For 150 years, brine leftover from oil and gas drilling was a major headache for producers.

But things are changing really fast.

Now, thanks to the electric vehicle (EV) boom, oil giants are looking to turn millions of barrels of salty water into wealth.

The latest titan to make waves in the lithium market is ExxonMobil, announcing plans to produce lithium for EVs as early as 2027.1

The news comes just six months after ExxonMobil paid $100 million to exploration company, Galvanic Energy, for its 120,000-acre property.2 Exxon aims to supply lithium for 1 million EVs annually by 2023 and is already in talks with Tesla, VW and Ford in an effort to secure buyers amid the EV boom.3

Oil giants Chevron, Occidental Petroleum and SLB are all considering or actively exploring opportunities for lithium.

This change in sentiment is happening at a time when lithium demand is expected to surge by over 40 times by 2040.4

Currently, the majority of lithium supply is mined from hard rock deposits and salt flats. Recovering lithium brine is generally a straightforward yet time-consuming procedure, often spanning several months to a few years for full completion, but a relatively new method called direct lithium extraction (DLE) could bridge the supply and demand gap a lot faster since it only takes a matter of hours!

There’s a reason why Goldman Sachs is calling DLE a “game-changing technology” that could accelerate lithium extraction and increase recovery rates.

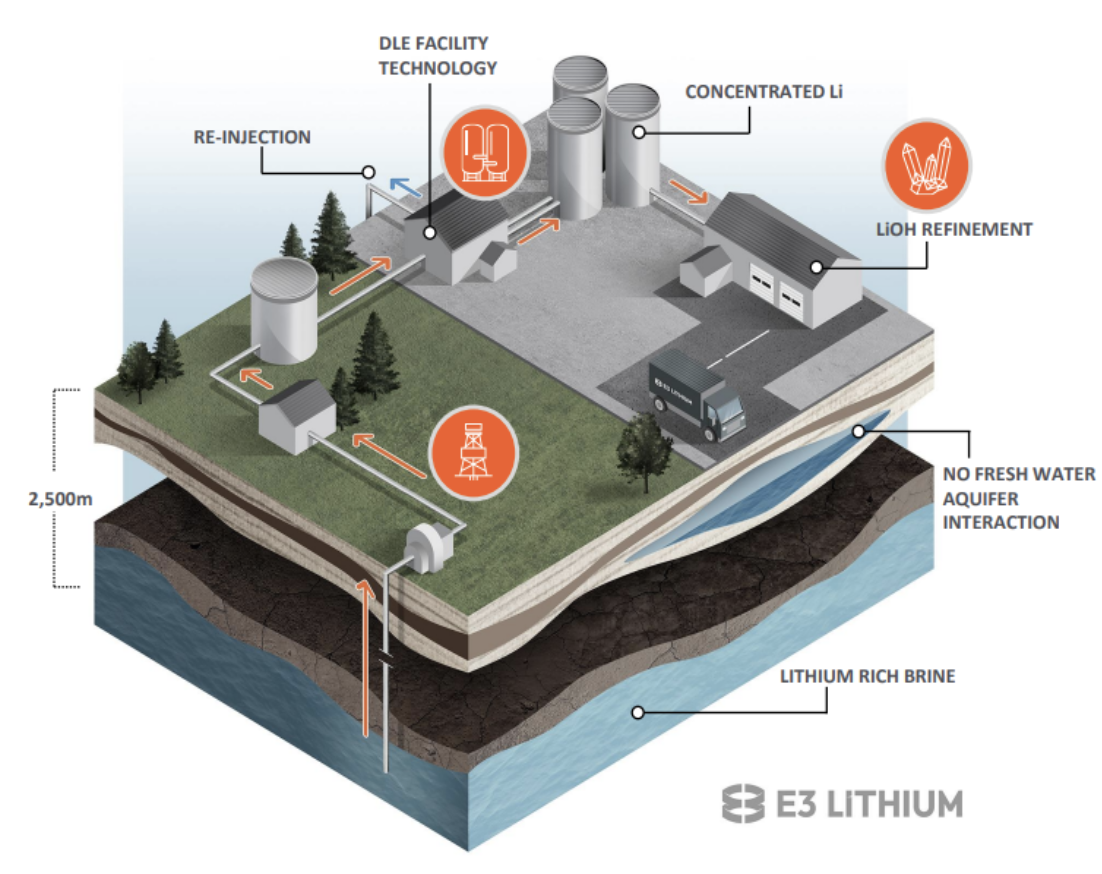

At the forefront of this revolutionary technology is E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3), Alberta’s leading lithium developer and extraction technology innovator.

The company just revealed it has successfully produced battery-quality lithium hydroxide monohydrate (LHM) with a purity level of 99.78%.

With the management team’s track record of success and proven ability to fund and execute on its plans, E3 Lithium is quickly becoming a lithium powerhouse..

It’s no wonder the Government of Canada is investing huge into this company.

Click Here to Watch E3 Lithium CEO on Canada’s $27 million investment

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has had an epic 2023, knocking down milestone after milestone on its path to commercialization.

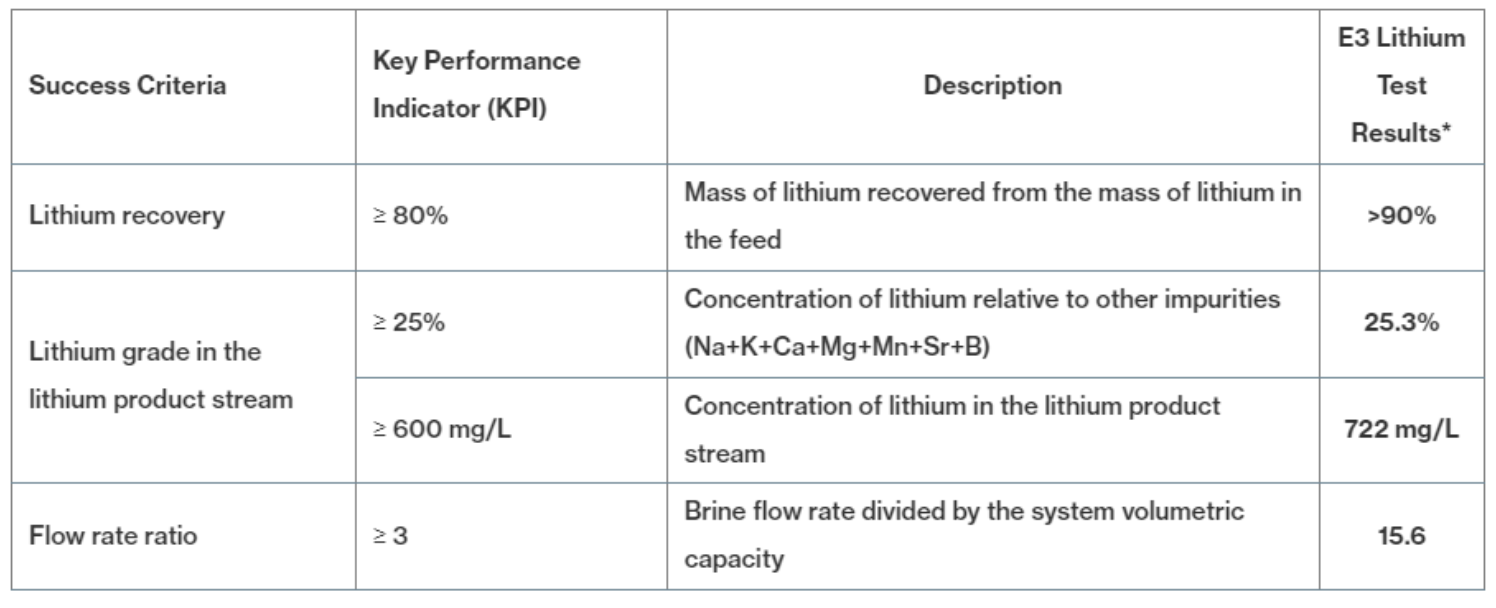

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) achieved some outstanding results from Field Pilot Plant testing for Direct Lithium Extraction (DLE) technology, reporting impressive results that far exceeded expectations.

E3 Lithium‘s DLE technology surpassed expectations, achieving a lithium recovery rate of over 90%, well above the target of 80%, and a high-purity lithium concentration of 722 mg/L against the anticipated 600 mg/L. The system also achieved an utterly impressive flow rate ratio of 15.6, quintupling its Key Performance Indicator (KPI).

Basically, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has proven DLE technology can produce high-grade lithium with impressive purity and efficiency, paving the way for lithium extraction and production.5

Imagine a future where our thirst for energy meets a supply that’s not only abundant but also economically harvested. That’s the promise E3 Lithium‘s cutting-edge DLE technology is bringing to the table.

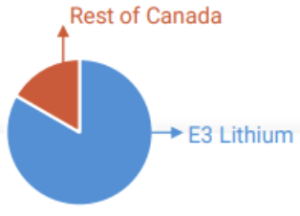

E3 Lithium also upgraded its Alberta-based lithium resource to an impressive 16.0 million tonnes (Mt) of Measured and Indicated (M&I) lithium carbonate equivalent (LCE).

Not only is this the largest M&I lithium resource in all of Canada,6 it is 5X more than Canada’s next largest M&I resource.

Not only is this the largest M&I lithium resource in all of Canada,6 it is 5X more than Canada’s next largest M&I resource.

Not to mention the project’s equally impressive economics as per the Preliminary Economic Assessment (more on that later).

This company This company is clearly a game-changer that simply cannot go unnoticed.

Now let’s break down the numerous reasons E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is poised to be a key player in the coming lithium shortage crisis.

8 Reasons

To Invest in E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) may be a Lithium Production Game Changer

1 Lithium Market is Booming: Thanks to surging demand for EVs and lithium-ion batteries for tech, the world is scrambling for lithium supply, with structural shortages in the lithium market for years to come.

2 Major Inflection Point Reached: E3 Lithium successfully produced 99.78% pure battery quality Lithium Hydroxide Monohydrate (LHM).

3 Flagship Asset with Globally Significant Resource: With 16 million tonnes of Measured and Indicated (M&I) LCE on the books, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has the largest M&I LCE resource in Canada. This only entails about 70% of the company’s entire permit area.

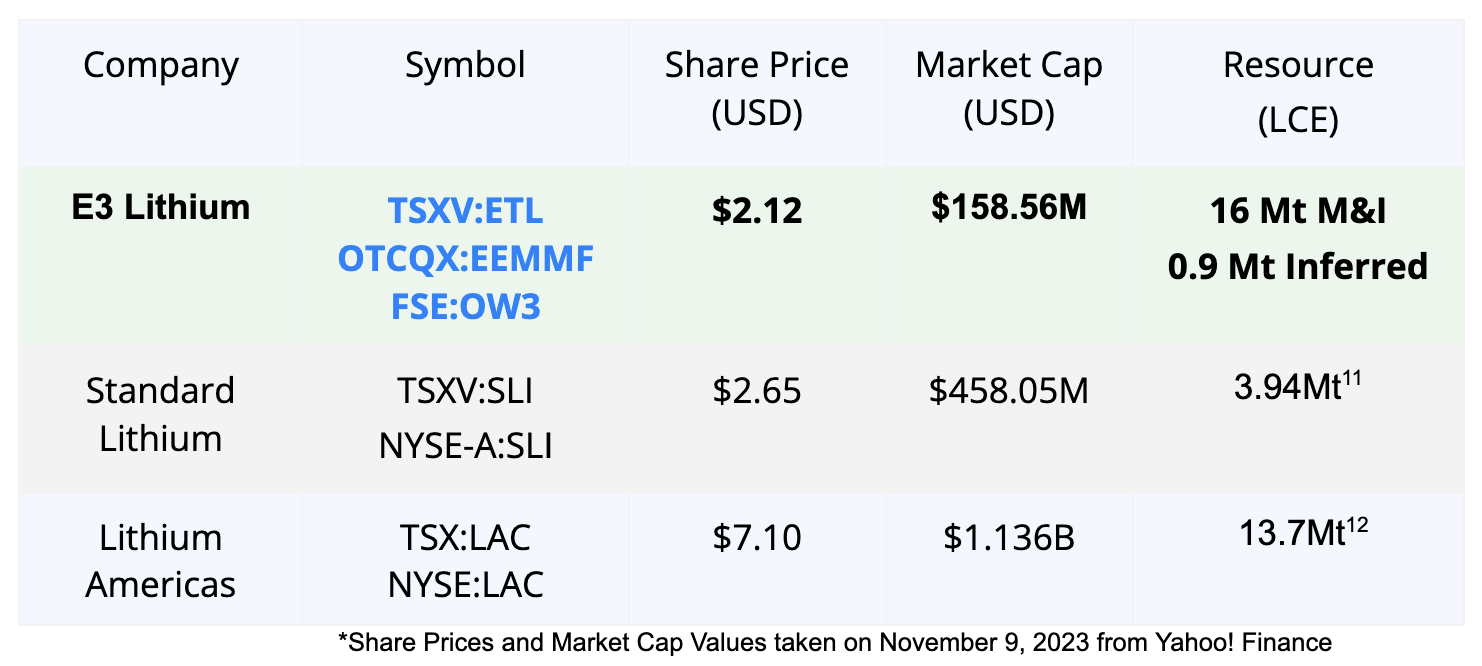

4 Very Attractive Economics: The project outlines a US$1.1B NPV (8%), for just the first phase of production of 20,000 tonnes of lithium hydroxide annually over the first 20 years, according to ETL’s PEA.7

5 Proprietary, ESG-Friendly Technology: 100% brine aquifer reinjection and a small land footprint makes the company’s DLE technology a potential monumental game changer in the lithium space.

6 Well-Funded: E3 Lithium has received over C$30 million in non-dilutive investments from the Government of Canada.8,9 The company has also raised approximately C$29 million in the capital markets in 2023 alone.

7 World-Class Jurisdiction: Within industry-friendly Alberta, E3 Lithium is capitalizing on the famous “Alberta Advantage”, with over 600,000 hectares of brine permits in an area where 4,000 oil and gas wells have already been drilled to date.10

8 Strong Leadership Team: Proven management team with over 150 years of combined experience in emerging technologies, finance, mining, petroleum and unconventional resource plays, including Peter Ratzlaff, who has over 30 years of experience in engineering and production/operations at companies like ConocoPhillips and Independent director Kevin Stashin, an oil and gas executive with over 40 years of experience and companies like Devon Canada Corp, Anderson Exploration, and Petro-Canada.

In the News

- ‘Game-Changing’ Tech Could Disrupt Lithium Extraction Market – StreetWise Reports

- Exxon aims to become a top lithium producer for electric vehicles with Arkansas drill operation – CNBC

- E3 to Test Whether it Can Get Lithium From Abandoned Oil Fields in First for Canada – Financial Post Speaks to E3 Lithium’s Progression

- Lithium Players Race for Breakthrough to Meet Electric Car Demand – Another Bloomberg Feature for E3 Lithium

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is Targeting Commercial Production by 2026

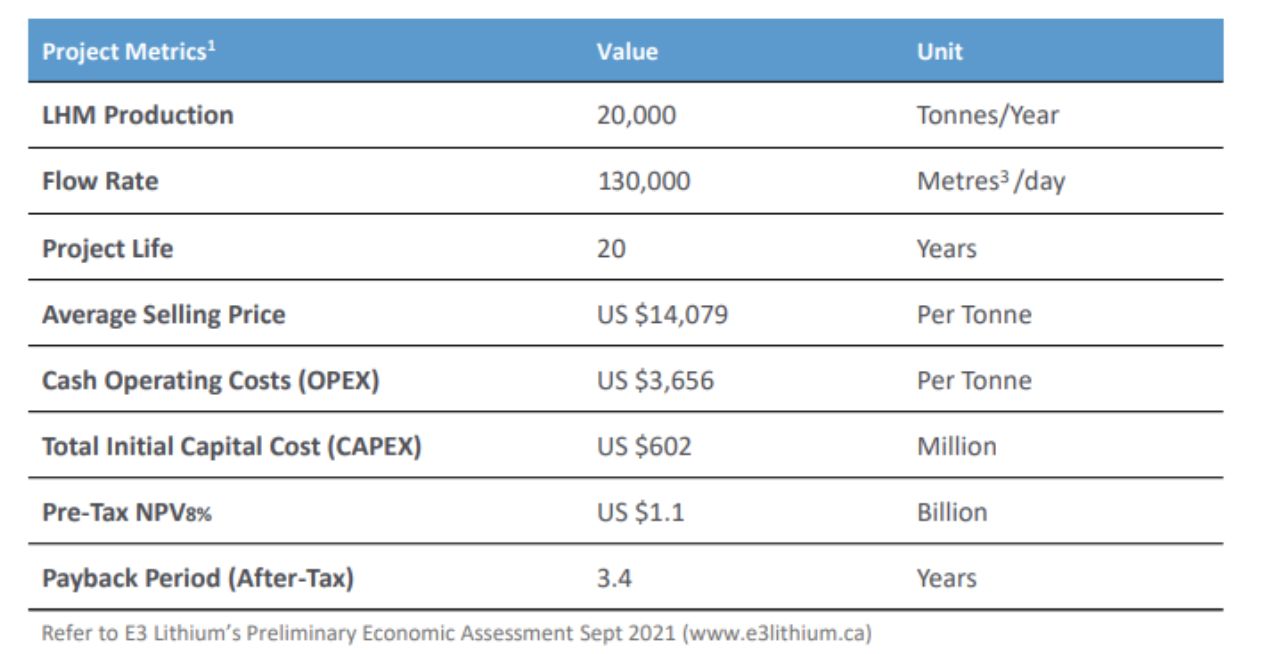

Unlike conventional lithium producers like Albemarle and Lithium Americas, who produce from evaporation ponds and/or hard rock mining, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has a unique strategy to succeed.

E3 Lithium has outlined a Preliminary Economic Assessment (PEA) from third-party experts, revealing that its proprietary DLE ion-exchange technology, large resource, and favorable jurisdiction are ideal for lithium development.

E3 Lithium has a clean share structure and is well-funded after receiving more than C$30 million in grants from the Government of Canada13 and raising more than C$29 million in the capital markets in 2023.

Canada’s second-largest integrated oil company Imperial Oil has also invested $6.35 million into the company to advance its pilot project in Alberta’s historic Leduc oilfield.

During the company’s recent Investor Day 2023 presentation, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) CEO Chris Doornbos and CFO Raymond Chow spoke about the company’s access to capital and how non-dilutive funding from the government opens the doors to Alberta’s untapped market.17

Globally Significant Lithium Resource In Energy-Friendly Alberta

As mentioned, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) just upgraded its mineral resource to 16 Mt Measured & Indicated (M&I), which includes 6.6 Mt of LCE Measured and 9.4 Mt of LCE Indicated, making it the largest M&I lithium resource in Canada.

The project economics are also very attractive. According to the Preliminary Economic Assessment (PEA) on the Clearwater Lithium Project, it has an NPV 8% of US$1.1 billion with a 32% IRR before taxes and US$820 million with a 27% IRR after taxes.

Now that the resource has been upgraded, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) will focus on completing a Pre-Feasibility Study (PFS) by the end of the year, which will outline the detailed plans for its first commercial facility and one of the world’s first DLE reserves.

Following the completion of the PFS, E3 Lithium plans to conduct a Feasibility Study (FS), obtain all necessary regulatory approvals and deliver a project finance arrangement to enable the construction of its first commercial facility in Alberta.

Press Releases

- E3 Lithium’s Collaborations with Two Universities Receive Federal NSERC Funding

- E3 Lithium Receives Final Alberta Innovates Payment, Successfully Completing Its $1.8M Grant

- E3 Lithium Announces Expansion Of Team And Presentations At Upcoming Conferences

- E3 Lithium Welcomes Former Alberta Energy Minister, Hon. Sonya Savage, to its Board of Directors

- Find E3 Lithium at PDAC 2024; Booth 2944 in the Investors Exchange and Presentation on March 5

Next-Generation Lithium Production Technology

Beyond the globally-significant lithium resource, one of E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) most promising assets is its DLE Technology, which utilizes a proprietary sorbent designed to be highly selective towards lithium ions.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has made massive strides at its DLE extraction pilot plant in the Clearwater Project Area, with promising results.19

The company announced the completion of its field pilot test on November 7, proving its ability to unlock the value of E3 Lithium‘s lithium resources and significantly de-risk the commercial design.

E3 Lithium‘s Direct Lithium Extraction (DLE) technology surpassed expectations, achieving a lithium recovery rate of over 90%, well above the success criterion of 80%. This means that more than 90% of the lithium present in the feed was successfully extracted.

When it comes to purity, the lithium concentration in the product stream has reached 25.3%, nudging past its 25% purity goal. The lithium concentration measured at an impressive 722 mg/L, surpassing the 600 mg/L benchmark, indicating a robust yield in the lithium product stream.

The real game-changer, though, is the astounding flow rate ratio of 15.6. To put that in perspective, E3 Lithium’s DLE system is processing brine at rates over five times the KPI metric expected.

This isn’t just good news; it’s a revolutionary stride that positions E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) as a future titan in the realm of energy innovation.

On October 31, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) produced 99.78% pure battery quality Lithium Hydroxide Monohydrate (LHM).

E3 Lithium is forging partnerships with top-tier equipment vendors to perfect the advanced refining processes required for a full-scale commercial operation.

The company’s objective is clear: to establish themselves as a key supplier within the battery industry, providing materials that meet stringent industry quality specifications using conventional equipment. This focus on innovation and adherence to industry standards marks a thrilling leap forward.

Committed to this vision, E3 Lithium‘s engineering teams are diligently progressing with the necessary refining phases, ensuring that these developments align with the overarching goals of their Clearwater Project’s Pre-Feasibility Study.

To top it off, E3 Lithium has enlisted industry powerhouse Fluor to lead the Pre-Feasibility Study (PFS) for the commercial project.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) partnered up with Pure Lithium to create its first successful lithium metal battery using lithium from its resources to demonstrate the proof of concept. Now they are completing a series of testing to define how their technologies can be combined to produce a commercially-viable production process for lithium metal batteries and electrodes.

Strong Leadership Team

It takes more than just a friendly business jurisdiction to make something like this work. Thankfully, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) is in VERY capable hands.

8 Reasons

To Seriously Look Into E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3)

1 Surge in Lithium Demand: The lithium market is experiencing a remarkable boom, fueled by the exponential growth in electric vehicles (EVs) and the widespread use of lithium-ion batteries in technology. This surge has sparked a global rush for lithium, leading to a sustained structural shortage that’s expected to persist for years.

2 E3 Lithium Hits Production Milestone: E3 Lithium has achieved a critical milestone with the creation of 99.78% pure battery-grade Lithium Hydroxide Monohydrate (LHM).

3 Canada’s Largest Lithium Resource: Boasting 16 million tonnes of Measured and Indicated (M&I) Lithium Carbonate Equivalent (LCE), E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) commands Canada’s most substantial M&I LCE resource, which represents only a portion (around 70%) of the company’s total permitted area.

4 PPromising Economic Projections: The projected numbers are striking, with a PEA suggesting a Net Present Value (NPV) of US$1.1 billion at an 8% discount rate. This is based on just the initial phase of annual production, which aims to deliver 20,000 tonnes of lithium hydroxide over the first two decades.

5 Innovative and Sustainable Technology: E3 Lithium‘s process, which proposes 100% reinjection of brine back into the aquifer and maintains a minimal land footprint, positions the company as a potential industry disruptor, aligning with Environmental, Social, and Governance (ESG) principles.

6 Robust Financial Backing: With over C$30 million in non-dilutive funding secured from the Government of Canada and an approximate C$29 million raised in the capital markets in 2023, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) stands on a solid financial foundation.

7 Optimal Operating Environment: E3 Lithium is leveraging the “Alberta Advantage” within the industry-supportive province, operating over 600,000 hectares of brine permits in a region already punctuated by 4,000 oil and gas wells, setting the stage for a world-class lithium production jurisdiction.

8 Strong Leadership Team: E3 Lithium‘s management team has over 150 years of combined experience in emerging technologies, finance, mining, petroleum, and unconventional resource plays at companies like ConocoPhillips, Devon Canada Corp, Anderson Exploration, and Petro-Canada.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) has made major strides in its path to full commercialization and is poised to make a significant impact in the lithium market, with its large land portfolio, globally-significant resource, and potentially industry-changing DLE technology, making this an ideal time for investors to follow this story.

So, make sure you don’t miss out on any of E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) (FSE:OW3) news and milestones by clicking here to sign up for the company’s newsletter.

Chris Doornbos P. GeoPresident, CEO and Director

Chris Doornbos P. GeoPresident, CEO and Director Raymond Cho, CPA, CACFO

Raymond Cho, CPA, CACFO Kevin Carroll, P.EngCDO

Kevin Carroll, P.EngCDO Leigh Clarke, LL.BVP Corporate Development

Leigh Clarke, LL.BVP Corporate Development Peter Ratzlaff P.EngVP, Resource Development

Peter Ratzlaff P.EngVP, Resource Development Brian Ceelen, P.EngDirector, Commercial Development

Brian Ceelen, P.EngDirector, Commercial Development Caroline Mussbacher, B.Sc, P.EngDirector, DLE Commercialization

Caroline Mussbacher, B.Sc, P.EngDirector, DLE Commercialization Robin Boschman, MBADirector, External Relations

Robin Boschman, MBADirector, External Relations