At a recent TED event, Palmer Luckey1 — founder of $8.2 billion defense tech giant Anduril — issued a dire warning:

“The US should double down on developing AI-controlled weapons, otherwise China could outperform in a future war fought with autonomous systems.”

This isn’t just another billionaire opinion piece. It’s a red alert from inside the war room.

Because like it or not, the next global arms race won’t be fought with bullets. It’ll be won with algorithms.

Autonomous drones. AI surveillance. Real-time threat detection.

We’re talking about systems that don’t sleep, don’t flinch, and never blink—all powered by artificial intelligence.

And while lawmakers argue over TikTok bans and semiconductor subsidies, the world’s richest entrepreneurs are already repositioning their portfolios for what comes next:

- Jeff Bezos’ Amazon is deploying satellite surveillance via Project Kuiper while AWS locks in billion-dollar Pentagon contracts2.

- Elon Musk’s SpaceX pivoted Starlink into a defense asset—now backed by a $23 million contract3 — and his early investment in OpenAI could give him a front-row seat to militarized machine learning.

- Palantir (NYSE: PLTR) is turning battlefield data into tactical advantage, with a $618.9 million U.S. Army contract extension4.

- And of course, Anduril, Luckey’s brainchild, is winning major border surveillance deals powered by fully autonomous AI systems5.

This isn’t future speculation.

It’s now.

But here’s what the mainstream media is missing…

While everyone’s eyes are locked on software-based AI, the hardware side of the equation — AI-powered security robots — is emerging as the real trillion-dollar opportunity.

In fact, the global physical security tech market is projected to reach $160.8 billion by 20326.

And one under-the-radar U.S. company is already leading that charge.

This isn’t a SPAC fantasy or pre-revenue startup.

It’s a publicly traded AI robotics company — already deployed across government facilities, hospitals, airports, universities, and law enforcement agencies and its generated millions in revenue already and operated millions of hours across the country – fully autonomously.

They’ve secured over $3 million in new contracts this year alone, won a Phase I deal with the U.S. Air Force, and received FedRAMP Authority to Operate, clearing the way for full federal deployment potential across all U.S. agencies.

They’ve even opened a permanent presence in Washington D.C., aligning themselves with strategic advisors who’ve worked directly with the Department of Defense, the Defense Innovation Board, and even former Google CEO Eric Schmidt.

That company?

Knightscope, Inc. (NASDAQ:KSCP).

Get investment opportunities before the rest of the market in real-time. Get this company's corporate presentation now. Subscribe to download! Over 120,000 subscribersSUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

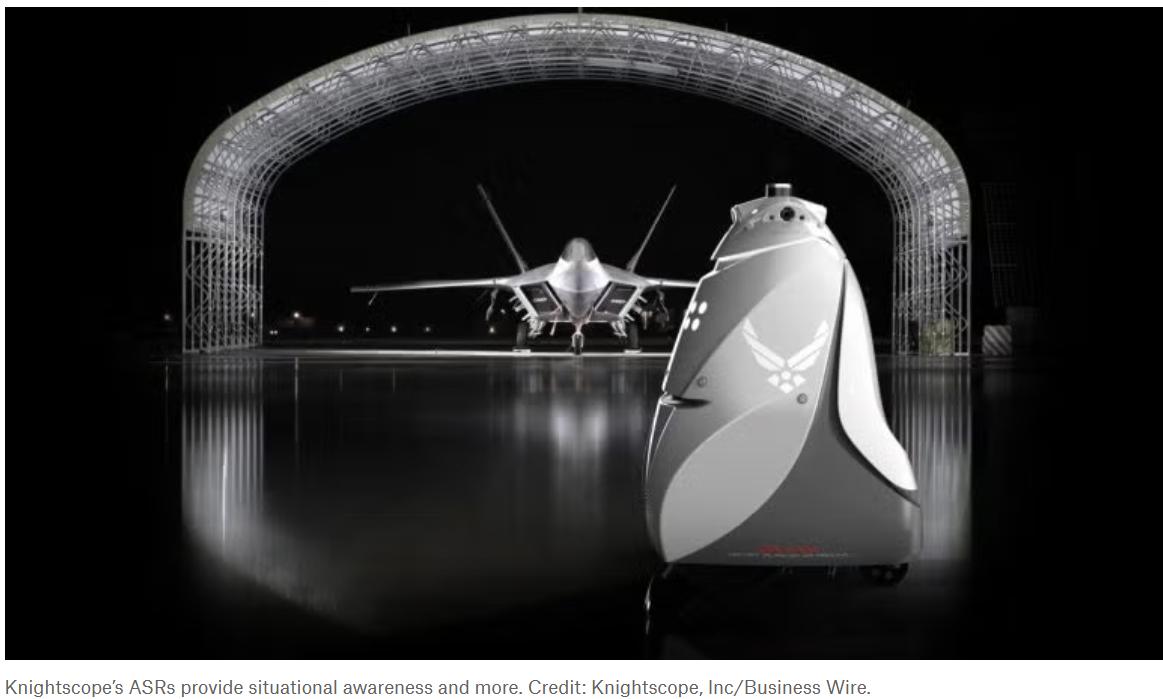

Knightscope is pioneering the future of autonomous security—using Autonomous Security Robots (ASRs) and advanced Emergency Communication Devices (ECDs) to patrol public spaces, detect threats, and respond in real time – and are offered on a Machine-as-a-Service (MaaS) business model.

Their K5 ASR robot is already live at police departments, as well as public and private properties, equipped with eye-level 360° HD vision, AI-driven anomaly detection.

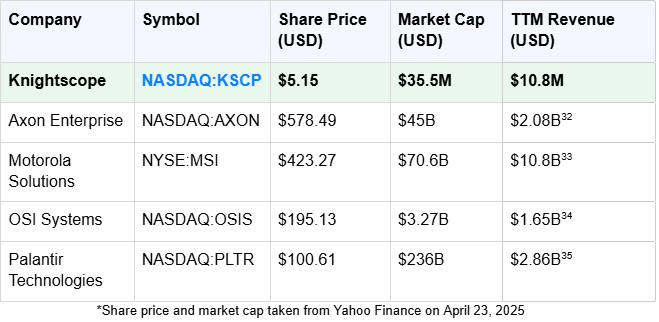

With a market cap under $35 million, Knightscope isn’t just early—it’s potentially undervalued by an order of magnitude. And many equity research analysts covering the stock agree.

The AI defense boom is here.

And Knightscope, Inc. (NASDAQ:KSCP) may be one of the last publicly traded ways to get exposure before this sector goes vertical.

The Growth Curve Could Be Just Getting Started

If there’s one thing Wall Street consistently underestimates, it’s early-stage companies with real technology, real customers, and a recurring revenue model baked in from day one.

That’s exactly what we’re looking at with Knightscope, Inc. (NASDAQ:KSCP).

This isn’t some prototype company hoping to generate sales someday.

Knightscope is already in motion—earning revenue, scaling deployments, and building predictable income streams through its Machine-as-a-Service (MaaS) business model.

And yet…

The market is valuing it at under $35 million and Knightscope’s growth trajectory just got a major boost with the recent closing of a $12.1 million financing7. This capital injection positions the company to scale its operations, advance its technology, and expand its footprint in the security robotics market.

That’s a rounding error compared to today’s AI titans. But it’s also where opportunity lives.

Just look at Nvidia (NASDAQ:NVDA). A decade ago, it was best known for gaming chips. Today? It’s the backbone of the AI revolution.

In just the past five years, NVDA stock surged more than 1,350% as investors caught on to its role in enabling next-gen intelligence.

Now ask yourself: What happens when the world catches up to the fact that Knightscope is doing for physical security what Nvidia did for AI computation?

In 2025 alone, Knightscope, Inc. (NASDAQ:KSCP):

- Locked in over $3 million in new contracts

- Expanded into universities, airports, and government agencies

- Secured a new 33,000 sq ft Silicon Valley headquarters to support manufacturing, engineering, and deployment

- And is continuing development on 2 all-new products – the K7 Autonomous Security Robot and the K1 Super Tower.

And this is just the start.

The broader trend is impossible to ignore.

In the US, there’s one human security officer for every 200 people. Labor shortages and rising costs are only compounding the problem. Meanwhile, crime and public safety concerns are escalating across the board.

That’s where Knightscope, Inc. (NASDAQ:KSCP) steps in—offering round-the-clock AI protection, remotely managed, highly scalable, and now, federally certified.

As government contracts ramp up and private sector demand grows, Knightscope’s recurring revenue model could start compounding rapidly—turning a tiny-cap robotics firm into one of the most important players in physical AI.

This isn’t theoretical anymore.

The infrastructure is built. The machines are online. And the revenue is already flowing.

The only thing that hasn’t caught up yet?

The market cap.

Press Releases

Wall Street Is Starting to Wake Up

The best gains often come before Wall Street catches on.

And right now, Knightscope, Inc. (NASDAQ:KSCP) is flashing all the early signs of a breakout — but it’s still flying under most investors’ radar.

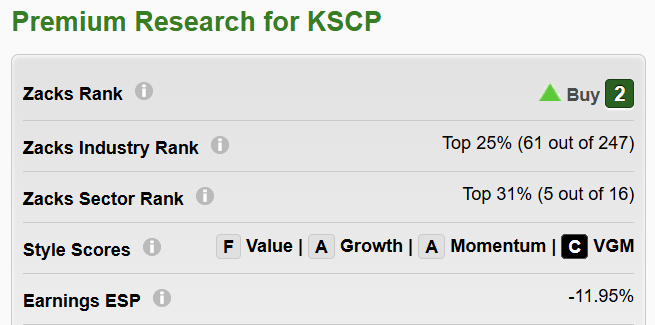

Zacks Investment Research recently ranked the company a #2 Buy8, backed by A-grade scores in Value, Growth, and Momentum — a trifecta that few small caps ever hit.

Source: Zacks

Analyst coverage is beginning to stack up:

- Ascendiant Capital9, H.C. Wainwright10, and Lake Street Capital Markets11 have all initiated coverage

- The stock holds an Average Brokerage Recommendation (ABR) of 1.33 — a consensus rating of “Strong Buy”12

- And unlike many AI startups chasing hype, Knightscope is already generating real revenue and closing multi-million dollar contracts across both the public and private sectors

Yet here’s the kicker…

It’s still only trading at a sub $35 million market cap with only 6.56 million shares outstanding.

That’s a tiny valuation and a low float for a company with:

- Government clearance to operate across federal agencies (via FedRAMP ATO)13

- A partnership with Verizon Frontline to power real-time, first-responder-grade connectivity14

- A freshly inked contract with the U.S. Air Force15

- A new 33,000 sq ft Silicon Valley headquarters built to scale operations nationwide16

- And a recurring revenue model through its Machine-as-a-Service (MaaS) platform – recurring revenue for the recurring societal problem of crime.

Insiders are aligned. CEO William Santana Li personally owns over 140,000 shares, and institutional players like Vanguard, Geode Capital, and State Street are already on the books.

If you believe AI is transforming every corner of modern life — from finance to medicine — ask yourself this:

Who’s leading the charge in physical security?

Knightscope may be the answer Wall Street hasn’t fully priced in… yet.

Get investment opportunities before the rest of the market in real-time. Get this company's corporate presentation now. Subscribe to download! Over 120,000 subscribersSUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

The Robots Are Coming to Washington — and They’ve Got Clearance to Operate

When the U.S. federal government green-lights your tech for secure deployment across its agencies, it’s a signal worth paying attention to.

Knightscope, Inc. (NASDAQ:KSCP) just earned that distinction.

Through the support of the US Department of Veterans Affairs, Knightscope’s flagship K5 Autonomous Security Robot was awarded a FedRAMP Authority to Operate (ATO)17 — one of the most difficult certifications to achieve in the federal cybersecurity world.

Translation?

Knightscope’s AI-powered security systems are now approved to operate across the entire US federal government.

That alone could be a game-changer for this fast-moving robotics firm. But it gets better.

To support this next phase of federal expansion, Knightscope, Inc. (NASDAQ:KSCP) has planted its flag in the heart of US policy: Washington, D.C..

It’s partnered with Washington Office18, a strategic advisory firm specializing in defense, homeland security, and emerging tech—co-founded by the minds behind 1776 and the Defense Innovation Board.

This isn’t a symbolic move. It’s a tactical one.

Knightscope, Inc. (NASDAQ:KSCP) now has boots on the ground near Capitol Hill to accelerate federal procurement, forge new agency relationships, and fast-track deployments to government facilities, military bases, and critical infrastructure sites.

And just weeks after the FedRAMP ATO announcement…

The U.S. Air Force came knocking19.

Knightscope, Inc. (NASDAQ:KSCP) was selected for a Phase I SBIR contract through AFWERX to reimagine and upgrade security protocols across Air Force installations.20

Their ASRs (Autonomous Security Robots) will be evaluated for perimeter and internal defense—offering real-time anomaly detection, 24/7 autonomous patrols, and AI-powered threat analysis.

This is a major credibility win. AFWERX isn’t a marketing partner — it’s the innovation engine behind the Department of the Air Force, tasked with integrating frontier technologies into national defense.

And behind it all is a powerful ally: Verizon.

And behind it all is a powerful ally: Verizon.

Knightscope’s K5 GOV robots now operate with priority access on Verizon’s Frontline network21 — the same first-responder-grade connectivity used by emergency crews nationwide.

That means continuous surveillance, instant threat alerts, and one-touch access to fire, police, and EMS… even in mission-critical black zones.

This type of government-grade, always-on security solution couldn’t be more timely.

Because across the US, the demand for scalable, autonomous safety infrastructure is rising fast. From schools to airports, transit hubs to federal facilities — America’s most sensitive locations are actively seeking cost-effective, AI-driven solutions that don’t call in sick or take coffee breaks.

Knightscope, Inc. (NASDAQ:KSCP) is already trusted by institutions like:

- The Huntington Park Police Department – a six-year client that credits Knightscope’s robots with slashing crime in Salt Lake Park22

- The Port Authority of New York and New Jersey23

- Penn Entertainment24

- University in Tennessee25

And recent traction backs it up.

Knightscope, Inc. (NASDAQ:KSCP) has:

- Secured over $2 million in new business, including major client renewals and device expansions26

- Sold 70+ Emergency Communication Devices and 11 new robots, including a deal with a Fortune 25 company27

- Secured a 33,000 sq ft headquarters in Sunnyvale, built for scale28

- Reported a 4% YoY increase in service revenue, now totaling $7.5 million29

- Launched upgrades to the K5 ASR, improving its autonomous navigation and machine-learning threat detection30

Oh, and it’s not just federal agencies watching. Knightscope also offers Automated Gunshot detection that can reduce response times to critical threats down to just two seconds31.

For a company still trading at small-cap levels, Knightscope’s growing presence in public safety, federal defense, and AI security infrastructure makes it one of the most overlooked stories in national tech.

And now that it’s got its clearance?

Expect the robots to keep marching.

Now, let’s take a look at some of the reasons Knightscope, Inc. (NASDAQ:KSCP) is a force to be reckoned with in the public safety arena.

8 Reasons

Why Knightscope (NASDAQ:KSCP) Could Be One of the Most Undervalued AI Defense Stocks on the Market

1

Rapid Revenue Growth: Knightscope (NASDAQ:KSCP) reported $10.8 million in total FY 2024 revenue, with service revenue growing 4% year-over-year to $7.5 million, reflecting strong client retention and expanding recurring revenues.

2

High Market Potential: AI-powered security robots—an industry projected to reach $160.8 billion by 2032.

3

Tight Share Structure and Strong Ownership: Only 6.5 million shares outstanding, significant insider and institutional ownership, including Vanguard Group, Geode Capital Management, and State Street.

4

Leading-Edge Technology: Knightscope’s Autonomous Security Robots (ASRs) feature HD 360° recording, thermal imaging, and integrated public address systems—delivering proactive real-time security.

5

Federal and Private Sector Momentum: In 2025 alone, Knightscope secured over $1.2 million in new contracts and expanded its federal presence with full FedRAMP® authorization, plus a new technology showroom opening in Washington, DC.

6

Cost-Effective Business Model: Machine-as-a-Service (MaaS) model Machine-as-a-Service (MaaS) model offers security services at $1 – $11 per hour, providing long-term recurring revenue streams for Knightscope, Inc. (NASDAQ:KSCP).

7

Experienced Leadership Team: Knightscope, Inc. (NASDAQ:KSCP) is led by a team of seasoned professionals including Co-founder & CEO, Chairman William Santana Li, a former senior executive at Ford Motor Company.

8

Analysts Are Taking Notice: Zacks rates it a #2 Buy, and multiple firms have initiated coverage with bullish outlooks.

Tapping into a $160.8 Billion Market

The global physical security tech market is projected to reach $160.8 billion by 2032 — driven by the urgent need for autonomous, AI-driven security solutions that can operate 24/7, reduce costs, and enhance situational awareness in real time.

As security threats evolve, governments and corporations aren’t just looking for data—they need action. This is where AI-powered security robots come in.

Knightscope, Inc. (NASDAQ:KSCP) isn’t waiting on policy shifts or theoretical applications—it’s already on the ground, actively patrolling hospitals, airports, corporate campuses, and federal buildings.

With strong institutional backing and a float of only 6.5 million shares, Knightscope’s stock is well-positioned for significant movement as it continues to expand its market presence and secure new contracts.

How Knightscope Stacks Up in the Security Tech Space

Security technology has come a long way, but most players in the space still rely on humans to take action.

Unlike traditional security firms that rely on stationary cameras, human guards, or reactive solutions, Knightscope, Inc. (NASDAQ:KSCP) is pioneering proactive, AI-driven, 24/7 security. Here’s how it compares to some of the biggest names in the industry:

- Axon Enterprise (NASDAQ:AXON) – Axon is known for Tasers, body cameras, and VR training systems, helping law enforcement document and respond to crime. Knightscope’s robots take a different approach—deterring crime before it happens with real-time AI-driven surveillance and proactive security measures.36

- OSI Systems (NASDAQ:OSIS): OSI focuses on stationary security screening systems, ideal for checkpoints and controlled environments37. But what about open, unpredictable spaces? Knightscope’s robots operate dynamically, moving through facilities and public areas, extending security beyond fixed locations.

- Palantir Technologies (NASDAQ:PLTR) – Palantir’s AI intelligence tools are used by defense agencies for high-level data aggregation and analysis. But software alone can’t physically intervene. Knightscope’s AI-powered security robots bring that intelligence to the field—serving as both an autonomous deterrent and a first line of defense.

On top of that, Knightscope’s (NASDAQ:KSCP) MaaS model creates long-term cash flow and unlocks enormous growth potential. This isn’t just a sale; it’s an ongoing partnership that ensures reliable revenue year after year.

And it’s not just about the numbers. Knightscope’s robots have already proven their value in the field—helping solve real crimes, from tracking down hit-and-run suspects to identifying armed perpetrators.

Meet the Minds Guiding Knightscope’s Security Revolution

The same team that founded, funded, grew, and listed Knightscope, Inc. (NASDAQ:KSCP) over the last decade is leading the company today. They plan to continue driving growth organically over the next two to three decades, all while achieving their goal of making America safer. Among the talented roster are:

This experienced leadership team drives Knightscope’s vision and success, leveraging decades of expertise to revolutionize public safety with cutting-edge technology.

The Window of Opportunity Is Cracking Open

We are witnessing the birth of a new sector—where AI, robotics, and national security collide.

Knightscope, Inc. (NASDAQ:KSCP) isn’t just participating in this shift. It’s helping lead it.

With federal clearance through FedRAMP, a contract with the U.S. Air Force, Verizon-backed infrastructure, and a presence now anchored in Washington D.C., this company is no longer a speculative concept—it’s an active, trusted player inside the halls of government.

And yet, it’s still trading at a market cap under $35 million.

That’s the kind of asymmetric setup early investors dream about.

Because once Wall Street catches up—once major institutions see the revenue growth, the federal momentum, the insider alignment—this story could rewrite itself very quickly.

If you missed Palantir under $10… if you hesitated when Anduril was still private…

This is your second chance.

Knightscope (NASDAQ:KSCP) is building the future of public safety—autonomously, intelligently, and at scale.

Now is the time to pay close attention. Before the rest of the market wakes up.

Get investment opportunities before the rest of the market in real-time. Get this company's corporate presentation now. Subscribe to download! Over 120,000 subscribersSUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

William Santana LiChairman and CEO

William Santana LiChairman and CEO Mercedes SoriaEVP and Chief Intelligence Officer / CISO

Mercedes SoriaEVP and Chief Intelligence Officer / CISO Apoorv S DwivediEVP and Chief Financial Officer

Apoorv S DwivediEVP and Chief Financial Officer Aaron J LehnhardtEVP and Chief Design Officer

Aaron J LehnhardtEVP and Chief Design Officer