Copper has become more than just a commodity. It’s a strategic asset.

On July 31st, the copper market took a sharp hit, with prices dropping from around $5.80 per pound to $4.35.

This sudden shift has rattled the industry, but it’s also highlighting the urgent need for reliable, stable copper sources.

Global demand for copper continues to surge. The rise of electric vehicles, the growth of AI infrastructure, and the ongoing transition to renewable energy are pushing copper consumption higher than ever.

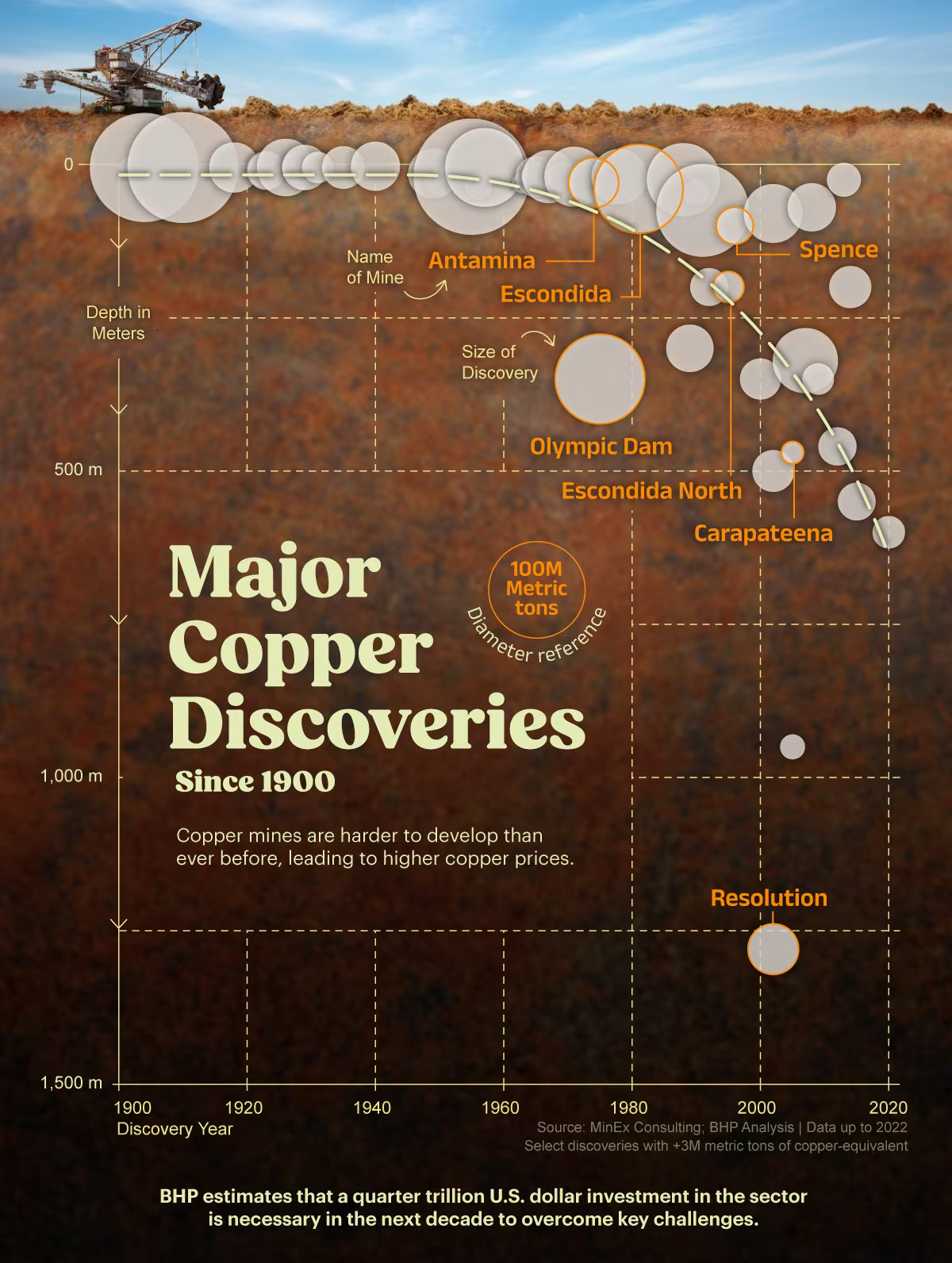

But the supply side is struggling to keep up. Major new copper discoveries have dropped by more than 80% since 2010, and 40% of current production comes from politically unstable regions.

With it now taking 15 years on average to develop a new copper mine, it’s clear the gap between supply and demand will only widen in the coming years.

The implications are huge. Copper has become a national security issue, with countries seeking to secure their supply chains amid growing geopolitical tensions.

This is where companies like NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) come in.

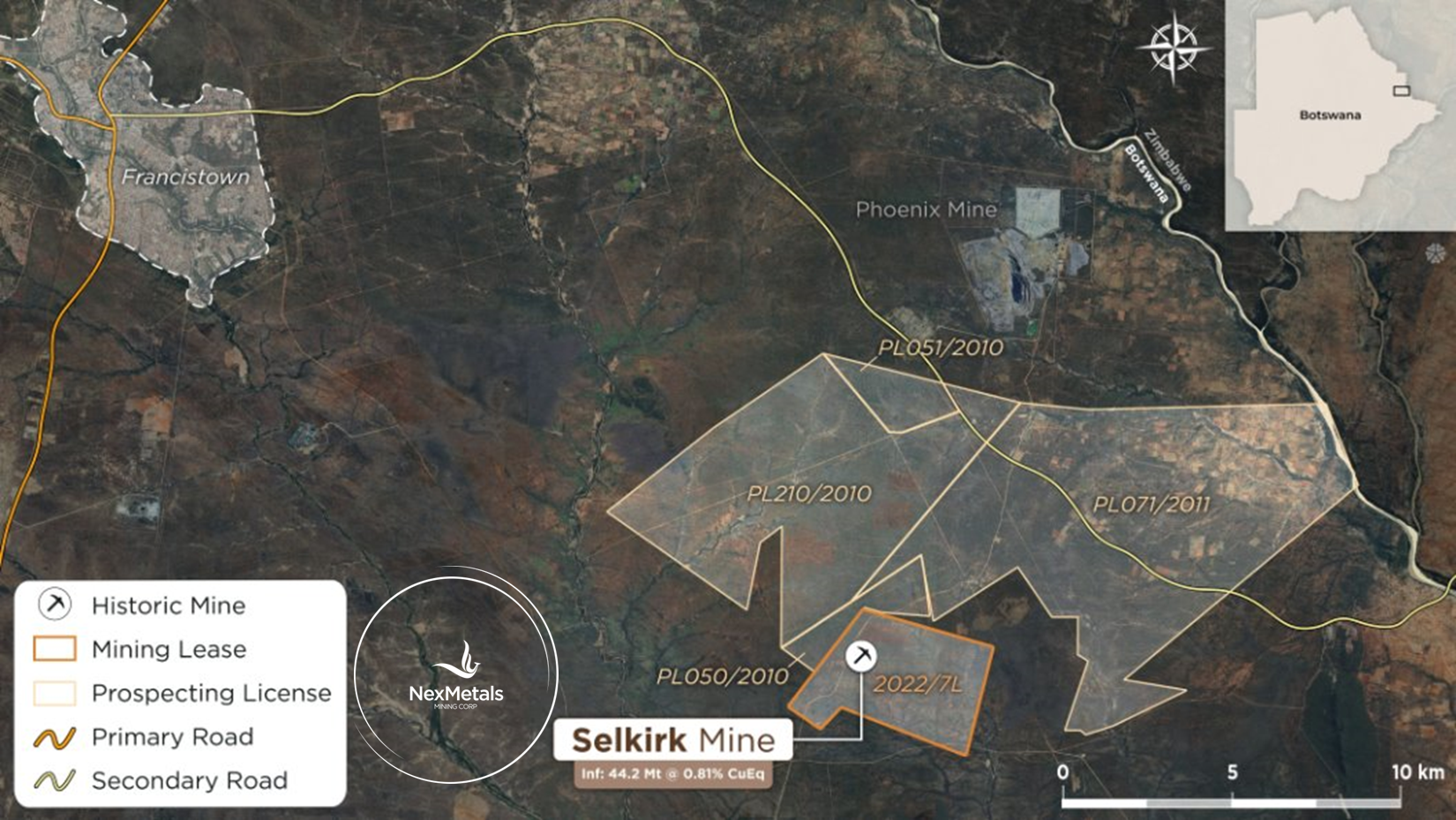

NexMetals Mining controls two high-grade copper-nickel projects in Botswana, a country known for its political stability and mining-friendly regulations.

These projects, Selebi and Selkirk host high-grade copper-nickel-cobalt resources, and aggressive drilling programs are underway to potentially expand those resources.¹

While copper prices may have dipped recently, the fundamentals haven’t changed. The global copper shortage is a real problem, and Nexmetals Mining is positioned to capitalize on the growing demand for secure, high-quality copper supply.

In June 2025, the company completed a 20-for-1 share consolidation, bringing its total share count to just ~21.45 million — a critical move to support Nasdaq uplisting, which could provide the company exposure to significantly larger pools of US capital.

At the same time, shareholders approved a formal name change from Premium Resources Ltd. to NexMetals Mining Corp., highlighting their strategic direction to become a leading critical metals company and further aligning leadership with long-term shareholder value ahead of what could be a transformational year.

NexMetals isn’t just sitting on potential.

They already control a newly confirmed 24.7 Mt (Inferred) and 3 Mt (Indicated)² of defined high-grade copper-nickel-cobalt sulphide resources at Selebi³ — with high-grade zones identified and aggressive expansion drilling now underway.

And that’s just one piece of the story.

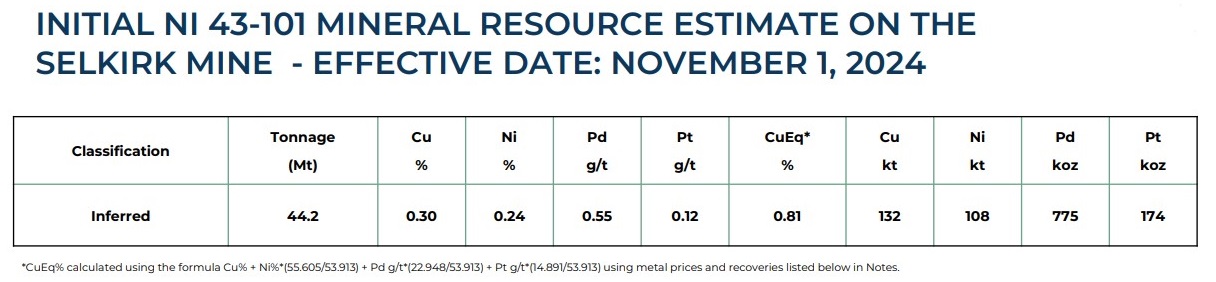

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) also holds the past-producing Selkirk Mine, where a newly published NI 43-101 resource outlines an additional 44.2 Mt (Inferred) of copper-nickel-platinum group elements sulphide mineralization — providing a second major growth platform and even more exposure to critical metals.

Even better, NexMetals announced a C$65 million upsized financing due to strong investor demand at C$5.70 per unit with a 24-month C$8.00 warrant, instantly transforming its balance sheet and clearing the path for the next stage of growth.

This raise pre-pays the milestone payment on the Selebi and Selkirk acquisition, giving NexMetals 100% title and eliminating the final overhang that’s been sitting on the story.

With full title locked in, NexMetals now controls two tier-one copper-nickel deposits outright and the market can finally value them as such.

The capital also gives the company serious momentum to accelerate drilling at the Hinge Zone, expand the Selebi Main deposit, and advance both the Preliminary Economic Assessment (PEA) and updated Mineral Resource Estimate (MRE).

Demand was so strong the deal was upsized from C$50 million to C$80 million, led by long-only and fundamentals-driven investors that see NexMetals as one of the most compelling new copper developers in the market.

Stack that on top of the previously announced C$67 million recapitalization⁴ led by Frank Giustra’s Fiore Group and EdgePoint Investment Group, one of Canada’s top institutional investors, and NexMetals now has the capital depth, institutional backing, and clean structure that every serious copper investor looks for.

And with critical minerals now designated a national security priority by the US, Europe, and Canada, companies like NexMetals are moving to the front of the line.

The project already benefits from infrastructure, permitting, and potential expansion catalysts.

This isn’t just another exploration story.

This is a timing story.

Reviving Two Past-Producing Mines at the Center of the Critical Minerals Boom

Meet NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) — a revitalized copper-nickel explorer that’s about to put Botswana’s Selebi and Selkirk mines back on the global map.

Rooted in a Tier One mining jurisdiction, NexMetals controls two past-producing, permitted mines — the Selebi Complex and the Selkirk Mine — once owned and operated by BCL Limited.

Their current resource?

Over 24.7 Mt (Inferred) and 3 Mt (Indicated) of defined high-grade copper-nickel-cobalt sulphide resources, averaging 2.92-3.40% copper equivalent at Selebi⁵, and a further 44.2 million tonnes (Inferred) of copper-nickel-cobalt-PGE mineralization averaging 0.81% copper equivalent at Selkirk.

Listen to CEO Morgan Lekstrom break down the latest drill results, expansion potential, and how NexMetals is positioning itself at the forefront of the global energy transition on the Mining Stock Daily podcast: Listen here.

But here’s what makes NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) different…

This isn’t some ten-year dream…

The Selebi North underground is already re-opened, the exploration drifts are advancing, an aggressive drill program is underway and fully funded by a $67 million recapitalization backed by Frank Giustra’s Fiore Group and EdgePoint Investment Group.

But it’s not just the money that sets NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) apart — it’s the strategic backing behind it.

But it’s not just the money that sets NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) apart — it’s the strategic backing behind it.

Frank Giustra is not just a financier; he’s a serial mining entrepreneur with a track record that speaks for itself.

He helped build Goldcorp,⁶ one of Canada’s most iconic gold producers, and Wheaton Precious Metals,⁷ a trailblazer in the streaming model that revolutionized mining finance and has structured and financed multiple world-class mining ventures, resulting in billions in market cap growth.

He also founded Lionsgate Entertainment, a global film powerhouse — underscoring his rare ability to build billion-dollar companies across sectors.

Giustra’s network — including connections with global financiers, institutional investors, and industry insiders — opens doors to new funding, strategic partnerships, and long-term growth.

Having Giustra at the helm is a signal to the market: NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is on the radar of top-tier institutional investors, and this project is built to scale.

He’s not just investing in NexMetals; he’s providing the strategic guidance needed to unlock the full potential of Selebi and Selkirk, with the intention of turning both into world-class assets in one of the most stable mining jurisdictions in Africa.

And to support that vision, NexMetals has expanded its leadership bench with a key appointment.

In June 2025, NexMetals welcomed former Lundin Mining finance leader Brett MacKay as CFO to support the company’s capital strategy and markets, as the company transitions to a more globally visible platform.

These additions reflect NexMetals’ evolution from a recapitalized junior into a fully integrated, growth-stage company — one equipped not just with projects and capital, but with the team to execute at scale.

Meanwhile, at Selkirk, surface drilling and metallurgical optimization studies are setting the stage for another leg of growth — giving NexMetals not just one, but two catalysts for value creation.

And they’re moving fast.

NexMetals is targeting near-term resource expansions, future production, and strategic optionality in a supply-constrained market desperate for new copper-nickel supply.

It’s early.

It’s high-grade.

And almost no one is paying attention yet.

Press Releases

- NexMetals Secures Title to Selebi and Selkirk Assets in Botswana Following Completion of Milestone Payment

- Trump Just Lit the Fuse on a Copper Supercycle and This Junior May Be One of the Best Positioned Plays on the Market

- NexMetals Announces C$65 Million Public Offering of Units

- NexMetals Metallurgical Assay Results Confirm Clean Copper & Nickel-Cobalt Concentrates from Selebi Mines

- NexMetals Announces Continuance into British Columbia

A Proven Path to Billion-Dollar Value — Right Next Door

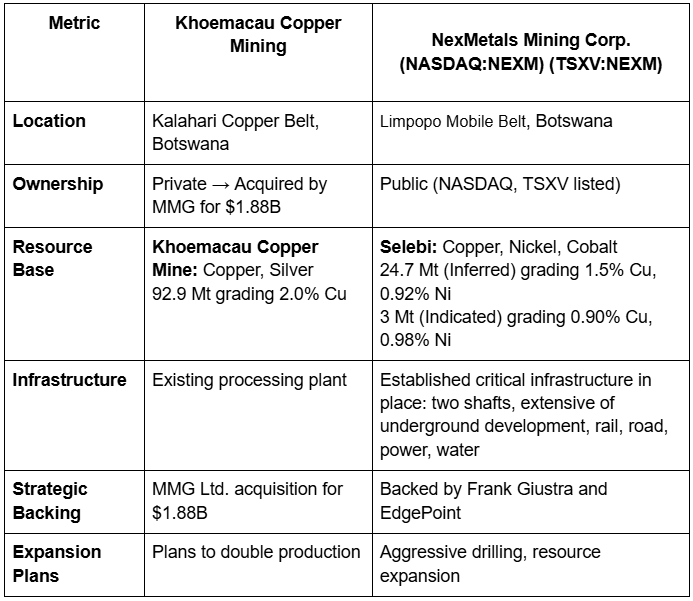

Want proof of Botswana’s copper potential? Look no further than the Khoemacau Copper Mine.

Khoemacau started as a small private developer working the Kalahari Copper Belt, long before most investors paid any attention to Botswana’s critical minerals potential.

Today?

Khoemacau is on track to produce up to 43,000-53,000 tonnes of copper in 2025, with plans to more than double capacity to 130,000 tpa through a major expansion.⁸

And in March 2024, China’s MMG Ltd. snapped up the Khoemacau assets for a staggering $1.88 billion.⁹

The key to Khoemacau’s success?

- High-grade copper discovery zones

- Strong resource growth through targeted drilling

- Existing infrastructure

- A mining-friendly, stable jurisdiction

- And most importantly, perfect timing — riding the surge in global copper demand

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) controls two permitted past-producing copper-nickel sulphide mines — Selebi and Selkirk — right in the heart of Botswana’s critical minerals corridor.

As of December 31, 2022, the Zone 5 deposit at Khoemacau Copper Mining had a total mineral resource of approximately 92.9 million tonnes grading 2.0% copper and 21.3 grams per tonne silver.¹⁰

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) has already outlined over 24.7 Mt (Inferred) and 3 Mt (Indicated) of high-grade resources at Selebi,¹¹ with aggressive expansion drilling underway to uncover new conductive targets even deeper and further along strike.

The company just completed a transformative $67 million recapitalization, funding a full pivot to resource growth.¹²

Like Khoemacau before its breakout, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is advancing ahead of the capital stampede now targeting critical minerals supply — not trailing behind it.

The difference?

Today, the world needs copper even more urgently than when Khoemacau started.

With a high-grade copper-nickel-cobalt resource and a refreshed balance sheet, NexMetals is shaping up to be one of the most strategic redevelopment stories in southern Africa.

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) could be the next breakout story.

8 Reasons

This Overlooked Critical Minerals Play Could Be One of 2025’s Biggest Breakouts

1

Copper is entering a full-blown supply crisis: The world is expected to need three times more copper by 2035, but major discoveries have collapsed by over 80% since 2010.¹³ Prices are already pushing toward all-time highs — and the squeeze is just beginning.

2

Two past-producing, high-grade critical minerals mines: With a combined tonnage of 68.9 Mt (Inferred) and 3Mt (Indicated) between Selebi and Selkirk — and brownfield infrastructure and key permitting in place — NexMetals has a serious head start most juniors can only dream of.

3

High-grade expansion drilling is already underway: NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is aggressively targeting new conductive plates beyond the known deposits — including a potential third horizon at Selebi Main and the untested hinge zone potentially connecting Selebi North and Main.

4

Fully recapitalized and funded for growth: With a C$80 million financing recently announced and an earlier C$67 million recapitalization led by Frank Giustra’s Fiore Group and EdgePoint Investment Group, NexMetals is fully financed to drive drilling, expansion, and development. The new capital secures full ownership of Selebi and Selkirk, removes the last market overhang, and positions the company to accelerate its MRE updates, and near-term growth plan.

5

Located in one of the safest, mining-friendly jurisdictions on Earth: Botswana’s political stability, mining laws, and critical minerals focus make it the ideal jurisdiction.

6

Early-mover advantage in line with a Nasdaq uplisting: Recent US uplisting — a move that could unlock a much broader investor base in 2025.¹⁴

7

Multiple catalysts in motion: Drill results, potential resource updates, metallurgical optimization and underground development progress all stack up to near-term news flow.

8

Key players are paying attention: NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) not only offers similar jurisdictional advantages, brownfield upside, and expansion potential — but at an early valuation stage.

Selebi: A High-Grade Critical Minerals Discovery Hiding in Plain Sight

In a copper market starved for new supply, the Selebi Complex stands out for one simple reason:

It’s not a dream.

It’s real, high-grade, and already produced millions of tonnes — long before today’s supply crisis ever existed.

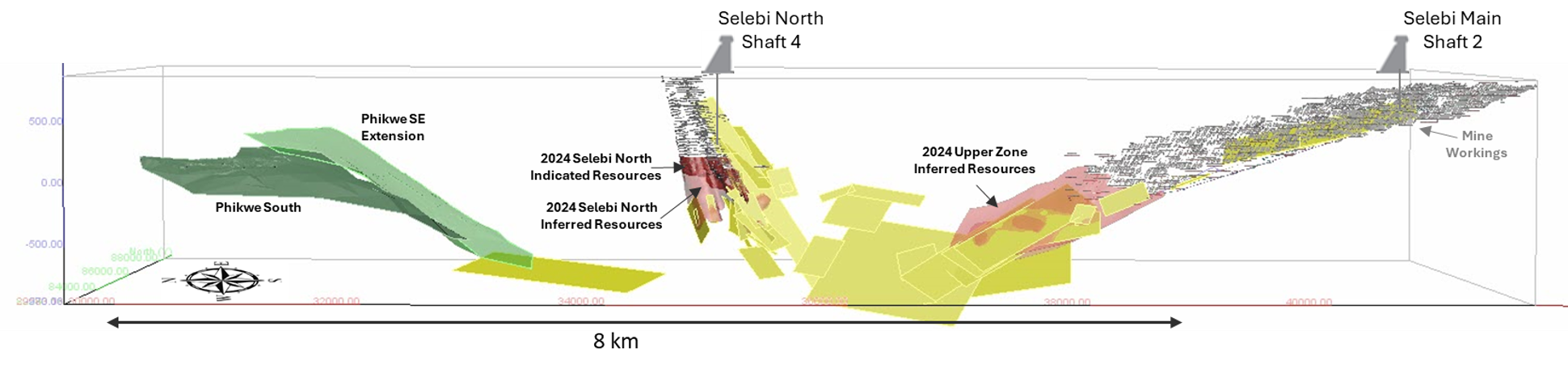

It is large and the resource is growing. Originally discovered in the 1960’s, Selebi North and Selebi Main together produced nearly 40 million tonnes of copper-nickel ore over decades of operation.¹⁵

These weren’t exploration dreams — they were real, revenue-generating mines owned by Botswana’s state-run mining company, BCL Limited.¹⁶

The closure of Selebi wasn’t geological.

It wasn’t because the deposit ran out of ore.¹⁷

In 2016, the former operator’s smelter, once the central processing hub for southern Africa, failed. Without processing capacity, the government mothballed the complex, leaving millions of tonnes of high-grade material still sitting underground.

That’s the opportunity NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) seized.

Today, NexMetals has full control over the Selebi Complex, and they’re wasting no time rewriting the story.

24.7 Million Tonnes Inferred — and Growing Fast

In 2024, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) delivered a new NI 43-101 Mineral Resource Estimate confirming:¹⁸

- Selebi Main:

- 18.89 million tonnes Inferred at 3.51% CuEq (1.69% copper, 0.88% nickel)

- Selebi North:

- 3.00 million tonnes Indicated at 2.92% CuEq (0.90% copper, 0.98% nickel)

- 5.83 million tonnes Inferred at 3.11% CuEq (0.90% copper, 1.07% nickel)

This totals 24.7 Mt (Inferred) and 3 Mt (Indicated) of high-grade critical metals, with room to grow in every direction.

Because NexMetals’ recent drilling campaign — comprising 41,018 metres over 91 holes — was completed after the effective date of the MRE.¹⁹

None of the H2 2024–2025 drilling results are reflected in the current resource yet.

Drilling Results That Outperform the Current Model

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) infill program at Selebi North wasn’t just about confirming the model.

It revealed something even more important:

Significantly higher grades than previously estimated.

- Drill trace SNUG-24-174 reported 27.55 metres grading 4.97% CuEq

- Drill trace SNUG-25-189 reported 19.40 metres grading 3.93% CuEq (including 13.55 metres at 4.02% CuEq)

- Drill trace SNUG-25-186 reported 16.25 metres grading 3.06% CuEq (including 10.45 metres at 4.16% CuEq and 6.45 metres of 5.28% CuEq)

- Drill trace SNUG-25-184 reported 13.50 metres grading 3.68% CuEq

These intercepts — thicker and higher-grade than the average modeled resource — suggest that Selebi’s next MRE could show both increased tonnage and improved average grades.

On June 30, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) announced a significant step-out intercept at Selebi North — intersecting mineralization almost 200 metres down-plunge from the existing envelope.²⁰

Then in October 2025, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) announced results from a drill hole between the two major step-out holes SNUG-25-184 and 186 , down-plunge from the Selebi North resource — intersecting strong mineralized intervals within a broader 32.60 metre mineralized zone and proving that the system is larger and more dynamic than previously understood.²¹

Assays are still pending from additional drill holes at Selebi North — including the newly targeted Hinge Zone, now being aggressively drilled with multiple rigs.

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM)) keeps delivering — and investor interest is accelerating.

Because in a tight copper market, every extra point of grade and every additional tonne becomes exponentially more valuable.

And NexMetals’ geologists aren’t just finding more of the same — they’re discovering completely new target areas.

The Hinge Zone: Linking Two Mines into One System?

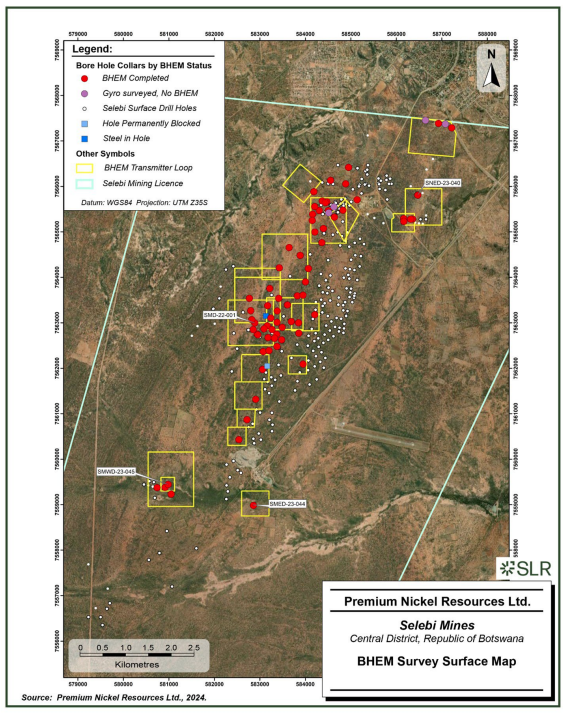

Modern Borehole Electromagnetic (BHEM) surveys — a technology that was underutilized by the previous operator — have now revealed a large conductive plates.

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) between Selebi North and Selebi Main known as the Hinge Zone — a previously untested 2-kilometre gap. Drills are being mobilized.

Holes are being drilled down to target depths.

The goal: prove mineralization between the two deposits showing a much larger continuous system.

If successful, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) could reframe Selebi not just as two isolated deposits— but as part of a district-scale copper-nickel sulphide system at the heart of Botswana’s critical minerals belt.

Underground Access: A Critical Speed Advantage

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) isn’t just drilling from the surface.

They’ve reactivated underground access at Selebi North — advancing an exploration infrastructure that will allow deep underground drilling directly into the heart of the higher-grade zones.

Why does this matter?

- NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) can test deeper targets faster, cheaper, and more accurately than juniors starting from scratch.

- Resource expansions can move faster — a huge advantage with copper markets tightening by the month.

Modern Technology Unlocking Value from Underground Early in the Process

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) isn’t just drilling efficiently, it’s enhancing process efficiency too.

At Selebi North, the company is evaluating X-ray transmission (XRT) pre-concentration technology underground: a potential game-changing move that strips out low-value waste before it ever sees the mill.²²

The payoff? A 15.2% jump in head grade, 98% recovery.

By reducing waste rock underground, NexMetals isn’t just improving potential efficiency, they’re unlocking more copper and nickel value per tonne, potentially setting the stage for a higher-margin operation in one of the world’s most strategic mining regions.

This is the kind of smart engineering that turns redevelopment plays into top-tier producers.

A Perfect Setup at the Right Time

The world is barreling into a critical minerals shortage — copper prices are surging back toward all-time highs — and clean, high-grade projects in safe jurisdictions are becoming prized assets.

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) Selebi Mine combines:

Proven past production (40Mt historically)²³

Confirmed high-grade resources (24.7 Mt (Inferred), 3Mt (Indicated) and expanding)

Significant upside drilling results already in hand

Multiple expansion vectors now being tested (third horizon, hinge zone)

Brownfield infrastructure and access already in place

A fully funded $46M exploration war chest with no debt

In short, it’s a rare case where the opportunity isn’t just theoretical — it’s already real, it’s already underway, and it’s still deeply under the radar.

Early investors aren’t just betting on future exploration.

They’re buying into a high-grade copper-nickel discovery engine — one with proven upside, funded drilling, and massive catalysts ahead.

And the window to get in early is closing fast.

Selkirk: A Second Past Producing Mine Few Are Watching — Yet

While the market is just beginning to wake up to the opportunity at Selebi, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) holds a second project that could quietly become a major catalyst in its own right.

Tucked just 75 kilometers north of the Selebi Complex, the past-producing Selkirk Mine could offer a second wave of critical minerals growth for early shareholders — and almost no one is paying attention yet.

Between 1989 and 2002, the Selkirk Mine produced over 1 Mt of copper-nickel ore.²⁴

And according to historic modeling from prior operators, Selkirk’s resource potential is estimated at well over 100 Mt — a figure that NexMetals is aiming to define with additional drilling, PGM analyses and modern metallurgy.

But unlike many past-producing mines, Selkirk was never fully exhausted. Instead, underground mining operations terminated in 2002 when the high grade sulphides were exhausted, leaving behind a wide halo of lower grade sulphides that has been evaluated for open pit extraction.

At the time, global copper and nickel prices were a fraction of today’s levels, and new technologies like bulk pre-concentration sorting and modern deep imaging were simply unavailable or not used.

Now, with a 2024 Mineral Resource Estimate of 44.2 Mt of 0.81% CuEq and proximal infrastructure, this deposit is a second asset in Botswana. By using today’s modern exploration technologies, Selkirk’s full potential could be realized.²⁶

In November 2024, NexMetals Mining Corp. published a new NI 43-101 resource estimate for Selkirk²⁷ — confirming an inferred resource of 44.2 million tonnes, grading 0.30% copper and 0.24% nickel, with meaningful byproduct credits from 0.55 g/t palladium and 0.12 g/t platinum.²⁸

While Selkirk’s copper and nickel grades are lower than Selebi’s high-grade underground material, the project’s scale, open-pit access, and polymetallic nature create strategic value few juniors can match.

Selkirk’s mineralization sits near the surface, making it amenable to low-cost, potential to open-pit development — an enormous advantage at a time when building new underground mines can take decades and billions in capex.

And as demand for palladium and platinum continues rising across the automotive and clean energy sectors, Selkirk’s platinum group elements (PGEs) could unlock an entirely new layer of optionality for NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM).

Engineering a Smarter Path to Growth

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) isn’t treating Selkirk like a second-tier asset.

Instead, they’re executing a strategic, methodical plan to maximize its value without burning massive capital.

Historic core is being re-logged and re-assayed to better define PGM content across the deposit.

Twinning of key historical drill holes is underway to tighten up the geological model and upgrade the resource confidence.

New metallurgical samples are being collected to optimize flowsheets for copper, nickel, and PGE recoveries.

But perhaps most exciting is the application of XRT pre-concentration sorting²⁹ — a game-changer for lower-grade deposits.

By applying X-ray transmission technology to pre-concentrates at the mine site, NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) could significantly boost head grades while stripping out waste rock early — potentially improving Selkirk’s operating margins and project economics.

Early testwork on similar styles of mineralization globally suggests XRT pre-concentration sorting can increase feed grades by 1.5x to 3x³⁰ — turning projects once viewed as marginal into profitable operations at today’s metal prices.

Strategic Optionality Few Juniors Can Offer

Selkirk gives NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) a flexible, valuable second growth platform.

It could evolve into a standalone open-pit copper-nickel-PGE mine supporting regional growth.

It could supply material for a future concentrate blending strategy, optimizing metallurgy alongside Selebi’s high-grade feed.

Or it could become a strategic asset for offtake agreements, joint ventures, or even larger scale partnerships as the global race for secure critical minerals supply intensifies.

Right now, the market isn’t pricing any of this in.

Selkirk’s value remains hidden — quietly building, quietly advancing — beneath the headlines focused on Selebi.

But for investors willing to look ahead, Selkirk could soon emerge as a powerful second growth engine — and one more reason why NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) may not stay “overlooked” for long.

A Team Built for Execution — Not Just Exploration

The opportunity at NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) isn’t just about rocks in the ground.

It’s about the people behind it.

Because in the mining business, assets don’t move themselves.

They need leadership teams who know how to discover, develop, finance, and maximize value through every stage of the cycle.

And NexMetals has assembled a team built for exactly that.

Strategic Advisors With Serious Institutional Weight

Backing NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) leadership is Fiore Management and Advisory Corp., led by legendary financier Frank Giustra.

Giustra’s track record includes founding and financing some of the biggest names in global mining — including Wheaton Precious Metals, Lionsgate Entertainment, and direct involvement in dozens of billion-dollar mining deals.

Fiore Management’s involvement isn’t passive. They are actively advising NexMetals’ board and executive team on strategic financing, project development, and growth initiatives — helping position the company to maximize value as copper and critical minerals demand surges.

When serious institutional names get behind a junior — especially at an early stage — it’s often a powerful signal. The same groups that built major mining success stories are now betting that NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) could be next.

Strategic Moves Are Happening and Momentum Is Building

Copper is surging. Nickel is tightening. And the clean energy transition is about to collide with a critical minerals shortage the world isn’t ready for.

NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM) is positioned right at the center of it.

- Two past-producing, permitted mines.

- Two mineral resource estimates already defined — and growing.

- High-grade results already outperforming the current model.

- Strong balance sheet following a C$67 million recapitalization and an C$80 million upsized public offering that secures full ownership of Selebi and Selkirk, removes the market overhang, and accelerates drilling, and MRE updates.

- Backed by institutional heavyweights like Frank Giustra’s Fiore Management and EdgePoint.

- And operating in one of the safest, most mining-friendly countries in the world.

- Drilling is underway.

- Expansion targets are being tested.

- A Nasdaq uplisting completed.³¹

Right now, the story remains largely undiscovered.

But that won’t last.

For those paying attention, the opportunity is clear.

Be the first to get updates about NexMetals Mining Corp. (NASDAQ:NEXM) (TSXV:NEXM).

Click here to sign up to our newsletter.

Scientific and Technical Information

Caution Regarding Historic Data

Certain scientific and technical information in this advertisement, including historic data compilation at the Selebi and Selkirk projects, are historic in nature. Reference should be made to the full text of the Selebi Technical Report (as defined herein) and the Selkirk Technical Report (as defined herein) for the assumptions, limitations and data verification relating to the historic data compilation presented in this advertisement, which are available electronically on SEDAR+ (www.sedarplus.ca) under NEXM’s issuer profile. The work undertaken by the Company, SLR Consulting (Canada) Ltd., and G Mining Services Inc., respectively, to verify the historic data compilation are further described in the Selebi Technical Report and the Selkirk Technical Report.

While (i) visual estimates of oxidized sulphides appear to correlate well with logged intercepts and analytical values, and (ii) analytical values compared between the logs and the digital database appear to compare well, the technical team continues to collect, compile, review and validate historic technical data relevant to the project. To that end, the Selebi and Selkirk Technical Report recommends continued compilation and verification to confirm that the QA/QC program results are adequate to support the inclusion of the historical drill hole information in future mineral resource estimate in accordance with NI 43-101.

Selebi Technical Report

The scientific and technical information in this advertisement relating to the Selebi project is supported by the technical report entitled “Technical Report, Selebi Mines, Central District, Republic of Botswana” (the “Technical Report”) and dated September 20, 2024 (with an effective date of June 30, 2024) (the “Selebi Technical Report”), and prepared by SLR Consulting (Canada) Ltd. for NEXM . Reference should be made to the full text of the Selebi Technical Report, which was prepared in accordance with NI43-101 and is available on SEDAR+ (www.sedarplus.ca) under NEXM ‘s issuer profile.

Selkirk Technical Report

The scientific and technical information in this advertisement relating to the Selkirk project is supported by the technical report entitled “NI 43-101 Technical Report Selkirk Nickel Project, North East District, Republic of Botswana”, dated January 10, 2025 (with an effective date of November 1, 2024) (the “Selkirk Technical Report”) prepared by SLR Consulting (Canada) Ltd. for NEXM . Reference should be made to the full text of the Selkirk Technical Report, which was prepared in accordance with NI 43-101, and available on SEDAR+ (www.sedarplus.com) under NEXM ‘s issuer profile.

QA/QC

The recent drilling programs were carried out using company owned drills through an agreement with Forage Fusion Drilling Ltd. of Hawkesbury, Ontario, Canada, who are providing training of local operators. The underground drilling program is being carried out with Zinex U-5 drills. Drill core size is BQTK (40.7 mm diameter). Surface drilling is being carried out using two converted Zinex U5s and a Marcotte HTM2500. Surface drill core size is typically NQ (47.6 mm diameter). Samples are generally 1.0 to 1.5 metre intervals or less at the discretion of the site geologists. Sample preparation and lab analysis was completed at ALS Geochemistry in Johannesburg, South Africa. Commercially prepared Blank samples and certified Cu/Ni sulphide analytical control standards with a range of grades are inserted in every batch of 20 samples or a minimum of one set per sample batch. Analyses for Ni, Cu and Co are completed using a peroxide fusion preparation and ICP-AES finish (ME-ICP81). Analyses for Pt, Pd, and Au are by fire assay (30 grams nominal sample weight) with an ICP-AES finish (PGM-ICP23).

Drilling on the Selkirk Project was completed by Discovery Drilling using a Boyles 56 machine. Drill core is HQ (63.5 mm diameter) size. Samples were sawn to produce quartered core. The quartered core samples submitted to the lab were generally 1 metre in length. Re-sampling of historic drill core (NQ: 47.6 mm diameter) is ongoing. Samples submitted to the lab were half core and generally 1 meter in length. Sample preparation and lab analysis of both new core and resampled core was completed at ALS Chemex in Johannesburg, South Africa. Commercially prepared blank samples and certified Cu/Ni sulphide analytical control standards with a range of grades are inserted in every batch of 20 samples or a minimum of one set per sample batch. Analyses for Ni, Cu and Co are completed using a peroxide fusion preparation and ICP-AES finish (ME-ICP81). Analyses for Pt, Pd, and Au are by fire assay (30 grams nominal sample weight) with an ICP-AES finish (PGM-ICP23).

Metallurgical testwork was carried out at SGS Minerals (Lakefield), XPS and Blue Coast Research, all in Canada. Bulk sample pre-concentrations studies using XRT technology were carried out by all minerals in Germany and IMS Engineering in South Africa.

SGS Minerals Lakefield, XPS, Blue Coast Research and ALS Geochemistry sites are accredited and operate under the requirements of ISO/IEC 17025 for specific tests as listed on their scope of accreditation, including geochemical, mineralogical, and trade mineral tests.

Qualified Persons

All scientific and technical information in this advertisement has been reviewed and approved by Sharon Taylor, VP Exploration of the Company, MSc, P.Geo, whom is a “qualified person” for the purposes of NI 43-101.

Morgan LekstromCEO and Director

Morgan LekstromCEO and Director Sharon TaylorVice President of Exploration

Sharon TaylorVice President of Exploration Sean WhitefordPresident

Sean WhitefordPresident Chris LeavyBoard Member

Chris LeavyBoard Member Paul MartinChairman of the Board

Paul MartinChairman of the Board