Along the road toward a net zero world,1 getting there will require levels of critical minerals the mining world isn’t currently capable of providing—the result is that we’re now in a “once-in-a-generation shift in demand for metals”.2

For example, copper inventories are now at the historically low level of 200,000 tonnes, whereas just 10 years ago they were at 900,000 tonnes.3 Meanwhile, analysts are forecasting there are not enough lithium projects in the pipeline to meet a looming major deficit of LCE.4

Ongoing reliance on China presents another challenge, as calls for securing domestic supplies for critical minerals grow louder.5 Since the passing of the 2022 Inflation Reduction Act (IRA) and its bold climate change reduction goals, the US is looking to Canada as the answer to China’s cleantech dominance.6

In response, Canada’s Critical Minerals Strategy7 prioritizes copper, lithium, graphite, nickel, cobalt and rare earth elements, and the government’s 2022 federal budget included earmarks for $3.8 billion in funding over 8 years for critical minerals development.

With two exciting critical minerals projects in Canada, New Energy Metals (TSXV:ENRG) (OTC:NEMCF) is positioned to grow value through its Troitsa Copper Project and Roslyn Lithium Project along with a tight share structure.

Strategically placed in the rising copper and lithium sectors is New Energy Metals (TSXV:ENRG) (OTC:NEMCF). Some of the most brilliant minds in the mining industry are increasingly bullish on the copper outlook in particular.

Now as it embarks on its fully-funded 2023 campaign towards defining a company-making resource in both copper and lithium, New Energy Metals (TSXV:ENRG) (OTC:NEMCF) is in a position for an early-mover advantage with the assets, valuation, tight share structure, management and other value creation opportunities in place to warrant your attention.

New Energy Metals (TSXV:ENRG) (OTC:NEMCF) currently has only 34 million shares outstanding, which in the junior mining sector counts as a tight share structure, with plenty of blue sky ahead.

5 Reasons

to Add New Energy Metals (TSXV:ENRG) (OTC:NEMCF) to Your Watchlist

1

Strategic Property Acquisitions in a supply constrained Battery Metals Markets: New Energy’s (TSXV:ENRG) (OTC:NEMCF) Roslyn Lithium Project in the high-potential Georgia Lake Pegmatite Field, Ontario, and Troitsa Copper Property in Central British Columbia, known for its significant copper mineralization.

2

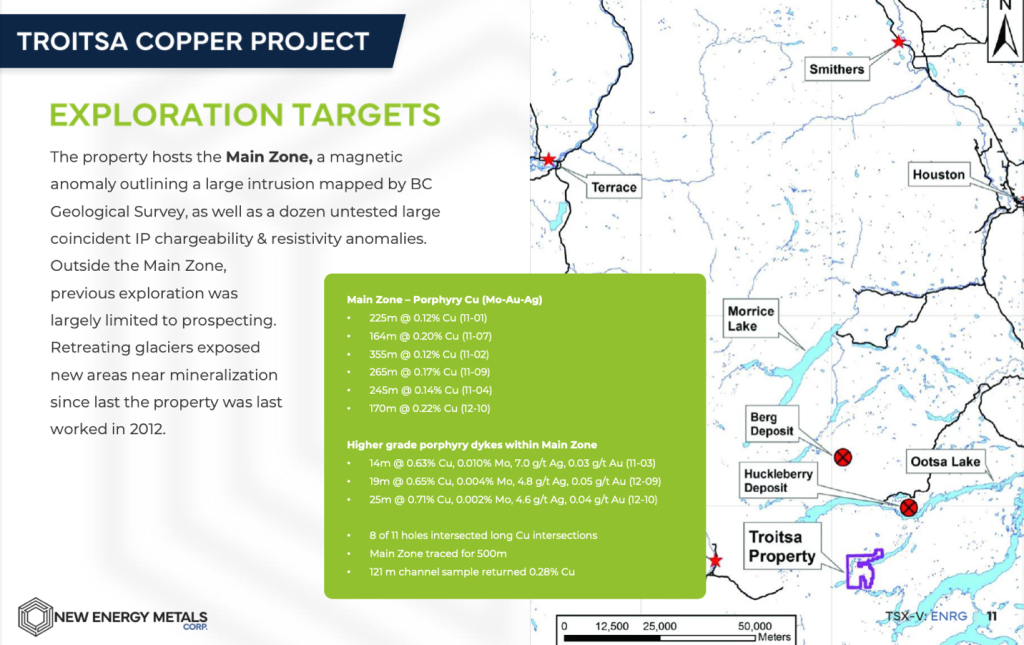

Strong Copper Potential: The Troitsa Copper Project, which boasts multiple long copper intersections in the Main Zone, is part of a large porphyry system with copper, molybdenum, gold, and silver mineralization spread across a 5 km by 2 km area.

3

Quality Lithium Project: The Roslyn Lithium Project shows a high merit for hosting lithium-bearing pegmatites with several indicators of fertile granitic melts, situated close to established lithium deposits and occurrences in the region.

4

Booming Critical Metals Market Ripe With Investments: Significant supply deficits and ever-rising demand for battery metals have led to a string of government investments geared towards mining companies with lithium and copper resources in North America.

5

Experienced and Globally Connected Management Team: New Energy Metals (TSXV:ENRG) (OTC:NEMCF) is led by a diverse and experienced team that brings together expertise in finance, mergers and acquisitions, legal and regulatory compliance, and exploration, including director Keenan H. Hohol who has held executive roles at BHP Billiton, Western Coal, Silver Standard Resources, and Pan American Silver and CEO Rishi Kwatra, who adds extensive experience in undertaking project generation, finance and business development along with evaluating early to advanced stage M&A opportunities in the mining sector.

Press Releases

North America Sees an Opportunity Amidst the Lithium Supply Crisis

Not only is copper’s supply a concern. The World Economic Forum projects the world needs two billion EVs (Electric Vehicles) to get to Net Zero, and the big question is—is there enough lithium to make all the necessary batteries?8

After passing the Inflation Reduction Act (IRA), which provides big incentives for automakers to source their materials from domestic sources, the US is still far behind on lithium production.9 As one of the trade-agreement nations counted by the IRA, Canada is set to introduce a 30% investment tax credit to boost clean-tech manufacturing, especially in the electric vehicle (EV) supply chain.10

Now Canada is winning the race to secure the new battery economy’s investment, for example with Volkswagen opting to build its first North American battery cell factory in Ontario.11

Located in northwestern Ontario, New Energy Metals’ (TSXV:ENRG) (OTC:NEMCF) Roslyn Lithium Project spans 5,100 hectares. The project is situated in a region known for hosting lithium-bearing pegmatites, making it a high-potential proximity play.

For example, it’s just 35 km southeast of Rock Tech Lithium’s flagship Georgia Lake Project that in 2022 put out a Pre-Feasibility Study that described an Indicated Mineral Resource of 10.6 million tonnes Li2O and an additional Inferred Mineral Resource of 4.2 million tonnes Li2O.12

One of the key factors that make New Energy’s (TSXV:ENRG) (OTC:NEMCF) Roslyn Lithium Project promising is its location within a type of granite with metasediments, which are excellent hosts for pegmatites, and within the Georgia Lake Pegmatite field, where several lithium deposits and occurrences are being explored and developed including Brunswick Exploration’s Hearst and Lowther Projects, Ultra Lithium’s Georgia Lake Lithium Pegmatites Project, Vital Battery Metals’ Dickson Lake Lithium Project and Imagine Lithium’s Jackpot Deposit, which has a historical resource of 2 Mt of Li2O and is currently being drilled for additional lithium targets.13

The area has been described as the largest concentration of rare-element mineralization in Ontario, containing 38 rare-element occurrences and 10 spodumene pegmatite deposits and occurrences. It’s worth noting that pegmatites can be relatively easy to mine due to their coarse-grained texture, which allows for efficient extraction and processing of lithium and other minerals.

Now after an important meeting between US President Joe Biden and Canadian Prime Minister Justin Trudeau, the focus on Canada’s contribution to the green energy transition is heightened. The talk highlighted the need for more investment in Canadian mining, and less US trade-policy uncertainty.14 Moving forward, Canada’s resource-heavy economy is set to contribute to the new economy and benefit greatly along the way.15

Here’s a look at some of New Energy Metals‘ (TSXV:ENRG) (OTC:NEMCF) neighbors and regional comparables in the lithium space:

It’s important to note that Rock Tech Lithium’s Georgia Lake Project—only 35km away from New Energy Metals‘ (TSXV:ENRG) (OTC:NEMCF) Roslyn Lithium Property—has a published Pre-Feasibility Study showcasing an indicated mineral resource of 10.6 million tonnes (Mt) of lithium oxide and an inferred mineral resource of 4.2 Mt.18

The pre-tax net present value of Rock Tech’s project is estimated at US$223 million, supporting the viability of lithium mining activities and spodumene concentration in the region.

Working to further incentivize the province’s lithium mining scene, Ontario just invested another $6 million in junior miners, amid the surging demand for critical minerals—taking the province’s total junior exploration investment to $35 million.19

The announcement was tied to Ontario’s Critical Minerals Strategy 2022-2023—a five-year roadmap to secure Ontario’s position as a global leader of responsibly sourced critical minerals.20

Tight Supply and Rising Demand Creates Bullish Case for Copper

Copper, which is used in wind turbines, solar photovoltaic panel wiring and to transfer electricity, is expected to play a major role in the shift to greener sources of energy.21 But there’s truly not enough copper in the world, with a shortage expected to last through 2030,22 making New Energy Metals (TSXV:ENRG) (OTC:NEMCF) Troitsa Project so appealing.

Goldman Sachs expects a commodities super cycle, with Jeff Currie, Global Head of Commodities stating: “On copper, the forward outlook is extraordinarily positive. We’ll be at the lowest observable inventories that have ever been recorded at 125,000 tonnes. We have peak supply occurring in 2024… Near term, we put (the copper price) at $10,500 and longer-term our price target is $15,000 a tonne.”23

Mining giant Rio Tinto sees a robust short-term outlook for copper, especially with global stockpiles trending down and supplies eroding from Latin America.24

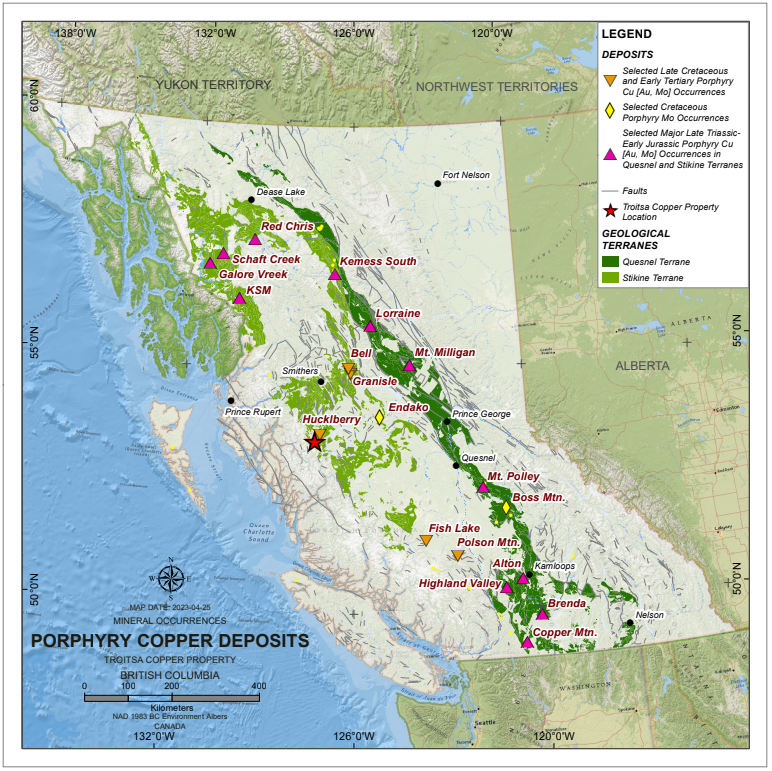

In response, big money is flowing into Canada, particularly in British Columbia, where more than half of the country’s copper is produced—about 310,000 tonnes of Canada’s roughly 540,000 tonnes of annual production—and where New Energy Metals (TSXV:ENRG) (OTC:NEMCF) Troitsa Project is located. In 2022, BC copper miners increased exploration spending by 84% to $235 million.25

BC’s Premier has instructed his mining minister to fast-track the province’s critical-mineral strategy, where eight new mines or expansions are underway with the potential to boost the province’s economy.26 Now according to the Mining Association of BC, the province has a “fairly limited window of opportunity” to demonstrate that it can execute on effectively increasing its output of copper and other elements because the US and other jurisdictions are “moving rapidly” to develop their own supply chains.27

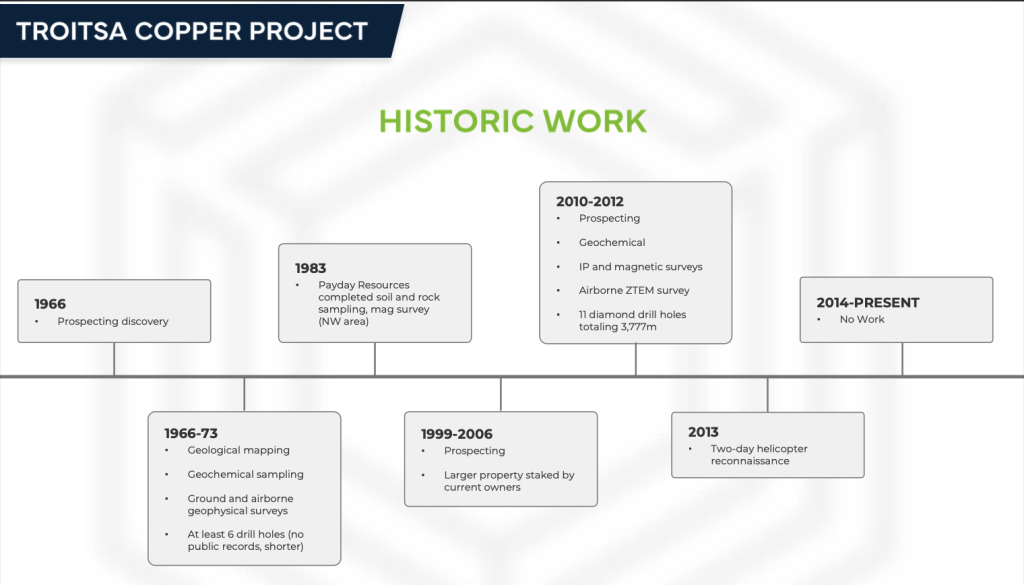

Getting out ahead of this is New Energy Metals (TSXV:ENRG) (OTC:NEMCF) with its Troitsa Project in central BC, which consists of mineral claims covering an area rich in porphyry copper-type deposits—the type where BC’s commodities are mostly found within, containing metals such as copper, gold and silver.

As per a recently completed NI 43-101 Technical Report,28 the Main Zone of the Troitsa Property has revealed multiple long copper intersections, with mineralization spanning at least 5 km by 2 km that includes copper, molybdenum, gold, and silver.

Within the Main Zone, higher-grade porphyry geological formations have been discovered, with notable intersections that included 14m at 0.63% copper, 19m at 0.65% copper, and 25m at 0.71% copper. For reference, Copper Mountain’s flagship mine’s feed grade was much lower, at 0.24% copper in Q4 2022.29

New Energy Metals‘ (TSXV:ENRG) (OTC:NEMCF) Troitsa Property is situated in a region with several advanced-stage exploration projects.

Adjacent to Troitsa is Surge Copper’s Ootsa Property, a 72,710-hectare advanced-stage copper, gold, molybdenum, and silver exploration project. In 2022, the company completed a resource estimate that showed 439 Mt grading 0.32% copper equivalent Measured and Indicated and 138 Mt grading 0.28% CuEq Inferred.30

Another nearby project is the Huckleberry porphyry copper mine, located 20 km northeast of Troitsa on Tahtsa Lake, a past-producing porphyry copper-molybdenum deposit that clearly demonstrates the high-grade potential of the region. The mine’s East Zone features a 40-meter-wide geological formation, which houses some of the highest-grade copper mineralization within the East Pit.

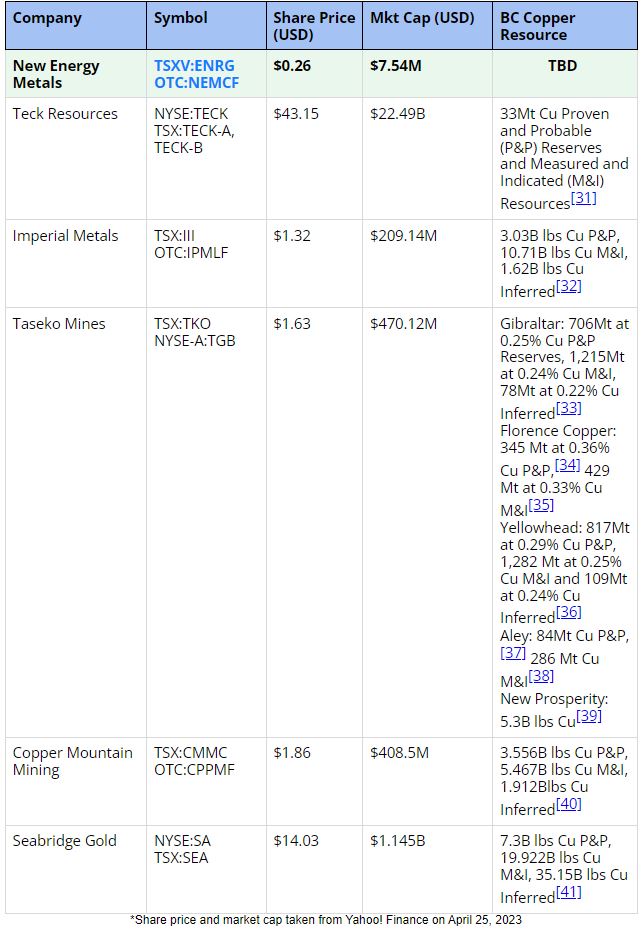

Looking into the space, it’s worth investigating some of the other main copper resources located in British Columbia that are being developed at the same time as New Energy’s (TSXV:ENRG) (OTC:NEMCF) Troitsa Project.

As you can see from the resources listed above, British Columbia offers significant discovery potential as seen by projects like New Gold’s New Afton, Teck’s Highland Valley copper mine, and exploration companies like North Isle Copper.

Taseko Mines has several copper properties across the province with significant resources including a 706 Mt proven and probable at Gibraltar,42 320 Mt proven and probable at Florence,43 831 Mt proven and probable at New Prosperity44 and 817 Mt proven and probable at Yellowhead.45

The province is also home to Seabridge Gold’s KSM Project, the largest undeveloped copper – gold project in the world which hosts an estimated proven and probable reserves of 7.3 billion lbs of copper and 47.3 million ounces of gold.46

Porphyry Deposits in British Columbia

Highly Skilled and Experienced Team

Leading the way for New Energy Metals (TSXV:ENRG) (OTC:NEMCF) is a diverse team that boasts extensive experience in finance, business development, legal and regulatory compliance, and exploration. Their combined expertise in capital markets, mergers and acquisitions, and industry-specific knowledge will be invaluable in driving growth and success.

The ENRG team includes:

RECAP: 5 Reasons

to Seriously Consider New Energy Metals (TSXV:ENRG) (OTC:NEMCF)

1

Strategic Property Acquisitions in a Supply Constrained Battery Metals Market: New Energy’s (TSXV:ENRG) (OTC:NEMCF) Roslyn Lithium property in the high-potential Georgia Lake Pegmatite Field, Ontario, and Troitsa Copper Property in BC, known for its significant copper mineralization.

2

Strong Copper Potential: The Troitsa Copper Property, which boasts multiple long copper intersections in the Main Zone, is part of a large porphyry system with copper, molybdenum, gold, and silver mineralization spread across a 5 km by 2 km area.

3

Quality Lithium Project: The Roslyn Lithium Property shows a high merit for hosting lithium-bearing pegmatites with several indicators of fertile granitic melts, situated close to established lithium deposits and occurrences in the region.

4

Booming Battery Metals Market Raking in Investments: Supply deficits and continuously rising demand for critical metals in green technology have led to a string of government investments geared towards mining companies with lithium and copper resources in North America.

5

Experienced and Globally Connected Management Team: New Energy Metals is led by a diverse and experienced team that brings together expertise in finance, mergers and acquisitions, legal and regulatory compliance, and exploration, ensuring a solid foundation for New Energy’s (TSXV:ENRG) (OTC:NEMCF) growth and success.

We are currently in the midst of a Once-in-a-Generation Shift in metals Demand,47 and New Energy Metals (TSXV:ENRG) (OTC:NEMCF) has strategically amassed valuable land positions in Canada with copper and lithium, both of which are critical metals for the ongoing green energy transition.

Because of its current early stage of development, New Energy Metals (TSXV:ENRG) (OTC:NEMCF) presents investors with a sizeable pre-discovery advantage, as it plans for upcoming exploration programs designed to further define the assets, and provide the kind of news flow that can really move the needle.

With any early-mover situation, there’s no better time than NOW to begin your due diligence, subscribe to monitor New Energy Metals’ (TSXV:ENRG) (OTC:NEMCF) news and milestones.