Wall Street has seen plenty of crises. Subprime mortgages. Junk bonds. Derivatives stacked like dominoes. Each time, the story was the same: too much hidden leverage brought the system to its knees.

But today’s risk looks very different.

It’s not sitting on balance sheets. It’s sitting in servers.

Billions of transactions are processed every day by banks running on decades-old infrastructure.1

Data scattered across hundreds of silos. Compliance teams drowning in manual reviews. Regulators circling like sharks.

And here’s the dangerous truth: artificial intelligence isn’t solving the problem.

It’s making it worse. More data. Faster flows. Higher risk. The very tool banks hoped would save them is accelerating the chaos.

This is the hidden fault line under modern finance. And it is widening by the day.

That’s why one company’s breakthrough is getting attention from some of the biggest banks and government agencies on the planet.

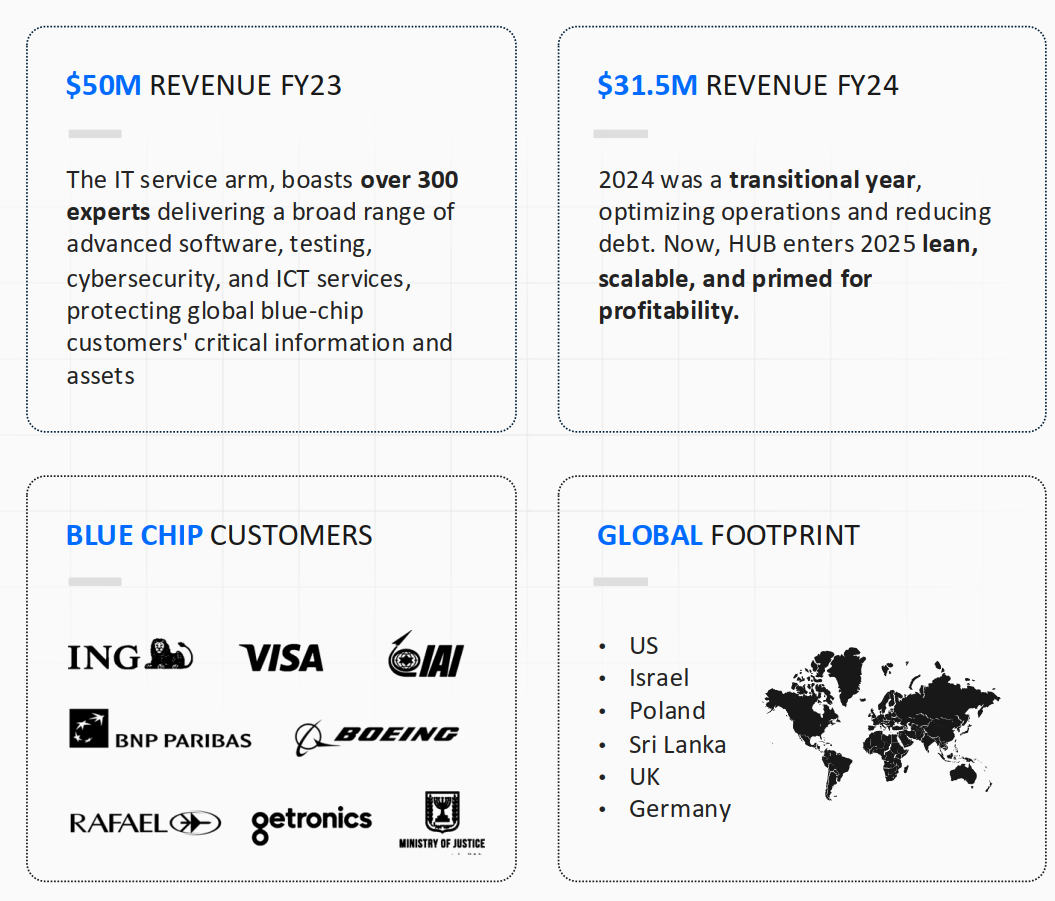

HUB Cyber Security Ltd. (NASDAQ:HUBC) has built what it calls a Secured Data Fabric, an AI-driven zero‑trust platform designed to unify all those silos, encrypt every flow, and automate compliance in real time.2

HUB Cyber Security Ltd. (NASDAQ:HUBC) has built what it calls a Secured Data Fabric, an AI-driven zero‑trust platform designed to unify all those silos, encrypt every flow, and automate compliance in real time.2

Instead of spending years and billions on fragile “data lakes,” banks can now modernize in a matter of months.

Early deployments of HUB Cyber Security (NASDAQ:HUBC) are proving it works.

Clients are already seeing compliance costs cut by up to 50%.3

Transaction monitoring streamlined. Customer onboarding reduced from weeks to days. And all of it done with the kind of military-grade security that comes from a team built out of Israel’s elite intelligence units.

This isn’t theory. This is live.

In June, HUB signed a perpetual KYC contract worth an estimated $25 million in recurring annual revenue, securing compliance for more than a million customers in a major crypto merger.4

In April, the company won a $23 million (€20M) modernization project for San Marino’s oldest bank, overhauling its entire core and mobile banking platform.5

By August, it raised $20 million in new institutional financing to accelerate US expansion and expand AI-powered enterprise intelligence and digital currency infrastructure.6

The world’s most sensitive institutions are choosing the same partner.

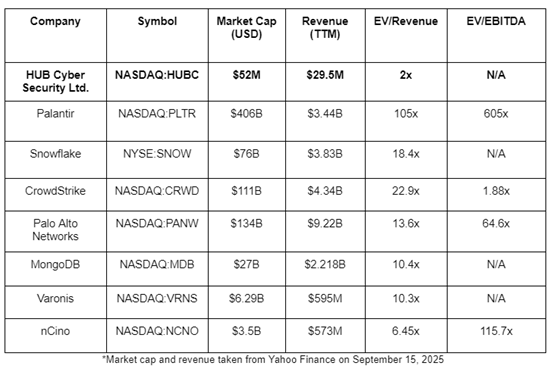

And here’s what Wall Street hasn’t priced in yet: HUB Cyber Security Ltd. (NASDAQ:HUBC) is trading at a market cap of just $52 million.

Compare that to Palantir (NASDAQ:PLTR) at $406 billion, Snowflake (NYSE:SNOW) at $76 billion, or CrowdStrike (NASDAQ:CRWD) at $111 billion.

This is the most overlooked “Palantir-for-banking” story on Wall Street today. And for investors, the timing could not be more urgent.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

A Tiny Float That Amplifies Every Move

Some stocks grind higher slowly. Others can move fast on very little volume.

HUB Cyber Security Ltd. (NASDAQ:HUBC) is in the second category.

The company has only 9.73 million shares in the float.7 That is a fraction of what you see in billion-dollar peers. With such limited supply, even a modest wave of buying can move the stock sharply.

And the float is even tighter than it looks. Insiders hold a significant block, while institutions like Bank of America, UBS Group, and Cantor Fitzgerald are already on the register. That leaves very little paper truly available to trade.

This kind of scarcity is rare. It means news can hit the market like a spark in dry grass. Quick, powerful, and hard to ignore.

For investors, it creates leverage. A single new contract or partnership could be enough to potentially send HUB Cyber Security (NASDAQ:HUBC) sharply higher.

Press Releases

- HUB Cyber Security Completes Financial Overhaul, Restructuring More Than 75% of Legacy Obligations and Enabling Long-Cycle Execution

- HUB Cyber Security Details HUB Token Key Use Cases for Trvsthub™ Platform in SSI-Driven Financial Applications

- HUB Cyber Security Outlines Visionary HUB Token Roadmap to Enable Frictionless Stablecoin, Crypto, and Remittance Transactions Through Self-Sovereign Identity

- HUB Cyber Security Launches HUB Compliance™ Globally – Expanding Its Next-Generation AI Compliance Platform Worldwide

- HUB Cyber Security Ltd. Appoints Romke E. de Haan III as Head of its Cybersecurity Strategy & Innovation Division

The Secret Weapon Behind the Transformation

Every major bank in the world has the same problem.

Too much data. Too many silos. And no way to keep regulators satisfied without burning mountains of cash.

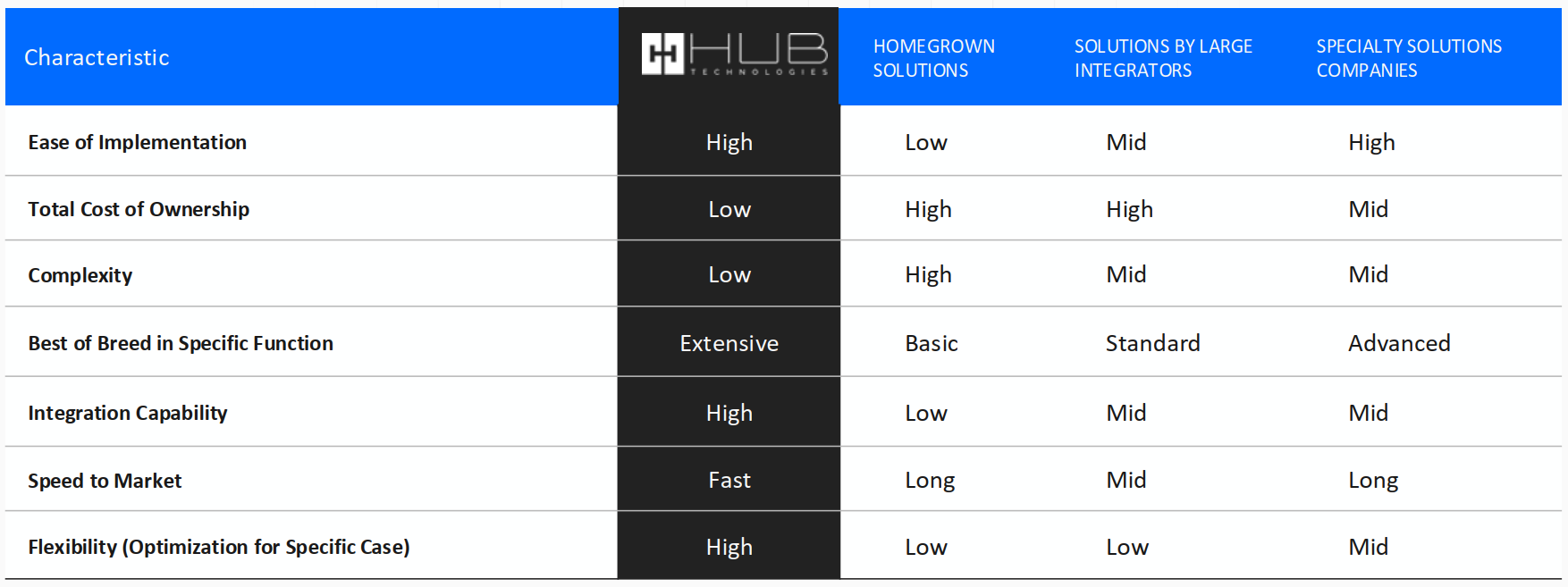

The traditional solution has been the so-called “data lake.”

Spend billions. Wait years. Pray the system works when it finally goes live.

But the reality is brutal. These projects almost always fail. They’re outdated before they’re finished. Worse, they create new vulnerabilities with massive centralized pools of sensitive information that hackers love to target.

That is why banks are now looking for something faster. Smarter. And above all, secure.

This is where HUB Cyber Security Ltd. (NASDAQ:HUBC) has changed the game.

Its Secured Data Fabric (or SDF) is not a data lake. It’s a nervous system.

Instead of ripping out old systems and replacing them, SDF weaves them together.

Silos remain intact, but they now “talk” to each other through an encrypted, zero-trust architecture. Every data flow is monitored. Every transaction is secure. Every compliance rule is checked in real time.

What once took years now takes months. What once cost billions now costs millions. The payoff is immediate.

- Tier-1 banks using the platform have already reported up to a 50% drop in compliance costs.8

- Digital onboarding that once dragged on for weeks can now be completed in days.

- Regulators get cleaner reports. Fraud detection improves.

- Customers get faster service.

And the advantage compounds. Once SDF is deployed, new compliance requirements can be coded directly into the system without building an entire new infrastructure. That means banks can stay ahead of regulators, instead of constantly playing catch-up.

This is the kind of solution regulators quietly prefer. And it’s why institutions from Europe to the Middle East have already signed deals.

The market is enormous. Analysts estimate the opportunity for secured data infrastructure at over $12.91 billion and growing.9

Yet, HUB Cyber Security Ltd. (NASDAQ:HUBC) controls a fraction of that market today giving investors a chance to step in at the ground floor.

Palantir took years to win government contracts and now trades at hundreds of billions. HUBC is landing contracts today, with Tier-1 banks and sovereign institutions already on its client roster, yet its market cap is still tiny compared to its peers.

That disconnect won’t last forever.

Investors often look back on billion-dollar winners like Palantir, CrowdStrike, or Snowflake and ask the same question: why didn’t I see it sooner?

The signs were always there.

Breakthrough technology. Tier-1 clients. An addressable market in the tens of billions. A stock trading for pennies on the dollar before the crowd caught on.

Today, those signs are flashing again. And they’re pointing straight to HUB Cyber Security Ltd. (NASDAQ:HUBC).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

8 Reasons

This MicroCap Could Be The Most Overlooked Banking Tech Play on Wall Street

1

A $12.9 Billion Market Growing Fast: The secured data fabric market is projected to grow at a CAGR of 21% from $2.29 billion in 2023 to $12.91 billion by 2032.10 While Palantir and Snowflake already command sky-high valuations, HUB Cyber Security (NASDAQ:HUBC) is just starting to capture market share with Tier-1 banks and governments already deploying its technology.

2

Cutting Compliance Costs by Half: Banks are under siege from regulators. Citigroup and HSBC have already been fined millions for failures. Early deployments of HUBC’s Secured Data Fabric are reducing compliance costs by up to 50 percent, turning regulatory pain into shareholder gain.

3

Military-Grade Technology Built by Israeli Intelligence Veterans: This is not another IT vendor. HUB Cyber Security Ltd. (NASDAQ:HUBC) was founded by veterans of elite Israeli Defense Force intelligence units.11 Its architecture is built for zero-trust, quantum-resilient security. That credibility is why Tier-1 banks and sovereign entities are signing multi-million-dollar deals.

4

Perpetual KYC Contracts Worth $25 Million a Year: Recurring revenue is king. HUBC’s perpetual KYC contract with a global crypto merger adds $25 million in annual recurring revenue, covering up to 1.5 million customer profiles. This one deal alone represents nearly half the company’s current market cap.

5

Landmark $23 Million (€20M) Banking Modernization Project: When San Marino’s oldest bank needed to overhaul its core and mobile banking systems, it turned to HUBC. The project validates the company’s role as a trusted partner for digital transformation in the regulated banking sector.12

6

A Clean Balance Sheet and Fresh Capital: Legacy liabilities have been resolved. Debt has been refinanced. And in August, HUB Cyber Security Ltd. (NASDAQ:HUBC) secured $20 million in new institutional financing. That cash is earmarked to accelerate North American expansion and crypto infrastructure growth.

7

A World-Class Leadership Team: Recent hires include Paul Parisi, former PayPal Canada President and senior executive at American Express, now Global CRO.13 John Rogers, former US Deputy Assistant Secretary of Defense, is leading US expansion.14 These are heavyweight operators joining forces with CEO Noah Hershcoviz to drive growth.

8

A $52 Million Market Cap vs. Billion-Dollar Peers: Palantir trades at a $406B market cap. CrowdStrike at $111B. Snowflake at $76B. HUB Cyber Security Ltd. (NASDAQ:HUBC) sits at just $52M despite already landing Tier-1 clients like ING, Visa and BNP Paribas and recurring contracts. The gap between current valuation and potential is staggering.

When you add it all up, the case is clear. This is not a concept stock. It’s a company with real contracts, real clients, and real momentum that’s trading like a startup nobody has heard of.

When you add it all up, the case is clear. This is not a concept stock. It’s a company with real contracts, real clients, and real momentum that’s trading like a startup nobody has heard of.

And that sets the stage for a comparison to the giants. Because when you line HUB Cyber Security (NASDAQ:HUBC) against Palantir, Snowflake, and CrowdStrike, the valuation gap becomes crystal clear.

This is where we can really create that Jeff Brown/Katusa “aha” moment. The comps are what make the valuation gap impossible to ignore.

Why the Market Disconnect Cannot Last

When you stack HUB Cyber Security Ltd. (NASDAQ:HUBC) against the giants of AI, cyber, and data infrastructure, the disconnect becomes obvious.

HUBC is solving the same problems, often faster, cheaper, and with security built into the foundation.

Here’s the comparison:

The Story the Numbers Tell

Palantir is hailed as the operating system for government data. But it took years and hundreds of millions in contracts to get there. HUB Cyber Security (NASDAQ:HUBC) is already landing Tier-1 banks like Deutsche Bank and ING, with a market cap less than one-tenth of one percent of Palantir’s.

Snowflake built a $76 billion valuation on its ability to store and analyze data. HUBC goes further by embedding security and compliance into the data fabric itself. In regulated industries, that’s the difference between adoption and fines.

CrowdStrike dominates endpoint protection. Palo Alto Networks rules enterprise firewalls. Both trade at rich multiples because Wall Street values their recurring revenue. HUB Cyber Security Ltd. (NASDAQ:HUBC) has already signed recurring contracts worth tens of millions annually at a valuation that barely registers.

MongoDB powers AI apps with operational databases. Varonis specializes in sensitive data control. nCino handles banking workflows. All three are niche players. HUBC is the only one combining core banking, compliance, and security into a unified platform.

At 2x sales, HUB Cyber Security (NASDAQ:HUBC) is trading like a distressed IT vendor, even as it pivots into 80%+ margin software with contracts across Tier-1 banks, governments, and crypto platforms.

That valuation gap will not last.

The Roadmap to Potential Triple-Digit Millions

The most powerful indicator for any small-cap isn’t what it has already done. It’s where it’s going.

When asked about their future trajectory, CEO Noah Hershcoviz said HUB Cyber Security Ltd. (NASDAQ:HUBC) expects to lock in $100 million in new contracts by Q1 2026, more than triple its 2024 run rate.

And unlike most microcaps, this isn’t just wishful thinking. The building blocks are already in place

Q1 2025: US Market Penetration and Initial SDF Deals (Completed)

HUBC began its North American push by appointing John Rogers, former Deputy Assistant Secretary of Defense, to lead U.S. operations. The objective was clear: open doors with Tier-1 banks and federal agencies. The foundation has been laid for a strong US presence and future contracts.

Q2 2025: Scaling and Expansion into Core Banking (Completed)

In Europe, HUB Cyber Security Ltd. (NASDAQ:HUBC) proved its model with major wins, including a $23M (€20M) modernization deal with San Marino’s oldest bank. These Tier-1 references validate the Secured Data Fabric in regulated banking environments. They also provide a playbook to replicate across mid-market and regional banks.

Q3 2025: SDF Features Launch and Strategic Partnerships (Current)

Now the focus is on turning innovation into revenue. HUBC is rolling out AI-driven compliance features for real-time monitoring and moving to finalize its Delta Capita partnership. The target is clear: $50M in new deals through expanded features and strategic alliances.

Q4 2025: Government and Federal Sector Focus

By the end of 2025, HUB Cyber Security Ltd. (NASDAQ:HUBC) expects to close its first US federal client for secure data infrastructure while adding European government wins. Management is guiding toward a $100M pipeline from government contracts alone. With leadership that includes veterans of the CIA, DoD, and Israeli intelligence, HUBC brings unmatched credibility to this sector.

Q1 2026: Expanding Government and Federal Pipeline

The early months of 2026 are about scaling what begins in Q4. HUBC is targeting additional US federal and European government projects with a goal of securing $100M in new contracts during the quarter.

Q2 2026: Continuous Growth in Global Banking

The second quarter of 2026 brings expansion into mid-sized US and European banks. HUBC is also pursuing global partnerships to leverage the full capabilities of its Secured Data Fabric. The client goal is to reach $250M in total contracted value by mid-year.

Q3 2026: Expansion into Healthcare and Insurance

By mid-2026 HUB Cyber Security Ltd. (NASDAQ:HUBC) intends to move beyond banking into healthcare and insurance. These industries are equally compliance-driven and data-heavy, making them natural fits for the platform. This expansion could push HUBC toward $500M in total contracts.

Q4 2026: Global Expansion and Market Leadership

The final stage of the roadmap is global leadership. HUBC aims to establish itself as a market leader in AI-driven compliance and secure data infrastructure with operations across Asia, Latin America, and the Middle East. The ultimate goal: $1 billion in total contracted value by year-end 2026.

For a company trading at a market cap of just $52 million, the upside is staggering.

This is how small companies become giants.

And when you stack those targets against billion-dollar peers like Palantir, Snowflake, and CrowdStrike, the gap between perception and reality becomes impossible to ignore.

The Sticky Revenue Engine Driving Growth

Winning a contract is one thing. Keeping it for a decade or more is another.

That’s where HUB Cyber Security Ltd. (NASDAQ:HUBC) stands apart.

Its Compliance Suite is not a nice-to-have add-on. It is the backbone of a bank’s ability to stay in business.15

Once deployed, it becomes woven into the very fabric of operations. Remove it and the entire regulatory structure of the institution falls apart. That makes these contracts incredibly sticky.

When a client signs with HUBC, it is not for a single project. It is for a long-term relationship that grows year after year.

Perpetual KYC: A New Gold Standard

Most banks still run compliance the old way. Customer files are updated once a year. The process is expensive, clunky, and outdated the moment it is finished. Regulators hate it.

HUB Cyber Security (NASDAQ:HUBC) replaces that model with perpetual KYC. Customer profiles are updated automatically the moment risk factors change. If a client is flagged by Interpol, if their credit rating shifts, or if sanctions lists are updated, the system reacts in real time.

That keeps regulators satisfied and eliminates the cost of running massive manual reviews. It’s faster, safer, and smarter.

Real-Time AML Monitoring

Anti-money laundering is another pain point. Banks are fined billions every year because their systems miss suspicious activity or generate endless false positives.

HUB Cyber Security Ltd. (NASDAQ:HUBC) has solved that with AI-driven monitoring that screens transactions instantly and reduces false positives by as much as 75%.

The result is fewer fines, stronger fraud protection, and happier regulators.

Regulation Never Sleeps

Governments are moving the goalposts constantly. New frameworks appear every quarter. Each one comes with the threat of penalties if banks cannot keep up.

With HUB Cyber Security (NASDAQ:HUBC), compliance does not have to be rebuilt from scratch every time rules change. The Compliance Suite updates automatically. New requirements are baked into the system as they appear. That turns compliance from a bottleneck into a competitive advantage.

Risk Scoring at the Speed of AI

Banks can now assess risk across entire customer bases with a few clicks. HUBC’s customizable dashboards give instant visibility.

This is more than convenience. In a world where regulators are watching closely, speed is survival. Being able to show accurate, real-time risk data means avoiding fines and protecting reputation.

Why This Matters for Investors

These capabilities are why HUB Cyber Security Ltd. (NASDAQ:HUBC) has already signed recurring deals including the $25 million annual KYC contract for a global digital currency merger. When a single contract exceeds the company’s entire market cap, it is hard to ignore the proof.

Sticky revenue like this is what Wall Street pays premiums for. CrowdStrike and Palo Alto Networks trade at rich multiples because their customers never leave. HUBC is building the same dynamic, only at the very core of banking, crypto, and soon healthcare and insurance.

Once the Compliance Suite is embedded, banks cannot afford to rip it out. Regulators would never allow it. Customers would not tolerate the disruption. It is concrete.

That’s why this revenue is not just sticky, it is compounding. Every new deployment strengthens the base, and every upgrade adds to annual recurring revenue.

And that is why the market has not yet woken up to the power of HUB Cyber Security (NASDAQ:HUBC). At less than one times sales, it is priced like a failing contractor. In reality, it is building the kind of recurring, regulator-proof revenue streams that have minted billion-dollar valuations for its peers.

The Power Players Behind the Transformation

The best ideas in technology often fail. Not because the tech is weak. But because the team behind it can’t execute.

That is not the case with HUB Cyber Security Ltd. (NASDAQ:HUBC).

Here the leadership is as much the asset as the platform itself. A mix of Wall Street operators, banking insiders, and defense-grade cyber veterans. The kind of people who don’t just know how to build technology, they know how to win billion-dollar clients.

This is the lineup turning HUB Cyber Security Ltd. (NASDAQ:HUBC) from an overlooked microcap into a contender on the global stage.

And when you combine this leadership with Tier-1 clients, recurring contracts, and a $52 million market cap, the opportunity becomes crystal clear.

Why This Overlooked Microcap Could Be the Next Palantir

The signs are always obvious in hindsight.

Investors watched Palantir go from an obscure government contractor to a $406B giant. They watched CrowdStrike turn cyber subscriptions into a $111B powerhouse. They watched Snowflake make fortunes as it scaled from zero to $76B.

Each time, the early clues were there. Breakthrough technology. Tier-1 clients. Seasoned leadership. And a market desperate for solutions.

Now those same signs are flashing again. Only this time, the company in question trades at a fraction of one percent of its peers.

HUB Cyber Security Ltd. (NASDAQ:HUBC) has already signed recurring contracts worth tens of millions. It has already landed Tier-1 banks, governments, and crypto platforms. It has already proven it can cut compliance costs by half and compress multi-year projects into months.

And yet, it trades at a market cap of just $52 million. Less than the value of a single contract.

The disconnect is staggering.

At 2 times sales, HUBC is priced like a distressed contractor, not a software company pivoting into 80% + plus margins. Wall Street has not caught on yet. But it will.

The roadmap points to $100 million in revenue by 2026. The Compliance Suite creates sticky, regulator-proof contracts. The Secured Data Fabric puts HUB Cyber Security Ltd. (NASDAQ:HUBC) at the center of a $12.9 billion market. And the leadership team has already built, scaled, and sold billion-dollar companies.

This is what an asymmetric opportunity looks like. Small market cap. Big market. Seasoned leadership. Tier-1 validation.

The question is not if Wall Street will recognize it. The question is when.

To see the full story for yourself, including HUBC’s latest corporate presentation, you need to act now.

Subscribe below to receive instant access to the corporate deck and every news release as it breaks. This is your chance to be first in line before the market wakes up.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers