Flying is a pain.

The lengthy travel time to and from major airports, large crowds, long check-in wait times, security screening, overcrowded cabins, delays, cancellations… the issues can seem never-ending and the experience is inconsistent at best.

Despite advancements in technology that have streamlined other parts of our lives, it’s almost as if the airport experience has gotten worse!

Approximately 21% of all US flights are now being delayed or canceled1. So even after you’ve gone through the hassle of getting to the airport 2-3 hours prior to departure, your flight isn’t even guaranteed.

Since the beginning of 2024, there have been an average of 21,445 delays across the world every day, including over 4,000 traveling within, into, or out of the US2.

The fact is, despite passenger volumes going back to pre-pandemic levels, there have been significantly fewer flights3.

The problem, in large part, is due to the massive overcrowding at large commercial airport hubs.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

What’s astonishing is that while there are more than 5,000 regional airports in the US, only 30 airports handle ~70% of the country’s air travel4. Surprisingly, major airlines either cannot or are unwilling to utilize these smaller airports. Thankfully, a solution is emerging in the form of regional air mobility (RAM), providing a new kind of mass transit alternative.

At the forefront of this revolutionary new aviation trend is Surf Air Mobility Inc. (NYSE:SRFM), which owns the largest commuter airline in the U.S by scheduled departures.

Surf Air is replacing long drives and overcrowded commercial airports with seamless point-to-point air travel by expanding its already-established network and connecting underutilized regional airports across the US.

But it’s not just its leadership in regional travel that make this company such a game changer. Surf Air Mobility is completely transforming flying through the power of electrification.

By partnering with the largest general aviation manufacturer Textron Aviation and AeroTEC, a leader in aviation technology, Surf Air Mobility (NYSE:SRFM) is gaining a first-mover advantage in the new age of aviation.

Instead of building a new electric aircraft completely from scratch, which could take decades, Surf Air plans to use existing aircraft that are already flying today and swap out their engines for hybrid or fully electric powertrains, putting the company miles ahead of the competition.

With an established customer base, a faster, practical path to electrification certification and an impressive roster of partners, Surf Air Mobility (NYSE:SRFM) is uniquely positioned to be the first company to commercialize green regional air travel.

Surf Air Mobility (NYSE:SRFM) is gearing up for an exciting 2024, with a string of strategic moves that bolster its position.

Some recent big wins include restructuring its capital structure with GEM,5 increasing its global presence in East Africa6 and Brazil,7 and bolstering its multiple revenue streams through additional low-risk commuter routes with planned launches in the future.8

But before we jump into all of the details, let’s take a look at some of the top reasons Surf Air Mobility (NYSE:SRFM) stands out in the aviation industry:

8 Reasons

Surf Air Mobility Inc. (NYSE:SRFM) is Leading the Revolution of Regional Air Travel

1

Green Regional Air Travel: Surf Air Mobility (NYSE:SRFM) is aiming to be the first to commercialize green regional air travel, presenting a major leap forward in sustainable transportation. Their focus on electric airplanes is expected to redefine short-haul flights, making air travel more affordable.

2

Large Addressable Market: The market potential for regional air mobility is significant, with an estimated global total addressable market (TAM) of $75-115 billion by 2035.9

3

Largest Commuter Airline in the US: Surf Air Mobility is already the largest commuter airline in the US by scheduled departures, flying over 450,000 passengers on ~75,000 flights to 48 destinations in the US in 2022.

4

Unique Business Model: Surf Air Mobility offers a comprehensive approach with an integrated model that supports the expansion of both sides of the equation: passengers (B2C) and aircraft operators (B2B).

5

Diversified Revenue Streams: Surf Air Mobility (NYSE:SRFM), which already boasts a respectable ~$101M in revenue in 2022, operates across multiple revenue streams which include scheduled air service, recurring government contracts, and Essential Air Service (EAS) programs, and off-fleet on-demand operations helping stability and growth potential.

6

Future Growth and Impact: The company has outlined a clear growth trajectory, aiming for a 20%-25% Revenue CAGR and a 35%-45% gross profit trajectory.

7

Strategic Partnerships: The company has strong commercial relationships with industry leaders across the value chain including Palantir Technology, Textron Aviation, Jetstream Aviation Capital.

8

Experienced Leadership Team: Surf Air Mobility boasts a seasoned leadership team with deep industry knowledge through executive leadership roles at companies including Delta, Bombardier Flexjet, United, Wisk, and Virgin America.

The Next Evolution – Electrifying Regional Air Mobility

In the ever-evolving realm of aviation, Surf Air Mobility Inc. (NYSE:SRFM) stands out with its forward-looking approach towards a new kind of mass transit solution.

A new way to travel made possible by electrification, lowering the cost of smaller planes and making them accessible in more places for more people.

Electric aircraft promise to be vastly more cost-effective. By reducing or removing expensive, polluting jet fuel from the equation and replacing it with electric batteries, operations become leaner, greener, and more financially sound.

What’s more, by connecting more places with seamless, quick flights it takes people off the roads and puts them into the sky, leading to less pollution, less traffic, and happier travelers.

In short, cars are a slow solution and planes are an expensive and tedious solution. Surf Air Mobility Inc. (NYSE:SRFM) is the best of all worlds. And will be better for the planet too.

Here’s a closer look at the company’s multi-pronged strategy to transform the skies:

After the strategic acquisition of Southern Airlines, Surf Air Mobility hit the ground running with an operational fleet of 50 aircraft at its disposal.

But that was just the beginning. The company also formed an exclusive relationship with Textron Aviation and placed an order for as many as 150 Cessna Grand Caravan EX models, they’ve signaled a clear intent: to prioritize electrification in aviation.10

Textron Aviation, one of the largest general aviation manufacturers, is poised to play a crucial role in supporting Surf Air Mobility’s (NYSE:SRFM) ambition of developing an electrified Cessna Grand Caravan EX.

But Surf Air doesn’t stop there. The company has also entered into an exclusive agreement with AeroTEC. This strategic alliance is designed to fast-track the development and certification process of its commercial electric aircraft technology.

And we’ve already seen examples of electrified technology take flight.

Thanks to AeroTEC, a fully-electrified Cessna Grand Caravan has already be flown on a demonstration flight11. This successful venture wasn’t just a statement of intent—it was tangible proof that the technology is not only feasible but ready for the present day.

What truly distinguishes Surf Air Mobility (NYSE:SRFM) from other companies in the space is the company’s strategic approach. Instead of constructing new aircraft from scratch, they’re focusing on electrifying existing aircrafts. By upgrading planes that have already been transporting thousands of passengers across the US, they’re taking a practical, efficient route to electric aviation.

Some of the clear advantages that set Surf Air (NYSE:SRFM) apart include:

- Exclusive Partnerships: Their unique relationship with Textron Aviation, the largest general aviation manufacturer, gives them unparalleled access to expertise and resources.

- Existing Infrastructure: With an established customer base and pre-existing routes, Surf Air doesn’t have to start from zero. They’re already integrated into the aviation ecosystem. Not to mention the ~5,000 underutilized regional airports that already exist in the US.

- Speed to Market: By upgrading existing aircraft with new electric and hybrid engines using a Supplemental Type Certificate, Surf Air Mobility is rapidly bringing their electric vision to life.

Surf Air Mobility (NYSE:SRFM) has already inked strategic supply deals with air operators in East Africa and Brazil to develop electric fleets.

On January 4, Surf Air Mobility unveiled a groundbreaking agreement with Safarilink and Yellow Wings Air Services, aimed at reshaping air travel across Kenya and Tanzania, and extensively throughout East Africa’s airfields. This electrifying partnership positions Surf Air Mobility at the vanguard of aviation innovation, as it plans to bring its revolutionary electrified powertrain technology to African operators, Safarilink and Yellow Wings. With these operator agreements to upgrade their existing Cessna Grand Caravan aircraft fleets with their cutting-edge, proprietary technology once certified, Surf Air Mobility (NYSE:SRFM) is not just expanding its global presence, but also pioneering a new era in sustainable aviation globally.

This trailblazing move follows closely on the heels of last year’s similar pact with Azul, Brazil’s largest airline, underscoring Surf Air Mobility‘s commitment to transform a fleet of up to 27 Cessna Caravans. Their first-generation fully-electric powertrain technology is set to revolutionize the industry, with targets to slash direct operating costs by up to 50% and achieving the remarkable feat of eliminating 100% of direct carbon emissions. This will mark a significant leap towards a cleaner, more efficient, and more sustainable future in air travel.

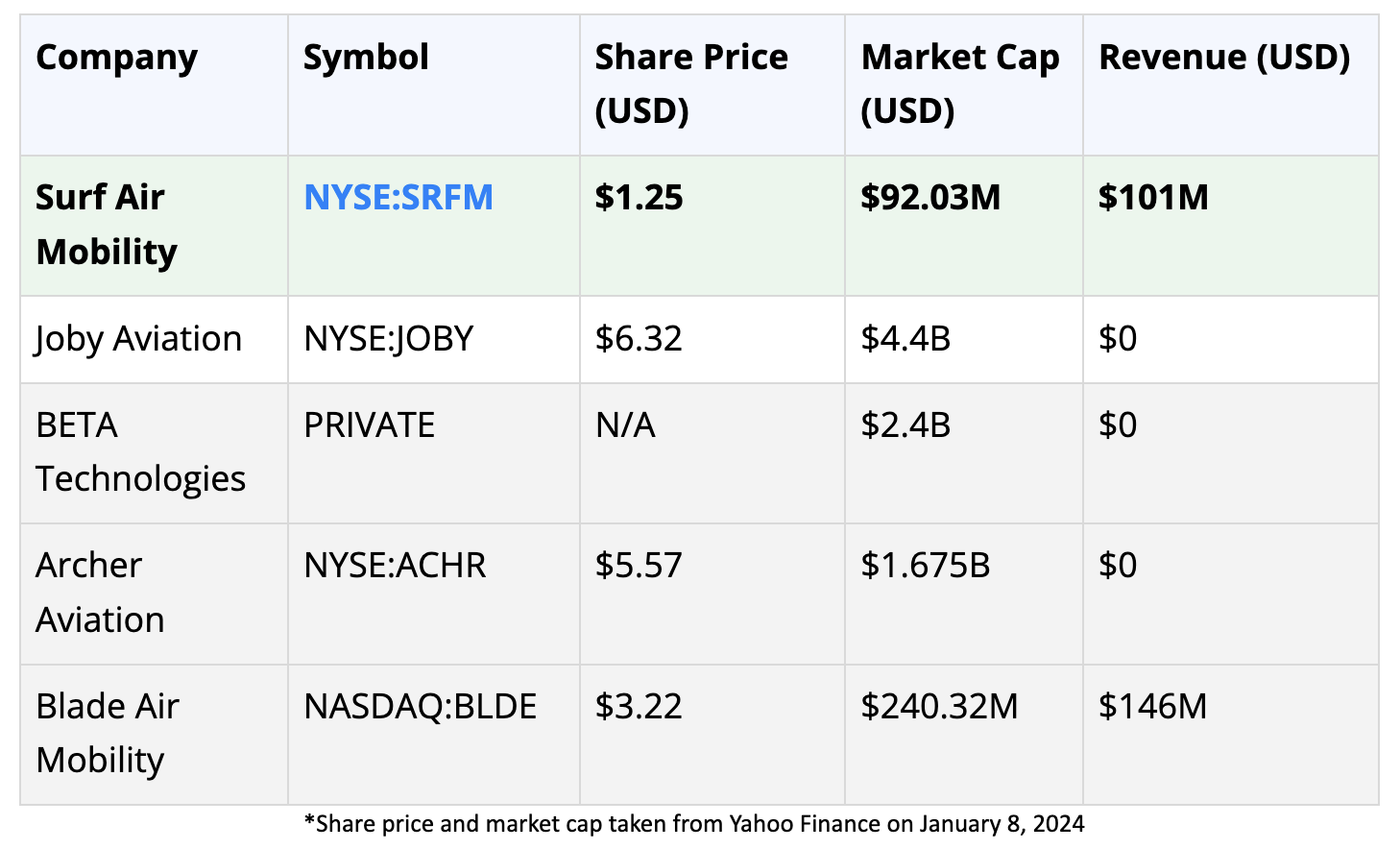

While several companies are vying for a share of the emerging electric aviation market, Surf Air Mobility (NYSE:SRFM) distinguishes itself in critical ways that offer tangible value to both consumers and investors. Unlike Joby Aviation, BETA Technologies, Archer Aviation, and Lilium N.V.—all of which are pre-revenue—Surf Air Mobility boasts a revenue of ~$101 million.

And unlike Blade Air Mobility, which lacks its own electrified IP, Surf Air Mobility is developing proprietary electric technology and is already offering consumer services.

Surf Air Mobility Inc. (NYSE:SRFM) also has access to $850 million in capital, giving the company runway to fuel its growth.

The company also recently restructured its capital structure with a term sheet related to the potential issuance of a mandatory convertible debenture to GEM, which aims to reduce near term overhang and dilution.12

Take a look at the company’s market cap compared to its peers.

Despite Surf Air’s revenue, access to capital and cutting-edge technology, its market value is $96.45 million. However, this could change based on the company’s revenue growth guidance for the coming years.13

It’s also important to note that the companies above shouldn’t even be considered competition. In fact, one day they could become customers of Surf Air Mobility (NYSE:SRFM) to support their go-to-market efforts with its tech-enabled operating software and leasing services.

Think about it this way, Uber doesn’t care which cars are being used to pick up passengers, as long as they get safely and efficiently from Point A to Point B. If company’s like Joby Aviation and Blade succeed and grow, it could result in more upside for Surf Air Mobility.

Creating a New ESG-Friendly Mass Transit Solution

Just like how Uber made hailing a ride as simple as tapping your phone, Surf Air Mobility Inc. (NYSE:SRFM) aims to make catching a short flight just as easy and convenient.

Imagine skipping the long lines and busy hubs, and instead, flying directly between smaller local airports, getting you closer to your desired destination. It’s a process the industry calls Regional Air Mobility (RAM).

With an already impressive footprint, Surf Air (NYSE:SRFM) connected 48 destinations across the US, brought in revenues of approximately $101 million, and facilitated over 450,000 passengers on ~75,000 flights in 2022.14

Now Surf Air has plans in motion to expand its network further across US regional avenues, focusing on premier routes.

“Regional Air Mobility (RAM) will fundamentally change how we travel, bringing the convenience, speed, and safety of air travel to all Americans, irrespective of their distance from a major hub.”15 – NASA

McKinsey & Company predicted that “Innovative propulsion… could introduce a new era of frequent, convenient passenger flights on smaller regional aircraft.”16

The financial horizon is even brighter. By 2035, the global market for these regional flights could be valued between $75 billion and $115 billion, translating to a passenger flow of 300 to 700 million people annually17.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

However, what truly makes Surf Air (NYSE:SRFM) the ‘Uber of Commercial Air Travel’ is its approach to streamlining and enhancing the user experience.

The company’s tech-savvy regional charter platform reimagines how we access air travel, making existing aircraft and pilots more accessible to the everyday traveler.

Press Releases

- Jim Sullivan, Airline Executive, to Become President of Air Mobility for Surf Air Mobility

- Surf Air Mobility Enters Agreement To Supply Electric Powertrains To Asta, A Brazilian Cessna Caravan Operator

- Surf Air Mobility Reports First Quarter Revenue Growth Above Guidance And Announces Ceo Transition

- Surf Air Mobility Enters Agreement to Supply Electric Powertrains to Tanzanian Cessna Caravan Operator Auric Air

- Surf Air Mobility Enters Agreement To Supply Electric Powertrains To Kenya’s Largest Cessna Caravan Charter Operator Z.Boskovic Air Charters

In 2022 alone, the platform witnessed about 220 bookings every month, with travelers spending an average of $8000 for a journey that covers roughly 500 miles18.

Star-Studded Partnerships in Place

In the emerging regional air mobility industry, Surf Air Mobility Inc. (NYSE:SRFM) has brought together a powerful network of industry-leading partners.

Aircraft Manufacturing: Textron Aviation

One of the cornerstones of Surf Air’s (NYSE:SRFM) strategy is its exclusive relationship with Textron Aviation, a subsidiary of Textron Inc. (NYSE:TXT), one of the world’s largest general aviation manufacturers. Textron Aviation will support Surf Air Mobility’s development of electrified Cessna Grand Caravan EX aircraft. This partnership comes with a large fleet order that ensures supply scalability, thereby providing a solid foundation for Surf Air’s regional air mobility (RAM) platform.

Software Development: Palantir Technologies

In a world that increasingly relies on big data and artificial intelligence, Surf Air (NYSE:SRFM) has teamed up with Palantir Technologies (NYSE:PLTR), a trailblazer in data-driven and AI operations. They’re working hand-in-glove to develop definitive AI and machine learning solutions for the burgeoning RAM industry, specifically for the ACaaS product. This partnership amplifies Surf Air’s operational efficiency and predictive capabilities, with the potential to put them leaps and bounds ahead of the competition.

Certification: AeroTEC

Ensuring that their technology is certified and up to industry standards, Surf Air has entered into an exclusive agreement with AeroTEC, a Tier-1 aerospace supplier. AeroTEC will certify the electrification technology for the Cessna Caravan, and the deal ensures that Surf Air Mobility (NYSE:SRFM) owns the Supplemental Type Certification IP, making them masters of their own technological destiny.

Aircraft Financing: Jetstream Aviation Capital

Surf Air Mobility (NYSE:SRFM) has ensured a consistent inflow by partnering with Jetstream Aviation Capital, the largest global aircraft lessor for commercially-operated turboprops. Through efficient off-balance-sheet financing of up to $450 million, Surf Air has obtained the flexible capital required to kickstart its aircraft financing program.

Pilot Recruitment: SkyWest Airlines

Surf Air Mobility’s (NYSE:SRFM) pilot pipeline agreement with SkyWest Airlines, a subsidiary of SkyWest Inc. (NASDAQ:SKYW), ensures a competitive advantage in pilot recruitment, effectively tackling a major HR challenge in aviation.

Ground Operations: Signature Flight Support

To ensure robust ground operations Surf Air (NYSE:SRFM) is working with Signature Flight Support, the world’s largest network of Fixed-Based Operators. They provide preferred ground infrastructure in key markets and offer future potential for sustainable aviation fuel and ground infrastructure co-development for RAM expansion.

Diversified Revenue Streams

In the ever-changing travel sector, Surf Air Mobility Inc. (NYSE:SRFM) has diversified its revenue streams, fortifying its financial stability for future expansion.

Scheduled regional flights remain the core offering of Surf Air, connecting 48 US cities across five time zones. The time-savings and convenience offered through these flights have positioned the company as a leader in the regional market. Customers can choose a single seat on a scheduled flight or a private on-demand charter.19

The company’s involvement in government-contracted essential air travel serves (EAS) as another pillar in its diversified revenue model. This not only adds a layer of financial security but also cements Surf Air’s (through its sub-brand Southern Airways) reputation as a reliable partner for crucial operations.

In December, Surf Air Mobility Inc. (NYSE:SRFM) inked an agreement with Purdue University to begin subsidized scheduled commuter air service between Purdue University Airport (LAF) and Chicago O’Hare Airport (ORD) targeted for early Q2 2024.20

This service, offering up to 24 weekly flights, will make travel easier for Purdue’s community, directly connecting them to one of America’s busiest airports. Uniquely, this initiative leverages the successful EAS model, but without federal funding, demonstrating Surf Air Mobility‘s innovative approach to enhancing regional connectivity.

Just weeks later, the company announced plans to initiate commuter air service between Williamsport Regional Airport (IPT) and Washington Dulles International Airport (IAD) starting May 2024. This service aims to offer the Williamsport and Lycoming County communities easier and more affordable access to air travel, targeting ten weekly flights directly connecting them to a major hub, bypassing long drives.

This marks the first commercial flights at Williamsport in over two years. The unique subsidized funding model for this service combines local grants and community donations, reducing financial risk for Surf Air.

Surf Air Mobility (NYSE:SRFM) is planning a big move with its Aircraft-as-a-Service (ACaaS) offering. This all-in-one package will let air operator companies lease planes, maintain their engines, and use special software to optimize their business, creating yet another way for Surf Air to generate revenue.

When it comes to growing its revenue, Surf Air is on a strong path. Estimates show that the company could see its revenue go up by 20-25% each year. What’s more, its gross profits could grow even faster, at a rate of 35-45% annually21.

This growth will come from a few key areas: cleaner, electric planes that cost less to operate and more ways to make money through services like ACaaS.

Stellar Leadership Team

Surf Air Mobility’s (NYSE:SRFM) leadership brings a wealth of experience from aviation, media, and technology, showcasing a track record of success.

RECAP: 8 Key Reasons to Consider Surf Air Mobility Inc. (NYSE:SRFM)

1

Pioneering Green Travel: Surf Air Mobility targets the forefront of sustainable air travel with a focus on electric airplanes, aiming to make short-haul flights more affordable.

2

Huge Market Potential: The regional air mobility sector has a projected global market value of $75-115 billion by 2035.

3

Top RAM Player: As the leading commuter airline in the US, Surf Air Mobility flew 450,000 passengers to 48 destinations in 2022 alone.

4

Innovative Business Model: The company’s integrated B2C and B2B approach, featuring Aircraft-as-a-Service, is poised to capitalize on the electric flight era.

5

Diverse Revenue Channels: With ~$101M in revenue in 2022, Surf Air and its other air travel brands (Southern Airways and Mokulele Airlines) has multiple revenue sources, from scheduled flights to government contracts and off-fleet platforms.

6

Growth Forecast: The company projects a 20%-25% revenue CAGR and a 35%-45% gross profit trajectory.

7

Powerful Partnerships: Strong ties with industry giants like Palantir Technology, Textron Aviation, and Jetstream Aviation Capital.

8

Expert Leadership: Surf Air’s team brings vast experience from global aviation and transportation leaders, including Delta, United, and Virgin America.

Surf Air Mobility Inc. (NYSE:SRFM) is leading a new era in sustainable, efficient regional air travel. With diverse revenue sources and a solid strategy, the company is set for both growth and stability across various sectors, including scheduled flights and Aircraft-as-a-Service.

If you’re an industry stakeholder, investor, or eco-conscious consumer, Surf Air Mobility offers promising value. Click here to stay up-to-date with all the company’s exciting news and developments.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Stan Little CEO

Stan Little CEO Sudhin Shahani Co-Founder

Sudhin Shahani Co-Founder Fred Reid Head of Global Business Development

Fred Reid Head of Global Business Development Carl Albert Chairman

Carl Albert Chairman