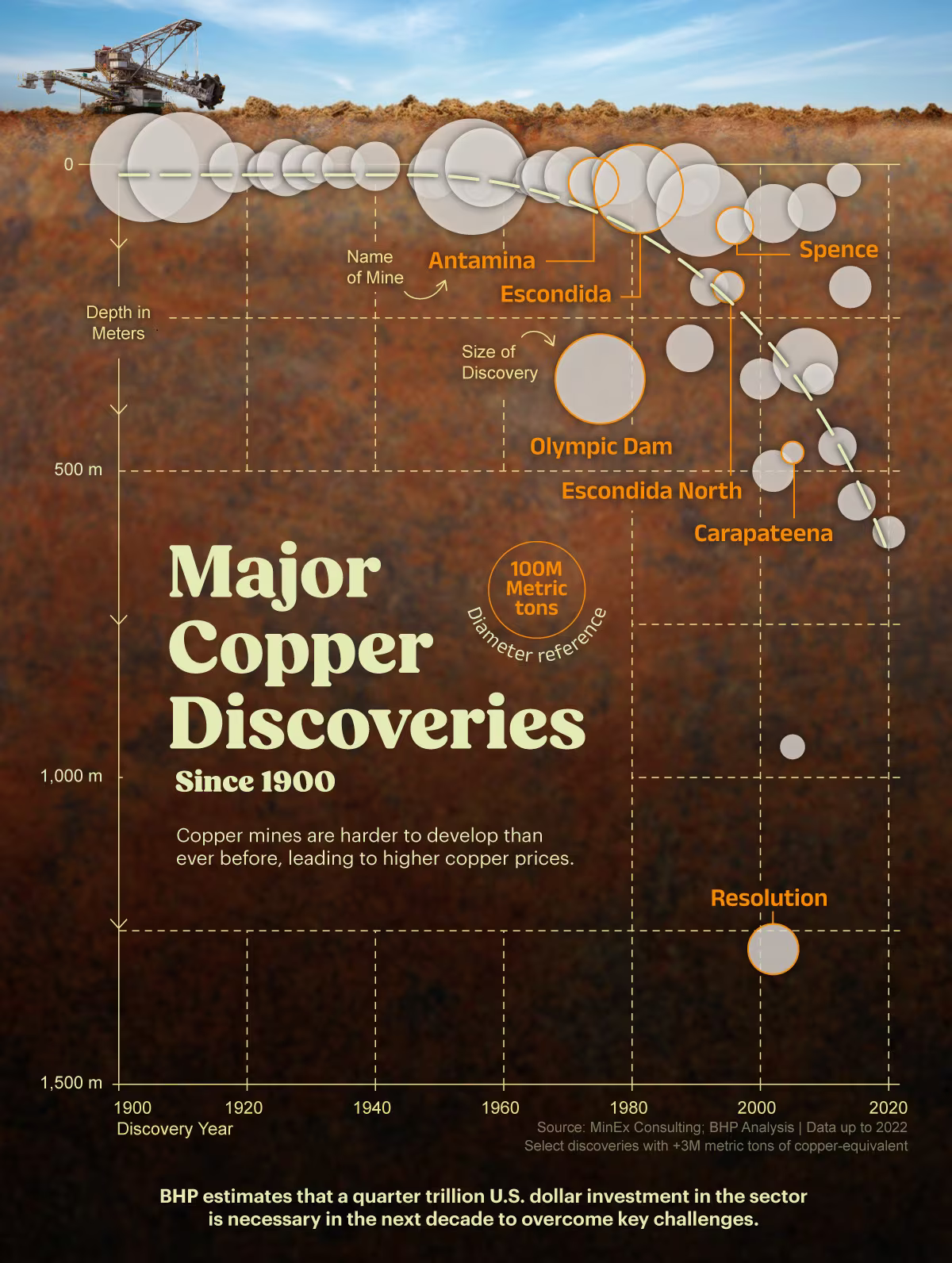

Copper prices recently plummeted from $5.80 per pound to $4.35 after the market reacted to the news about a 50% tariff on copper imports and the uncertainty surrounding global supply chains.

While the price has dipped, the underlying demand for copper remains incredibly strong, driven by electric vehicles, renewable energy projects, and AI infrastructure.

This price drop might seem like a setback for some, but in the long-term, it underscores an urgent need for secure, stable, and high-quality sources of copper.

The US tariff and the challenges in global trade have highlighted the critical importance of projects in politically stable and mining-friendly jurisdictions, like Botswana.

The problem?

Copper demand is set to double by 2035,¹ but new discoveries have collapsed by more than 80% since 2010.²

Source: bhp.com3

It now takes 16 years on average to bring a new mine online⁴ and most existing production is tied up in unstable regions like Chile⁵, Peru⁶, and the DRC.⁷

That’s exactly where NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) fits in.

With two past-producing mines in Botswana, a politically stable, mining-friendly country, and aggressive drilling already underway at its Selebi deposits.

This is a timing story—and the clock just started ticking a whole lot faster.

Reviving Two Past-Producing Mines at the Center of the Critical Minerals Boom

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM)controls two past-producing mines — the Selebi Mine Complex located in Selebi-Phikwe and Selkirk Mine located outside of Francistown — once owned by a parastatal Botswana mining company.

Current resource:

- Defined high-grade copper-nickel-cobalt resources at Selebi Mine — 18.89 million tonnes (Mt) (Inferred) at 3.51% CuEq, 5.83 Mt (Inferred) at 3.11% CuEq, and 3.00 Mt (Indicated) at 2.92% CuEq⁸

- 44.2 Mt of copper-nickel-palladium-platinum mineralization at Selkirk – averaging 0.81% CuEq , providing large-scale, open-pit potential with valuable PGM credits.⁹

- Expansion drilling is targeting massive conductive zones beyond the current resource boundaries.

But that’s not the only reason NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) stands out.

This isn’t some ten-year dream.

The existing underground infrastructure at Selebi North,is being utilized to support expansion drilling and technical evaluation activities. The program is well funded following a $67 million recapitalization led by Frank Giustra and EdgePoint Investment Group,¹⁰ and is further supported by a subsequent public offering recently upsized to C$80 million.¹¹

The latest raise secures full title of the Selebi and Selkirk projects, removes the market overhang, and accelerates drilling, and MRE work.

But it’s not just the money that sets NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) apart, it’s the strategic backing behind it.

Frank Giustra, a serial mining entrepreneur and founder of several mining companies including Wheaton Precious Metals and Goldcorp, has structured and financed world-class mining ventures. He also founded Lionsgate Films, now one of the world’s largest independent film studios. Giustra’s global network, strategic vision, and deal-making acumen have driven billions in market cap growth.

His involvement signals that NexMetals is a serious project positioned for scale and institutional support.

Giustra’s backing is more than financial — it’s about unlocking the full potential of Selebi and Selkirk, turning them into elite assets in one of Africa’s most stable mining jurisdictions.

Meanwhile, at Selkirk, surface drilling and metallurgical studies are laying the groundwork for a second leg of growth, giving NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) not just one, but two major catalysts for value creation.

They’re moving fast.

Resource expansion, concentrate production, and strategic optionality are all on the table in a supply-constrained market.

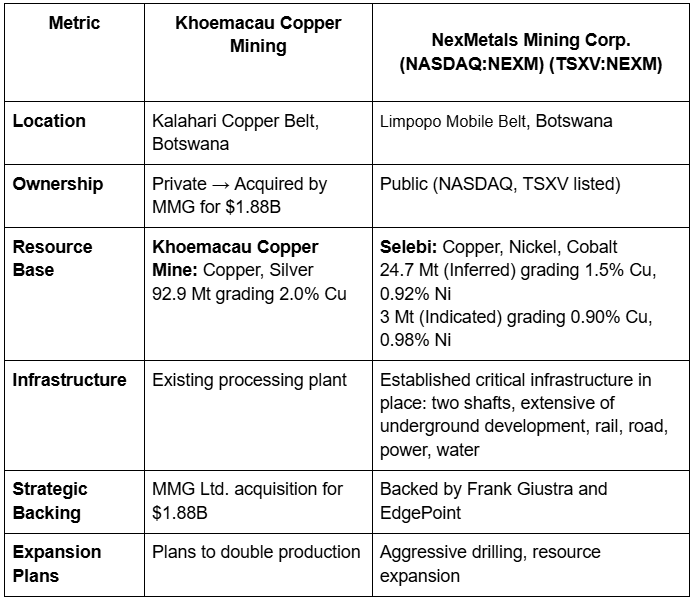

A Proven Path to Billion-Dollar Value — Right Next Door

If you want a real-world example of how Botswana’s copper potential can translate into serious value, look no further than Khoemacau Copper Mining.

Khoemacau started small — a private developer working the Kalahari Copper Belt, long before most investors paid any attention to Botswana’s critical minerals potential.

Today?

Khoemacau is producing over 60,000 tonnes of copper per year, with plans to double production by 2027.¹²

And in March 2024, China’s MMG Ltd. snapped up the Khoemacau assets for a staggering $1.88 billion.¹³

The key to Khoemacau’s success?

- High-grade copper discovery zones

- Strong resource growth through targeted drilling

- Existing infrastructure

- A politically stable, mining-friendly environment in Botswana

- Perfect timing — riding the surge in global copper demand

NexMetals controls two past-producing copper-nickel mines — Selebi and Selkirk — right in the heart of Botswana’s critical minerals corridor.

With its public offering recently upsized to C$80 million due to strong investor demand, NexMetals is well positioned to advance its copper-nickel portfolio at an accelerated pace.

8 Reasons

This Overlooked Critical Minerals Play Could Be One of 2025’s Biggest Breakouts

1

Copper is entering a full-blown supply crisis — Major copper discoveries have collapsed by over 80% since 2010, with prices pushing toward all-time highs.¹⁴

2

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) controls two past-producing, high-grade critical minerals mines: With 68.9 Mt (Inferred) and 3.0 Mt (Indicated) already defined between Selebi and Selkirk¹⁵— and infrastructure in place — NexMetals has a serious head start most juniors can only dream of.

3

High-grade expansion drilling is already underway: NexMetals is targeting new conductive plates, including a third horizon at Selebi Main and the hinge zone.

4

Backed by strong institutional investors: A C$67 million recapitalization completed in March 2025, together with a subsequent public offering recently upsized to C$80 million , gives NexMetals a clean balance sheet, full title of Selebi and Selkirk, and the capital to accelerate drilling, PEA, and MRE updates, backed by Frank Giustra’s Fiore Group, EdgePoint Investment Group and other mining-focused institutions.

5

Located in one of the safest, mining-friendly jurisdictions on Earth: Botswana’s stable political environment makes it ideal for long-term mining projects.

6

Early-mover advantage inline with a Nasdaq uplisting — Recently listed on the Nasdaq to unlock a broader investor base.¹⁶

7

Multiple catalysts in motion: Drilling results, resource updates, and strategic developments provide near-term news flow.

8

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is still in the early stages, with potential upside relative to larger peers.

Press Releases

- NexMetals Secures Title to Selebi and Selkirk Assets in Botswana Following Completion of Milestone Payment

- Trump Just Lit the Fuse on a Copper Crisis and This Junior Developer Could Be One of the Biggest Beneficiaries

- NexMetals Announces C$65 Million Public Offering of Units

- NexMetals Metallurgical Assay Results Confirm Clean Copper & Nickel-Cobalt Concentrates from Selebi Mines

- NexMetals Announces Continuance into British Columbia

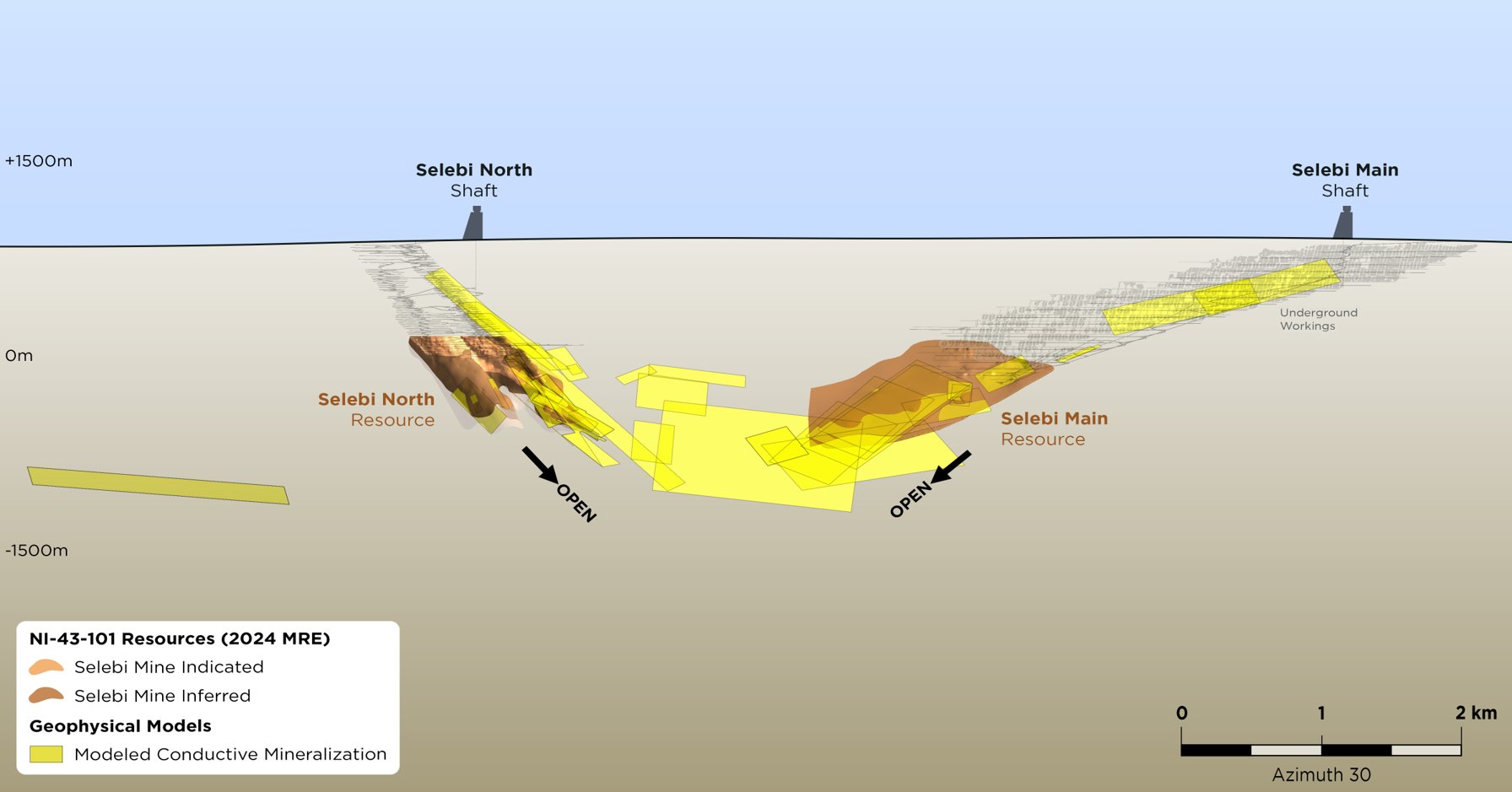

Selebi: A High-Grade Critical Minerals Discovery Hiding in Plain Sight

In a copper market starved for new supply, the Selebi Mine Complex stands out for one reason:

It is large and the resource is growing. Originally discovered in the 1960s, Selebi North and Selebi Main together produced nearly 40 Mt of copper-nickel ore. The closure of Selebi wasn’t due to geological reasons or resource exhaustion.

In 2016, the former operator’s smelter, once the central processing hub for southern Africa, failed. Without processing capacity, the government mothballed the complex, leaving millions of tonnes of high-grade material in place.

Today, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) controls Selebi, and they’re already rewriting the story.

24.7 Million Tonnes Inferred — and Growing Fast

In 2024, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) released a new NI 43-101 MRE confirming:¹⁷

- Selebi Main: 18.89 Mt inferred at 3.51% CuEq

- Selebi North:

- 3.00 Mt indicated at 2.92% CuEq

- 5.83 Mt inferred at 3.11% CuEq

This totals 24.7 Mt (Inferred) and 3 Mt (Indicated) of high-grade copper-nickel-cobalt resources. And this doesn’t include recent drilling.

Recent drilling — 41,018 metres over 91 holes — has already outperformed the model, revealing that the grades are getting better:¹⁸

- Drill trace SNUG-24-174 reported 27.55 metres grading 4.97% CuEq

- Drill trace SNUG-25-189 reported 19.40 metres grading 3.93% CuEq (including 13.55 metres at 4.02% CuEq)

- Drill trace SNUG-25-186 reported 16.25 metres grading 3.06% CuEq (including 10.45 metres at 4.16% CuEq and 6.45 metres of 5.28% CuEq)

- Drill trace SNUG-25-184 reported 13.50 metres grading 3.68% CuEq

These assays suggest Selebi’s next MRE could potentially show both increased tonnage and improved grades.

And the growth isn’t slowing down.

In October 2025, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) announced results from a drill hole between the two major step-out holes SNUG-25-184 and 186 , down-plunge from the Selebi North resource — intersecting strong mineralized intervals within a broader 32.60 metre mineralized zone and proving that the system is larger and more dynamic than previously understood.¹⁹

Why This Matters

With high-grade mineralization, ongoing drilling, and existing infrastructure, Selebi is set for rapid expansion, all while copper prices are soaring — making this a critical opportunity that’s still flying under the radar.

Engineering Smarter

NexMetals isn’t just growing the resource. It’s unlocking more value from every tonne.

At Selebi North, the company is evaluating the use of X-ray transmission (XRT) pre-concentration technology underground, potentially diverting waste rock to existing stopes before it even reaches the mill.²⁰

The results speak for themselves: a 15.2% jump in head grade, 98% copper and nickel recovery, and a leaner, potentially higher-margin operation from day one.

This isn’t theoretical. It’s already working. NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is turning historical infrastructure into a real-time advantage, boosting economics and reducing dilution at the source. In a market chasing high-grade copper, that’s a game-changer.

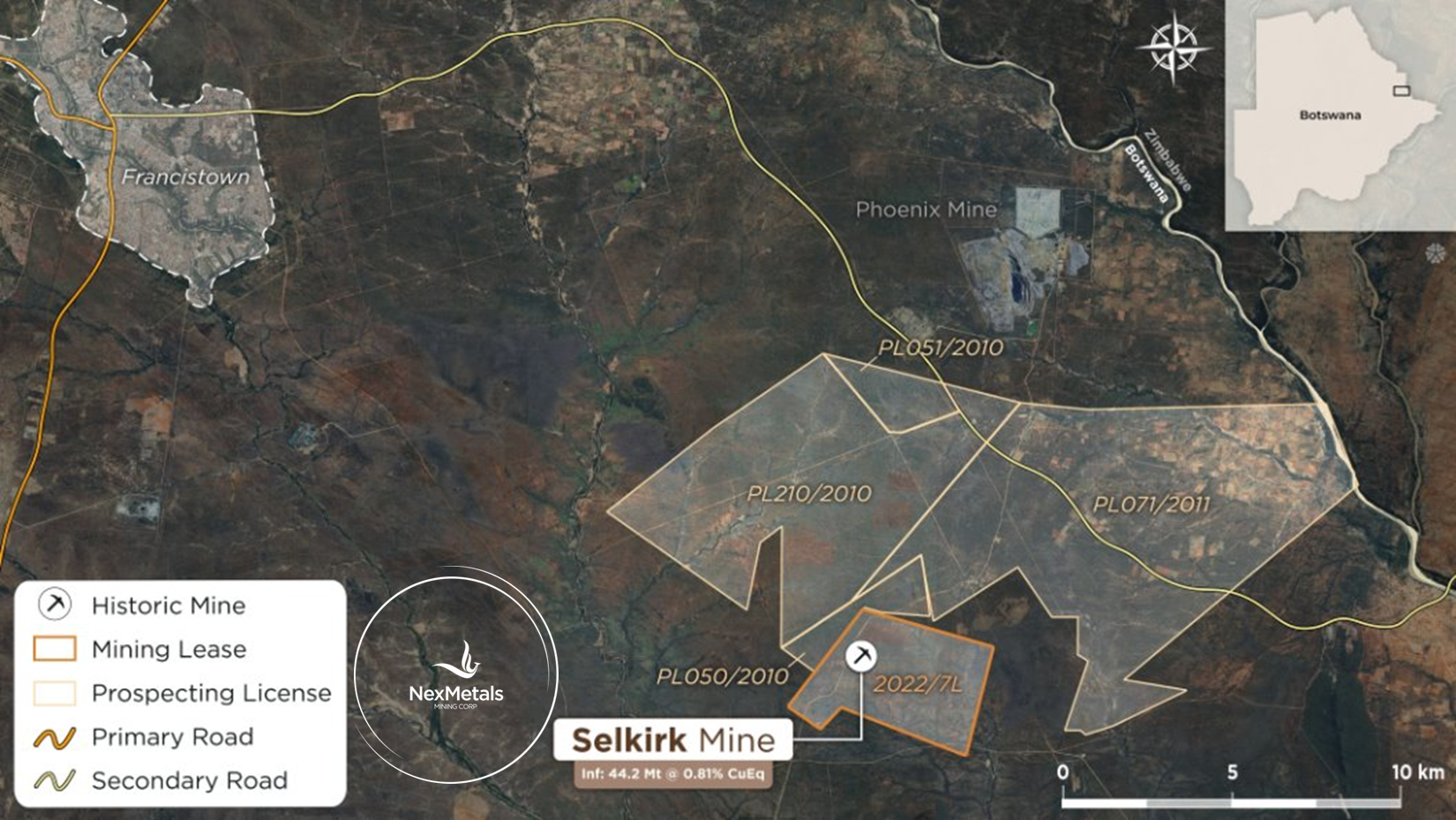

Selkirk: A Second Past-Producing Mine Few Are Watching — Yet

While the market is waking up to the opportunity at Selebi, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) holds a second critical minerals growth engine that almost no one is paying attention to yet.

Located just 75 kilometers north of Selebi, the Selkirk Mine has a rich history — producing over 1 Mt of copper-nickel ore between 1989 and 2002.

But unlike many past-producing mines, Selkirk wasn’t exhausted and the deposit was evaluated for its open pit potential — not resource depletion.

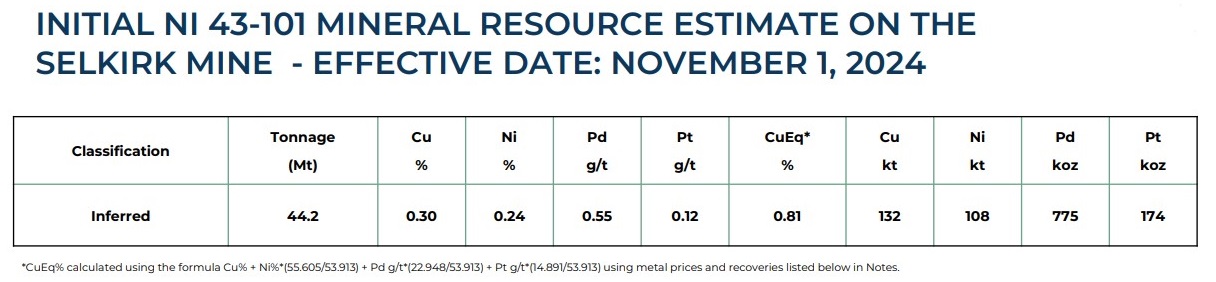

With a 2024 Mineral Resource Estimate of 44.2 Mt of 0.81% CuEq and proximal infrastructure, this deposit is a second asset in Botswana. By using today’s modern exploration technologies, Selkirk’s full potential could be realized.²¹

A Large, Near-Surface Polymetallic Resource

In November 2024, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) published an updated NI 43-101 resource for Selkirk, confirming:

44.2 Mt (Inferred) at 0.30% copper and 0.24% nickel

Byproduct credits of 0.55 g/t palladium and 0.12 g/t platinum.

Selkirk’s scale and polymetallic nature provide significant value.

Its near-surface mineralization makes it ideal for low-cost, open-pit potential, an advantage in a world where building new underground mines takes decades.

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is not treating Selkirk like a secondary asset. They’re re-logging core and optimizing metallurgy to improve recoveries.

Excitingly, they’re applying XRT ore sorting technology²² to boost head grades by up to 3x, lowering costs and improving operating margins.²³

Strategic optionality gives NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) significant flexibility and increased growth potential.

A Team Built for Execution, Not Just Exploration

The opportunity at NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) isn’t just about the rocks.

It’s about the team driving the vision forward.

NexMetals’ board is equally impressive. Paul Martin, the former CEO of Detour Gold and interim CEO of Osisko Gold Royalties, knows exactly what it takes to build world-class mines and deliver major shareholder returns. Chris Leavy, former Chief Investment Officer at BlackRock and Oppenheimer Funds, brings powerful Wall Street connections and decades of institutional investment experience.

And with Fiore Management and Frank Giustra’s strategic advice, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) has top-tier backing to navigate the complexities of today’s mining sector.²⁴

A Timing Story You Need To Put On Your Radar

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is positioned at the heart of a critical minerals boom.

Two past-producing mines, 68.9 Mt (Inferred) and 3 Mt (Indicated) of combined high-grade resources, recapitalized with strategic backing from some of the most successful mining financiers make this an opportunity few juniors can match.

With drilling underway, high-grade expansion, and a new Nasdaq uplisting coming soon,²⁵ NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is on track to deliver massive value — and the window to position early is closing fast.

The time to act is now.

For those paying attention, the opportunity is clear.

Timing is everything.

Click here to sign up to our newsletter.

Scientific and Technical Information

Caution Regarding Historic Data

Certain scientific and technical information in this advertisement, including historic data compilation at the Selebi and Selkirk projects, are historic in nature. Reference should be made to the full text of the Selebi Technical Report (as defined herein) and the Selkirk Technical Report (as defined herein) for the assumptions, limitations and data verification relating to the historic data compilation presented in this advertisement, which are available electronically on SEDAR+ (www.sedarplus.ca) under NEXM’s issuer profile. The work undertaken by the Company, SLR Consulting (Canada) Ltd., and G Mining Services Inc., respectively, to verify the historic data compilation are further described in the Selebi Technical Report and the Selkirk Technical Report.

While (i) visual estimates of oxidized sulphides appear to correlate well with logged intercepts and analytical values, and (ii) analytical values compared between the logs and the digital database appear to compare well, the technical team continues to collect, compile, review and validate historic technical data relevant to the project. To that end, the Selebi and Selkirk Technical Report recommends continued compilation and verification to confirm that the QA/QC program results are adequate to support the inclusion of the historical drill hole information in future mineral resource estimate in accordance with NI 43-101.

Selebi Technical Report

The scientific and technical information in this advertisement relating to the Selebi project is supported by the technical report entitled “Technical Report, Selebi Mines, Central District, Republic of Botswana” (the “Technical Report”) and dated September 20, 2024 (with an effective date of June 30, 2024) (the “Selebi Technical Report”), and prepared by SLR Consulting (Canada) Ltd. for NEXM . Reference should be made to the full text of the Selebi Technical Report, which was prepared in accordance with NI43-101 and is available on SEDAR+ (www.sedarplus.ca) under NEXM ‘s issuer profile.

Selkirk Technical Report

The scientific and technical information in this advertisement relating to the Selkirk project is supported by the technical report entitled “NI 43-101 Technical Report Selkirk Nickel Project, North East District, Republic of Botswana”, dated January 10, 2025 (with an effective date of November 1, 2024) (the “Selkirk Technical Report”) prepared by SLR Consulting (Canada) Ltd. for NEXM . Reference should be made to the full text of the Selkirk Technical Report, which was prepared in accordance with NI 43-101, and available on SEDAR+ (www.sedarplus.com) under NEXM ‘s issuer profile.

QA/QC

The recent drilling programs were carried out using company owned drills through an agreement with Forage Fusion Drilling Ltd. of Hawkesbury, Ontario, Canada, who are providing training of local operators. The underground drilling program is being carried out with Zinex U-5 drills. Drill core size is BQTK (40.7 mm diameter). Surface drilling is being carried out using two converted Zinex U5s and a Marcotte HTM2500. Surface drill core size is typically NQ (47.6 mm diameter). Samples are generally 1.0 to 1.5 metre intervals or less at the discretion of the site geologists. Sample preparation and lab analysis was completed at ALS Geochemistry in Johannesburg, South Africa. Commercially prepared Blank samples and certified Cu/Ni sulphide analytical control standards with a range of grades are inserted in every batch of 20 samples or a minimum of one set per sample batch. Analyses for Ni, Cu and Co are completed using a peroxide fusion preparation and ICP-AES finish (ME-ICP81). Analyses for Pt, Pd, and Au are by fire assay (30 grams nominal sample weight) with an ICP-AES finish (PGM-ICP23).

Drilling on the Selkirk Project was completed by Discovery Drilling using a Boyles 56 machine. Drill core is HQ (63.5 mm diameter) size. Samples were sawn to produce quartered core. The quartered core samples submitted to the lab were generally 1 metre in length. Re-sampling of historic drill core (NQ: 47.6 mm diameter) is ongoing. Samples submitted to the lab were half core and generally 1 meter in length. Sample preparation and lab analysis of both new core and resampled core was completed at ALS Chemex in Johannesburg, South Africa. Commercially prepared blank samples and certified Cu/Ni sulphide analytical control standards with a range of grades are inserted in every batch of 20 samples or a minimum of one set per sample batch. Analyses for Ni, Cu and Co are completed using a peroxide fusion preparation and ICP-AES finish (ME-ICP81). Analyses for Pt, Pd, and Au are by fire assay (30 grams nominal sample weight) with an ICP-AES finish (PGM-ICP23).

Metallurgical testwork was carried out at SGS Minerals (Lakefield), XPS and Blue Coast Research, all in Canada. Bulk sample pre-concentrations studies using XRT technology were carried out by all minerals in Germany and IMS Engineering in South Africa.

SGS Minerals Lakefield, XPS, Blue Coast Research and ALS Geochemistry sites are accredited and operate under the requirements of ISO/IEC 17025 for specific tests as listed on their scope of accreditation, including geochemical, mineralogical, and trade mineral tests.

Qualified Persons

All scientific and technical information in this advertisement has been reviewed and approved by Sharon Taylor, VP Exploration of the Company, MSc, P.Geo, whom is a “qualified person” for the purposes of NI 43-101.