As we stand on the cusp of the electric revolution, a new energy paradigm is unfolding.

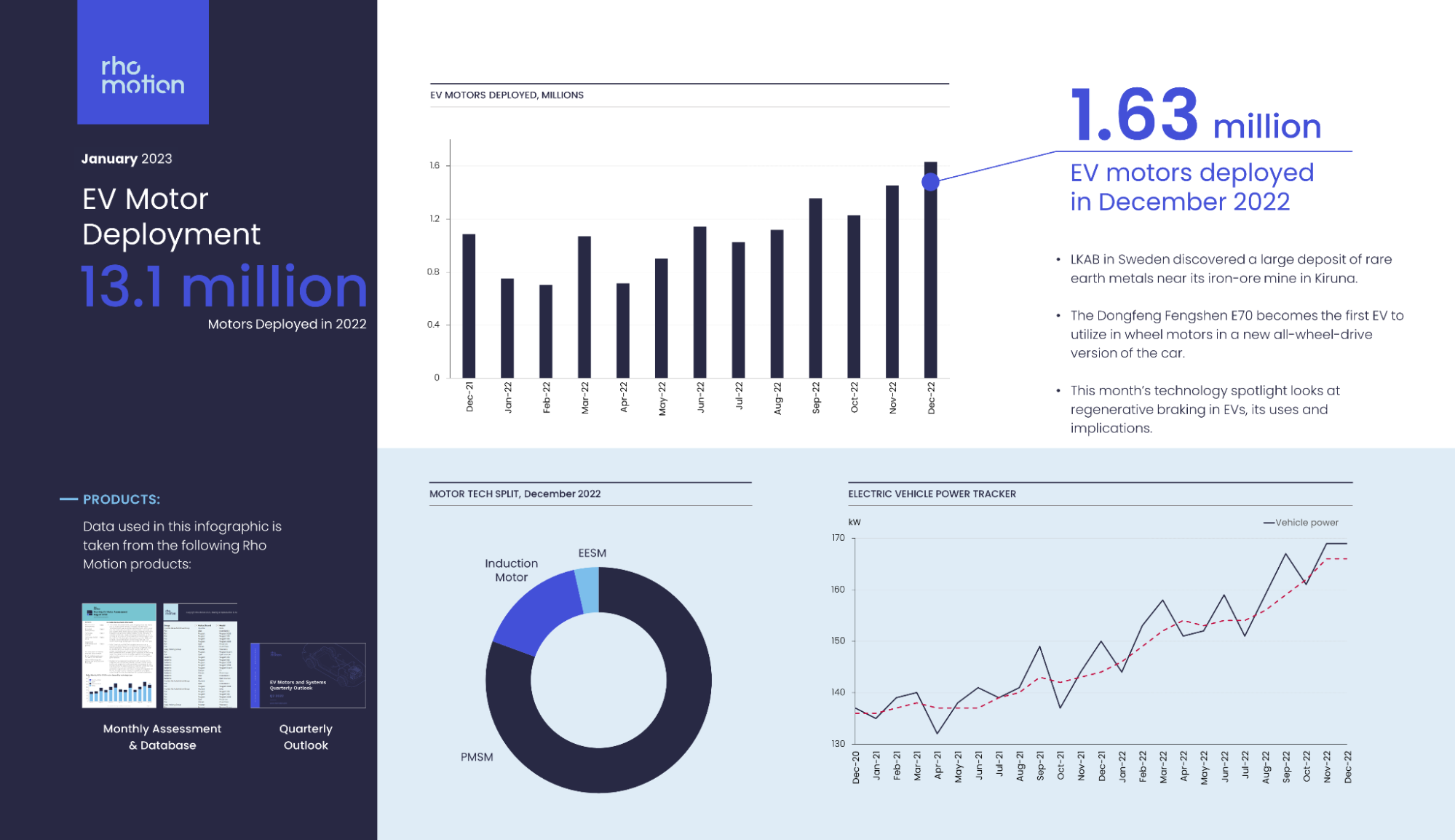

The global market for electric vehicles (EVs) is exploding, with sales set to leap 35% this year after a record-breaking 2022.1

Source: rhomotion.com

The key ingredient fueling this revolution? Lithium.

Without it, the entire electric revolution would come to a screeching halt.

Lithium is the lifeblood of the EV industry. As the demand for EVs soars, so too does the demand for lithium.

As major automakers like Tesla, Ford, and General Motors pivot towards electric, they’re racing to secure reliable lithium supplies.

General Motors invested $650M into Lithium Americas2 and led a $50M deal to secure lithium for its EVs.3

Ford recently signed a lithium supply deal with Canada’s Nemaska Lithium,4 and Tesla has signed a new agreement to secure lithium supply.5 These giants are not just investing in lithium – they’re investing in the future of transportation.

Despite a temporary slowdown in Chinese demand,6 contract prices between lithium miners and off-takers remain high,7 battery makers are still restocking supplies, and demand continues to outpace supply by 3%.8

It’s clear. The lithium market’s still hot and shows no signs of cooling down and it’s only a matter of time that the price will eventually start to shoot up again.

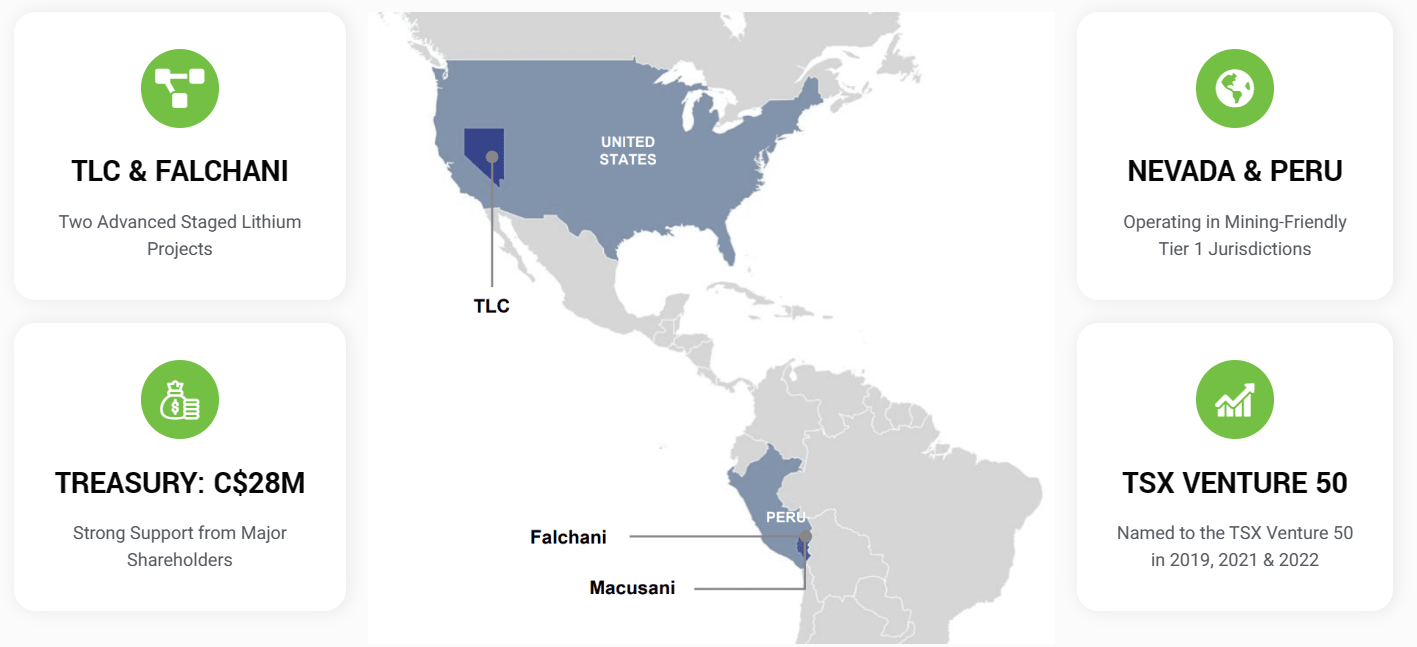

Discover the hidden gem that has been flying under the radar – American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI). This Nevada-based lithium mining company has burst onto the scene as the latest addition to the NASDAQ platform.

While others have overlooked its potential, we’ve unearthed a game-changer that demands attention.

Unlock the captivating tale of American Lithium, a company driven by strategic positioning and resourceful management.

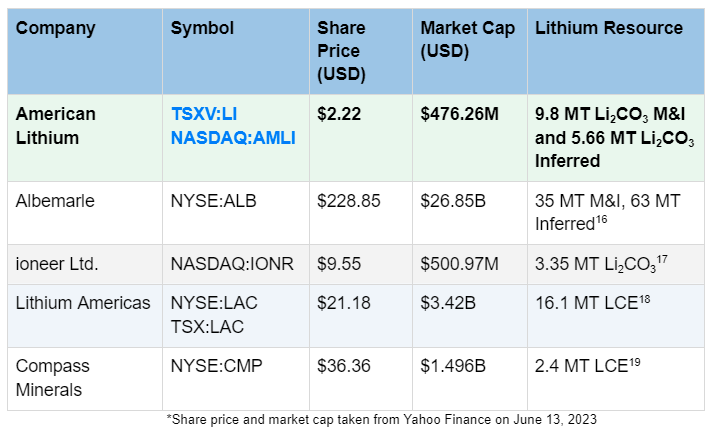

With a firm grip on two of the largest lithium deposits in the Americas, boasting a remarkable Measured and Indicated (M&I) resource of 9.8 million metric tons (MT) of9 lithium carbonate (Li₂CO₃) and an additional Inferred resource of 5.66 MT of Li₂CO₃, American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI) is making waves.

The company’s flagship TLC project in Nevada Mineral Resource Estimate at TLC – reported significant increase in lithium resources at TLC: Measured Resources increased 25% and Indicated Resources increased 129%.

Recent headlines hailed a couple of American Lithium Corp.’s milestone achievements: significantly increasing its lithium resources at its flagship TLC project in Tonopah, Nevada, with Measured Resources up 25% and Indicated Resources up an impressive 129%10 from previous estimates and securing approval from Peruvian authorities to commence development and discovery drilling at Falchani. This remarkable feat marks the first such permit issued in the country in two years, cementing American Lithium’s status as a serious player in the industry.

But their portfolio doesn’t end there. American Lithium (TSXV:LI) (NASDAQ:AMLI) also owns world’s fifth-largest undeveloped uranium deposit, which contains an indicated resource of 51.9 million pounds (Mlbs) of uranium concentrate (U₃O₈) and an inferred resource of 72.1 Mlbs of U₃O₈. In an effort to recognize the market value of this advanced, development stage project, AMLI has inked an agreement to spinout the project into an independent public company.11

Now let’s take a deeper dive into why American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI) is perfectly positioned as a serious player in the lithium revolution.

7 Reasons

Why American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI) Should Be Your Watchlist

1

Two of the Largest Lithium Deposits in the Americas: Across its two flagship lithium assets, American Lithium (TSXV:LI) (NASDAQ:AMLI) boasts 9.8 MT Li₂CO₃ M&I and 5.66 MT Li₂CO₃ Inferred.12

2

World’s 5th Largest Undeveloped Uranium Deposit: At its Macusani Uranium project, American Lithium has a resource of 51.9 Mlbs U₃O₈ Indicated and 72.1 Mlbs U₃O₈ Inferred.13

3

Robust Economics Underpinned by Low-Cost Position: Across all three projects, American Lithium’s cumulative NPV comes in at a very respectable $5.3 billion, representing a substantial difference from their current market cap of $400 million, suggesting AMLI could be significantly undervalued by the market.14

4

Accomplished Management Team: Leading the way is a team that brings deep technical expertise and a proven track record of wealth creation, including Chairman Andrew Bowering the founder of Millennial Lithium which was acquired by Lithium Americas for C$491 million, and President, COO and Director Dr. Laurence Stefan who was part of the team who made the discovery at the Falchani project.

5

Sustainable and Ethical Business Model: Unlike many projects of its peers, American Lithium’s (TSXV:LI) (NASDAQ:AMLI) assets come with key strengths that include no water issues, no endangered species, and low deleterious elements. As well, the company has built strong relationships with local communities and prioritizes ethical governance practices.

6

Well-Funded with Strong Treasury: With no debt, no royalties attached to their assets, and over C$28M in cash at hand, American Lithium is in a very strong position on the financial front.

7

Trading at a Steep Discount to Peer Group: Despite a potentially significant undervaluing by the market, American Lithium (TSXV:LI) (NASDAQ:AMLI) has plenty of key milestones ahead that should close the gap, including more project development, resource upgrades, and a uranium spin-out ahead that could really move the needle.

Addressing the Urgent Lithium Shortage in the EV Market

American Lithium’s (TSXV:LI) (NASDAQ:AMLI) controls two of the largest lithium deposits in the Americas. They include its “made in America” TLC project, which currently hosts 4.2Mt of Li₂CO₃ in measured resources, 4.63Mt Li₂CO₃ in indicated resources, and 1.86Mt Li₂CO₃ in inferred resources.15

The vast TLC deposit has the ability to provide a significant contribution to the necessary lithium supply for the growing EV market.

This project is strategically located in Nevada, just 25 miles from Albemarle’s Silver Peak, which is the only currently producing lithium mine in the US. Moreover, the TLC project’s resources are similar in scale to those of Lithium Americas’ multi-billion dollar Thacker Pass project, also in Nevada.

One key advantage that the TLC project has over Thacker Pass, however, is its position above the water table. This allows for more efficient and profitable lithium production, positioning it as a crucial contributor to meeting the lithium demand of the burgeoning EV market.

Yet, as can be seen below, American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI) is being significantly undervalued by the market, compared to its Nevada-asset peer group.

Robust Economics Underpinned by Low-Cost Position an NPV of $5.3B20

American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI) is strategically positioned with two flagship lithium projects, TLC and Falchani, both of which offer strong economic prospects thanks to their low-cost attributes.

In Nevada, American Lithium’s (TSXV:LI) (NASDAQ:AMLI) TLC Lithium Project is a 100% owned, large-scale lithium claystone project characterized by its near-surface deposit, weakly-bound lithium mineralization with minimal overburden.

The deposit sits above the water table, lending significant environmental advantages. Also noteworthy is that the area contains no threatened or protected plants or wildlife.

Importantly, the project also brings value addition through its magnesium by-product. The 12,300-acre property is conveniently located near highways, electrical and rail lines, and a natural gas line, and has secured water rights.

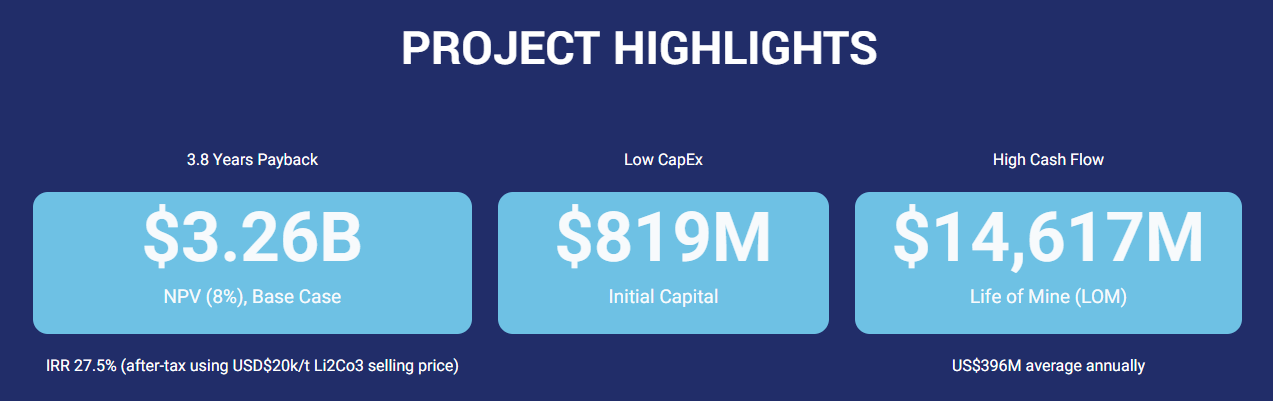

The economics of American Lithium’s (TSXV:LI) (NASDAQ:AMLI) TLC project are impressive with an NPV valued at $3.26 billion, and could pay off its costs in less than four years, making a 27.5% IRR. TLC also expects to make about $396 million each year, producing battery-grade lithium for 40 years.21

According to the PEA, over the 40 years LOM, the TLC project is expected to yield 1.46 Mt of lithium.22

Elsewhere, American Lithium’s (TSXV:LI) (NASDAQ:AMLI) Falchani Lithium Project in Peru, estimated to be the 6th largest hard rock lithium deposit globally, offers different strengths. The project holds the potential for additional revenue from by-products like cesium and sulfate of potash (SOP), both highly sought-after fertilizers in Peru.

With strong local community support and involvement, the project also benefits from proximity to the Two Oceans highway, hydroelectric power, and an abundant supply of water and labor.

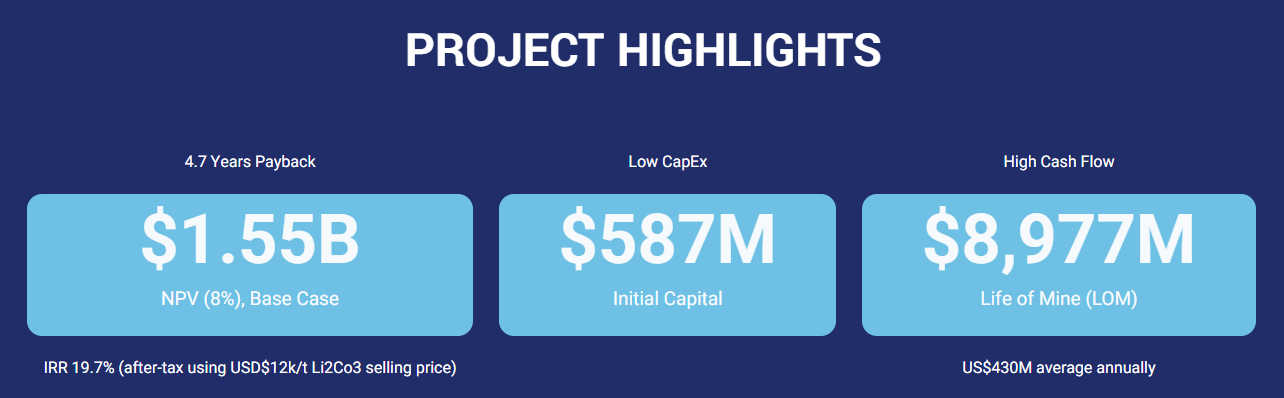

The economics of American Lithium’s (TSXV:LI) (NASDAQ:AMLI) Falchani project are also very robust with an NPV worth $1.5 billion, and could pay off its costs in just over four years, making an 19.7% IRR. It will cost around $587 million to start and about $3,958 for each ton of lithium carbonate that it produces.

The project plans to run for 33 years and make about $8.97 billion in total, which means about $430 million every year.24 For the first 7 years, it’s expected to produce 23,000 tons of lithium carbonate per year. But from year 8 to 26, it plans to produce 41,000 tons per year.25

Press Releases

-

- American Lithium Arranges $7,160,000 Strategic Investment In Surge Battery Metals

- American Lithium Receives First Of 3 Drill Permits To Commence Additional Development And Discovery Drilling At And Around Falchani Peru

- American Lithium Reports Vehicle Accident Near Company Project In Peru

- American Lithium Files TLC PEA Report Highlighting Potential For Excellent Project Economics PFS For TLC Immediately Launched With DRA Global; Bulk Sampling Commenced

Notably, Peru’s current situation adds value to the Falchani project.

With Peru’s fertilizer imports reaching $790 million in 2021 and an ongoing struggle to meet the country’s fertilizer demand,26 the potash and cesium by-products from Falchani present an exceptional opportunity. Furthermore, the country is eager to capitalize on the ‘window of opportunity’ presented by lithium, as indicated by the country’s leadership.27

World’s 5th Largest Undeveloped Uranium Deposit

American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI) is not only a significant player in the lithium market but also harbors one of the world’s largest and lowest-cost uranium deposits, the Macusani Uranium Project.

This project, also situated in the Americas, plays an essential role in the global drive for clean and efficient energy and is subject of its pending spin-out opportunity.28

American Lithium’s (TSXV:LI) (NASDAQ:AMLI) Macusani project looks very promising with a NPV8 (Net Present Value at an 8% discount rate) of $603M with just a 1.8-year payback period post-tax.29

The IRR is an impressive 40.6% if they’re selling uranium at $50 per pound—all while the price has been projected to reach $80 this year.30

The project is set to run for 10 years and is expected to produce about 6 million pounds of uranium annually. According to the Preliminary Economic Assessment, total production over the 10 year life of mine (LOM) will be 70 million pounds of uranium. But the crazy part is, this estimate only includes 15% of the exploration land package.31

The best part is that Macusani’s project is quite economical. It costs about $17 per pound LOM cash cost and $18 per pound all-in-sustaining costs (AISC). It’s going to cost around $300 million of initial capex to start, which is cost-efficient given how big this project is.32

As one of the world’s largest undeveloped uranium deposits, American Lithium’s (TSXV:LI) (NASDAQ:AMLI) Macusani Uranium Project has immense potential to contribute significantly to the global energy mix, especially as the demand for clean and efficient energy solutions continues to rise.

Well-Funded with Strong Treasury

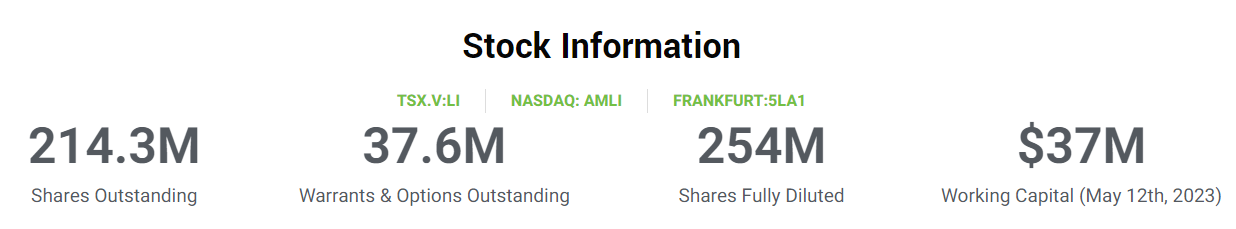

American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI) is in an enviable financial position, with a strong treasury underpinning its business operations. With $28 million in cash reserves, the company boasts a robust balance sheet that is devoid of debt and royalties. This financial strength allows American Lithium to focus fully on advancing its projects and exploring new opportunities without the constraints and pressure that debt often brings.

Taking a look at the capital structure of the company, it’s clear that American Lithium enjoys robust institutional support and a broad retail investor base.

A healthy mix of institutional ownership demonstrates the confidence that professional investment bodies have in American Lithium’s (TSXV:LI) (NASDAQ:AMLI) strategy, management, and projects.

On the other hand, the company’s wide retail base, with over 70,000 retail investors, shows American Lithium’s appeal to individual investors who recognize the company’s potential in the expanding lithium and uranium markets.

Sustainable and Ethical Business Model with an Emphasis on ESG

For American Lithium Corp. (TSXV:LI) (NASDAQ:AMLI), the focus is not solely on being a leader in lithium and uranium production. Equally important is the commitment to ensuring that the processes and methods used are sustainable and ethical. This dedication is clearly seen in the company’s strong emphasis on ESG – Environmental, Social, and Governance.

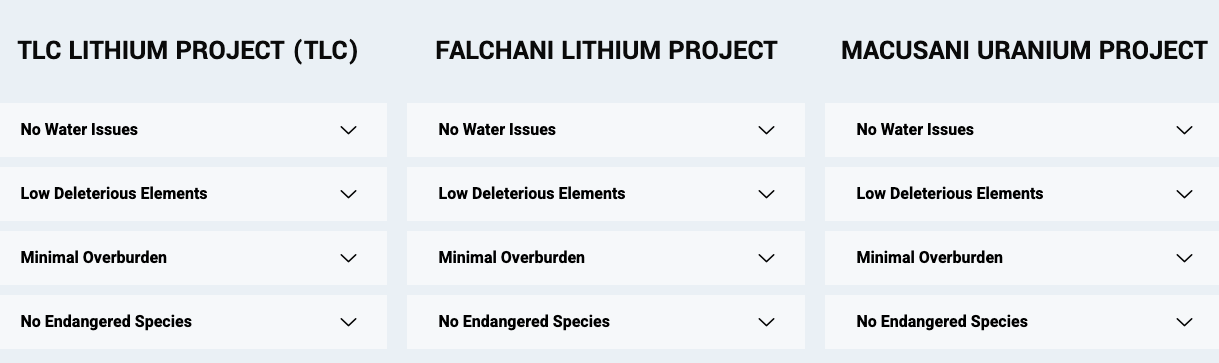

Environmental stewardship is at the forefront of American Lithium’s operational strategy. For all its projects – TLC, Falchani, and Macusani, the company takes a diligent approach to minimize ecological impact.

Key strengths include:

- No Water Issues: American Lithium (TSXV:LI) (NASDAQ:AMLI) operates its projects with a keen focus on water conservation. Through effective water management strategies, the company ensures it doesn’t strain local water resources, recognizing water as a critical and often scarce resource.

- Low Deleterious Elements: The unique mineralogy at TLC is low in deleterious elements (arsenic, mercury), allowing for rapid lithium leaching with over 90% recovery techniques and helping to reduce potential environmental harm.33

- No Endangered Species: Respecting biodiversity, American Lithium carefully ensures its operations don’t disrupt the habitats of endangered species. Its project sites are selected and managed with a careful understanding of local ecosystems.

On the social and governance fronts, the company is just as vigilant. From building strong relationships with local communities to prioritizing ethical governance practices, American Lithium (TSXV:LI) (NASDAQ:AMLI) exemplifies what it means to be a responsible corporate entity.

In a time when more and more investors and stakeholders value companies that can balance profit with responsibility, American Lithium’s commitment to its ESG goals places it as a company ready for a sustainable future.

Accomplished Management Team

American Lithium’s (TSXV:LI) (NASDAQ:AMLI) leadership team offers deep technical expertise and a proven track record of wealth creation. The AMLI team includes:

RECAP: 6 Reasons

To Keep an Eye on American Lithium (TSXV:LI) (NASDAQ:AMLI)34

1

Two of the Largest Lithium Deposits in the Americas: American Lithium (TSXV:LI) (NASDAQ:AMLI) possesses an impressive 9.8 MT Li₂CO₃ M&I and 5.66 MT Li₂CO₃ Inferred.

2

World’s 5th Largest Undeveloped Uranium Deposit: At the Macusani Uranium project, American Lithium holds 51.9 Mlbs U₃O₈ Indicated and 72.1 Mlbs U₃O₈ Inferred.

3

Robust Economics Underpinned by Low-Cost Position: American Lithium‘s cumulative NPV stands at a notable $5.3 billion, which is a substantial difference compared to its current market cap of $426 million.

4

Accomplished Management Team: The team brings deep technical expertise and a proven track record of wealth creation, including Chairman Andrew Bowering, the founder of Millennial Lithium, which was acquired by Lithium Americas for C$491 million, as well as members of the discovery team for the Falchani project including President, COO and Director, Dr. Laurence Stefan.

5

Sustainable and Ethical Business Model: American Lithium’s assets come with distinct advantages, including no water issues, no endangered species concerns, and low deleterious elements.

6

Well Funded with Strong Treasury: With no debt, no attached royalties, and a treasury holding over $40 million in cash, American Lithium maintains a strong financial position.

The EV isn’t coming – it’s already here. As automakers and battery manufacturers scramble for lithium, American Lithium. (TSXV:LI) (NASDAQ:AMLI) stands tall against its peers.

With a robust portfolio, strong financial footing, and a sustainable business model, American Lithium is well-positioned to ride the wave of the electric revolution. As the global demand for lithium continues to surge, the future holds electrifying potential for American Lithium.

Now is the perfect moment to embark on your due diligence. Stay informed and track AMLI’s latest news and milestones right here.

*Currency in USD unless otherwise stated