Robotics is entering a new era.

Not the walking, talking humanoids that chase headlines, but the autonomous machines built to get work done.

This is the age of applied robotics that move equipment, enable infrastructure, and replace manual deployments where human setup is too slow, too expensive, or too dangerous.

And the market is taking notice.

- Symbotic (NASDAQ:SYM) has soared on its robotic warehouse systems, climbing to a valuation of over $38 billion as retailers rush to automate logistics.¹

- Fanuc (OTC:FANUY), Japan’s industrial robotics giant, is up nearly 28% year to date as global demand surges.²

- ABB (OTC:ABBNY), a leader in electrified automation and robotics cells, has gained over 33% in 2025, driven by manufacturing and infrastructure demand.³

- UiPath (NYSE:PATH), one of the top automation software firms, is up over 12%, showing that both physical and digital automation are rising in parallel.⁴

- Intuitive Surgical (NASDAQ:ISRG), the pioneer behind robotic surgery, continues to deliver stable gains, climbing 10% YTD as new hospital deployments grow.⁵

These are not gadgets. They’re platforms reshaping trillion-dollar industries.

Across logistics, defense, mining, and energy, a clear pattern is emerging: The systems that move, adapt, and deploy themselves are the ones that win.

That’s what the next generation of robotics looks like.

It’s no longer about stationary towers or fixed-site infrastructure. It’s about autonomy in the field.

In remote mines, along border zones, in natural disasters, and across frontline defense operations, the world is facing a universal challenge:

Fixed infrastructure can’t keep up.

Recent events have made that painfully clear, from Hurricane Helene, which knocked out up to 66% of cell sites across the Carolinas,⁶ to missile strikes in Kharkiv that toppled a 240-meter broadcast tower in seconds.⁷ When storms or conflict hit, the networks built to keep people connected are often the first to fail.

Traditional towers take days or weeks to install. They require cranes, technicians, generators, and grid power. They are vulnerable to terrain, weather, and enemy targeting. And when the mission shifts, the infrastructure can’t move with it.

That’s the problem Critical Infrastructure Technologies Ltd. was built to solve.

Every so often, a new platform changes how the world gets connected.

First came satellites. Then came mobile towers. Now comes full autonomy, a deployable system that delivers communications, surveillance, and critical infrastructure where fixed networks fail.

It’s called the Nexus platform.⁸

Developed by Critical Infrastructure Technologies Ltd., also known as CiTech (CSE:CTTT) (OTC:CITLF), Nexus is a self-deploying, self-powering communications tower engineered for the harshest environments on Earth.

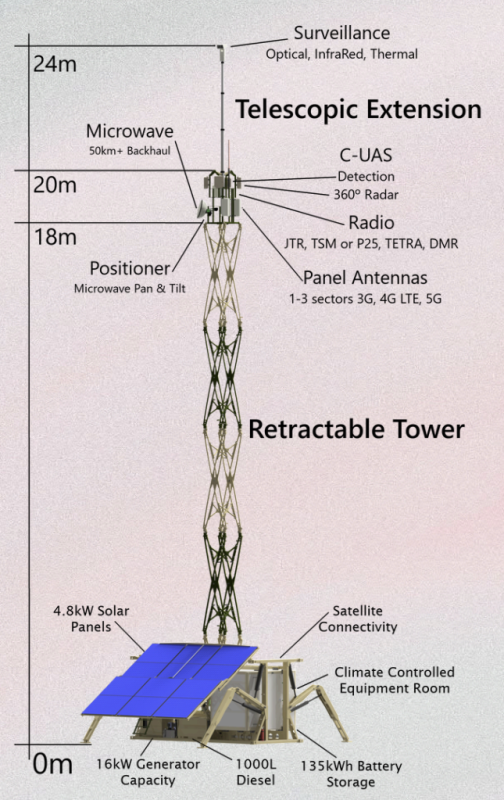

Each system arrives compact. It unfolds itself in under 30 minutes.⁹ And once deployed, it delivers high-performance connectivity with zero need for a grid, concrete, or crew.

Payloads can include 5G backhaul, ISR, radar, microwave, and counter-drone systems, depending on the mission profile. The platform is modular, rugged, and built for repeat deployment in the world’s most demanding conditions.

This isn’t a pitch deck fantasy.

It’s already in the field.

CiTech (CSE:CTTT) (OTC:CITLF) Nexus systems have been deployed by the Australian Department of Defence, where they’ve supported active military exercises, emergency response networks, and communications continuity during Cyclone Zelia.¹⁰ In the field, Nexus maintained real-time network integrity under cyclone conditions, a mission where fixed towers would have failed.

Now, more global deployments are underway. Defense clients across allied nations are reviewing the platform. US channels have opened through a new relationship with an NHO-certified contractor. And domestic deployments are growing.

One of the most significant steps in opening those US channels is CiTech’s newly announced NDA with Hui Huliau, a powerful Native Hawaiian Organization that oversees multiple SBA 8(a) certified federal contracting entities.

This partnership gives CiTech a fast-track into high-value US defense and homeland-security programs, exposure most small-caps never get.

This is not another satellite provider or antenna manufacturer.

It’s a robotics platform where infrastructure is the product.

This company was even awarded a US$757,636 (AUD$1.16M) Australian government grant in March 2025 to support the construction of three Nexus 16 mobile communication towers.¹¹

And with deployments active, contracts signed, and scale on the horizon, the window for early investors is now wide open.

From Warehouses to the Battlefield: Symbotic Shows What’s Possible

Every robotics breakout starts with the same pattern.

An overlooked pain point. An outdated system ripe for change. And a platform built to solve it faster, smarter, and fully autonomously.

That was Symbotic’s story.

A few years ago, Symbotic was an unknown warehouse robotics firm building full-stack automation systems to help retailers modernize logistics. Then Walmart adopted it at scale. The result? A vertical growth curve that few anticipated.

As the chart below shows, Symbotic’s valuation has exploded from US$1 billion in 2020 to US$38 billion in 2025, making it one of the fastest-growing robotics companies on the planet.¹²

Source: Google Finance

This wasn’t because of hype. It was because their platform worked. It solves a real operational bottleneck in logistics with a modular, scalable, AI-enhanced robotic system.

Now a similar story may be emerging in a different vertical.

CiTech (CSE:CTTT) (OTC:CITLF) is not building warehouse bots or factory arms. It is building deployable infrastructure for the battlefield, the border, the blackout zone.

The Nexus platform, engineered by CiTech, is a self-deploying, self-powering tower that unfolds in 30 minutes, connects without grid power, and supports ISR, radar, 5G, and counter-drone payloads.

Like Symbotic, CiTech (CSE:CTTT) (OTC:CITLF) is tackling a slow, expensive, mission-critical process and automating it. Its hybrid business model includes hardware sales plus Nexus-as-a-Service, a recurring platform subscription used by defense and emergency agencies.

The real lesson from Symbotic isn’t just that automation wins.

It’s that timing matters.

The biggest gains didn’t come after the contracts were public or after Wall Street analysts caught on. They came when the company was still proving itself in the field before the market understood how big it could get.

CiTech (CSE:CTTT) (OTC:CITLF) is now at a similar inflection point.

The infrastructure works. The customers are real. And the model is built to scale across defense, disaster, and telecom deployments worldwide.

Platforms like this don’t stay overlooked for long. And the investors who act before the curve often capture the biggest upside potential.

The Infrastructure Gap That Costs Time, Money, and Lives

There’s a reason even the best operators go dark in remote zones.

Towers take too long to build. Satellites can drop in storms. Diesel generators fail. And when comms go down, everything else breaks.

Defense teams lose coordination. First responders can’t relay intel. Remote mining ops fall silent. A single blackout can grind entire missions to a halt.

It’s not a fringe problem.

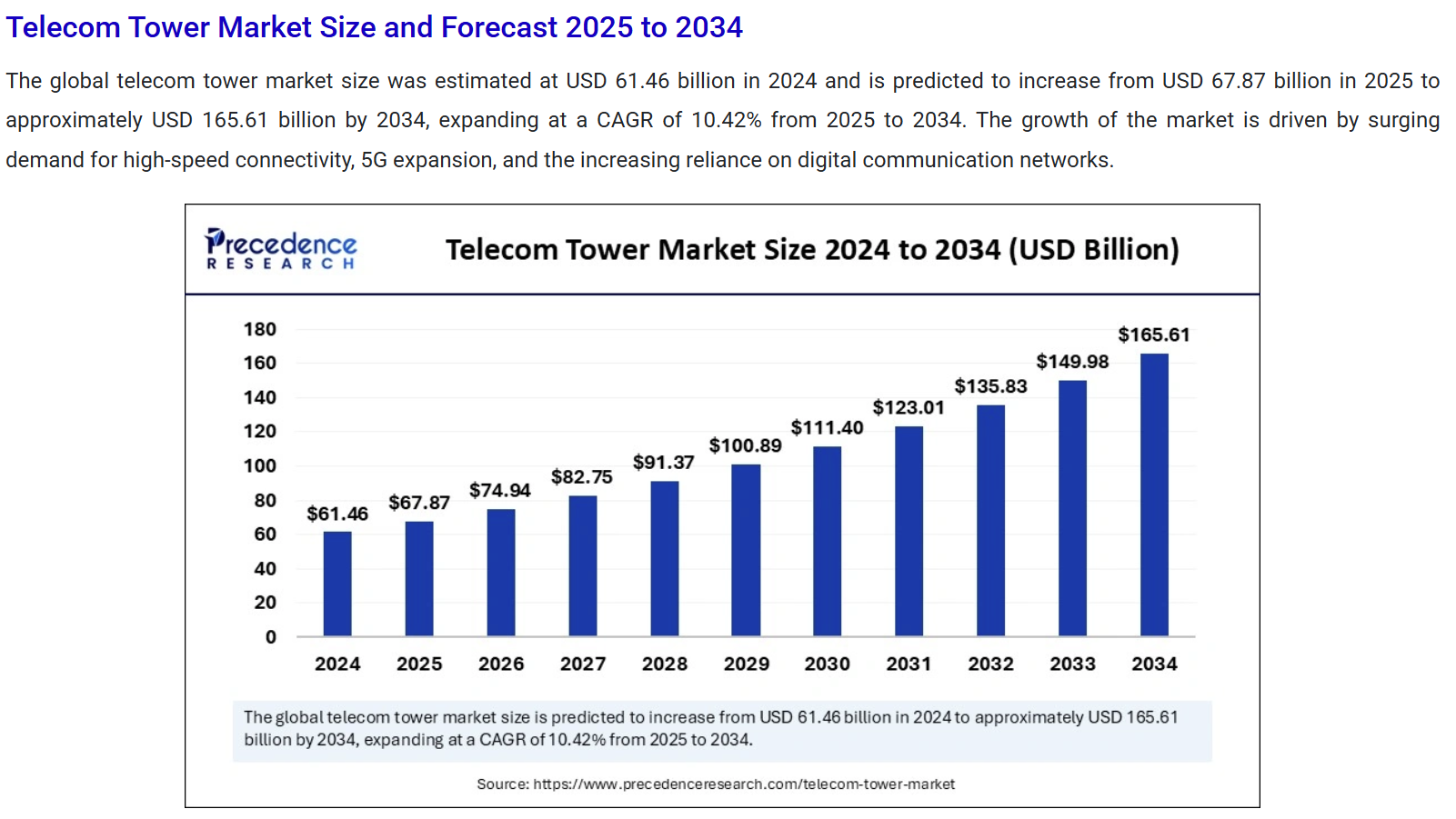

In 2025, the global telecom tower market is projected to hit $67.9 billion, growing to $165 billion by 2034. That doesn’t include the explosive growth in battlefield communications, public safety networks, and off-grid defense tech.¹³

And yet most of this market is still built around static infrastructure. Concrete pads. Crane setups. Weeks of downtime. It’s slow, expensive, and completely unfit for modern deployments.

That’s the gap CiTech (CSE:CTTT) (OTC:CITLF) is built to close.

Their Nexus platform wasn’t designed for city blocks or 5G suburbs. It was engineered for the edge. Anywhere conventional infrastructure fails, Nexus steps in.

Each unit can be dropped off by truck, trailer, or aircraft. In just 30 minutes, it lifts a 10-meter mast, stabilizes, powers itself with hybrid solar-battery, and activates secure communications or surveillance payloads.

No technician crew. No diesel. No waiting.

This is what CiTech (CSE:CTTT) (OTC:CITLF) is bringing to defense forces, emergency managers, and industrial operators who can’t afford to go offline.

And the market is massive.

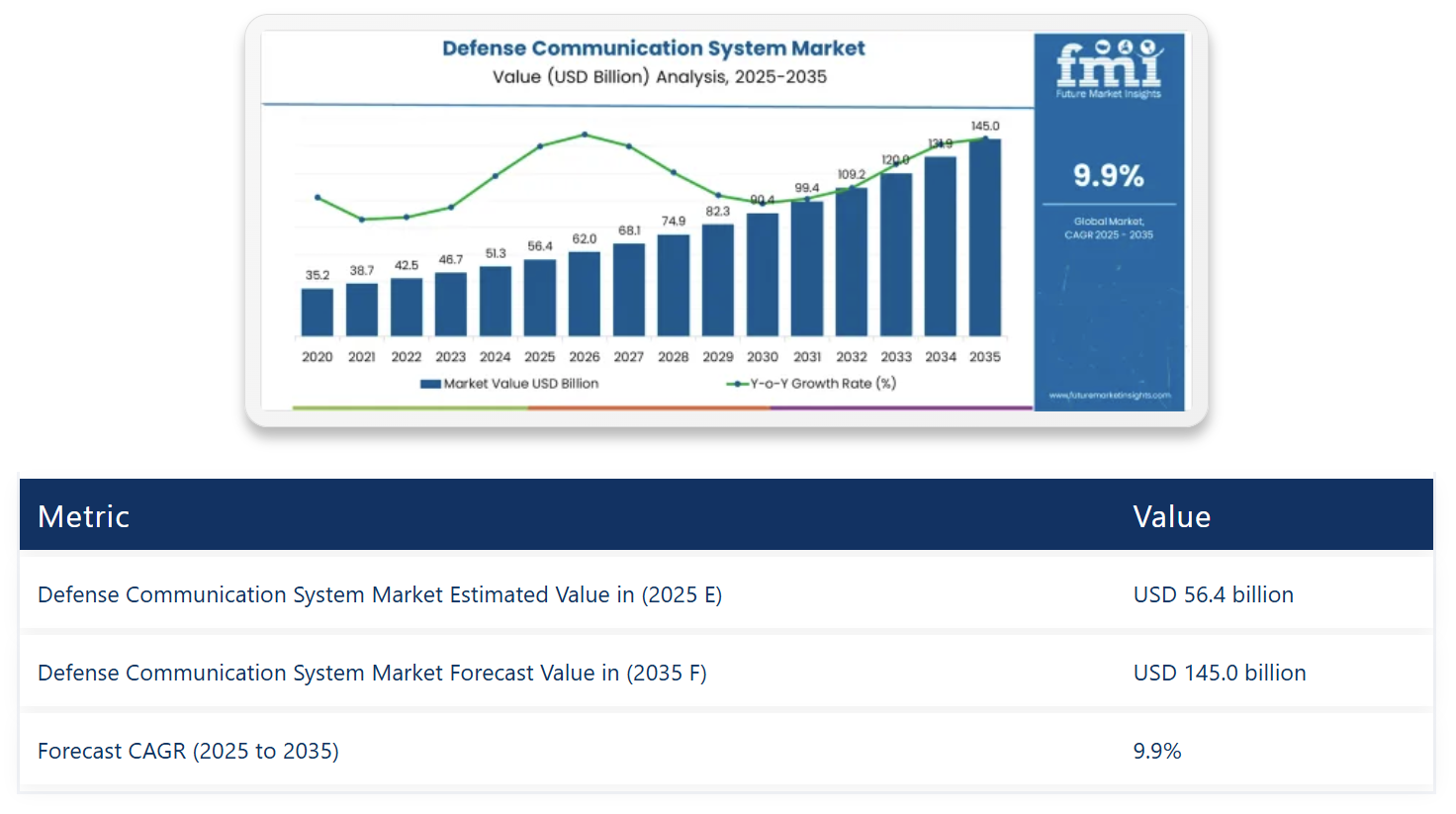

The global defense communications systems sector is forecast to more than double, from $56.4 billion in 2025 to $145 billion by 2035.¹⁴

Even the specialized “remote towers” segment is surging, with estimates showing growth from $472 million to over $2.3 billion by 2033, a 5x gain.¹⁵

CiTech (CSE:CTTT) (OTC:CITLF) is not trying to compete with 50-story cell towers in metro zones.

They’re building the only deployable tower system that operates like a field asset, one that creates instant, rugged infrastructure wherever it’s needed.

Think wildfire zones. Arctic borders. Temporary bases. Remote pipelines. Conflict corridors. Anywhere that needs signal, security, or surveillance and can’t wait for a tower team.

Nexus is not just a communications platform. It’s a physical product that generates recurring revenue in real-world environments where time is everything.

Governments are buying it. Defense agencies are deploying it. And a market worth hundreds of billions is shifting toward mobility, speed, and full autonomy.

CiTech (CSE:CTTT) (OTC:CITLF) is one of the only public companies offering that right now.

And they’re not starting from scratch. They’re already in the field.

From Drop-Zone to Operational in Minutes: What Makes Nexus a First-of-Its-Kind Solution

At the heart of CiTech (CSE:CTTT) (OTC:CITLF) is the Nexus platform. It is not just a communications tower. It is a self-contained, self-powering, and fully autonomous field infrastructure system that delivers mission-critical capabilities within minutes.

The platform is packaged in a reinforced container that can be delivered by flatbed, helicopter, or cargo aircraft. Once in position, the system performs a complete deployment cycle without human intervention. Four hydraulic legs lower and stabilize the unit. A solar array unfolds from the roof. A rigid mast extends vertically to heights of 16, 20, or 24 meters, depending on the model. The entire process takes less than 30 minutes from arrival to operation.

No cranes. No fuel trucks. No labor crews.

CiTech (CSE:CTTT) (OTC:CITLF) has engineered the Nexus family to support a wide range of payloads. These towers are payload agnostic and can carry LTE radios from Ericsson or Nokia, radar systems, ISR payloads, drone launch platforms, counter-drone equipment, and high-definition optical or thermal cameras.

Nexus has been tested and evaluated with select defense-grade payload systems under active non-disclosure agreements, including radar, counter-drone, and ISR capabilities.

Each tower operates independently, using a high-capacity solar power system with battery storage and optional backup generators.

This means Nexus can run off-grid for weeks or even months. Its feather-light footprint causes minimal ground disturbance, making it suitable for use on sensitive or indigenous lands.

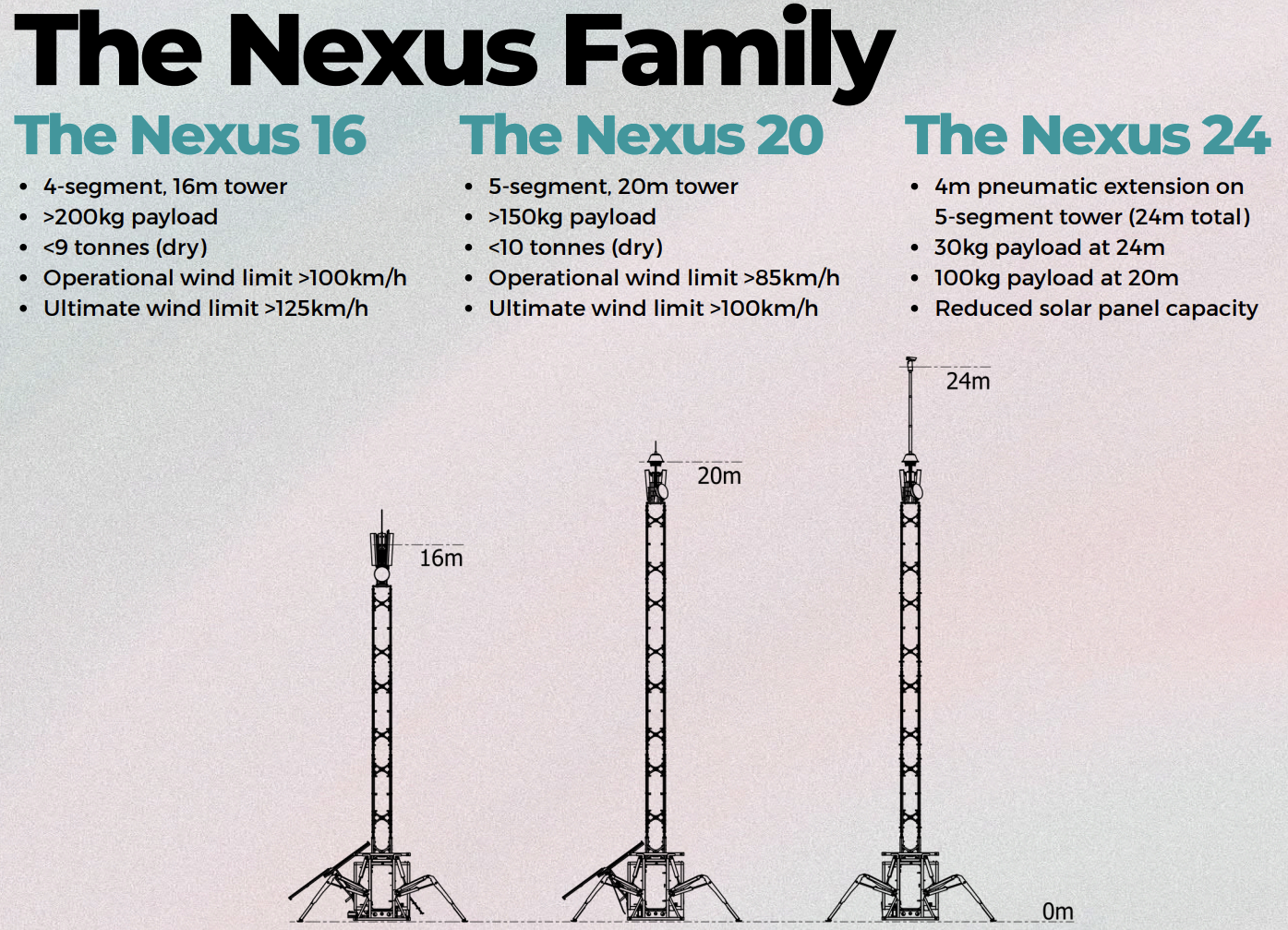

There are currently three models: the Nexus 16, Nexus 20, and Nexus 24.

The Nexus 16 is designed for mining and commercial deployments with a 200-kilogram payload capacity. The Nexus 20 supports defense applications, carrying over 150 kilograms of high-value mission systems. The Nexus 24 adds a pneumatic extension for surveillance and border operations, offering 24 meters of elevation for camera payloads and up to 100 kilograms of support at reduced height.¹⁶

Each platform connects to CiTech (CSE:CTTT) (OTC:CITLF)’s proprietary Synap software, offering full remote management and monitoring. Operators can manage power levels, system health, payload performance, and live video feeds from a secure browser dashboard. Whether it is five platforms or fifty, an entire field network can be deployed and managed from a central location with no permanent infrastructure.

In a recent deployment, Atlas Iron, one of Australia’s largest miners, used the Nexus system to eliminate blackspots at a remote site where autonomous haul trucks lost connection. The Nexus has remained operational for 18 months, including through a direct hit by a cyclone.¹⁷

In military applications, Nexus supports counter-UAS payloads, ISR sensors, and secure battlefield communications. It enables mission planners to establish a surveillance and communications perimeter within an hour anywhere power and signal are lost or infrastructure is compromised.

The Ukrainian Ministry of Defence has already requested 50 Nexus units pending funding.¹⁸ Global defense and engineering giant Babcock International has signed an MOU to co-develop these platforms for Ukraine’s needs.¹⁹

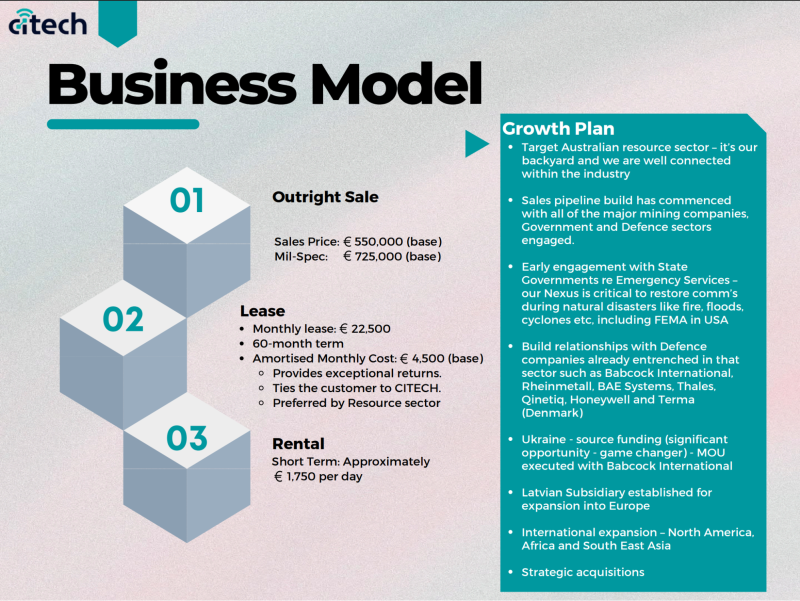

What makes this business model powerful is not just the hardware. Nexus platforms are sold outright, leased long-term, or rented for short-term operations.

Here’s a breakdown:

Outright Sale

Sales Price: € 550,000 (base)

Mil-Spec: € 725,000 (base)

Lease

Monthly lease: €22,500

- 60-month term

- Amortised Monthly Cost: €4,500 (base)

- Provides exceptional returns.

- Ties the customer to CiTech.

- Preferred by Resource sector

Rental Short Term:

Approximately €1,750 per day

In addition, CiTech (CSE:CTTT) (OTC:CITLF) generates recurring revenue from remote software subscriptions, maintenance, and payload support services. Each Nexus can deliver gross profit margins above 50%, with additional revenue through software and system upgrades.

This is not just a tower. It is a new category of rugged, fully autonomous, dual-use intelligent infrastructure designed for the world’s most challenging environments.

And CiTech (CSE:CTTT) (OTC:CITLF) is the company that created it.

Press Releases

- Nexus 20 Sale to Critical Metals Corp for their Tanbreez Project in Greenland

- Critical Infrastructure Technologies and AIRmarket Inc. Execute a Memorandum of Understanding (MOU)

- CRITICAL INFRASTRUCTURE TECHNOLOGIES: ACQUISITION AND FINANCING UPDATE

- Critical Infrastructure Technologies Provides Nexus Production Update

- Critical Infrastructure Technologies: Acquisition and Financing Update

Real Contracts, Not Just Prototypes

For most small‑cap defence and infrastructure companies, the biggest hurdle is moving from concept to customer.

That’s not the case with Critical Infrastructure Technologies Ltd. (CSE:CTTT) (OTC:CITLF).

The company has already moved into active deployment, not just pilots. Systems are field‑tested, contracts are signed, and full delivery cycles are in motion.

Multi‑Phase, Field‑Tested Deployments

CiTech (CSE:CTTT) (OTC:CITLF) has secured multiple agreements with defence and emergency‑services customers. For example, the company entered into a memorandum of understanding (MOU) with Babcock International Group to co‑develop a 5G, ISR (Intelligence, Surveillance & Reconnaissance), and Counter‑UAS (Unmanned Aerial Systems) rapidly‑deployable platform for the Ukrainian Armed Forces.²⁰

Under the MOU:

- The platform is containerised (20‑foot) for rapid truck transport.

- The system includes a 20m cyclone‑rated tower and full payload support.

- A potential order of 50 units was referenced by the parties.

These are not one‑off prototypes. They are structured for multi‑unit deployments and part of a regional expansion strategy.

Strategic Manufacturing & Sovereign Capability Expansion

- CiTech (CSE:CTTT) (OTC:CITLF) announced a binding term sheet to acquire a Western Australian precision manufacturing business, providing:

- Revenue: US$5.28 million+ (AUD $7.4 million+) and EBITDA: US$1.36 million+ (AUD $1.9 million+) (based on 2025)²¹

- Fully functional fabrication capacity including CNC machining, robotic welding, ISO certifications (9001, 14001, 45001)

- DISP (Defence Industry Security Program) accreditation enabling Defence‑level contracts in Australia

This acquisition enables vertical integration, faster delivery, and cost control for the Nexus platform. In effect, the company is shifting from simply developing dual-use technology to operating end‑to‑end defence‑grade production.

In addition, CiTech (CSE:CTTT) (OTC:CITLF) executed a Confidentiality Agreement with DroneShield Limited (ASX:DRO) to integrate Counter‑UAS (unmanned aerial systems) capabilities into the Nexus 20 platform at the request of the Ukrainian Ministry of Defence.²²

This collaboration paves the way for potential co-development of advanced infrastructure solutions that improve energy resilience, field communications, and national security applications. It marks another major step in CiTech’s strategy to align sovereign innovation with global tech leaders.

Communications Systems Integration Partnerships

CiTech (CSE:CTTT) (OTC:CITLF) executed two three‑way NDAs in September 2025 with leading global telecom and defence players:

- With Babcock‑Land Defence, Nokia Solutions and Networks Oy and the Company

- With Babcock‑Land Defence, Ericsson Limited and the Company²³

These agreements cover design & integration of full‑scope 4G/5G communications into the Nexus 20 platform, requested by the Ukrainian Ministry of Defence.

This positions the Company’s system not just as a hardware tower, but as a full communications node built for modern defence environments.

Recurring Revenue Model: Nexus‑as‑a‑Service

While many defence platform companies sell hardware and walk away, CiTech (CSE:CTTT) (OTC:CITLF) is building a model with both hardware and ongoing service.

Customers deploy Nexus platforms, then subscribe to:

- Managed services (monitoring, power uptime, signal uptime)

- Payload updates, software upgrades, lifecycle support

- Unit leasing and short‑term deployments for mission‑critical infrastructure

This is recurring revenue, not just project‑based.

According to their October 2025 investor deck, hardware gross margins are 50‑55% depending on configuration.²⁴ Services and software margins are higher, meaning the larger long‑term value lies in the recurring stream.

Multi‑Unit Deployments & Long‑Term Customer Relationships

The deal structure supports major deployments. Some customers are planning 5 to 10 Nexus units per region, to create mesh networks across difficult terrain. Each delivered contract builds operational relationships with defence agencies, emergency service organisations and industrial‑infrastructure operators.

With the hardware proven, the model transitions toward service multiples and longer‑term revenue growth.

At This Stage, Most Risk Is Already Mitigated

The product is field‑tested. The ecosystem of manufacturing, deployment, and services is underway. The contracts are booked and the platform is being delivered.

This is a rare setup for a public company at this developmental stage.

Why It Matters

- Scale and repeatability: Moving from one‑off pilots to multi‑unit, multi‑phase deliveries

- Vertical integration: Manufacturing acquisition removes external dependency

- Global partnerships: High‑end communications and defence integrations

- Recurring model: Focus shifting to high‑margin service streams

- Defence‑market fit: True alignment with sovereign needs for fully autonomous, deployable communications infrastructure

Why the Next Frontier Isn’t Just Bandwidth. It’s Owning the Field

In the world of mobile communications, few companies carved out a niche quite like Gilat Satellite Networks (NASDAQ:GILT).

With a market cap of approximately US$709 million, Gilat became a global supplier of transportable satellite systems for clients in defense, mining, disaster relief, and other mission-critical industries.

The formula worked: bring broadband to places where conventional networks break down.

But what if you didn’t need a satellite at all?

What if the infrastructure was the product?

That is the opportunity CiTech (CSE:CTTT) (OTC:CITLF) is creating by building physical, self-deployable tower platforms that remove the need for fixed telecom lines, dish systems, or extended installation windows.

The Nexus platform does not just extend signal. It establishes field-grade, power-autonomous infrastructure that can integrate high bandwidth links, surveillance payloads, radar, and counter-drone systems — all in one deployable unit.

Where Gilat brings a signal into the field, CiTech enables full mission operations in the field.

This is what investors often miss. Gilat sells satellite-based terminals. CiTech (CSE:CTTT) (OTC:CITLF) sells the structure that other systems run on, the mast, the power source, the sensors, the platform, and the software layer that connects them all. The margins and control potential are higher. The expansion footprint is wider. And the capital per unit is anchored to physical assets.

That is a model closer to tower companies like American Tower (NYSE:AMT) or infrastructure asset developers, but with the mobility, flexibility, and real-time deployment edge that traditional players cannot match.

It also opens up long-term value creation through software licensing, predictive maintenance, and smart payload rotation. A single Nexus tower can be repurposed for ISR missions, emergency communications, industrial mesh networking, or tactical support — without needing a new structure.

And for investors, the upside is in the convergence.

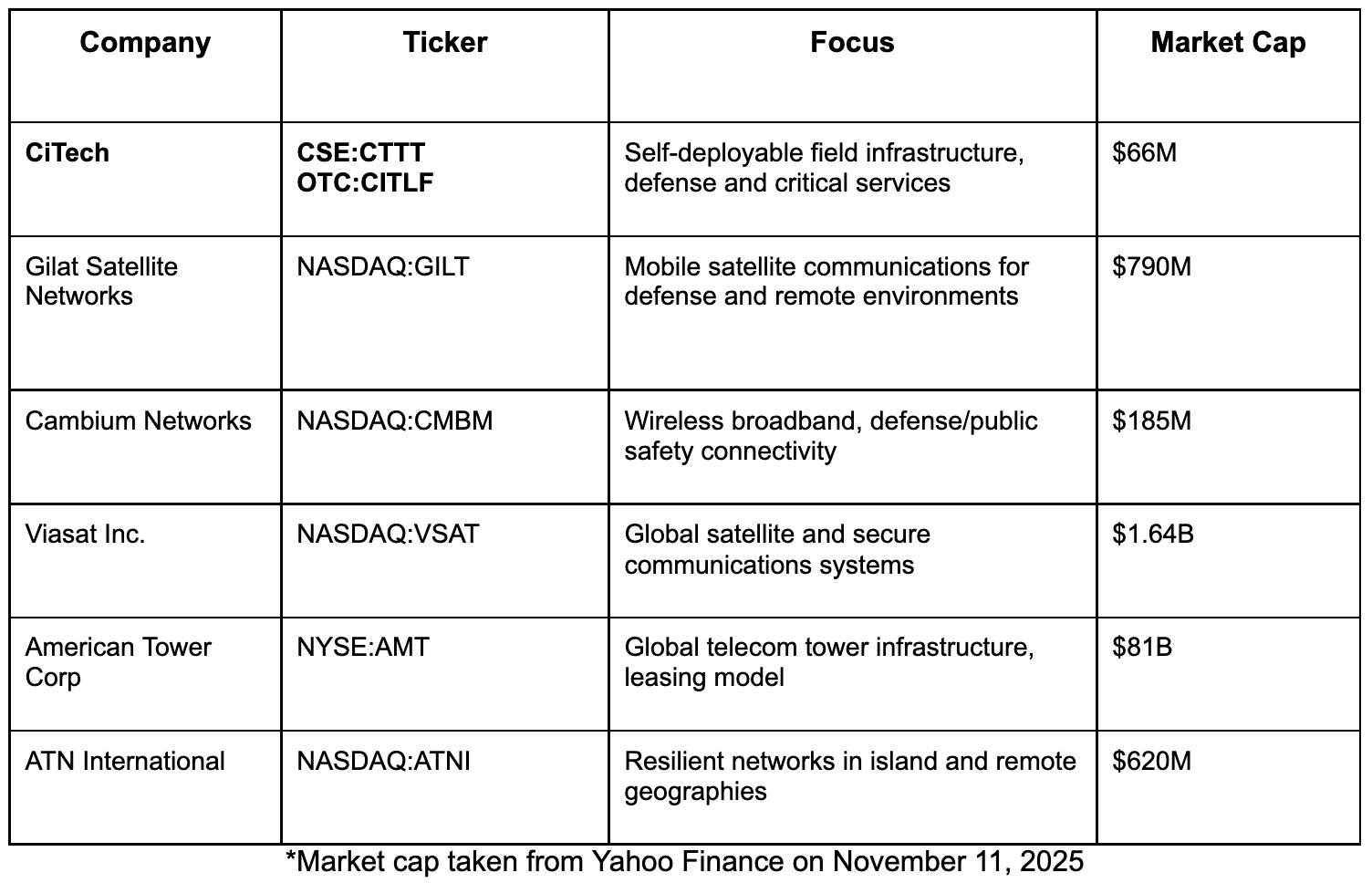

Satellite hardware. Edge compute. Communication intelligence. Mobile infrastructure. These are billion-dollar segments. Gilat, Viasat, Cambium, and American Tower each own slices of that world. CiTech (CSE:CTTT) (OTC:CITLF) is stitching those layers together into a physical-first platform designed to scale.

Here is how it compares to others in the space.

While no one comp is a perfect match, the most relevant from a structural and product-level perspective is Gilat.²⁵

Both companies are solving the same problem. Delivering high-bandwidth connectivity and control to remote locations. But CiTech (CSE:CTTT) (OTC:CITLF) goes one layer deeper by embedding those capabilities into its own platform.

Gilat proved that governments and defense operators will spend heavily to maintain communication at the edge.

CiTech proves that they are now willing to buy the field infrastructure too.

This shift is what makes the upside asymmetric.

The margin potential of recurring Nexus-as-a-Service contracts. The scalability of modular payloads. And the capital leverage of owning the mast, the compute, the power, and the uplink.

Few companies can bring that package to market.

Right now, only one is doing it this early, and it is trading at a fraction of the comps.

When a small-cap moves this quickly, with real contracts, sovereign backing, and major global partners, it demands attention.

Here’s why CiTech (CSE:CTTT) (OTC:CITLF) could be one of the most compelling under-the-radar stocks in autonomous defense and infrastructure tech:

8 Reasons

to Put CiTech (CSE:CTTT) (OTC:CITLF) on Your Radar Right Now

1

Real Revenue, Real Contracts: CiTech has secured over US$5.28M ($7.9M AUD) in signed defense contracts, including with the Australian Department of Defence, Leidos, Babcock, and regional emergency service groups.²⁶ This isn’t future potential, it’s revenue already booked and deployed.

2

Australian Government-Backed: In March 2025, the company was awarded an AUD $1.16 million government grant to manufacture three Nexus 20 units. That’s hard validation from a sovereign client, showing that the platform is seen as a critical national asset.²⁷

3

Strategic Manufacturing Acquisition: CiTech signed a binding term sheet for AUD $7.7 to acquire a Western Australian defense-grade manufacturing facility producing AUD $7.4M+ in revenue and AUD $1.9M+ in EBITDA, fully equipped with CNC machining, robotic welding, ISO certifications, and DISP accreditation.²⁸ This gives CiTech in-house control over delivery, margin, and security clearance.

4

DroneShield Collaboration Signals Market Confidence: In October 2025, DroneShield (ASX:DRO) announced plans to integrate its counter‑UAS technology with CiTech’s Nexus platform. With DroneShield supplying defense agencies in the US, UK, and Australia, this opens doors for joint deployments, stacking military-grade detection onto CiTech’s fully autonomous towers.²⁹

5

Full-Stack Platform, Not Just Hardware: The Nexus platform isn’t just a tower, it includes power, compute, radar, communications, and ISR payload capacity, all deployable in under 30 minutes. This allows for recurring revenue through the Nexus-as-a-Service model: managed services, software updates, signal uptime, and short-term leasing.

6

Massive Industry Tailwinds: Defense and emergency infrastructure spending is surging. The US defense budget for 2025 tops US$849.8B, with growing urgency around mobility, resiliency, and field-ready communications.³⁰ Few companies are positioned like CiTech to offer modular, fully autonomous platforms ready for sovereign deployment.

7

Infrastructure-Grade Margins and Recurring Revenue: Hardware gross margins range between 50–55%, and higher on software and services. Unlike project-based vendors, CiTech’s recurring services model builds long-term value through uptime guarantees, software updates, and leasing structures.

8

Still Trading at a Fraction of Its Peers: While peers like Gilat, Cambium Networks, and ATN International trade between US$185M and US$790M, CiTech remains under US$69.9M. Yet it already holds signed government contracts, real deployments, and owns its product platform end to end, a rare setup in the microcap defense and infrastructure space.

When a company has the product, the contracts, the recurring revenue model, the team, and the strategic channels already lined up, and it is still trading like a pre-commercial microcap, smart investors pay attention.

CiTech (CSE:CTTT) (OTC:CITLF) is doing something rare.

It is quietly building the infrastructure behind the next generation of mobile, secure, and intelligent deployments.

And with its new Hui Huliau NDA, CiTech now has a direct fast lane into US federal deployment channels.³¹

The Team Built for Execution in Defense and Telecom

You don’t build defense-grade infrastructure in a garage.

CiTech (CSE:CTTT) (OTC:CITLF) is led by a team of proven operators, engineers, and capital markets veterans who understand the demands of mission-critical deployment and have decades of experience delivering for government, telecom, and industry.

Brenton Scott – Director/ CEO

- Chartered Accountant Australia/NZ

- Previously a partner in Walker Wayland, Chartered Accountants

- Extensive experience in equity markets, capital raising and public company auditing

- 30 year career encompassing accounting, child care, financial services and marine industries

Andrew Hill – Director/COO

- Electronics Engineer

- 35 year career in resource sector product development and business leadership

- Extensive experience in technology sales and product marketing

- Proven ability to recruit and develop talented and high performing teams

Rodney Louden – CiTech Lead Engineer

- 15 year career in resource sector engineering, project management and field services

- Extensive experience in delivering automation projects for Tier-1 mining companies

- Deep understanding of both rail and resource sector compliance and safety protocols

This is a company with real systems, built by field-tested engineers, governed by public market professionals, and advised by leaders with direct experience in defense, public safety, and infrastructure investment.

CiTech (CSE:CTTT) (OTC:CITLF) is built to execute.

The Bottom Line: Infrastructure That Moves First

In a world where edge deployment is everything, from ISR to telecom to public safety, having mobile infrastructure is no longer a luxury. It is a requirement.

CiTech (CSE:CTTT) (OTC:CITLF) is the first small-cap platform company to bring all of it together:

- The tower.

- The power.

- The signal.

- The software.

- The service model.

- And most importantly, the contracts.

This is not a speculative blueprint. It is a real system, already earning revenue, already expanding, and already backed by institutional capital and defense procurement.

Most early-stage defense and critical systems companies trade on potential.

CiTech is already executing.

The platform is built. The team is proven. The field work is validated. The contracts are active. And the upside is asymmetric, especially at this stage of the public journey.

For investors looking for the next category-defining move in tactical infrastructure, autonomous communications, and defense-grade edge deployment…

CiTech (CSE:CTTT) (OTC:CITLF) is already in motion.

Subscribe to download the corporate presentation now and see what’s being built.