Gold bears shouldn’t wave their victory flag just yet.

Prices may have retreated slightly from all-time highs but the perfect storm of economic conditions could propel gold to never-seen-before highs.

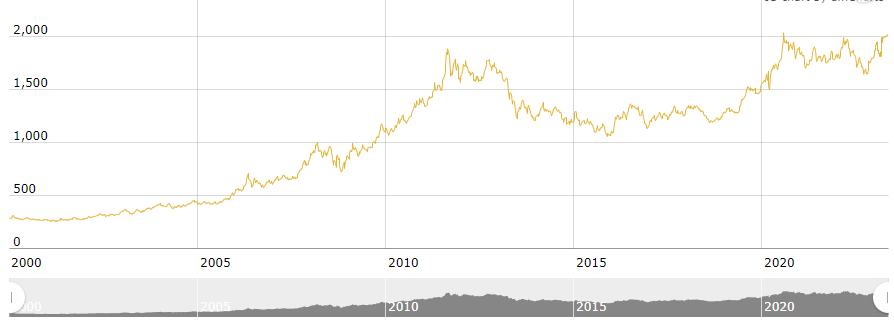

When you look at how far the price of gold has climbed since early November, it’s easy to see why Citibank, ANZ, Commerzbank, Goldman Sachs1 and Bank of America recently raised their gold price forecasts as high as $2,200 as early as Q4 2023.2

On October 31, 2022, gold was sitting at $1672.50 an ounce. Fast-forward to January 2, 2023 and gold was up to $1829.31.

By May 3, it hit $2052.04 for a 12.1% increase in 3 months…which was just shy of gold’s record high in 2020 of $2,069.40.3

Gold Price USD/oz

Source: Kitco.com

Now that chart above is the kind of chart investors like to see – and the best part is several major factors are expected to boost demand for gold even higher including a possible recession, struggling banks and the US Fed’s decision to halt rate hikes.4

But perhaps the biggest catalyst for gold price is the $1.5 trillion in mortgage loans that will be due in the next two years. Combined with higher interest rates and rising office vacancies, it creates a potential time bomb for the financial system.5

Why?

Right now, 70% of commercial mortgages are held by smaller lenders. If the value of these loans drops or if businesses can’t pay them back, it will cause serious problems for not only the banks, but the entire US economy.

It’s no wonder central banks have been buying gold at the fastest pace on record.

In fact, demand jumped to an 11-year high in 2022 largely because of what the World Gold Council called “colossal central bank purchases” that marked a 55-year high.6

All of which is very good news for gold producers, especially Luca Mining Corp. (TSXV:LUCA) (OTCQX:LUCMF), which is on track to have its second mine reach commercial production by the end of 2023.

Junior Producer Advancing its Profit-Generating Assets

Luca Mining Corp. (TSXV:LUCA) (OTCQX:LUCMF) (formerly Altaley Mining) has the assets, funding and leadership needed to solidify its position as Mexico’s upcoming diversified metals producer.

The Canada-based mining company has two high-quality assets each with decades of resources – a combined 2.2 million gold equivalent ounce M&I resource – and existing cash flow from an operating multi-metal mine. But its biggest upcoming catalyst will be reaching full production at its Tahuehueto gold/silver mine, scheduled for later this year.

The Canada-based mining company has two high-quality assets each with decades of resources – a combined 2.2 million gold equivalent ounce M&I resource – and existing cash flow from an operating multi-metal mine. But its biggest upcoming catalyst will be reaching full production at its Tahuehueto gold/silver mine, scheduled for later this year.

Once the second mine is in operation, Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) expects its highest ever cash flow generating year in 2024 with estimated consolidated production of 65,000 gold equivalent ounces and projected cash flow of C$41 million.

At the same time, a 2022 Prefeasibility Study concluded that the Tahuehueto Mine project alone represents a Net Present Value (NPV) of $161 million.7 That’s over 5x the company’s current market cap range of $30M, which means the stock is significantly undervalued.

The good news is Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) has the funding it needs to get to full production…and then the potential to self-fund ongoing asset growth initiatives.

Luca Mining announced an overall financing package of up to C$33.2M8 in March and closed the first of 2 tranches in the non-brokered private placement in April for C$18.3M.9 The company has also been significantly reducing its debt level, which had been weighing on the stock, through a combination of paying down debts from cashfows, and swapping C$12.9M of loan debts for company shares.10

The debt-reduction strategy is just one of the ways Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) is benefiting from its new leadership. The company was struggling historically before the current management arrived, including CEO Mike Struthers with 40+ years of international mining experience including 7 years at Lundin Mining, and President Ramon Perez with 15 years international mining experience, including deal structuring and strategic initiatives to optimize commercial development portfolios.

Now Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) has the funding, the assets, and the proven experience needed to get its intrinsic value lined up with its market price.

7 Reasons

to Watch Luca Mining (TSXV:LUCA) (OTCQX:LUCMF)

1

GOLD FORECASTS: Gold expected to hit new price highs, including $2200 as early as Q4 2023.11

2

TOP-TIER JURISDICTION: Mexico’s $1.8-billion-dollar mining sector has grown by over 10% annually since 2017.12

3

UNDERVALUED STOCK: Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) is trading at less than 5x the estimated NPV of just 1 of their assets at Tahuehueto.

4

REVENUE GENERATION: Strong consolidated cash flow of C$41 million expected in 2024 with both mines operational, creating potential to self-fund growth.

5

QUALITY & QUANTITY RESOURCES: Tahuehueto +10-year reserves & +18-year resource (2022 PFS); Campo Morado +20-year resource (2018 PEA); combined 2.2 million gold equivalent ounce M&I resources.

6

OPERATIONAL EXPERTISE: New leadership team with decades of combined mining and capital markets experience, including CEO Mike Struthers, former projects director for Lundin Mining and Ramon Perez, former co-portfolio manager of Carrelton Natural Resource Fund and founding member of Sociedad Minera Reliquia.

7

ATTRACTIVE GROWTH POTENTIAL: Large resources allow for throughput expansion initiatives and multi-mine strategy.

Strategic World-Class Mining Location

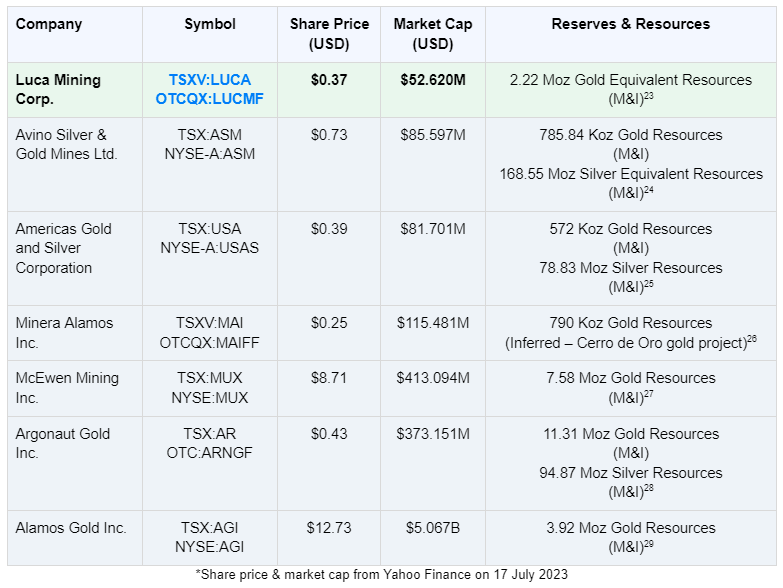

Junior precious metals producers like Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) would be hard pressed to find more opportunities than there are in Mexico.

Mexico has a mining history dating back almost 500 years. Today, it’s the world’s largest producer of silver and a top global producer of gold, copper, zinc and other metals,13 with about half of its production coming from precious metals.

While its mining sector has grown by +10% annually since 2017, Mexico’s production actually increased by 23% in 2021 when so many other economic sectors around the world were hit hard by CV-19. The country’s mining sector was valued at $US1.81 billion that year.14

Two regions in Mexico that are gaining the most attention are in the states of Durango and Guerrero, where Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) assets are, along with several other producing mines.

Two regions in Mexico that are gaining the most attention are in the states of Durango and Guerrero, where Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) assets are, along with several other producing mines.

Also located in Durango, the 4th largest mining state in Mexico,15 are Avino Silver & Gold Mines, which operates the producing Avino silver, gold and copper mine,16 and Argonaut Gold, which operates 2 producing gold and silver mines (in addition to a producing gold and silver mine in Sonora State).17

In Sonora State, Minera Alamos started producing gold in 2021 at its Santana gold mine,18 and McEwen Mining produced 308 thousand ounces (Koz) gold and 115 Koz silver at the El Gallo Complex in 2022.19

In Sinaloa State, Americas Gold and Silver Corporation owns and operates the Cosalá Operations20 and Alamos Gold has produced over 2 million ounces (Moz) gold since 2005 at the Mulatos mine where it expects to produce 175-185 Koz gold in 2023.21

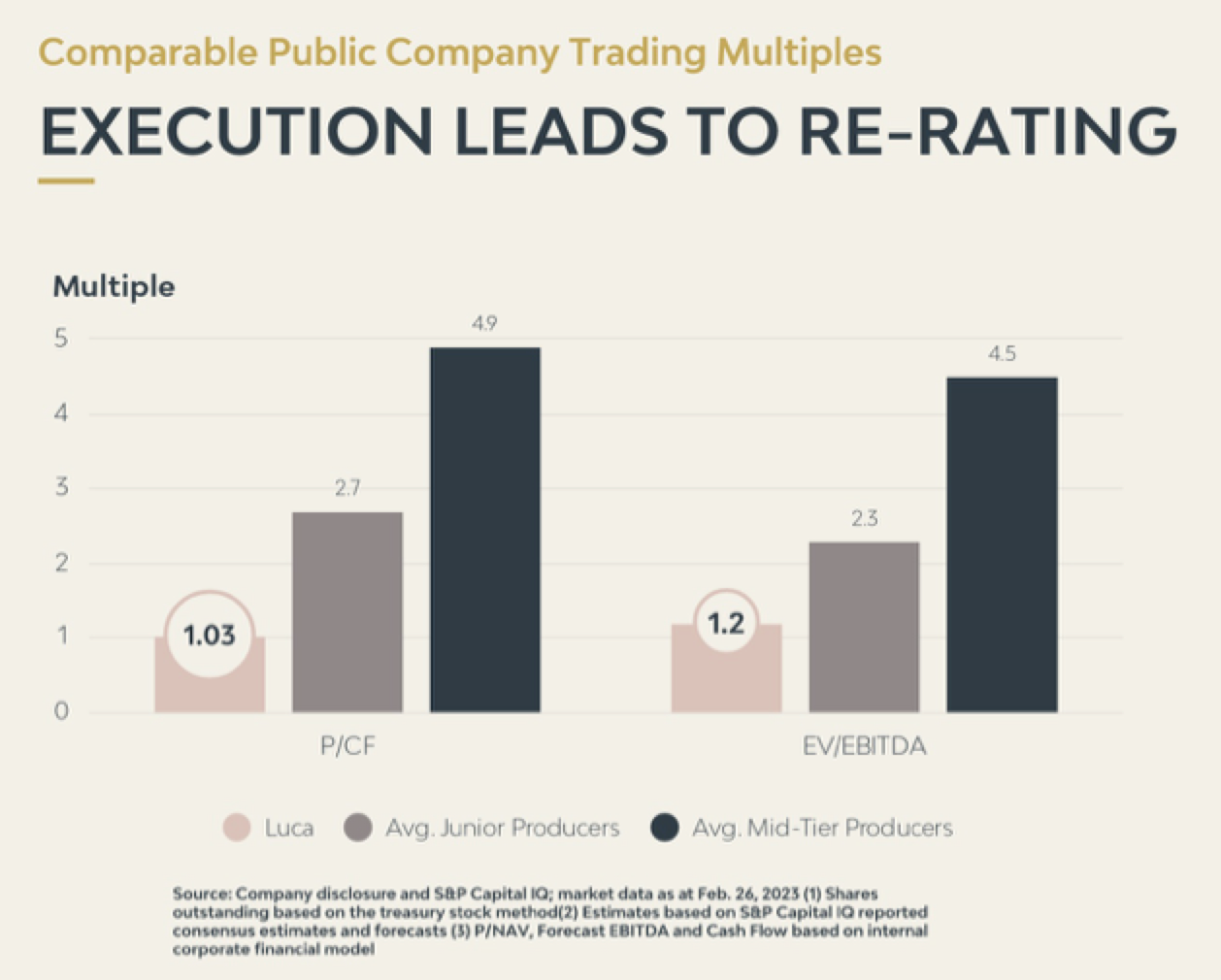

Since each of these companies – and other junior and mid-tier producers in Mexico and elsewhere – has its own story and assets, one of the most objective ways to compare them to Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) is through stock valuation indicators.

Such indicators include Price-to-Cash Flow (P/CF) and Enterprise Value to EBITDA (EV/EBITDA), where a low multiple compared to other stocks implies being undervalued by the market.

The chart below, from Luca’s investor presentation,22 shows P/CF and EV/EBITDA multiples are around 2x lower than the average for junior producers and around 3.75x lower than for mid-tier producers.

While those multiples would indicate Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) is significantly undervalued today, it’s to be expected that the company will receive a significant re-rating upward in the near term on the strength of its Tahuehueto gold mine reaching 500 tonnes per day by June 30th, and full production later this year, coupled with its expected strong cash flow performance in 2024.

Quality Resource #1: Tahuehueto Gold and Silver Mine

Luca Mining’s (TSXV:LUCA) (OTCQX:LUCMF) flagship asset is the 100% owned Tahuehueto Gold and Silver Mine.

- Location: Durango State, Mexico, within the prolific Sierra Madre Belt, which has produced over 80+ Moz gold & 4.5 Boz silver30

- Size: 28 mining concessions totaling 7,492 hectares (18,513 acres)

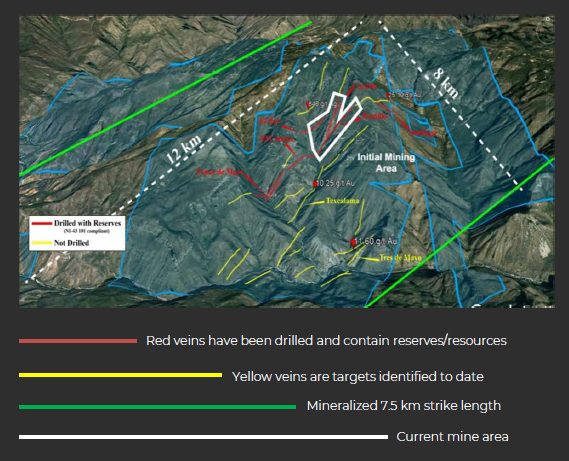

- Mineralization: Multiple vein systems over 8 km strike length.

- Invested to Date: $30M+ between Exploration, Pre Feasibility Study and Mine Development

- Resource: Measured & Indicated (M&I) 6.3M tonnes at 2.11 grams per tonne (g/t) gold (4.44 g/t gold equivalent) containing 425 Koz gold and a total of 886,000 ounces gold equivalent

- Mine Life: +10 years based on reserves; +18 years based on resources (2022 PFS)

- All In Sustaining Costs (AISC): $855/oz gold equivalent…that means Luca Mining’s (TSXV:LUCA) (OTCQX:LUCMF) complete cost of keeping its Tahuehueto Mine in business is less than half of gold’s current price

- Internal Rate of Return (IRR): 65.5%

- Payback Time: 2.0 years

Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) is actively marching the Tahuehueto Gold Mine toward sustainable profitability.

In 2022, the mine started pre-production at a rate of 320 tonnes per day (tpd) of ore processed.

In 2023, the company’s fully funded plans for Tahuehueto include:

- Stage 1: completing construction of the 500-tpd production project by June 30th

- Stage 2: ramping up to estimated commercial production by year’s end at a rate of 1,000 tpd or >41,000 gold equivalent ounces per year, which the company expects to maintain over the mine’s first 6 years

In 2024, average commercial production is expected to generate cash flow of around C$2M monthly or C$24M per year.

It’s important to note that the projected production rate is only based on Luca Mining’s (TSXV:LUCA) (OTCQX:LUCMF) existing resources and development plans at Tahuehueto. Future production could be significantly higher given the company’s goal to increase the mine life 2x to 3x in 2024.31

Press Releases

-

- Jameson Cell Technology Shows Promise In Improving Base And Precious Metals Recoveries At Luca’s Campo Morado Mine

- Luca Mining Set to Benefit from New Additions to Board of Directors, and Announces Grant of Stock Options, Appointment of Investors Relations Advisors, and Extension of the Private Placement

- Luca Mining Corp. announces Tahuehueto Construction on Schedule and Digital Marketing Agreements

- Luca Mining Corp. Announces Attendance At Metal Investors Forum

- Luca Mining Announces First Tranche Closing Of CAD$18.34 Million

Less than 10% of Tahuehueto’s land package has been explored by drilling so far.

With a structural corridor that’s at least 7.5 km (4.7 miles) in length, that means Luca has excellent potential to meaningfully increase the asset’s resource and work toward growing a multi-million-ounce gold deposit, especially since the mine area’s mineralization is open at depth and along strike.

The map below shows multiple undrilled and largely unexplored vein targets in close proximity to the Tahuehueto Mine, creating the potential for Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) to pursue a multi-mine strategy on the property.

Tahuehueto’s multi-vein potential is similar to First Majestic Silver’s (NYSE:AG) San Dimas Silver/Gold Mine, which is also located in Durango State, Mexico. San Dimas has expected production for 2023 of 6.4-7.2 Moz silver and 72-81 Koz gold.32

Better yet, Tahuehueto also represents district scale potential, giving Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) even more opportunities to expand its flagship project’s resource through strategic land acquisition.

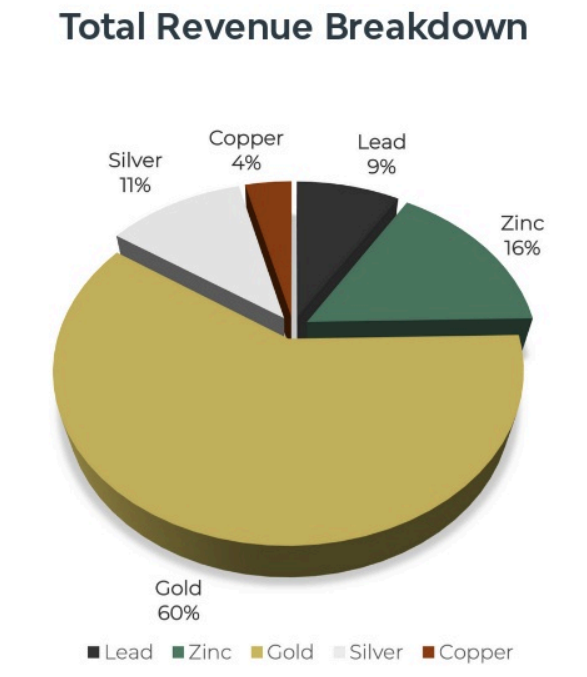

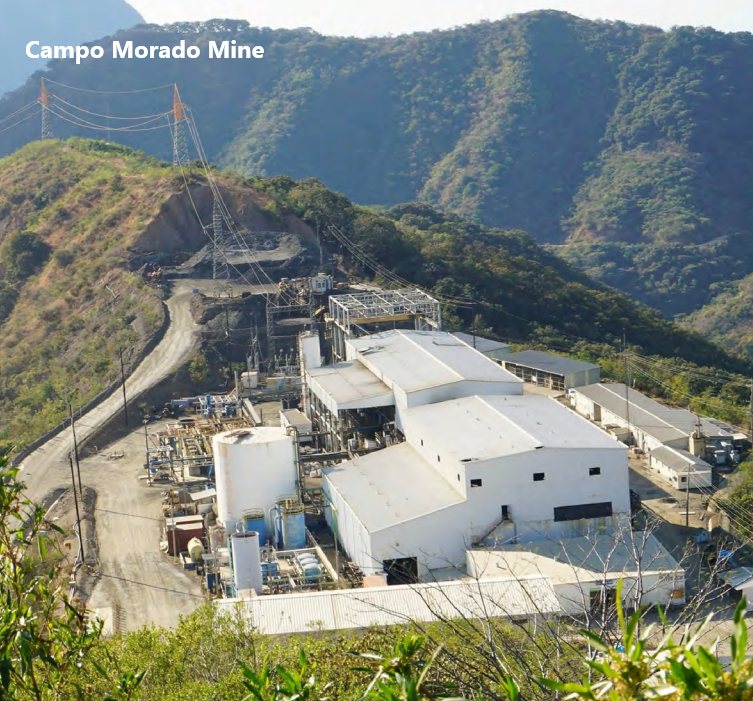

Quality Resource #2: Campo Morado Copper Mine

Luca Mining’s (TSXV:LUCA) (OTCQX:LUCMF) second asset is its 100% owned, revenue-producing, polymetallic underground Campo Morado Mine.

- Location: Guerrero State, Mexico

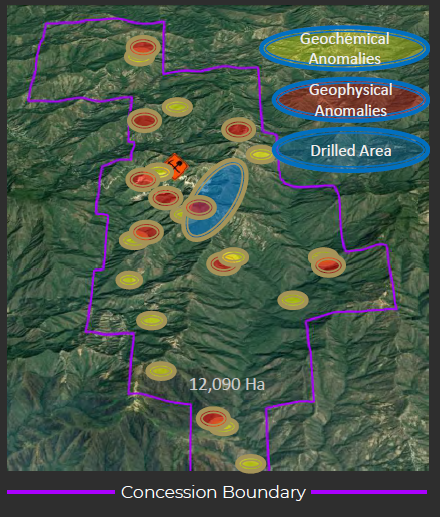

- Size: 12,090 hectares (29,875 acres)

- Drilling to Date: 3,069 core holes drilled (580,886 meters total) for exploration & mine development (1995-2014)

- Mineralization: at least 7 zones containing volcanic massive sulfide (VMS) mineralization

- Resource: Measured & Indicated (M&I) 16.6 million tons grading 4.01% zinc, 0.80% copper, 0.93% lead, 123 g/t silver and 1.70 g/t gold

- Commercial Production: 2009 (previous owners); May 2018 (Luca Mining)

- Current Processing Rate: 2,400 tonnes of ore per day (tpd) through the mine’s milling facilities

- Minerals Produced: zinc, copper and bulk copper-lead concentrates; gold and silver as by-products

- Revenue Mix: 25% from copper planned for 2023 with potential to increase further

- Mine Life: +20 years based on reserves (2018 PEA)

Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) is strategically optimizing its already-profitable Campo Morado Mine’s production and resource.

In 2021, the mine’s operating profit was C$34.3M, demonstrating the mine’s potential.

By 2022, Luca (TSXV:LUCA) (OTCQX:LUCMF) had transitioned the mine operations to focus on a copper-rich ore body. Production that year included 1,300 tonnes copper, >16,000 tonnes zinc, 122 kg gold and 23 tonnes silver.

The company’s aggressive production plan for 2023 calls for significantly greater mine output overall: 100% increase in copper (2,600 tonnes); 25% increase in zinc (>20,000 tonnes); 70% increase in gold (208 kg); 20% decrease in silver (20 tonnes).

Based on targeted production increases from 2023, average cash flow projections for 2024 would be C$1.4M per month or C$17M per year.

As with the Tahuehueto Mine project, Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) has significant potential to increase the production potential of the Campo Morado Mine asset.

The property is still largely unexplored and includes numerous undrilled surface targets and at least 16 drill-ready, large-scale exploration targets that the previous owner identified following an extensive regional exploration program in 2015 (see the map below).

As Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) works toward growing Campo Morado’s resource, its long-term goal is to more than double the mine’s processing rate, from the current 2,400 tpd to 5,000 tpd.

Further supporting the company’s hypothesis for potential resource growth is that the region hosts many large polymetallic volcanic massive sulfide (VMS) and vein deposits, including:

- Tizapa Mine (operated by Industrias Peñoles), with 2022 production of 37.6 Koz gold and 5.8 Koz silver33

- El Limon (operated by Torex Gold Resources | TSX:TXG), with a 2.0 Moz gold resource (M&I) and a 2.95 Moz silver resource (M&I)34

- Ana Paula Project (Heliostar Metals Ltd | TSXV:HSTR), with a 1.46 Moz gold resource (M&I) and a 3.27 Moz silver resource (M&I)35

The bottom line is that Luca Mining (TSXV:LUCA) (OTCQX:LUCMF) has lots of room for expansion with this profitable, revenue-generating asset.

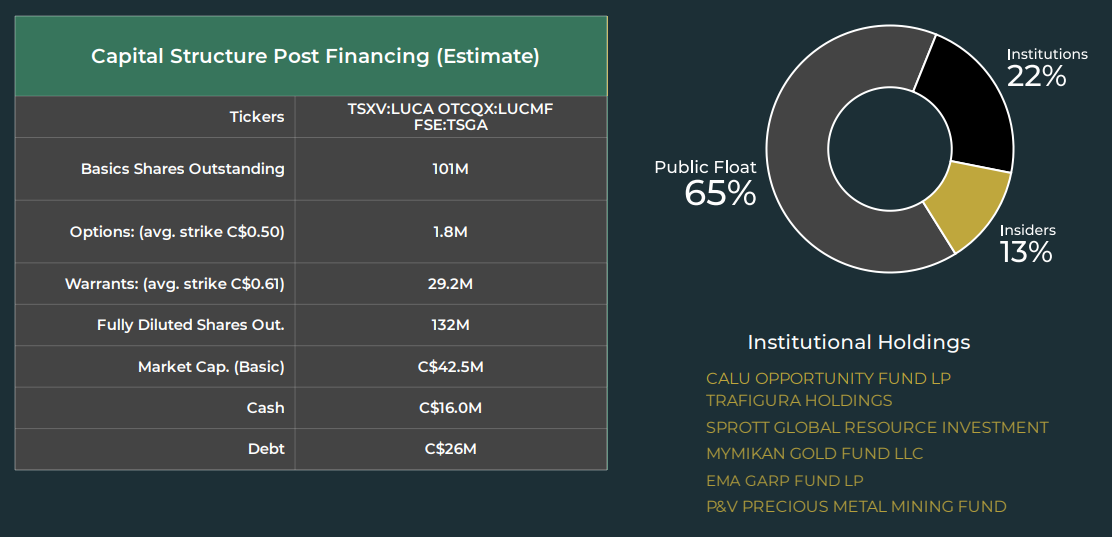

Solid Cap Structure & Balance Sheet

Between Luca Mining’s (TSXV:LUCA) (OTCQX:LUCMF) quality assets, large resources, profitable cash flow from the Campo Morado Mine, upcoming near-term production and revenue from the Tahuehueto Gold/Silver mine, room to expand its assets’ resources, and the proven leadership team to pull it off, it’s to be expected that the company has attracted strong interest from insiders (13% ownership) and Institutional investors (22% ownership).

In particular, two Institutional investors recently helped strengthen Luca’s balance sheet through strategic debt conversions of C$8M (with offtake partner Trafigura Holdings) and C$4.9M (with lead investor Calu Opportunity Fund, LP), as outlined in Luca’s news release announcing an all-in $33M Financing Package on March 31, 2023.

Another notable Institutional investor is Sprott Global Resource Investment, a global asset manager providing more than 250,000 clients with access to precious metals and energy transition investment strategies.

Interest like that from Institutional investors helps establish the type of credibility that attracts more money to a stock.

At the same time, it also helps that Luca Mining’s (TSXV:LUCA) (OTCQX:LUCMF) operations are expected to generate projected cash flow of C$41 million in 2024 with the Tahuehueto Mine operating at full capacity, giving the company the potential to self-fund ongoing asset growth plans.

Strong Leadership Team with Outstanding Operational Expertise

Luca Mining’s (TSXV:LUCA) (OTCQX:LUCMF) new leadership brings over 250 years of combined mining and capital markets experience to the goal of strategically increasing shareholder value.

7 Reasons

to Watch Luca Mining (TSXV:LUCA) (OTCQX:LUCMF)

1

GOLD FORECASTS: Expected to hit new price highs.

2

TOP-TIER JURISDICTION: Mexico’s $1.8-billion-dollar mining sector.

3

UNDERVALUED STOCK: Luca trading at less than 5x the estimated NPV of just its Tahuehueto asset.

4

REVENUE GENERATION: Consolidated cash flow of C$41 million expected in 2024 .

5

QUALITY & QUANTITY RESOURCES: combined 2.2 million gold equivalent ounce M&I resource.

6

OPERATIONAL EXPERTISE: New leadership team with over 250 years of combined mining and capital markets experience, including CEO Mike Struthers, former projects director for Lundin Mining and Ramon Perez, former co-portfolio manager of Carrelton Natural Resource Fund and founding member of Sociedad Minera Reliquia.

7

ATTRACTIVE GROWTH POTENTIAL: Large resources allow for throughput expansion initiatives and multi-mine strategy.

With a gold/silver mine coming online this year and significantly greater production expected at its already profitable Campo Morado Mine, those catalysts alone will likely attract valuable market attention for Luca Mining (TSXV:LUCA) (OTCQX:LUCMF).

If you’re interested in gold mining opportunities, you’ll want to keep an eye on Luca Mining Corp. (TSXV:LUCA) (OTCQX:LUCMF) and its upcoming news and updates by subscribing here.

Mike StruthersCEO

Mike StruthersCEO Ramon PerezRamon Perez

Ramon PerezRamon Perez