The lithium race is accelerating again… but this time it’s fueled by billion-dollar deals and breakthrough extraction tech that could reshape the EV supply chain.

Yet few truly understand how to spot the most exciting (and tangible) opportunities in the lithium market.

You see, the lithium space is very different from the gold or copper markets, where lithium grade quality is king.

While most investors are focusing on how high the grades are at lithium projects, they’re missing out on the bigger picture.

We’re talking about Lithium Extraction.

No lithium extraction = No batteries = No EVs.

It doesn’t matter how high the grades are at a lithium mining project – if it can’t be economically extracted, it’s basically useless.

New mines can face a ton of hurdles but the biggest challenge for lithium deposits is extraction.

Take the Salton Sea discovery in Lithium Valley. It’s so significant it could meet all of America’s lithium needs and 40% of the world’s demand.1

But environmental concerns, including water usage and effects on the Colorado River, pose challenges.2

Traditional methods like open-pit mining or evaporation ponds strain agriculture and drive up costs, while high-grade deposits like spodumene and lithium-rich brines require complex, resource-heavy processes such as high-temperature calcination and lengthy evaporation.

This is where Direct Lithium Extraction technology (DLE) comes into play. It’s a revolutionary method that outperforms the traditional salt brine process, both in efficiency and time.

DLE offers a much more eco-friendly approach to lithium mining, eliminating the need for resource-intensive practices that produce chemical waste and worsen climate change.

There’s a reason Goldman Sachs is calling DLE a “game-changing technology” that could accelerate lithium extraction and increase recovery rates.3

The recent surge in M&A activity, such as Rio Tinto’s $6.7 billion blockbuster acquisition of a leading lithium developer, highlights how the big players are positioning themselves to secure future supply.4

And with global lithium demand expected to increase nearly 500% by 20505 DLE is the key to meeting this massive uptick.

Up North in Canada, E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) is spearheading this revolutionary advancement in lithium extraction and is aiming to become one of Canada’s first producers utilizing groundbreaking DLE technology to extract lithium from brine.

Source: E3 Lithium/Depositphotos

Source: E3 Lithium/Depositphotos

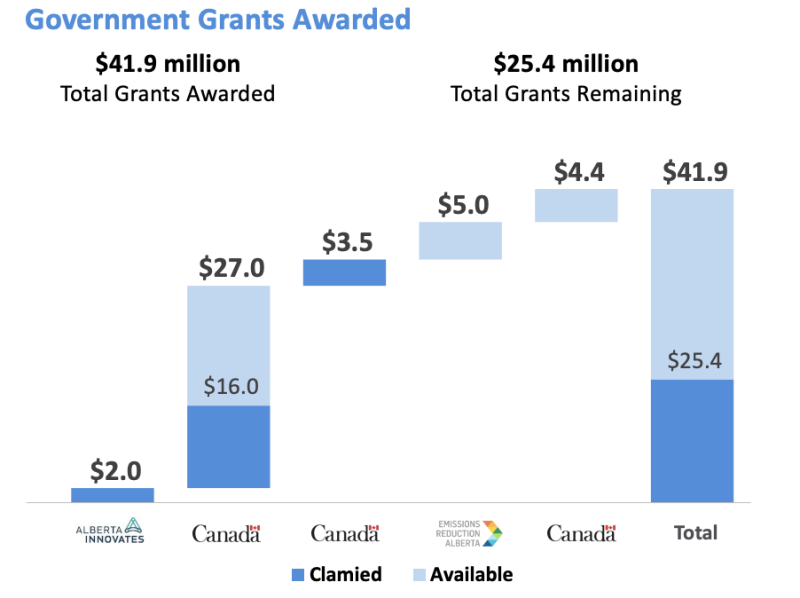

The company’s demonstration plant’s results are turning heads. With more than C$42 million in government support, including a C$5.0 million grant from Emissions Reduction Alberta (ERA)6 and over C$30 million in federal government funding E3 Lithium is making major waves in the lithium space in 2024.7

The Canadian government isn’t the only supporter of E3 Lithium (TSXV:ETL) (OTCQX:EEMMF). The company also has support from heavy hitters like Imperial Oil and Pure Lithium (more on that later).

Unlocking Domestic Lithium Supply with Groundbreaking Technology

Right now, most of the global lithium supply comes from outside of North America.

North America may be rich in lithium deposits, but it’s doing poorly in production. And even if hard rock lithium mining started, there are no places to process the lithium for batteries.

The US produces less than 2% of the world’s annual supply.8

The only producing mine in the country, Nevada’s Silver Peak is only producing a modest 5,000 tons a year.9 A drop in the global demand ocean.

Fortunately, Lithium Valley has become an attractive location for major energy companies exploring advanced mining techniques to solve these problems, especially a process known as Direct Lithium Extraction (DLE).

Recognizing lithium’s pivotal role in the booming EV market, the Trump Administration has committed a Billion dollars from the Department of Energy to expand domestic lithium mining for US Battery Supply Chains.10

This investment aligns with lagging supply not able to meet the demand for batteries and positions the US as a significant player in lithium production.

The world is talking about the importance of local sources of critical minerals to fuel energy security initiatives. Governments are stepping in, take MP Metals, the US government is backing this project in a big way11

Even the Canadian government, leading the G7, is focusing on local sources of minerals through the Critical Minerals Action Plan.12

What does this all mean, we are bring production back home and the government is looking like it is prepared to back projects like E3’s.

All of this is making Canadian-based lithium companies like E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) look more valuable.

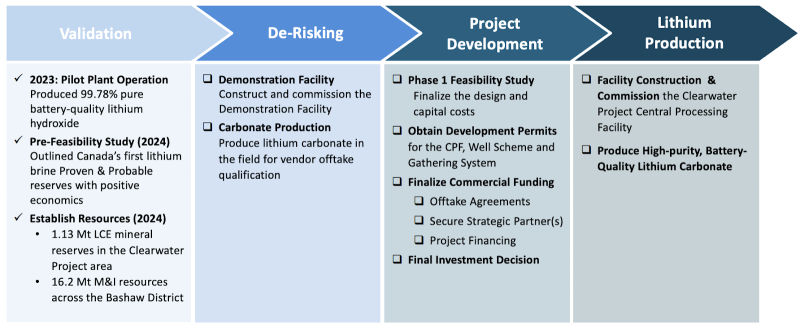

E3 Lithium is continuing to gain momentum, knocking down milestone after milestone in 2025 on its accelerated path to commercialization, and the rest of this year and 2026 is shaping up to be another big year.

E3 Lithium’s Demonstration Facility is a major milestone, setting the Company apart from its peers. When fully operational into Phase 3, it will be Canada’s largest, and one of the World’s largest, DLE demonstrations operating.

E3 Lithium’s Demonstration Facility is a major milestone, setting the Company apart from its peers. When fully operational into Phase 3, it will be Canada’s largest, and one of the World’s largest, DLE demonstrations operating.

With the Phase 1 Demonstration Facility up and running, the Company has shown it can make battery grade lithium carbonate without needing to send it to China for processing, which is where the rest of Canada’s lithium needs to go to be ready for batteries.

The Company also recently announced it had all the permits needed for Phase 2 to get started.13

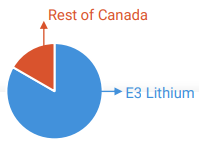

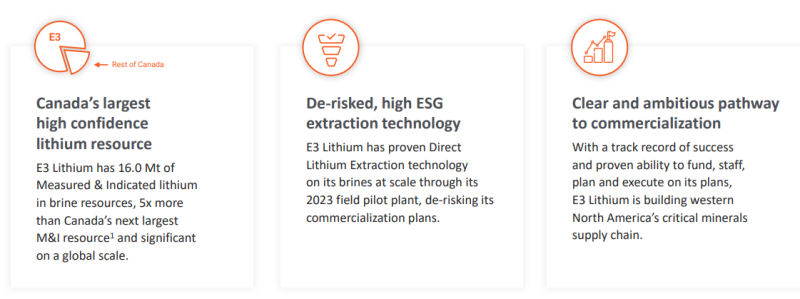

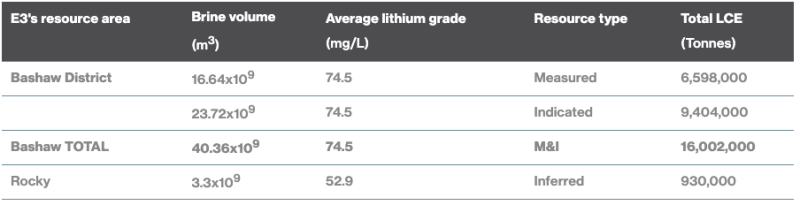

The company has almost half of Canada’s Measured and Indicated (M&I) lithium within its Alberta-based lithium resource with an impressive 16 million tonnes (Mt) of Measured and Indicated (M&I) LCE.14

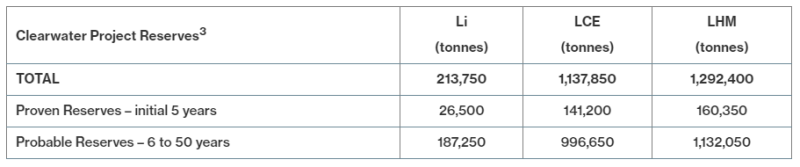

Last year, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) completed a major milestone by completing a Pre-Feasibility Study (PFS), which outlines the detailed process to produce battery grade lithium hydroxide and confirms the first lithium brine proven mineral reserves in Canada.15

Highlights on the Pre-Feasibility Study (PFS):

- Initial production: 32,250 tonnes per annum Lithium Hydroxide Monohydrate (LHM)

- 50-year operating life: covers only a portion of the total Bashaw District

- Reserves: 1.29 Mt of LHM Proven & Probable lithium mineral reserve (1.14 Mt LCE from the total Bashaw District of 18.4 Mt of LHM Measured and Indicated mineral resource (16.2 Mt LCE) located in the Leduc Reservoir

- Strong Project Economics: After-tax NPV $3.72 Billion with a 24.6% IRR at an 8% discount rate (pre-tax NPV8 of $5.18 Billion with a 29.2% IRR) using Benchmark Mineral Intelligence’s (BMI) LHM price forecast

- Initial Capital Expenditure (CAPEX): $2.47 Billion includes water recycling and contingency

- Initial Operating Costs (OPEX): $6,200 per tonne LHM provide for a long life and robust project fundamentals

- Sustainably produced lithium: Process water for the operation will be sourced from recycling and make-up water from waste brine stream, smaller surface footprint relative to conventional lithium production with potential plant emissions of 1.9 tonnes CO2e/tonne LHM.

As you can see, the PFS positions E3 Lithium’s Clearwater Project as a sustainable source of lithium in the stable and reliable jurisdiction of Alberta.

E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) also built and operated its DLE field pilot plant in 2023, exceeding all KPIs for lithium concentration, contaminant rejection and flow rates.

Over the years, the company has continually produced battery-quality lithium products, from lithium hydroxide monohydrate (LHM) with a purity level of 99.78%16 to Li₂CO₃ with a purity of 97.71%.17 AND they just announced they can do it from the Demonstration Facility, showcasing 97.70% purity, a major achievement at a much larger scale.

In short, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) has been on a serious roll and is showing no signs of slowing.

The company plans to advance the Clearwater Project towards commercial operations which includes huge milestones like progressing engineering studies, advancing commercial permitting, and releasing the NI 43-101 report.

Before we dive deeper into everything E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) has to offer, let’s talk a little bit about lithium grades…

Why Grade Isn’t Everything

As we mentioned earlier, lithium grades don’t necessarily dictate how successful a project will be.

Unlike gold or copper, where higher grades usually translate to higher profits, lithium projects depend on a variety of factors beyond just grade.

High-grade lithium does not automatically mean a feasible project due to several reasons:

- Complex Processing Requirements: lithium deposits often require costly processing techniques, increasing operational costs.

- Geological and Technical Challenges: Extracting lithium can be technically challenging due to complex geology, leading to delays and higher costs.

- Capital Intensity: Lithium projects require substantial upfront investment. Unexpected expenses can make high-grade projects financially unviable.

- Market Volatility: Lithium prices are highly volatile. Projects based on high-grade deposits can suffer if market conditions change unfavorably.

- Regulatory and Environmental Hurdles: Lengthy permitting processes and environmental compliance can add significant costs and delays.

Nemaska Lithium’s Whabouchi mine in Quebec, Canada, serves as a prime example. Despite its high-grade lithium deposits, the project faced numerous challenges including high operating costs, capex overruns, technical difficulties, fluctuating lithium prices and eventually, debt issues.

Zimbabwe is a prime example of how high-grade lithium deposits don’t always translate to straightforward success. Despite having high-grade spodumene deposits (about 6.7 grams per metric ton, compared to the global average of 5.5 g/mt), the country’s lithium extraction and production face significant challenges.18

The complex chemical processes required for lithium extraction can lead to quality problems if not managed properly, as evidenced by past issues in Australian lithium mines where initial extraction led to poor quality batteries.19

That’s why E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) stands out.

E3 Lithium processes differently by using advanced DLE technology, which is designed to be scalable and more efficient than traditional mining and processing methods.

On top of that, operating in the well-regulated and geologically stable region of Alberta, E3 Lithium benefits from a supportive regulatory environment, ensuring smoother project execution and sustainability.

And that’s just the tip of the iceberg. Let’s take a look at some of the reasons why E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is an absolute game-changer in the lithium supply race.

7 Reasons

E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) May Be a Lithium Production Game Changer

1

Lithium Demand is Booming: — With batteries at the core of the energy security movement, as well as EVs and tech, driving soaring domestic demand, the world is racing to secure lithium amidst a looming supply shortage.

2

Major Inflection Point Reached: E3 Lithium successfully operates one of the largest demonstration facilities producing 97.7% pure battery quality lithium.

3

Flagship Asset with Globally Significant Resource: — With 16 Mt of Measured and Indicated (M&I) LCE on the books,20 E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) has the largest M&I LCE resource in Canada. This only entails about 70% of the company’s entire permit area.

4

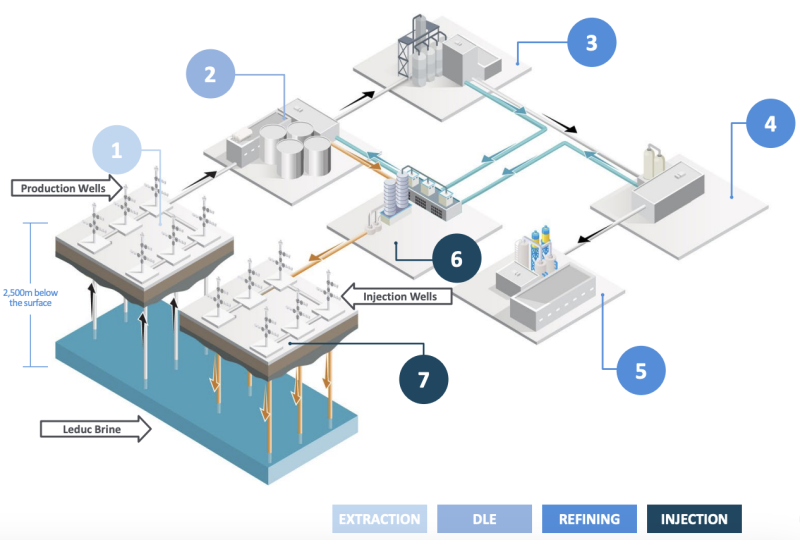

Aiming for a sustainable Extraction Process: — 100% brine aquifer reinjection and a small land footprint makes the company’s DLE process a potential monumental game changer in the lithium space.

5

Strong Financial Backing and Government Support: — E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) has received over C$42 million in non-dilutive investments from the Province of Alberta and the Government of Canada21,22. The company also raised close to C$30 million in the capital markets in 2023 alone.

6

World-Class Jurisdiction: — Leveraging the “Alberta Advantage,” E3 operates in a resource-rich, industry-friendly region with over 600,000 hectares of brine permits.23

7

Strong Leadership Team: — With 150+ years of combined experience, E3’s team includes industry veterans like Kevin Carroll with 35 years experience in building projects in Alberta including working at Deltastream and Huron, Peter Ratzlaff, with 30 years of experience in engineering and production/operations at companies like ConocoPhillips and Independent director Kevin Stashin, a 40-year oil and gas industry vet with experience at Devon Canada Corp, Anderson Exploration, and Petro-Canada.

E3 Lithium (TSXV:ETL) (OTCQX:EEMMF) on the Fast Track to Commercial Production

E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is setting a new standard in the lithium production landscape as it targets commercial production.

Diverging from traditional methods like evaporation ponds or hard rock mining used by companies like Albemarle and Lithium Americas, E3 Lithium leverages Direct Lithium Extraction (DLE) technology.

According to a report from Goldman Sachs:

“Direct Lithium Extraction (DLE) has the potential to significantly impact the lithium industry, with implementation on the extraction of lithium brines potentially revolutionary to production/capacity, timing, and environmental impacts/permitting.”24

This technology, along with E3’s large resource base and strategic location, is highlighted in their Preliminary Economic Assessment (PEA)25 for its Clearwater Project area in Alberta, suggesting an advantageous position for lithium development.

Not to mention, E3 Lithium Ltd.’s (TSXV:ETL) (OTCQX:EEMMF) resource is among the Top 4 LCE Resources in the World.26

In total, E3’s resources cover just 69% of the company’s permit area in south-central Alberta.

Source: https://www.e3lithium.ca/_resources/reports/technical/bashaw-technical-report.pdf?v=062011

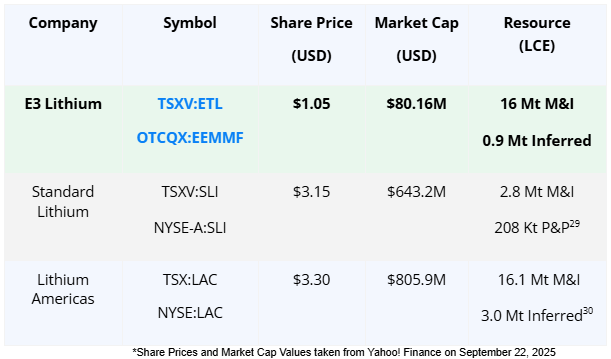

But what makes E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) resource really stand out, is how it’s somehow flying under the radar of the market.

How so?

Well, for starters, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is aiming to start production not far behind when Lithium America’s Thacker Pass chemical processing plant’s go-live date.27

It’s worth noting that both Lithium America’s Thacker Pass and E3’s Clearwater Project have similar resource sizes; with 16.1 Mt and 16.0 Mt respectively in the Measured & Indicated category.28

Meanwhile, the market is also giving attention to Standard Lithium’s flagship Smackover Projects located in Southern Arkansas near the Louisiana border.

Much like E3’s Clearwater, the Smackover Projects are set to use a fully integrated, start to finish, DLE process.

E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) DLE process offers significant advantages over conventional methods. This efficient process recovers lithium in minutes instead of months, drastically reducing the time for production.

All the while, the market is giving E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) a valuation that’s significantly lower than both Standard Lithium and Lithium Americas.

But as E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) works its way towards production, the market will have no choice but to pay closer attention to this exciting company.

And to sweeten the pot further, E3 has a clean share structure and strong funding, having received over C$42 million in government grants and raised close to C$30 million in 2023.

In March, E3 Lithium and Imperial Oil agreed to increase access to additional freehold lands across the Clearwater Area. E3 Lithium Ltd.’s (TSXV:ETL) (OTCQX:EEMMF) unique approach and solid financial backing distinctly position it in the competitive lithium market, poised for success as it approaches its commercial production phase.

Clearwater’s Significant Potential

E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) Clearwater project isn’t just impressive in scale, it’s progressing steadily along the milestones to commercialization.

Following the PFS, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) plans an exhaustive Feasibility Study (FS), obtaining regulatory approvals, and securing project finance arrangements.

These steps are crucial for the construction of its pioneering commercial facility in Alberta, which when in operation is surely set to transform the lithium production landscape.

E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is advancing beyond mere lithium extraction. It aims to redefine industry standards, fuel sustainable energy advancements, and catalyze Alberta’s economic progress.

With its pioneering approach and meticulous planning, E3 Lithium is on track to emerge as a key player in the global lithium market.

Breakthrough Direct Lithium Extraction Technology

In the heart of Canada’s petroleum landscape in the province of Alberta, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is redefining the future of lithium production with the results from field testing ground-breaking Direct Lithium Extraction (DLE) technology.

E3 is de-risking its DLE by designing a system that can utilize any sorbent, enabling a shorter timeframe to commercial while achieving high recovery, ensuring an efficient and effective extraction process.

DLE technology has been rigorously tested at E3 Lithium’s (TSXV:ETL) (OTCQX:EEMMF) pilot plant within the Clearwater Project Area. It is now being tested a its Demonstration Facility, that will produce lithium carbonate directly from brine. Here, the company has achieved remarkable milestones, significantly advancing the lithium extraction process.

The Demonstration Facility is now operating , a pivotal moment, showcasing E3 Lithium’s capability to unlock the true value of its lithium resources. This milestone significantly de-risks the commercial design and sets a solid foundation for future developments.

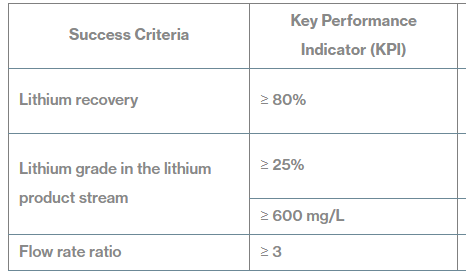

In 2023, E3 Lithium Ltd.’s (TSXV:ETL) (OTCQX:EEMMF) field pilot plant achieved significant results, including:31

- 94% lithium recovery

- 80.1% and 909.0 mg/L lithium grade in the lithium product stream

- Flow rate ratio of 9

The company measured the success of the field pilot plant against the KPIs below, outlining their significance:

In addition to these technical achievements, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) has produced 99.78% pure battery-quality lithium.32 This level of purity is critical for the high demands of the battery industry and showcases E3 Lithium’s commitment to delivering top-tier products.

E3 Lithium is also strengthening its position through strategic partnerships, collaborating with top-tier equipment vendors to refine its advanced processes for full-scale commercial operation. Industry powerhouse Fluor has been enlisted to lead the Pre-Feasibility Study (PFS) for the commercial project, ensuring that every step towards commercialization is guided by expertise and innovation.33

In a significant collaboration, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) partnered with Pure Lithium to create a successful lithium metal battery using lithium from its resources. This collaboration is not just about producing lithium; it’s about demonstrating the practical application of their product.

E3 Lithium’s advancement in DLE technology, combined with its strategic location in Alberta, marks a new era in lithium production. The company’s innovative approach, backed by strong partnerships and technical excellence, sets it on a path to becoming a leading name in the global lithium market.

With these achievements, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is not just extracting lithium; it is shaping the future of energy.

RECAP: 7 Reasons

E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is a Major Player in the Lithium Market

1

Lithium Market Boom: — Energy security driving the need for domestic battery production, along with increasing demand for EVs and tech batteries leads to lithium shortage.

2

Battery Grade Lithium Carbonate: — E3 Lithium has consistently achieved over 99.7% purity in Lithium Production.

3

Significant Lithium Resource: — Canada’s largest Measured and Indicated LCE resource at 16 Mt

4

Innovative, ESG-Friendly Technology: — 100% brine aquifer reinjection, minimal land impact.

5

Robust Funding: — Over C$42 million in non-dilutive investments, plus close to C$30 million raised in 2023.

6

Prime Location in Alberta: — Over 600,000 hectares of brine permits in a well-established oil and gas region.

7

Experienced Leadership Team: — Over 150 years of collective experience in emerging technologies and resource management.

As you’ve now seen, E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF) is at the forefront of revolutionizing lithium production.

With the largest Measured and Indicated lithium resource in Canada, this company is poised to play a pivotal role in the energy sector.

Discover more about E3 Lithium Ltd. (TSXV:ETL) (OTCQX:EEMMF), its innovative approaches, and how this company is shaping the future of lithium production at their official website.