Markets are on edge.

Inflation is sticky. Rate cuts are looming. Geopolitical risks are rising.

And investors are scrambling for real assets with staying power.

That’s why gold is smashing through all-time highs.2

And why copper is quietly staging its own comeback.

Gold thrives in chaos. Copper thrives in transition.

And right now, both metals are breaking out for very different reasons—but with the same result: capital is flooding back into the resource sector.

And one forgotten stock could be the biggest winner of all.

While everyone’s fixated on macro noise and mega-cap miners, this under-the-radar junior has been steadily unlocking one of Canada’s most promising high-grade copper-gold deposits.

The numbers are staggering:

- Nearly 550 million pounds of copper and 369,000 ounces of gold.1

- Grades hitting up to 11.4% CuEq.2

- A high-grade core zone was recently brought out to the market.

And yet, the company behind this has a market cap of just $31 million.3

Wall Street hasn’t caught on yet.

But insiders have.

And so has BMO Capital Markets4—one of Canada’s preeminent metals and mining investment banks and the same investment bank that supported a tiny miner that turned into a billion-dollar copper powerhouse.5

This is the kind of setup Jeff Brown would call a “wealth window.”

Let’s break it down.

Why Copper Is Exploding — And Why It’s Still Early

2025 started with a bang.

Copper has been on a tear, breaking through $5.25/lb in March—its highest level in over a decade.

After a short-lived dip, prices are gearing up for another rally.

The spark?

US national security tariffs.

In February, the Trump administration launched a Section 232 investigation into copper imports.6 Traders responded fast—front-running a potential import squeeze by flooding US ports with over 500,000 tonnes of copper.7

At the same time:

- Codelco’s production has stagnated.

- Chinese smelters are slashing output.

- Inventories are vanishing.

All while AI data centers, EVs, and grid expansions are pushing global copper demand through the roof.

Now, analysts are forecasting copper to hit $12,000/ton.8

This isn’t a rally. It’s a global repricing.

And Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) is sitting on one of the highest-grade copper-gold VMS deposits in the trade-friendly jurisdiction of Quebec.

Right when copper demand is peaking.

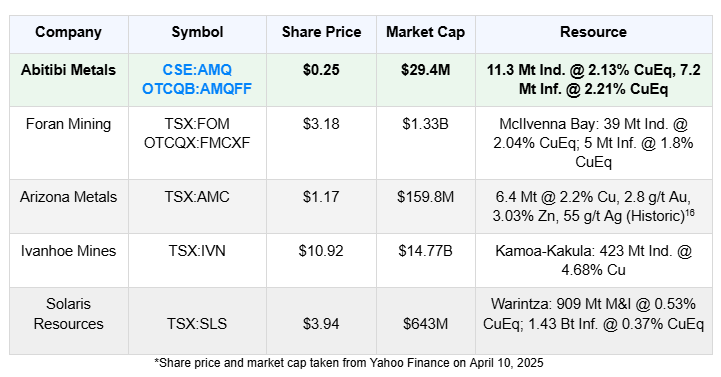

Better Grades. Lower Cap. Bigger Potential.

At first glance, Koryx Copper (TSXV:KRY) might seem like the stronger play — it’s backed by nearly 760 million tonnes of low-grade copper resources at its Haib project in Namibia and currently trades at a $72 million market cap.

But when you dig into the numbers, the story flips.

Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) has something Koryx doesn’t: high grades.

Its B26 VMS deposit in Quebec holds:

- 11.3Mt @ 2.13% CuEq (Indicated)9

- 7.2Mt @ 2.21% CuEq (Inferred)

- That’s 553M lbs of Copper, 369k oz of Gold, 15M oz of Silver, and 340M lbs of Zinc

All of that… in a Tier 1 jurisdiction, with institutional backing (BMO led their recent $10M financing), and a market cap of just $31 million.

Koryx may have more tonnes. But Abitibi offers better grades, stronger jurisdiction, and more upside per dollar.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Introducing the Undiscovered Copper Junior Lighting Up Quebec

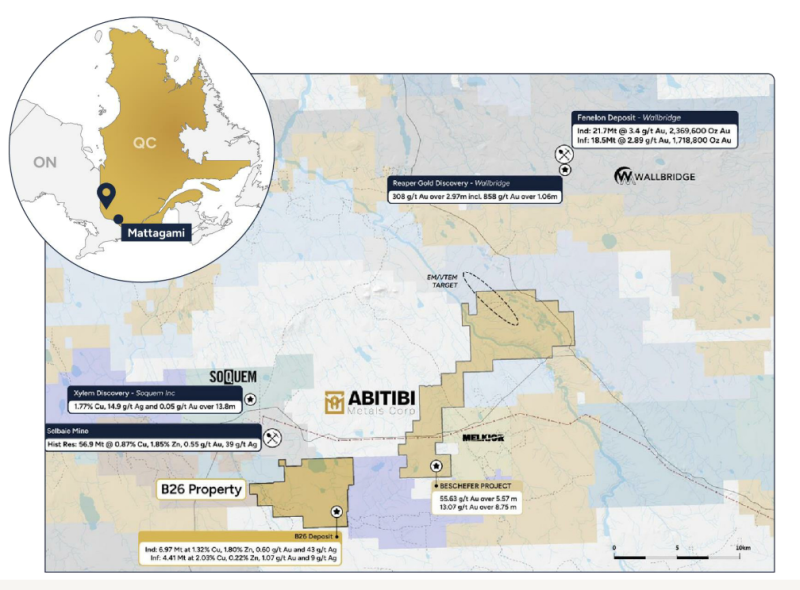

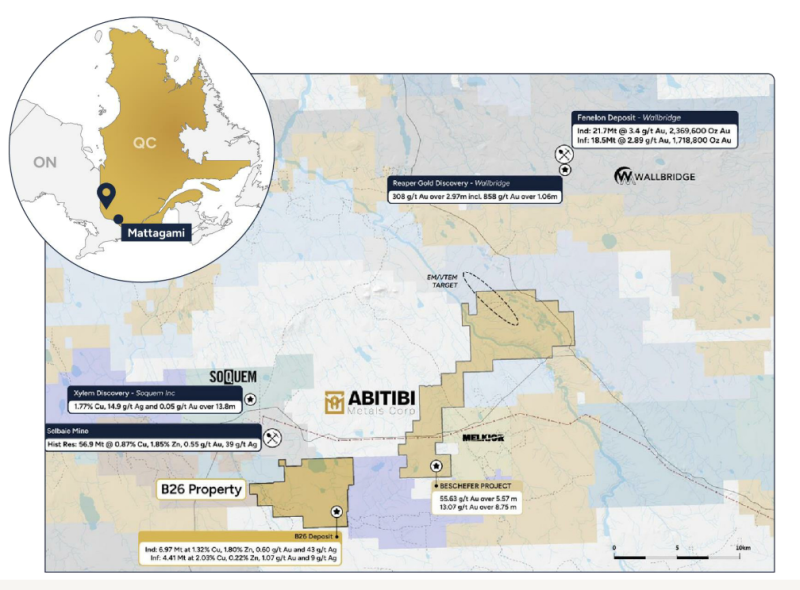

Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) is a Quebec-focused copper-gold explorer with two major assets:

- The B26 Polymetallic Deposit – a VMS copper-gold system in the heart of Quebec’s Abitibi Greenstone Belt12

- The Beschefer Gold Project – a high-grade gold zone near Detour Lake, held 100% by the company13

Let’s start with the main prize.

B26: Nearly a Billion Pounds and Growing

B26 is located just 5 km from the past-producing Selbaie Mine (53 Mt of ore) and 140 km from the Horne Smelter.10

It’s a textbook VMS system—and one of the highest-grade undeveloped polymetallic deposits in North America.

In 2024, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) completed 30,000 metres of drilling and delivered a 62% increase in Indicated resources.

But only 13,500 metres were included in the official resource.

That means more than 16,500 metres of drilling is still untapped, and a follow-up resource is targeted for 2026, with another 20,000 metres being drilled now.

This is a project still in the early innings.

Show-Stopping Intercepts

Recent drill highlights include:

- 10.6m at 11.4% CuEq

- 44.5m at 2.82% CuEq

- 97.5m at 1.47% CuEq (near surface)

- 20.6m at 2.24% CuEq

- 17.5m at 2.4% CuEq (deepest intercept to date)

The geometry is ideal: near surface, stacked lenses, excellent widths.

The metallurgy? Even better.

- 98.3% copper recovery

- 90% gold recovery

SGS completed the resource estimate in the 2024 NI 43-101 technical report.11

Fully Funded. Fully Focused.

Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) raised $10 million in Q1 2025 and is now fully funded for 50,000 metres of drilling.

Ownership is clean. Management owns stock. And insiders have bought over 3 million shares on the open market since January.

This isn’t a lifestyle company.

It’s an execution story.

Press Releases

- Abitibi Announces Closing of Partial Exercise of Over-Allotment Option

- Abitibi Metals Launches Fully Financed 20,000m Phase III Drill Program to Advance B26 Deposit

- Abitibi Metals Launches Fully Financed 20,000m Phase III Drill Program to Advance B26 Deposit

- Top 5 Copper Stocks to Watch in 2025

- Abitibi Metals Concludes Phase II Drill Program with Strong Results: 8.08% CuEq Over 2.9 Metres Within 1.94% CuEq Over 29 Metres at B26 Deposit

The Valuation Gap Is Absurd

Let’s look at comps.

On a grade-to-valuation basis, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) might be the cheapest high-grade copper junior in Canada.

Notable Backers — Including a Billionaire

Abitibi’s (CSE:AMQ) (OTCQB:AMQFF) shareholder base isn’t just retail.

- Deluce family office (Porter Airlines) holds 30%+

- Frank Giustra, billionaire mining financier (Wheaton, Endeavour), invested in a no-warrant placement17

- Greg Chamandy, co-founder of Gildan and former Richmont Mines chair

- Delbrook Capital holds equity (>$1B Fund)

This is heavyweight capital—not fast money.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Gold-Leveraged Bonus: The Beschefer Project

While B26 leads the story, Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) also owns 100% of the Beschefer Gold Project—near Detour Lake in Quebec.

Historic highlights include:14

- 4.92 g/t Au over 28.65m

- 13.07 g/t Au over 8.75m

- 10.28 g/t Au over 8.00m

It’s an option on rising gold—and adds serious upside as gold surpasses $3,200/oz.

A Veteran Team With Skin in the Game

The rocks may tell the story…

But it’s the people behind Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) that make this one of the most credible copper-gold juniors in the market.

This isn’t a lifestyle company. It’s led by dealmakers, mine builders, and insiders who own real equity—and continue to buy more.

Strategic Shareholders

- Frank Giustra – Billionaire mining financier and early investor; known for building Wheaton Precious Metals and Endeavour Mining

- Greg Chamandy – Co-founder of Gildan Activewear and former Executive Chairman of Richmont Mines (acquired by Alamos Gold)

- Delbrook Capital – Vancouver-based investment management firm specializing in alternative investment strategies with a focus on the natural resource sector.

These aren’t figureheads.

They’re operators, builders, and financiers who’ve helped take projects from grassroots to billion-dollar exits.

This is a team that’s aligned, active, and ready to scale.

The Final Word: This Could Be the Most Asymmetric Copper Play in North America

- Copper is rallying once again

- New tariffs could further spike US prices

- Supply is tightening

- Institutions are circling

- And one junior explorer has a near-billion-pound, high-grade deposit in a Tier 1 mining jurisdiction… with a $31M valuation

Abitibi Metals (CSE:AMQ) (OTCQB:AMQFF) is hitting all the markers needed for big things in 2025.

They’re ahead of schedule, fully funded, and backed by billionaires, banks, and insiders.

And they’ve only scratched the surface.

This is the kind of rare copper breakout story investors wait years for.

Do your due diligence. But do it fast.

Because the market won’t sleep on this for much longer.

*All figured in CAD unless otherwise stated.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Jon DeluceChief Executive Officer & President

Jon DeluceChief Executive Officer & President Louis GariepyVice President of Exploration

Louis GariepyVice President of Exploration Laurent EustacheExecutive Vice President

Laurent EustacheExecutive Vice President