The global resource race is on and one mine could tip the scales.

The headlines argue politics. The capital is chasing rock.

Washington just shifted critical minerals onto a war footing. Not speeches. Checks.

The United States is racing to lock supply as China tightens its grip on the chain. Trade tensions are rising before Trump’s sit-down with President Xi in South Korea, and the market is pricing a minerals arms race in real time.

The US tied up an $8.5 billion minerals pact with Australia and started writing checks into North American supply. 1

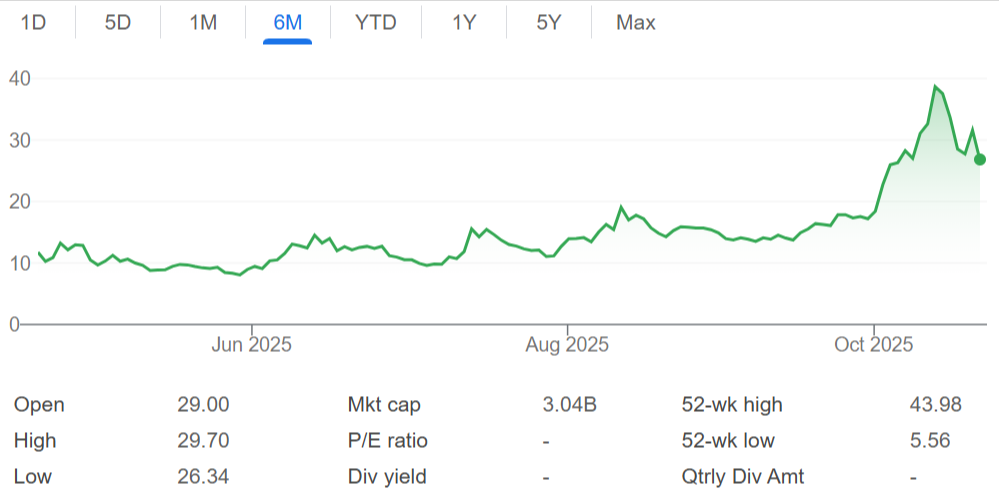

Lithium Americas caught the White House spotlight in early October and traders did not wait.

The stock jumped from $5.71 to $7.04 on the day, with volume nearly tripling.

Two weeks later it touched $10.52.

That is policy turning into price, in real time.

Then a single message about rare earth security hit the tape and the whole group jumped. One stock, USA Rare Earth, looks like it was hit with a lightning bolt. USAR moved from about $18 to $43.98. That’s a gain of $25.98, or approximately 144.33%.

Policy signal. Instant repricing across the basket. That is the tape to watch when the next mineral headline hits.

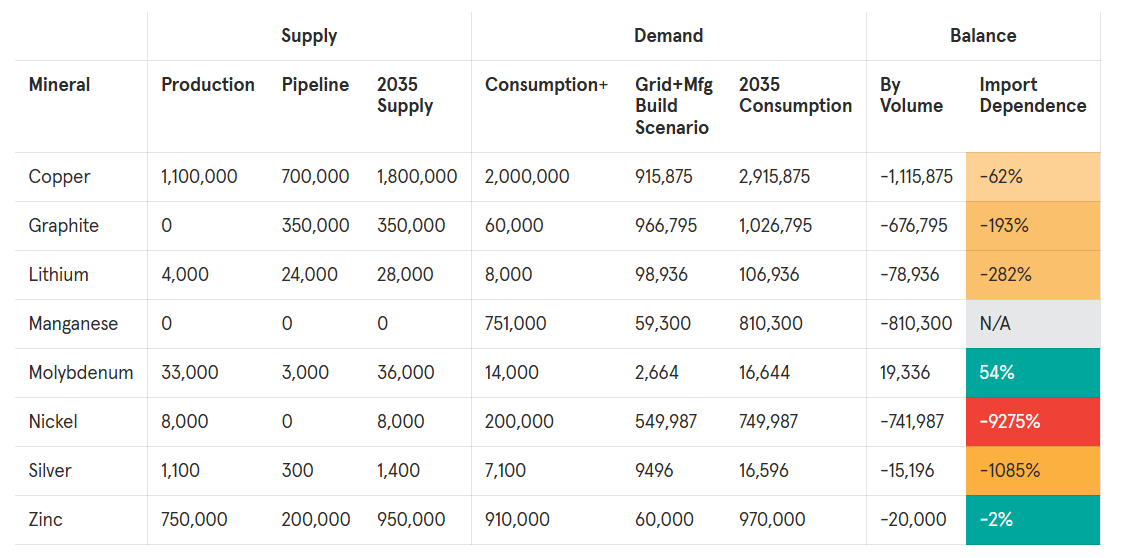

Here is the part most investors miss. The United States is short of the metals that power everything new.

Copper for AI data centers and the grid. Nickel for batteries. Platinum for hydrogen fuel cells, Graphite for anode supply. Silver for solar. Manganese for chemistry stability. Domestic output does not cover it.

Even after new permits, the gap into 2035 is wide. The charts are ugly. Demand lines are rising. Supply bars are flat.

So the new playbook is simple. Onshore what you can. Friendshore the rest. Put long-term floors under prices. Back the projects that feed North American factories now, not five years from now.

Where Washington Wants Its Metals To Come From

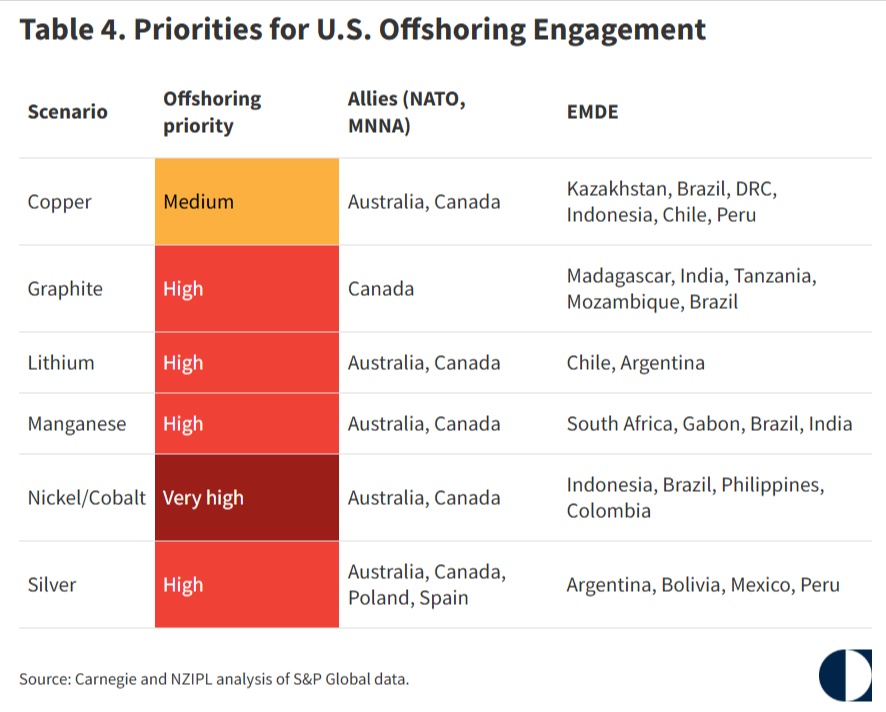

Carnegie Endowment just mapped the friendshoring playbook for critical minerals.2 Their index blends mining cost with production capacity to rank the best jurisdictions for US offshoring.

The punchline is simple.

Canada and Australia screen as top allies across the board. Nickel and cobalt carry a very high offshoring priority. Lithium, graphite, manganese, and silver rank high. Copper is medium, but still on the list.

Policy follows the map.

If the United States cannot mine enough at home, it will buy from trusted partners with scale, power, and rule of law.

That directs capital and offtake toward Canada and Australia first. It also explains why sector moves have been broad when Washington talks supply.

This is exactly where Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) fits. Quebec is a G7 jurisdiction on the ally list.

It’s also a stock with an amazing track record. Last year, it was the top performing mining stock in the TSXV3 and this year it’s up 42%.

And it looks very much like it could repeat its 2024 stock performance where it raised money in the spring and the stock dipped in the summer and roared back in the fall…

Coupling this catalyst with rising geopolitical tensions could set up the perfect trade.

The project’s mix of nickel, copper, PGMs, silver, and gold lines up with the high and very high priority categories. If friendshoring expands, the assets that solve US shortages from Canada sit in the slipstream. That is the setup to watch before the next headline hits.

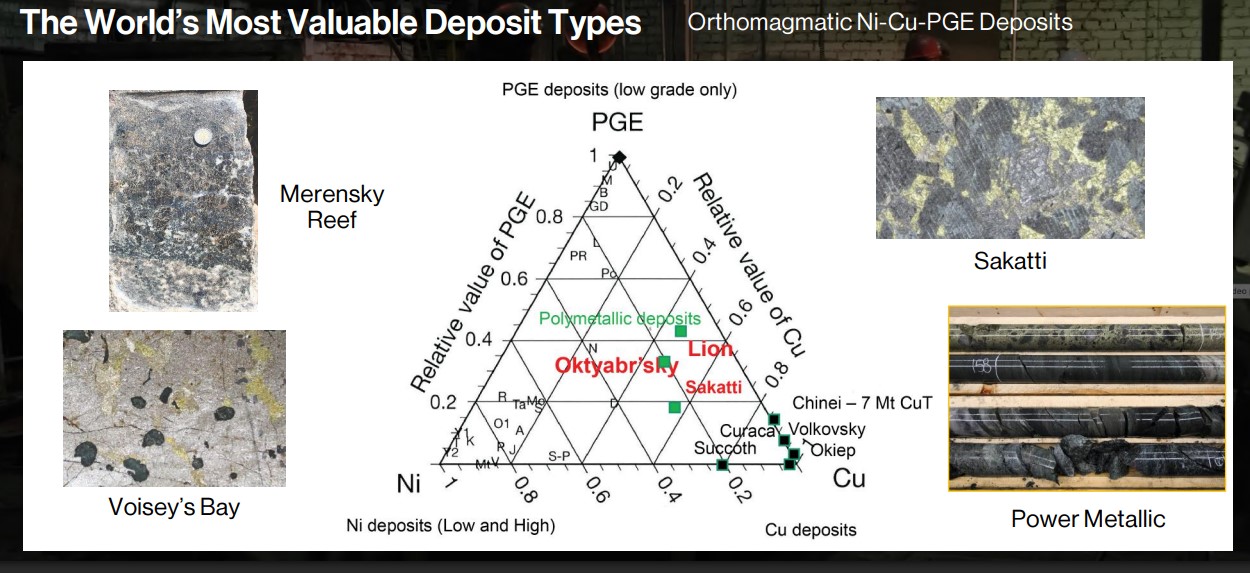

It’s not just a copper mine. It’s not just nickel, or gold, or platinum group metals. It’s the Everything Mine. This is an Ortho Magnetic Nickel Copper PGE discovery and they are the rarest most valuable mines in the world. The exact mix US policy makers keep asking for. The kind of asset that benefits when a White House press conference lifts the tide.

He does not have to pick a single junior. He just has to keep pointing the firehose at supply.

When he talks, baskets of stocks have moved.

That is why Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) belongs on a serious watchlist while this policy cycle plays out.

Investors who understand that dynamic look for quality rock in friendly ground with real news cadence. Power Metallic (TSXV:PNPN) (OTCQB:PNPNF) checks those boxes.

Keep reading. The next section lays out what a second Trump term is likely to push next and why the project fits what America needs.

What Trump Could Do Next, And Why This Fits The Brief

Three levers matter from here.

First, more direct capital into the chain. The government has already funded miners and processors. A price-floor model for critical metals is on the table. If floors extend from rare earths to copper and nickel, bankability changes overnight. That pulls financing forward. It also re-rates peers by association. One policy move could push an entire basket of stocks in an industry higher.

Assets like Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) stand to potentially benefit when capital hunts credible North American tonnes.

Second, targeted protection with speed. Expect tariff pressure where China dominates and fast-track approvals where North America can win. That combo tells private money exactly where to go. Bring tonnage to US and Canadian soil. Secure offtakes. Cut permitting lag. Keep hostile pricing out. The winners are projects that can move from drill core to development without political friction. Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) sits in Quebec with power, roads, and rule of law, which is the right kind of boring for big checks.

Third, friendshoring at volume. The US will still import big tonnage through 2035. Preferred partners are not a mystery. Canada and Australia sit at the top of every list. That is why a Quebec system with copper, nickel, PGMs, gold, and silver in the same rock package is more than a drill headline. It’s supply insurance in a G7 jurisdiction with cheap power and a skilled workforce.

Now match that to what America needs.

Copper for data centers and grid rebuilds. The US shortfall runs into the millions of tonnes. A copper-forward system in Quebec puts Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) in the slipstream of grid and AI buildouts.

Nickel to stabilize battery plans. Domestic nickel is thin. Nickel plus by-product credits give the project a second pillar that matters in any tape.

PGMs, silver, and gold as margin boosters. Polymetallic systems cut unit costs and create multiple ways to win. That is how a portfolio survives policy volatility and still prints value.

Jurisdiction, timing, and cadence. Quebec ticks the rule-of-law box. Assays are flowing. Targets are expanding. Catalysts are lined up for a market that is rewarding credible resources in friendly ground.

Discoveries like this don’t happen every day. In fact, nothing like it has been found in over 18 years since Anglo American discovered Sakatti in Finland in 2007.

And this mine isn’t buried in a remote jungle or trapped behind geopolitical red tape, it’s right here, in North America.

That’s where the dark horse comes in, an under-the-radar company positioned to lead the charge: Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF).

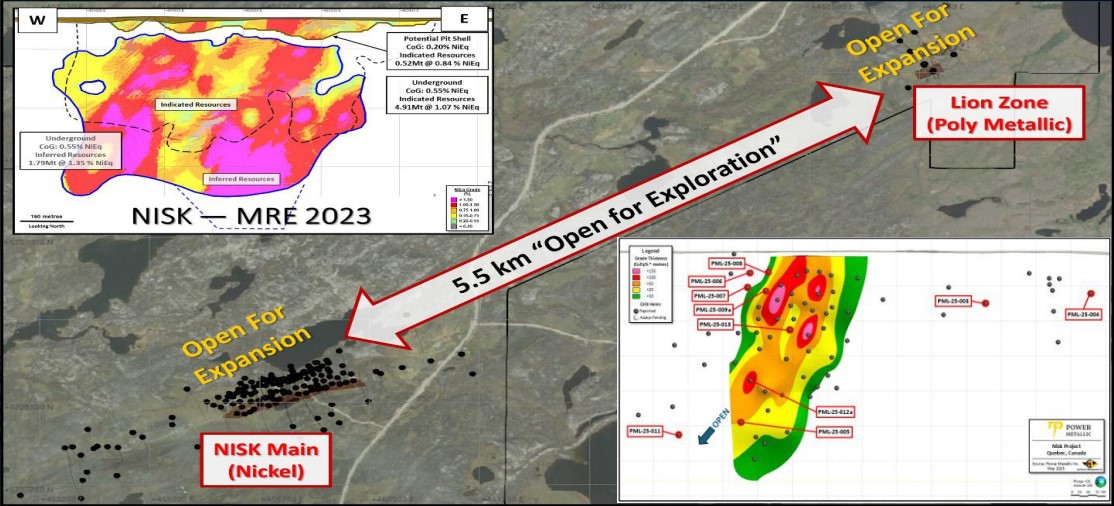

Since acquiring adjoining ground from Li-FT Power in June 2025 and from staking , Power Metallic has expanded its flagship Nisk Project to ~331 km², transforming it into one of the world’s largest and most advanced polymetallic exploration footprints.

Keep reading, because this discovery could change everything.

This isn’t just another exploration story.

It’s a project with proven results, with new drill assays being released every 3-4 weeks between now and mid-April. Each result isn’t just an update, it’s another step towards reshaping how the world secures its most vital resources.

This Canadian polymetallic powerhouse is sitting on what could be the mother lode of copper nickel and PGM deposits. The mineral rich drill intersections also contain 10% gold and 5% silver by value.

8 Reasons

You Don’t Want to Sleep on Power Metallic Mines (TSXV:PNPN) (OTCQB:PNPNF)

1

Policy Tailwind From Washington: With Trump prioritizing critical minerals, expect more tariffs, friendshoring, price-floor support, and direct equity into North American supply. Canada screens as a top ally, and Quebec copper-nickel projects fit the brief

2

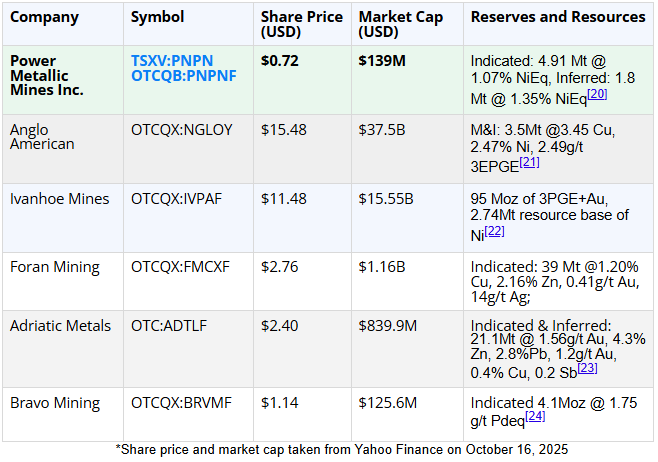

Polymetallic Supergiant Potential: Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) has uncovered a Cu-Ni-PGE-Ag-Au polymetallic discovery in Quebec with world-class intercepts, including 32 meters at 6.97% copper equivalent (CuEq Rec).4 Along with an initial NI 43-101 resource of 7.1Mt NiEq on the Nisk deposit, the Lion discovery also holds an analyst estimated 9.4Mt* of 7% CuEq

3

Commodity Tailwinds: Precious metals like gold, platinum, palladium and silver are on fire, up more than 50% since the company’s last financing, while copper has gained over 12.5%, yet Power Metallic’s share price remains largely unchanged.

4

Expanding Discovery Footprint: The company has expanded its land position by more than 600% to 331 km² after acquiring mineral claims totalling 167 km² from Li-FT Power in June 2025 and adding ground that directly borders the discovery trend by staking.5

5

Fully Funded for Growth: The company exploration is fully funded through the end of 2026, including a 100,000-meter drill program underway since July of 2025.6 With assays delivering news every 3-4 weeks.

6

Prominent Investors Backing the Project: Notable investors like Robert Friedland and Rob McEwen are supporting Power Metallic, aligning their capital with the project’s success. The most recent financing round, led by these investors and several top resource funds, was priced at C$1.45 per share, nearly identical to yesterday’s closing price of C$1.40. This close alignment in pricing underscores continued confidence in the company’s valuation and future potential.

7

Renowned Technical Leadership: Power Metallic has added Dr. Steve Beresford, a globally-renowned polymetallic expert, as a special advisor and board member. His experience as Chief Geologist with companies like First Quantum, MMG and IGO adds exceptional value to the team.7

8

Strategically Positioned in Quebec: The Nisk Project lies in Quebec, one of the top mining jurisdictions globally, with access to clean, cost-effective hydropower Proactive and ProMining First Nations and excellent infrastructure.

Press Releases

- Power Nickel Recognized as a 2024 Top 50 Performer on the TSX Venture Exchange and Ranked #1 Mining Company

- Power Nickel Recognized as a 2024 Top 50 Performer on the TSX Venture Exchange and Ranked #1 Mining Company

- Power Nickel Hole PN-24-095a Delivers 10.60% CuEq1 over 5.35 Metres Within 3.61% CuEq1 over 19.40 Metres

- Power Nickel Hole PN-24-095a Delivers 10.60% CuEq1 over 5.35 Metres Within 3.61% CuEq1 over 19.40 Metres

- Power Nickel and Chilean Metals Announce Completion of Spin-Out

US Production Potential vs. What Industry Will Actually Need

US rocks are loaded. Iron, copper, zinc, lithium, molybdenum, gold, silver, PGMs, phosphate. America still ranks near the top in several of them. Fifth in copper. Fourth in molybdenum. Fifth in palladium. Third in phosphate. Fifth in gold. A real pipeline exists too.

If everything in that pipeline hits the tape, the numbers look meaningful. About 700,000 tonnes of copper a year. About 200,000 tonnes of zinc. About 350,000 tonnes of graphite. About 24,000 tonnes of lithium. About 3,000 tonnes of molybdenum. That is real metal8.

Here is the catch. Even if all of those projects come online in the next five to ten years, they only cover projected demand for molybdenum and zinc.

The US industrial base still needs more nickel, manganese, graphite, copper and PGMs. The gap remains, and the charts say the shortfall widens into the 2030s.

Source: https://carnegieendowment.org/research/2025/10/securing-americas-critical-minerals-supply?lang=en

Policy will fill that gap with friendshoring. That points capital to Canada and Australia first. Which is exactly where Power Metallic Mines Inc.(TSXV:PNPN) (OTCQB:PNPNF) fits.

A Quebec polymetallic system with copper and nickel at its core, plus PGMs and silver. The right metals, in the right jurisdiction, lining up with what US manufacturers will keep importing even if every American project gets built.

The Nisk Project: Canada’s Answer to Russia’s $1 Trillion Norilsk Mine

When mining experts look at Power Metallic (TSXV:PNPN) (OTCQB:PNPNF) Nisk Project, they see something extraordinary: a discovery that echoes the legendary Norilsk Mine in Russia.

Norilsk is the richest polymetallic deposit in the world, the only mine in world history with over $1 trillion worth of metals produced or in reserves.9

What makes Norilsk special isn’t just its scale—it’s the combination of metals: copper, PGMs, nickel and gold, all sitting in one of the most high-grade deposits ever discovered.

Now, Power Metallic (TSXV:PNPN) (OTCQB:PNPNF) Nisk Project is showcasing similar characteristics:

-

-

- Polymetallic Potential: High-grade copper, nickel and PGMs—essential for clean energy, EVs, and industrial innovation.10

- Exceptional Grades: Drill results like 32m at 6.97% CuEq and 34.2m at 5.8% CuEq Rec rival the intercepts seen at world-class discoveries.11

- A Small Footprint, Big Potential: History shows that polymetallic deposits are often compact but incredibly rich. Like Norilsk, Nisk’s high grades suggest a high-value, efficient operation.

-

But here’s where Nisk has a distinct edge: LOCATION.

Unlike the remote challenges of Russia, Nisk is situated in mining-friendly Quebec, with easy access to infrastructure (you can literally drive to the site from the highway), low-cost hydroelectric power, and significant tax incentives that cover 50% of exploration and development costs.12

This makes Power Metallic Mines’ (TSXV:PNPN) (OTCQB:PNPNF) Nisk Project not just world-class but also cost-effective, a rare advantage in today’s market.

And the 2025 Li-FT acquisition locked in another 167 km². Power Metallic coupled this with direct staking to boost the total land package to ~331 km² and extending both northern and southern basin margins that host Nisk, Lion and Tiger targets.

A fully funded drill program to the end of 2026 is now underway, aiming to build on the success of recent results and unlock even more of Nisk’s untapped potential.

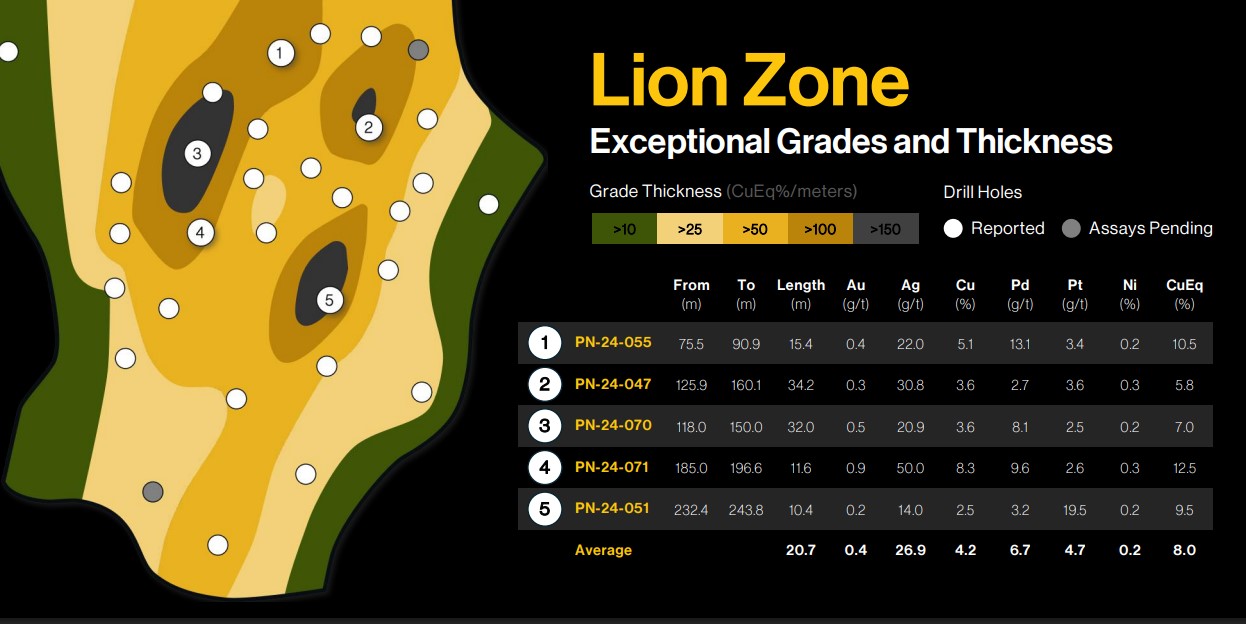

The Lion Zone at Nisk is shaping up to be a game-changing discovery, delivering results that are nothing short of extraordinary. Highlights include 32m at 6.97% copper equivalent (CuEq) and 34.2m at 5.8% CuEq Rec, with some intervals exceeding 12% CuEq.13

Recent assays also revealed a stunning 29.4m hit grading 2.01% CuEq Rec, including intervals up to 11% CuEq Rec from Hole 78,14 showcasing that the mineralized area is growing with additional high-grade copper, gold, silver, and platinum group elements.15

Together, these results underscore the Lion Zone as a standout discovery with immense promise for further growth.

This discovery reaffirms the Lion Zone’s immense potential, with mineralization stretching deeper and wider than ever before.

Why Power Metallic Should Be On Your Radar Right Now

Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is a hidden gem, and here’s why smart money is piling in.

Last year it was the top performing mining stock in the TSXV in 2024 and this year it’s up 42%.

And it looks very much like it could repeat its 2024 stock performance where it raised money in the spring and the stock dipped in the summer and roared back in the fall

But here’s what really makes this story exciting: the big players are already in.

Robert Friedland, the mastermind who turned Ivanhoe Mines into a giant, rarely touches junior mining companies. Yet he owns 4% of Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF).16

That’s like having Warren Buffett invest in your startup – it’s a massive vote of confidence.

The Lynch family holds 18% of the company, showing they’re betting big on their own success. When company insiders put their money where their mouth is, it’s usually a good sign.

Now, let’s talk about value.

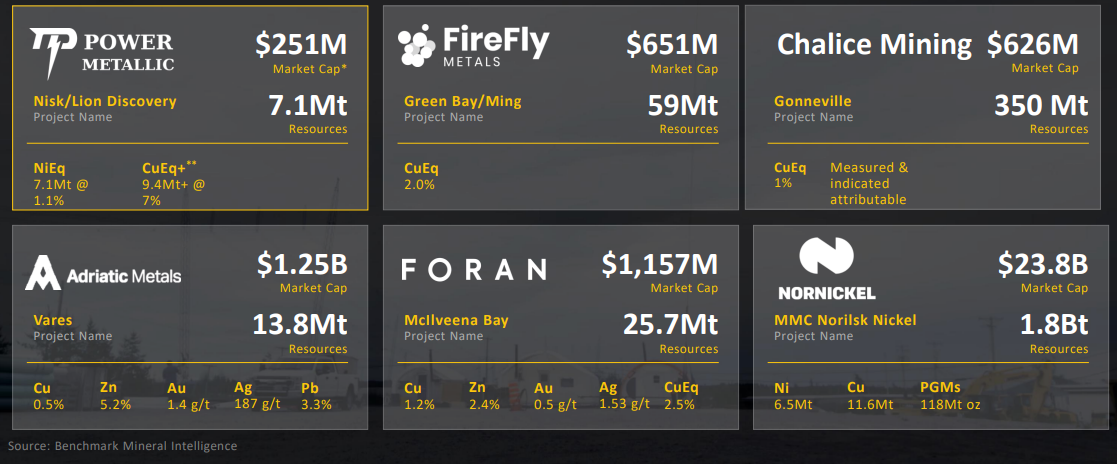

While Foran Mining is worth over $1 billion and Adriatic Metals with a polymetallic mine in Serbia with similar value metal in the ground just sold to Dundee Precious Metals for $1.3 billion dollars,17 Power Metallic Mines sits at just under $245 million. Yet, their Nisk Project is delivering grades that match or beat these bigger players.

It’s like finding a Ferrari at Toyota prices.

The numbers tell the story: they’re hitting zones with up to 12% copper equivalent – grades that make geologists’ jaws drop.

Here’s the kicker – Power Metallic Mines isn’t just sitting on these assets.

They’re fully funded for their drilling program through the end of 2026, with over $40 million in the bank as of last quarter.18

That means they can keep delivering news and results without asking shareholders for more money anytime soon.

The stock chart shows what happens when good news meets smart money – steady growth with room to run.

With mining superstars like Rob McEwen, the founder of GoldCorp.19 also backing the project, Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) looks like a race car at the starting line, engine revving, ready to go.

For investors looking for the next big thing in mining, Power Metallic Mines checks all the boxes: stellar grades, legendary backers, strong treasury, and a share price that hasn’t caught up to its true potential.

While the big mining companies trade at billions, Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) has something special and it’s still taking shape.

Dr. Steve Beresford, one of the world’s foremost polymetallic geologists, sees the parallels clearly. The Nisk Project’s unique combination of copper, nickel and PGMs positions it to be a global-scale asset with unmatched potential in Canada.

But there’s more. Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is not just advancing the Nisk Project, it also acquired an additional 600% of its land package over 270 square kilometers of adjacent and near ground because discoveries like this are rarely every just one mine. It is very likely a new world class mineral district is being shaped in front of our eyes and Power Metallic Metals has the cards.

The Nisk Project: Drill Results and the Game-Changing Lion Zone

Power Metallic Mines’ Nisk Project in Quebec is proving itself with some of the most significant polymetallic drill results seen globally in recent years.

Not only has the company delivered industry-leading copper-equivalent grades, but the discoveries within the Lion Zone have expanded the project’s potential far beyond initial expectations.

It was of course the presence of a solid Nickel resource which ultimately led to the exciting discovery of the Lion Zone.

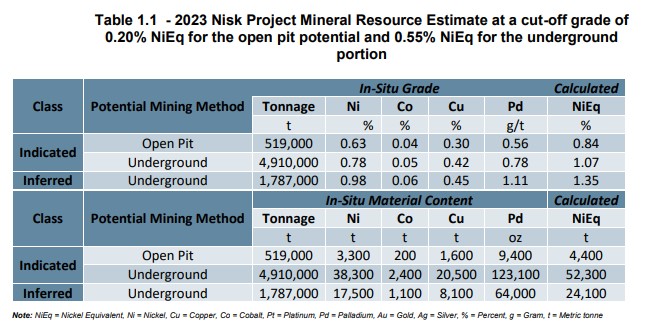

Nisk’s 2023 NI 43-101 Mineral Resource Estimate highlights a robust resource base:25

-

-

- Indicated Underground Resource: 4.91 Mt @ 1.07% NiEq (including 0.78% Ni, 0.42% Cu, 0.05% Co, and 0.78 g/t Pd).

- Inferred Underground Resource: 1.8 Mt @ 1.35% NiEq (including 0.98% Ni, 0.45% Cu, 0.06% Co, and 1.11 g/t Pd).

- Open Pit Resource (Indicated): 0.52 Mt @ 0.84% NiEq (including 0.63% Ni, 0.30% Cu, 0.04% Co, and 0.56 g/t Pd).

-

Most importantly, it led to drilling that discovered the Lion zone and made PNPN the top performing mining stock on the TSXV in 2024.

When compared to industry peers on a metal in the ground basis, Power Metallic looks to be trading at a whopping discount of greater than 50%.

These numbers aren’t just impressive—they’re exceptional.

Compared to hundreds of copper intercepts reported globally, Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) consistently ranks among the top results for 2024.26

The Lion Zone: A High-Grade Polymetallic Powerhouse

The Lion Zone, discovered by Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) just 5.5 kilometers along strike from the Nisk Main Zone, is emerging as a game-changing find. Drilling has revealed:

-

-

- A lateral extent of 350 meters, with an average thickness of 12–15 meters and a depth extending to 700 meters.

- Potential for multi-fold expansion as mineralization remains open both laterally and at depth.

-

Step-out drilling at Lion delivered:

-

-

- Hole 70: 32 meters at 8.4% CuEqRec—the best result to date.

- Hole 69: 17 meters at 4.64% CuEqRec, confirming the western core’s high-grade plunge.

-

Leading analysts estimate that the Lion Zone alone could host a mineralized area of at least 9.4 million tonnes at 7% CuEq.27 If further drilling confirms deeper extensions and lateral continuity, the resource could multiply in size, placing Lion among the top-tier polymetallic systems globally

When 12% CuEq Hits, Screens Light Up

In a world where most copper projects average grades below 1%, Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is delivering results that are truly exceptional:

-

-

- High-Grade Copper: Drill intercepts exceed 12% CuEq, significantly outperforming global peers.

- Polymetallic Mix: Lion’s unique combination of copper, nickel, PGMs, and precious metals creates a rare and valuable deposit.

-

These results not only highlight the richness of the Nisk Project but also confirm its potential to become Canada’s premier polymetallic discovery.

What’s most exciting is that Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) has only scratched the surface.

The newly expanded Nisk property spans 331 square kilometers, including 5.5 kilometers of unexplored strike between Nisk Main and Lion.

Drilling continues to prove the Lion Zone’s depth and lateral extent, with geophysical surveys suggesting the potential for additional mineralized pods throughout the system.

As exploration continues, the possibility of a multi-pod resource connecting Lion and Nisk Main could elevate the project to global prominence

Leading the Way to Canada’s First Carbon-Neutral Mine

Imagine a mining company that’s not just digging for metals but also rewriting the rules of how mining impacts our planet. That’s exactly what Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is doing at the Nisk Project in Quebec.

Their goal? To build the world’s first carbon-neutral polymetallic mine, proving that mining and environmental responsibility can go hand in hand.

So, how are they doing it? Here’s the story:

A Green Mining Revolution

Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) is using the latest technology and smart partnerships to shrink their carbon footprint and protect the environment. Here’s what makes their approach groundbreaking:

-

-

- Offsetting Emissions from Drilling: When they drill to find metals, they partner with Karbon X to balance out the carbon dioxide (CO₂) emissions by purchasing Verra-certified carbon offsets.

- Clean Energy from Quebec: Instead of using polluting energy sources, they plan to tap into Quebec’s hydropower—a clean, renewable energy source.

- Eco-Friendly Processing: With the help of CVMR, a global leader in refining, they’ll use cutting-edge technology to process metals in a way that’s cleaner and more efficient than ever before.

- Natural CO₂ Capture: The rocks left behind after mining (called ultramafic tailings) can naturally absorb and trap CO₂ from the air. They’re currently studying how much this process can help reduce emissions.

-

The Future of Responsible Mining

Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) isn’t just digging for metals—they’re digging for a better future.

By combining clean energy, smart technology, and natural carbon capture, the Nisk Project is set to become a shining example of how mining can be sustainable and profitable.

This is more than just mining. This is mining done right—for Canada and the planet.

The People Turning Rock Into Value

Power Metallic Mines Inc. (TSXV: PNPN) (OTCQB: PNPNF) has stacked the bench with operators who know how to advance discoveries and attract serious capital.

8 Reasons

to Watch Power Metallic Mines (TSXV:PNPN) (OTCQB:PNPNF)

1

Policy Catalyst In Play: Washington is prioritizing critical minerals. Tariffs, friendshoring, and price support steer capital to Canadian copper and nickel.

2

Polymetallic Giant Potential: Power Metallic Mines has uncovered a Cu-Ni-PGE-Ag-Au discovery in Quebec with standout intercepts like 32 m at 6.97% CuEq.

3

Commodity Tailwinds: Gold, platinum, palladium, and silver are up over 50% since the last financing, and copper has gained 12.5%, yet Power Metallic’s stock remains flat.

4

Expanding Discovery Footprint: The company expanded its land position by 600% to ~331 km² after acquiring 167 km² from Li-FT Power, directly bordering the discovery trend, and additional staking.

5

Fully Funded Exploration: Backed for 16 months of exploration, including a 100,000-meter drill program underway since July 2025, with assays released every 3–4 weeks.

6

Top-Tier Investors: Supported by industry heavyweights like Robert Friedland and Rob McEwen.

7

Renowned Leadership: Dr. Steve Beresford brings global expertise from First Quantum and MMG.

8

Prime Location: Located in one of the world’s best mining jurisdictions, with low-cost hydropower, supportive First Nations, and excellent infrastructure.

From Headline To Pricing Power. Friendshoring points to Quebec, Canada

Policy is the catalyst. Price is the tell.

Washington signed an $8.5 billion minerals pact with Australia and the tape reacted. Lithium Americas caught the spotlight and sprinted from $5.71 to $10.52 in two weeks. One line about rare earth security hit and USA Rare Earth ripped about 144.33%. That is not hype. That is how this market is trading policy.

The setup is bigger than one ticker. The United States is short copper, nickel, graphite, and manganese through the 2030s.

Even if every US project in the pipeline gets built, the gap remains. Carnegie’s friendshoring index points straight to Canada and Australia as priority suppliers. Capital follows that map.

This is the slipstream for Power Metallic Mines Inc. (TSXV: PNPN) (OTCQB: PNPNF). Quebec jurisdiction. Hydropower. Roads. A polymetallic system with copper and nickel at its core, plus PGMs, silver, and gold. Exactly what US industry keeps importing when policy tightens.

If the White House extends price floors beyond rare earths. If tariffs pressure Chinese supply chains. If friendshoring accelerates with offtakes and equity. Each lever pulls capital toward credible North American tonnes. That lifts the basket first. The best rock in the best ground moves most.

Newsflow is the near-term engine. A fully funded 100,000-meter program. Assays every three to four weeks. Expansion ground locked. Tier-one backers aligned. That is the cadence institutions want when policy is turning into price on headlines.

He does not need to single out a junior for this to work. He only needs to keep pushing supply security. Each announcement can potentially make the needle move.

The screens keep surfacing Power Metallic (TSXV:PNPN) (OTCQB:PNPNF) because it fits what America actually needs.

Put Power Metallic Mines Inc. (TSXV:PNPN) (OTCQB:PNPNF) on a live watchlist.

Subscribe to our newsletter to review the corporate presentation. Track the assays. Watch the policy tape. When the next minerals headline hits, the right North American tonnes tend to move first.

Terry LynchChief Executive Officer (CEO)

Terry LynchChief Executive Officer (CEO) Joe CampbellVP, Exploration

Joe CampbellVP, Exploration Dr. Steve BeresfordSpecial Advisor and Director

Dr. Steve BeresfordSpecial Advisor and Director Seamus O’Regan Jr.Director

Seamus O’Regan Jr.Director Jon Christian “JC” EvensenStrategic Advisor

Jon Christian “JC” EvensenStrategic Advisor