Every great boom hides in plain sight.

For years, investors chased tokens and apps, ignoring the one resource that fuels them all.

Electricity.

Today, data is the new oil, but power is the pipeline.

And the pipelines are running dry.

Across the United States, utilities are refusing new data-center connections.¹ AI clusters are draining grids faster than they can be built.² Energy costs are spiking, and even giants like Amazon³ and Google⁴ are being forced to delay projects.

Yet while America struggles to keep the lights on, something remarkable is happening elsewhere.

The world’s largest institutions are quietly racing to secure the next generation of compute infrastructure. Microsoft and BlackRock just committed $30 billion to build and finance data centers globally.

And OpenAI, Oracle, and SoftBank are now constructing five new “Stargate” sites, a colossal buildout targeting nearly 7 gigawatts of capacity and more than $400 billion in investment over the next few years.⁵

Even NVIDIA is pledging up to $100 billion to supply the advanced compute systems that will drive OpenAI’s expansion.⁶

Together, these moves confirm what insiders already knew, the real money is no longer in apps or tokens. It’s in owning the power and the machines that process everything.

As Marin Katusa says, “use the giants as proof the flood has started.”

Because once the biggest names arrive, the tide is irreversible.

ETF investors have already followed. The Global X Data Center & Digital Infrastructure ETF (DTCR) has soared roughly 40% in the past year, pulling in nearly half a billion dollars in assets.⁷ The iShares Digital Infrastructure ETF (IDGT) is adding millions more. Wall Street is paying attention to the builders of the digital age.

But there’s one corner of this market they haven’t priced in.

Before the flood of institutional money, before the power crunch became headline news, a small group of engineers and investors began locking up access to gigawatts of clean, low-cost electricity in the cold climates of Northern Europe and North America.

Among them stands Bitzero Holdings Inc. (CSE:BITZ.U), an energy-infrastructure company backed by Shark Tank star and billionaire investor Kevin O’Leary,⁸ who describes it as “the picks and shovel” play for the next generation of compute.⁹

Built on the belief that the future of wealth will belong to those who control the world’s cheapest power, Bitzero is turning that vision into reality through renewable-powered infrastructure spanning Norway, Finland, and the United States.

The company is led by Mohammed Bakhashwain, a data infrastructure executive with deep experience in power optimization and sustainable energy systems.

Under his leadership, Bitzero Holdings Inc. (CSE:BITZ.U) has demonstrated profitable operations at its Norway site while maintaining a sustainability focus.

And that story is just beginning.

The next few pages reveal how Bitzero’s (CSE:BITZ.U) network of hydro and nuclear-powered data centers could redefine what “infrastructure investing” means in the age of AI and digital currency.

The Next Trillion-Dollar Boom Is Hiding in Plain Sight: Power

AI isn’t powered by dreams.

It’s powered by megawatts.

Every time ChatGPT answers a question, an image generator renders a picture, or an algorithm trains a new model, it draws electricity from somewhere. And that “somewhere” is quickly becoming the most valuable real estate on Earth.

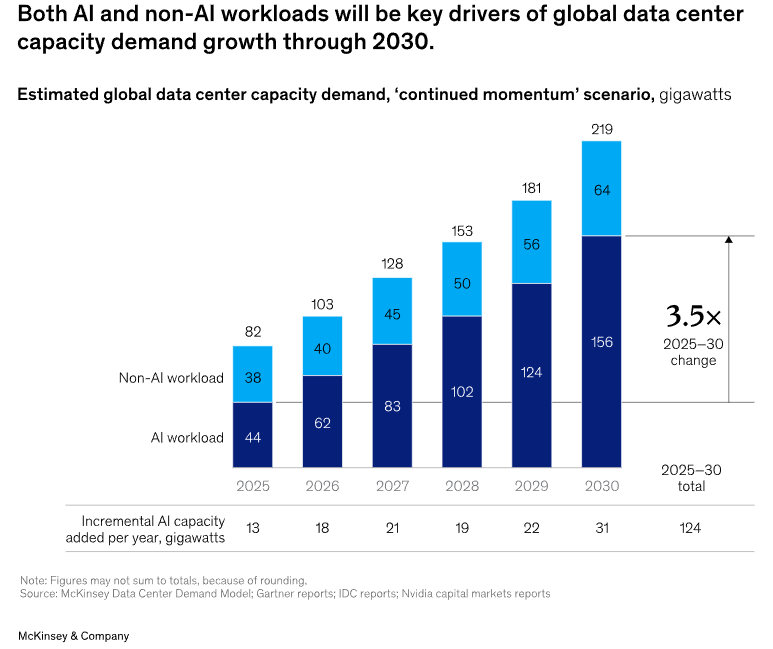

In 2022, global data centers consumed roughly 460 terawatt-hours of electricity (highest case scenario), more than the entire country of Sweden. Analysts now project that number could triple by 2026 to 1.1 petawatt-hours, as AI, Bitcoin, and high-performance computing expand across every sector.¹¹

The bottleneck isn’t chips anymore. It’s power.

Even Nvidia’s $4.56 trillion market cap means nothing without electricity to feed its GPUs. Data centers are the only gateways that can deliver it at scale. That’s why Microsoft, Amazon, and Google are spending tens of billions to secure power before anyone else can.¹²

The US once had an advantage. Cheap natural gas kept data-center costs low. Today, the grid is taxed to the breaking point. Utilities in Georgia, Texas, and Virginia have begun rejecting new power requests because there simply isn’t enough supply.

Average commercial electricity prices in the US now hover around $0.14 per kilowatt-hour (kWh).¹³ In states hosting large AI clusters, it’s even higher.¹⁴

Compare that to Norway, where Bitzero Holdings Inc. (CSE:BITZ.U) operates its flagship facility, where industrial electricity prices (for energy-intensive industry, excluding taxes and grid rent) averaged 40.1 øre per kWh (US$0.037/kWh) in Q2 2025.¹⁵

That’s roughly one-third of broad US commercial rates, powered almost entirely by renewable hydroelectric energy.

And while top public miners also secure power in the 3 to 5 cent range, Bitzero’s edge lies in owning its power infrastructure outright, ensuring those low costs remain stable as energy demand spikes worldwide.

This energy crunch has triggered the next great industrial boom: the global race to control power infrastructure.

This isn’t a tech cycle. It’s an industrial one.

The power crunch isn’t slowing innovation. It’s accelerating it.

BITZ In The News

In 2025, Microsoft and BlackRock launched their $30 billion AI infrastructure fund,¹⁶ calling power access “the defining constraint of this decade.” McKinsey estimates global data-center buildout will require $6.7 trillion in investment by 2030.¹⁷

While others are scrambling to find power, Bitzero Holdings Inc. (CSE:BITZ.U) saw this coming years ago. Its leadership began acquiring power-rich properties years before the crowd.

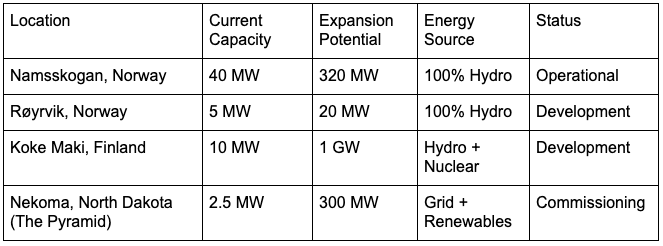

At its flagship facility in Namsskogan, Norway, Bitzero Holdings (CSE:BITZ.U) operates a 50,000-square-metre complex in the country’s lowest-cost power region (NO4).

Here, the company has purchased 16,500 miners and running across 39 high-security containers, powered entirely by 100% renewable hydro energy. Electricity costs average just 4 cents per kilowatt-hour, less than one-third of what most US operators pay.¹⁸

That stability translates into millions in annual savings per site. It’s the reason Bitcoin miners, cloud providers, and AI startups are flooding into Nordic regions while US operators struggle to keep the lights on.

Phase 1 expansion is already underway, increasing operating capacity to 110 megawatts. Phase 2 will take the site to a staggering 315 MW, enough to make it one of Europe’s largest renewable-powered compute hubs.

Just north, Bitzero’s (CSE:BITZ.U) second Norwegian facility in Røyrvik has the potential to add up to 20 MW of capacity and sits directly on high-voltage infrastructure, providing seamless scalability and operational redundancy.

Across the border in Finland,Bitzero Holdings Inc. (CSE:BITZ.U) has secured a 971,500-square-metre site near the port city of Pori, a power-rich region fueled by hydro, nuclear, wind, and solar energy.

With 40 MW ready to activate in the near term and a 1 GW total build-out potential, this property alone could rival some of the world’s largest data-center projects.

These Nordic assets give Bitzero Holdings Inc. (CSE:BITZ.U) a critical edge: access to cheap, renewable power in politically stable, energy-abundant regions. It’s the perfect foundation for what comes next.

And now, Bitzero is expanding that footprint to the United States.

As negative effects of giga scale compute located in highly populated areas impact the domestic power users and population through noise pollution and other negative impacts,¹⁹ Bitzero’s North Dakota facility is perfectly positioned to capture the demand in a remote location which solves the above problems.

The company’s North Dakota facility, built on a 184-acre former Cold War military complex, is strategically positioned to capture the increasing demand of HPC and compute power load which is expected to grow astronomically . It’s fortified, and with access to a diversified power mix of wind, natural gas, and grid supply.

While others scramble to adapt, Bitzero Holdings (CSE:BITZ.U) is already positioned to feed America’s growing appetite for domestic compute.

The Power Footprint of Bitzero Holdings Inc. (CSE:BITZ.U)

Total Potential Capacity: Over 1 Gigawatt

Bitzero Holdings‘ (CSE:BITZ.U) diversified energy footprint spans hydro, nuclear, and grid-connected power giving it scalability, geographic stability, and a clean energy advantage.

Fueling Expansion with $25 Million in Fresh Capital

In July 2025, Bitzero Holdings Inc. (CSE:BITZ.U) secured $25 million in new investment to accelerate the growth of its high-performance compute and blockchain operations.²⁰

The initial deployment under this capital raise included 2,900 Bitmain S21 Pro units, representing the best return on cash in the market upon purchase. Each operates at 15 joules per terahash, setting a new standard for power-to-performance efficiency.

The 2900 units are now operational, with management projecting roughly $10 million in additional annual revenue from this rollout alone.

That statement captures what sets Bitzero Holdings Inc. (CSE:BITZ.U) apart from traditional miners. The company isn’t chasing price cycles, it’s building a durable infrastructure platform that can generate consistent returns while remaining fully aligned with global sustainability goals.

Each facility is designed to integrate with local communities. In Norway, waste heat from operations is repurposed to various uses, creating value beyond the power grid.

This model reflects BITZ.U’s community-centered approach — profitable, clean, and socially integrated — and reinforces its standing as a next-generation infrastructure operator rather than a speculative miner.

By combining ultra-efficient hardware, low-cost renewable power, and cold-climate cooling, Bitzero Holdings Inc. (CSE:BITZ.U) operates at one of the lowest cost bases in the world.

It’s a formula that makes profitability sustainable, even during market volatility — a balance few data-center operators can claim.

With new equipment coming online by early 2026, Bitzero Holdings Inc. (CSE:BITZ.U) is entering its next growth phase just as the rest of the world begins fighting over clean, affordable power.

Press Releases

- Bitzero Holdings Inc. (Formerly WBM Capital Corp.) Announces Closing of Reverse Takeover Transaction and Conditional Approval to List on the Canadian Securities Exchange

- Bitzero raises $25M to expand sustainable bitcoin mining and AI infrastructure

- Bitzero: $25 Million Secured For Advancing Sustainable Blockchain Mining

- Cryptofirm Bitzero secures $25m in funding to power mining operations

- Blockchain startup Bitzero raises $25m

Beyond Mining: Powering the Future of AI Infrastructure

Bitzero Holdings Inc. (CSE:BITZ.U) was never designed to be just another Bitcoin miner.

From the beginning, its strategy has focused on owning the infrastructure backbone that powers the digital economy from land to power and more.

Its renewable-powered data centers are being built for flexibility, capable of supporting both blockchain validation and high-performance computing (HPC) for artificial intelligence workloads.

This dual-purpose design allows Bitzero Holdings Inc. (CSE:BITZ.U) to adapt quickly to the most profitable compute markets.

When Bitcoin prices are high, its facilities generate strong returns through mining. As AI demand surges, the same power infrastructure can be repurposed for GPU hosting, AI inference, or decentralized computing applications.

That versatility separates Bitzero Holdings Inc. (CSE:BITZ.U) from nearly every other miner in the world.

Instead of being exposed to the volatility of a single asset class, BITZ.U is positioned at the crossroads of two global megatrends—digital assets and artificial intelligence.

By owning and operating its high voltage energy connections, land, and hardware outright, Bitzero Holdings Inc. (CSE:BITZ.U) can pivot toward whichever sector offers the greatest long-term yield, all while maintaining industry-leading efficiency.

It’s not just a mining company anymore.

It’s becoming a renewable data infrastructure powerhouse—one positioned to power the AI revolution cleanly, profitably, and at scale.

The $6.7 Trillion Market Opportunity

By 2030, the world will face one of the biggest spending booms in modern history.

McKinsey’s research shows that data centers will demand nearly $6.7 trillion in global investment just to keep pace with the explosion in compute power.²³

Here’s the breakdown:

Roughly $5.2 trillion will pour into facilities built for AI workloads. The massive clusters training language models, powering autonomous systems, and fueling the new industrial revolution of intelligence.

Another $1.5 trillion will go toward traditional IT infrastructure, the backbone that keeps the world’s digital economy running.

All told, that’s almost $7 trillion in new capital needed before the decade ends.

It’s not just a number, it’s the price tag of the next global arms race in computing power.

Goldman Sachs calls it the “largest capex cycle in tech history.”²⁴

The rest of the market is fragmented—smaller miners, outdated facilities, and speculative builders chasing high power prices.

Bitzero Holdings Inc. (CSE:BITZ.U) isn’t chasing. It’s already building.

By securing its power and land instead of leasing it, Bitzero Holdings Inc. (CSE:BITZ.U) keeps control of both operating costs and expansion.

That’s what separates it from overleveraged peers that rent capacity from third-party providers. It’s the difference between being a tenant and being a landlord in the age of AI.

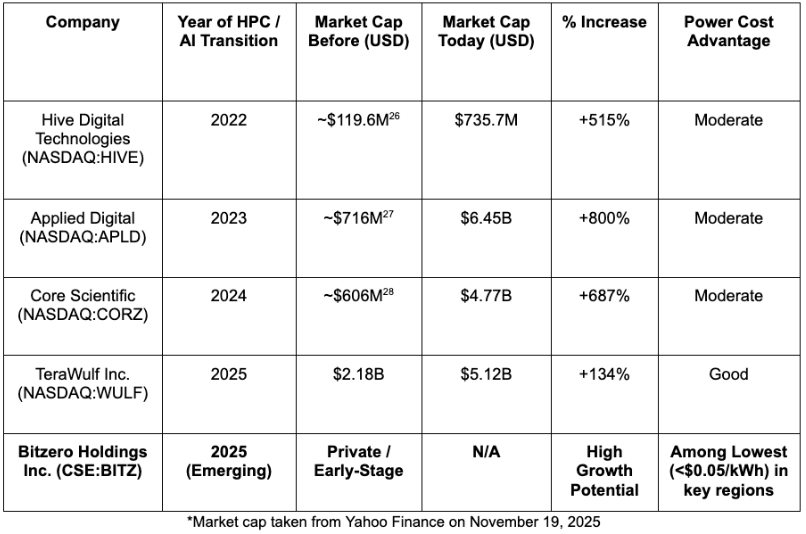

Performance & Market Proof: Who’s Already Winning

Bitzero Holdings Inc. (CSE: BITZ.U) is positioning itself where every major miner is now trying to go.

While the rest of the industry scrambles to retrofit old Bitcoin infrastructure for AI and high-performance computing (HPC), Bitzero has been building that foundation from day one: low-cost power, owned sites, and scalable renewable energy.

It’s the same playbook that turned early crypto miners like Hive Digital, Riot Platforms, and Core Scientific into billion-dollar names… Only this time, Bitzero Holdings Inc. (CSE:BITZ.U) is starting at a fraction of their market cap.

When Hive Digital (NASDAQ:HIVE) pivoted from Bitcoin to HPC workloads in 2022, its market value tripled within a year. Applied Digital (NASDAQ:APLD) made a similar move, signing multi-year GPU hosting contracts worth hundreds of millions and the stock surged 250%.

By 2024, Core Scientific (NASDAQ:CORZ) joined the shift, surging more than 260% as it diversified from Bitcoin into AI and cloud infrastructure.

Now, the biggest players in the industry are following that same path.

Riot Platforms (NASDAQ:RIOT) recently added 238 acres to its Corsicana, Texas campus, now 858 acres total, with 600 MW earmarked for AI workloads.

And TeraWulf (NASDAQ:WULF) signed two 10-year AI hosting agreements covering 200+ MW at its Lake Mariner campus, backed by Google’s lease support, sending shares sharply higher.²⁵

Bitzero Holdings Inc. (CSE:BITZ.U) is following that same evolutionary path, but with a stronger foundation: cheaper power, owned infrastructure, and a diversified energy mix.

If the pattern repeats, the opportunity could be enormous.

Every bull market begins quietly.

Before headlines appear, before the big money moves, there’s a whisper—an early signal that the tide has already turned.

That signal has arrived in the data-center world.

Just two years ago, the idea of investing in data-center infrastructure barely made Wall Street’s radar. Today, it’s one of the fastest-growing sectors in the market. Global funds and public companies are racing to secure power, capacity, and land before it’s gone.

The proof is in the charts.

The Global X Data Center & Digital Infrastructure ETF (DTCR), one of the first ETFs built purely around this theme, has surged roughly 39% year-to-date, reaching about $21.40 per share as of October 9, 2025. Its assets under management have climbed to nearly $470 million, fueled by inflows from institutional investors looking for exposure to the builders behind the AI revolution.

Meanwhile, iShares Digital Infrastructure ETF (IDGT) has also attracted steady inflows, rising close to 32% year-to-date. The fund’s holdings include the same kind of companies leading the digital transformation: data-center REITs, connectivity providers, and energy-efficient hardware operators.

Together, these ETFs show where the capital is moving: toward the infrastructure powering AI and cloud growth, not just the software built on top of it.

Each of these names started small. Each faced skepticism. And each exploded once Wall Street recognized their pivot from mining to infrastructure.

Now, the same setup is forming again, only this time, the conditions are even stronger. Power costs are climbing in the US, demand for clean compute is rising exponentially, and investors are beginning to understand that the companies controlling renewable energy will define the next decade of technology.

That’s exactly where Bitzero Holdings Inc. (CSE:BITZ.U) is positioned.

Before the funds catch on, Bitzero is already building where others aren’t, on top of hydro and nuclear grids that offer among the lowest power costs in the world.

The smart money has already placed its bets. The ETFs, the public peers, and the price action all point in the same direction.

Bitzero Holdings Inc. (CSE:BITZ.U) isn’t following that trend. It’s been there all along, quietly building the foundation for what comes next.

The story of AI and Bitcoin is now the story of electricity.

Those who control power, efficiency, and scale will control the future of computing. That’s why Bitzero Holdings Inc. (CSE:BITZ.U) stands out in a sea of digital infrastructure names.

Here are eight reasons investors are starting to take notice:

8 Reasons

Bitzero Holdings Inc. (CSE:BITZ.U) Belongs on Your Radar

1

Timing the Perfect Inflection Point: AI and digital compute demand are growing faster than global energy supply. The International Energy Agency projects that data-center electricity consumption could triple by 2030. Bitzero Holdings Inc. (CSE:BITZ.U) is expanding its renewable-powered capacity at the exact moment the world begins to run short.

2

One Gigawatt of Renewable Power in Motion: BITZ.U has already secured access to more than one gigawatt of potential capacity across Norway, Finland, and North Dakota. These sites are hydro, nuclear, and grid-integrated, capable of scaling compute infrastructure for both AI and Bitcoin operations.

3

Among the Lowest Power Costs Worldwide: While US operators pay an average of $0.14 per kilowatt-hour, Bitzero Holdings Inc. (CSE:BITZ.U) enjoys industrial rates below $0.04.²⁹ That cost advantage translates directly into higher margins and greater resilience against market volatility.

4

Backed by Kevin O’Leary: “Shark Tank” investor Kevin O’Leary recognized the opportunity early. He invested in BITZ.U not for speculation, but because it owns the infrastructure that makes AI and Bitcoin possible. He calls it “the new picks and shovels” of the digital economy.

5

Ahead of Institutional Capital: When Microsoft and BlackRock commit $30 billion to building AI data centers, it signals a global race to secure power. Bitzero Holdings Inc. (CSE:BITZ.U) already controls the kind of low-cost capacity those institutions are now trying to acquire.

6

A Proven Model with Room to Run: Peer companies like Hive Digital, Applied Digital, and Core Scientific tripled in value after pivoting to HPC workloads. Bitzero Holdings Inc. (CSE:BITZ.U) is positioned to follow that same path, with a stronger energy base and less overhead.

7

Sustainable and Scalable: Every Bitzero facility runs on clean energy. The Norway sites are 100% hydro-powered, and Finland combines hydro and nuclear. This ensures compliance with ESG standards while keeping operations future-proof against environmental regulation.

8

Built for Two Booming Markets: Bitzero Holdings Inc. (CSE:BITZ.U) earns from both ends of the spectrum, Bitcoin mining today and high-performance computing tomorrow. As the company expands into AI hosting and GPU infrastructure, it gains exposure to two trillion-dollar industries from one platform.

Putting It All Together

AI, Bitcoin, and data infrastructure are converging into a single global megatrend. The winners will be those who can deliver compute at scale, sustainably, and at the lowest cost per megawatt.

With new Bitmain S21 Pro units already deployed and a further order of even more efficient miners to be deployed within the next 4 months , Bitzero Holdings is positioned for potential near-term revenue growth in 2025 following deployment just as demand for green compute surges worldwide .

That’s exactly what Bitzero Holdings Inc. (CSE:BITZ.U) has built its business around.

It’s early, it’s efficient, and it’s positioned in the right places at the right time. For investors searching for ground-floor exposure to the infrastructure behind AI and digital assets, Bitzero (CSE:BITZ.U) is a name worth watching closely.

The Builders Behind Bitzero Holdings Inc. (CSE:BITZ.U)

The Team That Turned Power Into Profit Before Anyone Else Saw It Coming

Behind Bitzero Holdings Inc. (CSE:BITZ.U) is a leadership group that has built, scaled, and exited some of the most recognized ventures in digital finance and technology.

Bitzero Opens the Market

A milestone moment featuring Kevin O’Leary and Mohammed Bakhashwain as Bitzero Holdings Inc. (CSE:BITZ.U) marks its expansion and vision for renewable-powered AI infrastructure.

The Next Great Infrastructure Story Is Already Being Written

Every few decades, a new industrial backbone emerges.

In the 1990s, it was the internet.

In the 2000s, it was cloud computing.

Today, it’s the data centers and power grids that will feed the age of artificial intelligence.

The signs are all around us.

Energy demand is breaking records. AI clusters are draining grids faster than nations can build them. Governments are rewriting policy to prioritize clean power, and investors are pouring billions into infrastructure that most people will never see, but will rely on every day.

Bitzero Holdings Inc. (CSE:BITZ.U) saw this before it became headline news.

Its strategy was never about speculation. It was about preparation—locking in access to the cleanest, cheapest, and most reliable energy sources on the planet. While others chased hype cycles, Bitzero built the foundation for the next trillion-dollar transformation.

Now, as institutional capital floods into the sector, the company’s timing looks extraordinary.

Securing power, efficiency, and scale has become the ultimate advantage.

The question isn’t whether the world will need more compute. It’s who will have the power to provide it.

And that’s where Bitzero Holdings Inc. (CSE:BITZ.U) stands apart.

For those who understand how rare early positioning like this can be, now is the moment to look closer.

The full story, including expansion plans, capacity breakdowns, and next-phase development timelines is available in the Bitzero Holdings Inc. (CSE:BITZ.U) Corporate Presentation.

Mohammed BakhashwainPresident

Mohammed BakhashwainPresident Kevin O’LearyStrategic Investor

Kevin O’LearyStrategic Investor