In early 2024, uranium quietly surged to $106 per pound, its highest level since 2007.1

Then, just as quickly, the price pulled back into the $70s… and the headlines faded.

But that’s often when the real money is made.

Because while retail investors obsess over daily price swings, institutional capital is moving into long-term positions and for good reason.

In June 2025, Sprott Physical Uranium Trust announced a US$200 million upsized bought-deal financing capital they plan to use to buy physical uranium, removing supply from the market and reinforcing long-term bullish fundamentals.2

In another show of institutional support, Bill Gates’ TerraPower officially broke ground on the first next-generation Natrium reactor3 a project backed by the US Department of Energy and designed to redefine nuclear power for the modern grid. Globally, over 70 new nuclear reactors are under construction right now including major projects in China, India, and the Middle East.4

And in a historic policy shift, both the US Inflation Reduction Act5 and the EU Green Taxonomy6 have now reclassified nuclear as a green energy source unlocking hundreds of billions in ESG investment flows.

This isn’t the end of a cycle. It’s the beginning of a global nuclear resurgence.

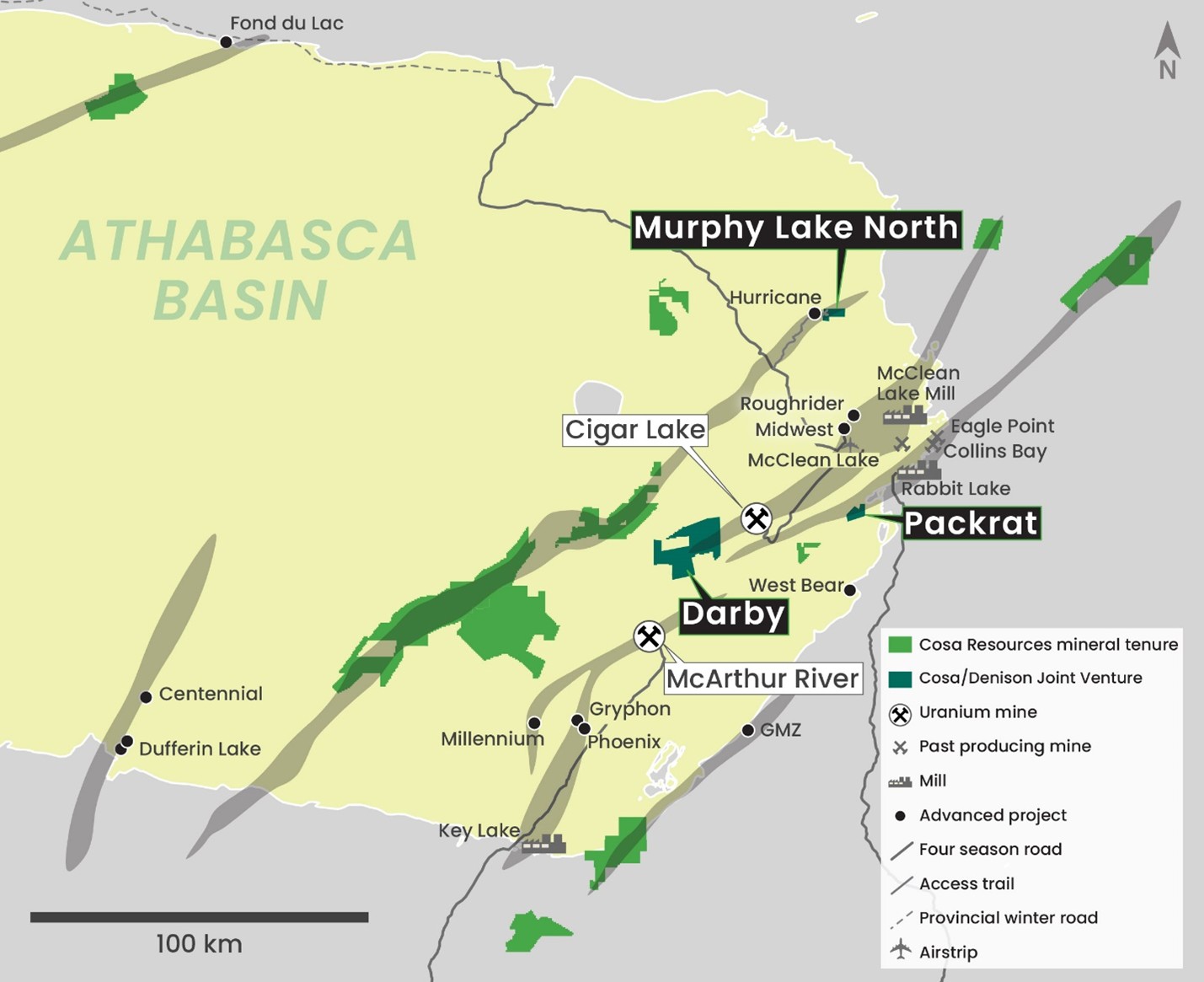

And at the center of it all is one region: the Athabasca Basin in northern Saskatchewan home to the highest-grade uranium deposits on Earth.

But the best-known zones are already spoken for.

That’s why a handful of geologists including the minds behind IsoEnergy’s Hurricane deposit are turning their attention to overlooked areas with striking similarities… and one company that got there first.

That company is Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF).

The World’s Richest Uranium District Is Still Yielding Surprises

If you’re serious about uranium, there’s only one place you start: the Athabasca Basin in northern Saskatchewan.

Spanning over 100,000 square kilometers, this remote expanse hosts the highest-grade uranium mineralization on Earth with ore grades often 100+ times richer than global averages.

And the track record here is unmatched:

Cigar Lake and McArthur River, both mega-mines, define the Basin’s status.

But in recent years, junior explorers have also made seismic moves:

-

-

- IsoEnergy’s Hurricane Deposit emerged in 2018 as a 48.6 million‑lb discovery averaging 34.5% U₃O₈7, earning the company a peak market cap near $650 million before expanding to depth.8

- NexGen Energy’s Arrow Deposit, located in the southwestern sector, unveiled a massive 95,000 t U₃O₈ indicated resource grading 3.7% (peaking at 16.1% in high-grade zones), driving NexGen’s market cap over $2 billion in early 2021.9

-

The takeaway? The Athabasca Basin continues to deliver Tier 1 discoveries, lifting valuations for explorers who were early to drill.

That’s where Cosa Resources (TSXV:COSA) (OTCQB:COSAF) enters the picture.

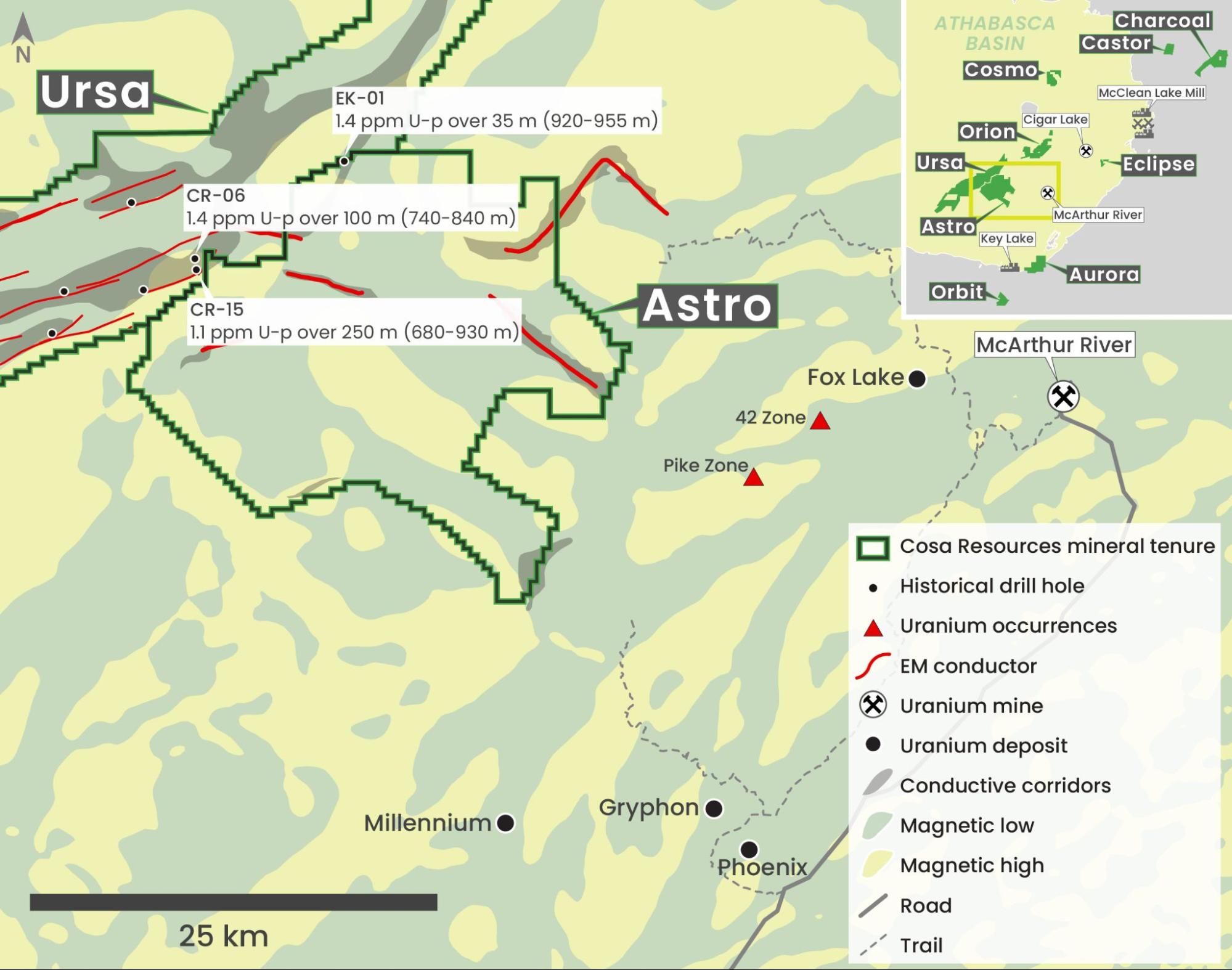

While the spotlight has often focused on the southwest, Cosa secured and advanced a vast portfolio in the Basin’s underexplored eastern and northern corridors, areas that share key geological hallmarks with past discoveries and are close to existing infrastructure including roads, powerlines, and uranium mills.

They’ve since executed massive geophysical campaigns (ANT, ZTEM, gravity, magnetics) covering hundreds of thousands of hectares, defining drill-ready targets that mirror the systems that hosted Hurricane, Cigar Lake, and other major deposits.

So while peers surged to billion-dollar valuations after new hits, Cosa Resources has quietly built the blueprint and is now beginning to drill, positioning itself for a potential breakout that could potentially re-price its market valuation dramatically.

In June 2025, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) launched a fully funded 3,000-metre summer program backed by Denison Mines to test multiple high-conviction corridors at Murphy Lake North.

This marks the company’s largest drill campaign ever. And early results are already turning heads (more on that in a moment).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

The Team That Helped Build Billion-Dollar Discoveries Is Doing It Again

What makes the Athabasca Basin so unique isn’t just the rock.

It’s the people who know how to read it.

And Cosa Resources (TSXV:COSA) (OTCQB:COSAF) is led by one of the most experienced uranium exploration teams in the Basin today, many of whom played central roles in some of its most valuable discoveries.

Together, this team has:

-

-

- Raised hundreds of millions in capital for uranium ventures since 201710

- Built exploration programs that led to multi-hundred-million and billion-dollar valuations

- Now assembled over 400,000 acres of high-potential exploration ground for Cosa Resources (TSXV:COSA) (OTCQB:COSAF), a land position that rivals or exceeds many of their better-known peers

-

And in February 2025, they raised an additional $6 million in a uranium-focused private placement, giving the company a runway to drill aggressively into 2026.

This is more than a well-funded explorer. It’s a proven uranium discovery team now executing the next chapter of their success story.

Press Releases

- Cosa Identifies Two Kilometres of Strong Sandstone Alteration and Graphitic Faulting at the Cyclone Trend on the Murphy Lake North Uranium Project

- Cosa Commences 3,000 Metre Summer Drilling Program at the Murphy Lake North Uranium Project

- Cosa Resources Announces Drilling Plans for Murphy Lake North Uranium Project, Athabasca Basin, Saskatchewan

- Cosa Resources Announces Drilling Plans for Murphy Lake North Uranium Project, Athabasca Basin, Saskatchewan

- Cosa Resources Announces Commencement of Ground Geophysics and Expansion of Its Uranium Exploration Technical Team

Why Cosa Could Be the Next Tier‑1 Uranium Success

History isn’t kind to juniors with small land and no momentum. What matters is scale, location, and technical execution.

Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) checks all those boxes and here’s how it stacks against key peers:

The Roadmap to Tier‑1 Status

1

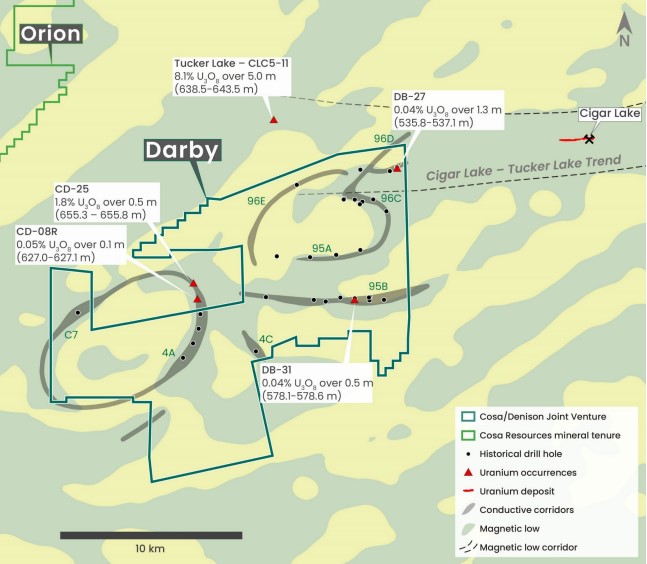

Land Scale and Structure: Cosa Resources has assembled one of the largest underexplored land packages in the Athabasca Basin, over 400,000 acres across key structural corridors. This includes Murphy Lake North, located just 3.2 km from the highest-grade uranium discovery in the history of the Athabasca Basin, and Darby, another Denison Joint Venture located within just 10 kilometres of Cameco’s Cigar Lake Mine. Location is the foundation of any Tier‑1 discovery and Cosa is in the right place.

2

The Team Behind Billion-Dollar Discoveries is Leading This Effort: Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) is led by the same geologists behind IsoEnergy’s Hurricane, Denison’s Gryphon, and 92 Energy’s Gemini Zone. This proven team has collectively raised over US$800 million since 2017 and has a track record of advancing early-stage projects into high-grade discoveries that have attracted billion-dollar valuations.

3

Murphy Lake: Active Drilling Near a World-Class Deposit: Cosa has already confirmed Hurricane-style structures at Murphy Lake, just downtrend from IsoEnergy’s 48.6M‑lb deposit. Following a successful winter drill campaign, the fully funded summer 2025 program is now targeting additional high-conviction zones giving Cosa near-term potential for discovery on one of the Basin’s most proven trends.

4

Darby – Another Mature, Discovery Ready Project Near Cigar Lake: A 70/30 Joint Venture between Cosa and Denison Mines, Cosa’s geologists plan to begin drilling at Darby as early as Q1 2026. Just ten kilometres from active mining operations at Cameco’s Cigar Lake Mine, Darby boasts abundant drill targets with all the hallmarks of a potentially world-class uranium discovery.

5

A Pipeline Built for Continuous Discovery: In addition to Murphy Lake and Ursa, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) is advancing Orion, Cosmo, and multiple other 100%-owned projects. Surveys used include advanced geophysics, including ANT and ZTEM. This pipeline gives Cosa multiple opportunities to create value and sustain momentum beyond a single discovery.

6

Valuation Delta = Asymmetric Upside: With a market cap of just US$17 million, Cosa trades at a fraction of peers like IsoEnergy (US$376 million) and NexGen (US$3.69 billion). If Cosa’s current campaigns yield strong results, the company could experience a major re-rating in line with historic moves by other Athabasca juniors.

7

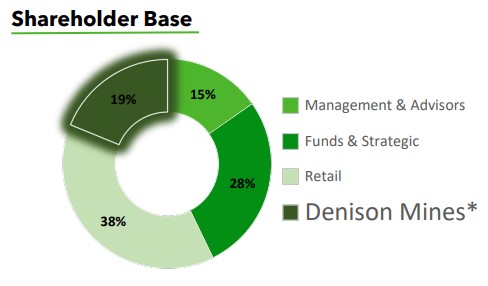

Strategic Collaborations with Denison Mines: Not only does Cosa operate three high-upside Joint Ventures with Denison Mines, but Cosa also receives strong corporate, financial, and technical support from Denison, a global leader in uranium exploration and development.

Tracking Their Path

-

-

- IsoEnergy rose from $0.30 to $6.00 after confirming Hurricane high-grade, a ~20× run in just 18 months.

- NexGen ran from sub‑$5 to >$9 on Arrow resource validation.

- Even UEC, now US$4B in market cap, started as a micro-cap.

-

Cosa is following these same templates, junior status, technical validation, large structurally rich land packages, top-tier leadership, and aggressive drilling.

It’s the classic junior explorer value formula: land + team + execution + catalysts at tiny valuation.

If Murphy Lake or Ursa delivers, Cosa could potentially follow the same ascent path.

Time to zero in on the projects that could put this stock on the map.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

One of the Most Undervalued Portfolios in the Athabasca Basin

In uranium, location is everything.

And few companies have quietly secured more strategic real estate or a more advanced exploration portfolio than Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF).

At first glance, the numbers speak for themselves:

-

-

- Over 400,000 acres in total land holdings.16

- 100% ownership of multiple highly prospective projects.

- Several Joint Ventures, three with Denison Mines, another with Global Uranium Corp.

-

But it’s what lies beneath that makes this story urgent.

Because the same team that helped discover the highest-grade uranium deposit on the planet, the Hurricane deposit, is now deploying modern geophysics and decades of in-basin experience to unlock what may be the next billion-dollar find.

Let’s break it down.

A High-Grade Uranium Target in the Making – Murphy Lake

When Denison Mines Corp. (TSX:DML) (NYSEAMERICAN:DNN) decides to partner with a junior, it sends a clear message: there’s big potential hiding underground.

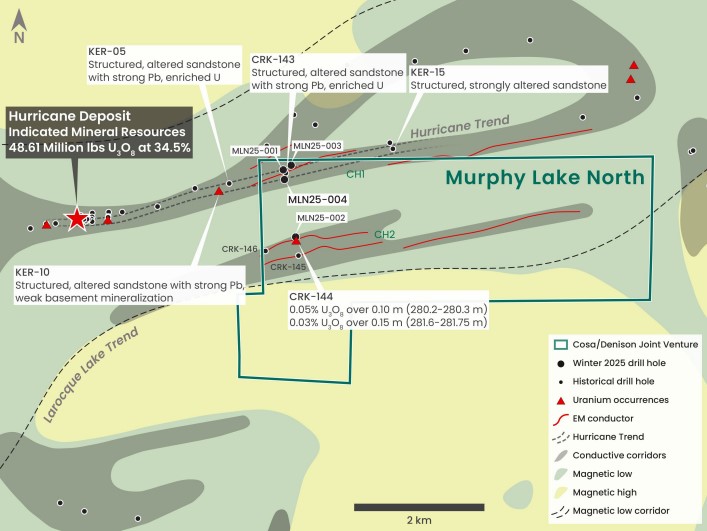

And that’s exactly what Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) has with its Murphy Lake North Joint Venture.17

This isn’t just any land package, it’s located just 3.2 kilometers from IsoEnergy’s Hurricane Deposit, which holds the world’s highest-grade Indicated Mineral Resource at an astonishing 34.5% U₃O₈ across 48.61 million lbs.

That deposit was discovered by the same team now leading Cosa Resources.

In early 2025, the company launched a winter drill campaign at Murphy Lake North. 18

It was a bold first move but one that quickly paid off.

The results were immediate:

-

-

- Drilling intersected structures and alteration zones remarkably similar to those controlling the Hurricane deposit.

- Broad zones of sandstone hydrothermal alteration were uncovered, a hallmark of uranium-fertile systems.

-

This wasn’t a coincidence, it was a confirmation.

Cosa Resources (TSXV:COSA) (OTCQB:COSAF) is working within the Larocque Lake Trend, a corridor that has already delivered the highest-grade uranium discovery in the history of the Athabasca Basin, and may still hold even more.

And now they’re doubling down.

Building on that success, the company began its largest-ever summer drill program at Murphy Lake North in July 2025, fully funded and supported by Denison Mines.

More importantly, this is one of the last remaining underexplored zones in the entire corridor.

With tight structures, known mineralization just downtrend, and large zones of hydrothermal alteration already intersected, the setup is textbook for a major discovery.

Breakthrough Results at the Cyclone Trend

In August 2025, Cosa reported its strongest results yet from that program. Summer drilling confirmed two kilometres of strong sandstone alteration and graphitic faulting at the newly defined Cyclone trend, structures that are textbook indicators of high-grade Athabasca uranium systems.

Key highlights included:

- Broad sandstone alteration zones extending across multiple drill fences, underlain by major graphitic faulting.

- Up to 30 metres of unconformity relief at Cyclone, increasing the potential for structural traps.

- Alteration and structure open in both directions, leaving multiple follow-up targets untested.

- Extension of sandstone alteration along the Hurricane trend, confirming additional search space.

- Cosa has now met its sole-funding obligation, securing an irrevocable 70% interest in Murphy Lake North, with Denison Mines holding 30%.

- Shallow drill targets. Targets are Cyclone are up to 80 metres shallower than at the nearby Hurricane deposit

Cosa Resources (TSXV:COSA) (OTCQB:COSAF) President & CEO Keith Bodnarchuk called the Cyclone results “the most significant to date for Cosa,” while VP Exploration Andy Carmichael emphasized that the basement structures are “textbook examples of major graphitic faults critical to Athabasca uranium deposits.”

Here’s what investors need to keep in mind:

-

-

- Proximity matters. Murphy Lake North is just 3.2 km from the highest-grade Indicated uranium deposit on the planet.

- Technical validation. The same team that discovered Hurricane is leading this project.

- Strategic capital. Denison Mines holds a 30% stake in the JV and a 19.95% equity interest in Cosa Resources itself.

- Valuation gap. Even after these results, Cosa’s market cap sits near C$23 million (US$17 million), a fraction of peers with validated discoveries.

-

This is why Cosa Resources (TSXV:COSA) (OTCQB:COSAF) is gaining attention across the junior uranium space.

With uranium prices rising and the US ban on Russian imports tightening the supply chain, the timing couldn’t be better.

Murphy Lake North is more than just a satellite play, it may potentially be the next big discovery on one of the most prolific uranium trends in the world.

Stay tuned as this story unfolds… and prepare for results that could change everything.

One of the Largest Untested Uranium Trends Left in the Athabasca Basin – The Ursa Project

The Athabasca Basin has a reputation for making millionaires.

It’s where NexGen’s Arrow was discovered. Where Denison’s Gryphon was drilled. Where IsoEnergy hit the Hurricane deposit.

And the geologists behind all three of those high-grade discoveries are now directing their attention to something new.

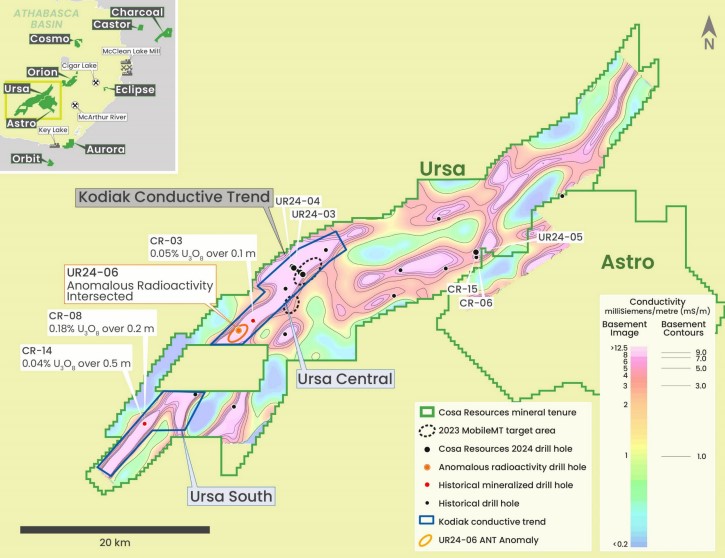

A 65-kilometre-long corridor so underexplored, it might be the last of its kind in the entire eastern Basin.

It’s called the Ursa Project and it’s already starting to deliver.

A Technical Success on the First Drill Program

In the winter of 2024, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) launched its inaugural diamond drill campaign at Ursa’s Kodiak target zone.19

This wasn’t a shot in the dark. This was the team’s first real test of a highly prospective, but barely touched, piece of ground.

Drill hole UR24-03 hit exactly what the team was hoping for:

-

-

- A broad zone of sandstone hydrothermal alteration over 190 metres thick.

- Alteration included fracture- and fault-controlled sulphides, dravite breccia, clay, hematite, siderite, chlorite, and drusy quartz, all hallmarks of unconformity-related uranium systems.

- Multiple occurrences of massive to semi-massive dravite, a key pathfinder mineral in Athabasca discoveries.

- The alteration zone sat 250 to 460 metres above the unconformity, a signature often seen proximal to high-grade mineralization.

- Beneath that, the basement showed high-strain cordierite-augen gneiss, and graphitic fault zones, classic structural hosts for uranium.

-

Cosa’s technical team called this early success “tremendous” and it instantly upgraded Kodiak to a top-priority follow-up target for summer drilling .

A Game-Changing Geophysics Breakthrough

Most companies in the Basin rely on electromagnetic (EM) surveys. But Cosa is leading a new wave of exploration using Ambient Noise Tomography (ANT) to map hydrothermal systems in 3D.

And in May 2025, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) reported updated ANT results from both the Ursa and Orion projects, confirming deep-seated structural features and alteration patterns consistent with unconformity-style uranium systems in the region.

These findings helped refine the U1 and U2 targets at Ursa and significantly advanced modeling efforts at Orion, where follow-up exploration is now underway.20

Two of the most significant targets to emerge from the ANT survey dubbed U1 and U2, are now redefining what might be possible at Ursa:

Target U1

-

-

- A prominent low-velocity ANT anomaly, interpreted as deep hydrothermal alteration.

- Located directly above strongly conductive basement rocks, previously mapped by EM.

- Already tested by hole UR24-06, which hit:

- Over 100 metres of altered sandstone, including a 65-metre zone with core loss and desilicification.

- Several zones of weak uranium mineralization in the basement.

- This target alone could represent a new structural corridor, now validated by drilling.

-

Target U2

-

-

- A 2-kilometre-long ANT anomaly rooted in the basement, extending into sandstone.

- Overlaps a known basement EM conductor and historical drill hole CR-04.

- CR-04 intersected:

- Lost core zones, intense fracturing, illite, and uranium enrichment, again, consistent with the outer halo of a deposit.

-

These aren’t one-off anomalies. They align along the same 27-kilometre segment of the Kodiak trend which also includes the weakly mineralized historical holes previously drilled into the project.

And crucially, this entire corridor is still mostly untested .

Why This Matters Now

Many uranium juniors claim to be near “elephants.”

But at Ursa, we’re looking at:

-

-

- 65 kilometres of strike length along the Cable Bay Shear Zone, a major regional fault structure comparable to the Larocque or Patterson corridors.

- Multiple conductors, ANT anomalies, and boulder geochemistry showing uranium, illite, and boron classic Athabasca pathfinders.

- Only 21 drill holes have been completed across the entire project to date.

-

As Cosa Resources’ (TSXV:COSA) (OTCQB:COSAF) VP of Exploration Andy Carmichael put it:

“We’ve demonstrated that modern geophysical surveys can produce lower-risk drill targets than conventional EM alone.”

More importantly, the next phase of work could test the roots of these hydrothermal zones exactly where discoveries tend to be hiding.

Orion Never Drilled, Fully Modeled, and Sitting on Tier-1 Anomalies

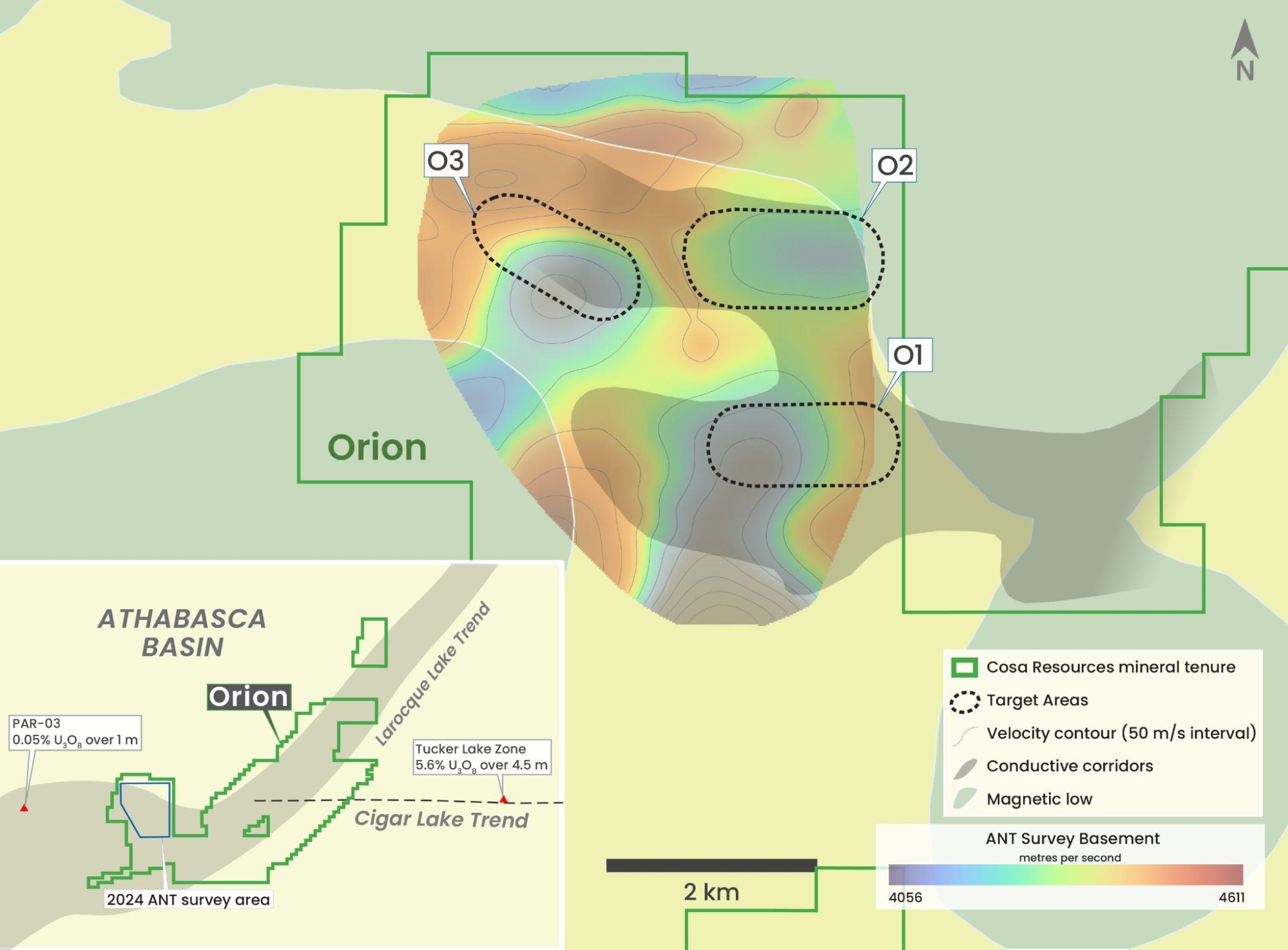

Just east of Ursa lies Orion, another 100%-owned Cosa project that has quietly become one of the company’s highest-priority and most actively explored properties.

Here’s why:

In 2024, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) completed an Ambient Noise Tomography (ANT) program, the same seismic technology now being adopted by majors like IsoEnergy and Uranium Energy Corp. The results were striking:

-

-

- Multiple kilometre-scale velocity anomalies were identified at the unconformity.

- On June 4, Cosa kicked off a 618-line-kilometre ZTEM survey at its Cosmo and Orion projects targeting deep uranium corridors and laying the groundwork for follow-up drilling.21

-

What’s more, Orion lies on a trend between Cigar Lake to the east and Orano’s Parker Lake project to the west and shares the same deep-crustal structural control.

This project has never been drilled in this area, but the data package Cosa Resources (TSXV:COSA) (OTCQB:COSAF) has assembled would rival a full feasibility-stage explorer.

Expect drill targeting to be finalized in early 2026

Astro Partner-Funded Upside Near McArthur River

While Cosa (TSXV:COSA) (OTCQB:COSAF) focuses capital on its core assets, it also benefits from partner-funded exploration through a high-value earn-in agreement.

The Astro Project, located just 30 km from Cameco’s McArthur River Mine, is under option to Global Uranium Corp, which has committed to up to:

-

-

- $9.5 million in exploration expenditures

- 2.6 million shares of Global issued to Cosa

- $800,000 in cash to Cosa

-

- Target generation work is underway. As operator, Cosa is undertaking a work plan like that which delivered basement mineralization at Cosa’s neighbouring 100% owned Ursa project.

Aurora, Orbit, and Cosmo The Next Wave of Fully Modeled Exploration

While Murphy Lake North, Darby, Ursa and Orion take center stage, Cosa’s (TSXV:COSA) (OTCQB:COSAF) technical team is quietly advancing multiple additional 100%-owned projects: Aurora, Orbit, and Cosmo.

Each has now been flown with ZTEM or ANT.

Here’s what’s emerging:

-

-

- Aurora and Orbit: High-resolution ZTEM and gravity identified multiple drill ready target areas.

- Cosmo: ZTEM flown in early 2025 is expected to identify unexplored conductive corridors, with follow-up fieldwork planned for 2026.

-

These aren’t just placeholder properties. They’re fully modeled, data-rich assets being advanced in parallel, giving Cosa a pipeline that could support discovery news year after year.

Darby Next in the JV Queue

Located just 10 kilometers from Cigar Lake, Darby is Cosa’s second JV with Denison Mines, and is a perfect candidate for 2026 fieldwork.

The property was drilled historically, but most targets were missed or ignored using outdated techniques. Cosa Resources (TSXV:COSA) (OTCQB:COSAF) and Denison are now:

-

-

- Reprocessing legacy drill logs

- Refining what could become one of the most prospective JV projects near existing production infrastructure

-

A Portfolio Built for What’s Coming Next

When you zoom out, what Cosa Resources (TSXV:COSA) (OTCQB:COSAF) has built is extraordinary.

-

-

- A massive, underexplored land package in the world’s richest uranium district

- A team that’s already discovered a high grade deposit (Hurricane)

- Active partnerships with Denison Mines and Global Uranium

- Drill programs fully funded into 202622

- Multiple high-priority projects that could yield resource-grade results at any moment

-

And yet the company still trades at a fraction of the value of peers like IsoEnergy, Skyharbour, or Canalaska.

Follow the Smart Money: How Cosa Resources Is Fully Funded Into 2026

In a market where junior explorers often scramble for capital, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) stands apart.

Backed by a technical team that’s raised over $700 million for mining ventures since 2017, including successes like IsoEnergy and NexGen, Cosa Resources has attracted serious institutional and strategic capital.

In February 2025, the company announced a $6 million private placement, led by uranium-focused investment funds. 23

This included significant participation from Denison Mines (NYSEAMERICAN:DNN), which is now Cosa’s largest shareholder with a 19.95% equity stake .

This is no small vote of confidence. Denison doesn’t just bring capital, it brings validation, technical expertise, and access to a global network of uranium partners.

Cosa (TSXV:COSA) (OTCQB:COSAF) entered Q2 2025 with over $5.2 million in cash, enough to fully fund its ambitious summer drill program at Murphy Lake North and continue target generation across the Ursa, Orion, Cosmo, and Darby projects into 2026.

Unlike many peers who dilute endlessly just to keep the lights on, Cosa Resources Corp. (TSXV:COSA) (OTCQB:COSAF) maintains a tight capital structure with substantial insider and institutional ownership reflecting high internal conviction.

With strong backing, a best-in-class technical team, and transformative drill campaigns underway, Cosa is doing what every smart investor looks for:

Executing from a position of strength.

Stay tuned because fully funded explorers with major catalysts on deck can move fast.

With capital secured, drills spinning, and a uranium bull market gaining steam, Cosa Resources (TSXV:COSA) (OTCQB:COSAF) is positioned to turn potential into discovery.

But this story is still early and the biggest upside often comes before the headlines hit.

To stay ahead of the crowd, subscribe to the Trading Whisperer Newsletter.

You’ll get exclusive access to Cosa’s latest corporate presentation, insights into their joint venture with Denison, and early alerts on new trade ideas from across the uranium and energy sectors.

Don’t wait for the market to catch up. Get the edge now.

*All figures in CAD unless otherwise stated

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers