- Gold prices reached an all-time high in mid-July 2024, with a stunning 16% gain year-to-date, fueled by global uncertainty and economic instability.

- Major banks are forecasting further growth, with Goldman Sachs predicting gold could hit $2,700 per ounce by year-end, and Citi targeting an ambitious $3,000 per ounce.

- Key drivers behind the gold surge include escalating geopolitical tensions, political polarization in the US, and a trend toward de-dollarization as nations diversify away from the US dollar.

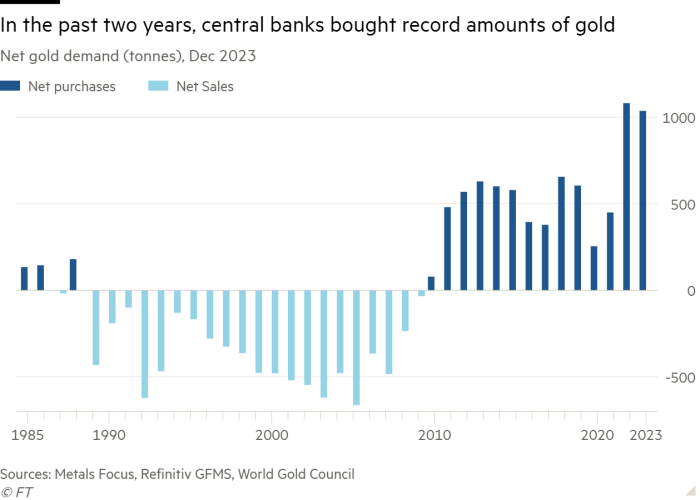

- Central banks are on a gold-buying spree, setting new records as countries like China, India, and Russia boost their reserves, further driving up demand.1

Global Instability Pushes Gold Prices to Historic Highs

In mid-August 2024, gold prices soared to a record $2,571 per ounce, marking a 32% gain year-to-date.2 This impressive rally has been driven by a confluence of factors that are pushing investors towards the safety of gold.

The ongoing conflict in Ukraine, rising tensions in the Middle East, and the political polarization in the US have all contributed to a heightened sense of global uncertainty. Investors are flocking to gold as a safe haven, driving demand and prices to new heights.

Major financial institutions are taking notice, with Goldman Sachs predicting that gold could reach $2,700 per ounce by the end of the year. Citi is even more bullish, forecasting that gold could hit $3,000 per ounce within the next 12 months.4

Central Banks and Investors Drive Unprecedented Demand for Gold

One of the key drivers of the current gold bull market is the record buying spree by central banks around the world. Countries like China, India, and Russia have been aggressively increasing their gold reserves, setting new records in the process.5 This trend is a clear indication of the growing desire among nations to diversify away from the US dollar and reduce their reliance on fiat currencies.

In addition to central banks, individual investors are also turning to gold as a hedge against inflation and currency devaluation. The cooling inflation rate in the U.S. and the Federal Reserve’s anticipated rate cuts before the end of the year are further stoking demand for gold.

Supply Constraints and Valuation Gaps Create Opportunity in Gold Mining Stocks

While demand for gold is surging, the supply side of the equation is facing significant challenges. Aging mines, a lack of new large discoveries, and geopolitical issues are all contributing to a constrained supply environment. This supply crunch is making existing gold deposits and new discoveries increasingly valuable, sparking a wave of mergers and acquisitions in the gold mining sector.

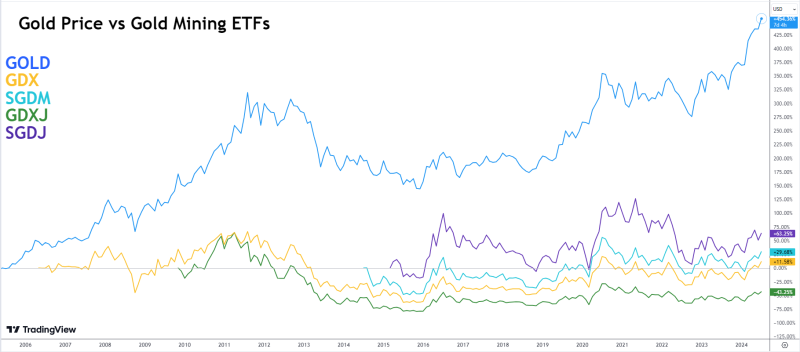

Despite the strong fundamentals, gold mining stocks have been largely overlooked by the market. With mega-cap tech stocks dominating headlines, the S&P 500’s P/E ratio has reached bubble territory, leaving gold stocks trading at some of the most attractive prices relative to earnings in history.7

This disconnect between gold prices and gold mining stock valuations presents a golden opportunity for savvy market participants.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Goldshore Grows Resource to 1.54M Ounces Gold Indicated and 5.20M Ounces Inferred

Amidst this favorable environment, Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) has been hard at work with its Moss Gold Project. Since 2021, the company has grown the project’s resource to 1.54M ounces Au Indicated at 1.23 g/t Au and 5.20M ounces Au Inferred at 1.11 g/t Au.9

This growth is underpinned by three pillars:

- Growth:

-

-

- Prolific Resource Growth exhibited since company inception

- Targeting numerous targets immediately adjacent to the conceptual open pit in the top 200m from surface

- Blue Sky potential for new discovery with 23 km of structural corridors to evaluate within 5km of the Moss Gold Deposit

-

- Economic Studies:

-

-

- G-Mining Services hired to conduct PEA+

- Potential for phased production

- Deliver Pre-Feasibility work program

-

- Permitting

-

- One-eighty consulting hired to lead external permitting team and advance ongoing community engagement and development of strategic permitting plan

- Three years of environmental baseline data completed

- Two exploration agreements signed with First Nations (2022)

With these initiatives, Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) is well-positioned to expand the value of its flagship asset and attract significant interest.

The Moss Gold Project is situated in Ontario, Canada’s top gold-producing province, which is known for its prolific gold belts and supportive mining environment.This location offers a safe and stable environment for mining operations, with easy access to key infrastructure including direct accessibility from the Trans-Canada Highway and associated power lines, supportive local communities and skilled workforce, and more.

[pressresleases]

Why Goldshore Resources Stands Out in the Gold Bull Market

In a market where gold stocks are heavily undervalued, Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) is an exciting company to watch. Here’s why:

- Safe and Prolific Jurisdiction: Located in Ontario, Canada’s top gold-producing province, the Moss Gold Project benefits from excellent infrastructure, including access to highways, power, and a skilled workforce. The province is home to several major gold mines, and its supportive regulatory environment makes it a good location for gold exploration and development.

- Significant Resource Growth: The Moss Gold Project has increased its resource to 1.54M ounces Au Indicated at 1.23 g/t Au and 5.20M ounces Inferred at 1.11 g/t Au

- Seasoned Leadership: Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) is led by Michael Henrichsen, the former global structural geologist for the world’s largest gold company (Newmont), where he was involved with multiple discoveries and the extension of existing gold deposits.10 Alongside Henrichsen, VP of Exploration Peter Flindell, who also spent 12 years with Newmont and brings over 35 years of experience in mineral exploration, strengthens the team’s depth in advancing the Moss Gold Project. Their combined expertise in large-scale gold projects positions Goldshore for its next phase of growth.

- Strong Financial Backing and Strategic Investments: Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) has secured substantial financial support from SAF Group, a leading alternative capital provider, under the leadership of Managing Partner Brian Paes-Braga, who has been involved in over $1 billion in growth equity financings and over $5 billion in market value creation across the mining and metals, energy, entertainment, consumer goods, and technology sectors.11 In November 2023, SAF Group led a $3.75 million financing round,12 providing Goldshore with capital to advance its Moss Gold Project. In May 2024, they further demonstrated their confidence in the company by acquiring an additional 7% of GSHR in a private transaction.13 Most recently, in July 2024, SAF Group was part of exercising $4.9 million worth of warrants,14 further reinforcing their commitment to Goldshore’s growth and development.15 These strategic investments not only bolster the company’s financial position but also align SAF Group closely with Goldshore’s long-term success.

- Upcoming Catalysts: Look forward to near-term milestones, including results from a recent 2,787-meter drill program and the completion of the PEA by Q1 2025. These milestones are expected to provide critical data that will further de-risk the project and demonstrate its economic potential. The PEA, in particular, will be a key document that outlines the project’s development plan, expected production rates, and financial metrics.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Uncovering a Major Gold Deposit in a Tier 1 Jurisdiction

Goldshore Resources’ (TSXV:GSHR) (OTCQB:GSHRF) 100% owned Moss Gold Project clearly stands out.

The project is located in a Tier 1 mining jurisdiction, known for its rich gold deposits and favorable mining policies. Ontario’s gold production grew by 38% in 2022, reflecting the province’s continued dominance in the Canadian gold mining industry.16

Ontario, Canada is home to several major gold assets that are either in production or nearing production including:

- Agnico Eagle’s Detour Lake, the largest gold-producing mine in Canada with reserves of 19.9 million ounces of gold and substantial growth potential.17

- New Gold’s Rainy River, 100% owned and in production, which has been a major contributor to Ontario’s gold output.18

- IAMGOLD’s Cote Lake, which had its first gold pour in March 202419 and expects commercial production to start in Q3 2024.

Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) is positioned in this great mining jurisdiction, and the Moss Gold Project has already increased its resource to 1.54M ounces Au Indicated at 1.23 g/t Au and 5.20M ounces Inferred at 1.11 g/t Au. This kind of growth is a signal of the continued upside potential.

Equinox recently paid C$995 million to buy out Orion’s 40% interest in the Greenstone Gold Mine,20 giving the project an in situ value of just under C$3.5 billion.

Construction at the Greenstone Gold Mine started in Q4 2021. By Q2 2024, the company poured its first gold. Once in full production, Greenstone will be one of Canada’s largest open-pit mines, producing approximately 400,000 ounces of gold every year for the first five years of its nearly 15-year mine life.

G Mining Services, the consultant that completed the 2021 feasibility study for Greenstone, have also been engaged to complete the PEA on the Moss Gold Project. This collaboration marks a critical milestone, as G Mining will develop an optimized and staged mine plan, and infrastructure layout, and to advance the Project toward a Project Description that will provide clarity on the scope of permitting work required.

Adding to this wave of consolidation in the gold sector, Gold Fields made headlines with its August 2024 announcement of a C$2.16 billion acquisition of Osisko Mining, a deal at a 55% premium that highlights the high value placed on strategic gold assets in Tier 1 jurisdictions.

Osisko’s Windfall Project, known for its size and high-grade deposits, was a prime target for Gold Fields, underscoring the continued appetite for large, high-quality gold projects.21

As global economic instability drives gold prices to record highs, the market is witnessing an unprecedented surge in demand, fueled by central banks and investors alike.

With major banks forecasting further gains, the outlook for gold remains strong, making this an opportune time to explore the potential within the gold sector.

Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) has strategically positioned itself to potentially benefit from this bull market, growing its resource to 1.54M ounces Au Indicated at 1.23 g/t Au and 5.20M ounces Inferred at 1.11 g/t Au.

With its advanced-stage project in a prolific mining jurisdiction, significant exploration potential, and a strong leadership team, Goldshore stands out among the masses.

Want to learn more about this up and coming gold stock?

Click here for a full detailed report on Goldshore Resources (TSXV:GSHR) (OTCQB:GSHRF).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Qualified Person

Peter Flindell, PGeo, MAusIMM, MAIG, Vice-President, Exploration, of the Company, and a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has approved the scientific and technical information contained in this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains statements that constitute “forward-looking statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “projects,” “potential” and similar expressions, or that events or conditions “will,” “would,” “may,” “could” or “should” occur. Forward-looking statements in this news release include, among others, statements relating to expectations regarding the exploration and development of the Moss Gold Project; the timing and release of assay results; timing and release of a PEA; the expectation that the development of Goldshore will be successful; and other statements that are not historical facts.

Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this press release, including that the exploration and development of the Moss Gold Project will be as expected by the Company’s management; the timing and release of assay results will be as expected by management; timing and release of a PEA will be as expected by management; the development of the Company will be successful.

These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important risks that may cause actual results to vary, include, without limitation, the risk that the exploration and development of the Moss Gold Project not be expected by the Company’s management or will be completed at all; the timing and release of assay results not be as expected by the Company’s management or will not be completed at all; timing and release of a PEA will not be as expected by the Company’s management or will not be completed at all; the development of the Company will not be successful.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws.

PAID ADVERTISEMENT. This communication is a paid advertisement for Goldshore Resources Inc. (TSXV:GSHR) (OTCQB:GSHRF) (the “Company”) to enhance public awareness of the Company, its products, its industry and as a potential investment opportunity. Native Ads Inc., and their owners, managers, employees, and assigns were paid by the Company to create, produce and distribute this advertisement. This compensation should be viewed as a major conflict with Native Ads Inc.’s ability to be unbiased.

This communication is not intended as, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Company purport to provide a complete analysis of the Company or its financial position. The Company is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the Company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the profiled Company’s SEDAR+ and/or other government filings. Investing in securities is speculative and carries a high degree of risk.