Vancouver, BC – November 22, 2022, Clarity Gold Corp. (“Clarity” or the “Company”) (CSE:CLAR, OTC:CLGCF, FSE:27G) is pleased to announce it has entered into an assignment and assumption agreement dated November 21, 2022 (the “AssignmentAgreement”) among Opus One Resources Corp (“OpusOne”) and the two original optionors (the “Optionors”) pursuant to which Clarity has obtained the option to acquire a 100% interest (the “Option”) in the property known as the Fecteau Property located in the Province of Quebec (the “Property”). Pursuant to the Assignment Agreement, Opus One has assigned all of its rights and obligations with respect to a property option agreement dated June 20, 2016, as amended September 29, 2020 (the “Original OptionAgreement”) to the Company to acquire a 100% interest in the Property.

Highlights of the Fecteau Property

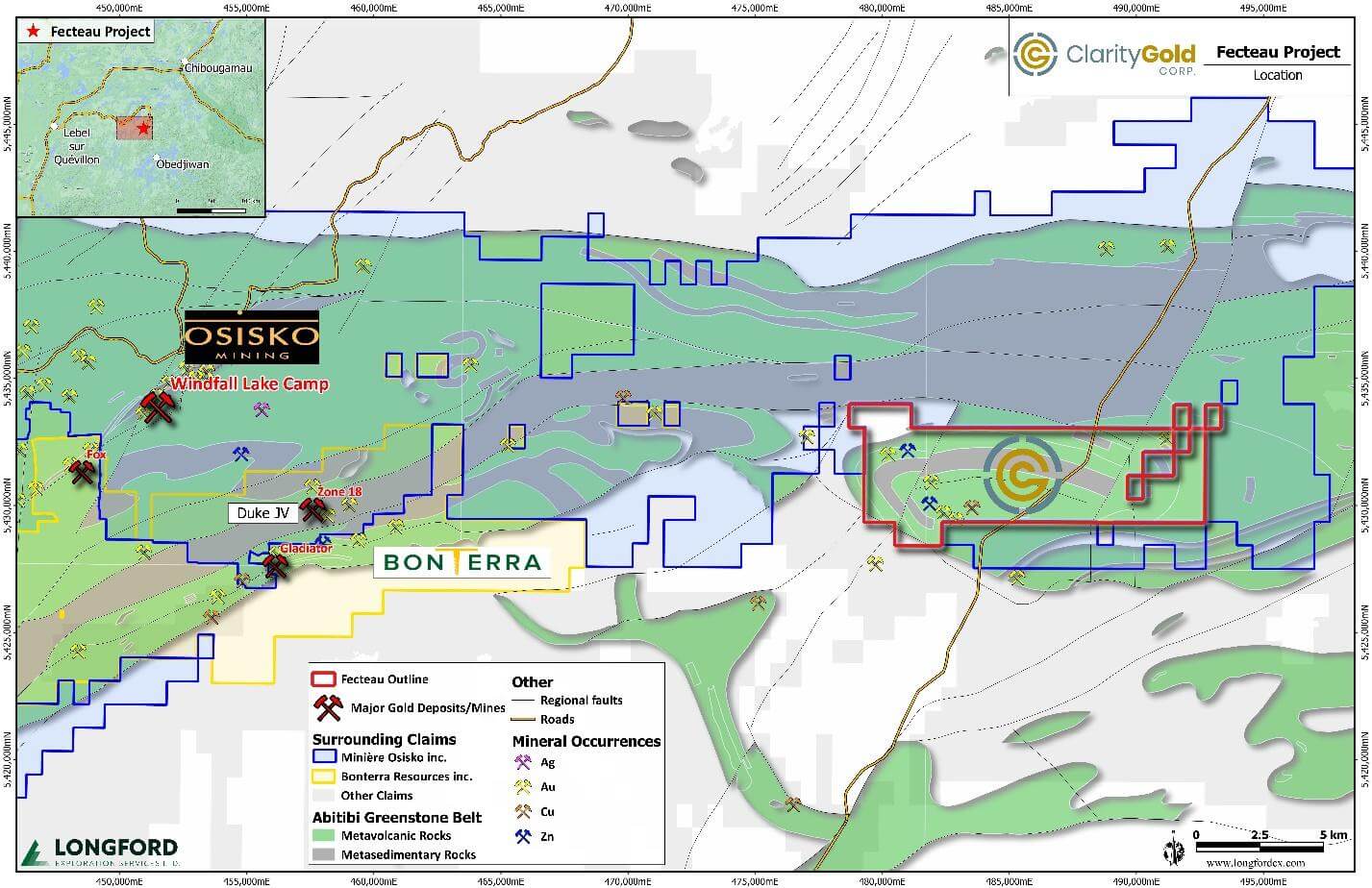

- 30km east of Osisko Mining’s Windfall Lake Project and Bonterra Resources’ Gladiator Project (Figure 1).

- Five new exploration targets generated from till sampling, some of which have been followed up with an IP survey.

- Nine mineral showings including:

- Lac Fecteau Est: 2.42g/t Au over 2.65m, 1.82 g/t Au over 4.9m in drill core

- Buteux-Marceau: up to 4.11 g/t Au in grab samples

- Lac Pistolet: up to 1.08 g/t Au and 1.91% Cu in grab samples

- Desgagné: up to 1.00 g/t Au in a trench over massive sulphide

- Lac Fecteau Nord: 1.71 g/t Au over 1.5m in drill core

- Lac Fecteau Porphyry: up to 7.09 g/t Au in grab samples

The QP (as defined below) has not verified the results of the historic exploration and sampling on the Fecteau Property. Additional sampling would be required to verify the data.

“With Osisko and Bonterra’s continued successes on this trend and the overarching tenure of gold in the Abitibi as a whole, we are excited to continue our exploration in the belt and this project shows the mineralization, alteration and structural complexity that we look for.” Stated James Rogers, CEO “We are excited to get to work advancing the targets Opus has diligently worked to define.”

Figure 1 Location map of the fecteau project within the Abitibi Greenstone Belt.

The Fecteau Property

- The Property consists of one claim block containing 107 claims for a total of 5,979.02 hectares in the Urban-Barry Windfall mining district.

- The property is known to host two types of mineralization: VMS (Cu-Zn-Au) and mesothermal gold. Both styles of mineralization will be targeted during the Company’s program.

- VMS targets are represented in the field by numerous gossans of semi-massive to massive sulphides located along and near an east-west trending rhyolite-dacite contact observed over 10 km of strike. Past drilling near surface intersected anomalous copper-zinc intervals associated with anomalous gold.

- Mesothermal gold bearing quartz veins are observed at both ends of the property (western and eastern portions) where the volcanic sequence is folded. East-west striking metric wide shear veins developed parallel to the axial plan of the folds. This drilling program will target potential down dip or down plunge extensions of the known mineralization.

About the Assignment Agreement

As consideration for the Option, the Company has agreed to pay Opus One a cash payment of $60,000, payable within 15 days of the date of the Assignment Agreement.

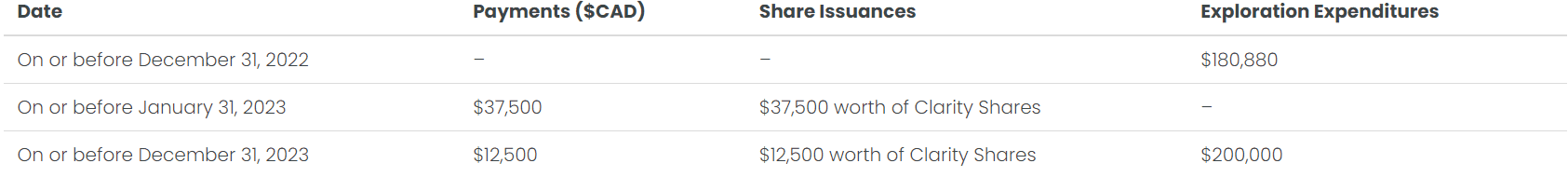

Pursuant to the Assignment Agreement, the Company will assume all obligations of Opus One under the Original Option Agreement to acquire the Property including, but not limited to, making certain payments of cash and issuances of common shares in the capital of the Company (each, a “Clarity Share”) to the Optionors and incurring certain exploration expenditures on the Property as follows:

The Clarity Shares will be issued at a price per Clarity Share equal to the closing price of such Clarity Shares the Canadian Securities Exchange (the “CSE”) on the trading day immediately before the date of issuance, subject to applicable securities laws and the policies of the CSE.

The Company agreed to pay an arms length finder an aggregate of 250,000 shares as a finder’s fee in connection with the Assignment.

Qualified Person

Mr. Rory Kutluoglu P. Geo., a member of the advisory board and a consultant of the Company, is a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has reviewed the technical information in this news release.

About Clarity

Clarity Gold Corp. is a Canadian mineral exploration project generator company focused on the acquisition, exploration and development of precious and base metals projects. The Company’s objective is to identify, acquire and develop gold-primary and base metals projects which have been overlooked, underfinanced or have become non-core assets and fallen dormant. Clarity’s exploration mandate is global and focused on countries with established legal and regulatory systems supporting mining investment. The Company is based in Vancouver, British Columbia, and is listed on the CSE under the symbol “CLAR”.

Clarity also has title on three additional early-stage projects in British Columbia:

- Empirical Gold Copper Molybdenite Property (10,518 ha) – Lillooet, B.C.

- Tyber Gold Copper Silver Property (928 ha) – Southeast Vancouver Island, B.C.

- Gretna Green Gold Copper Silver Property (1,331 ha) – Port Alberni, Vancouver Island, B.C.

To learn more about Clarity Gold Corp. and its projects please visit www.claritygoldcorp.com.

ON BEHALF OF THE BOARD

“James Rogers”

Chief Executive Officer

Tel: 1 (833) 387-7436

Email: [email protected]

Website: www.claritygoldcorp.com

Featured Image MegaPixl @ Kodym

This news release contains forward-looking statements. All statements, other than statements of historical fact that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future are forward-looking statements. Forward-looking statements in this news release include statements regarding: the proposed drilling program on the Property; the Company making the cash payment to Opus One in consideration of the Option; the Company completing the required cash payments and issuances of Clarity Shares to the Optionors; the Company incurring the expenditures on the Property; and the Company completing the payments, Clarity Share issuances and expenditures on or before the dates indicated in the Option Agreement. The forward-looking statements reflect management’s current expectations based on information currently available and are subject to a number of risks and uncertainties that may cause outcomes to differ materially from those discussed in the forward-looking statements including: that Company may not complete the drilling program on the Property as proposed; that the Company may not be able to make the payments, Clarity Share issuances, or incur the expenditures on the Property; adverse market conditions; and other factors beyond the control of the parties. Although the Company believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, undue reliance should not be put on such statements due to their inherent uncertainty. Factors that could cause actual results or events to differ materially from current expectations include general market conditions and other factors beyond the control of the Company. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2)The Article was issued on behalf of and sponsored by, Clarity Metals Corp. Market Jar Media Inc. has or expects to receive from Clarity Metals Corp.’s Digital Marketing Agency of Record (Native Ads Inc.) forty-six thousand, three hundred and twenty US dollars for 24 days (18 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. Market Jar has not independently verified or otherwise investigated all such information. None of Market Jar or any of their respective affiliates, guarantee the accuracy or completeness of any such information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on PressReach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on PressReach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Clarity Metals Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Clarity Metals Corp.’s industry; (b) market opportunity; (c) Clarity Metals Corp.’s business plans and strategies; (d) services that Clarity Metals Corp. intends to offer; (e) Clarity Metals Corp.’s milestone projections and targets; (f) Clarity Metals Corp.’s expectations regarding receipt of approval for regulatory applications; (g) Clarity Metals Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Clarity Metals Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Clarity Metals Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Clarity Metals Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Clarity Metals Corp.’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Clarity Metals Corp.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Clarity Metals Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Clarity Metals Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Clarity Metals Corp.s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Clarity Metals Corp.’s business operations (e) Clarity Metals Corp. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Clarity Metals Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Clarity Metals Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Clarity Metals Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Clarity Metals Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Clarity Metals Corp. or such entities and are not necessarily indicative of future performance of Clarity Metals Corp. or such entities.