After years of stagnant prices, green-energy-driven investment in nuclear power is thrusting uranium back into the spotlight and sending prices to a 12-year high.

In the last 24 months, uranium prices have more than doubled, reaching up to US$65 per pound and this is likely just the beginning.

Source: https://tradingeconomics.com/commodity/uranium

Why?

In short, the world is desperate for clean energy sources.

In fact, climate protesters worldwide called for an end to fossil fuels amid escalating weather extremes on September 15th.1

In fact, climate protesters worldwide called for an end to fossil fuels amid escalating weather extremes on September 15th.1

Forget what the mainstream media says about electric vehicles, solar panels and wind power being the only solution for clean energy. Despite pushback over the years, nuclear has and always will be one of the few sources of energy that can support base load power requirements and significantly reduce carbon emissions.

Uranium prices are still ‘nowhere near the peak of the last cycle’

Uranium prices are still ‘nowhere near the peak of the last cycle’

Demand for uranium in nuclear reactors is expected to climb by 28% by 2030 and nearly double by 2040 as governments ramp up nuclear power capacity to meet zero-carbon targets, according to Reuters, citing a World Nuclear Association’s report in early September.

Right now, there are about 440 nuclear power reactors in 32 countries2 providing 10% of the world’s electricity,3 but the sector is rapidly picking up speed as more and more reactors come online.

Each year, there is a significant shortfall, amounting to 50 million pounds, of uranium, creating a gap between the supplies sourced from mines and the amount needed to run nuclear power plants. “The nuclear reactors globally use about 185 million pounds [of uranium] per year, and that’s going up each year, but the mines can only supply about 135 million pounds,” stated Mike Kozak, an expert on metals and mining at Cantor Fitzgerald.

When it comes to fueling these reactors with uranium, the Athabasca Basin has become the center of attention and is home to the world’s largest high-grade deposits.

In fact, the grades of uranium deposits found in the Athabasca Basin can be 10 to 100 times greater than the global average mined everywhere else in the world.4

Among those gaining attention in this red-hot region is Cameco Corp, one of the largest global producers.

Cameco’s stock price has shot up over 80% in the last 9 months, increasing the company’s market cap to more than C$17 billion.

Source: https://tradingeconomics.com/cco:cn

Exploration companies are basking in the glow of this booming market too.

Take F3 Uranium as an example. F3’s stock price has increased by an incredible 370% following their spectacular discovery in the Athabasca Basin in November 2022.5

Another company that looks to benefit from the uranium gold rush is junior miner ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U).

Atha Energy holds the largest prospective land package in the highest-grade uranium district in the world6 – 3.4 million acres in the Athabasca Basin.

Nestled amidst groundbreaking discoveries, ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) isn’t just a powerhouse with a lucrative land package. It’s steered by a stellar management team renowned for amplifying shareholder value. We’re talking seasoned geologists with deep roots in the Athabasca Basin who have worked with Cameco, NexGen, Denison Mines, 92 Energy – the list goes on.7

In fact, ATHA (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) founders were responsible for delivering NexGen’s foundational assets at inception, leading to the discovery of NexGen’s Arrow deposit which has a net present value of about C$3.5 billion.8

Investors have taken note by investing over C$40 million into the company as they ride the nuclear energy wave with this top-tier contender.

Last month, ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) announced an exploration program that includes the largest ever multiplatform electromagnetic survey in the history of the Athabasca Basin – a critical step in its large-scale discovery process.9

That’s really just the beginning of what this company has to offer. Let’s look at some of the key points that make ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) stand out:

6 Reasons

Why ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) Deserves To Be On Your Radar

1

Booming Uranium Market: Uranium prices just hit a 12-year high and have more than doubled in two years, reaching US$65/lb.

2

Largest Footprint in World’s Best Basin: ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) holds the largest prospective land package in the highest-grade uranium district in the world10 – 3.4 million acres in the Athabasca Basin.

3

Desirable Carried Interest: ATHA Energy’s (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) assets include 10% carried interests on exploration blocks owned and operated by two successful development teams in the Athabasca Basin: NexGen Energy & IsoEnergy.

4

Massive Supply Deficit: The uranium market is currently in a 26% production deficit and expected to increase significantly by 2040, with over 50% of global production embedded with significant geopolitical risk.11

5

Proven technical and capital markets team: ATHA Energy’s (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) leadership team is stacked with industry heavyweights with solid experience in the region. ATHA CEO Troy Boisjoli played a pivotal role in NexGen’s world-class Arrow Deposit, Doug Engdahl worked on Cameco’s premier McArthur River Mine; and Doug Adams, who has been part of significant uranium discoveries across the Athabasca region including Eagle Point, McArthur River & West McArthur River, Crowe Butte, Brown Ranch, and most recently the GMZ zone on 92 Energy’s Gemini project.12

6

Tight Share Structure and Cashed Up: Well financed with C$25 million in cash to aggressively pursue its exploration assets and any accretive acquisition opportunities.

Nuclear Revival Could Spur Uranium Supply Crunch

When it comes to fighting climate change, nuclear energy is the clear winner with the lowest CO2 emissions of any energy option. And with uranium’s unparalleled energy density, nuclear production can provide primary energy with a tiny footprint.

Right now, there are over 60 power reactors being constructed in 15 countries,15 all of which cost billions of dollars to build. At the same time, the US has launched a $6 billion program to preserve the existing US fleet of nuclear power reactors.16

Press Releases

-

-

- Atha Energy Announces $12 Million Option with Stallion Discoveries for Exploration of Southwestern Athabasca Claims

- Atha Energy Announces Changes To Board Of Directors And Management Team

- ATHA Energy Announces Filing Of Final Prospectus And Receipt Of Approval To List On The Canadian Securities Exchange

- ATHA Energy Announces Conversion Of Subscription Receipts And Completion Of Significant Asset Acquisition

-

But demand is outpacing supply, with only 130 million pounds of uranium extracted from the ground each year, leaving a deficit of 26% that’s expected to grow.17

This creates an opportunity for companies like ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) to benefit from the increased demand.

The recent innovation of small modular reactors (SMRs)18 also suggests there could be an increase in the scope of demand from areas previously unsuitable to nuclear energy production.

Is Sprott Causing a Uranium Short Squeeze?

SPUT’s (Sprott Physical Uranium Trust) injection of billions in liquidity19 with uranium spot purchases aiding price discovery and supporting the need for new discoveries.

As this fund keeps getting larger, more and more uranium will be taken out of supply and could potentially create a supply squeeze. Take a look at its chart.

Sprott Update on Uranium – Watch This Video

Right now, three countries make up two-thirds of the world uranium production21 but more than 40% of that supply is embedded with significant geopolitical risk.22 Russia’s invasion of Ukraine clearly demonstrated the fragility in the uranium supply chain and prompted a focus on domestic supply.

Although the US is the largest consumer of uranium, it accounts for less than 0.02% of global production, creating a big opportunity for potential North American exploration companies like ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U).

ATHA Energy Corp’s Gigantic Land Package in the Athabasca Basin: The Key to Unlocking Nuclear Energy’s Potential

As a uranium explorer setting sights on North America, there’s no better destination than the expansive Athabasca Basin, spanning 100,000 km² across the fertile lands of Saskatchewan and Alberta.

Stand where the world’s most abundant and premium uranium reserves flourish, in a region crowned as the global runner-up for investment allure. Saskatchewan was just ranked second in the world in overall investment attractiveness by the Fraser Institute – Canada’s top think-tank.23

It’s precisely here that ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) has strategically anchored its roots, boasting one of the most impressive exploration portfolios in the Basin. Over the span of a decade, a renowned Canadian uranium staking team meticulously assembled this massive 3.4 million-acre position, setting the stage for unprecedented opportunities in uranium exploration.

The Athabasca Basin has all the hallmarks of an incredible uranium production project. It has a long and rich history of uranium production boasting over 900 million lbs of U3O8 produced since 1975.24 Currently, the known resource estimate stands at about 606,600 tonnes of U3O8 but there is significant room for further exploration.25

ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) will have the advantage of its projects being located in one of the lowest production cost regions in the world with deposits averaging 20 times the international average grade.26

ATHA Energy’s land coverage in the basin is over five main areas, which are all located in very close proximity to some globally significant projects.

SW Partnership Area

It’s no surprise why ATHA Energy scooped up this land – it’s adjacent to NexGen and Fission Uranium’s carried lands which currently represent the top two development assets in the Basin. Several experts agree that this zone is the pre-eminent uranium exploration area globally for high-grade, high-tonnage mineralization.27

According to NexGen’s feasibility study, its Rook I project in the southwestern area of the Athabasca Basin is the largest development-stage uranium project in Canada. Measured and indicated mineral resources total 3,754 kt grading 3.10% U3O8 containing 256.7 million lbs.28

In July, ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) announced a $12 million option agreement, providing Stallion Discoveries Corp. the option to acquire 70% interest in 47 mineral claims in southwest Athabasca.29

East Rim

Hosts the largest production uranium mine (McArthur River) in the world with a significant history of production. The zone sits next to Cameco’s Cigar Lake which is the world’s highest-grade uranium mine and has produced a total of 105 million lbs30 since commissioning in 2014.

It has excellent infrastructure in place for extraction, milling, and transportation,31 making it perfect for ATHA Energy Corp’s (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) exploration plans.

Cable Bay

The Cable Bay district lies west of many of the Basin’s largest uranium discoveries in ATHA’s East Rim exploration district. Historically, the area has been difficult to explore due to the limits of geophysical technologies used during the last uranium bull cycle that were unable to investigate beyond depths of 800 meters. The application of modern exploration techniques to an underexplored area within the Athabasca Basin provides a high amount of potential as to what might be found now that deposits at greater depths are being considered economic.

North Rim

The NW Basin has historically shown that it’s highly prospective for additional high-grade mineralization. The major advantage of this zone is that surface showings by other explorers support the potential for open-pit mining in the area. Already, major uranium development and production companies like Cameco, Orano, and NexGen have begun exploring the area.32

West Rim

Historically, this zone has been under-explored for uranium despite multiple uranium showings in the area. It is adjacent to the Maybelle deposit held by Orano and GoldMining and it appears that there is potential for more discoveries in the area. Most important of all, the zone gives ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) the advantage of low holding costs across the prospective acreage.33

With the company’s land position adjacent to all these past and currently producing uranium mines, ATHA Energy Corp’s prospects look extremely encouraging.

But this is not the only thing that makes ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) an attractive North American uranium play. Let’s take a look at how the company stacks against its peers in the region.

- ATHA Energy (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) has a modest market capitalization of C$118 million but has the least number of shares outstanding compared to uranium companies like NexGen and Cameco, which have approximately 3x-5x the number of shares.

- Has the largest land package among all its peers in the Athabasca basin, a fact that the market seems to be discounting.

- Has significant exploration budget available, with over $25 million cash on hand.

Now add this to the fact that the company owns a 10% carried interest on prospective exploration grounds owned and operated by some of the most successful development teams in the Athabasca basin, it becomes clear just how undervalued ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) is.

ATHA Energy (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) Has Valuable Ownership Stake on Key Prospective Exploration Blocks

The 10% carried interest is on certain grounds owned and operated by NexGen Energy and IsoEnergy. The carry was acquired privately in the depths of the uranium bear market and maintained privately for a decade.

For those who are unfamiliar, carried interest means ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) will receive a 10% share of these projects as a free carry until they become an economic deposit.

Judging from the potential they offer, it could be a very lucrative investment.

ATHA Energy Corp’s carried interest on NexGen’s land is located on a conductive corridor located southeast of the Derkson and Patterson conductive corridors.

Not only has historic drilling on the corridor returned radioactivity with the right structure, alteration, and geology, but several major discoveries on adjacent lands suggest the next big find could be here.

NexGen’s Arrow deposit, which is currently the largest, highest grade ‘to-be-developed’ uranium deposit in Canada, has an indicated resource of 257 million lbs of uranium with an NPV of C$3.5 billion.38

Meanwhile, Fission Uranium Corp’s Patterson Lake South (PLS) boasts a indicated resource of 114.9 million lbs of uranium39 with an NPV of about C$1.2 billion.

ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) also has 10% carried interest on certain IsoEnergy’s land, which is located adjacent to Canada’s only two operating uranium mines: Cigar Lake, the world’s highest grade uranium mine that has been producing 105 million lbs of uranium since 201440 and McArthur River, the world’s largest high-grade uranium mine with 235 million lbs proven & probable U3O8 reserves.41

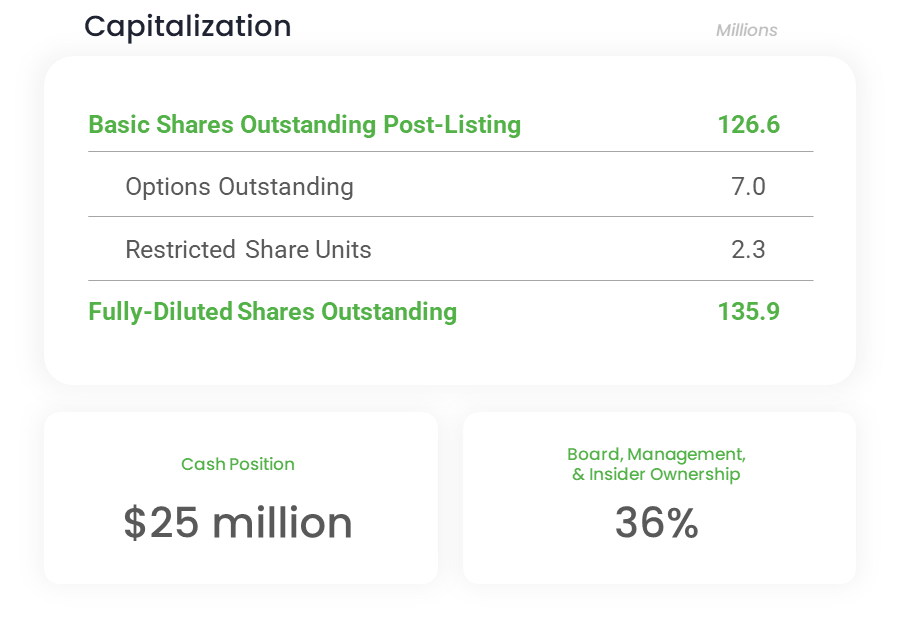

Well Financed With Tight Share Structure

Apart from having the largest land package in one of the world’s most prolific uranium mining regions, ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) also has a very tidy cap structure and more than enough cash to explore its vast property.

The company has a tight share structure with only 126.6 million outstanding shares, 36% of which is held by the board, management and insiders.

Not to mention ATHA Energy Corp has plenty of money in the bank. After raising over C$40 million through two separate financings, ATHA still maintains C$25 million cash even after initiating the Athabasca Basin’s largest ever EM survey – the first step in its strategy of exploration at scale.

ATHA’s (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) Stacked Team With Strong Value Creation Track Record

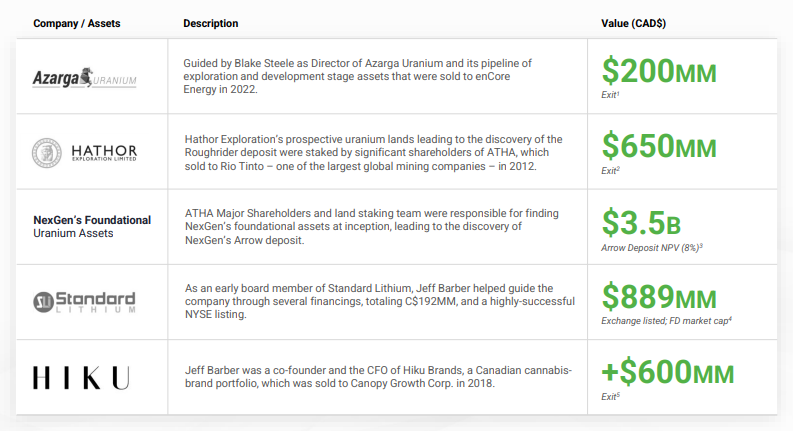

ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) ambitious goal of becoming one of North America’s top uranium companies is definitely attainable thanks to an amazing leadership team which has a long history of creating shareholder value.

As you can see from the chart below, this company’s leadership has facilitated some pretty sizable deals and capital raises over the years, including Jeff Barber guiding Standard Lithium through several financings totally C$192 million.42

ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) founding shareholders were also responsible for providing NexGen with its foundational uranium assets, leading to the discovery of the Arrow deposit, which has an NPV of C$3.5 billion.43

Source: ATHA Energy investor Presentation

Here’s a closer look at some of ATHA Energy’s (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) current leadership:

RECAP: 6 Reasons

Why ATHA Energy Corp (CSE:SASK) (OTCQB:SASKF) (FRA:X5U) Is A Promising North America Uranium Play

1

Booming Uranium Spot Price: Uranium price just hit a 12-year high and has more than doubled in the last 24 months, reaching up to US$65/lb..

2

ATHA Energy Corp holds the largest land package in thehighest-grade uranium district in the world, the Athabasca Basin, totaling about 3.4 million acres.

3

Valuable and desirable 10% ownership stake in prospective exploration grounds owned and operated by successful development teams in the Athabasca Basin, NexGen and IsoEnergy.

4

The uranium market is currently in a supply deficit with over 40% of global production embedded with significant geopolitical risk. With demand expected to increase significantly by 2040,44 North American producers like ATHA Energy Corp are well positioned to capitalize on this opportunity.

5

ATHA Energy Corp’s leadership has a strong track record of creating significant shareholder value.

6

ATHA Energy Corp has a strong balance sheet, financial flexibility, and capital structure, aggressively pursuing accretive acquisition opportunities.

While there is no doubt about the imminent nuclear resurgence, it can be pretty difficult for investors to weed through the multitude of uranium exploration companies. However, one thing is quite clear – the Athabasca Basin is a red-hot district with a TON of uranium and companies like ATHA Energy Corp, with the right projects and the right management are destined to lead the charge.