If there was one thing that last year taught digital currency investors, it was the importance of having clear regulations in the whole sector. Not only did the collapse of several digital asset firms like FTX, Voyager, Three Arrows Capital, BlockFi and Genesis wiped out billions of investor funds, but it also contributed significantly to driving down prices of a host of digital assets.

Understandably it’s no surprise that governments in the US, European Union, and the UK have decided to take steps to reign in the entire sector.

Understandably it’s no surprise that governments in the US, European Union, and the UK have decided to take steps to reign in the entire sector.

For instance, Elizabeth Warren has been pressing Congress to adopt new bipartisan legislation1 which would force digital currency asset firms to abide by the same regulations as banks and corporations.

The proposal reaffirms what SEC chief Gary Gensler has been saying all along. In a recent statement2 he said he believes that the majority of digital currencies are indeed securities, which is why he asked SEC staff to work directly with entrepreneurs to get their tokens registered and regulated, where appropriate, as securities.

The UK has also announced plans to regulate3 the digital currency asset space. Clearly, regulation will be a major theme in the digital currency asset space, and companies already making headway in this regard are likely to stand out and benefit the most once prices start recovering.

This is where The INX Digital Company Inc. (NEO:INXD) and its regulated trading platform for digital securities and currencies come in.

Unlike other trading platforms, INX has been focused on compliance right from the start. Instead of playing hide and seek with regulators, INX Digital worked with them directly with the goal of becoming the world’s first fully regulated platform for investors, traders, and issuers seeking to raise capital. A goal that is now a reality.

INX (NEO:INXD) is one of the world’s first companies to get FINRA clearance for trading and settling security tokens in the US and worldwide.

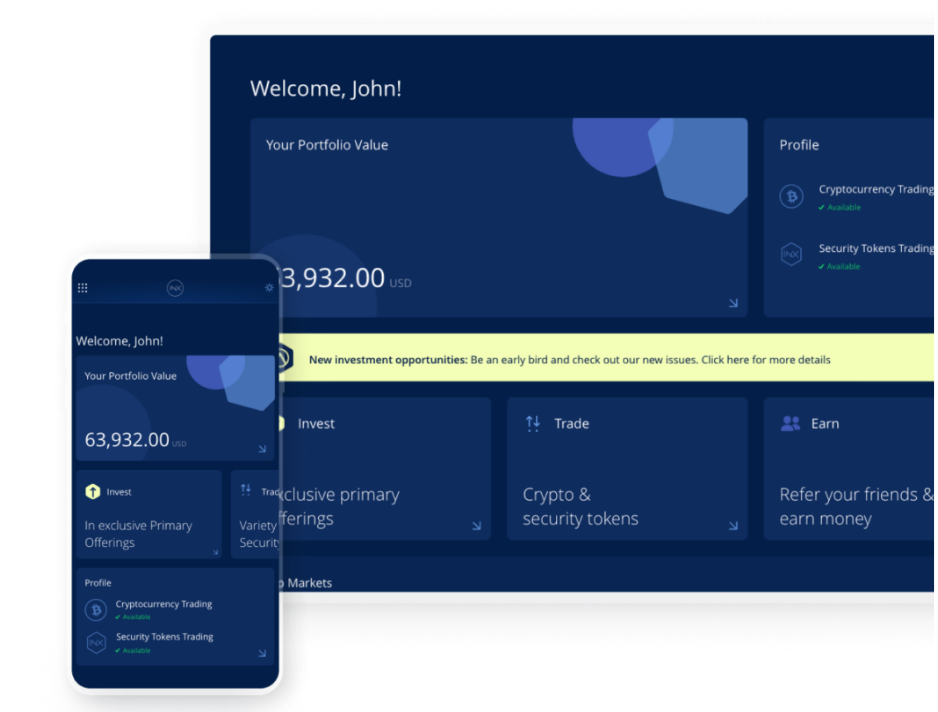

In addition to that, the company offers a US-regulated digital currency trading platform called INX.One, which is licensed to conduct security token private and public offerings differentiating it from other exchanges like Coinbase and Binance.

In fact, the company successfully completed the world’s first SEC-registered security token IPO raising $84 million from over 7,200 retail and institutional investors worldwide.

INX.One builds on the company’s mission to increase access for US and international investors to the growing opportunities in the digital economy.

INX.One also sets a global standard for effectively achieving democratization in financial markets while simultaneously providing the necessary regulatory guardrails through close collaboration with US and global regulators.

Not to mention, INX (NEO:INXD) is backed by an executive team and board of industry veterans with years of experience in leading global financial institutions, including an Ex-Vice Chairman of NASDAQ, Ex-CEO of Toronto Stock Exchange and Ex-CEO of TD Ameritrade and recently appointed Demetra Kalogerou4 who served as chairman of the Cyprus Securities and Exchange Commission (CYSEC).

Now, let’s take a look at a few of the reasons INX stands apart from its peers.

7 Reasons

Why INX (NEO:INXD) Is The Future Of SEC Regulated Digital Currency And Security Token Trading

1

INX.One is the first fully regulated platform for trading digital currencies and security tokens in one place. INX (NEO:INXD) is the only secure way to trade, invest and raise capital, all under the SEC’s regulatory umbrella.

2

Leading the future of regulated digital markets: The INX Token is the world’s first SEC-registered security token IPO on the blockchain.

3

Fostering multiple strategic partnerships that further lead the way in the new digital economy by building solid, secure, and truly innovative, responsible foundations for the digital future. These include the recent partnership with SICPA for the development of central bank digital currency (CBDC) solution and Bitgo’s partnership to provide a secure and efficient trading platform.

4

The INX.One platform is already enabling the primary capital raise of several new security tokens. Since the platform launch in September 2022, INX has brought on 4 new security token offerings, which include: Trucpal, the first digital security token for the Chinese freight market, Turncoin is first security token offering to the fan economy, which offers investors an opportunity to own a share in the potential global gross revenue of the “world’s first exchange for talent, Treasure Experience token, which allows holders to share in profits generated by the company from live adventure streaming and Advent token, Hollywood’s first entertainment token; giving investors an opportunity to invest in the Stan Lee (Yes, the guy behind the Marvel Universe) undeveloped IP for “Legion of 5” among other assets, listed exclusively on INX.One.

The INX.One platform is already enabling the primary capital raise of several new security tokens. Since the platform launch in September 2022, INX has brought on 4 new security token offerings, which include: Trucpal, the first digital security token for the Chinese freight market, Turncoin is first security token offering to the fan economy, which offers investors an opportunity to own a share in the potential global gross revenue of the “world’s first exchange for talent, Treasure Experience token, which allows holders to share in profits generated by the company from live adventure streaming and Advent token, Hollywood’s first entertainment token; giving investors an opportunity to invest in the Stan Lee (Yes, the guy behind the Marvel Universe) undeveloped IP for “Legion of 5” among other assets, listed exclusively on INX.One.

5

Its superstar team members include board chairman David Weild ex-Vice Chairman of NASDAQ, ex-CEO of TSX, and ex-CEO of TD Ameritrade, along with others from Wall Street stalwarts like Merill Lynch and Morgan Stanley.

6

Unlike competitors that failed in digital asset securities, INX (NEO:INXD) has been focused on security from day one. The company built its own proprietary tech stack from scratch with enhanced security (spending two years on this alone).

7

INX has an attractive valuation compared to peers who aren’t as tightly regulated.

Blazing a Trail Towards the Digital Economy

INX Digital Company’s (NEO:INXD) INX.One platform enables investors to diversify their portfolio with multiple digital currency assets and security tokens by offering the first combined trading platform in the world. The platform allows companies to do it all – issue a security token, raise capital through a primary offering and then list their security token all from one convenient online account.

For context, security tokens are the digital form of traditional investments like stocks, bonds, or other securitized assets.

INX has taken a series of initiatives to make it easier for users to take part in the trading of both registered security tokens and other assets in a regulated environment, just as SEC chief Gensler envisioned.5 For instance, during Q2 2022, INX‘s digital currency trading platform INX Digital launched a native mobile application for the trading of digital assets on both Google Play and iOS app stores.

The move resulted in over 73,000 new registered users to the INX (NEO:INXD) trading platforms, compared to just 17,674 in Q1 2022. This resulted in the company reporting $1.1 million in revenue by Q3 2022, representing a 25% increase compared to the preceding quarter.

That user growth is likely to maintain an upward trajectory since holding digital assets on the INX.One platform is much safer compared to other alternatives. This is because the company puts its customers first and doesn’t allow leveraging and re-investing of traders’ assets, which was one of the major precursors to the downfall of FTX.

INX also holds an audited and segregated reserve fund, maintains 1:1 balances for customers and does not use customer assets, and does NOT, in any way, shape, or form, leverage or re-invest a customer’s assets

The INX Digital Company Inc. (NEO:INXD) also has a secured and segregated reserve fund which stood at about $36 million6 as of Q2 2022.

Unlike its peers, INX gives its users complete control over their private keys. Users can withdraw any currency and amount at any time without restrictions. This is important since it means that INX (NEO:INXD) users won’t find themselves in a situation similar to what happened to FTX users when it had to suspend withdrawals. 7

Best-In-Class Regulated Trading Platform

The implosion of FTX8 set off a chain reaction of bankruptcies for digital asset lending firms with exposure to the digital currency giant. In order to ensure that such a scenario does not occur at INX (NEO:INXD), the company’s founders seem to have found a solution five years ago.9 Looking beyond the unregistered initial coin offerings (ICOs) that marked that era, INX developed a forward-thinking vision: work with regulators to bring the offering and trading of blockchain assets within the legal framework that governs securities.

Although blockchain assets had been sold in private markets and through unregistered ICOs, there was no precedent for going through a registration process with the SEC for a public offering of security tokens but the recent bankruptcies have shown why this is so critical.

How has the company achieved this?

INX holds transfer agent, broker-dealer, and ATS licenses under the SEC and FINRA, as well as the majority of money transmitter licenses that allow for digital currency trading. It is currently authorized to operate in 43 states and territories.

Additionally, INX has a Transfer Agent license, offering a solution for public and private companies seeking to raise capital and list digital securities. INX (NEO:INXD) enables others to issue digital securities and raise capital by providing them with a nose-to-tail solution, including a licensing umbrella, technology, marketing, compliance/ KYC services, and more – Token as a Service.

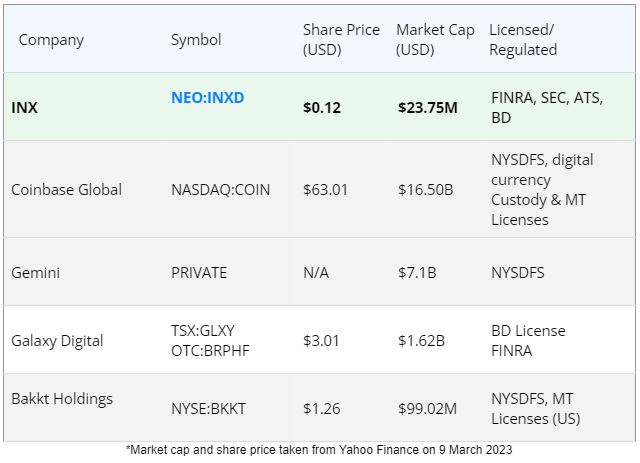

As the table below shows, INX (NEO:INXD) meets the highest regulatory standards compared to all its peers but it trades at the lowest valuation. It not only combines traditional financial markets expertise with a novel fintech approach, it also offers a single point of entry to trade both SEC-registered security tokens and digital assets around the world while also offering instant settlement.

However, it is likely that this won’t be the case for too long as more and more market participants look for safer and more secure trading options for their digital assets.

The NYSDF license held by Coinbase, Gemini and Bakkt Holdings only requires the companies to safeguard sensitive customer data and assess their cybersecurity risk profile which does little to ensure investor protection.

Press Releases

- INX Announces Integration With Polygon

- INX Announces the Listing of Hashrate Asset Group’s (HAG) Bitcoin Mining Security Token

- Keren Avidar Names INX Global General Counsel

- Inx.One To Facilitate Hollywood’s First Entertainment Security Token Offering

- Inx One Launches As First And Only Fully-Regulated Trading Platform For Both Security Tokens And Cryptocurrencies

World’s First Fully-Regulated Platform To Trade Digital Currency and Security Tokens

Security tokens are the digital form of securitized assets. Think of it this way. If a company wants to raise capital, it can issue fractionalized ownership of the company through a digital token instead of issuing stock which could then be listed on an exchange that allows security tokens.

Following the successful issuing of Turncoin,10 Treasure Experience, and Trucpal11 security tokens, The INX Digital Company (NEO:INXD) began working with new token issuers, most notably Advent Entertainment.12

In October, the INX.One platform facilitated the primary capital raise of Advent Token, the first digital security that opens the door to profit participation in Hollywood movies, television shows and video games created by Advent Entertainment. The offering will allow investors to invest in the Stan Lee (Yes, the guy behind the Marvel Universe) undeveloped IP for “Legion of 5” among other assets, and will be listed exclusively on INX.One.

INX’s (NEO:INXD) is also expanding the potential of SEC-registered security tokens.

INX’s CFO, Renata Szkoda, recently articulated the breakthrough of the company’s designated security tokens, which can provide creditors and customers access to potential company profits, allowing them to recover their losses.13

INX is reshaping the paradigm since the company is geared to leverage the power and versatility of the regulated INX.One trading platform to preserve and create value for so many companies as they restructure.

A $16 Trillion Market Opportunity

Last year, the security token market grew 14x and according to a newly-Fpublished report by global consulting firm BCG and ADDX forecasts that asset tokenization will explode into a $16.1 trillion business opportunity by 2030.14

In fact, BlackRock’s CEO Larry Flint recently said he believes the next generation for markets and securities, will be tokenization of securities.

BlackRock has joined a rising number of traditional finance leaders standing behind the tokenization of securities, including JPMorgan and U.S. Bancorp.15

This growth comes as the crisis in the digital currency asset space is prompting market participants to focus on more viable blockchain use cases.

Assets being fractionalized and tokenized on platforms such as INX’s (NEO:INXD) INX.One can reduce minimum investment sizes from millions of dollars to just thousands of dollars. Previously investments of this kind were only available to very selected few individuals. One of the major advantages of tokenization is that it creates liquidity by making it easier for the assets to be distributed and traded among more investors.

INX (NEO:INXD) is perfectly positioned here, considering that tokenized investments are effectively ‘borderless’, allowing investors around the world access to markets they were previously exempt from.

Strategic Relationships Geared To Driving Future Growth

INX (NEO:INXD) has forged new strategic global partnerships and has undertaken multiple initiatives to expand its services as it seeks to not only promote brand recognition and drive future revenues but to be the pioneers that provide solid, secure and innovative infrastructure that will benefit the entire industry.

Just recently, INX (NEO:INXD) announced that it was partnering with SICPA, a global leader in authentication, revenue realization, and secure traceability solutions, to help governments develop innovative and sovereign central bank digital currency ecosystems.16

The joint venture will combine both blockchain-based infrastructure and digital cash technologies to address the key requirements for CBDCs, including privacy, security, financial inclusion, resilience and more – paving the way for the development and launch of a secure and scalable environment for all central banks to deploy digital currencies.

BitGo Settlement Network also announced a new partnership with INX (NEO:INXD) to enable more secure and efficient trading for institutions. Together, the companies will launch an innovative product designed to assist institutions in trading with security and efficiency.16

Another notable milestone announced by INX is a new founding partner of the Plug and Play Digital Assets program, along with industry giants Visa, AllianceBlock, IGT, and Franklin Templeton. The partnership will allow INX (NEO:INXD) to broaden its efforts to introduce a responsible digital economy while allowing more companies to utilize the blockchain through its primary and secondary offerings to raise capital responsibly.

Led By An All-Star Management Team

INX’s (NEO:INXD) leadership includes an Ex-Vice Chairman of NASDAQ, Ex-CEO of Toronto Stock Exchange and Ex-CEO of TD Ameritrade and former executives from Morgan Stanley, Merrill Lynch, HSBC Brokerage USA, TP-ICAP, Standard Chartered, GE Capital, Societe Generale, eToro, and American Express.

Apart from deep experience in the traditional capital markets, there are top tech specialists, blockchain experts, and key opinion leaders and insiders in critical positions.

The INX (NEO:INXD) team includes:

RECAP: 7 Reasons

To Why INX (NEO:INXD) Could Become One of the Leaders In This New Era of Digital Currency

1

INX (NEO:INXD) is the only company to offer an end-to-end solution for capital raising, including a link to the digital currency market.

2

The only secure way to trade, invest and raise capital, all under the SEC’s regulatory umbrella.

3

Huge market opportunity that is set to grow 50x by 2030.

4

World-class leadership team that can coordinate and responsibly transition between traditional and digital economy.

5

INX (NEO:INXD) has an attractive valuation compared to less-regulated peers.

6

Multiple strategic partnerships that will drive future growth.

7

End-to-end tokenization platform under US regulation.

Considering the events of the past year, it’s clear that regulators will remain a major factor in the digital currency space in order to protect investors.

Investors in the digital currency space are also likely to become more selective of where they park their digital assets or carry out their trading activities, meaning regulated digital exchanges will be a much more attractive option.

Considering that INX is regulated by both the SEC and FINRA, in addition to having several licenses that facilitate regulated trading activities, it is likely to stand out among peers as the digital currency market rebounds.

If you want to keep this exciting company on your watchlist, don’t forget to subscribe for email updates and make sure you don’t miss out on any of INX (NEO:INXD) news and milestones.

David WeildChairman Board Member, ex-NASDAQ

David WeildChairman Board Member, ex-NASDAQ Shy DatikaCo-founder & CEO

Shy DatikaCo-founder & CEO Itai AvneriDeputy CEO & COO

Itai AvneriDeputy CEO & COO Alan SilbertCEO, North America

Alan SilbertCEO, North America