It’s not what’s under the hood that’s transforming the future of mobility.

It’s what’s on the surface — and what’s replacing the mirrors.

While most headlines obsess over Tesla’s humanoid robots, Nvidia’s AI supercomputers, or Apple’s next big reveal…

A quieter revolution is happening where few investors are looking.

Across highways, skylines, and cockpits — the materials we’ve taken for granted are waking up.

Glass is no longer just glass.

Thanks to breakthroughs in material science, display integration, and light control technologies, windows can now shade automatically, block heat, and even transform into immersive information displays — without a single mechanical part.

At the same time, a massive shift is underway in vehicle safety systems.

Bulky side mirrors are disappearing.

In their place? Sleek, AI-powered camera modules that eliminate blind spots, reduce drag, and deliver real-time driver assistance — all through embedded edge computing.

This isn’t some futuristic prototype.

It’s already happening.

And one company is leading both of these revolutions — simultaneously.

On one hand, they’ve developed high-performance smart glass systems already deployed in luxury vehicles, private jets, and next-gen buildings.

On the other, they’ve built a vertically integrated camera and display platform — with proprietary software and AI — that’s replacing mirrors across transit fleets and commercial vehicles worldwide.

From panoramic sunroofs that tint on demand…

To mirrorless trucks that see clearly through rain, fog, and glare…

This company is turning everyday surfaces into intelligent systems.

And while the media chases the next chatbot, smart glasses, or silicon breakthrough…

They’re building something much bigger — and it’s already rolling off production lines across four continents.

But this company is betting on the surfaces around us — and it’s already winning contracts with Tier-1 suppliers and global OEMs.

This could rival what Nvidia did for GPUs.

It’s not just a story about smart glass technology.

It’s a story about where the world is heading.

And as headlines warn of volatility and analysts debate whether to jump ship or double down… a growing chorus of seasoned investors is calling this moment what it really is: a market on sale.

A time when long-term plays with real-world traction become generational opportunities.¹

And this is one of them.

Gauzy Ltd. (NASDAQ:GAUZ), a fully-integrated global pioneer in light and vision control technologies, boasting an impressive portfolio of 146 issued patents and 23 more pending worldwide.²

Their systems don’t just capture what’s happening on the road.

They interpret it. Think of it like this:

Tesla is the Apple of autonomous vehicles — a vertically integrated walled garden.

But Gauzy? It’s aiming to become the Android of vision-based mobility — a platform built for millions of vehicles across every brand.

And insiders are buying like they believe it. The CEO just scooped up 210,000 shares. A top investor grabbed 350,000 more.³ That’s conviction — not commentary.

And here’s the comparison that should grab every investor’s attention:

In 2014, Mobileye — the Israeli pioneer of vision-based ADAS — went public at a $5.3 billion valuation. Just two years later, Intel bought them for $15.3 billion.⁴

Gauzy (NASDAQ:GAUZ) is walking a similar path — but in a much more advanced, post-Tesla world… with superior imaging hardware, more flexible software, and faster time to market.

With more than 1,300 customers, including major brands, in over 60 countries spanning automotive, aeronautics, architecture, and public transit, Gauzy’s innovations are reshaping industries.⁵

Still skeptical? Look at what happened with Ambarella (NASDAQ:AMBA).

They started by selling computer vision chips for HD cameras… and rode the ADAS and smart camera wave from a $150 million valuation in 2012 to over $3 billion by 2021 (see chart below).

Gauzy (NASDAQ:GAUZ) is riding the same wave — combining intelligent hardware with mission-critical software in one streamlined package.

In fact, Gauzy and Ambarella recently partnered up to power next-gen ADAS technology — enabling Gauzy’s cutting-edge Smart-Vision® system with Ambarella’s AI-driven CVflow® chips to deliver safer, smarter driving for commercial vehicles, including Ford Trucks.⁶

And the market is just beginning to catch on.

The Android of Smart Mobility?

8 Reasons

Gauzy (NASDAQ:GAUZ) Could Be the Next Big Winner

1

First-Mover in Smart Surface Intelligence: Gauzy (NASDAQ:GAUZ) is the only public company delivering dynamic glass technology and vision systems under one roof. Its patented smart glass is already in production with Ferrari, Mercedes, Bombardier, and more — transforming glass from a passive material into a premium, dynamic surface that adapts to light, heat, and privacy needs.

2

Full-Stack Vision Platform (Smart-Vision®): While Gauzy’s smart glass is built for comfort, energy efficiency, and design — its Smart-Vision® system is where the AI comes in. These mirror-replacement camera displays integrate proprietary imaging hardware, edge-based AI, and computer vision software for safer, more aerodynamic vehicles. It’s already deployed in over 2,500 buses in London, with the US market next,⁷ starting with the great state of New York.

3

2024 Revenue Surge — With Real Growth: Gauzy (NASDAQ:GAUZ) reported $103.5 million in revenue for 2024, up 32.8% year over year from $78.0 million in 2023.⁸ That growth puts them ahead of the curve in a sector where most early-stage players are still pre-revenue or bleeding cash.

4

Profitable Gross Margins in a Capital-Hungry Sector: While many smart mobility startups rely on continuous fundraising, Gauzy is already operating with record gross margins of 28.7%.⁹ With scale and high-margin verticals (like defense and aerospace) coming online, profitability could expand fast.

5

Beyond Automotive: A Multibillion-Dollar Surface Play: Gauzy’s smart glass technology isn’t just for EVs. It’s already being integrated into trains, planes, buses, and even skyscrapers. From HUD windshields to privacy partitions and ambient computing displays — the total addressable market is massive.

6

1,300 Customers, 146 Patents, and a Global IP Moat: Gauzy (NASDAQ:GAUZ) isn’t just shipping — it’s protected. With 146 patents issued, 23 pending,¹⁰ and over 1,300 customers worldwide, Gauzy has built a global IP moat that’s hard to match. It’s this patent wall and proven traction that turn a smart glass innovator into a long-term platform play.

7

Mobileye and Ambarella All Over Again: Mobileye went from IPO to a $15.3 billion Intel acquisition in just two years. Ambarella rode the ADAS wave from $150 million to over $3 billion. Now Gauzy is stepping into the spotlight — with a strong platform, global partnerships, and a clear path to capitalize on the next wave of smart mobility.

8

Still Flying Under Wall Street’s Radar: Gauzy (NASDAQ:GAUZ) already has global contracts, real revenue, and growing margins. But with a market cap still a fraction of legacy players, the revaluation potential is massive — and institutional investors are only just starting to notice.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The “Ambarella of Smart Glass”?

In 2004, Ambarella (NASDAQ:AMBA) started with a bold vision: build high-efficiency chips that could power HD cameras for sports and security.

Then came the real unlock.

By 2012, they were supplying key components for automotive Advanced Driver Assistance Systems (ADAS) — embedding computer vision into dash cams, rearview monitors, and eventually full driver-assist platforms.

Their strategy?

- Develop high-performance video and vision processors

Embed AI directly into edge devices - Power the transition from “seeing” to “understanding”

The results?

Ambarella rode the rise of intelligent cameras — across cars, drones, and surveillance systems — from a $150 million valuation in 2012 to over $3 billion by 2021.

That’s a 20x move in under a decade, powered by the convergence of computer vision, AI, and real-world demand for smarter sensing.

Now here’s the exciting part…

Ambarella (NASDAQ:AMBA) made its name by powering cameras — building chips that helped vehicles “see” the road.

Now, Gauzy (NASDAQ:GAUZ) is following their lead— partnering with Ambarella to integrate their CVflow® AI into our Smart-Vision® systems, helping to reshape how commercial vehicles navigate the world.

They’re building both the eyes and the interface — a full-stack visual intelligence platform that combines proprietary imaging hardware, edge-based software, and dynamic material science.

Not just better sensors.

Not just smarter glass.

But both — together, under one roof.

Gauzy’s patented vision systems — including mirror-replacing displays powered by onboard AI — are already in production, helping commercial vehicles eliminate blind spots and navigate in real time. This is the same type of “edge AI” functionality that made Mobileye and Ambarella breakout names in automotive tech.

But Gauzy (NASDAQ:GAUZ) doesn’t stop at the cameras.

They also manufacture smart glass — the kind that tints on command, blocks solar heat, or turns opaque for privacy. This tech is already embedded in the cabins of Ferraris, Gulfstreams, and Mercedes-Benz vehicles.

The magic?

It’s not about putting AI inside the glass.

It’s about combining two distinct — but deeply complementary — technologies into one vertically integrated platform:

- Smart glass that adapts

- Vision systems that interpret

One shapes how drivers and passengers experience the cabin.

The other shapes how vehicles respond to the world around them.

Together, they create a feedback-rich, safety-forward, comfort-optimized system — and it’s already shipping globally.

This isn’t a prototype. This is $103.5 million in 2024 revenue. A 32.8% YoY surge. And gross margins pushing 28.7%.

While Ambarella focused on chips…

Gauzy (NASDAQ:GAUZ) is controlling the whole stack — from the window to the road ahead.

And with over 1,300 customers, $1B+ in pipeline, and ADAS laws tightening globally…

This could be the breakout moment Wall Street’s been too distracted to see.

Why Smart Glass + Vision Tech Could Be the Next $124 Billion Breakout

This overlooked market is quietly transforming cars, buildings—and your investment portfolio.

While the media obsesses over AI chatbots and the next iPhone refresh, another transformation is happening right in front of our eyes—literally.

The global smart glass industry is no longer a science fair gimmick or luxury novelty. It’s a full-blown, high-growth sector that’s becoming mission-critical across automotive, aerospace, architecture, and even defense.

And the numbers? They’re staggering.

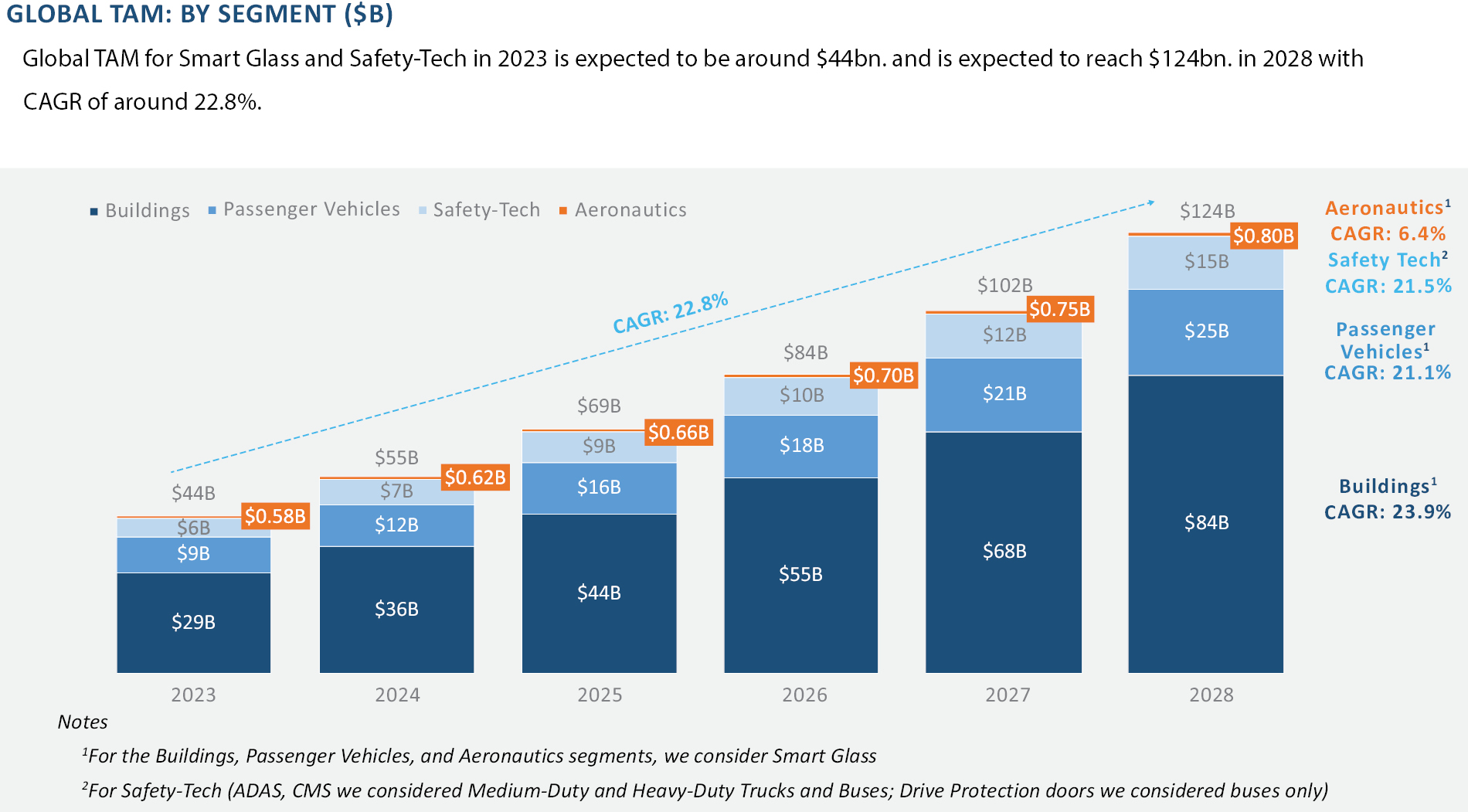

According to Frost & Sullivan, the global smart glass market is on track to hit $124 billion by 2028, growing at a staggering 22.8% CAGR from 2023 through 2028.¹¹

What’s fueling that breakout?

Widespread adoption in architecture, automotive, and aerospace — three massive markets undergoing seismic tech shifts.

From HUD windshields to energy-efficient buildings and high-altitude dimming systems, demand for intelligent glass is exploding.

And as more industries shift from passive surfaces to interactive, adaptive ones…

Smart glass is quickly becoming a foundational layer in tomorrow’s infrastructure.

The chart below shows just how fast the market is expanding — with buildings, passenger vehicles, and aeronautics leading the charge.

And AI is the accelerant.¹²

Here’s how:

- AI algorithms are now powering predictive maintenance of smart surfaces, reducing costly downtime.

- Integrated with IoT devices, smart glass can automatically adjust tint, transparency, and display modes based on ambient light, temperature, motion, or even user intent.

- In vehicles, AI enhances driver assistance, glare reduction, and safety overlays—using data from embedded cameras and sensors to adapt in real time.

- In buildings, AI-optimized glass systems help regulate interior environments, cut energy use, and align with green building codes.

At CES 2025, companies like Xreal and Rokid unveiled next-gen smart glasses and AR eyewear powered by real-time AI vision—a powerful signal that we’re entering an era where glass isn’t just passive. It’s intelligent.

And it’s not just about convenience—it’s about enabling a new category of responsive, data-driven surfaces that dynamically adapt to the world around them.

That’s where Gauzy (NASDAQ:GAUZ) comes in.

By combining proprietary imaging hardware, edge-based AI software, and advanced material science, Gauzy is building a next-gen visual intelligence platform.

Its smart mirror and camera systems don’t just capture the road — they interpret it in real time.

And its smart glass transforms surfaces into adaptive, responsive interfaces for comfort, privacy, and safety.

The result?

Smarter vehicles. Safer cities. More sustainable infrastructure.

Press Releases

Big Names, Big Contracts, Big Proof: The Smart Glass Company Already Embedded in Ferrari, Mercedes, and More

This isn’t just another moonshot startup hoping for a deal.

Gauzy (NASDAQ:GAUZ) is already under the hood — and in the cabins — of some of the most elite machines on the road, in the air, and on the tracks.

Let’s start with the big one: Ferrari.¹³

Yes, that Ferrari.

In 2024, the legendary Italian automaker selected Gauzy (NASDAQ:GAUZ) as a strategic supplier for the Purosangue, their first-ever four seater. Not only is this Ferrari’s serial debut into smart glass — it’s their first time ever adopting SPD-based panoramic roofs at scale.

That’s a bold vote of confidence.

Now add this to the stack:

- McLaren, the ultra-premium

performance brand, has integrated Gauzy’s tech into its advanced cabin glass systems.

performance brand, has integrated Gauzy’s tech into its advanced cabin glass systems. - Mercedes-Benz is shipping vehicles with Gauzy-enabled panoramic roofs — merging luxury with intelligence.

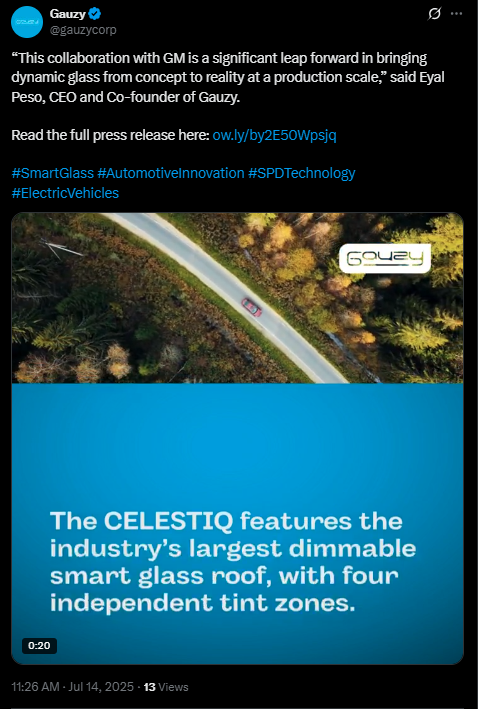

- In Q1 2025, Gauzy’s SPD smart glass entered serial production on GM’s Cadillac Celestiq — a high-end EV featuring a four-zone panoramic roof. It marks a major milestone in Gauzy’s OEM expansion and a continuation of its relationship with General Motors.¹⁴

These aren’t one-offs. These are serial production deals.

And now, Gauzy (NASDAQ:GAUZ) just made it easier than ever to bring smart glass to the masses.

On July 1, the company launched the world’s first prefabricated smart glass stack for cars — a game-changing innovation that cuts costs, slashes install time, and unlocks high-speed production for Tier-1s and OEMs.¹⁵

No extra processing. No delays. Just a fully integrated, ready-to-go solution built for scale.

With the automotive smart glass market set to triple by 2030, this is how Gauzy takes the lead — and keeps it.

US manufacturing is in place and major vehicle programs are already evaluating it for rollout, this is how smart glass goes mainstream — fast.

Then there’s Ford Trucks.

Gauzy (NASDAQ:GAUZ) landed a multi-year production agreement with Ford’s commercial vehicle division to deploy its ADAS vision systems, specifically designed to eliminate external mirrors — cutting drag, reducing blind spots, and improving driving safety into the next generation.

This is real traction — not vaporware.

But Gauzy’s (NASDAQ:GAUZ) not stopping with the road.

In aerospace, they’ve landed cabin shading deals with giants like Gulfstream, Bombardier, and Embraer, embedding smart dimming technology directly into jet interiors. These aren’t test pilots — these are commercialized integrations in aircraft currently flying at 40,000 feet.

And now, it’s hitting the water.

In 2025, Gauzy secured nine marine programs, including high-profile installations on yachts, cruise vessels, and a major terminal upgrade in Miami – entering the $6.2 B marine glass market.¹⁶

Their PDLC and SPD smart glass delivers instant privacy, glare control, and energy savings—supporting cruise-line ESG goals and premium passenger experiences.

Their product was even showcased at Miami’s Cruise Ship Interiors Expo, underlining Gauzy’s growing footprint in maritime architecture.

All of This Is Backed by Serious Expansion — And It’s Already Happening Worldwide

In early 2024, Gauzy (NASDAQ:GAUZ) opened a second production shift in Lyon, France,¹⁷ to meet surging European demand — further anchoring its position as a global smart glass and vision tech leader.

With manufacturing hubs now in Israel, France, Germany, and the U.S., Gauzy is strategically positioned to serve Tier 1 clients across every major time zone.

But this isn’t about factories — it’s about traction. And the numbers don’t lie.

Revenue surged 32.8% year-over-year in 2024, fueled by high-margin smart glass and ADAS contracts from automakers, public transit networks, and aerospace clients around the globe.

This is where most investors miss the mark.

Because while the market chases paper prototypes and pitch-deck dreams, Gauzy (NASDAQ:GAUZ) is already in production… already in the market… and already embedded in some of the most prestigious vehicles on the planet.

Just look at where this platform is landing.

Paris now joins over 80 cities worldwide — including London, Brisbane, Lyon, and New York — that have adopted Gauzy’s Smart-Vision® CMS to reduce blind spots and improve road safety for public transit.

In South Korea, a new partnership with MABA Industrial positions Gauzy to penetrate a market with over 255,000 commercial vehicles sold annually.¹⁸

In the UK, its collaboration with Journeo is powering safety enhancements in London’s transit system — creating a beachhead for further expansion across Europe. As of early 2025, Gauzy’s Smart-Vision® advanced driver assistance system (ADAS) has been installed on over 2,500 buses in London, capturing approximately 30% market share of the city’s fleet of 8,500 buses.¹⁹

And in the US, a renewed exemption from the FMCSA gives Gauzy’s Smart-Vision® CMS full clearance to be retrofitted onto more than 900,000 buses — unlocking one of the most lucrative retrofit markets in North American transit.²⁰

This isn’t a company preparing to go to market.

This is a company that’s already there — scaling, shipping, and accelerating.

And right now, with revenue climbing and global partners lining up, Gauzy (NASDAQ:GAUZ) may be the rare public company that’s still early… with the hard proof to back it.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The Numbers Are In — and They’re Blowing Past Expectations

It isn’t hard to validate Gauzy’s momentum…

Gauzy Ltd. (NASDAQ:GAUZ) just shattered its own records — reporting FY 2024 revenues of $103.5 million, a staggering 32.8% year-over-year increase.

That alone would be impressive.

But Q4 lit up even brighter: $31.1 million in revenue, up 41.8% year-over-year, capping off a historic quarter that sent a clear message to the market:

This isn’t some moonshot tech bet. It’s a revenue-generating machine.

Even better? Margins are expanding.

Gross margin hit 28.7% in 2024 — up 310 basis points from 25.6% the year before — showing how scale, integration, and higher-margin smart glass deals are all starting to kick in.²¹

With $40.6 million in total liquidity — including $5.6 million in cash and a $35 million undrawn credit facility — Gauzy (NASDAQ:GAUZ) is not only well-capitalized, but primed to execute.

That strength carried into 2025.

In Q1, Gauzy (NASDAQ:GAUZ) reported $22.4 million in revenue and expanded gross margins to 25.6%, up from 25.1% a year earlier — even as temporary customer-side disruptions delayed some deliveries.²²

The company ended the quarter with a $35.7 million backlog, secured a $10 million credit facility from Mizrahi Bank under improved terms, and reaffirmed full-year guidance — including its first-ever year of positive Adjusted EBITDA.

And that’s just the beginning.

Management is guiding 2025 revenues between $130 million and $140 million²³ — a massive leap forward as production ramps and global partnerships deepen.

Behind the scenes?

A sales pipeline exceeding $1 billion.²⁴

That includes a multi-year deal to supply smart glass technology for 50,000 electric vehicles annually, plus over $240 million in long-term aeronautics contracts already secured.²⁵

This isn’t about potential anymore.

This is about velocity — real growth, real margins, real contracts.

And as more Tier 1s and OEMs adopt Gauzy’s (NASDAQ:GAUZ) vision systems and smart glass platforms, those numbers could accelerate even faster than Wall Street expects.

In a market obsessed with storytelling, Gauzy (NASDAQ:GAUZ) is doing something far more rare:

Delivering.

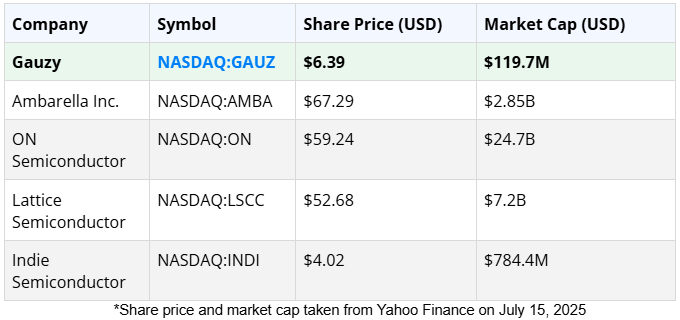

The $150M Tech Company Positioned Against Giants — But Built to Move Faster

Wall Street loves safe bets.

That’s why $7 billion is parked in Lattice Semiconductor (NASDAQ:LSCC), $17 billion in ON Semiconductor (NASDAQ:ON), and billions more in Ambarella (NASDAQ:AMBA).

Each of these companies plays a role in the future of autonomous driving, advanced sensors, or AI at the edge.

But here’s the truth:

None of them own the entire stack.

They sell the chip. Or the sensor. Or the firmware.

Gauzy (NASDAQ:GAUZ) is different.

They’re not building one layer of the solution — they’re building the whole platform.

Hardware. Software. Glass.

AI-enabled cameras. Edge-based vision systems. And smart glass that turns ordinary windows into dynamic, light-adaptive surfaces — while their vision platforms handle the safety layer.

It’s a vertically integrated play — not unlike what Tesla did for EVs… or what Apple did for mobile.

And here’s why that matters for investors:

- Ambarella (NASDAQ:AMBA) rode the vision-chip wave from a $150M valuation in 2012²⁶ to over $3B by 2021—just on camera chips.

- Lattice (NASDAQ:LSCC)—the FPGA leader—is now worth over $7B, driven by demand for low-power processing in ADAS systems.

- Indie Semiconductor (NASDAQ:INDI) is making custom chips for EVs, with a $784M market cap.

- ON Semiconductor (NASDAQ:ON)—one of the biggest players in the space—is worth over $24B and rising on the back of sensor demand.

Gauzy (NASDAQ:GAUZ)?

It’s still trading under a $120M market cap — but it’s already shipping to OEMs, powering Yutong buses, and locking in contracts for over 50,000 EVs annually.

This is not a prototype.

It’s a revenue-generating, multi-division powerhouse with $1B+ in pipeline opportunities, 1,300+ customers, and visibility into some of the biggest trends in smart mobility and ambient computing.

While legacy players fight over slices of the ADAS pie…

Gauzy (NASDAQ:GAUZ) is creating a new category — and taking the entire layer of vision, glass, and intelligence with it.

This is what asymmetry looks like.

Insiders seem to agree. With 560,000 shares bought in July — including 210,000 from the CEO — they’re not waiting for Wall Street to catch up.

And it’s why early investors are starting to take notice.

The company has approximately 18.72 million shares outstanding, resulting in a market capitalization of about $118 million.²⁷

Institutional investors hold significant stakes in Gauzy (NASDAQ:GAUZ). Ibex Investors LLC is the largest shareholder, owning 17.8% of the company’s shares.²⁸

Other notable institutional shareholders include Infinity Holding Ventures Pte Ltd. with 7.355%, Olive Tree Ventures with 6.826%, and Avery Dennison Corp. holding 4.57%.²⁹

Additionally, CEO Eyal Peso holds a 1.97% stake in the company, aligning management’s interests with those of shareholders.³⁰

Gauzy’s Executive Team: Engineering a Transparent Future with Deep Tech Expertise

Gauzy Ltd. (NASDAQ:GAUZ) is led by a world-class leadership team that blends visionary innovation with operational excellence — the kind of experience you want when investing in cutting-edge material science and smart glass technologies.

Together, Gauzy’s executive team is not just building smart glass — they’re building a smart future.

Tiny Tech. Massive Potential. And Almost No One’s Watching

Wall Street hasn’t caught up.

Gauzy Ltd. (NASDAQ:GAUZ) is already delivering next-gen visual intelligence systems to some of the biggest names in transportation — from Ferrari to Mercedes, Bombardier to Ford.

They’re generating real revenue. They’re expanding production across continents. They’re guiding for up to $140 million in 2025 sales — and still flying under the radar.

This is the kind of setup that made early investors in Ambarella, Mobileye, and Lattice a fortune.

Except this time, it’s not just about chips or sensors.

It’s about building the infrastructure that brings intelligence to every surface — in every car, plane, building, and train.

And Gauzy Ltd. (NASDAQ:GAUZ) is the company engineering that platform — from smart glass to AI-powered vision systems.

If you’re looking for the next breakout tech stock before the market wakes up…

Now is the time to start your due diligence.

Visit this link to download their corporate presentation.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Eyal PesoCo-Founder and CEO

Eyal PesoCo-Founder and CEO Adrian LoferCo-Founder and Chief Technology Officer

Adrian LoferCo-Founder and Chief Technology Officer