The financial landscape of 2023 was nothing short of remarkable.

The S&P 500 saw a stunning 24% surge last year and that positive trajectory has extended into 2024 by another 5%.

But it’s all about to come to a screeching halt.

Experts are predicting that 2024 will bring a major crash.

Renowned financial educator, author, and investor Robert Kiyosaki has issued a stark warning – The S&P is about to crash by 70%.1

He’s not talking about a soft landing. It’s going to be a hard crash.

Inflation is at a 40-year high, national debt is rising, government spending is unchecked and rate cuts are on the horizon, which are all indicators of a coming recession.

All of this is brewing a perfect storm for what is projected to be the largest market crash of our lifetime.

His advice? Buy Gold.

Central banks have quietly been preparing for the inevitable, buying up gold at record rates.2

Gold is already responding to the coming market meltdown, reaching past a record high of $2,200 per ounce.

And it’s expected to potentially soar much higher, meaning it could be the perfect time to get in on the action.

As the gold market prepares for takeoff, gold stocks may prove to offer even more value than buying gold bars and one NYSE American-listed gold stock has caught our attention.

Junior mining companies in particular are poised for success and this company has been flying under the radar despite having an enormous amount of potential and close ties with the world’s largest gold producer.

Fury Gold Mines Limited (TSX:FURY) (NYSE-A:FURY) is a well financed high-grade gold exploration company strategically positioned in some of Canada’s most prolific mining regions.

Look, we get it. Almost every gold company claims to have high grade gold.

But, with Fury Gold Mines Limited (TSX:FURY) (NYSE-A:FURY), the numbers don’t lie.

Fury’s targeted approach and revised exploration plan gave them an expanded footprint of high-grade gold, with discoveries exceeding 30 grams per ton (g/t) gold over 3.5 meters3 and a hit rate of nearly 55% at the Hinge target contingent with the company’s Eau Claire resource.

To put that into perspective, anything above 8 grams per ton is considered high grade.

But that’s really just the tip of the iceberg. Let’s dive into the many reasons to be excited about this junior mining explorer.

5 Reasons

Fury Gold Mines (TSX:FURY) (NYSE-A :FURY) is on the Cusp of Something Big

1

Canadian-Focused, High-Grade Gold Explorer: Fury Gold Mines (TSX:FURY) (NYSE-A :FURY) has strategically maneuvered its way to an advanced high-grade, gold portfolio in low-risk jurisdictions across three projects, with two major projects in the mining-friendly jurisdiction of Quebec.

2

Actively Drilling Multiple Robust Exploration Projects in Quebec: Fury has been active through the drill bit, intercepting multiple zones of high-grade gold expanding the Eau Claire deposit footprint and at the Percival Prospect.

3

Experienced Management Team with a Proven Record of Success: Since appointing Tim Clark as CEO in 2021, Fury Gold Mines is focusing on its best in class projects in Quebec, reducing costs by 30% and strengthening the company’s balance sheet.

4

Strong Balance Sheet: After completing the most recent private placement in March 2023, Fury Gold Mines (TSX:FURY) (NYSE-A :FURY) is arguably one of the best financed junior exploration companies in the sector with C$5.7 million in its treasury and 54m free trading shares of Dolly Varden Silver worth approximately C$54.6M.

5

Additional Blue-Sky Potential in Nunavut: Fury Gold Mines has 100% ownership of the Committee Bay project, where there is significant resource expansion and discovery potential. This high-grade gold endowment is located in the mining-friendly jurisdiction of Nunavut, Canada where there is major mine development underway.

Gold Price Rally Fuels M&A in Canada and Creates Upside Potential for Gold Juniors

The impending recession and ongoing geopolitical concerns may be creating uncertainty in the markets, but it’s doing wonders for gold.

Gold demand hit record highs in 2023 with central banks purchasing more than 1,000 tons for two consecutive years.4

Canada, which is the third largest gold producer in the world, is gaining a ton of attention from gold majors and investors alike.

There’s been a surge in mega gold M&A deals in the region as industry giants look to solidify their spot in the booming market.

In Q4 2023 alone there were 100 M&A deals announced in Canada worth a whopping total value of $8.1 billion. There were also several monumental deals closed last year.

Newmont acquired Newcrest Mining for $15 billion in November, becoming the world’s leading gold mining company.5

Agnico Eagle and Pan American Silver joined forces in a joint acquisition of Yamana Gold for $4.8 billion.6

B2Gold bought Sabina Gold & Silver Corp. and its Back River Gold District located in Nunavut, Canada for $840 million in April.

Press Releases

- Fury Announces 2023 Eau Claire Exploration Program Focusing On Expanding Known Mineralized Zones And Advancing Early Stage Exploration Targets

- Fury Announces Closing Of C$8.75 Million Financing

- Fury Announces Upsized C$8.75 Million Financing

- Fury Announces C$7 Million Financing

- Fury Drills 45 G/T Gold Over 1 Metre In The Gap Zone At Eau Claire

After a flurry of mega deals among the majors, many are turning their attention towards junior exploration companies with a lot of promise like Fury Gold Mines (TSX:FURY) (NYSE-A :FURY).

Elevated gold prices are injecting more capital into the exploration space and creating some exciting possibilities for companies like Fury Gold Mines.

After closing a placement for C$8.75 million in March 2023,7 and completing the sale of 5.45 million Dolly Varden shares this March,8 Fury (TSX:FURY) (NYSE-A:FURY) has one of the strongest financial positions in the sector with $5.7 million left in its treasury even after buying Newmont’s 49.9% interest in the Éléonore South gold project.9 The company also has C$57.1 million in equity. 10

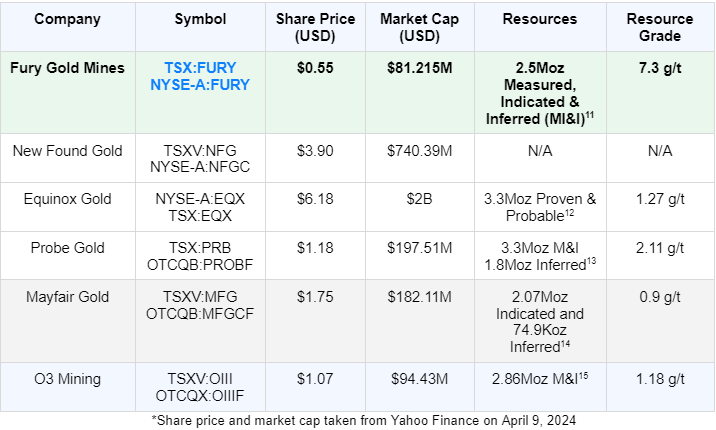

Yet, according to the chart below, Fury (TSX:FURY) (NYSE-A :FURY) is priced well below its peers despite offering a sizable resource and the highest grades among the group.

Fury’s James Bay Flagship Gold Project – Eau Claire

Fury Gold Mines (TSX:FURY) (NYSE-A:FURY) has wasted no time at all getting to work on its flagship Eau Claire project

In 202216 Fury (TSX:FURY) (NYSE-A:FURY) set off to demonstrate the potential to significantly expand the Eau Claire deposit in all directions at its Hinge Target.

Here are some highlights from the last two years of drilling:

2022 Exploration Highlights:

- August 2022: Discovery of multiple zones of gold mineralization, showcasing:

- 3.50m at 4.79 g/t gold

- 1.00m at 14.19 g/t gold

- 3.50m at 5.86 g/t gold

- 1.00m at 20.6 g/t gold

- 17.50m at 1.29 g/t Au17

- October 2022: Expansion of the mineralized footprint at Eau Claire, with drilling results including:

- 4.0m at 5.75 g/t gold

- 1.0m at 21.40 g/t gold

- 3.5m at 5.86 g/t gold18

2023 Exploration Highlights:

The 2023 Fury Gold Mines (TSX:FURY) (NYSE-A:FURY) exploration drilling at the Hinge Target confirmed that the mineralization encountered is the direct extension of the existing Eau Claire resource significantly expanding the overall potential of the project.19

- Notable intercepts from the 2023 Hinge Target drilling include:

- 3.50m at 31.77 g/t gold from drillhole 23EC-07720

- 3.50m at 17.62 g/t gold from drillhole 23EC-08221

- 3.50m at 5.73 g/t gold from drillhole 23EC-06522

In February 2023, Fury (TSX:FURY) (NYSE-A:FURY) shared an update on targeting at its fully owned Lac Clarkie project, which is located directly to the east of its Eau Claire project.23 Through the conclusion of a B-horizon soil sampling program, the company has defined a total of eight gold targets.

Six of the targets are located along the Cannard Deformation Zone, which contains numerous gold occurrences along its >100 km mapped extent, including FURY‘s Eau Claire Deposit and the Percival Prospect.

-

- Percival Prospect Drilling: Results from the first five 2023 core drill holes at Percival Main include:

- 279 g/t gold over 1.5m

- 5.0m at 2.68 g/t gold

- 7.5m at 2.31 g/t gold24

-

- Continued Success at Percival: Additional drill holes confirmed with notable intercepts such as:

- 48.5m at 0.86 g/t gold

- 16.5m at 1.42 g/t gold

- 14m at 1.09 g/t gold

The multiple stacked zones of gold mineralization clearly demonstrate that Eau Claire remains open to the west and has the potential to be expanded significantly with approximately a 25% increase to the mineralized footprint realized to date.

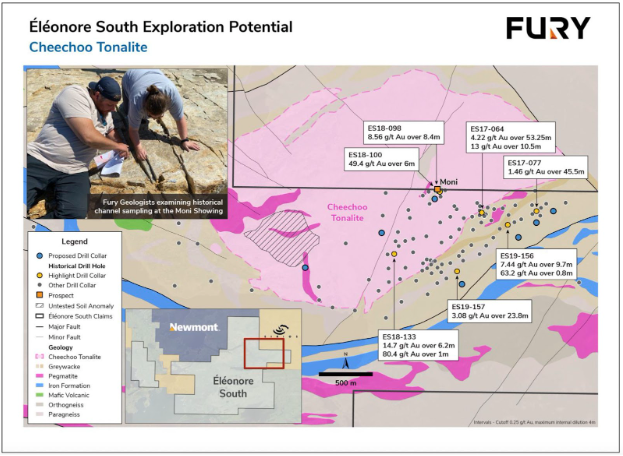

Éléonore South Project: A Clear Path to Gold Discovery

To the Northwest of the Eau Claire project is the 14,000-hectare Éléonore South, which Fury Gold Mines Limited (TSX:FURY) (NYSE-A:FURY) recently acquired 100% ownership of after sharing the rights to the property with the world’s largest gold producer, Newmont Corporation.25

This move to gain full ownership of Éléonore South not only underscores Fury’s commitment to growth but also highlights the project’s significant potential.

Located in the heart of Quebec’s James Bay region, within the prolific Eeyou-Istchee Territory, Éléonore South spans an impressive 14,700 hectares. It’s ideally situated just south of Newmont‘s Éléonore property and mere kilometers from the Éléonore Mine, which houses the renowned +5 million-ounce Roberto gold deposit.

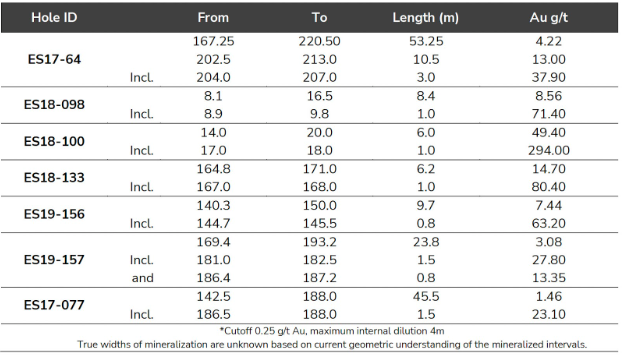

Fury Gold Mines Limited (TSX:FURY) (NYSE-A:FURY) has made significant strides at the Éléonore South project, and has commenced a 2024 exploration program comprised of 2,000 m following up on previous drill intercepts of 53.25 m of 4.22 g/t Au; 6.0 m of 49.50 g/t Au and 23.8 m of 3.08 g/t Au.26

But the intrigue of Éléonore South doesn’t stop at its extensive mineralized zone.

The project has also revealed areas with much higher gold grades, found within structurally controlled quartz vein stockworks.

Below are results from previous drilling at Éléonore South:

- 53.25 meters with 4.22 g/t gold,

- 6 meters with an exceptional 49.50 g/t gold

- 23.8 meter area yielding 3.08 g/t gold.27

These significant findings mark Éléonore South as a project with both volume and high-grade potential. Building on these successes, Fury Gold Mines has commenced a focused drilling campaign for Spring 2024.

This next phase aims to further explore these high-grade structural corridors, following up on the promising results already achieved.

For investors, Fury Gold Mines’ (TSX:FURY) (NYSE-A:FURY) Éléonore South project represents a straightforward opportunity in gold exploration. With substantial groundwork laid and a clear direction for future drilling, Éléonore South is demonstrating its potential to be a significant gold discovery in Quebec.

Experienced Management and Leadership

In the gold mining game, it takes a strong team of explorers, developers, and financial wizards to make it all work—and for all that Fury Gold Mines (TSX:FURY) (NYSE-A :FURY) ticks every box. This is an experienced management team with a proven record of success. FURY’s leadership team includes:

RECAP: 5 Reasons

to Seriously Look Into Fury Gold Mines (TSX:FURY) (NYSE-A :FURY)

1

Canadian-Focused, High-Grade Gold Explorer: Fury Gold Mines (TSX:FURY) (NYSE-A :FURY) has strategically maneuvered its way to an advanced high-grade, gold portfolio in low-risk jurisdictions across three projects, with two major projects in the mining-friendly jurisdiction of Quebec.

2

Actively Drilling Multiple Robust Exploration Projects in Quebec: Fury has been active through the drill bit, intercepting multiple zones of high-grade gold expanding the Eau Claire deposit footprint and at the Percival Prospect.

3

Experienced Management Team with a Proven Record of Success: Since appointing Tim Clark as CEO in 2021, Fury Gold Mines is focusing on its best in class projects in Quebec, reducing costs by 30% and strengthening the company’s balance sheet.

4

Strong Balance Sheet: Fury (TSX:FURY) (NYSE-A :FURY) is arguably one of the best financed junior exploration companies in the sector with C$5.7 million in its treasury and owning 54m shares of Dolly Varden Silver worth approximately C$54.6m and free trading.

5

Additional Blue-Sky Potential in Nunavut: Fury Gold Mines has 100% ownership of a 300 km greenstone belt known as the Committee Bay project, where there is significant resource expansion and discovery potential.

When it comes to the gold market, significant developments occur rapidly for new discoveries and Fury Gold Mines is already active with numerous drills targeting multiple targets in favorable mining districts in Quebec.

The chance to become a part of Canada’s flourishing gold mining industry could be right at your fingertips.

Click here and add Fury Gold Mines (TSX:FURY) (NYSE-A:FURY) to your watchlist today.

Tim ClarkCEO and Non-Independent Director

Tim ClarkCEO and Non-Independent Director Bryan AtkinsonSVP Exploration

Bryan AtkinsonSVP Exploration