Quite possibly the most important metal in most of today’s electric vehicles (EVs) isn’t lithium, cobalt, nor manganese – it’s NICKEL.1

However, right now the world’s fourth largest nickel producer (Russia)2 remains under sanctions, taking 5-6% of the world’s supply, 9% of its production, and 17% of its high-purity nickel production offline with it.3,4

According to London-based CRU Group’s principal base metals analyst Nikhil Shah, the chaos that has ensued in this market is not only “unprecedented” but prices will likely remain higher for the rest of 2022.5

Showing how potential nickel shortages were already a concern before the conflicts began, Tesla CEO Elon Musk pointed out back in 2020 the importance of adding more nickel production.6

Showing how potential nickel shortages were already a concern before the conflicts began, Tesla CEO Elon Musk pointed out back in 2020 the importance of adding more nickel production.6

With Russia out of the picture for the foreseeable future, and the world’s largest nickel producer (Indonesia) is under fire for its ESG issues,7 demand for newer, safer, cleaner nickel supplies is skyrocketing.8,9

Thankfully, recent discoveries in Canada have given hope to a market fearing shortages of some of the world’s most important battery metals.

This is why you need to know about Gama Explorations Inc. (CSE:GAMA), an attractive early-stage copper-nickel explorer with promising properties in two of the world’s most favorable jurisdictions in British Columbia and Quebec, Canada with an important project next door to one of the country’s most significant nickel discoveries of the year.

7 Reasons

Gama Explorations Inc. (CSE:GAMA) is Built to Succeed in the New Nickel Era

1

Great Real Estate: Next door to one of the bigger new discovery stories in the market (Go Metals) with its HSP Quebec Nickel project.

2

Types of Deposits: Gama’s Tyee project covers an area that is along trend from where Go Metals is, and is only 12km away. The company strategically staked this project because of strong geophysical indicators.

3

The PEOPLE Behind This Project: Leading the way for Gama Exploration is a management and advisory team stacked with expertise in management, exploration geology, and capital markets, that includes experience with BHP, Ivanhoe, Haywood Securities, Go Metals and more.

4

Favourable Share Structure: With only ~42 million shares outstanding (a significant % of which is owned by insiders and strategic shareholders), the structure of Gama Exploration remains closely held, having recently raised $1.2 million at $0.25, with only 86k warrants outstanding at $0.30 (no overhang).

5

Strong Canadian Portfolio: The flagship Big Onion Copper project has a past historical resource with exploration upside potential, extensive drilling and other generative work already done on it, and is ideally situated a short drive from Smithers, BC.

6

Huge Global Trend in Battery Metals: The world is being moved into electric battery power due to global warming and the rising price of oil and gas. Battery metals, such as copper and nickel, are crucial to this transition.

7

Strong Comparables: While Go Metals is the obvious comparison, other stories come to mind, such as when properties like those of Great Bear Resources and K92 had discoveries, and those that were in close proximity went up, such as Northwest Copper.

Experienced Management and Leadership

In any mining operation, in order to be successful, the team needs to be strong in finding, developing, and financing the project to make it all work—and for all that Gama Explorations Inc. (CSE:GAMA) ticks every box.

At the core of the GAMA story is the leveraging of management’s technical and operational track record. In particular, this team has a significant amount of experience working with Majors, specifically with M&A activity in the mining space. They are growth-oriented with a particular focus on technically sound exploration assets.

GAMA’s management and advisors have diverse backgrounds including geology and Equity Research, including:

Follow the Battery Metals Trends

BOTH nickel and copper are in the spotlight due to the green electric revolution already underway.

In nickel, the long-term outlook is VERY strong. Earlier this year, the London Metals Exchange halted trading of nickel for several days, because excessive short sellers stood to lose billions.10

According to analyst Nikhil Shah, who was quoted as saying: “In my 15 plus years (working in the industry), I mean, it’s definitely unprecedented… I’m thinking that the price still will remain elevated in the second half of the year.”11

But there’s a shortage looming in the type of high-grade nickel that’s needed for EV batteries.12

More nickel is needed to maintain the energy density (battery life) of new batteries.

According to Mark Beveridge at Benchmark Mineral Intelligence:

“We’re heading towards, you know, 90 percent of the cathode being nickel for certain specific cell types.”

And a LOT of high-grade nickel was coming from Russia, prior to its conflict. Domestically, the US is short on nickel resources, with only one primary nickel mine (Michigan’s Eagle Mine) in operation—and that mine is expected to close in 2025.13

Copper is another story, having seen its price fall by nearly a third since March. However, a massive shortfall looms for the world’s most critical metal.14

Goldman Sachs Group estimates that miners need to spend about $150bn in the next decade to solve an eight million-tonne deficit,15 according to a report published in September 2022.

Goldman Sachs also forecasts that the benchmark London Metal Exchange price will almost double to an annual average of $15,000 a tonne in 2025.16

BloombergNEF predicts that by 2040, the mined-output gap could reach 14 million tonnes, which would have to be filled by recycling metal.

Press Releases

- Gama Explorations Announces Appointment of Dr. Jacob Verbaas as VP, Exploration

- Gama Explorations Announces Appointment of Mick Carew as Chief Executive Officer

- Gama Explorations Introduces Tyee Nickel Project

- Gama Explorations Announces Closing of Acquisition of Tyee Nickel Copr. and Proposed Private Placement

- Gama Explorations Enters Into Definitive Agreement to Acquire Tyee Nickel Corp.

“We’ll look back at 2022 and think, ‘Oops’”

– John LaForge, Head of Real Asset Strategy at Wells Fargo on copper’s downturn

It’s clear that inventories tracked by trading exchanges are now near historical lows.

Coupled with the latest price volatility, this means that new mine output—already projected to start petering out in 2024—could become even tighter in the near future. Because it takes years to get a mine into production, supply simply can’t keep up with demand.17

So we’re left with upcoming shortages in both nickel and copper on deck.

In recent years, the market greatly rewarded explorers when making new copper or nickel discoveries, especially those in the most mining-friendly jurisdictions in Canada.

For Gama Explorations Inc. (CSE:GAMA), it has the right geologists to lead the exploration programs in both their Big Onion and Tyee projects in British Columbia and Quebec respectively.

Directly adjacent to Gama’s Tyee project is the HSP Nickel project of Go Metals, which most recently had a discovery on it that sent the company’s stock soaring.

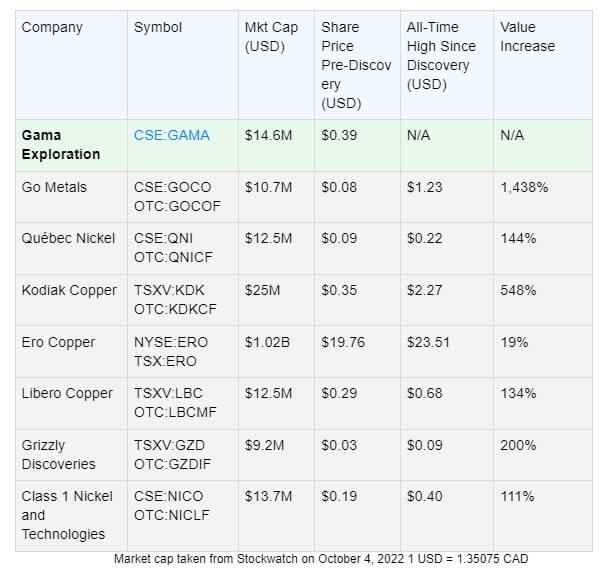

It’s worth taking a look at the impact that a new discovery has had on some of Canada’s miners, and their respective share prices.

Tyee Ni-Cu Project – Nickel Sulphide in Quebec

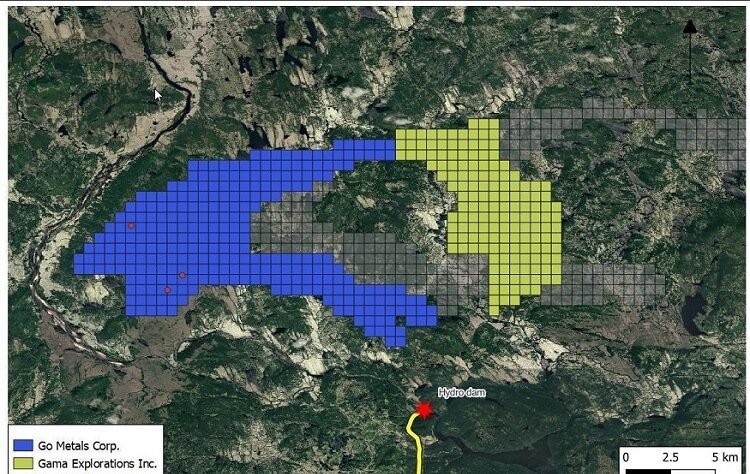

Located 130km north of the town of Havre St. Pierre, Quebec, and adjacent to Go Metals’ recent HSP Ni-Cu discovery, Gama Explorations Inc.’s (CSE:GAMA) newly-acquired Tyee Ni-Cu project is optimally positioned for big moves ahead.

The Tyee Claims cover the Havre St. Pierre anorthosite complex, which contains known nickel, copper and PGE occurrences.

In terms of infrastructure, the project is only 12km from the Romaine IV hydroelectric power facility, with roads in place to the property.

Initially not meant to be a flagship property, it’s hard to ignore what the Tyee Ni-Cu project brings to the table with its nearly 81.5km2 footprint and glaringly obvious vicinity to the Go Metals discovery.

A distinct magnetic anomaly is present within the claims, which could represent a mafic to ultramafic feeder to the surrounding anorthosite (magnetic low). This feature will be a key focus for exploration as these types of feeders and conduits are prospective for nickel-copper sulphide cumulate systems.

Big Onion Cu-Mo-Au Project – Smithers, BC

Like the Tyee, the Big Onion Cu-Mo-Au project is located close to current infrastructure, providing access to experienced local workers. The project is only 16km (only a 20-minute drive) away from the mining-friendly town of Smithers, BC.

Far ahead of the Tyee in terms of development, Gama’s (CSE:GAMA) flagship project, the Big Onion already has nearly 50,000 metres of historical drilling on the site, as well as 630km of heliborne magnet geophysical survey completed in 2016, with defined 2D and 3D anomalies in place.

Early exploration work recognized the property’s potential to host a large, low-grade bulk tonnage copper resource. Work further developed the premise that a significant portion of the mineralization is hosted within a near-surface zone of supergene enrichment.

It’s directly to the west of the Dome Mountain Project that’s currently owned by Blue Lagoon Resources Inc., which published a mineral resource on the project in 2020.

Copper and molybdenum mineralization is largely contained within northeast trending, northwest dipping shears and veinlets that parallel the fault controlled intrusive.

Cashed Up with Very Little Overhang

Recently Gama Explorations Inc. (CSE:GAMA) successfully raised $1.28 million at $0.25 with no warrant attached.18

The company has only 86,000 warrants outstanding at $0.30.

RECAP: 7 Reasons

to Seriously Look Into Gama Explorations Inc. (CSE:GAMA) NOW!

1

Great Leadership

2

Favourable Share Structure

3

Strong Canadian Portfolio With The Tyee Project in Close Proximity to Go Metals Big Discovery

4

Great Real Estate

5

Huge Global Trend in Battery Metals

6

Types of Deposits

7

Strong Comparables

For those looking at junior miners that have great discovery potential involving battery metals in Canada, they’ll want to do more research on this well-structured company and great management team presented by Gama Explorations Inc. (CSE:GAMA).

As stated, big things can happen quickly for new discoveries in the mining sector, just like what happened with Go Metals. GAMA is set for action in both British Columbia (copper) and Quebec (nickel) with world-class geologists.

Look out for them to be releasing a steady stream of updates in the weeks and months to come.

So, be sure to continue following the Gama Explorations (CSE:GAMA) story starting today.