Most investors don’t get a second chance.

The first time a CBD (cannabidiol) medicine rewrote the rules, hardly anyone was watching. A team of scientists purified a single plant molecule. They used it to treat kids with some of the worst seizure disorders on earth.1

For families, it was a miracle.

For investors, it was a blip until the day Jazz Pharmaceuticals dropped $7.2 billion to buy the company behind it.2 By then, it was already too late to get in early.

But something big is stirring in the shadows of biotech.

Some of the smartest funds on Wall Street are taking notice.

Veteran analysts who called the last CBD wave are whispering that history could repeat itself. Only this time, it’s not for seizures.

You see, while headlines chased the next AI chip or the latest weight loss pill, a different health crisis kept building quietly in the background.

It’s not a household name. Most people have never heard of it. But if you or someone you care about has ever faced a heart inflammation disease like pericarditis, you know how brutal it can be.

For those affected, the condition brings persistent pain, frequent hospital visits, and a lingering fear of recurrence. You’d think in this age of medical science, there would be options for recurrent pericarditis.

But there’s only one FDA-approved drug for this heart disease.3 The price? Over $270,000 a year.4

The risks? It suppresses the immune system and leaves patients at higher risk for infections.

Insurance fights. Tradeoffs. There is no miracle cure.

But now, for the first time there might be real hope for a breakthrough.

Why? Because for the first time, a next-generation therapy is targeting cardiac inflammation with science that goes way beyond wellness trends.

Not a generic “CBD”. Not another immune suppressant.

This is a pharmaceutically manufactured drug, developed for the heart.

Big names in healthcare are paying attention.

What the Street Is Starting to See

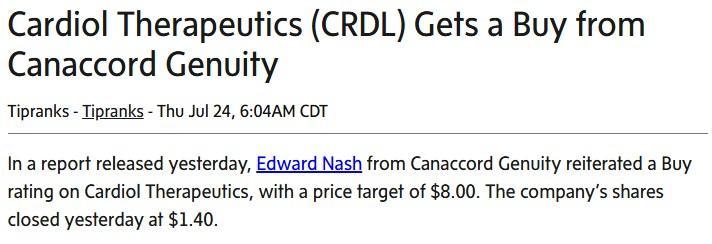

Multiple analysts have initiated targets on Cardiol Therapeutics, and their projections land with serious conviction:

Right now, very few investors are paying attention. That window is closing…

The company at the center of this opportunity is Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL).

And the world’s smart biotech investors are starting to take notice because they’ve seen what happens when a breakthrough therapy hits a market this underserved.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Kiniksa Was Once a Tiny Biotech Company. Then the FDA Gave Them a Green Light, and its Market Cap Exploded

It’s easy to forget now, but Kiniksa Pharmaceuticals wasn’t always over $2 billion in market cap.

Not long ago, they were just another small-cap biotech fighting for attention. They had no revenue. No approved drug. And very few investors cared.

Then everything changed.

Kiniksa’s lead drug, an immunosuppressant injectable biologic called rilonacept, was approved by the FDA for one specific condition.5 Recurrent pericarditis. A painful condition resulting from inflammation of the heart lining that keeps coming back again and again.

The company scaled fast. Sales followed and the stock moved quickly.6

Kiniksa has climbed to over $2 billion in market cap. All because of selling a biologic for a single condition that most people had never heard of.

This is the same condition now being targeted by Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL). But the difference is night and day.

Whereas Kiniksa’s treatment costs more than $270,000 a year7 and suppresses the immune system, Cardiol’s approach is designed and developed to be safer, simpler, more affordable, and taken orally.

And yet Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) trades at a fraction of Kiniksa’s value with a market cap of $120 million.

Same condition. Same market. But with a strong product profile, lower cost of delivery, and a vastly superior safety profile.

Kiniksa proved the market exists.

Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) may now be in position to disrupt it.

With FDA clinical trials advancing, analyst interest rising, and near-term clinical catalysts which could force Wall Street to reprice the entire story, Cardiol offers a case worth examining for investors looking beyond the mainstream.

With FDA clinical trials advancing, analyst interest rising, and near-term clinical catalysts which could force Wall Street to reprice the entire story, Cardiol offers a case worth examining for investors looking beyond the mainstream.

If you missed KNSA when it was small, Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) might be your second shot.

Press Releases

- Cardiol Therapeutics Receives U.S. Patent Allowance Broadly Protecting its Heart Drugs to Late 2040

- Cardiol Therapeutics’ Phase II ARCHER Trial Results to be Presented at the European Society of Cardiology Scientific Meeting on Myocardial & Pericardial Diseases

- Cardiol Therapeutics Completes US$11.4 Million Financing and Extends Cash Runway into Q3 2027

- Cardiol Therapeutics Secures US$11 Million Financing and Extends Cash Runway into Q3 2027

- Cardiol Therapeutics to Participate in Fireside Chat at Canaccord Genuity’s 45th Annual Growth Conference

8 Reasons

Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) Could Be the Next Major Breakout in Heart-Focused Biotech

1

Targeting a Billion-Dollar Market That’s Already Proven: Recurrent pericarditis puts thousands of Americans in the hospital every year8 and the only approved therapy costs over $270,000 per year.9 Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) is developing an oral, non-immunosuppressive alternative that could completely reshape the treatment landscape.

2

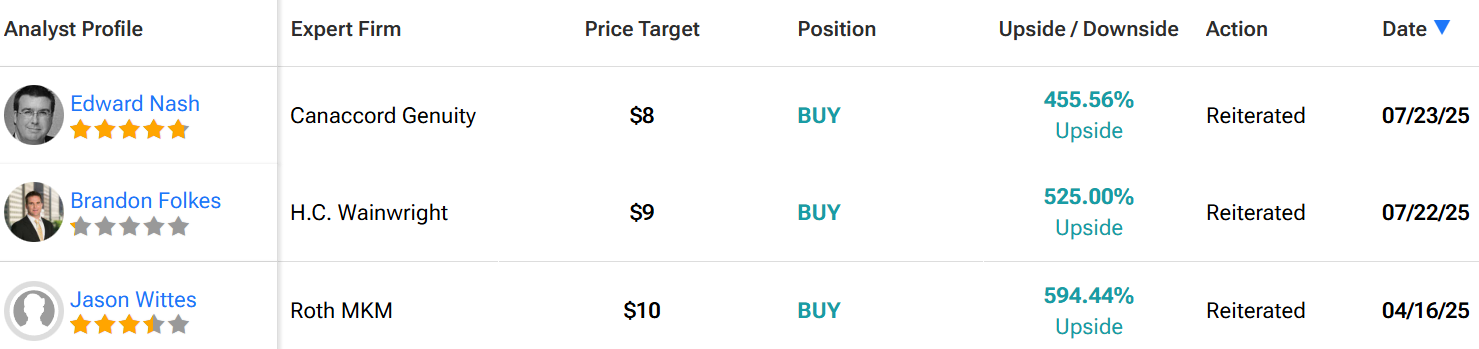

Data from a Landmark Phase III Trial Is Just Quarters Away: The MAVERIC Phase III trial has officially enrolled its first patients, marking a major milestone for Cardiol Therapeutics. Advancing into this pivotal stage Phase III trial positions the company favourably, as it moves closer to commercializing the first FDA-approved non-immunosuppressive treatment for recurrent pericarditis.

3

The Science is Solid: CardiolRx™ is backed by compelling data showing strong anti-inflammatory properties without immune suppression.10 It’s a therapy that avoids many of the complications and challenges seen with current treatments.

4

Big Money Is Already Watching: Institutional investors like UBS Group have taken a position. This type of fund doesn’t invest in hype, they invest in companies with proven science.11

5

Analysts Are Calling for Major Upside: Canaccord Genuity, Roth, and H.C. Wainwright recently reiterated their Buy ratings for Cardiol Therapeutics with price targets that implies several multiples of upside from current levels.12

6

FDA Orphan Drug Designation: Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) has received Orphan Drug designation for CardiolRx™ in for the treatment of pericarditis (which includes reduction in risk of recurrence), granting potential market exclusivity in the US for 7 to 9 years, along with fee waivers, tax credits, and a faster path to potential regulatory approval. This creates a robust competitive moat around its lead program.

7

Led by World-Class Experts: Cardiol’s collaborators include world class clinicians from Harvard, Cleveland Clinic, and other prestigious research centers, and management along with the Board of Directors is stacked with biotech talent and experience.

8

Still Flying Below Wall Street’s Radar: At a $120 million market cap, Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) is trading at early-stage levels, despite being further along than many billion-dollar peers.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Wall Street Analysts Are Quiet Now. But That’s Starting to Change

Every breakout biotech story starts the same way.

For months, even years, the market sleeps on it.

Institutions stay on the sidelines. Analysts stay quiet. Retail barely knows the name.

But then something shifts.

One firm moves first. They issue a bold price target. They plant a flag. And everyone else starts paying attention.

That’s exactly what’s happening right now with Cardiol Therapeutics (NASDAQ: CRDL) (TSX: CRDL).

In early June, H.C. Wainwright initiated coverage with a Buy rating and a target that turned heads: $9.00 per share.14

At the time, CRDL was trading just around $1.25.

That implied over 600% upside.

And they’re not alone.

Four analysts cover the stock.15 Tipranks says the consensus target is $8.50.

So, what does this tell us?

It tells us the smart money is positioning ahead of the MAVERIC Phase III trial.

And it tells us that Cardiol Therapeutics (NASDAQ: CRDL) (TSX: CRDL) may not remain under the radar much longer.

A Billion-Dollar Blind Spot Cardiol Therapeutics is Taking Aim At

Some biotech stories are about speculation. This one is about numbers. Big ones.

Recurrent pericarditis may sound like medical jargon. But this condition represents a quietly valuable market in cardiovascular medicine.

Every year, thousands of patients in North America and Europe suffer repeat episodes of debilitating chest pain, inflammation, and hospital visits.

Most doctors treat the condition with steroids, colchicine, or immune suppressants. Only one FDA-approved therapy exists called rilonacept and it costs a staggering $270,000 per patient per year.16

Despite that sky-high price, the market keeps growing. Current revenue for 3rd line therapies such as rilonacept in the U.S. alone is expected to exceed $600M per year in 2025 and is expected to grow to over $1 billion by 2028, based on analyst forecasts. Rilonacept already has achieved over $1 billion in cumulative sales since its launch for recurrent pericarditis in 2021, despite only 5.5% of the 38,000 patients with recurrent pericarditis in the US being on treatment as of Q2 2025.

This is the window Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is targeting.

Its lead product, CardiolRx™, is being developed as a non-immunosuppressive oral therapy. That means fewer complications, easier administration, and a chance to compete directly against the current approved product, at a fraction of the cost and none of the infection risks.

If Cardiol captures even a slice of the recurrent pericarditis market, it could transform its revenue profile, and fast.

This is not a niche. It’s a potential billion-dollar setup hiding in plain sight.

And Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) is moving first.

One Drug, Two Shots on Goal.

In biotech, most companies hope for a single shot on goal.

Cardiol is lining up two.

Let’s look at where it all started.

In early 2023, Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) enrolled its first patients into the MAvERIC-Pilot, multi-center, randomized, placebo-controlled Phase II study in recurrent pericarditis, a painful, often debilitating condition with few treatment options.

The gold-standard treatment, rilonacept, costs more than $270,000 per year.17 And yet, it’s delivered as a biologic injection that suppresses the immune system.

CardiolRx™ was developed to change that.

It’s oral. Non-immunosuppressive. Scalable. And now, it has momentum.

By February 2024, CardiolRx™ was granted Orphan Drug Designation by the FDA for the treatment of pericarditis, which provides seven to nine years of US market exclusivity and underscores the company’s regulatory traction in a high-need space.

Around this time, MAvERIC-Pilot completed enrollment at top US cardiac centers including Cleveland Clinic, Mayo Clinic, and Massachusetts General Hospital.

Early results were encouraging. The MAvERIC-Pilot completed in mid-2024 and delivered positive topline results, showing rapid and durable reductions in both pericarditis pain and inflammation.18

Not only that, these improvements were also maintained across the full six-month study, alongside a notable reduction in recurrence rates. The therapy was also shown to be safe and well tolerated.

On the back of those results, Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) advanced to the pivotal Phase III MAVERIC trial, which officially began in April 2025, with the first patient enrolled at Northwestern University. Another step towards potential regulatory approval.19

The trial is expected to enroll 110 patients at ~20 sites across the US, Europe and Canada, and aims to confirm CardiolRx™’s ability to prevent recurrence in high-risk patients, laying the groundwork for potential regulatory approval.

The MAVERIC trial’s success alone was a major announcement.

But that’s not Cardiol’s only clinical trial.

On July 22, 2025, the company announced that its ARCHER trial, its Phase II multi-national study in acute myocarditis, had locked its database and reported topline results on August 6, 2025.20

“We couldn’t be happier with the data we just announced” – David Elsley, CEO

Acute myocarditis remains one of the leading causes of sudden cardiac death in young people under 35 and can lead to heart failure. Patients face hospital stays of up to 7 days, a 6% mortality risk, and costs exceeding $110,000 per stay. But there are no FDA-approved therapies indicated for the treatment of acute myocarditis.

ARCHER enrolled over 100 patients at 34 clinical sites in the US, France, Brazil, and Israel. And the trial design was randomized, double-blind, and placebo-controlled, the FDA’s preferred framework.

ARCHER was designed to assess the impact of CardiolRx™ on cardiac magnetic resonance imaging (CMR) parameters that measure heart structure (edema (swelling) and fibrosis (thickening and scarring)) and function, key measurements used to predict the course of the disease in both myocarditis and heart failure patients.

CMR results show CardiolRx™ improved these parameters that measure heart structure and/or function, which represents exciting first in human (“clinical proof of concept”) evidence and justify the continued development of Cardiol’s second cannabidiol therapeutic product—CRD-38—for the mass market of heart failure.

CardiolRx™ was found to be safe and well tolerated, consistent with outcomes from Cardiol’s Phase II MAvERIC trial in recurrent pericarditis. The ARCHER results have been proposed for presentation at an upcoming scientific meeting and are planned for publication.

It’s rare for a company with a market cap of $120 million to have results from two late-stage clinical trials in rare heart diseases and a product in development for heart failure, all three of which target inflammatory heart conditions with high unmet needs.

But that’s exactly what’s happening with Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) right now.

The countdown has already begun.

Heart Failure is a $280 Billion Crisis. Cardiol Therapeutics (NASDAQ:CRDL) (TSX:CRDL) Has a Second Shot at It

What happens if Cardiol Therapeutics’ (NASDAQ:CRDL) (TSX:CRDL) lead drug works?

CardiolRx™ paves the way for regulatory approval and eventual commercial launch, providing early investors with potential positive returns fueled by the expected valuation growth in the market.

But what happens if its second drug does too?

One that never gets the spotlight, but could end up being the sleeper hit.

That’s when the real upside kicks in.

For Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL), that asset is CRD-38.21

Their new drug candidate is being developed for heart failure, one of the biggest and most expensive conditions in modern medicine.

And unlike CardiolRx™, which is taken orally, CRD-38 is delivered subcutaneously, designed for patients with chronic, progressive cardiac disease who need long-term control over inflammation and fibrosis.

So why does this matter?

Because heart failure affects more than 6 million adults in the US alone.22 It’s the top reason seniors get hospitalized. And once you’re diagnosed, your risk of death in the next 5 years is over 50%.23

It’s also one of the most expensive conditions in the system. The US spends almost $40 billion a year treating heart failure,24 while the estimated global cost is upwards of $280 billion,25 and that number is growing fast.

Yet even with all that spending, doctors don’t have enough tools. Other drugs only reduce symptoms. CRD-38 is being developed to target the root causes like fibrosis and inflammation, which is where Cardiol is focused.

CRD-38 targets the inflammatory cascade that drives disease progression.

Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) believes it could offer a safe, more targeted approach for millions of patients stuck on therapies with side effects that are often not well-tolerated.

The program is currently in pre-clinical stage, with the ARCHER Phase II trial anticipated to yield important insights that will advance CRD-38’s development and create an attractive collaboration opportunity with Big Pharma.

The science is real. The market has shown a clear demand. And the delivery method could unlock new patient groups who can’t tolerate oral meds.

In other words, it’s the kind of optionality biotech investors love.

If CRD-38 succeeds, Cardiol Therapeutics (NASDAQ: CRDL) (TSX: CRDL) won’t just be a one-drug story.

Insiders Built This Company for Success and Now the Market Is Catching Up

In biotech, skin in the game matters.

And a company’s leadership lends credibility to its efforts.

That’s exactly the situation at Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL).

CEO David Elsley isn’t just a public face. He’s the founder. He owns shares.26 He has spent over a decade shaping the company’s vision, long before CardiolRx™ ever made it into the clinical pipeline.

He’s been through biotech cycles before. He knows how Wall Street works. And he’s not here to flip shares, he’s here to finish what he started.

Then there’s Dr. Andrew Hamer, the company’s Chief Medical Officer and Head of Research & Development.

He spent several years at Amgen, the first and largest biotech company in the world. Before that, he was a practicing cardiologist.

New Board member Dr. Tim Garnett, a distinguished pharmaceutical industry executive with over 30 years’ experience, including two decades at Eli Lilly, where he served as Chief Medical Officer from 2008 until his retirement in 2021.

And when they joined Cardiol, they weren’t following hype, they were following the science.

Cardiol Therapeutics’ (NASDAQ:CRDL) (TSX:CRDL) scientific advisory board and international steering committees includes global leaders in cardiology, including pre-eminent researchers from Cleveland Clinic, Harvard, and major European medical institutions.

Investors often chase the next approval. But the smart ones chase the people who’ve done it before.

With Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL), that’s exactly what you’re getting.

Wall Street still hasn’t priced this in.

The MAVERIC Phase III trial has enrolled its first patients, marking a major milestone for Cardiol Therapeutics. Advancing into this pivotal Phase III trial positions the company for a significant potential revaluation, as it moves closer to delivering the first FDA approved non-immunosuppressive treatment for recurrent pericarditis.

The ARCHER Phase II trial provided compelling clinical proof of concept for CardiolRx™ and strongly supports advancing the clinical development of CardiolRx™ and CRD-38 in cardiomyopathies, myocarditis, and heart failure. With over 6 million adults in the US alone suffering from this devastating disease27 and almost $40 billion a year spent treating heart failure,28 the company believes it could offer a safe and more targeted approach for millions of people. CRD-38 represents an attractive collaboration opportunity with Big Pharma.

This is a company with real data coming. A biotech built by industry veterans. And a drug that could solve one of medicine’s biggest blind spots, cardiac inflammation.

Cardiol Therapeutics Inc. (NASDAQ:CRDL) (TSX:CRDL) is still under the radar for now.

But that won’t last.

Subscribe now to get our full research briefing and download the latest corporate presentation.

We’ll send you everything you need to understand the story before the crowd wakes up.

The countdown has already started.

Don’t find out after the move.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers