Something monumental is happening right now.

An energy revolution is underway, and it’s reshaping how we power the world.

Forget solar and wind.

This is about nuclear power, the unsung hero of our clean energy future.

For years, uranium prices dwindled and global uranium production declined by 25%1 as the market struggled through a decade-long slump.

That slump is over. In early 2024,2 uranium prices hit $106 per pound—a 17-year high—and despite a recent correction, they’re still at levels not seen in over a decade.

Why?

Global demand for nuclear power is exploding.

Countries like Japan are ramping up nuclear energy production, aiming for a 20% increase by 2040. Across Asia, nations are fast-tracking new nuclear projects to meet skyrocketing energy needs.

And it’s not just governments taking notice.

Tech giants,3 investment banks, and hedge funds4 are all jumping on the nuclear bandwagon, securing power supplies and investing in uranium stocks.5

According to Mark Zuckerberg, energy constraints could be the biggest bottleneck for AI advancements, positioning nuclear energy as a clear solution.6

Meanwhile, supply is tight and the uranium bull market is about to kick into overdrive in 2025 on the back of the US ban on Russian uranium imports.7

This is where the opportunity lies.

Uranium Energy Corp (UEC) Executive VP Scott Melbye expects three-digit uranium prices to return in 2025.8

And according to Sprott Asset Management CEO John Ciampaglia, Uranium miners are well-positioned to benefit from growing demand.

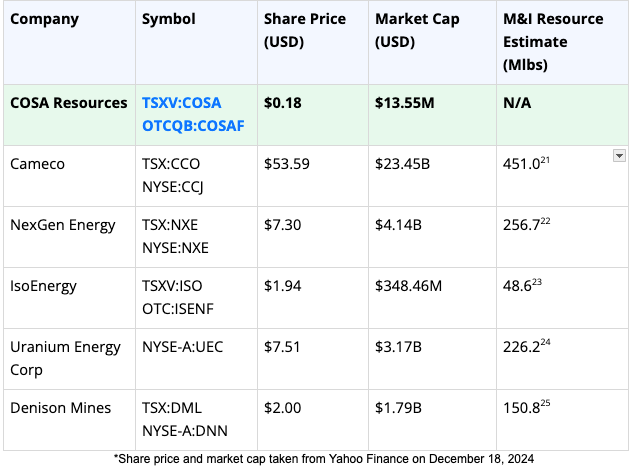

As this momentum builds, one company stands out as a key player in the uranium renaissance: Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF).

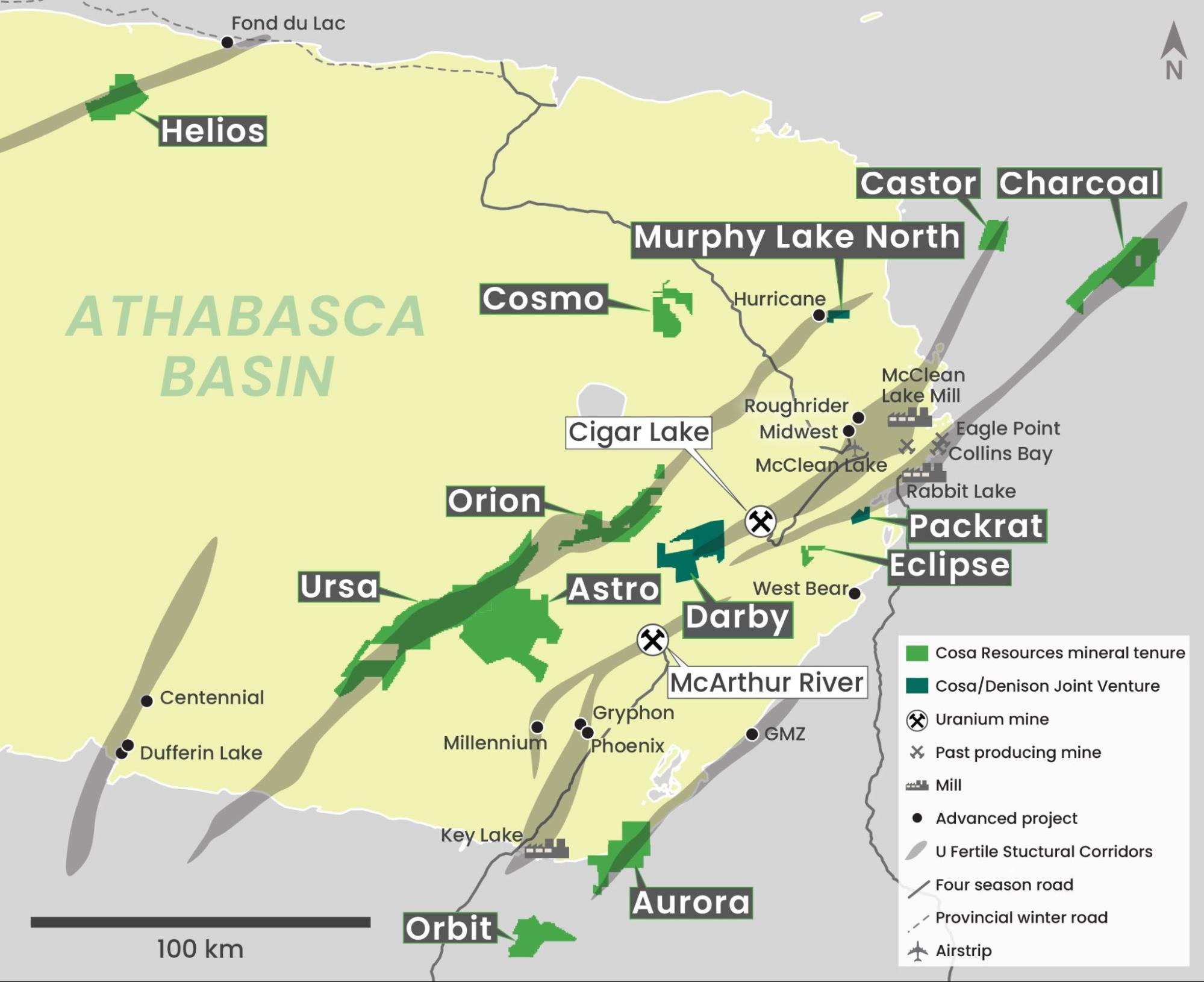

Cosa Resources is actively establishing its presence in Canada’s Athabasca Basin—the world’s largest and highest-grade uranium district.

The company boasts an impressive portfolio of eleven uranium exploration properties, covering over 237,000 hectares (580,000 acres) in this prolific region.

Backed by a leadership team with strong insider ownership and an unmatched track record of major discoveries over the past 15 years, both technically and corporately, Cosa is primed for success. 9

And now, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is making headlines with a game-changing joint venture agreement with none other than Denison Mines Corp. (TSX:DML) (NYSE American:DNN), one of the most respected names in the uranium industry.10

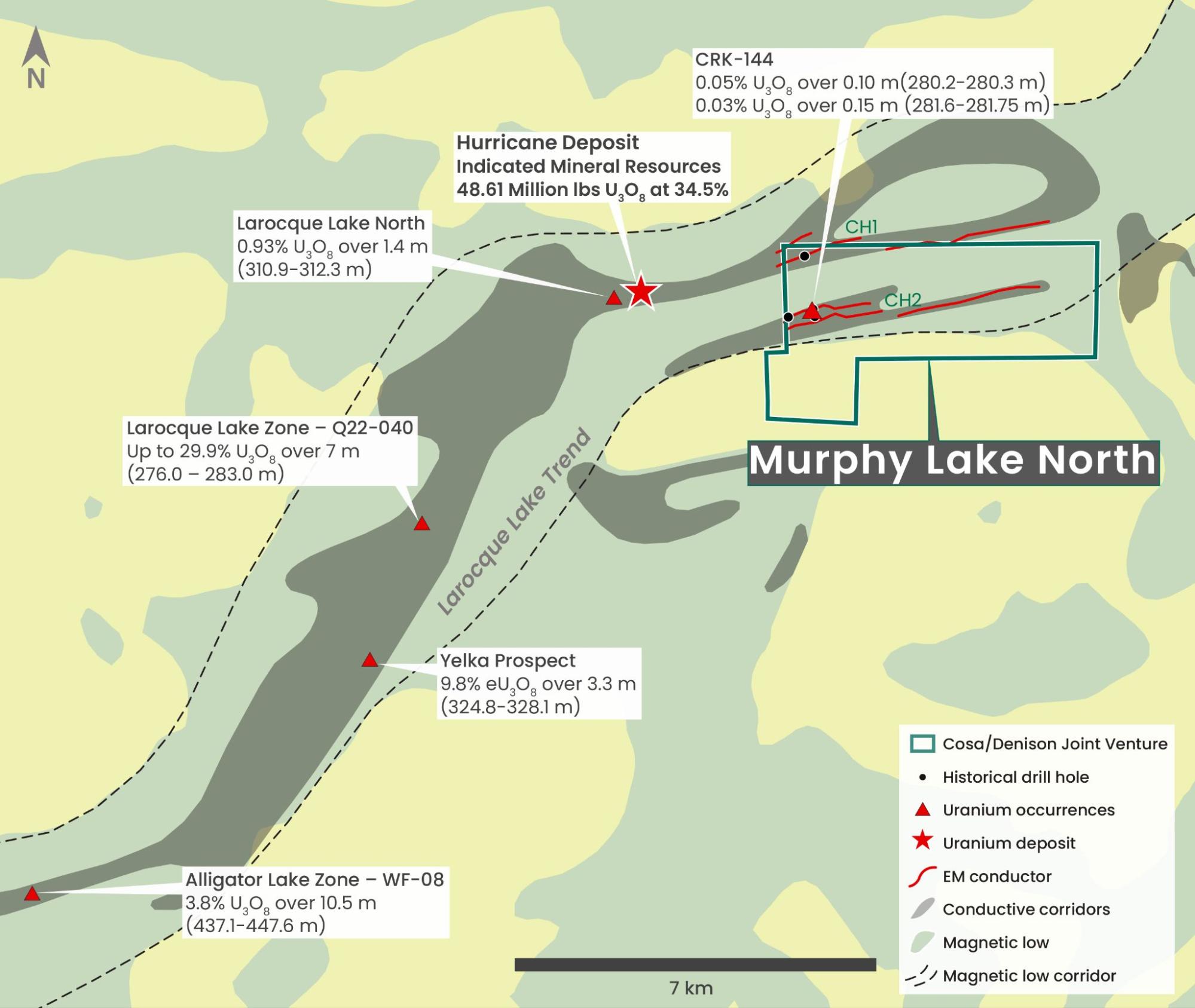

This isn’t just a land transaction—it’s a transformative partnership that grants Cosa a 70% interest in three premier uranium projects. This includes the Murphy Lake North Project, located just 3.2 kilometers from the Hurricane Deposit, the world’s highest-grade Indicated Mineral Resource for uranium, discovered by Cosa’s management team in 2018, as well as strong corporate and financial support from Denison Mines.

Also included is the Darby Project, located within 10 kilometers of the Cigar Lake Uranium Mine. Currently the world’s largest high-grade uranium mine.

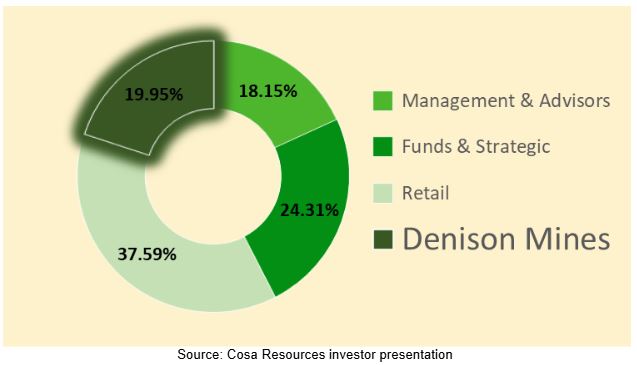

On top of that, Denison will become a 19.95% shareholder in Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF), solidifying the strategic collaboration and further underscoring the potential of these discovery-ready projects.

This isn’t just a deal—it’s a defining moment for Cosa Resources, setting it apart as a leading contender in the uranium sector at a time when global demand for secure, high-grade uranium has never been more critical.

As the uranium market continues its remarkable rise, we believe companies like Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) are destined for big things in 2024 and beyond.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Cosa Resources: Transforming Potential into Discovery in the Athabasca Basin

Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is making bold moves in the Athabasca Basin, the world’s premier uranium region.

With over 237,000 hectares across multiple 100% owned and Cosa operated Joint Venture projects, the company is targeting high-grade uranium corridors that have already produced some of the most valuable deposits on the planet.

Recent advancements across key projects like Ursa, Aurora, and Orbit highlight the company’s progress in this world-class uranium region.

-

-

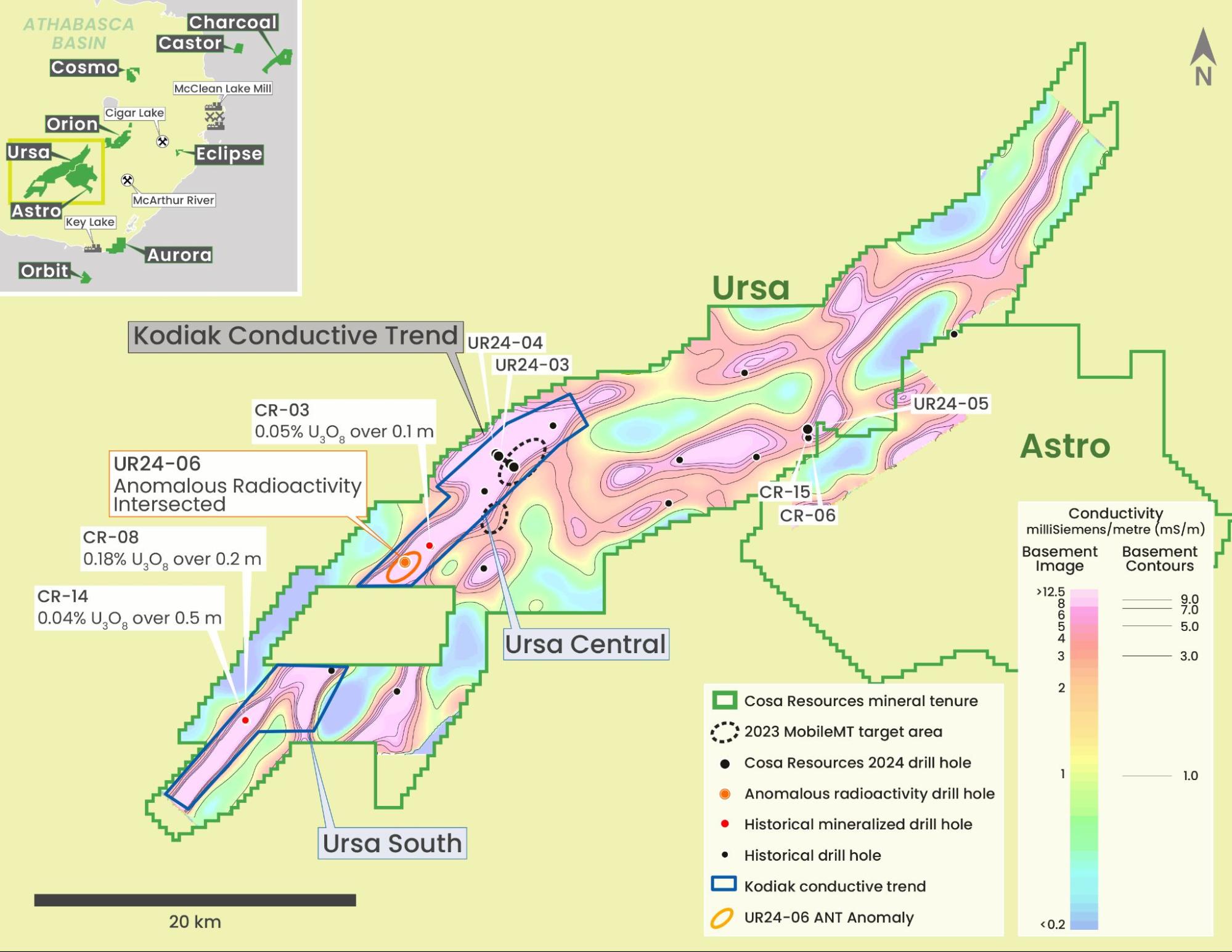

- Ursa Project: Located 45 km west of the MacArthur River Mine, Ursa has shown strong potential. In late 2024, Cosa intersected basement-hosted uranium mineralization and unconformity-style sandstone alteration during drilling—a hallmark of uranium-fertile systems in the Athabasca Basin.11

- Aurora and Orbit Projects: These projects, strategically positioned near Cameco’s Key Lake Mill, have yielded promising airborne geophysical survey results. Geophysical surveys have identified anomalies that Cosa considers to be analogues to the geology hosting Cameco’s past producing Key Lake Mine, pointing to compelling drill targets for 2025.12

-

By integrating cutting-edge geophysical tools and modern drilling strategies, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is accelerating its timeline for discovery while maximizing the value of its vast land package.

The company is positioning itself as a frontrunner in the next wave of uranium discoveries, just as demand for secure, high-grade uranium sources reaches a critical inflection point.

Proven Discoverers in a World-Class Uranium Region

In uranium exploration, success isn’t just about the land—it’s about the team. A skilled and experienced team can mean the difference between unearthing a major discovery or missing the opportunity entirely.

Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is led by an elite team of uranium discoverers who know the Athabasca Basin like the back of their hand.

Over the past 15 years, they’ve played key roles in major discoveries and built reputations with companies like IsoEnergy (Market Cap: US$348M), Denison Mines (Market Cap: US$1.79B), and NexGen Energy (Market Cap: US$4.08B).

Chairman Steve Blower is no stranger to discovery.

As VP Exploration at IsoEnergy, he helped lead the team behind the Hurricane Deposit discovery in 2018, which boasts 48.61M lbs of uranium at an astonishing average grade of 34.5% U₃O₈. 13

That’s the highest-grade discovery in the Athabasca Basin. He followed that with the GMZ Zone discovery for 92 Energy in 2021 and was previously involved in Denison Mines’ Gryphon Deposit discovery. 14

Now, Blower is focused on building Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) into the next big name in uranium exploration.

Joining him is Keith Bodnarchuk, President & CEO, whose corporate development work at IsoEnergy helped its stock rise from ~$0.30 to over $6.00.

On the technical side, Andy Carmichael, VP Exploration, was part of the IsoEnergy team that announced the highest-grade indicated resource in Athabasca history in 2022, also at 34.5% U₃O₈.

This team brings decades of experience in discovering, funding, and advancing uranium projects.

Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) all-star team has assembled a huge land package, covering over 237,000 hectares in the heart of the Athabasca Basin.

This land provides a steady pipeline of exploration projects, all positioned in one of the world’s richest uranium-producing regions.

Since 2017, this team has raised over $700 million in capital, including C$6.5 million in February 2024 through a private placement largely supported by uranium-focused funds.15

That means the company is funded into 2025 and fully funded for the anticipated upcoming drill program at Murphy Lake North, giving it the runway to execute its exploration strategy. 16

The timing couldn’t be better. With uranium at the beginning of a long-term bull market, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is a fresh new uranium exploration story led by a team of pros with a proven ability to find uranium, and who know how to generate significant value for shareholders.

Press Releases

- Cosa Resources Announces Summer Exploration Plans For Athabasca Basin Uranium Projects

- Cosa Enters into Agreement to Acquire the Titan Uranium Project, Athabasca Basin, Saskatchewan

- Cosa Announces Commencement Of Ground Geophysics And Access Trail Establishment At The 100% Owned Ursa Uranium Project In The Athabasca Basin, Saskatchewan

- Cosa Completes Acquisition Of The Aurora Uranium Project, Athabasca Basin, Saskatchewan

- Cosa Acquires The Aurora Uranium Project, Athabasca Basin, Saskatchewan

10 Reasons

Cosa Resources Could be the Next Breakout Uranium Stock

1

Encouraging Results and Upcoming Work: Summer drilling successfully intersected basement-hosted uranium mineralization below a broad zone of unconformity-style sandstone alteration, a typical target for world-class eastern Athabasca uranium deposits.

2

Track Record of Discovery: Technical and corporate contributions by Steve Blower, Keith Bodnarchuk and Andy Carmichael, all formerly with IsoEnergy, toward major Athabasca Basin discoveries.

3

Strong Joint Ventures with Industry Leaders: Cosa’s multiple Joint Ventures with Denison Mines sets them apart as a leading explorer with strong support from a leading uranium development company.

4

Premium Land Package: Pipeline of 100% owned high-upside projects in Athabasca Basin near industry leaders like Cameco (TSX:CCO | Market Cap: US$25B).

5

Under-Explored Holdings: Past work has only explored a fraction of the company’s massive land portfolio while modern technologies offer a new lens on exploration

6

Strategic Relationships: Access to capital due to past industry successes and raising over $700 million through the Inventa group since 2017.

7

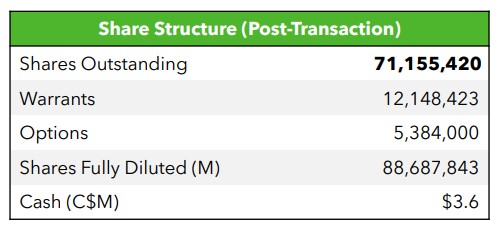

Fully Funded: With C$3.6 million in cash as of end Q3 2024, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is well-funded for continued exploration.

8

Reassuring Ownership: High ownership by management and advisors (~24%) and funds and strategic investors (~41%) is a major vote of confidence for investors to note.

9

Hot Market Outlook: Uranium prices are expected to continue climbing due to long-term zero-carbon goals driving surging demand and supply being squeezed for the foreseeable future, which has been further exacerbated by the US bill banning the import of Russian uranium.

10

Significant Upside Potential: Low stock price has room to increase through uranium discovery success and further land acquisitions.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Canada’s Answer to Growing Demand & Supply Constraints

Canada’s response is Saskatchewan, where all of the nation’s uranium is produced.17

It’s also home to the Athabasca Basin, the world’s most prolific area for uranium exploration, with the world’s highest-grade deposits.

The basin includes the world’s 2 highest-grade uranium mines, both operated by Cameco (TSX:CCO):

-

-

- McArthur River – the world’s largest high-grade uranium deposit18: Produced 535M lbs uranium to date; Proven and Probable Reserves of 275M lbs U3O8 (Cameco’s share)19

- Cigar Lake Mine: Produced 105M lbs uranium to date; Proven and Probable Reserves of 84.4M lbs U3O8 (Cameco’s share)20

- McArthur River – the world’s largest high-grade uranium deposit18: Produced 535M lbs uranium to date; Proven and Probable Reserves of 275M lbs U3O8 (Cameco’s share)19

-

The Athabasca Basin is also where Cosa Resources Corp.’s (TSXV:COSA) (OTCQB:COSAF) land portfolio is located.

It makes you wonder what Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) stock will do when they begin work following up exciting results from a recently completed 2024 exploration program and when they begin to explore the newly acquired Denison Mines Joint Venture projects.

Robust Capital Structure with Substantial Insider and Strategic Investor Ownership

Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is well capitalized (C$3.6M in cash) and has a very tight share structure.

It also offers assurance to investors in the form of management and advisors having significant stakes (~18% of ownership) with funds and strategic investors recognizing the value and potential of the Company’s team and projects (~24% of ownership).

The Next Logical Trends in the Athabasca Basin

The map below highlights Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) strategic position in the prolific Athabasca Basin. With 100% ownership of over 219,000 hectares (>494,368 acres) of exploration properties and an additional 21,000 hectares of Cosa operated Joint Ventures with Denison, Cosa has secured a significant footprint in one of the world’s most valuable uranium regions.

The map also reveals a clear trend: high-grade uranium discoveries consistently align along the northeast-trending corridors on the eastern side of the basin.

This area is home to some of the largest producing mines, including Cigar Lake and MacArthur River, and benefits from established infrastructure and access.

While it boasts world-class infrastructure, the chances of finding another “elephant-sized” discovery are shrinking.

That’s why Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is focusing on areas like the Cable Bay Shear Zone, a promising but underexplored area.

Armed with modern geophysics and an innovative drilling strategy, Cosa is already delivering results.

In November 2024, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) completed its second drill program at the Ursa Project, successfully intersecting basement-hosted uranium mineralization and encountering unconformity-style sandstone alteration—a hallmark of major uranium deposits in the region.26

The Ursa Project is just the start.

With a strategic land position covering over 60 kilometers of the Cable Bay Shear Zone—an area comparable in scale to the Cigar Lake-MacArthur River corridor—Cosa is building momentum in this untapped frontier.

And they’re not stopping there.

Cosa Resources’ new Murphy Lake North Joint Venture with Denison Mines is drill-ready and within just four kilometres of the world-class Hurricane Deposit. Murphy Lake North is also on the remarkably uranium-rich Larocque Lake Trend, and has over ten kilometres of untested conductive strike length. With several mineralized prospects on the trend, in addition to the Hurricane Deposit, it’s no wonder why Cosa’s Geologists are so eager to begin drilling as soon as possible.

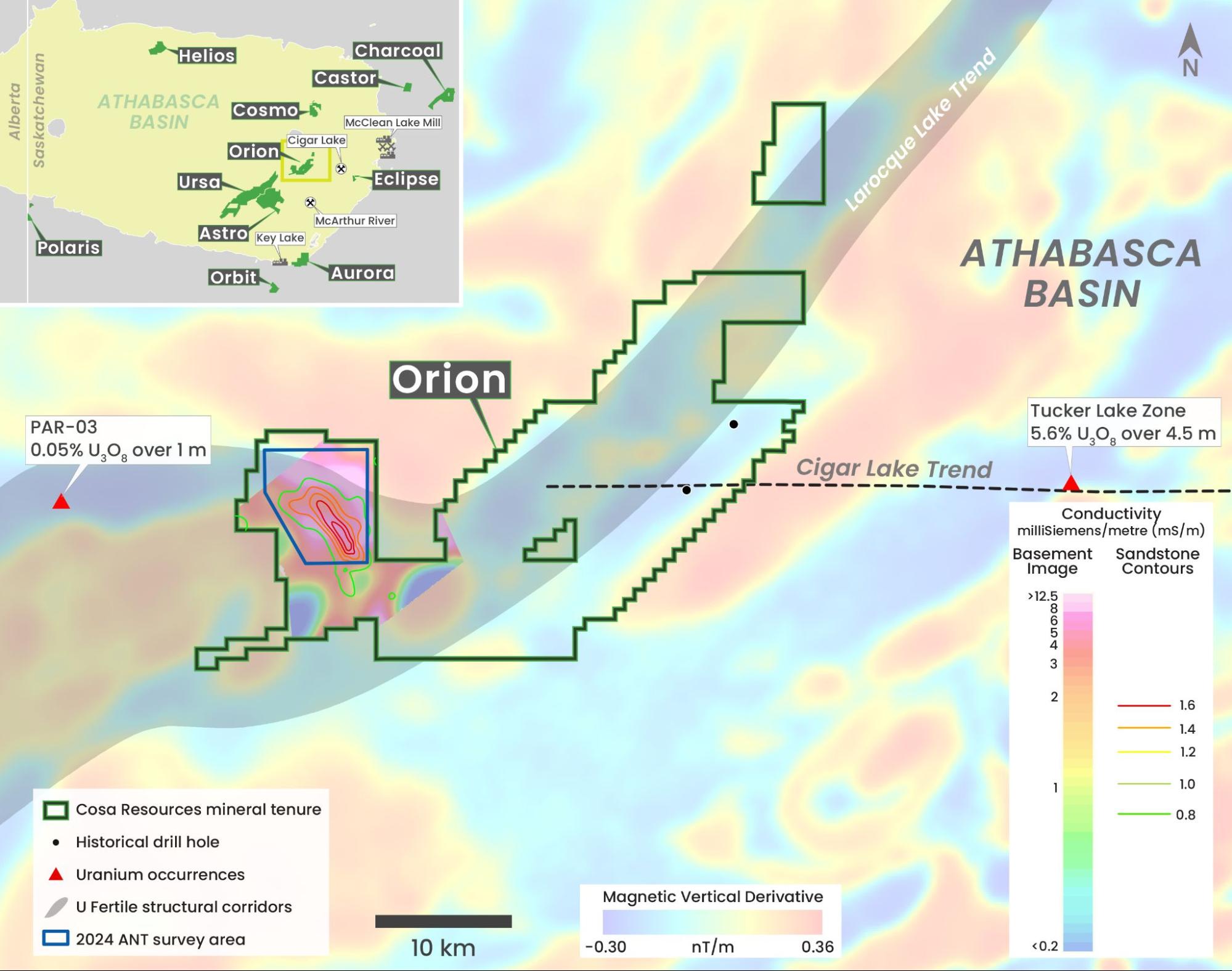

At the Orion Project, located on the same corridor as high-grade deposits like Hurricane (48.61M lbs uranium at 34.5% U₃O₈),27 Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) recently completed an Ambient Noise Tomography (ANT) survey, with results expected soon.

The company aims to identify kilometre-scale geophysical anomalies for future drill testing, similar to their success at Ursa.

Advanced Technology, Major Potential

Cosa Resources is using cutting-edge techniques like ANT, which has already proven effective for major players like Uranium Energy Corp and IsoEnergy.

By leveraging modern technology, Cosa is accelerating its discovery timeline and improving its chances of finding the next major uranium deposit.

With its high priority Ursa and Orion Projects, the promising Denison Joint Venture Projects including Murphy Lake North, and strategic positioning in the Athabasca Basin, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is poised to emerge as a key player in the uranium space.

Upcoming Exploration Plans

Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is rewriting the playbook for uranium exploration by leveraging advanced geophysics and cutting-edge seismic technologies.

Historical drilling at the company’s Ursa Project missed key targets due to outdated methods. Cosa has changed that by deploying state-of-the-art tools like MobileMT electromagnetic (EM) surveys and Ambient Noise Tomography (ANT) to uncover hidden anomalies that could point to significant uranium deposits.

Key Achievements to Date:

-

-

- Modern Geophysics Integration: Successfully combined EM and ANT data to refine drill targets, delivering strong results.28

- Breakthrough Drill Results: Summer drilling at Ursa intersected multiple zones of basement-hosted radioactivity within a broad hydrothermal alteration zone—classic markers of uranium-fertile systems.

-

With these achievements in hand, the stage is set for the next phase of exploration that could unlock even greater potential.

What’s Next for Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF):

-

-

- ANT Results: Publish final seismic surveying data from Ursa and Orion to guide future drilling.

- 2025 Exploration Plans: Launch a multi-project drilling campaign to capitalize on newly identified targets.

- 2025 Beginning of Drill Program: Drilling on newly acquired Murphy Lake North Project with partner Denison Mines

-

Cosa Resources has positioned itself as a leader in innovative uranium exploration. By applying these advanced technologies, the company is accelerating the timeline for discovery while reducing risk—giving it a competitive edge in the Athabasca Basin.

With modern techniques and a clear vision, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is setting the stage for significant uranium discoveries, helping to fuel the future of clean energy.

Track Record of Value Creation

As we’ve already seen, Cosa Resources Corp.’s (TSXV:COSA) (OTCQB:COSAF) leadership team has made significant technical and corporate contributions toward building successful mining companies and making major uranium discoveries in the Athabasca Basin.

Here’s more about the achievements of the team’s top members.

10 Reasons

Cosa Resources Could be the Next Breakout Uranium Stock

1

Encouraging Drilling Outcomes: Fall 2024 drilling intersected basement-hosted uranium mineralization and significant sandstone alteration with only the first of several ANT anomalies tested and a number of follow up target areas remaining.

2

Athabasca Uranium Discovery Vets: Key discoveries in the Athabasca Basin were made by team members Steve Blower, Keith Bodnarchuk, Andy Carmichael, and Justin Rodko

3

Strong Joint Ventures with Industry Leaders: Cosa’s multiple Joint Venture with Denison Mines Corp sets them apart as a leading explorer with strong support from a leading development company.

4

Strategic Land Holdings: Operates high-potential projects near industry leader Cameco (TSX:CCO) in the Athabasca Basin.

5

Untapped Potential: The vast, under-explored land portfolio offers new prospects with advanced exploration technologies.

6

Strong Financial Backing: Established relationships have facilitated over $700 million raised through the Inventa group since 2017.

7

Financial Stability: With C3.6 million in the bank going into Q4 2024, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) can fund exploration into 2025.

8

Confident Ownership: Management and advisors hold about 24%, with funds and strategic investors holding 21%, reflecting strong confidence.

9

Uranium Market Prospects: Expected uranium price rise due to long-term demand for zero-carbon energy and reduced supply, exacerbated by US bans on Russian imports.

10

Growth Opportunities: Low stock price with potential for significant gains through discovery success and further acquisitions.

With the new uranium bull market just getting started, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is emerging as a company to watch.

Armed with a best-in-class team, a strategically positioned land package in the world’s premier uranium region, a major partner in Denison Mines, and highly anticipated exploration results on the horizon, Cosa is well-positioned to make waves in the market.

As the story unfolds, now is the time to keep a close eye on this exciting exploration company.

Don’t miss a moment—subscribe here to stay up to date on the latest news and updates from Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Craig ParryAdvisor

Craig ParryAdvisor Keith BodnarchukPresident & CEO, Director

Keith BodnarchukPresident & CEO, Director Steve BlowerChairman

Steve BlowerChairman Justin RodkoCorporate Development Manager

Justin RodkoCorporate Development Manager Andy CarmichaelVice President of Exploration

Andy CarmichaelVice President of Exploration