% – Rb2O

- Tantalum – 0.135% Ta2O5

This is especially significant considering that petalite concentrate created from a 5-tonne sample from the Big Mack Pegmatite was approved by Corning Laboratory Services.

Pan American Energy (CSE:PNRG) (OTC:PAANF) just completed the joint magnetic survey collaboration project with Avalon Advanced Materials at the Big Mack and Big Whopper Project to gain better understanding of the structural behaviours and stress of the pegmatites in the Separation Rapids area. The company will also be collaborating with EarthEx to fly a drone-borne gamma-ray spectrometry, LiDAR and high-resolution air photography once the snow melts as a follow-on work program.28

Pan American (CSE:PNRG) (OTC:PAANF) has commissioned Axiom Exploration Group to run their fully funded Spring/Summer 2023 exploration campaign that consists of geological, geophysical, and drilling (~5,000m).

Strong Leadership Team

Having world-class lithium projects in the top mining jurisdictions requires leadership with the necessary experience to fully capitalize on the opportunity. Luckily Pan American Energy (CSE:PNRG) (OTC:PAANF) has a solid management team to steer it in the right direction. The team includes:

RECAP: 7 Reasons

To Put Pan American Energy Corp. (CSE:PNRG) (OTC:PAANF) On Your Watchlist

1

Booming lithium demand that requires the US to produce at least 900,000 tons for EVs alone

2

Government incentives for domestic lithium producers with battery material sources being classified as a national priority.

3

Diversified lithium projects located in multiple favorable mining jurisdictions adjacent to projects with historical drilling samples confirming lithium resource potential.

4

Rare earth minerals opportunity in the company’s Big Mack project.

5

Projects are located close to critical infrastructure such as roads, rail, power and Tesla’s Gigafactory.

6

Well-funded to carry out drilling and exploration on its projects after the recent C$8 million capital raise.

7

Experienced leadership team with over five decades experience in resource extraction.

Ultimately, Pan American Energy Corp. (CSE:PNRG) (OTC:PAANF) is perfectly positioned to become the next big player in North America’s lithium supply chain thanks to its high-quality lithium projects.

Add this to the fact that the US government is giving major incentives to domestic lithium producers and producers in the Lithium Triangle are battling a host of issues that are stifling production, there is no doubt that the future for Pan American Energy looks extremely bright.

If you want to keep this exciting company on your watchlist, don’t forget to subscribe for email updates and make sure you don’t miss out on any of Pan American Energy Corp. (CSE:PNRG) (OTC:PAANF) news and milestones.

Jason LatkowcerChief Executive Officer And Director

Jason LatkowcerChief Executive Officer And Director Emilio BunelAdvisory Board

Emilio BunelAdvisory Board Brad NicholAdvisory Board

Brad NicholAdvisory Board Foster WilsonAdvisory Board

Foster WilsonAdvisory Board William GibbsDirector

William GibbsDirector