Nuclear power is making a comeback. Several of the world’s most developed nations have been announcing their plans to extend the life of their existing nuclear power plants, with some even expanding their fleets instead of shuttering them as had already been scheduled.

Whether or not it’s being done quietly/sheepishly, the result has accelerated the robust recovery in the uranium market over the last two years, after nearly a decade of low prices. This has included new build announcements and additional incentives and funding coming from Japan,1 France,2 South Korea,3 India,4 the UK,5,6 and the US7 as well as new, term contracts and spot purchasing from utilities and financial players.

But, after so many years in a slump during which mines were shuttered and most undeveloped projects struggled to advance, uranium production is faced with falling reserves and grades.8 Supply looks set to struggle as demand continues to increase. With uranium commentators suggested the required incentive price for new supply is over $70 per pound9 and even up to +$90 /lb – an approximate 80% increase on today’s prices – an exceptional tightening of the already thin uranium market looks set to happen as early as 2025.

Perfectly positioned within a World-Class uranium district is Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF), specializing in the strategic development of the Patterson Lake South (PLS) uranium property, which hosts the class-leading, high-grade Triple R deposit. Fission has a clear development path at PLS, having just completed the much-coveted Feasibility Study (FS) at the property which revealed robust economics including the potential to become one of the lowest cost operators in the uranium industry (more on that shortly).

This nuclear shift is relatively new, as up until 2020, uranium producers had little reason to believe that long-term demand would begin to accelerate, and that public sentiment would begin to change even in countries that had decided to reduce or phase out nuclear energy.

This renaissance includes Japan, which has announced a nuclear energy plan to tackle energy prices and decarbonization, including extending its current reactor life and constructing new reactors.10 With Fukushima behind them, Japanese sentiment towards nuclear has swung back to positive, with over 60% of the country now supporting nuclear, and the restarting of the country’s reactors.11

Meanwhile, last summer the US government approved a $700M funding package in support of the US nuclear industry.12

According to Sprott Asset Management, the renewed focus on energy security will provide long-term support for the uranium market and continue the bull run.13

Some analysts are even calling it the start of a 10-year uranium bull market and the “Coming of the Second Atomic Age”.14

8 Reasons

Investors Should Do a Deep-Dive on Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF)

1

Greatly Strengthened Uranium Sector: For the full year 2022, uranium’s performance was notably strong.15 The U3O8 spot price returned 14.74% for the 12 months, outperforming most asset classes. All the while uranium mining equities fell 11.42% for 2022, showing a potential imbalance and opportunity to ride a wave in 2023

2

Uranium Shortage Approaching: Higher uranium prices and continually increasing focus and spending on green energy is shining the spotlight on the few tier one uranium development projects.

3

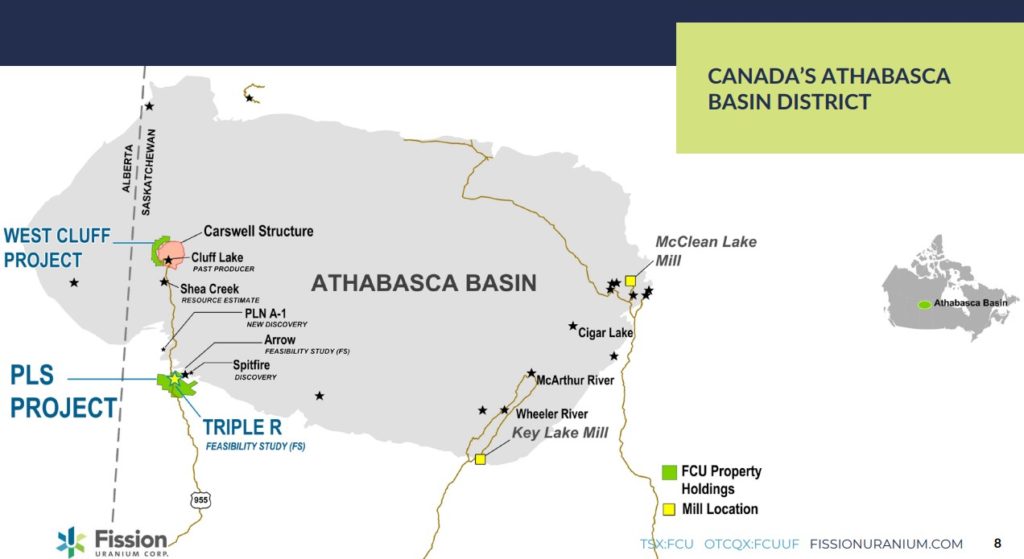

World-Class Uranium District: Saskatchewan consistently ranked in the Top 10 Mining Investment jurisdictions in the world, ranking in the Fraser Institute Top 3 for two years in a row.16 The Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) PLS Project has excellent access to highways and a skilled workforce, making the opportunity even more attractive as it advances through the final stages towards production.

4

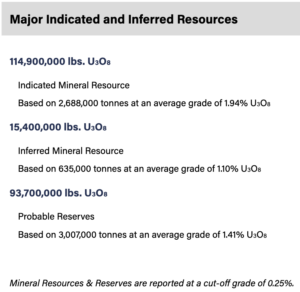

Updated, Larger Indicated Resource: According to a September 2022 Updated Resource, Fission Uranium is in possession of an Indicated resource of 2.69 Mt at an average grade of 1.94% totaling 114.9 Mlb U3O8; Inferred resource of 0.64 Mt at an average grade of 1.10% U3O8 totaling 15.4 Mlb.

5

Clear Development Path: The results of a recent Feasibility Study (FS) at PLS further enhance the robust economics from the 2019 Pre-Feasibility Study, and minimal environmental impact. Some of the highlights from the FS include a 42% increase in the mine life to 10 years with life of mine production of 90.9 million pounds of U3O8, a much higher after-tax NPV of C$1.204 billion at an 8% discount, and a higher after-tax IRR of 27.2% while maintaining a very low OPEX of C$13.02/lb. In US dollars, that’s below US$10.00/lb.

6

As well, Fission Uranium Corp.’s (TSX:FCU) (OTCQX:FCUUF) social and environmental responsibilities have consistently been met since project commencement and moving forward the project has two industry-leading experts on board for the permitting and environmental processes.

7

Expert Team with Deep Knowledge of Uranium Project Advancement: Highly respected, award-winning management, technical, and operations team led by President and CEO, Ross McElroy, who’s played a significant role in at least four major uranium discoveries in the Athabasca Basin, and VP of Project Development Gary Haywood who brings significant experience running uranium mining operations for Cameco, each bringing tier-one expertise in all aspects of mine development, operations, community affairs and environmental work.

8

Timing Advantage: Thanks to continued work programs during the last ten years, the Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) PLS project is one of the few high-grade uranium projects advanced enough to potentially reach production during this cycle.

Enter the 10-Year Uranium Bull Market

According to Sprott Asset Management, uranium and nuclear energy’s critical role in energy security could provide long-term structural support for uranium and uranium miners in 2023 and beyond.17

Prices for uranium conversion and enrichment services more than doubled last year, a significant outperformance relative to the U3O8 uranium spot price, and according to the report the upward price pressure could flow down to the uranium spot price in 2023.

At the same time, analysts at The Oregon Group believe we are entering the start of a 10-year uranium bull market, and the “Coming of the Second Atomic Age”.18

It’s worth noting that The Oregon Group has a wealth of experience in the uranium sector, with connections going back over a decade.

These analysts point to a significant, continuing increase in global nuclear reactors, which require uranium as fuel—and as the demand for clean energy increases and more countries shift towards nuclear power, so is the demand for uranium expected to rise.

This scenario provides a unique opportunity for observant investors as the yellow metal is driving the uranium sector to outshine other sectors in the market.

But choosing which uranium project to follow and support can be difficult among a field of choices.

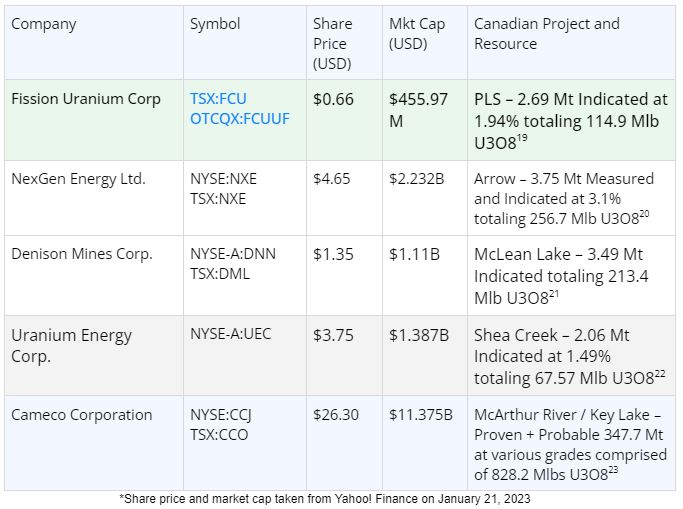

Let’s now take a moment to look at how Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) stacks up to comparable companies in the uranium marketplace.

While the market is giving valuations north of a billion dollars to every other comparable on this chart, it’s worth digging into whether or not Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) is potentially being undervalued when looking from a resource perspective.

For example, Uranium Energy Corp. (UEC) which is trading at $3.75 and has a market value of nearly $1.4 billion—or close to a billion more than FCU.

UEC’s Shea Creek comes with 2.06 million tonnes of indicated resource at a grade of 1.49%, totaling 67.57 million pounds of uranium.

Compare this to Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) and its PLS Project, which has a 30.5% larger Indicated resource of 2.69 million tonnes, a +30% higher grade of 1.94% U3O8, and 70% more U308 at 114.9 million pounds.

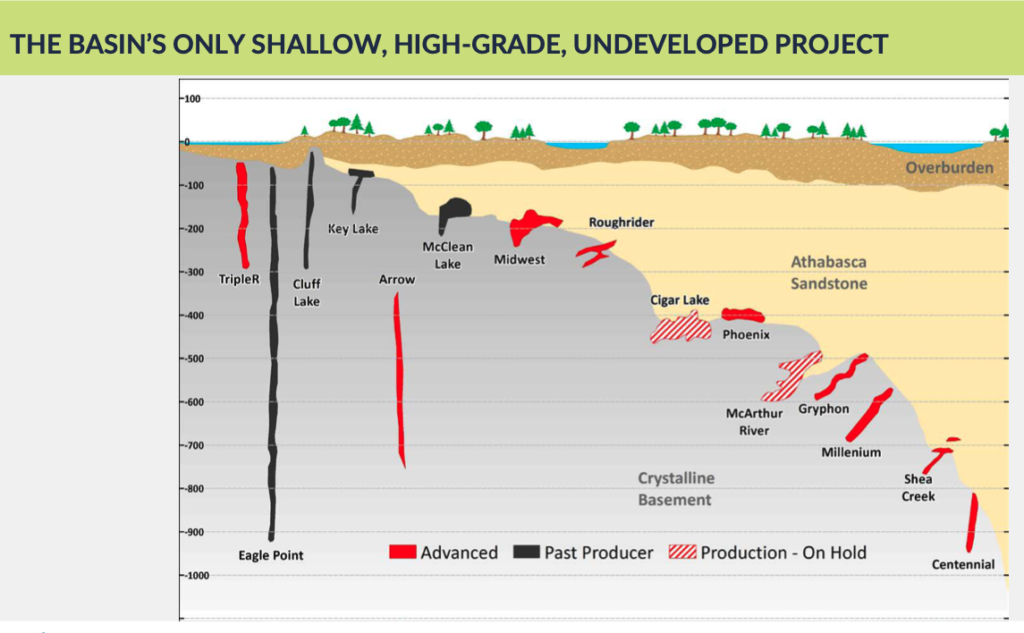

And now, looking at the diagram below, you can also clearly see the difference in depth between both UEC’s Shea Creek, which has a depth of greater than 600m,24 versus FCU’s PLS Project, which has mineralization starting at less than a tenth of that depth, beginning at just 50 meters deep.

Not to mention, Fission’s PLS project boasts a very low OPEX projection of US$9.74 per lb U3O8, giving it the potential to be one of the most cost-effective uranium operations in the world.

When analyzing how the market is valuing Fission Uranium’s resource, compared to a closer comparable in UEC, it’s clear to see that there’s a strong argument in place that Fission’s uranium is quite undervalued.

Moving beyond the market’s current valuations of the field, it’s the perfect time to delve into how Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) is potentially undervalued at this time, given the potential of its PLS Project and its economics and jurisdiction, as shown above.

Press Releases

- Fission Hires Environment And Regulatory Expert To Lead Environmental Assessment Process

- Fission Announces Tier 1 Economics For PLS With Feasibility Study

- Fission Signs Capacity Funding Agreement With Métis Nation – Saskatchewan

- Fission Signs Engagement And Capacity Agreement With Birch Narrows Dene Nation

Saskatchewan: World-Class Uranium District

Comprised of 17 mineral claims totaling 31,039 ha, Fission Uranium Corp.’s (TSX:FCU) (OTCQX:FCUUF) 100%-owned PLS Property is located on the southwest margin of the Athabasca Basin in Saskatchewan, the world’s 2nd most attractive jurisdiction for mining investment, according to the 2021 Fraser Institute survey.25

This marked the second year in a row Saskatchewan ranked in the Fraser Institute’s Top 3—a testament to the province’s strong mining industry and its commitment to fostering a supportive environment for mining companies.

Saskatchewan supplies almost a quarter of the world’s uranium for electrical generation,26 making it a significant global supplier. The region is arguably even more important when you consider that the number one supplier is Kazakhstan, which is adjacent to Russia and very much in Russia’s political orbit. Fission Uranium is well-positioned to capitalize on Canada’s advantages as a mining nation.

Strategically, Fission Uranium Corp.’s (TSX:FCU) (OTCQX:FCUUF) decision to set up shop in this top-tier uranium sector is advantageous. The Athabasca Basin is well-known for its well-established infrastructure, skilled labor force, and friendly local mining communities.

This makes it a prime spot for any future mining endeavors, facilitating the unimpeded and effective extraction of uranium ore.

Additionally, with its strict but clear permitting procedures, Saskatchewan makes it straightforward for companies like Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) to navigate the regulatory landscape and obtain the necessary approvals to proceed with the project.

The Triple R Advantage

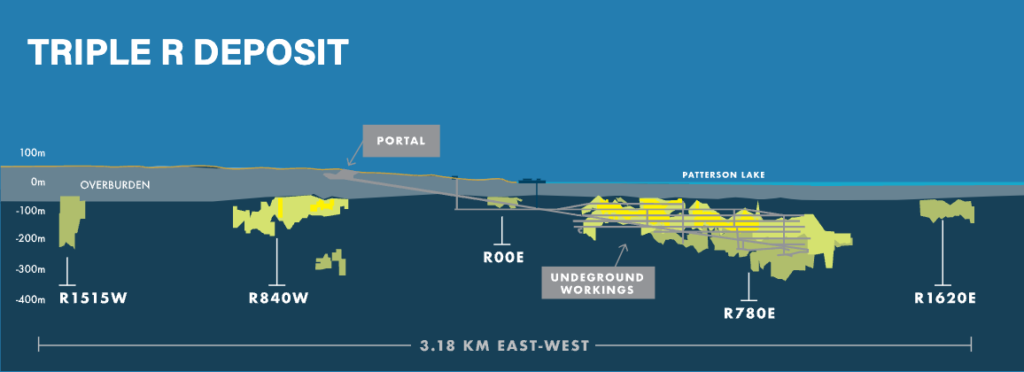

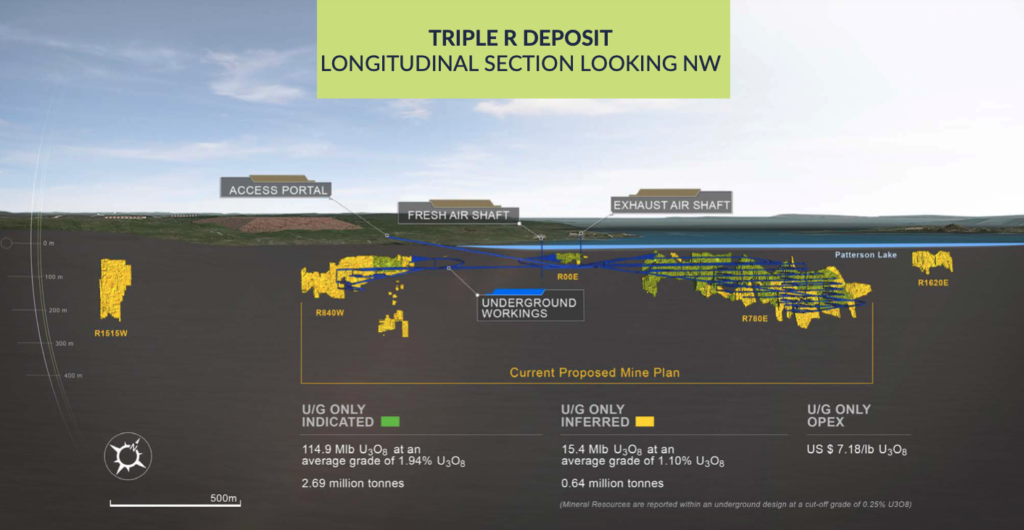

In the PLS project, Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) has secured the Athabasca Basin’s only shallow, large, high-grade, undeveloped deposit.

In fact, the PLS project boasts a grade of 10-20x the global average, making it one of the highest-grade uranium projects in the world—further enhanced by its shallow, more easily accessible depth.

Being so shallow – with significant, high-grade mineralization starting at just 50m from the surface, helps to minimize the environmental footprint and means a shorter construction time compared to the famously deep deposits in the region.

The deposit, which is a part of a 3.18 km mineralized trend at PLS, is not fully explored and remains open in several directions, with the potential to add to the resource estimate in all zones.

Attractive Economics: The PLS Project

Fission Uranium Corp.’s (TSX:FCU) (OTCQX:FCUUF) PLS Project has been thoroughly evaluated in a recent Feasibility Study (FS) that has further enhanced the PLS project’s robust economics and includes several key factors that make it an attractive investment opportunity.27

As mentioned, the PLS project boasts a very low projected OPEX cost of US$9.74 per lb U3O8, making it one of the most cost-effective uranium operations in the world. This low cost of operation is due to the high-grade ore and the efficient mining methods that will be used.

On top of that, the FS increased the after-tax NPV by 70% to $1.204B at 8% discount which clearly indicates the project’s long-term value. For those who may not know, the NPV is the single most important factor in the evaluation of any mining project.

The FS also revealed a higher after-tax IRR of 27.2%, a strong indicator of the project’s profitability.

“There are a couple of reasons why the economics are so strong. Obviously, uranium prices have risen in the last few years, but we’ve also added an additional large high-grade zone to the mine plan. And then on top of that, you have an incredible in-house team.” – Fission President and CEO Ross McElroy28

Click here to listen to the full podcast

Once greenlit, Fission Uranium Corp.’s (TSX:FCU) (OTCQX:FCUUF) PLS project is expected to come with an incredibly short construction of just three years with an estimated initial capital cost of $1.155 billion and a payback period of just 2.6 years—adding even more to the project’s economic attractiveness.

UPDATED: Larger Indicated Resource

For investors with Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) on their radar, the company’s updated, larger indicated resource provided added optimism for several reasons.

Firstly, the indicated resource size increase gave Fission Uranium a larger and more reliable estimate of the amount of uranium ore that can be extracted from its mining operations—Increasing its potential revenue and the potential mine life of the operation.

Firstly, the indicated resource size increase gave Fission Uranium a larger and more reliable estimate of the amount of uranium ore that can be extracted from its mining operations—Increasing its potential revenue and the potential mine life of the operation.

Secondly, the average grade of 1.94% U3O8 in the indicated resource is high—further reducing the mining cost and increasing the operation’s profitability.

These factors contribute to what makes the Feasibility Study stand out. The FS boasted average projected cash costs of US$9.74/lb U3O8, which are relatively low, meaning Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) can extract uranium at a relatively lower cost and be more competitive in the global market.

Additionally, the inferred resource of 0.64 Mt at an average grade of 1.10% U3O8 totaling 15.4 Mlb provides Fission Uranium additional potential resources to explore and extract, expanding its long-term growth prospects, which could include two high-grade zones – one on each side of the deposit – which are not yet part of the mine plan due to limited drilling on those zones.

Debt Free, With Cash in Hand

Following an announcement of a potential Canaccord-led C$50M ATM financing facility29 in April 2022, Fission Uranium Corp.’s (TSX:FCU) (OTCQX:FCUUF) found itself in the enviable position of being totally debt free, with +C$40M cash in hand30 to set off on the next phases of its project’s development following the Feasibility Study.

While finding uranium and developing it has been Fission Uranium’s management team’s forté over their careers, it’s also important to see how successful the team has been in raising the funds necessary to get through each of the hoops to get the PLS Project up to this point.

In the company’s history, Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) has also successfully brought in multiple 8-digit deals, including:

- C$82.2M deal with CGN Mining in 201531

- C$15M private placement in 202032

- C$30M bought deal public offering in 202133

Expert Leadership Team

Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) is built upon the foundation of a team of respected, award-winning mining experts. This is a team that has played significant roles of at least four major uranium discoveries, and leading uranium mining operations. Among the talented Fission Uranium roster, includes:

RECAP: 8 Reasons

to Seriously Look Into Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF)

1

Greatly Strengthened Uranium Sector

2

Uranium Shortage Approaching

3

World Class Uranium District

4

Updated, Larger Indicated Resource

5

Clear Development Path and Robust Economics

6

Social and Environmental Responsibilities

7

Expert Team with Deep Knowledge of Uranium Project

8

Timing Advantage

After considering the data presented in this report, the uranium space is clearly preparing for a nuclear-driven bull market.

This is an ideal time to follow the ongoing Fission Uranium Corp. (TSX:FCU) (OTCQX:FCUUF) story—because with an upgraded resource, and a recently completed Feasibility Study, the company’s PLS project is turning heads with its high-grade, shallow-depth resource that’s primed and ready for major development towards potential production in the not-so-distant future.

So, do your due diligence, and don’t forget to subscribe for email updates and make sure you don’t miss out on any of Fission Uranium’s news and milestones.