In December 2023, Government ministers representing nearly 200 countries went to Dubai.

This wasn’t just an ordinary conference.

This time, at the 2023 United Nations Climate Change Conference, a crucial decision was made.

It has nothing to do with the markets themselves.

It wasn’t about interest rates, it’s not about inflation, or anything else you read in the news.

In our opinion, it was much more important than that.

This decision is going to completely transform the world’s energy landscape forever.

We’re talking about the next-generation of global energy.

Fotografía oficial de la Presidencia de Colombia, Public domain, via Wikimedia Commons

World leaders backed a plan to TRIPLE global renewable energy capacity by 2030.1

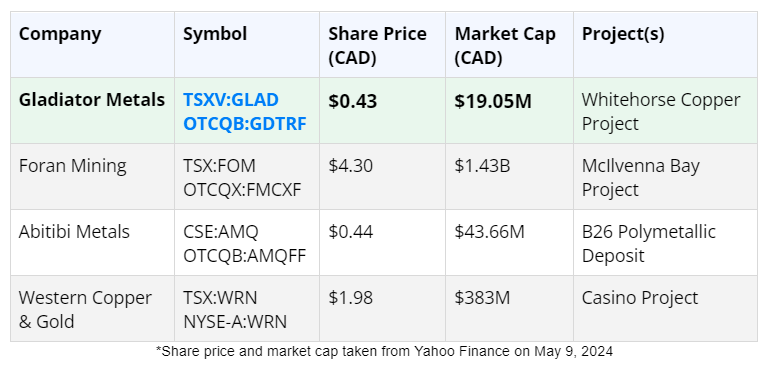

That’s a lofty goal… and according to Citibank, the move “would be extremely bullish for copper” and it could also be a major development for copper exploration companies, including Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF).

Breaking News

AI Is Utilizing More Copper Faster Than The Speed Of Light

Copper futures in New York hit a record high2 after a short squeeze led to a scramble to divert metal to US shores. This surge, with Comex futures jumping over 7% in mid-May, caused July delivery metal to trade at a record premium over later months and at unprecedented levels compared to other global exchanges.

“Short spread and futures holders are being squeezed,” said Michael Cuoco of StoneX Group.

The sharp price move, focused on the July contract on Comex, prompted traders in China to arrange shipments to Comex warehouses in the US.

“The short squeeze is set to continue as traders might not be able to ship enough metal from Chinese bonded warehouses or Europe ahead of the delivery date,” said Jia Zheng of Shanghai Dongwu Jiuying Investment Management Co. Metal could also be sourced in the Americas.

So what’s causing this short squeeze?

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Multiple factors are causing this increase in demand, but AI is leading the charge.

Most people don’t realize the amount of energy needed to advance future technologies like Artificial Intelligence (AI).

Most people don’t realize the amount of energy needed to advance future technologies like Artificial Intelligence (AI).

Fewer realize how much copper is required to power the influx of AI data centers coming online.

Tech giants like Meta’s Mark Zuckerberg stated that energy limitations will impede the expansion of AI data centers…3

Bank of America Merrill Lynch sees the copper demand from AI data centers increasing to 500,000 tons by 2026… and that’s only taking into account the copper used in equipment.4

Commodity trader Trafigura said AI has the potential to add one million tonnes of annual copper demand by 2030.5

That’s as much as Escondida, the world’s largest copper mine, produced in all of 2022.6

Microsoft has partnered up with BHP to increase copper recovery at Escondida using AI and machine learning.7

It’s a double edged sword really…

To recover more copper, we need AI. To power AI, we need more copper.

“As grade declines at existing mines and fewer new copper deposit discoveries are made, next-generation technologies like artificial intelligence, machine learning and data analytics will be used to unlock more production and value from our existing mines.” – BHP Chief Technical Officer Laura Tyler

But, even if Escondida boosts production, it’s still not enough to fill the 4.5 million tonne annual deficit on the horizon…

Microsoft isn’t the only tech giant expressing interest in copper mining.

A coalition of billionaires including Microsoft Founder, Bill Gates and Jeff Bezos are backing an exploration start-up, KoBold Metals, with a massive copper discovery in Zambia.8

KoBold Metals is using AI to create “Google Maps” of the earth’s crust to find new deposits of copper, as well as other metals lithium, cobalt and nickel.

There’s no denying the importance of KoBold’s Mingomba copper project.

Press Releases

- Gladiator Announces C$10M Private Placement

- Gladiator Metals Highlights Large Scale Copper Magnetic Anomalies

- Gladiator Stakes New Copper Skarn Prospect at the Whitehorse Copper Project

- Gladiator Extends Cowley Park Geological Model to Include Additional High-Grade Copper Mineralization

- Gladiator Metals Ready for Expansion Amid AI-Driven Copper Boom

Copper: An Essential Ingredient to the Global Energy Crisis

New copper discoveries are far and few between.

Even with new deposits discovered, it can take up to 18 years for the project to become operational.

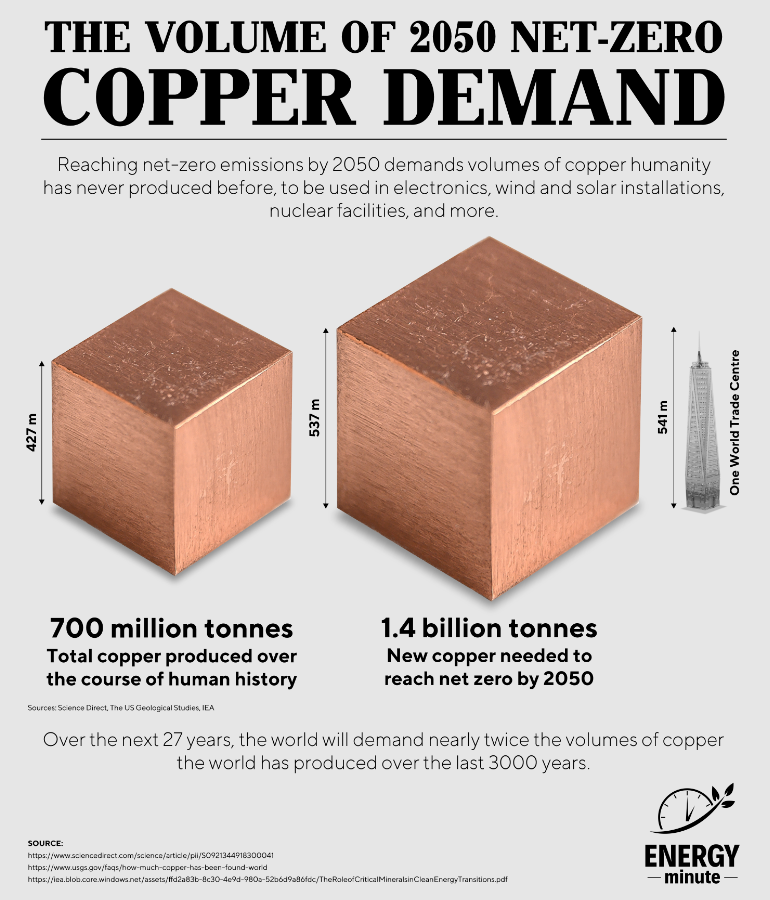

Achieving net-zero emissions by 2050 requires unprecedented amounts of copper for electronics, wind and solar installations, nuclear facilities, and more.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

In the next 27 years, global demand for copper will nearly double the total volume produced in the past 3,000 years.

9

9

That’s what makes Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) so exciting.

Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) has emerged as a rising player with the assets, expertise, and financial backing to make a substantial impact.

Its flagship Whitehorse Copper Project in Yukon, Canada stands out for its significant high-grade copper mineralization, evidenced by historical drilling results and recent geophysical surveys.

Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) Whitehorse Copper Project boasts over 30 known prospects within a 35 km x 5 km belt.

The previous owners, Hudbay Minerals, produced over 10 million tons of copper at approximately 1.5% Cu, plus gold and silver credits.

But they just barely scratched the surface.

Hudbay also didn’t have the technology to unlock what these deposits had to offer and no modern exploration has occurred since 1982, giving Gladiator Metals a unique opportunity to uncover substantial new resources.

Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) employs a thorough exploration strategy, including geological mapping, geochemical sampling, and geophysical surveys, to identify high-potential drilling targets.

The project is strategically located in a stable, mining-friendly Tier-1 jurisdiction. Excellent infrastructure, including good roads and access to grid hydro power, supports lower-cost, low-emission copper production.

With a proven management team and funding for 25,000 meters of drilling this year, Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) is well-positioned to capitalize on the growing demand for copper driven by the transition to electric vehicles and renewable energy.

But what Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) is about to uncover could be a complete game changer.

Why? Because the grades at the company’s Whitehorse Project are beyond significant.

To put it into perspective, anything above 1% is considered high grade copper and Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) is consistently uncovering significant high grade copper and gold mineralization, including:

-

-

- 49.83m @ 3.06% Cu from 70.26m

- 54.10m @ 2.05% Cu from 77.42m

- 33.99m @ 2.10% Cu from 148.89m, Incl. 15.24m @ 3.26%Cu

- 32.22m @ 2.11% Cu from 83.91m, Incl. 17.07m @ 3.47% Cu

- 13.72m @ 1.28% Cu from 66.14m and 41.15m @ 2.22% Cu from

- 87.48m

- 50.99m @ 1.87% Cu from 18.11m, Incl. 39.84m @ 2.19% Cu from

- 23.16m

-

8 Key Reasons

Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) is Poised to Become a BIG Copper Player

1

High-Grade Copper Potential: Significant historical copper production and recent drilling results confirm substantial high-grade copper and molybdenum mineralization.

2

Strategic Location in Yukon: Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF)benefits from a stable, mining-friendly jurisdiction with excellent infrastructure and year-round site access.

3

Exploration Upside: Multiple high-grade prospects with no modern exploration since 1982 offer substantial discovery opportunities.

4

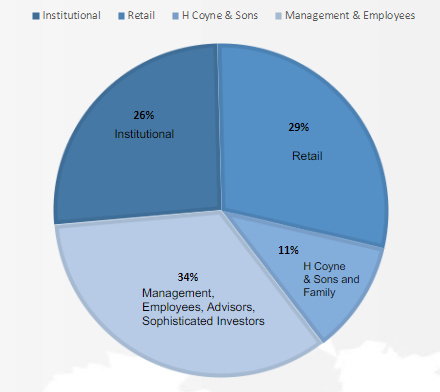

Strong Local Support and Shareholders: The Coyne family own international drilling company Kluane Drilling and 12% of Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF), and provide local support, ensuring efficient operations. The remaining shareholder base includes Institutional (26%), Management/Insider (34%) and Retail (31%) investors.

5

Environmental Commitment: Proximity to grid hydro power supports lower-cost, low-emission copper production, aligning with growing investor demand for environmentally responsible mining.

6

Proven Leadership Team: Led by a seasoned management team with experience from Centric Energy, Dolly Varden Silver, Ernst & Young, First Quantum Minerals, K92 Mining, Northern Empire Resources, and Snowline Gold.

7

Tight Capital Structure: Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) a very tight share structure and strong insider ownership aligning management and shareholder interests.

8

Market Opportunity: Well-positioned to capitalize on the increasing demand for copper driven by the transition to AI, electric vehicles, renewable energy, growing construction and transport.

High-Grade Copper Exploration in Canada’s Whitehorse Copper Belt

In Yukon’s mineral-rich landscape, Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) is making waves with its flagship Whitehorse Copper Project.

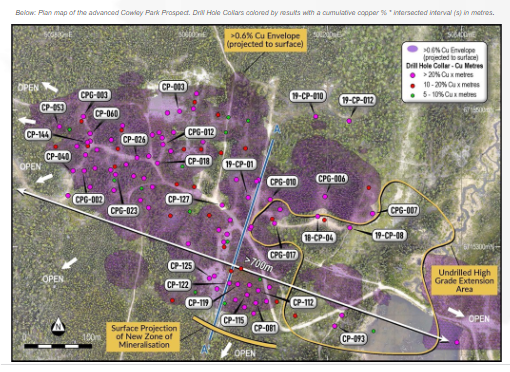

Spanning a 35 km x 5 km area, this project includes over 30 known prospects.

Historically, Hudbay Minerals produced over 10 million tons of copper from the region at an average grade of 1.5% Cu, along with significant gold and silver credits.

As we mentioned, despite this impressive output, the area has seen no modern exploration since 1982, giving Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) a unique opportunity to leverage advanced techniques and uncover new resources.

Recent drilling at the Cowley Park prospect has confirmed high-grade mineralization, with notable results such as:

-

-

- CP-040: 89.61m @ 1.89% Cu from 26.21m

- 18-CP-04: 12.5m @ 8.02% Cu from 85.04m

- 19-CP-08: 43.28m @ 2.24% Cu from 93.27m

-

These results underscore the significant expansion potential of the Whitehorse Copper Project.

The project is further enhanced by the presence of valuable metals like gold, silver, and molybdenum.

Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) is strategically located in a stable, mining-friendly jurisdiction with excellent infrastructure, including grid hydro power and well-maintained roads, supporting lower-cost, low-emission copper production.

The Whitehorse Copper Project stands out for its high-grade potential and underexplored nature, offering substantial potential upside.

Abitibi Metals Corp.’s B26 project in Quebec boasts a historical resource of 6.97 Mt at 2.94% CuEq indicated and 4.41 Mt at 2.97% CuEq inferred.10 Recent drill results included 44.5m at 2.82% CuEq11 and 97.5m at 1.47% CuEq,12 demonstrating continuous high-grade mineralization.

Abitibi’s fully funded 50,000-meter drill program13 aims to expand this resource significantly.

Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) Whitehorse Copper Project benefits from similar recent promising drilling results, positioning it favorably for substantial resource expansion and potentially achieving market valuation such as Abitibi.

Western Copper and Gold’s Casino Project is a cornerstone in Yukon’s mining sector, with proven and probable reserves of 1,217.1 Mt at 0.19% Cu, 0.22 g/t Au, 0.021% Mo, and 1.7 g/t Ag14. The 2022 feasibility study reveals strong economics, including a $2.3 billion NPV and an 18.1% IRR over a 27-year mine life15.

Despite the Casino Project’s scale, Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) Whitehorse Copper Project offers an opportunity to leverage higher-grade copper mineralization averaging 1.5% Cu from a much lower valuation.

Foran Mining’s McIlvenna Bay project in Saskatchewan is a significant copper development with an indicated resource of 39 million tonnes at 2.04% Cu Eq,16 Foran has gained strong market confidence, highlighted by a successful C$200 million private placement in late 2023.17

Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) Whitehorse Copper Project stands out with similar potential for copper resources at similar grades which could one day reach a comparable valuation as Foran.

The Whitehorse Copper Project: A Game-Changer for Gladiator Metals

Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) Whitehorse Copper Project is not just another asset; it’s a significant opportunity in the copper market.

With high-grade historical production, substantial exploration upside, and a strategic location with excellent infrastructure, the project has the potential to make a significant contribution to the copper industry.

The surge in copper demand, fueled by the transition to green energy and technological advancements, underscores the growing importance of ventures like the Whitehorse Copper Project.

Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) is advancing rapidly with a comprehensive exploration strategy, including an aggressive drilling plan over the next 12 months.

Having already completed 7,000 meters confirming historical drill results , the company is targeting a potential future resource of 100 million tonnes at 1.5-2% CuEq.

Recent press releases highlight significant drilling results from the Middle Chief, Cub Trend, and Chiefs Trend prospects:

-

-

- Middle Chief results include: 49.83m @ 3.06% Cu from 70.26m (LCU-009) and 54.10m @ 2.05% Cu from 77.42m (LCU-017).18

- Cub Trend results include: 24.99m @ 1.4% Cu from 23.93m (G-018) and 34.75m @ 1.65% Cu from 8.84m (BLC-008).19

- Chiefs Trend results include: 20.44m @ 2.17% Cu from 221.6m to EOH (LCG-009D1).20

-

The Whitehorse Copper Project is poised to be a key player in the copper market—so now is the perfect time to seize the opportunity.

Unmatched Local Support and Infrastructure

One of Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) key strengths is its robust local support and exceptional infrastructure.

The Coyne family, significant shareholders of First Nations descent, own an international drilling company called Kluane Drilling, providing invaluable support. Their involvement assists with priority access to nearby, efficient drilling operations—a major advantage.

Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) Whitehorse Copper Project is strategically located along a 25 km stretch of the western margin of Whitehorse City, offering excellent access to infrastructure, including roads, power, and skilled labor.

This proximity reduces operational costs and allows employees to live in town, enhancing workforce stability.

Additionally, the Yukon Government is investing over US$17 million to upgrade the ore dock in Skagway, Alaska.21 This agreement, still to be finalized, will secure preferential access for Yukon mining companies for the next 35 years. The improved port facilities will enhance the export of critical minerals, providing a reliable long-term transportation link.

This generational opportunity solidifies Skagway’s position as the gateway to the Klondike and ensures a strategic advantage for projects like Gladiator Metals’ (TSXV:GLAD) (OTCQB:GDTRF) Whitehorse Copper Project.

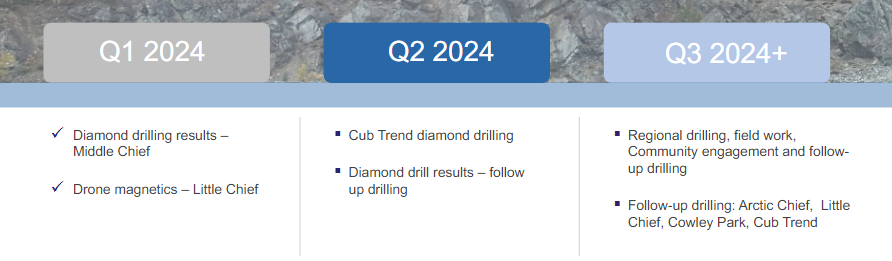

Ambitious Exploration and Growth in 2024

Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) is set for a transformative 2024 with an ambitious exploration plan.

The company has scheduled an aggressive drilling plan over the next 12 months, following the recent successful completion of 7,000 meters confirming historical drilling results.

This approach includes geological mapping, geochemical sampling, and geophysical surveys to identify high-potential drilling targets.

The steady flow of updates from these activities is expected to sustain interest and confidence, further positioning Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) as a key player in the surging copper market.

As the company progresses through its exploration milestones, each new discovery and drilling result will underscore the significant potential of the Whitehorse Copper Project, paving the way for substantial growth and long-term value creation.

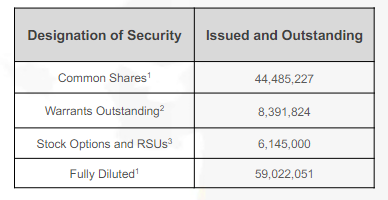

Tight Share Structure and Solid Funding with Strong Institutional and Insider Ownership

Gladiator Metals (TSXV:GLAD) (OTCQB:GDTRF) boasts an admirably tight share structure with 40.8 million shares outstanding and strong institutional (26%) and insider (34%) ownership.

Experienced Leadership and Management Team

Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) is led by a seasoned, capable Management Team and Board of Directors. Each member is very active in the mission, bringing to Gladiator a wealth of experience and expertise from such enterprises as Centric Energy, Dolly Varden Silver, Ernst & Young, First Quantum Minerals, K92 Mining, Northern Empire Resources, and Snowline Gold.

RECAP: 8 Reasons

Why Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF) Has The Potential To Be a Major Copper Player

1

Exceptional Copper Grades: Proven high-grade copper and molybdenum from both historical production and recent drilling confirm substantial resource potential.

2

Prime Location in Yukon: Untapped high-grade prospects with no modern exploration since 1982 offer substantial discovery opportunities.

3

Significant Exploration Potential: Untapped high-grade prospects with no modern exploration since 1982 offer substantial discovery opportunities.

4

Robust Local Support: Backed by the Coyne family and Kluane Drilling ensuring efficient, low-cost operations. Ownership is well-balanced among institutional, management/insider, and retail investors.

5

Sustainable Production Practices: Proximity to grid hydro power supports environmentally responsible, low-emission copper production.

6

Proven Leadership Team: Led by a team with a proven track record in resource discovery and project development.

7

Tight Capital Structure : tight share structure and strong insider ownership, aligning management and shareholder interests.

8

Rising Market Demand: Positioned to capitalize on the increasing demand for copper driven by the transition to AI, electric vehicles, renewable energy, growing construction and transport.

With copper prices projected to potentially hit $15,000/ton by 2025,22 the time is NOW to stay ahead of the market.

Perhaps now is the perfect time to take an even closer look at Gladiator Metals Corp. (TSXV:GLAD) (OTCQB:GDTRF)?

Click here to explore why Gladiator Metals deserves a spot on your watchlist today.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers