The uranium bull market is officially in full effect.

Uranium prices are up 2.4X over the past 3 years and have jumped over 49% since January 1, 2023 to highs not seen in 12 years.1

Just one of the long-term drivers behind the boom is what The Financial Times calls the “global renaissance in nuclear power“.2

Uranium demand is surging from nations ramping up nuclear power capacity to meet zero-carbon targets. That even includes longtime nuclear opponents that have recently flipped to being pro-nuclear power, like Finland…which sparked Spain, Belgium, Sweden, and others to follow.3

Demand for uranium from nuclear reactors is now projected to grow by 28% by 2030 and nearly double by 20404 when global nuclear capacity jumps by 76%.5

But then there are supply issues.

Uranium’s 10-year bear market resulted in under investment in mining projects, with global uranium production dropping by 25% from 2016 to 2020.6

And since the invasion of Ukraine, countries are dumping Russia as their uranium supplier and turning to politically stable regions for supply. That includes Ukraine. They signed a 12-year supply deal in early 2023 with the world’s largest uranium producer, Canada’s Cameco Corporation (Market Cap: $17.72B).7

The Cameco deal is great news for surrounding companies in Canada’s world-class Athabasca Basin uranium jurisdiction, especially junior miners with lots of upside potential, like Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU)…more on that in a moment.

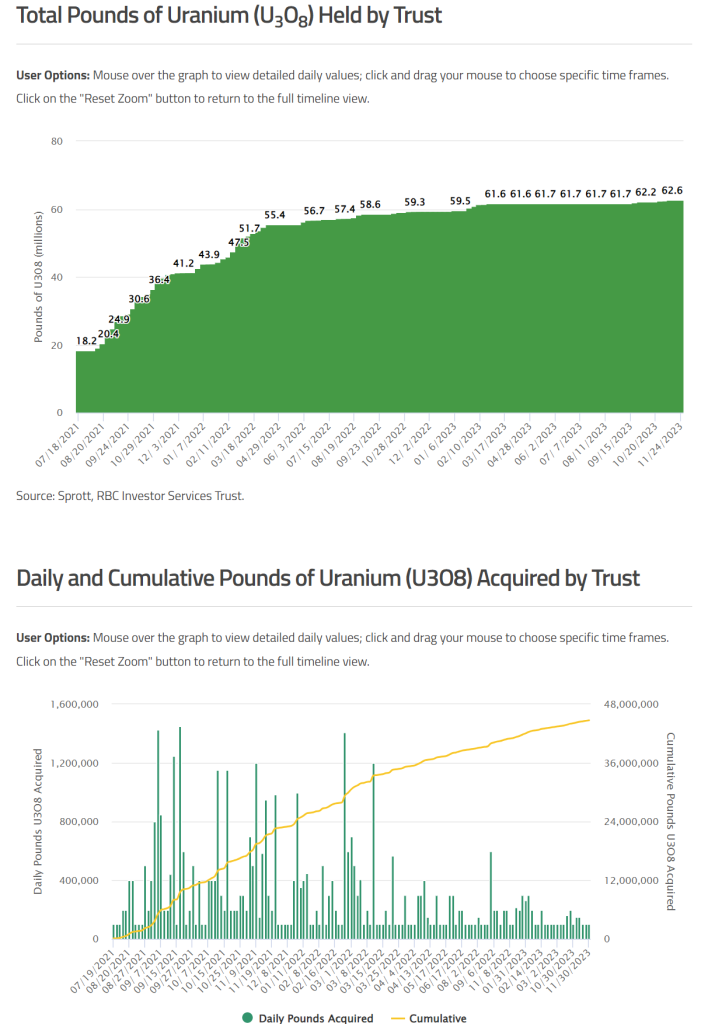

Supplies are also getting squeezed from strategic stockpiling. In particular, Sprott Physical Uranium Trust is on a buying spree that has more than doubled their uranium holdings in the last 2 years8 and shows no sign of slowing.

There are still more reasons uranium prices are expected to keep climbing:

-

-

- Nuclear power is looking even more attractive due to rising natural gas prices (24% YoY increase expected for 2024).9

- The world’s 2 largest uranium producers – Cameco and Kazatomprom – are currently sold out until 2027. 10

- Cameco recently announced 2.7 million pounds of cuts to uranium production for 2023.11

-

When you add it all up, uranium miners have the most to gain, especially when their stock price has a lot of room for growth, like Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Proven Discoverers in a Proven Region

Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU), which just began trading on the OTCQB Market this August12 and on the TSX Venture Exchange in October13, has an exceptional backstory.

Their team has an almost unmatched track record of major discoveries in Canada’s prolific Athabasca Basin over the past 15 years, at both the technical and corporate level.

That includes extensive involvement with the likes of IsoEnergy (Market Cap: $301.31M), Denison Mines (Market Cap: $1.40B), and NexGen Energy (Market Cap: $2.97B).

Cosa’s Chairman, Steve Blower, was VP Exploration of IsoEnergy when they discovered their Hurricane Deposit in 2018 (Indicated Mineral Resources: 48.61M lbs uranium).14 Then in 2021 he helped 92 Energy discover their GMZ zone.15

Now he’s looking to make the next big uranium discovery, so he’s reassembled former IsoEnergy all-stars to create the team at Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU).

That includes Keith Bodnarchuk as President & CEO. During his time at IsoEnergy managing corporate development, their stock rose from ~$0.30 to $6.00.

Andy Carmichael, VP of Exploration, meanwhile, was VP of Exploration at IsoEnergy when they announced their initial resource in 2022, with the highest grade indicated resource in the history of the Athabasca Basin at 34.5% uranium.

Now that team has assembled Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) massive land package (>160,000 hectares; >395,368 acres), offering a steady pipeline of high-upside projects that are 100% owned. Better yet, they’re right in the heart of the Athabasca Basin and Saskatchewan’s nearly $1-billion-a-year uranium industry that made Canada the world’s second-largest producer in 2022.16

This is a team that’s raised over $700 million in capital since 2017, including Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) C$5 million private placement in June 2023 that was largely taken down by uranium funds.17 That means the Company is easily funded for their upcoming winter drill program and into 2024.

Their timing couldn’t be better. With uranium at the beginning of a long-term bull market, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) is a fresh new uranium exploration story led by a team of pros with a proven ability to find uranium, and that know how to generate significant value for shareholders.

9 Reasons

Cosa Resources Could be the Next Breakout Uranium Stock

1

Hot Market Outlook: Prices expected to continue climbing due to long-term zero-carbon goals driving surging demand and supply being squeezed for the foreseeable future

2

Track Record of Discovery: Technical and corporate contributions by Steve Blower, Keith Bodnarchuk and Andy Carmichael, all formerly with IsoEnergy, toward major Athabasca Basin discoveries

3

Premium Land Package: Pipeline of 100% owned high-upside projects in Athabasca Basin near industry leaders like Cameco (TSX: CCO | Market Cap: $17.72B)

4

Under-Explored Holdings: Past work has only explored a fraction of their massive land portfolio while modern technologies offer a new lens on exploration

5

Strategic Relationships: Access to capital due to past industry successes and raising over $700 million since 2017

6

Fully Funded: ~C$5 million in cash is more than enough for upcoming winter drill program and advancing projects into 2024

7

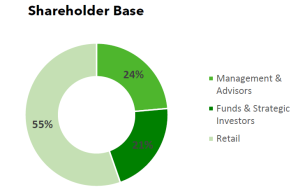

Reassuring Ownership: High ownership by management and advisors (~24%) and funds and strategic investors (~21%) is a major vote of confidence for investors to note

8

Near-Term Catalysts: Q4 2023/Q1 2024 announcements pending on initial exploration results from upcoming work

9

Significant Upside Potential: Low stock price has room to increase through uranium discovery success and further land acquisitions

Press Releases

- Cosa Acquires The Aurora Uranium Project, Athabasca Basin, Saskatchewan

- Cosa Receives Exploration Permits for the Ursa Uranium Project in the Athabasca Basin, Saskatchewan

- Cosa Resources Announces Results Of Airborne Geophysics At The 100% Owned Ursa And Orion Uranium Projects In The Athabasca Basin, Saskatchewan

- Cosa Resources Announces Acquisition Of Solstice Uranium Exploration Property In The Athabasca Basin Region, Saskatchewan

- Cosa Resources To Commence Trading On The TSX Venture Exchange Under The Ticker Symbol “COSA”

Long-Term Uranium Demand & Squeeze

Nuclear energy already generates 10% of the world’s electricity.18 But net-zero goals and the global nuclear renaissance are expanding the nuclear sector further than ever.

Current global investment in nuclear power includes both extending lifetimes of existing plants and building new reactors and Small Modular Reactors (SMRs) that are easier and cheaper to build. In turn, demand for uranium in nuclear reactors is expected to nearly double by 2040.19

Add to that the supply squeeze caused by physical investment. Sprott Physical Uranium Trust (TSX: U.UN) (OTC: SRUUF) is the world’s largest and only publicly-listed physical uranium fund. They’ve more than doubled their uranium holdings in the last 2 years to reach nearly 62.6 million pounds20 with with a Total Net Asset Value of $5.119 billion.21

But don’t expect Sprott to slow down any time soon. Their CEO, John Ciampaglia, thinks this uranium bull market will last several more years.22

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Canada’s & Cosa’s Answer to Growing Demand & Supply Constraints

Canada’s response is Saskatchewan, where all of the nation’s uranium is produced.23

It’s also home to the Athabasca Basin, the world’s most prolific area for uranium exploration, with the world’s highest-grade deposits.

The basin includes the world’s 2 highest-grade uranium mines, both operated by Cameco (TSX: CCO):

-

-

- McArthur River – the world’s largest high-grade uranium deposit24: Produced 535M lbs uranium to date; Proven and Probable Reserves of 275M lbs U3O8 (Cameco’s share)25

- Cigar Lake Mine: Produced 105M lbs uranium to date; Proven and Probable Reserves of 84.4M lbs U3O8 (Cameco’s share)26

-

The Athabasca Basin is also where Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) land portfolio is located.

When you combine their ideally-located land portfolio, proven team and lower share price, it’s understandable how Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) stock has outperformed year-to-date compared to their neighbors in the Athabasca Basin despite them all having the advantage of established Resource Estimates:

-

-

- Cosa Resources: up 82%

- Cameco: up 67%

- Uranium Energy Corp: up 51%

- NexGen Energy: up 41%

- Denison Mines: up 36%

- IsoEnergy: up 29%

-

It makes you wonder what Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) stock will do when they release their first exploration findings shortly and then move on to ground-based exploration.

The Next Logical Trend in the Athabasca Basin

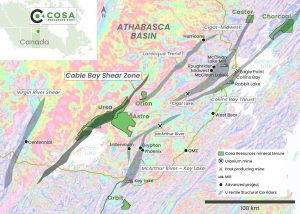

The map below shows how Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) has locked up 100% ownership of 10 uranium exploration properties in the prolific Athabasca Basin region totaling over 160,000 hectares (>395,368 acres).

The map also shows the pattern of the region’s high-grade uranium discoveries: the long northeast-trending uranium corridors down the eastern side of the basin.

The eastern side contains all the current producing mines, including Cigar Lake and MacArthur River, and a tremendous amount of infrastructure and access. But it’s also extensively explored, making it less likely for anyone to discover the next elephant-sized deposit.

That’s why Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) strategically acquired projects in the next logical place to go: the Cable Bay Shear Zone (as seen in the map below).

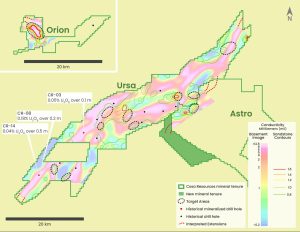

Cosa’s team of experts views the Cable Bay Shear Zone as potentially the last great northeastern trend in the basin without a significant discovery. It’s also the most underexplored, with only 15 holes drilled on Cosa’s Ursa project due to the limited budgets of past explorers. But some of those holes intersected uranium with some structure, which is a sign that it’s a fertile trend, considering its size.

In short, it’s a highly prospective and significantly underexplored analogue to past and currently producing uranium corridors in the eastern Athabasca Basin.

Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) gained control over 60 km (37 miles) of the Cable Bay Shear Zone by piecing together their flagship Ursa Project. Ursa is 45 km (28 miles) west of the McArthur River uranium mine and covers an area roughly the equivalent of Cigar Lake down to McArthur River.

Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) completed airborne geophysics (MobileMT) on their Ursa Project in Q3 2023. The company released news on November 1st and emphasized that several high-priority target areas have been identified, none of which have been tested by historical drilling.

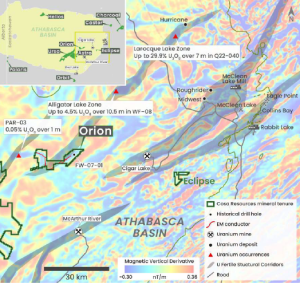

At the same time, the Company is also advancing its Orion Project, which they believe to be a continuation of the Larocque trend (home to the Hurricane deposit) extending down from the northeast (as seen in the map below).

Orion is 45 km (28 miles) from McArthur River and 29 km (18 miles) from Cigar Lake uranium mine. It also covers an interpreted extension of the uranium corridor where IsoEnergy discovered their high-grade Hurricane Deposit in 2018 (Indicated Mineral Resources of 48.61M lbs uranium).32

As with their Ursa Project, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) completed airborne geophysics (MobileMT) on Orion and has identified a very exciting target area.

Pipeline of Value-Adding Projects

During their time at IsoEnergy, the Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) team noted that the Hurricane discovery didn’t come from one of IsoEnergy’s first few projects.

That’s why today, the team is keeping a pipeline of exploration projects for Cosa while systematically gaining control of the land around their top projects.

In addition to their Eclipse and Polaris projects, the Company’s other 100% owned projects include:

- Astro: Continuation of many of the trends associated with Ursa.

- Helios: A long trend of the Wares uranium occurrence and contains a portion of the large scale Grease River Shear Zone.

- Orbit: Represents a long trend of structure and alteration that are key components of a uranium deposit.

- Charcoal & Castor: Represent prominent magnetic low anomalies that extend northeast from, or parallel to, those that host the Eagle Point Mine.

That means Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) has a total of 10 projects, each with the potential to deliver the Athabasca Basin’s next big uranium discovery.

Advanced Technology & Upcoming Exploration Plans

The holes drilled on Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) Ursa property were sunk before today’s modern geophysics technologies were available. As a result, a lot of those holes missed their intended conductive targets.

To avoid repeating that mistake, the Company leveraged airborne MobileMT electromagnetic (EM) technology over its Ursa and Orion projects to take advantage of its deep earth imaging capabilities.33

With MobileMT, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) can see deeper anomalies that indirectly point to target areas for uranium deposits similar to Cigar Lake, MacArthur River or Hurricane, as well as sandstone hosted anomalies which may be related to hydrothermal alteration systems.

The Company’s next steps for actively moving forward their flagship Ursa Project include ground geophysics in Q4 2023 to refine their understanding ahead of a drill campaign that’s planned for early 2024.

Plans to advance their other projects in 2024 include airborne MobileMT EM surveys for Helios, Astro and Orbit, and gravity surveys for Castor and Charcoal to prioritize drill targets.

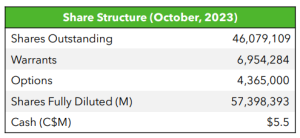

Robust Capital Structure with Substantial Insider and Strategic Investor Ownership

Cosa Resources (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) is well capitalized (C$5M in cash) and has a very tight share structure.

It also offers assurance to investors in the form of management and advisors having significant skin in the game (~24% of ownership) and funds and strategic investors recognizing the value and potential of the Company’s team and projects (~21% of ownership).

Track Record of Value Creation

As we’ve already seen, Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) leadership team has made significant technical and corporate contributions toward building successful mining companies and making major uranium discoveries in the Athabasca Basin.

Here’s more about the achievements of the team’s top members.

9 Reasons

Cosa Resources Could be the Next Breakout Uranium Stock

1

Hot Market Outlook: Prices expected to keep climbing and supply to remain squeezed

2

Track Record of Discovery: Contributions by Steve Blower, Keith Bodnarchuk and Andy Carmichael, all formerly with IsoEnergy, toward major Athabasca Basin discoveries

3

Premium Land Package: High-upside projects in Athabasca Basin near industry leaders like Cameco (TSX: CCO | Market Cap: $17.72B)

4

Under-Explored Holdings: Limited historic exploration without the benefits of modern technologies

5

Strategic Relationships: Access to capital due to past successes and raising >$700 million since 2017

6

Fully Funded: ~C$5 million in cash for upcoming winter drill program and advancing projects into mid-2024

7

Reassuring Ownership: High ownership by management and advisors (~24%) and funds and strategic investors (~21%)

8

Near-Term Catalysts: Q4 2023 announcements on exploration results from top 2 uranium projects

9

Significant Upside Potential: Low stock price has room to increase through uranium discovery success and further land acquisitions

With the new uranium bull market just getting started, it’s an exciting time for Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) and its shareholders. Keep a close eye on the Company’s stock as the market starts to learn more about this relatively new story with its best-in-class team, ideally located land package, and upcoming exploration results.

To stay on top of Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) (FRA:SSKU) upcoming news and updates, subscribe here.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Craig ParryAdvisor

Craig ParryAdvisor Keith BodnarchukPresident & CEO, Director

Keith BodnarchukPresident & CEO, Director Steve BlowerChairman

Steve BlowerChairman Justin RodkoCorporate Development Manager

Justin RodkoCorporate Development Manager Andy CarmichaelVice President of Exploration

Andy CarmichaelVice President of Exploration