An electric revolution is underway, causing EV sales, and the prices of lithium hydroxide and carbonate, as well as lithium spodumene prices, to rise tenfold in just two years.1

The incredible demand for this battery metal has set the stage for what many experts are calling a lithium supercycle of supply deficits and lasting high prices.

Rio Tinto is predicting lithium demand will grow by 25-to-35% a year over the next decade with a significant supply-demand deficit expected to open up over the second half of this decade.2

This has caused the mining giant to go on the hunt for lithium deals as demand and prices continue to soar,3 and kicking into gear a pursuit of “organic and M&A growth opportunities”.4

Now, M&A activity is on the rise,5 and S&P Global Commodity Insights reported that over the last year lithium M&A typically involved assets with resources.6

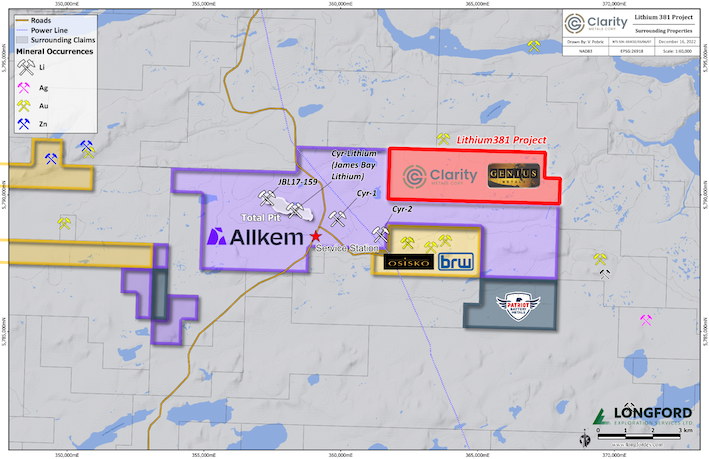

One significant M&A event that the market just witnessed was Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF) acquiring interest in the Lithium381 Property in James Bay, Quebec. Clarity strategically picked up this prime real estate, which is contiguous and in the same host geology as one of Quebec’s next big lithium mine set to go into construction in Q1 2023.

In order to survive a pivot from its dependence on China, the lithium sector will need to invest $42 billion to meet 2030 demand, according to Benchmark.7

Much of this investment will be directed at North American assets, as both the Canadian and US governments are set to incentivize domestic production to the tune of $2 billion8 and $2.8 billion,9 respectively.

Today there are a growing number of eyes focusing on the lithium potential of Quebec, which has multiple mines approved and soon to go into construction,10,11 Having strategically secured a geologically-similar project only 2.5km away from one of Quebec’s next big lithium mines, it’s now worth taking a deeper look at Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF) and it’s Lithium381 Project, and why it’s advantageously positioned to make an impact in the Lithium super cycle.

7 Reasons

Investors Need to Keep a Close Eye on Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF)

1

The Lithium Super Cycle: Several respected analysts have said we’re entering a battery metals supercycle driven by a clean tech transition, including J.P. Morgan,12 Goldman,13 VanEck14 and Eurasian Resources Group15, With the lithium market predicted to remain in structural shortage until 2025,16 and shocking acute lithium shortages forecast by 2035,17 Clarity Metals (CSE:CMET) (OTC:CLGCF) is now strategically positioned with great timing ahead of a coming ‘Lithium Supercycle’.18

2

Battery Metals in Quebec: According to the Fraser Institute, Quebec is recognized as a Top 10 Global Mining Jurisdiction.19 The province is taking its role in battery metals production very seriously,20 as is the Canadian government. Analysts have singled out Quebec as a viable contender to be a lithium hub in the near future,22 and the province could add significant value to industry by taking part in the lithium revolution.23

3

Optimum Proximity to Quebec’s Next BIG Lithium Mine: Just over a year since releasing its 2021 Feasibility Study and Maiden Ore Reserve,24 Allkem is set to begin construction and is projected to produce 321ktpa of spodumene concentrate with a 19-year mine life. Clarity Metals (CSE:CMET) (OTC:CLGCF) has secured a path to a 50% interest in the Lithium381 Project that’s directly contiguous to Allkem’s property, and only 2.5km from the proposed mine site. Lithium381 consists of 21 mineral claims comprising 1107 hectares of property and is comprised of the same host rocks as Allkem’s James Bay Lithium Deposit.

4

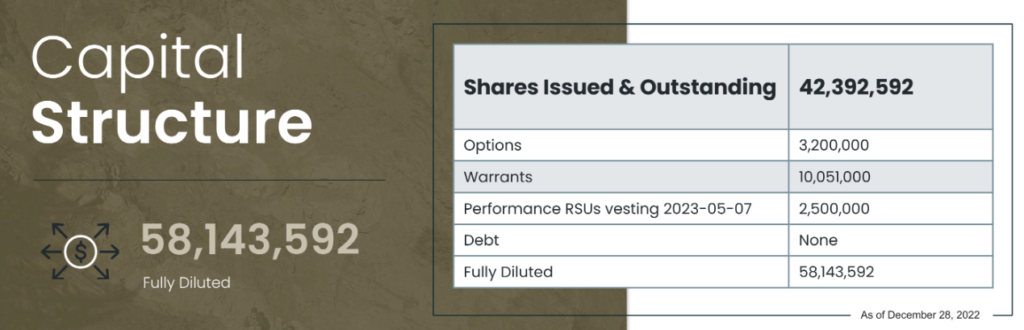

Tight Share Structure: With only 58 million shares fully diluted, 42 million issued and outstanding, the Clarity Metals (CSE:CMET) (OTC:CLGCF) financial structure is still very tight for a mining company of this size with the assets that it holds.

5

Fully-Funded Work Program: Without watering down the company’s stock, Clarity has managed to stockpile the funds necessary to take the company and its assets to the next level. Now the budgets have been set in place to effectively spend on groundwork with the expressed goal of making a big new discovery that will exponentially propel Clarity Metals into the same tier as their giant neighbors.

6

Skilled Team of ‘Finders’: Leading the way for Clarity Metals (CSE:CMET) (OTC:CLGCF) as it now works to develop out its lithium assets in Quebec are a team with the skills and history to pinpoint where best to focus the company’s attention. Utilizing proprietary finding technology, and many decades of experience, the Clarity team is fully capable of thoroughly developing the company’s assets and greatly growing their value.

7

Multi-Commodity Assets: Not to be ignored are Clarity’s other assets that were integral to getting the company to this point, including its respectable GOLD assets in the prolific Abitibi Gold Belt region of Quebec, and their proximity to Osisko, as well multiple gold, copper, silver, and molybdenum projects located in British Columbia.

Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF) is currently conducting an exploration campaign with an IP/resistivity survey on the entire Lithium381 Property.25

Lithium381: Not Just Any Area Play

Located in Northern Quebec, the Lithium381 Property covers 1,107 hectares comprised of 21 mineral claims that are contiguous with Allkem Limited’s James Bay Lithium Property that hosts a lithium-bearing pegmatite deposit with Indicated resources of 40.8 Mt @1.40% Li2O.26

Construction on Allkem’s new mine at The James Bay Lithium deposit is slated to start construction in Q1 2023,27 and is slated to produce 321 kilotonnes per annum (ktpa) of 5.6% Li20 concentrate with a ~19 year mine life.28

Clarity Metals’ (CSE:CMET) (OTC:CLGCF) Lithium381 Property isn’t just contiguous with Allkem, but it is underlain primarily by the same host rocks of the adjacent James Bay Lithium Deposit. Allkem’s long life James Bay Project is supported by a Mineral Resource Estimate of 40.3Mt at 1.4% Li2O including Ore Reserve of 37.2Mt at 1.3% Li2O.29

The name ‘Lithium381’ comes from its ~3 km proximity to the James Bay Road and the service station at KM381 which provides infrastructure to the local area, and year-round access.

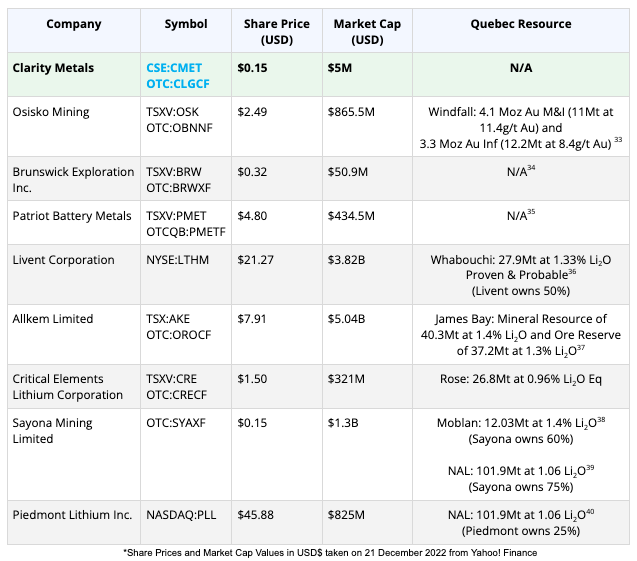

As can be seen in the map above, the region also hosts nearby projects from Osisko Mining, Brunswick Exploration and Patriot Battery Metals, which come with $868.5 million, $48.2 million, and $418.8 million market caps respectively.

Press Releases

- Clarity Reports Positive Preliminary Results And Indentifies Target On Lithium381 Project

- Clarity Gold Announces Name Change To Clarity Metals Corp

- Clarity Gold Enters Option To Acquire A 50 Interest In The Lithium381 Property

- Clarity Gold Acquires Option To Purchase Fecteau Property

- Clarity Acquires Harp Lake Nickel Project And Expands Exploration Portfolio

With a $4.7 million market cap, Clarity Metals (CSE:CMET) (OTC:CLGCF) is currently valued at less than 1/10th in terms of market cap of even the smallest of the above examples.

It’s also worth noting that Clarity Metals (CSE:CMET) (OTC:CLGCF) also has an option to earn 100% interest in the Fecteau project located in the prolific Abitibi gold belt adjacent to Osisko Mining’s Windfall project.30

However, it’s worth strongly noting, Clarity has a significant timing advantage as the Lithium381 Project has had ZERO drilling to date.

The Lithium381 Property has not previously been explored for lithium-bearing pegmatites but is underlain primarily by amphibolite facies metasedimentary and minor metavolcanic rocks of the Lower Eastmain Group of the Eastmain Greenstone belt in the northeastern part of the Superior Province; which are the same host rocks of Allkem’s adjacent James Bay Lithium Deposit.

“We are excited to begin exploring such a well positioned project with favorable underlying geology adjacent to a world class lithium deposit.” – Clarity CEO James Rogers

Taking into consideration Clarity Metals’ (CSE:CMET) (OTC:CLGCF) optimal location of the Lithium381 Project, and how the company is already fully funded for the work program that they just initiated.31

Now, the market awaits the results of every action Clarity Metals takes to improve the value of its 50% interest32 in the Lithium381 Project.

Let’s now take a look at how Clarity Metals stacks up to comparable companies already operating in Quebec with lithium plays or nearby properties.

World Class Jurisdiction in Quebec

Quebec, where Clarity’s (CSE:CMET) (OTC:CLGCF) Lithium381 project is located, has become a favorable jurisdiction for critical mineral exploration investment.

Quebec, where Clarity’s (CSE:CMET) (OTC:CLGCF) Lithium381 project is located, has become a favorable jurisdiction for critical mineral exploration investment.

The province’s ‘2030 Plan for a Green Economy’41 targets a reduction in carbon emissions as well as its ‘Plan for Development of Critical and Strategic Minerals (2020-2025)’42 which includes commitments to share financial risk and plans to improve infrastructure for projects in Northern Quebec.

According to the Fraser Institute, Quebec is recognized as a Top 10 Global Mining Jurisdiction.43

Now international interests including the US military44 are weighing funding mining projects in Canada, of which investment in Québec is included in the conversation.

Tight Share Structure with Strong Management Ownership

Exceptionally Skilled Leadership Team

Leading the way for Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF) is a very capable team in Management, Directors and Advisors, with many decades of experience and accomplishments in the mining industry. In particular, two standouts from the team who warrant extra attention from investors are:

Bonus Multi-Metal Assets in the Portfolio

Along the journey towards securing a favorable position in the Quebec lithium scene, Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF) built its portfolio through gold, silver, copper and molybdenum.

It’s important to note the other properties that make up Clarity’s portfolio beyond the recently entered into an option agreement to acquire 50% of the Lithium381 Project adjacent to Allkem Limited’s James Bay Lithium feasibility stage project.

Clarity Metals (CSE:CMET) (OTC:CLGCF) was also recently assigned an option to acquire 100% of the Fecteau project located in the prolific Abitibi gold belt adjacent to Osisko Mining’s Windfall project, which comes with a resource estimate of 4.1M oz Au Measured+Indicated and 3.3M oz Au Inferred.45

Additionally, Clarity has title on several early-stage projects in British Columbia and Newfoundland:

- Empirical Gold Copper Molybdenite Property (10,518 ha) – Lillooet, B.C.

- Tyber Gold Copper Silver Property (928 ha) – Southeast Vancouver Island, B.C.

- Gretna Green Gold Copper Silver Property (1,331 ha) – Port Alberni, Vancouver Island, B.C.

- Harp Lake Nickel Property (3,452 ha) – Labrador, NL

- Eddies Cove MVT Property (450 ha) –NW Newfoundland

- Hare Bay Nickel Property (750 ha) –NW Newfoundland

RECAP: 7 Reasons

To Look Into Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF)

1

The Lithium Super Cycle

2

Battery Metals in Quebec

3

Optimum Proximity to Quebec’s Next BIG Lithium Mine

4

Tight Share Structure

5

Fully-Funded Work Program

6

Skilled Team of ‘Finders’

7

Multi-Commodity Assets

With a work program already underway, and fully funded to take the company through near-term development, this is an ideal time to take a more serious look at Clarity Metals Corp. (CSE:CMET) (OTC:CLGCF) story.

James RogersDirector and CEO

James RogersDirector and CEO Michel RobertAdvisor

Michel RobertAdvisor