Something major is unfolding in the copper market.

After more than a decade of rising demand and fewer discoveries, the world’s supply of new copper is drying up.

Since 1990, only 239 major copper deposits have been found.1 In the last 10 years, just 14 of them.2 Grades have fallen by half since the early 90s, which means miners are digging more rock to get less metal.

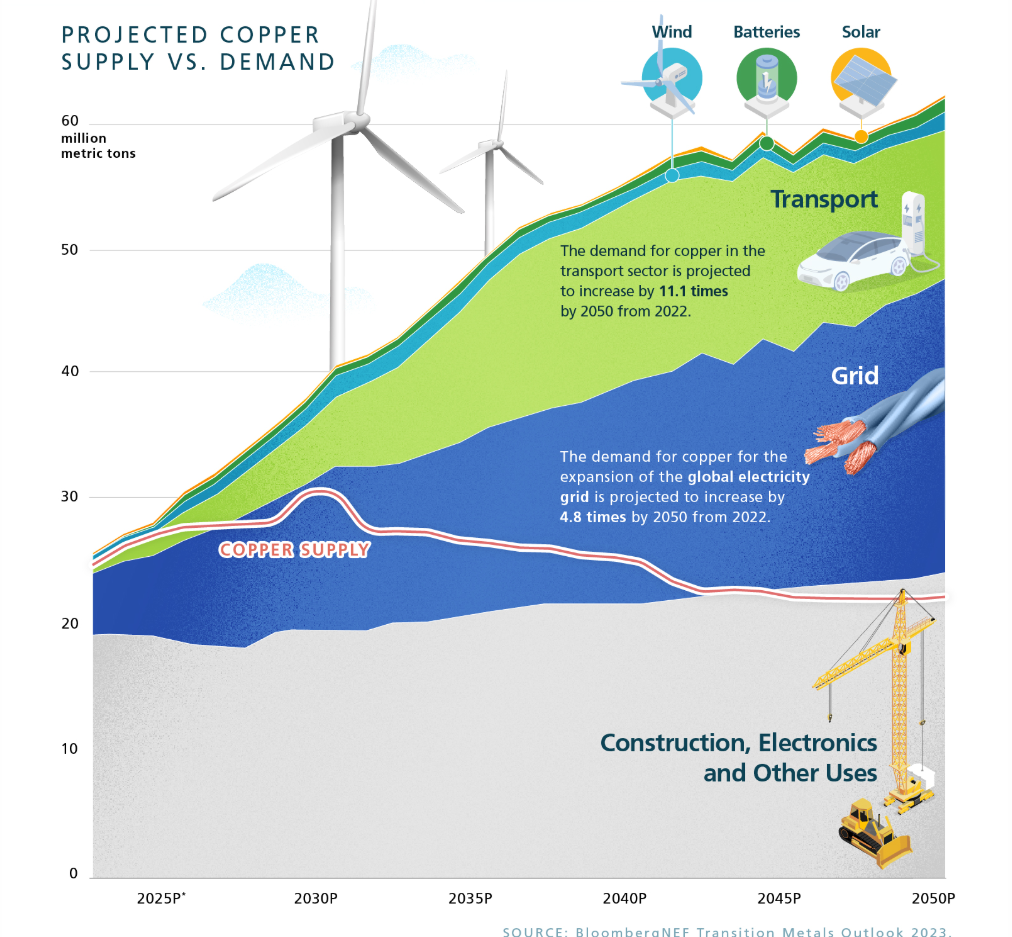

Yet demand keeps rising.

Electric vehicles, power grids, solar farms and data centers are all driving a copper boom that shows no signs of slowing down.3 Every clean energy forecast points to the same problem. The world does not have enough copper to build the future it wants.

That shortage is now meeting a new policy shift in Ottawa. On October 31, 2025, Canada moved from talk to action. Ottawa launched a plan to fast track $4.6 billion of critical mineral projects under a new G7 production alliance, backed by offtake agreements that lock in future purchases and help de-risk financing.4

The goal is to give producers a steady buyer and to cut reliance on China. Copper is one of Canada’s priority minerals, grouped with nickel, cobalt, graphite, lithium, and rare earths. This is not talk. It is a funded plan to move mines from study to build and to keep supply inside the G7.

And in the Yukon, the timing couldn’t be better. The Yukon Party’s majority win this month brings a more pro-development government focused on cutting red tape, improving infrastructure, and supporting responsible exploration across the territory.5

For the first time, the mining sector has the backing of the federal government as a strategic industry. This changes everything for Canadian copper explorers.

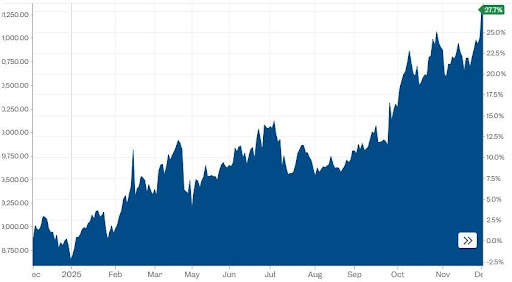

Prices are already telling the story. Copper is now trading above $11,000 per ton,6 reaching new record highs.

JPMorgan expects copper prices to reach $12,500 per tonne by Q2 2026 as deep supply shocks, a looming 330 kmt deficit, and surging demand from China and AI-driven data centers collide to create an increasingly tight, bullish copper market.7

UBS sees copper prices rising as high as $13,000 per tonne by the end of next year, with a market deficit that is expected to widen amid global mine disruptions and strong momentum on the demand side.8

And right as this shift takes hold, one Yukon-based company is preparing to scale up exploration on a copper system that could become the next major discovery in Canada’s North. It comes from the same prospector group behind Snowline Gold (TSXV:SGD), a discovery that grew into a C$2 billion story9 and proved what this group can deliver.

That company is Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF), a Canadian explorer unlocking a portfolio of copper and precious-metal discoveries in the North.

Its flagship Birch Project is hitting consistent copper-gold mineralization in every hole drilled, while the emerging AZ Project offers district-scale copper potential near the Alaska Highway, a direct route south to Skagway, Alaska that provides access to a deep-water port.

In addition to these two projects, Yukon Metals has a pipeline of assets it is advancing to drilling, with 17 assets total, across 43,000 hectares (106,000 acres).

Two copper-gold projects, one mission: turn discovery into scale.

With new permits in progress to extend operations for the next decade, Yukon Metals is entering this tightening copper market at exactly the right time.

Why Copper Is Becoming the World’s Next Bottleneck

The copper market is reaching a breaking point.

Global refined copper demand reached almost 27 million tonnes (Mt) in 2024, according to the International Energy Agency (IEA), and it is projected to climb to 33 Mt by 2035 and nearly 37 Mt by 2050.10

The reason is simple.

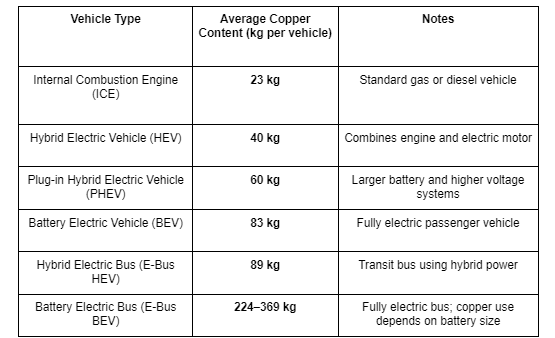

Electric vehicles, renewable grids, and data centers all rely on copper. Every EV requires an insane amount of copper, roughly four times more than a conventional car, and solar and wind installations require two to five times more copper per megawatt than fossil fuel systems.11

But while demand is rising, supply is falling behind.

In the last decade, only 14 major copper deposits have been discovered worldwide, compared with more than 200 discoveries between 1990 and 2010, according to S&P Global. Grades are also sliding.13

The average mined copper grade has dropped from 1.2% in 1990 to around 0.6% today, meaning producers must move twice the material to yield the same tonnage.14

Even long-standing producers are struggling to keep output steady. First Quantum’s Cobre Panamá mine, which supplied about 1.5% of global copper,15 was forced to close in 2023.16 In Peru and Chile, production continues to slide due to social unrest, droughts, and declining ore grades.

Now even North America is feeling the strain. On November 3, Glencore confirmed plans to close the Horne smelter in Quebec, Canada’s largest copper operation, which produces more than 300,000 tonnes per year. The site requires over $200 million in upgrades to meet new environmental standards.17

Each closure tightens the balance further. Wood Mackenzie now projects a 6-million-tonne deficit by 2030, meaning six Escondida-sized mines would need to come online within that period.18

Press Releases

- Drilling Expands Near-Surface Copper-Gold Mineralization at the Birch Project

- Yukon Metals Launches Digital Marketing Campaign

- First Drill Hole Confirms High-Grade Copper Skarn Mineralization at the Birch Project

- Yukon Metals Confirms Large Copper-Bearing System at the AZ Project

- Multiple Mineralized Skarn Horizons Intersected At The Birch Copper-Gold Project

That is where Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) fits in, a well-financed exploration company advancing a project in Canada’s North that aligns perfectly with the shift toward secure, domestic supply.

Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) is entering this environment at a pivotal time. As aging mines shut down and new projects stall under environmental or political pressure, investors are looking north toward new jurisdictions where copper discoveries can move quickly from drill bit to development.

Top 8 Reasons

Why Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) Should Be At The Top of Your Watchlist

1

The Birch Project is a Key Driver: Early drilling hit copper-gold mineralization in every hole across roughly 750 meters of strike, including zones over 3% CuEq and continuous mineralized intervals up to 46 meters in core visuals.19 Surface samples south of the drill area returned high gold and silver values. With assays pending, the goal is clear: prove continuity, step out, and build a much larger discovery.

2

Permit Scale-up Unlocks Bigger Programs: Yukon Metals is moving from Class 1 to Class 3 at Birch, opening up a 10-year window for exploration.20 The upgrade allows larger camps, drilling campaigns in the 10’s of thousands of meters, new roads up to 15 km, and 5,000 m³ of trenching per year. It’s the framework for bigger grids, longer seasons, and faster de-risking.21

3

AZ Shows District-Scale Copper Potential: Early exploration at Yukon Metals’ 13,100-hectare AZ Project returned visible copper mineralization, with surface samples grading up to 26.0% copper and 5.73 g/t gold across several target areas. The 2 km² alteration zone supports a porphyry-style target.22

4

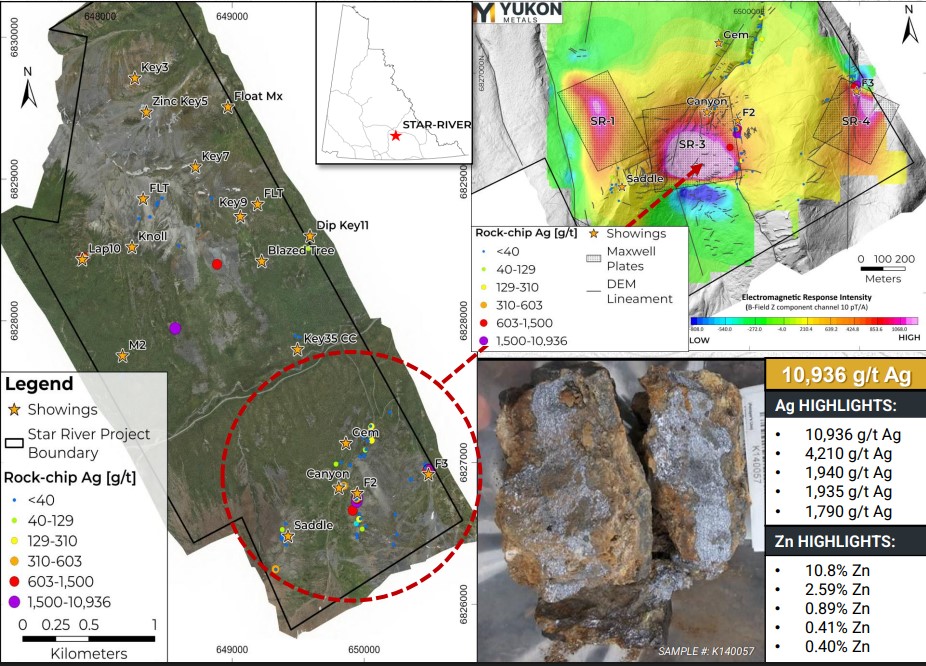

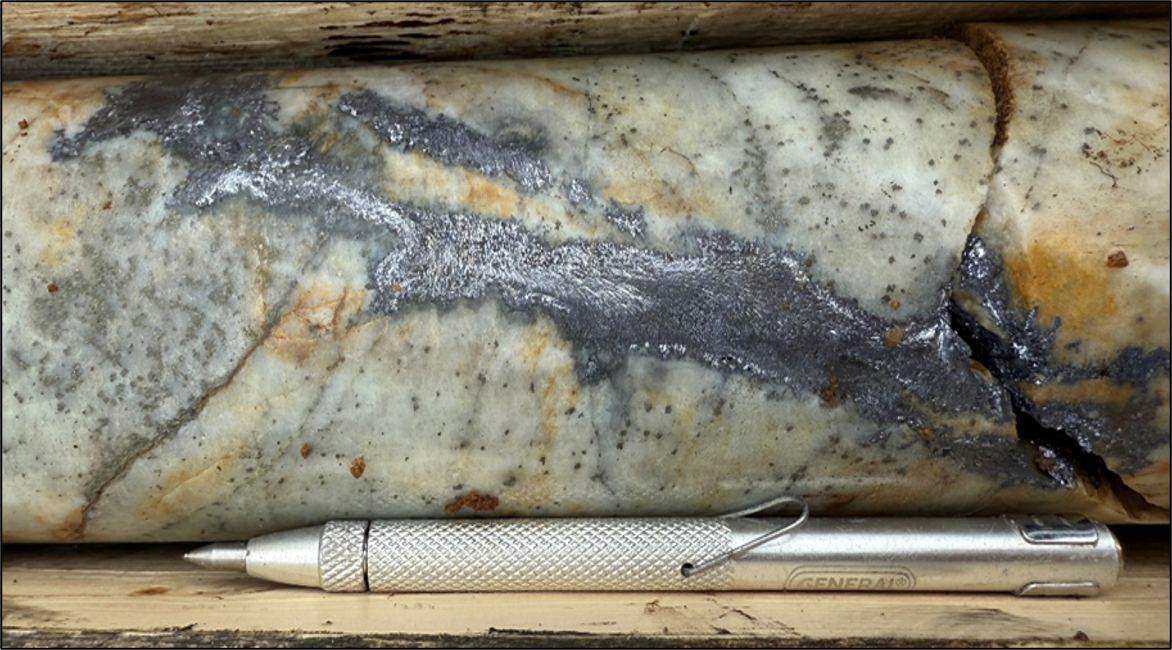

Star River Project Brings Grade at Surface: Yukon Metals has sampled bonanza-grade gold and silver from multiple areas at Star River. Highlights include up to 101 g/t gold and a spectacular 10,936 g/t silver at surface. These results confirm exceptional grades across several showings over hundreds of meters. Overlapping gravity and TDEM anomalies define an 800-meter shallow drill target corridor, with road access nearby to help increase the efficiency of future drill programs.23

5

Cash and Runway to Execute: Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) reported about $6.4 million (C$9.1M) in cash with no debt and an indicated market cap near $32 million (C$45M). That supports the permit push, follow up drilling at Birch, and steady model building at AZ without a forced raise.

6

People and Partners That Fit the Yukon: Leadership includes Rory Quinn, Patrick Burke, Darryl Clark, PhD, Helena Kuikka, Jim Coates and Susan Craig. The discovery lineage ties back to the Berdahl family, the prospectors behind Snowline Gold. Field execution utilizes local First Nation and Yukon partners, including Vision Quest Drilling, Käganì, Archer Cathro, and Capital Helicopters.

7

Macro Tailwinds Just Got Stronger: Canada just fast-tracked $4.6B in critical mineral projects under the Defence Production Act, backed by G7 partnerships and offtakes. Fireweed Metals secured $35M in funding from the US Department of Defense to advance its MacTung project in Yukon, showing how cross-border investment is accelerating.24 Copper trades above $11,000 per tonne, with JPMorgan eyeing $12,500/t by Q2 2026. Supply remains tight as Cobre Panamá removed 1.5% of global mine output in 2023, Glencore plans to close Quebec’s 300,000-tonne-per-year Horne smelter, and Wood Mackenzie forecasts a 6 million-tonne deficit by 2030.

8

Clear 2025 and 2026 Catalysts: Birch assays.25 Class 3 permit process.26 Birch step-outs to test strike and depth. AZ geophysics and mapping to refine the model and vector into the expected porphyry source. Star River first-pass drilling across the gravity high.27 Each step helps to build scale.

The copper market is tightening faster than anyone expected, and governments are now competing to secure supply. Few companies are in a position to benefit from that shift. Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) is one of them.

With consistent results at Birch, new drilling about to begin at Star River, and a permit that could expand operations for the next decade, the company is advancing at the right time, in the right place, with the right team to meet this growing global demand.

Inside the Birch Project: A New Copper System Emerging in Canada’s North

A Discovery Taking Shape Beneath the Yukon Sky

In the quiet hills northeast of Burwash Landing, a new discovery is starting to take shape. The Birch Project, owned 100% by Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF), is rewriting what investors thought they knew about copper potential in Canada’s North.

to take shape. The Birch Project, owned 100% by Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF), is rewriting what investors thought they knew about copper potential in Canada’s North.

This isn’t a blind target or a recycled property. Birch sits within the Finlayson assemblage of the Yukon-Tanana Terrane, a rock package already known for producing district-scale discoveries.

Beneath frost-heaved boulders and thin overburden lies a system that geologists describe as alive: a skarn system that could be the outer halo of a buried intact gold-rich copper porphyry.

It’s early, but the signs are strong.

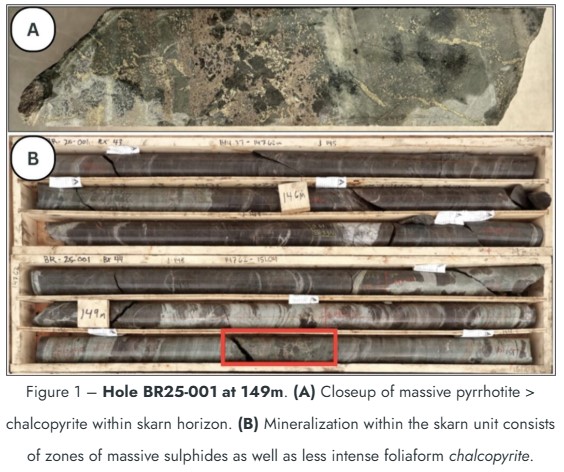

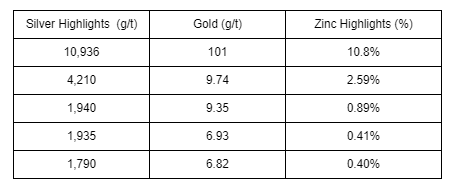

The first drill program at Birch delivered exactly what the technical team hoped for: continuous, copper-bearing skarn horizons stacked across multiple intervals, intersected by the first-ever drill holes into the target zone.

What the First Hole Proved

Drilling began this summer with six holes totaling 1,685 meters of HQ core from four pads. The first hole, BR25-001, was a proof-of-concept test, and it hit on the very first try.

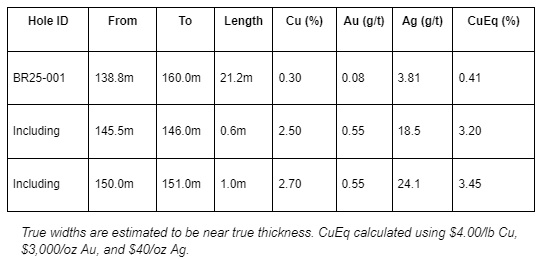

Highlights from the Oct 15, 2025 results include:28

For context, 0.40% CuEq is the same average reserve grade at Western Copper and Gold’s Casino Project,29 a multi-billion-pound deposit with a market capitalization rising towards $500 million.

The hole cut stacked copper-bearing skarn horizons adjacent to intrusive contacts.

High-grade zones with chalcopyrite and pyrrhotite occurred within bands of magnetite-garnet skarn, indicating strong heat and metal flow, key signs of a nearby porphyry source.

Even more compelling, Hole 3, drilled 250 meters east, intersected 46 meters of continuous skarn-altered rock beginning near 25 meters depth, confirming that Birch’s mineralization extends across a 750-meter east-west corridor within a 1.4-kilometer-long surface copper-gold soil anomaly trend.30

That’s the kind of continuity that defines scalable systems and it’s why Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) is now expanding its model from surface skarn to porphyry source.

Geology That Points Toward a Larger System

Birch sits on the kind of rocks that build mines. Copper and gold are hosted in ancient marbles and schists cut by younger intrusions: the same recipe behind some of the world’s biggest skarn deposits.31

Early drilling has already revealed what geologists look for in a system with size:

- Multiple layers of copper mineralization, reaching 3.5% CuEq, stacked across the target zone.

- Intense garnet and magnetite alteration — a classic signature of copper-rich skarns.

- A porphyry intrusion showing strong silica alteration and elevated copper at depth.

- A 2-kilometer southern extension enriched in molybdenum, silver, and gold.

Each indicator strengthens the argument that the current skarn zone is only the edge of something larger.

Southern Target Expands the Story

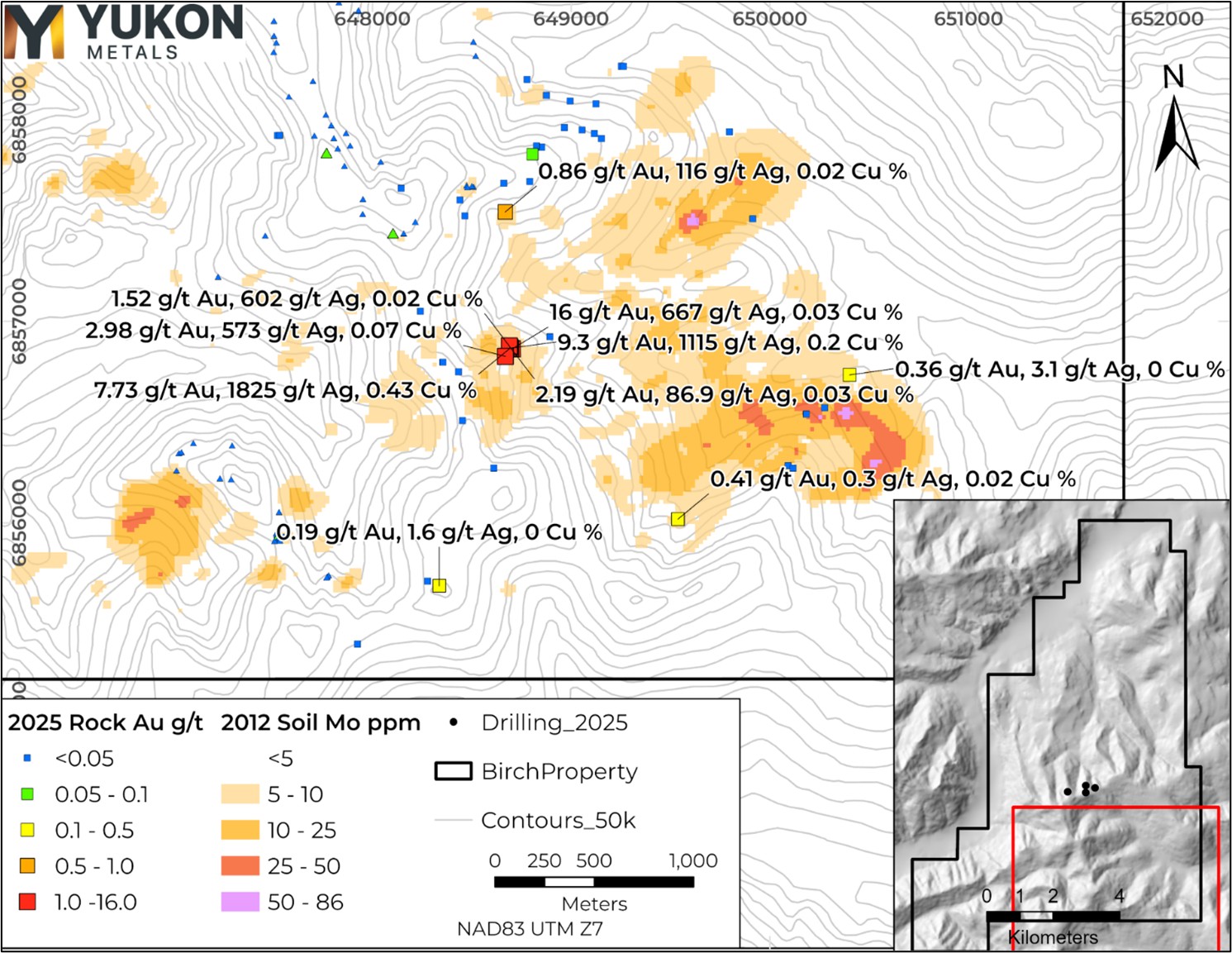

The second vector of value is emerging two kilometers south of the main drill zone, where surface sampling returned exceptional grades:

- 16.0 g/t gold, 1,825 g/t silver, and 0.43% copper from quartz-epidote vein float.

- 9.3 g/t gold, 1,115 g/t silver, and 0.20% copper from subcrop vein material.

- 2,320 ppm molybdenum and 0.10% copper from limestone skarn subcrop.

These results come from an area coincident with a large molybdenum-in-soil anomaly identified in 2012 and reinforced by 2024 soil sampling. High molybdenum values, along with lead-silver-sulfosalt associations, are typical pathfinders near porphyry centers, suggesting the skarn zones drilled to the north may connect to a deeper, mineralized intrusion below this southern zone.

This broader footprint gives Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) two powerful exploration levers: shallow, high-grade skarn zones that can deliver near-term results, and deeper porphyry targets that could define long-term scale.

How the Work Is Being Done: Local Partnerships and Real Execution

Birch is being built the Yukon way through partnerships that bring experience, efficiency, and community alignment.

The company’s 2025 fieldwork was completed by Minconsult, Vision Quest Drilling, Capital Helicopters, and Käganì, a Kluane First Nation-owned enterprise, with operational oversight by Archer Cathro Geological Consulting.

This collaboration ensures that Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) operates with both technical rigor and local engagement — a combination that matters to long-term investors and Yukon regulators alike.

QA/QC and Technical Oversight

Core from Birch was carefully logged, photographed, and cut in half, one side sent for testing and the other kept for reference. About 10% of all samples were quality checks, including blanks, standards, and duplicates, to ensure accuracy.32

Samples were processed by ALS Labs, with available preparation in Whitehorse and analysis in North Vancouver using industry-standard methods for both copper and gold. Any sample showing extremely high copper was re-tested using a specialized ore-grade analysis to confirm the result.

All results were reviewed in real time to meet strict precision and accuracy standards before being included in Yukon Metals’ data.

Looking Ahead: Building the Yukon’s Next Copper Discovery

The 2025 drill season is only the beginning. Birch is currently permitted under Class 1,33 but a Class 3 exploration permit is now in progress. Once approved, it will allow a 50-person camp and a ten-year exploration runway, with capacity for up to 10,000 to 20,000+ meters of drilling annually.

This will shift the project from small-scale testing to the potential for continuous discovery.

Upcoming catalysts include:

- Pending assays from 2025 drill holes.

- Completion of the Class 3 permit.

- Expansion drilling along the 1.4 km trend and into the southern molybdenum-gold anomaly, likely the porphyry source of emplaced mineralization in the area

If copper prices continue to strengthen, and the system at Birch continues to expand, the potential upside for Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) could move this from an early-stage story to a defining Yukon discovery.

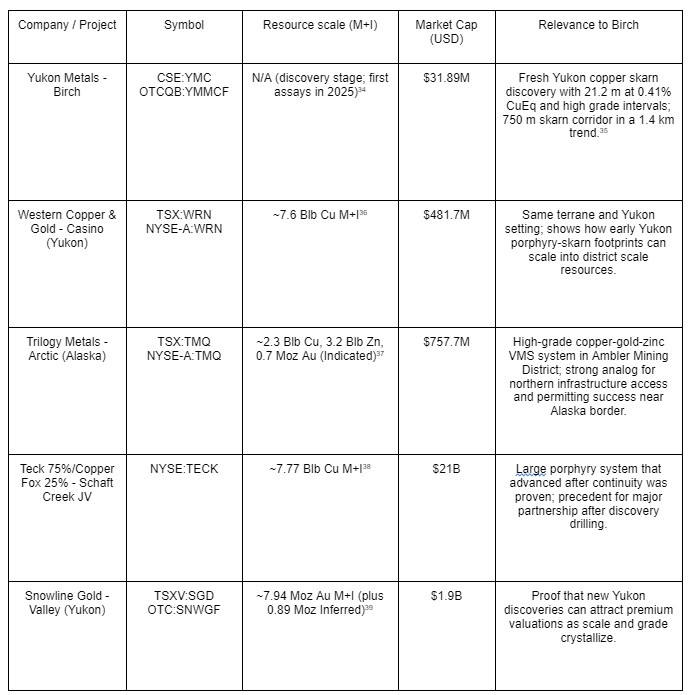

How Big Could Birch Become? Quick Benchmarks

Connecting the Dots

Each of these company assets began where Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) stands today, with early mineralization, credible geology, and a system open in all directions.

Casino’s story is particularly telling. Western Copper and Gold’s early 2010s drilling returned intervals similar in grade and continuity to Birch’s current hits. As resource definition expanded to more than 7.6 billion pounds of copper,40 its market cap grew from under $40 million to more than $480 million.

The same geological terrane, the same style of mineralization, and now, the same jurisdictional support from Ottawa through the C$6.4 billion Critical Minerals Production Alliance announced in October 2025.41

Schaft Creek followed a similar trajectory. Once early continuity was proven, the project attracted Teck Resources, validating the concept that majors are again turning north for copper exposure.

The takeaway for investors is simple:

- Jurisdiction matters. Canada is now guaranteeing price floors and strategic offtakes for key metals, including copper.42

- Discovery scale drives valuation. Projects that prove large mineralized envelopes move from $20–30 million valuations to hundreds of millions.

- Timing is critical. The world is facing an estimated 5-6 Mt copper shortfall by 2030, according to Wood Mackenzie, and few new mines are being built.43

In this context, Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) offers what investors look for in the early innings of a copper bull cycle: a new discovery, district-scale geology, and a clean path to expand with a Class 3 permit on the horizon.

If Birch continues to deliver thick, mineralized intervals across the 1.4-kilometre trend, the company could follow the same trajectory that lifted its Yukon peers from early-stage explorers to owning internationally recognized district-scale discoveries.

AZ: District-Scale Copper Discovery Potential

A Broad Gossan That Could Signal Something Bigger

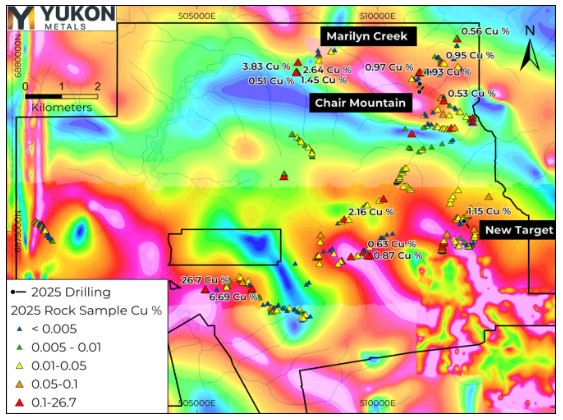

The AZ Project, located in southwestern Yukon, could be Yukon Metals’ (CSE:YMC) (OTCQB:YMMCF) second discovery front. Here, a 1.2-kilometer-long gossan, a rust-colored surface expression of oxidized sulfides, lines up with soil and rock samples showing copper grades above 1%.44

Elsewhere on the property, separate sampling returned values up to 26.0% copper, discovered by Ron Berdahl, and 5.73 g/t gold, underscoring the scale and intensity of mineralization across multiple zones. Together, the results point to a porphyry system capable of emplacing copper over a wide area, a key sign of district-scale potential.

In 2025, Yukon Metals completed an inaugural 1,500-meter, five-hole drill program across two targets (Chair Mountain and the Southeast Prospect), confirming a large copper-bearing system.45

Best intercept: 14.4 m at 0.44% Cu in AZ25-001, with higher-grade sub-intervals up to 2.10% Cu over 0.9 m; AZ25-004 cut increasing potassic alteration at depth, interpreted as a vector toward a porphyry center.

The target lies roughly 6 km south of the Alaska Highway. Early geochemical and mapping data suggest the mineralization is associated with iron-rich skarn and fault-controlled structures.

What makes AZ exciting for the technical team at Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) is surface grade, scale and setting. The property sits within the same geological domain that hosts multiple large copper-gold systems across the Yukon-Alaska border. Work focused on vectoring toward the mineral source has been underway through detailed soil sampling, and will continue in earnest through an expanded follow up drill program.

Next Steps and Strategic Value

Follow-up work is underway to refine the geological model: a contour soil program (ICP-MS), ground IP, high-resolution airborne magnetics, and hyperspectral/petrographic studies and prioritization of vectoring in toward a porphyry center.46

In a market where copper discoveries are rare and governments are actively supporting domestic supply chains, AZ provides real portfolio optionality alongside Birch: near-highway logistics, district-scale alteration, and first-pass drilling that already confirmed continuous copper mineralization from surface.

For investors looking at the long game, this is what makes Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) different. It’s not one project. It’s a portfolio of 17 high-quality assets hand-picked by the legendary Berdahl prospecting family, in a jurisdiction now backed by policy, funding, and a global shortage of new copper supply.

Star River: High-Grade Gold and Silver Potential at Surface

Where Copper Meets Precious Metals

While Birch is defining a new copper corridor, Yukon Metals’ (CSE:YMC) (OTCQB:YMMCF) Star River Project adds high-grade precious metals to the story.

Located about 50 km from the town of Ross River and 4-hours drive from Whitehorse airport, this project is showing surface results that would stand out in any market.47

Star River was identified during regional sampling programs that traced a series of coincident gravity and electromagnetic anomalies. Follow-up fieldwork confirmed what the data hinted at, significant silver and gold at surface.

The mineralization is exposed in shallow veins and shear zones within schists and carbonates, which makes it fast and relatively inexpensive to test with the drill bit.

According to preliminary mapping, the most prospective area stretches across an 800-meter-long corridor where multiple samples returned visible sulfide mineralization.

The results suggest that Star River could represent the top of a larger hydrothermal system, capable of supporting both silver-gold and copper-bearing zones.

The Numbers That Caught the Market’s Attention

Select grab samples have returned exceptionally high silver values, reaching 10,936 grams per tonne (g/t), alongside gold grades up to 101 g/t.48 These are not isolated outliers. Dozens of samples from the same trend confirm consistent precious-metal enrichment.49

These grades place Star River among the highest-silver showings reported in the Yukon in the past decade. Just as importantly, the system shows a close association between silver, lead, zinc, and copper, a combination often linked to intrusion-related or carbonate-replacement systems.

Next Steps and What Makes Star River Different

In August 2025, Yukon Metals’ (CSE:YMC) (OTCQB:YMMCF) commenced its inaugural 1,500-metre diamond drill program at Star River, targeting the high-priority F2 zone where the strongest silver-gold results align with an 800-metre gravity-TDEM corridor.

Early holes have intersected vein swarms containing pyrite, arsenopyrite, quartz, ankerite, and galena, consistent with a structurally controlled system.

The ongoing drill campaign is supported by gravity infill and high-resolution UAV magnetic surveys, along with continued mapping and rock-chip sampling to refine additional targets across the 720-hectare property.

Key features that make Star River particularly compelling include:

- Easy access: A seasonal road and short helicopter hop from staging points reduce costs.

- Fast drill timelines: Near-surface mineralization means results can be generated a lot quicker.

- Polymetallic potential: Strong silver, gold, and copper values suggest a large, mixed-metal system.

- Scalable upside: The system remains open along strike and at depth, with multiple untested anomalies.

The combination of road access, near-surface targets, and eye-catching grades gives Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) a third leg of exploration torque. While Birch and AZ build copper scale, Star River brings near-term excitement to the portfolio, a balance few juniors manage to achieve.

The Structure Behind the Story: Ownership, Alignment, and Leadership That Matter

A Tight, Well-Structured Stock Built for Leverage

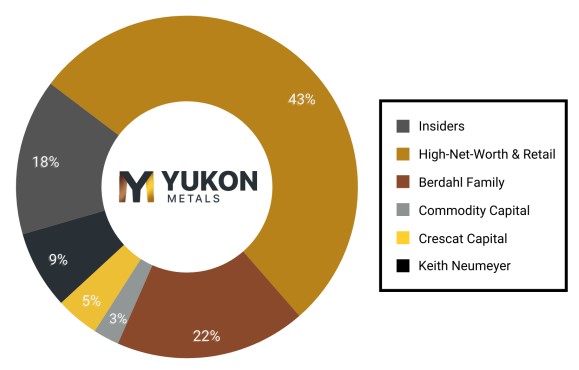

Behind every successful discovery story is a well-structured share base and Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) maintains one of the cleanest capital structures among Canadian copper explorers.

The company has approximately 114.3 million basic shares outstanding,51 a figure that remains tight relative to its peer group. With no debt and roughly $5.79 million in cash.

Ownership is tightly held. Insiders and strategic investors collectively hold 57% of the company’s shares, including the Berdahl Family (22%), Commodity Capital (3%), Crescat Capital (5%), and Keith Neumeyer (9%),52 ensuring that key decision-makers are directly invested in the company’s success.

The remaining 43% sits with high-net-worth and retail investors who have long-term exposure to Yukon exploration. This creates a shareholder base that understands the discovery cycle and tends to hold through drilling milestones.

Yukon Metals has also attracted attention from respected resource funds and family offices with a track record of financing successful northern Canadian discoveries such as Snowline Gold and Western Copper and Gold.

That kind of smart money participation signals confidence in both management and the technical path being taken.

The company’s capital structure gives it the leverage investors look for. A tight float with strong insider ownership and institutional exposure that can amplify returns if Birch, AZ or Star River deliver the kind of grade and scale that the surface geology suggests.

Leadership With Proven Discovery DNA

Exploration stories are built on people, not just rocks. The leadership team at Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) brings a blend of technical expertise, financing capability, and Yukon experience that few early-stage explorers can match.

Berdahl Family Legacy – Founders and Prospectors

The company’s roots trace back more than 30 years through the Berdahl family, the same prospectors behind Snowline Gold’s Rogue Project – Valley Discovery. That lineage gives the company field credibility and deep regional knowledge that few competitors can claim.

Operational Backbone: Real Yukon Partnerships

The company’s operational success depends on the right partnerships. For 2025, Vision Quest Drilling, Käganì, and Capital Helicopters provided logistics and drilling services, while Archer Cathro Geological Consulting led the geological modeling and interpretation.

These groups are not just contractors, they are long-term Yukon collaborators. Their participation ensures that exploration programs are efficient, locally integrated, and compliant with Yukon environmental and community standards.

By working closely with First Nation partners and experienced operators, Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) has built a foundation of trust and sustainability that complements its technical work.

The Bottom Line for Investors

As copper tightens globally and investors search for new North American supply stories, Yukon Metals Corp. (CSE:YMC) (OTCQB:YMMCF) stands out as one of the few companies capable of delivering both near-term results and long-term growth potential.

Here is what matters. A tight share structure. Patient capital. Insider alignment. Institutional support. Proven leadership. And deep roots in one of the most prospective mining regions in the world.

This is a discovery story built to last, not a trade that fades when the weather turns.

Copper supply keeps tightening while policy and buyers shift to North America. That is the setup smart capital wants. A credible team, a growing system, and a structure that can deliver leverage when results land.

When you combine that structure with three advancing projects — Birch, AZ, and Star River — you get a junior that’s built for longevity and discovery-driven leverage.

If you have been waiting for a clean way to get copper exposure in a trusted jurisdiction, this could be the moment to lean in.

Take the next step now.

Download the corporate presentation and review the drill data, maps, and plan for the coming seasons. Then enter your email to subscribe to the Trading Whisperer newsletter so you get the next updates as they break.

Rory QuinnPresident and CEO

Rory QuinnPresident and CEO Dr. Darryl Clark PhDDirector

Dr. Darryl Clark PhDDirector Helena Kuikka, P.Geo.VP Exploration and Qualified Person

Helena Kuikka, P.Geo.VP Exploration and Qualified Person Patrick BurkeChairman

Patrick BurkeChairman Susan CraigDirector

Susan CraigDirector Jim CoatesExecutive VP & Director

Jim CoatesExecutive VP & Director