Picture this: You’re walking through a scrapyard, surrounded by twisted metal and discarded appliances.

To most, it’s just junk.

But to Greenwave Technology Solutions, Inc. (NASDAQ:GWAV), it’s a goldmine—a $42.3 billion opportunity in the US scrap metal market.¹

While others in the recycling industry are stuck in the past, Greenwave is revolutionizing an industry ripe for transformation, leveraging cutting-edge technology, diversified revenue streams, and smart growth strategies to claim its place as a major player.

This isn’t just a story about recycling.

It’s about seizing untapped potential, capitalizing on industry shifts, and creating value where others see waste.

Let’s dive in.

Disaster Recovery: A Catalyst for Growth

In the wake of Hurricane Helene, damages are estimated in the billions of dollars. Roads, bridges, and homes need rebuilding, and raw materials like steel, aluminum, and copper are critical to these efforts.

Disasters like this are becoming more frequent.

In 2024 alone, the US experienced 27 separate billion-dollar weather and climate disasters, resulting in a total cost of $182.7 billion.²

This is where Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) steps in.

In December 2024, Greenwave secured a game-changing $15-$35 million contract for Hurricane Helene recovery efforts in North Carolina.³

This contract isn’t just about debris removal—it’s about processing massive amounts of high-value scrap metal, positioning Greenwave as a key player in disaster recovery and recycling operations.

This isn’t the company’s first major success in disaster recovery. CEO Danny Meeks brings over two decades of experience in the industry, including managing a $100 million federal subcontract for Hurricane Katrina cleanup.

Under Meeks’ leadership, this massive operation involved coordinating 1,500 trucks and 5,000 personnel over two years, showcasing his ability to execute large-scale, high-impact projects

But this is only the beginning.

With steel tariffs set to rise as high as 25% under the new administration, domestic producers are scrambling to secure recycled materials.

With its strategic position and operational expertise, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is primed to meet this surging demand and emerge as a key supplier to the US steel industry.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Market Tailwinds Driving Unstoppable Growth

Disaster recovery isn’t the only catalyst driving Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) growth. The US steel industry is undergoing a seismic shift:

- 79% of domestic steel production now focuses on meeting internal demand.⁴

- The rise of electric arc furnaces (EAFs), which rely heavily on recycled metal, is fueling demand for high-quality scrap.

- Tariffs as high as 25% on imported steel are forcing manufacturers to prioritize domestic sourcing.⁵

With the US ramping up infrastructure and sustainability initiatives, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is perfectly positioned to deliver critical materials and reap the rewards.

Press Releases

- Greenwave Technology Solutions, Inc.’s Scrap Metal Inventories Estimated to Surpass $6 Million as Prices Surge, Poised for Further Gains

- Greenwave’s Scrap App Adopted by a Leading U.S. Junk Car Buyer, Powering Expansion to 27 New Markets

- Greenwave’s Scrap App Adopted by a Leading U.S. Junk Car Buyer, Powering Expansion to 27 New Markets

- Greenwave Technology Solutions, Inc. Poised for Explosive Growth Amid New Steel, Aluminum, and Copper Tariffs

- Greenwave Technology Solutions, Inc. Poised for Explosive Growth Amid New Steel, Aluminum, and Copper Tariffs

8 Reasons

Why Investors Can’t Ignore Greenwave (NASDAQ:GWAV)

1

High-Value Disaster Recovery Contracts: $15-$35 million Hurricane Helene contract highlights Greenwave’s ability to secure high-value opportunities.⁶

2

New Revenue Streams: Expansion into wood recycling diversifies operations and taps into new markets.

3

Debt-Free Growth: Elimination of $35.2 million in debt creates financial flexibility for expansion.⁷

4

Processing Power: A new shredder doubles ferrous processing capacity and drives projected annual revenue increases of $4.8 million.⁸

5

Beneficiary of Market Trends:Rising demand for recycled materials, domestic sourcing, and tariffs create a prime growth environment.

6

Innovative Technology: The Scrap App is transforming customer engagement and operational efficiency.

7

Proven Leadership: CEO Danny Meeks has decades of experience and a track record of managing massive recovery contracts, including $100 million after Hurricane Katrina.

8

Undervalued Stock: With a market cap of $9.4 million and FY 2025 revenue projections of $43-$45 million, Greenwave offers ground-floor growth potential.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Where Innovation Meets Opportunity

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) isn’t your typical scrap metal company.

It’s a visionary leader in the industry, embracing innovation to outpace competitors and capture lucrative markets:

- Wood Recycling Expansion: By leveraging decades of expertise, Greenwave has diversified into wood recycling—a move that’s opening up entirely new revenue streams.

- Digital Transformation: The AI-powered Scrap App is redefining how scrap is bought, sold, and processed with real-time pricing and seamless transactions, setting a new gold standard for the industry.

- Processing Power Boost: The installation of a second automotive shredder has doubled Greenwave’s ferrous metal processing capacity, potentially adding $4.8 million in annual revenue.

Greenwave isn’t just keeping up—it’s leading the charge.

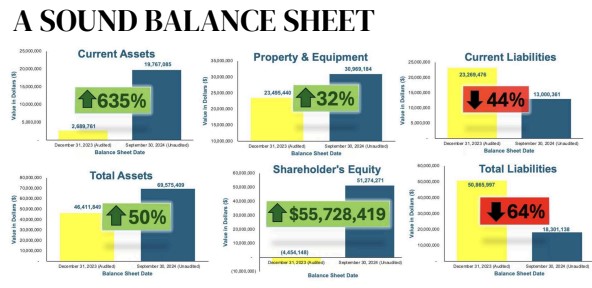

De-Risking Operations: A Sound Balance Sheet

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) has built a rock-solid financial foundation while pursuing aggressive growth in the booming scrap metal and recycling markets.

The numbers speak for themselves:

- 635% Growth in Current Assets: From $2.7M to $19.8M in nine months, boosting liquidity for expansion.

- 64% Reduction in Liabilities: Debt cut from $50.9M to $18.3M, reducing risk and enabling growth.

- 32% Increase in Property and Equipment: Strategic investments, including a second shredder, enhance capacity.

- 50% Growth in Total Assets: From $40.4M to $57.6M, strengthening market positioning.

- $55.7M Equity Turnaround: From a $4.5M deficit to $51.3M in equity, highlighting financial discipline.

These aren’t just numbers—they’re a roadmap to growth and stability.

Insider Buying: A Vote of Confidence

When the people running the company are putting their money where their mouth is, it’s worth paying attention.

In December 2024, CEO Danny Meeks acquired 377,002 shares in Greenwave Technology Solutions, Inc. (NASDAQ:GWAV),⁹ and other insiders followed suit:

- Jason T. Adelman, Director, purchased 100,000 shares.¹⁰

- Audit Committee Chair Henry Sicignano III, a double Harvard graduate, bought 100,000 shares.¹¹

This increased insider ownership to 15.4%, aligning management’s interests closely with those of investors.¹²

Institutional investors are also jumping in, with names like Anson Funds Management LP and Citadel Advisors LLC adding Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) to their portfolios.¹³

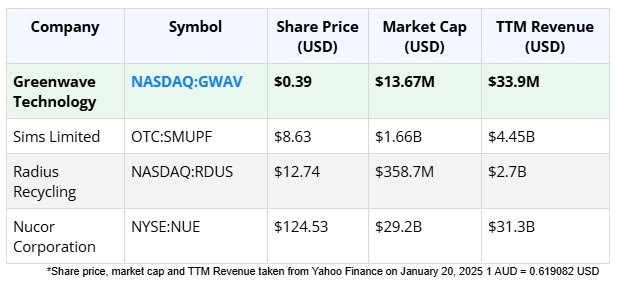

Crushing the Competition

While major players like Sims Metal and Radius Recycling dominate the headlines, Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) is quietly outmaneuvering them in key markets.

Here’s how Greenwave is breaking the mold:

- Agility Over Scale: While competitors deal with legacy systems and acquisition inefficiencies, Greenwave’s lean operations allow it to adapt quickly.

- Niche Markets: From disaster recovery to wood recycling, Greenwave is carving out opportunities others overlook.

- Innovative Technology: The Scrap App provides a digital edge, attracting customers with convenience and transparency.

The Bottom Line: Why Greenwave Deserves Your Attention

Greenwave Technology Solutions, Inc. (NASDAQ:GWAV) isn’t just turning scrap into gold—it’s reshaping an entire industry.

From disaster recovery contracts and wood recycling to its AI-powered Scrap App and expanded processing capacity, Greenwave is seizing every opportunity in the $42.3 billion US scrap metal market.

With a market cap of just $9.4 million and shares trading at $0.42, Greenwave offers investors an unparalleled chance to get in early on a company poised for explosive growth.

The time to act is now. Don’t let this exciting opportunity pass you by.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers